Professional Documents

Culture Documents

CHI - One Pager - Version 1.3 - September 2021

Uploaded by

ShihbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHI - One Pager - Version 1.3 - September 2021

Uploaded by

ShihbCopyright:

Available Formats

Version_1.

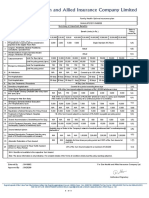

0_SP Parameters Star Comprehensive Insurance Policy

SHAHLIP22028V072122

About the policy Covers hospitalization expenses incurred as a result of illness and/or accidental injuries

Type of Cover Individual and Floater (Family Size - 2 Adults + 3 Dependent Children)

For Adults: 18 years – 65 years

Entry Age

For Dependent Children: 91 days to 25 years

Available for including Newly married spouse and New Born on paying additional premium

Midterm Inclusion

(Intimation about the marriage/ newborn should be given within 60 days from the date of marriage/ new born)

Co-payment 10% Co-payment is applicable if the Insured age at entry 61 years and above

Renewal Lifelong

Policy Term One Year, Two years & Three Years

Pre Policy Medical Checkup Not Required

Sum Insured Options (Rs. in Lakhs) 5 7.5 10 15 20 25 50 75 100

Hospitalization - Room Rent Private Single AC Room (Actuals)

ICU, Dr Fees, Tests, Medicines Covered (Actuals)

Covered (Actuals)

Road Ambulance Charges

(i) for transportation to hospital (ii) from one hospital to other hospital (iii) from hospital to residence

Pre & Post Hospitalization 60 days & 90 days (Actuals)

Covered (Actuals)

Organ Donor Expenses

Additional SI up to Basic SI for the Complications(if any) that necessitate a Redo Surgery/ICU admission

Day Care Procedures All day care procedures are covered (Actuals)

Covered (Actuals)

Domiciliary hospitalization

Covered for the period exceeding three days

Air Ambulance

Covered. Up to Rs.2,50,000 per hospitalization and maximum up to Rs.5,00,000 per policy year

Wellness platform is available both in our mobile app “Star Power” & Customer Portal (Retail)

Star Wellness Program

The Insured can earn reward points and avail premium discount up to 10% on the renewal premium by

Available for Insured aged => 18 yrs

enrolling and achieving the wellness goals. For details please refer the policy wording / prospectus.

Sum Insured Options (Rs. in Lakhs) 5 7.5 10 15 20 25 50 75 100

5 7.5 10 15 20 25 50 75 100

Accidental Death & PTD

For Dependent Child & Persons aged above 70 years, this cover is available up to 10 Lakhs only.

Bariatric Surgery

2,50,000 2,50,000 2,50,000 2,50,000 5,00,000 5,00,000 5,00,000 5,00,000 5,00,000

(Waiting Period 36 months)

Ayush Treatment

(For Ayurveda, Unani, Sidha & Homepathy)

15,000 15,000 15,000 15,000 20,000 20,000 30,000 30,000 30,000

Normal 15,000 25,000 30,000 30,000 30,000 30,000 50,000 50,000 50,000

Delivery Exp.,

(Waiting Period Caesarean 20,000 40,000 50,000 50,000 50,000 50,000 1,00,000 1,00,000 1,00,000

24 months) &

New Born Cover 1,00,000 1,00,000 1,00,000 1,00,000 1,00,000 1,00,000 2,00,000 2,00,000 2,00,000

New Born

Cover New Born 5,000 5,000 5,000 5,000 5,000 5,000 10,000 10,000 10,000

Vaccination

OP Dental/ Ophthalmic treatment

5,000 5,000 10,000 10,000 10,000 10,000 15,000 15,000 15,000

(after every block of 3 policy yrs)

Health Check-up benefit (Rs.)

2,000 2,500 3,000 4,000 4,500 4,500 5,000 5,000 5,000

(for every claim free year)

Out Patient Consultation (Rs.)

1,200 1,500 2,100 2,400 3,000 3,300 5,000 5,000 5,000

(Limit per consultation Rs.300)

Hospital Cash Benefit (Rs.)

