Professional Documents

Culture Documents

CHI One Pager

Uploaded by

POS-ADSR TrackingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHI One Pager

Uploaded by

POS-ADSR TrackingCopyright:

Available Formats

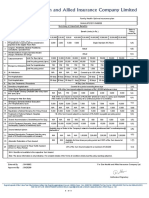

Benefits Star Comprehensive Insurance Policy

UIN: SHAHLIP2077V041920

01 About the policy Covers hospitalization expenses incurred as a result of illness and/or accidental injuries

02 Type of Cover Individual Sum Insured / Floater Sum Insured (Family Size - up to 2 Adults + 3 Dependent Children)

For Adults: 18years – 65years

03 Entry Age

For Dependent Children: 91 days to 25 years

Available for including Newly married spouse and New Born on paying additional premium

04 Midterm Inclusion

(Intimation about the marriage/ newborn should be given within 60 days from the date of marriage/ new born)

05 Co-payment 10% Co-payment is applicable if the Insured age at entry is above 60 years

06 Renewal Lifelong

07 Policy Term One Year & Two years

08 Pre Policy Medical Checkup Not Required

09 Sum Insured Options 5Lacs 7.5Lacs 10Lacs 15Lacs 20Lacs 25Lacs 50Lacs 75Lacs 1Cr.

10 Hospitalization - Room Rent Private Single AC Room (Actual)

11 ICU, Dr Fees, Tests, Medicines Covered (Actual)

12 Pre & Post Hospitalization 60 days & 90 days (Actual)

13 Day Care Procedures All day care procedures are covered (Actual)

Automatic Restoration

14 Can be utilized for illness/ disease for which claim/s was/ were already made during the policy year.

(Up to 100%, Once in every policy year)

15 Road Ambulance Charges Covered (Actual) (i) for transportation to hospital (ii) from one hospital to other hospital (iii) from hospital to residence

16 Air Ambulance Covered Up to Rs.2,50,000/- per hospitalization and maximum up to Rs.5,00,000/- per policy year

17 Organ Donor Expenses Covered (Actual) Additional SI up to Basic SI for the Complications(if any) that necessitate a Redo Surgery/ICU admission

18 Domiciliary hospitalization Covered (Actual) Covered for the period exceeding three days

19 Psychiatric & Psychosomatic Covered (Actual)

Hospital Cash Benefit (Rs.)

20 500 750 750 1,000 1,000 1,500 2,500 2,500 2,500

(7days per admission, 120 days in P.yr)

Health Check-up benefit (Rs.)

21 2,000 2,500 3,000 4,000 4,500 4,500 5,000 5,000 5,000

(for every claim free year)

Out Patient Consultation (Rs.)

22 1,200 1,500 2,100 2,400 3,000 3,300 5,000 5,000 5,000

(Limit per consultation - Rs.300/-)

OP Dental/ Ophthalmic treatment

23 5,000 5,000 10,000 10,000 10,000 10,000 15,000 15,000 15,000

(after every block of 3 policy yrs)

AYUSH Treatment

24 15,000 15,000 15,000 15,000 20,000 20,000 30,000 30,000 30,000

(For Ayurveda, Unani, Sidha & Homepathy)

No Claim Bonus 50%

25 100% 100% 100% 100% 100% 100% 100% 100%

(Up to 100% of the Basic SI) + 50%

Delivery Exp., Normal 15,000 25,000 30,000 30,000 30,000 30,000 50,000 50,000 50,000

26

(Waiting Period 24 Caesarean 20,000 40,000 50,000 50,000 50,000 50,000 1,00,000 1,00,000 1,00,000

months) & New Born New Born Cover 1,00,000 1,00,000 1,00,000 1,00,000 1,00,000 1,00,000 2,00,000 2,00,000 2,00,000

27 Cover Vaccination Exp., 5,000 5,000 5,000 5,000 5,000 5,000 10,000 10,000 10,000

5Lacs 7.5Lacs 10Lacs 15Lacs 20Lacs 25Lacs 50Lacs 75Lacs 1Cr.

28 Accidental Death & PTD

For Dependent Child & Persons aged above 70 years, this cover is available up to 10 Lacs only.

