Professional Documents

Culture Documents

Activ Secure PBT

Uploaded by

Ankita KalaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activ Secure PBT

Uploaded by

Ankita KalaniCopyright:

Available Formats

Health Insurance

Aditya Birla Health Insurance Co. Limited

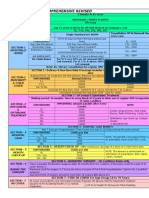

Activ Secure - Table of Benefits

1. Personal Accident Cover

Plan Plan I Plan II Plan III Plan IV Plan V

Sum Insured ` 1Lac, ` 1Lac, 2Lacs, ` 1Lac, 2Lacs, ` 5Lacs, ` 10Lacs,

2Lacs, 3Lacs, 3Lacs, 4Lacs, 3Lacs, 4Lacs, 6Lacs, 7Lacs, 15Lacs,

4Lacs, 5Lacs, 5Lacs, 6Lacs, 5Lacs, 6Lacs, 8Lacs, 9Lacs, 20Lacs,

6Lacs, 7Lacs, 7Lacs, 8Lacs, 7Lacs, 8Lacs, 10Lacs, 25Lacs,

8Lacs, 9Lacs, 9Lacs, 10Lacs, 9Lacs, 10Lacs, 15Lacs, 30Lacs,

10Lacs, 15Lacs, 15Lacs, 20Lacs, 40Lacs,

15Lacs, 20Lacs, 20Lacs, 25Lacs, 50Lacs, 1Cr,

20Lacs, 25Lacs, 25Lacs, 30Lacs, 1.5Cr, 2Cr,

25Lacs, 30Lacs, 30Lacs, 40Lacs, 5Cr, 7.5Cr,

30Lacs, 40Lacs, 40Lacs, 50Lacs, 1Cr, 10Cr, 15Cr,

40Lacs, 50Lacs, 1Cr, 50Lacs, 1Cr, 1.5Cr, 2Cr, 20Cr

50Lacs, 1Cr, 1.5Cr, 2Cr, 5Cr 1.5Cr, 2Cr, 5Cr 5Cr, 10Cr

1.5Cr, 2Cr

A. Basic 1 Accidental Death 100% of SI 100% of SI 100% of SI 100% of SI 100% of SI

Covers Cover (AD)

2 Permanent Total Not covered 100% of SI 100% of SI 100% of SI 100% of SI

Disablement(PTD)

3 Permanent Partial Not covered Not covered 100% of SI 100% of SI 100% of SI

Disablement(PPD)

4 Education Benefit 10% of SI max 10% of SI max 10% of SI max 10% of SI max 10% of SI max

up to 10 Lacs up to 10 Lacs up to 10 Lacs up to 10 Lacs up to 10 Lacs

5 Emergency Road Not covered Not covered Not covered Covered up to Covered up to

Ambulance Cover ` 10,000 ` 10,000

6 Funeral Expenses Not covered Not covered Not covered Covered up to Covered up to

1% of SI, 1% of SI,

maximum maximum

up to ` 50,000 up to ` 50,000

7 Repatriation of Remains Not covered Not covered Not covered Not covered Lump sum

benefit of

` 50,000

8 Orphan Benefit Not covered Not covered Not covered Not covered Lump sum

benefit of 10%

of SI,maximum

up to ` 15Lacs

9 Modification Benefit Not covered Not covered Not covered Not covered Covered up to

(Residence and vehicle) ` 1Lac

10 Compassionate visit Not covered Not covered Not covered Not covered Domestic: up

to 10,000

International:

up to 25,000

11 P.A Cumulative Bonus 5% per claim 5% per claim 5% per claim 5% per claim Applicable for

free year, free year, free year, free year, Sum Insured up

to 10 Crores

maximum maximum 50% maximum 50% maximum 50% only.

50% of of Sum Insured of Sum Insured of Sum Insured 5% per claim

Sum Insured free year,

maximum 50%

of Sum Insured

B. Optional 12 Temporary Total Weekly benefit equal to 1/100th of TTD limit, maximum up to 50,000 per week,

Covers Disablement (TTD) up to 100 weeks. Max TTD limit will be 2 times the income

Weekly benefit options : 1000 , 2000 ,3000, 4000, 5000, 7500, 10000, 12500,

(Available 15000 ,20000 ,25000, 30000 ,40000 ,50000

only with

death SI

5 Lacs

and above)

13 Accidental in-patient Covered up to 1% of AD SI or Rs. 1Lac whichever is higher

Hospitalization Cover

Activ Secure, Product UIN: ADIHLIP18076V011718.

