0% found this document useful (0 votes)

820 views2 pagesComprehensive Health Insurance Plan

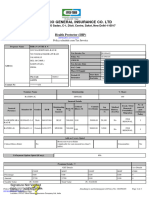

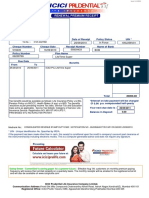

This document summarizes the coverage provided by the Star Comprehensive Revised health insurance plan, which includes:

1. Hospitalization coverage (Section 1) for individuals ages 3 months to 65 years with sum insured options from Rs. 5 lacs to Rs. 25 lacs. It also covers pre- and post-hospitalization expenses, day care procedures, domiciliary hospitalization, and ambulance charges.

2. Maternity and child coverage (Section 2) including normal delivery, caesarean section, and coverage for newborn children with certain benefit limits.

3. Outpatient dental and ophthalmic treatment coverage (Section 3) with certain limits provided every 3 years.

Uploaded by

vinujohnpanickerCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

820 views2 pagesComprehensive Health Insurance Plan

This document summarizes the coverage provided by the Star Comprehensive Revised health insurance plan, which includes:

1. Hospitalization coverage (Section 1) for individuals ages 3 months to 65 years with sum insured options from Rs. 5 lacs to Rs. 25 lacs. It also covers pre- and post-hospitalization expenses, day care procedures, domiciliary hospitalization, and ambulance charges.

2. Maternity and child coverage (Section 2) including normal delivery, caesarean section, and coverage for newborn children with certain benefit limits.

3. Outpatient dental and ophthalmic treatment coverage (Section 3) with certain limits provided every 3 years.

Uploaded by

vinujohnpanickerCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

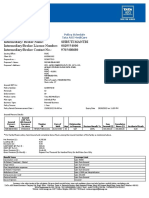

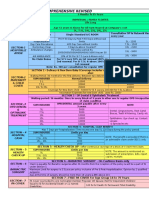

- Hospitalization: Details the hospitalization cover, including room options, post and pre-hospitalization coverage, and exclusions.

- Options: Describes the options related to who can buy the plan and pre-existing medical conditions coverage, including senior citizen policies.

- Additional Cover: Provides information about additional benefits such as newborn baby cover, major illness coverage, and waiting periods.

- Automatic Restoration: Discusses automatic restoration of sum insured after hospitalization claims.

- Optional Benefits: Explains optional benefits available for policyholders, including personal accident cover and second medical opinion.