Bariatric Surgery

29 2,50,000 2,50,000 2,50,000 2,50,000 5,00,000 5,00,000 5,00,000 5,00,000 5,00,000

(Waiting Period 36 months)

Wellness platform is available both in our mobile app “Star Power” & Customer Portal (Retail)

Star Wellness Program

30 The Insured can earn reward points and avail premium discount up to 10% on the renewal premium by enrolling and achieving the

Available for Insured aged => 18 yrs

wellness goals. For details please refer the policy wording / prospectus.

Optional Cover

Will reduce the PED/s waiting period to 12 months from 36 months (Additional Premium will be charged)

- This Option is available only for the first purchase of This Star Comprehensive Insurance Policy

31 Buy back of PED waiting period

- In case of floater policy, this reduction is applicable only for the persons who opted for this facility

- This Option is not available for renewal/ migrated/ ported policies

Waiting Period

Initial waiting period 30 days for all illnesses (except accident) (Not Applicable in case of PORT if previous policy is running from last 1-year)

32 For Specific diseases 2 years (Not Applicable in case of PORT if previous policy is running from last 2-years)

For Pre-existing diseases 3 years (Not Applicable in case of PORT if previous policy is running from last 3-years)

You might also like

- Tokio Marine Life - IHealth Plus Brochure-2019Document44 pagesTokio Marine Life - IHealth Plus Brochure-2019kinosraj kumaranNo ratings yet

- QuizDocument18 pagesQuizParul AbrolNo ratings yet

- Care Health ProposalDocument12 pagesCare Health ProposalNaldre Phamhinthuan100% (1)

- Bank PPL Mobile EmailDocument83 pagesBank PPL Mobile EmailPOS-ADSR TrackingNo ratings yet

- Sin Missing The MarkDocument2 pagesSin Missing The MarkCeray67No ratings yet

- CHI - One Pager - Version 1.3 - September 2021Document1 pageCHI - One Pager - Version 1.3 - September 2021ShihbNo ratings yet

- CHI - One Pager - Version 1.0 - Feb 20Document2 pagesCHI - One Pager - Version 1.0 - Feb 20Prasad.MNo ratings yet

- Hospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Document4 pagesHospitalization Benefit Plan 1 Plan 2 Plan 3 Plan 4Jahankeer MzmNo ratings yet

- Star Women Care Insurance Policy: FeaturesDocument2 pagesStar Women Care Insurance Policy: FeaturesAnoop AravindNo ratings yet

- Young Star Insurance Policy ParametersDocument1 pageYoung Star Insurance Policy ParametersVivek Sharma100% (1)

- Youngstar - One Pager PDFDocument1 pageYoungstar - One Pager PDFRickyNo ratings yet

- Youngstar - One PagerDocument1 pageYoungstar - One Pagersahilbajaj12No ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Protect your family's health with Chola HealthlineDocument3 pagesProtect your family's health with Chola Healthlinearaban datesNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- EightDocument1 pageEightNaveen PeramalasettyNo ratings yet

- MediSaversVIP Takaful Product Disclosure SheetDocument12 pagesMediSaversVIP Takaful Product Disclosure Sheetesh ktasNo ratings yet

- YSI One Pager Version 1.0 Feb 21Document2 pagesYSI One Pager Version 1.0 Feb 21Prasad.MNo ratings yet

- JIO Sailent FeaturesDocument3 pagesJIO Sailent FeaturesReeta DuttaNo ratings yet

- ReportDocument5 pagesReportRoshan MandalNo ratings yet

- LIC's Jeevan Arogya health insurance plan contact detailsDocument21 pagesLIC's Jeevan Arogya health insurance plan contact detailsPaul PrakashNo ratings yet

- Give Your Health Insurance Backup PlanDocument54 pagesGive Your Health Insurance Backup PlanColin GeneraliNo ratings yet

- SBI General Arogya Top Up Policy ProspectusDocument64 pagesSBI General Arogya Top Up Policy Prospectusyashmpanchal333No ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- Celebrating 60 Years of Excellence, Sri Lanka Insurance PresentsDocument2 pagesCelebrating 60 Years of Excellence, Sri Lanka Insurance PresentsSivaneswaran ChandrasekaranNo ratings yet

- Star Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Document1 pageStar Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Viki for gmail GmailNo ratings yet