B. Optional 14 Broken Bones Benefit Benefit limit up to ` 1Lac/ 3 Lacs/ 5 Lacs

Covers (lump sum as per table)

15 Coma Benefit Benefit limit equal to Accidental Death Cover Sum Insured,

maximum up to ` 10Lacs

16 Burn Benefit Benefit limit up to ` 1Lac/ 2 Lacs/ 3 Lacs (lump sum as per table)

17 Accidental Medical Coverage up to the lowest of following:

Expenses 1) Actual Expenses

2)10% of Accidental death SI

3) 40% of admissible claim under PTD

4) 40% of admissible claim under PPD

5) 40% of admissible claim under TTD

6) ` 50,000

(in-patient expenses not covered)

18 Adventure Sports Cover Benefit up to Accidental Death Cover Sum Insured, maximum up to ` 10Lacs

19 Worldwide Emergency Available

Assistance Services

(including Air Ambulance)

20 EMI Protect 3 EMI totaling upto the following options (in `):

50000, 75000, 100000, 200000, 300000, 400000, 500000

21 Loan Protect Options `: 1Lac, 2 Lacs, 3 Lacs, 4 Lacs, 5 Lacs, 6 Lacs, 7 Lacs, 8 Lacs, 9 Lacs,

10 Lacs, 15 Lacs, 20 Lacs, 25 Lacs, 30 Lacs, 40 Lacs, 50 Lacs, 1 Cr, 1.5Cr,

2 Cr, 5 Cr

(Available with Sum Insured up to ` 10 Crores only, Option may be chosen

maximum upto AD S.I)

2. Critical Illness Cover

Plan Plan 1 Plan 2 Plan 3

A. Basic Sum Insured ` 1Lac, ` 1Lac, 2Lacs, ` 5Lacs,

Covers 2Lacs, 3Lacs, 3Lacs, 4Lacs, 6Lacs, 7Lacs,

4Lacs, 5Lacs, 5Lacs, 6Lacs, 8Lacs, 9Lacs,

6Lacs, 7Lacs, 7Lacs, 8Lacs, 10Lacs,

8Lacs, 9Lacs, 9Lacs, 10Lacs, 15Lacs,

10Lacs, 15Lacs, 20Lacs,

15Lacs, 20Lacs, 25Lacs,

20Lacs, 25Lacs, 30Lacs,

25Lacs, 30Lacs, 40Lacs,

30Lacs, 40Lacs, 50Lacs, 1Cr

40Lacs, 50Lacs, 1Cr

50Lacs, 1Cr

Critical Illness Cover 20 CIs Covered 50 CIs Covered List A: 50 CIs

(100% SI (100% SI) (100% SI) List B:

14 CIs (50% SI

max 10 Lacs)

Initial waiting period 90 days 90 days 90 days (180 days

for conditions as

mentioned in

list B)

Survival Period 15 days 15 days 15 days

B. Optional Second E Opinion

Covers Available Available Available

(optional)

3. Cancer Secure Cover

Cancer Secure Plan

A. Basic Sum Insured ` 5 Lacs, 6 Lacs, 7 Lacs, 8 Lacs, 9 Lacs, 10 Lacs, 15 Lacs, 20 Lacs, 25 Lacs, 30

Cover Lacs, 40 Lacs, 50 Lacs, 1 Cr

Cancer Cover Early: 50% SI, max 10 Lacs

Major: 100% SI

Advanced: First detected at metastatic stage (cancer spreading to other organs

of body)- 150% SI

Activ Secure, Product UIN: ADIHLIP18076V011718.