500 750 750 1,000 1,000 1,500 2,500 2,500 2,500

(7days per admission, 120 days in P.yr)

50%

No Claim Bonus

+ 100% 100% 100% 100% 100% 100% 100% 100%

(Up to 100% of the Basic SI)

50%

Automatic Restoration

Can be utilized for illness/ disease for which claim/s was/ were already made during the policy year.

(Up to 100%, Once in every policy year)

Modern treatments Based on the Sum insured chosen limits differ, refer policy wording for further details

Quarterly/ Half-Yearly/ Yearly. Premium can also be paid Annually, Biennial

Instalments Options

(Once in 2 years) and Triennial (Once in 3 years).

Optional Cover

Will reduce the PED/s waiting period to 12 months from 36 months

Buy back of PED waiting period This Option is available only for the first purchase of this Star Comprehensive Insurance Policy

In case of floater policy, this reduction is applicable only for the persons who opted for this facility

This Option is not available for renewal/ migrated/ ported policies

Waiting Period

Initial waiting period 30 days for all illnesses (except accident)

For Specific diseases 2 years

For Pre-existing diseases 3 years

* The information provided in this document is only indicative. For more details on the terms and conditions, please read the policy wordings before concluding a sale.

You might also like

- CHI One PagerDocument1 pageCHI One PagerPOS-ADSR TrackingNo ratings yet

- Medical Integration Model as it Pertains to Musculoskeletal ConditionsFrom EverandMedical Integration Model as it Pertains to Musculoskeletal ConditionsNo ratings yet

- CHI - One Pager - Version 1.0 - Feb 20Document2 pagesCHI - One Pager - Version 1.0 - Feb 20Prasad.MNo ratings yet

- Star Women Care Insurance Policy: FeaturesDocument2 pagesStar Women Care Insurance Policy: FeaturesAnoop AravindNo ratings yet

- Star Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Document1 pageStar Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Viki for gmail GmailNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Protect your family's health with Chola HealthlineDocument3 pagesProtect your family's health with Chola Healthlinearaban datesNo ratings yet

- Young Star Insurance Policy ParametersDocument1 pageYoung Star Insurance Policy ParametersVivek Sharma100% (1)

- Youngstar - One Pager PDFDocument1 pageYoungstar - One Pager PDFRickyNo ratings yet

- Hospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Document4 pagesHospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Jahankeer MzmNo ratings yet

- Youngstar - One PagerDocument1 pageYoungstar - One Pagersahilbajaj12No ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- Comprehensive insurance policy featuresDocument1 pageComprehensive insurance policy featuresvamsiklNo ratings yet

- PDF Document Icici Midi ClamDocument48 pagesPDF Document Icici Midi Clam3sanjaypatilNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Presentation on Medi-Classic Insurance CoverageDocument24 pagesPresentation on Medi-Classic Insurance CoverageS S Biradar LicNo ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- EightDocument1 pageEightNaveen PeramalasettyNo ratings yet

- Star Health Premier - Version 1.0 - Mar - 22Document33 pagesStar Health Premier - Version 1.0 - Mar - 22Anoop AravindNo ratings yet

- Give Your Health Insurance Backup PlanDocument54 pagesGive Your Health Insurance Backup PlanColin GeneraliNo ratings yet

- YSI One Pager Version 1.0 Feb 21Document2 pagesYSI One Pager Version 1.0 Feb 21Prasad.MNo ratings yet

- Virtusa Policy Benefit1Document1 pageVirtusa Policy Benefit1Venkatesh KumarNo ratings yet

- Family Health Optima Insurance Plan detailsDocument1 pageFamily Health Optima Insurance Plan detailsChetan tripathiNo ratings yet

- Tokio Marine Life - IHealth Plus Brochure-2019Document44 pagesTokio Marine Life - IHealth Plus Brochure-2019kinosraj kumaranNo ratings yet

- ReportDocument5 pagesReportRoshan MandalNo ratings yet

- Benefits ManualDocument34 pagesBenefits ManualRupayan DuttaNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- AIA HS Gold Elite BrochureDocument12 pagesAIA HS Gold Elite BrochureBensam JoysonNo ratings yet