- I-Great Medi Care: Your Hassle-Free Personal Medical CareDocument24 pagesI-Great Medi Care: Your Hassle-Free Personal Medical Carenrlyn_mduNo ratings yet

- Future Advantage Top Up Brochure 21 Dec 2018 1Document27 pagesFuture Advantage Top Up Brochure 21 Dec 2018 1Subham sikdarNo ratings yet

- Family Health Optima Insurance Plan detailsDocument1 pageFamily Health Optima Insurance Plan detailsChetan tripathiNo ratings yet

- Star Health Premier - Version 1.0 - Mar - 22Document33 pagesStar Health Premier - Version 1.0 - Mar - 22Anoop AravindNo ratings yet

- Presentation on Medi-Classic Insurance CoverageDocument24 pagesPresentation on Medi-Classic Insurance CoverageS S Biradar LicNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- Arogya Sanjeevani - One Pager PDFDocument1 pageArogya Sanjeevani - One Pager PDFstar health Vadavalli50% (2)

- Arogya - One Pager - Version 1.0 April 2020Document1 pageArogya - One Pager - Version 1.0 April 2020Ari BanerjeeNo ratings yet

- Arogya Sanjeevani Policy ParametersDocument1 pageArogya Sanjeevani Policy Parametersstar health Vadavalli0% (1)

- ICICI GMC Quote - Baroda Decorators Revised 02.04.2024Document6 pagesICICI GMC Quote - Baroda Decorators Revised 02.04.2024silvershield.generalNo ratings yet

- PDF Document Icici Midi ClamDocument48 pagesPDF Document Icici Midi Clam3sanjaypatilNo ratings yet

- Young Star - One Pager - Version 1.4 - September 2021Document1 pageYoung Star - One Pager - Version 1.4 - September 2021ShihbNo ratings yet

- Young Star PolicyDocument1 pageYoung Star PolicyStar HealthNo ratings yet

- Comprehensive insurance policy featuresDocument1 pageComprehensive insurance policy featuresvamsiklNo ratings yet

- I-Medik RIDER Suite: Your One Stop Medical Protection SolutionDocument83 pagesI-Medik RIDER Suite: Your One Stop Medical Protection SolutionainafaqeeraNo ratings yet

- #Sampoorna Four Pager - ABHI276 - OrganizedDocument4 pages#Sampoorna Four Pager - ABHI276 - OrganizedBrijesh RaiNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Tata INsurance AnalysisDocument13 pagesTata INsurance AnalysisSomil GuptaNo ratings yet

- Afyaimara Seniors CoverDocument8 pagesAfyaimara Seniors CoverjaykaksNo ratings yet

- ReportDocument5 pagesReportvinaykumar333777No ratings yet

- KHP - One Pager - Edge - 05112018-2-1Document2 pagesKHP - One Pager - Edge - 05112018-2-1Ashok JhamerNo ratings yet

- Shri Ganesh Insurance Mechanism: Recovery Benefit On Single Hospitalisation More Than 10 DaysDocument4 pagesShri Ganesh Insurance Mechanism: Recovery Benefit On Single Hospitalisation More Than 10 Dayspattani_viral04No ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- EQ Employee Benefits Plan Brochure (January 2023)Document8 pagesEQ Employee Benefits Plan Brochure (January 2023)Darren ChenNo ratings yet

- Virtusa Policy Benefit1Document1 pageVirtusa Policy Benefit1Venkatesh KumarNo ratings yet

- PROTECT YOUR FAMILY'S HEALTHDocument3 pagesPROTECT YOUR FAMILY'S HEALTHRohit ParmarNo ratings yet

- Senior Citizens Red Carpet Health Insurance Policy PDFDocument8 pagesSenior Citizens Red Carpet Health Insurance Policy PDFrohit22221No ratings yet

- FHO - One Pager - Version 1.0 - Oct 2020Document2 pagesFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- Arogya Sanjeevani PremiumDocument16 pagesArogya Sanjeevani PremiumGiriMahaNo ratings yet

- SBI General Arogya Plus Policy BrochureDocument8 pagesSBI General Arogya Plus Policy Brochureyashmpanchal3330% (1)

- Star Cancer Care Platinum One PagerDocument2 pagesStar Cancer Care Platinum One Pagerricky aliaNo ratings yet