Initial waiting period 90 days (180 days for Early stage)

Survival Period 7 Days

Cancer Cumulative Bonus 10% per claim free year, maximum 100% of Sum Insured

B. Optional Second E opinion Available

Covers

4. Hospital Cash Cover

Hospital Cash Plan

Daily Cash Benefit (DCB) ` 500, ` 1000, ` 2000, ` 3000, ` 4000, ` 5000, ` 10,000

Days per Policy Year limit 30 days/ 45 days/ 60 days

Coverage Deductible per claim 1 day

Double Benefit Cover 2 times Daily Cash Benefit is paid for each day of hospitalization (post deductible)

(Max up to 10 days within the in case of one or more of following events:

days per Policy Year limit) - ICU hospitalization days

- Hospitalization due to Road Traffic Accidents

Convalescence Benefit Lump sum benefit equal to 1 DCB, for hospitalization>7 days (in addition to

other DCB/double benefit)

Parental Accommodation Lump Sum benefit equal to 1 DCB, when the insured aged 12 years or less has

Benefit been hospitalized for a period exceeding consecutive 72 hours

Initial waiting period 30 days

5. Optional Cover

Optional Cover which may be taken along with any combination of Cover 1, 2 ,3, 4

Coverage

Wellness Coach Available

Notes

1. Policy to be offered on a multi individual basis, where 10% discount is available for more than two individuals in a Policy as family discount

2. A long term discount of 7.5% and 10% on selecting a 2 and 3 years Policy respectively. Long term discount will apply only in case of

Single Premium Policies.

3. Policy can be purchased for the following relations

a. Self

b. Legally married spouse as long as they continue to be married; and/or

c. Up to four of their children; and/or

d. Up to 2 Parents; and/or

e. Up to 2 Parent in law

4. The minimum Age at entry is 5 years for all the plans under the Policy except Critical Illness Cover plan 3 and Cancer Secure Cover, for

which minimum entry Age is 18 years. Maximum entry Age is 65 years under the Policy. Proposer’s Age should be at least 18 years.

5. Same plan under each selected cover shall be applicable to all members in the Family Policy

6. Eligibility for Personal Accident Cover, Critical Illness Cover, Cancer Secure Cover:

a. Personal Accident Cover

i. For Earning Member(s)

• Basic cover Sum insured (in case Loan Protect benefit is not opted) Up to 12 times gross annual income of Insured.

• Personal Accident Cover taken along with Loan Protect optional benefit: Basic Cover Sum Insured plus Loan Protect optional benefit

limit up to 15 times his/her gross annual income.

• TTD SI – Salaried/ Self-employed – Up to 2 times of Annual gross income.

ii. Non-earning Spouse / Parent/Parent in laws – 100% of Proposer’s Basic cover sum insured/eligibility or 30L whichever is lower.

TTD Benefit is not applicable.

iii. Children/Student – 100% of Proposer’s Basic cover sum insured/eligibility or 15L whichever is lower. TTD Benefit is not applicable.

b. Critical Illness Cover and Cancer Secure Cover

i. Earning Member– Sum insured Up to 12 times Annual gross income of Insured.

ii. Non-earning Spouse– 50% of Proposer’s sum insured/eligibility or 30L whichever is lower.

iii. Non-earning Parent/ Parent in laws – 50% of Proposer’s sum insured/eligibility or 10L whichever is lower.

iv. Children/Student – 50% of Proposer’s sum insured/eligibility or 15L whichever is lower.

7. TTD optional cover is available only for earning members under the Policy maximum up to 2 times his/her annual Income. However,

TTD S.I cannot be higher than the personal accident S.I. TTD cover is not available with occupation risk class 3.

8. For other optional covers under Personal Accident Cover, if chosen, will be applicable to all members in the Policy.

Activ Secure, Product UIN: ADIHLIP18076V011718.

Aditya Birla Health Insurance Co. Limited. IRDAI Reg.153. CIN No. U66000MH2015PLC263677.

Product Name: Activ Secure, Product UIN: ADIHLIP18076V011718.

Address: 9th Floor, Tower 1, One Indiabulls Centre, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone

Road, Mumbai 400013. Email: care.healthinsurance@adityabirlacapital.com, Contact us:

Website: adityabirlahealthinsurance.com, Telephone: 1800 270 7000, Fax: +91 22 6225 7700. Contact us:

1800 270 7000

For more details on risk factors, terms and conditions please read terms and conditions carefully before concluding a sale. 1800 270 7000

Trademark/Logo Aditya Birla Capital is owned by Aditya Birla Management Corporation Private Limited and is used by

Aditya Birla Health Insurance Co. Limited under licensed user agreement(s). adityabirlacapital.com

You might also like

- FHO, CHI, WC, ASSURE, Coparison One PagerDocument1 pageFHO, CHI, WC, ASSURE, Coparison One PagerLakshmikanth SNo ratings yet

- Future Advantage Top Up Brochure 21 Dec 2018 1Document27 pagesFuture Advantage Top Up Brochure 21 Dec 2018 1Subham sikdarNo ratings yet