- I-Great Medi Care: Your Hassle-Free Personal Medical CareDocument24 pagesI-Great Medi Care: Your Hassle-Free Personal Medical Carenrlyn_mduNo ratings yet

- SBI General Arogya Top Up Policy ProspectusDocument64 pagesSBI General Arogya Top Up Policy Prospectusyashmpanchal333No ratings yet

- JIO Sailent FeaturesDocument3 pagesJIO Sailent FeaturesReeta DuttaNo ratings yet

- Young Star - One Pager - Version 1.4 - September 2021Document1 pageYoung Star - One Pager - Version 1.4 - September 2021ShihbNo ratings yet

- Young Star PolicyDocument1 pageYoung Star PolicyStar HealthNo ratings yet

- PACIS-Amani Medical Insurance-BrochureDocument15 pagesPACIS-Amani Medical Insurance-BrochureNjeri AsiahNo ratings yet

- Tata INsurance AnalysisDocument13 pagesTata INsurance AnalysisSomil GuptaNo ratings yet

- Activ Care PBTDocument4 pagesActiv Care PBTAnkita KalaniNo ratings yet

- Future Advantage Top Up Brochure 21 Dec 2018 1Document27 pagesFuture Advantage Top Up Brochure 21 Dec 2018 1Subham sikdarNo ratings yet

- MediSaversVIP Takaful Product Disclosure SheetDocument12 pagesMediSaversVIP Takaful Product Disclosure Sheetesh ktasNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- Senior Citizens Red Carpet Health Insurance Policy PDFDocument8 pagesSenior Citizens Red Carpet Health Insurance Policy PDFrohit22221No ratings yet

- HFFP-2015 Revised ProspectusDocument25 pagesHFFP-2015 Revised Prospectuspooja singhalNo ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- Star Cancer Care Platinum One PagerDocument2 pagesStar Cancer Care Platinum One Pagerricky aliaNo ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- Sme Product Brochure PDFDocument37 pagesSme Product Brochure PDFNoor Azman YaacobNo ratings yet

- FHO - One Pager - Version 1.0 - Oct 2020Document2 pagesFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- Care Senior BrochureDocument4 pagesCare Senior Brochuresatishch27No ratings yet

- HEALTH SHIELD 360 PROTECTIONDocument12 pagesHEALTH SHIELD 360 PROTECTIONDhina KaranNo ratings yet

- TATA Medicare Premier 871b2dee42Document8 pagesTATA Medicare Premier 871b2dee42ramana reddy KotaNo ratings yet

- Celebrating 60 Years of Excellence, Sri Lanka Insurance PresentsDocument2 pagesCelebrating 60 Years of Excellence, Sri Lanka Insurance PresentsSivaneswaran ChandrasekaranNo ratings yet

- #Sampoorna Four Pager - ABHI276 - OrganizedDocument4 pages#Sampoorna Four Pager - ABHI276 - OrganizedBrijesh RaiNo ratings yet

- Koti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052Document4 pagesKoti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052nirav56No ratings yet

- FHO - One Pager - Version 1.1 - MayDocument2 pagesFHO - One Pager - Version 1.1 - MaySakshi Jain50% (2)

- J Care Medical Insurance BenefitsDocument8 pagesJ Care Medical Insurance BenefitssolomonNo ratings yet

- PantryDocument1 pagePantryShihbNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document3 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Shihb100% (1)

- Young Star - One Pager - Version 1.4 - September 2021Document1 pageYoung Star - One Pager - Version 1.4 - September 2021ShihbNo ratings yet

- Material Sample TagDocument1 pageMaterial Sample TagShihbNo ratings yet

- Admission DischargeDocument30 pagesAdmission Dischargedigracia manatigaNo ratings yet

- Philippine Health Care SystemDocument86 pagesPhilippine Health Care SystemKhylamarie VillalunaNo ratings yet

- Improving Teamwork to Manage Stress in Emergency NursingDocument3 pagesImproving Teamwork to Manage Stress in Emergency NursingEdreilyn ShienNo ratings yet