- StudentsurakshabrochureDocument4 pagesStudentsurakshabrochureEathesh DhumalNo ratings yet

- Koti Suraksha One Pager - HealthDocument2 pagesKoti Suraksha One Pager - HealthShobhit MathurNo ratings yet

- PROTECTING Your Wellbeing Is Important Aer An Accident.: Health InsuranceDocument6 pagesPROTECTING Your Wellbeing Is Important Aer An Accident.: Health Insuranceshivamkatare0No ratings yet

- Give Your Health Insurance Backup PlanDocument54 pagesGive Your Health Insurance Backup PlanColin GeneraliNo ratings yet

- Income Tax Table - Part 1 and 2Document8 pagesIncome Tax Table - Part 1 and 2Rebecca TatadNo ratings yet

- 4 in 1 Product RecknorDocument1 page4 in 1 Product RecknorNirvana ThortiNo ratings yet

- Paper Finance IVDocument3 pagesPaper Finance IVAbhijeetNo ratings yet

- Consolidated Scale of Fines PDFDocument124 pagesConsolidated Scale of Fines PDFKevin AmpuanNo ratings yet

- Consolidated Scale of Fines PDFDocument124 pagesConsolidated Scale of Fines PDFKevin Ampuan100% (3)

- Module 2 Know Your TRADsDocument11 pagesModule 2 Know Your TRADsJun Reyes RamirezNo ratings yet

- Travelsafe With COVID-19 Coverage - 2022-08 (August 15)Document5 pagesTravelsafe With COVID-19 Coverage - 2022-08 (August 15)Kre GLNo ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- Shri Ganesh Insurance Mechanism: Recovery Benefit On Single Hospitalisation More Than 10 DaysDocument4 pagesShri Ganesh Insurance Mechanism: Recovery Benefit On Single Hospitalisation More Than 10 Dayspattani_viral04No ratings yet

- SBI Sanction Letter 2019-20-1Document14 pagesSBI Sanction Letter 2019-20-1s2amirthaNo ratings yet

- Grand Launch of Lic'S New Ulips On 02 Grand Launch of Lic'S New Ulips On 02 March 2020 at Nav Rs.10/ March 2020 at Nav Rs.10Document2 pagesGrand Launch of Lic'S New Ulips On 02 Grand Launch of Lic'S New Ulips On 02 March 2020 at Nav Rs.10/ March 2020 at Nav Rs.10Rajendra PandaNo ratings yet

- Budget ReportDocument2 pagesBudget ReportMitesh ChauhanNo ratings yet

- ETMONEY 10 Crore Calculator-1-1Document2 pagesETMONEY 10 Crore Calculator-1-1Bhanu PratapNo ratings yet

- Star Health InsuranceDocument2 pagesStar Health InsurancevinujohnpanickerNo ratings yet

- Module 3 Getting Ahead With VULDocument10 pagesModule 3 Getting Ahead With VULJun Reyes RamirezNo ratings yet

- Health CompareDocument1 pageHealth CompareHasmukh patelNo ratings yet

- 5.sheep FarDocument9 pages5.sheep FarGurunath NaikodiNo ratings yet

- Additional Questions 9Document3 pagesAdditional Questions 910 368 Zakwan BaigNo ratings yet

- Goat Farming Economics of The Project Basis & Presumptions Particulars Unit Quantity Techno-Economic ParametersDocument2 pagesGoat Farming Economics of The Project Basis & Presumptions Particulars Unit Quantity Techno-Economic Parameterssohalsingh1No ratings yet

- EH Brochure IndividualDocument8 pagesEH Brochure Individualbhanu sharmaNo ratings yet

- Important McqsDocument23 pagesImportant McqsAmit ChaudhryNo ratings yet

- HC - Brochure - (Mob) - 11may17Document11 pagesHC - Brochure - (Mob) - 11may17Ksl VajralaNo ratings yet

- 10th Module ELearningDocument68 pages10th Module ELearningMahalingam RamasamyNo ratings yet

- Sri It Changes RevisedDocument1 pageSri It Changes Revisedarti chowdhryNo ratings yet

- Real Estate - Proposal - TemplateDocument58 pagesReal Estate - Proposal - Templatepalanisamy744100% (1)

- BenefitsDocument2 pagesBenefitsAbdalla RayanNo ratings yet

- Health Insurance - Variants: # Description Medisure Prime Medisure Classic Medisure PLUS Medisure Super Top UpDocument1 pageHealth Insurance - Variants: # Description Medisure Prime Medisure Classic Medisure PLUS Medisure Super Top UpRajarshi GuhaNo ratings yet

- SBI Life - Poorna Suraksha - Product GuideDocument2 pagesSBI Life - Poorna Suraksha - Product GuideVenkateswarlu BusamNo ratings yet

- NagarnigamDocument15 pagesNagarnigamAkshay GianchandaniNo ratings yet

- Hostel Challan For Existing StudentsDocument1 pageHostel Challan For Existing StudentsDarwesh Faqeer0% (1)

- Keywords For LICDocument95 pagesKeywords For LICVivek SharmaNo ratings yet

- Bakri Palan Project Report Small 2Document5 pagesBakri Palan Project Report Small 2arvind kadam100% (1)

- Tax RatesDocument2 pagesTax RatesSalma GurarNo ratings yet

- Goat-Sheep 101 Hills SC-STDocument5 pagesGoat-Sheep 101 Hills SC-STarvind kadamNo ratings yet

- Scan 25-Oct-2018 PDFDocument2 pagesScan 25-Oct-2018 PDFarunsawaiyanNo ratings yet

- BF2 AssignmentDocument5 pagesBF2 AssignmentIbaad KhanNo ratings yet

- MediclassicDocument6 pagesMediclassicarulkumarNo ratings yet

- Goat Project - 500+25Document11 pagesGoat Project - 500+25karannehra82No ratings yet

- Comp One Pager With Premium ChartDocument3 pagesComp One Pager With Premium ChartnithinNo ratings yet

- Travel Insurance BrochureDocument7 pagesTravel Insurance BrochureArunava SahaNo ratings yet

- Agency A Good ProfessionDocument17 pagesAgency A Good ProfessionPrasannakumar PatilNo ratings yet

- Kaycee Tolentino 1 Year Old Child Educ Funding ProposalDocument2 pagesKaycee Tolentino 1 Year Old Child Educ Funding ProposalRheianne Dela IslaNo ratings yet

- Internal Reconstruction-Journal EntriesDocument25 pagesInternal Reconstruction-Journal EntriesParth GargNo ratings yet

- Yy 1000000.00 06/11/1984 15 37 15 Male Yearly: Benefit Illustration For Shriram New Shri Life Plan V02 128N047V02Document2 pagesYy 1000000.00 06/11/1984 15 37 15 Male Yearly: Benefit Illustration For Shriram New Shri Life Plan V02 128N047V02Dark HoundNo ratings yet

- Mvan Budget Sheet 2Document20 pagesMvan Budget Sheet 2karenmoller0No ratings yet

- V2 Restaurant Case Study - Yamatcha, ChennaiDocument4 pagesV2 Restaurant Case Study - Yamatcha, ChennaiMuhammad khanNo ratings yet

- V2 Restaurant Case Study - Yamatcha, ChennaiDocument4 pagesV2 Restaurant Case Study - Yamatcha, Chennaikhattak1978No ratings yet

- Chaanakya 4 - 12Document26 pagesChaanakya 4 - 12Kshitij KumarNo ratings yet

- Invest Well, Save Well.... EXCELDocument4 pagesInvest Well, Save Well.... EXCELPankaj SNo ratings yet

- Medical Comparison Chart 2020Document3 pagesMedical Comparison Chart 2020hollingermikeNo ratings yet

- Archivetemp 35Document1 pageArchivetemp 35IzzNo ratings yet

- Schedule of Benefits 2023 (Including Covid-19)Document1 pageSchedule of Benefits 2023 (Including Covid-19)Sykesh BhivahNo ratings yet

- 1 Individual: Project at A Glance - Top SheetDocument10 pages1 Individual: Project at A Glance - Top SheetDigital InfotechNo ratings yet

- Activ Health PBTDocument10 pagesActiv Health PBTAnkita KalaniNo ratings yet

- ABHI Protect Add On PBTDocument3 pagesABHI Protect Add On PBTAnkita Kalani100% (2)

- Activ Fit PBTDocument4 pagesActiv Fit PBTAnkita KalaniNo ratings yet

- Activ Care PBTDocument4 pagesActiv Care PBTAnkita KalaniNo ratings yet

- SSS Law PDFDocument147 pagesSSS Law PDFTiff Dizon100% (3)