- Philos Intro PageDocument3 pagesPhilos Intro PageRed StohlNo ratings yet

- RTI Swasthya BhavanDocument55 pagesRTI Swasthya BhavanPrabir Kumar ChatterjeeNo ratings yet

- Bad Blood - Fatal Hospital Blood Transfusion InvestigationDocument14 pagesBad Blood - Fatal Hospital Blood Transfusion InvestigationMark J. RochesterNo ratings yet

- ICICI Lombard Health Care Claim Form - HospitalisationDocument6 pagesICICI Lombard Health Care Claim Form - HospitalisationEazhil DhayallanNo ratings yet

- Hospital Incident Management Team ChartDocument2 pagesHospital Incident Management Team ChartslusafNo ratings yet

- Introduction To Artificial Intelligence AssignmentDocument48 pagesIntroduction To Artificial Intelligence AssignmentSreePrakashNo ratings yet

- Myanmar HealthcareDocument8 pagesMyanmar Healthcarezawminn2No ratings yet

- Hawaii Crisis Standards of Care Triage Allocation Plan and FAQsDocument33 pagesHawaii Crisis Standards of Care Triage Allocation Plan and FAQsHonolulu Star-AdvertiserNo ratings yet

- Thomas Neville Bonner - Becoming A Physician - Medical Education in Great Britain, France, Germany, and The United States, 1750-1945 (1996)Document425 pagesThomas Neville Bonner - Becoming A Physician - Medical Education in Great Britain, France, Germany, and The United States, 1750-1945 (1996)musicisti100% (1)

- Company Profile Set Final 1Document2 pagesCompany Profile Set Final 1jolo_hynson17No ratings yet

- Senior Citizen's Act 2010 RA 9994: Alman-Najar Namla XU-College of Law Zamboanga Social Legislation and Agrarian ReformDocument15 pagesSenior Citizen's Act 2010 RA 9994: Alman-Najar Namla XU-College of Law Zamboanga Social Legislation and Agrarian ReformlazylawstudentNo ratings yet

- Building A Healthier Nation: Annual Report 2018Document55 pagesBuilding A Healthier Nation: Annual Report 2018tarunpetluriNo ratings yet

- Community Health NursingDocument41 pagesCommunity Health NursingDennis Michael Esteban ZequerraNo ratings yet

- Sample - Software Requirements Specification For Hospital Info Management SystemDocument6 pagesSample - Software Requirements Specification For Hospital Info Management SystemMohamed FaroukNo ratings yet

- PGDHMDocument222 pagesPGDHMjyothiNo ratings yet

- WBHS Claim Form C2Document3 pagesWBHS Claim Form C2P SinghNo ratings yet

- E MeditekDocument2 pagesE MeditekShah AbhiNo ratings yet

- Health Referral System Manual - Central VisayasDocument103 pagesHealth Referral System Manual - Central VisayasAlfred Russel Wallace50% (10)

- I. Population: Sex Ratio 96 Males: 100 Females InterpretationDocument25 pagesI. Population: Sex Ratio 96 Males: 100 Females InterpretationanreilegardeNo ratings yet

- Medela Boon HospitalsDocument22 pagesMedela Boon HospitalsAkash RajNo ratings yet

- Liji GeorgeDocument5 pagesLiji GeorgeLiji GeorgeNo ratings yet

- Chintamani PHCDocument2 pagesChintamani PHCSandeep GhosthNo ratings yet

- Scar AcademyDocument3 pagesScar AcademyplastaukNo ratings yet

- Ali Vali - (Harry & Desi's L-Story 1) How Do You Mend A Broken HeartDocument153 pagesAli Vali - (Harry & Desi's L-Story 1) How Do You Mend A Broken HeartSdekNo ratings yet

- SJT Secret For Success Dec 2018Document115 pagesSJT Secret For Success Dec 2018saswotNo ratings yet

- Petitioner Respondent: First DivisionDocument8 pagesPetitioner Respondent: First DivisionReyar SenoNo ratings yet

- PewsDocument21 pagesPewsrubertusedyNo ratings yet