- Governance Questions For UPSC MainsDocument4 pagesGovernance Questions For UPSC Mainscommissioner social welfareNo ratings yet

- Child Support Acompromise AgreementDocument3 pagesChild Support Acompromise AgreementRomnick100% (1)

- Mukesh Chauhan - ResumeDocument1 pageMukesh Chauhan - ResumeGS QuestionNo ratings yet

- Central Motor Vehicle Rules, 1989: Form 1-ADocument1 pageCentral Motor Vehicle Rules, 1989: Form 1-ADADADADGGGNo ratings yet

- Case Study On Memorial HospitalDocument3 pagesCase Study On Memorial Hospitalcharus2890% (5)

- UCD35 Katrina ToyneDocument3 pagesUCD35 Katrina ToyneKatrinaNo ratings yet

- Pho Contact List Jan 24 2017Document1 pagePho Contact List Jan 24 2017Sanketh GuptaNo ratings yet

- Service Employees 32BJ North - Redacted Bates HWDocument20 pagesService Employees 32BJ North - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Forging A World of LibertyDocument96 pagesForging A World of LibertypinotagemanNo ratings yet

- GSK Placements Ppt-2012Document41 pagesGSK Placements Ppt-2012Saakshi WadhawanNo ratings yet

- An Electronic Copy of This Volunteering Opportunities List Can Be Found atDocument9 pagesAn Electronic Copy of This Volunteering Opportunities List Can Be Found atapi-249582844No ratings yet

- Jargons in Human Resource Management 256Document89 pagesJargons in Human Resource Management 256NukdNo ratings yet

- Indian Olympiad Qualifier (IOQ) 2020 - 21 (IOQB - Hall Ticket) Test Date: 07/02/2021 OfficeDocument4 pagesIndian Olympiad Qualifier (IOQ) 2020 - 21 (IOQB - Hall Ticket) Test Date: 07/02/2021 OfficeSampanna HotaNo ratings yet

- An Ordinance Regulating The Use of KaraokeDocument4 pagesAn Ordinance Regulating The Use of Karaokedon congNo ratings yet

- Kalyana Karnataka Art 371 JDocument3 pagesKalyana Karnataka Art 371 JRakesh MyleNo ratings yet

- Philhealth Act - Irr Ra 9241Document58 pagesPhilhealth Act - Irr Ra 9241Linda Himoldang Marcaida100% (1)

- Decentralization and Local Governance PoliticsDocument23 pagesDecentralization and Local Governance PoliticssamsamNo ratings yet

- VPD Manual Regulations ProceduresDocument647 pagesVPD Manual Regulations ProceduresBlairWilsonNo ratings yet

- Cp/res 1124Document2 pagesCp/res 1124Crónica Uno100% (1)

- Human Trafficking SatyajitDocument17 pagesHuman Trafficking SatyajitsenlawdebarnabNo ratings yet

- Sikaran Martial Arts Act of 2009Document6 pagesSikaran Martial Arts Act of 2009Baras Rizal OnlineNo ratings yet

- CCMT OBC Certificate FormatDocument2 pagesCCMT OBC Certificate FormatAnweshaBose100% (1)

- Waivers For NSTP 2 With Data PrivacyDocument1 pageWaivers For NSTP 2 With Data PrivacyALDRIN NEGRIDONo ratings yet

- Sphere Handbook 2011Document203 pagesSphere Handbook 2011Alberto MancaNo ratings yet

- Municipal ProfileDocument51 pagesMunicipal ProfileGina Lee Mingrajal Santos100% (1)

- 4 Quarter Least Learned Skill: Schools Division of Himamaylan CityDocument3 pages4 Quarter Least Learned Skill: Schools Division of Himamaylan CityJodie Mae LapricoNo ratings yet

- Post-Approval Safety Data Management: Definitions and Standards For Expedited Reporting ICH Harmonised Tripartite Guideline DraftDocument12 pagesPost-Approval Safety Data Management: Definitions and Standards For Expedited Reporting ICH Harmonised Tripartite Guideline DraftasdasNo ratings yet

- Sabreen AhmedDocument10 pagesSabreen AhmedAbhinav Rakesh MaruNo ratings yet

- Alabama Department of Corrections Response To Prison Staffing OrderDocument86 pagesAlabama Department of Corrections Response To Prison Staffing OrderMike CasonNo ratings yet