- Medical Integration Model as it Pertains to Musculoskeletal ConditionsFrom EverandMedical Integration Model as it Pertains to Musculoskeletal ConditionsNo ratings yet

- Using Casemix System for Hospital Reimbursement in Social Health Insurance Programme: Comparing Casemix System and Fee-For-Service as Provider Payment MethodFrom EverandUsing Casemix System for Hospital Reimbursement in Social Health Insurance Programme: Comparing Casemix System and Fee-For-Service as Provider Payment MethodNo ratings yet

- IBC - First Call ScriptDocument3 pagesIBC - First Call ScriptPOS-ADSR TrackingNo ratings yet

- BBP - Manual - Hindi 1607Document100 pagesBBP - Manual - Hindi 1607POS-ADSR TrackingNo ratings yet

- IIJS JAN CompanyDocument9 pagesIIJS JAN CompanyNaveenJainNo ratings yet

- Food Processing & Exporter CXO Email MobileDocument239 pagesFood Processing & Exporter CXO Email MobilePOS-ADSR TrackingNo ratings yet

- GSTN Numbers and Details of 56 DealersDocument16 pagesGSTN Numbers and Details of 56 DealerssidharthNo ratings yet

- Faculty Directory SP Medical College, BikanerDocument17 pagesFaculty Directory SP Medical College, BikanerPOS-ADSR Tracking100% (1)

- Doctor Email MobileDocument109 pagesDoctor Email MobilePOS-ADSR TrackingNo ratings yet

- US V RuizDocument2 pagesUS V RuizCristelle Elaine ColleraNo ratings yet

- Empiricism, Sensationalism, and PositivismDocument43 pagesEmpiricism, Sensationalism, and PositivismJohn Kevin NocheNo ratings yet

- How to Optimize Your Website for Search EnginesDocument130 pagesHow to Optimize Your Website for Search EnginesKunika KittuNo ratings yet

- Tom Barry - International Skateboarder!: Lesson 2 HomeworkDocument1 pageTom Barry - International Skateboarder!: Lesson 2 HomeworkMr TrungNo ratings yet

- Employee Stock Option SchemeDocument6 pagesEmployee Stock Option Schemezenith chhablaniNo ratings yet

- PSYC 2026 Assignment 1 - Individual Project - 25%Document9 pagesPSYC 2026 Assignment 1 - Individual Project - 25%Carissann ModesteNo ratings yet

- Understanding The Mindanao ConflictDocument7 pagesUnderstanding The Mindanao ConflictInday Espina-VaronaNo ratings yet

- Judge and Court Aide Administrative CasesDocument9 pagesJudge and Court Aide Administrative CasesJarvin David ResusNo ratings yet

- Tax QuizDocument2 pagesTax QuizMJ ArazasNo ratings yet

- GMRC 5 - 4th Quarter ExaminationDocument12 pagesGMRC 5 - 4th Quarter ExaminationTeacher IanNo ratings yet

- Chapter 11Document48 pagesChapter 11Rasel SarkerNo ratings yet

- Response To Salazar TAA Labor Commission PetitionDocument15 pagesResponse To Salazar TAA Labor Commission Petitionrick siegelNo ratings yet

- Avantgarde CalligraphyDocument12 pagesAvantgarde CalligraphyMilena MedakovicNo ratings yet

- Unit 2 Export Policy Framework: 2.0 ObjectivesDocument11 pagesUnit 2 Export Policy Framework: 2.0 ObjectiveskajalNo ratings yet

- Regulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsiteDocument12 pagesRegulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsitepunNo ratings yet

- Property rights in news, body parts, and wild animalsDocument22 pagesProperty rights in news, body parts, and wild animalskoreanmanNo ratings yet

- ABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFDocument4 pagesABDULLAH BOZKURT - Iran Plays Subversive Role in Turkey PDFAnonymous Bbxx7Z9No ratings yet

- Ethical Theories and Principles in Business EthicsDocument4 pagesEthical Theories and Principles in Business EthicsMuhammad Usama WaqarNo ratings yet

- Corporate Strategy Assignment 2 ScriptDocument5 pagesCorporate Strategy Assignment 2 ScriptDelisha MartisNo ratings yet

- 61 Ways To Get More Exposure For Your MusicDocument17 pages61 Ways To Get More Exposure For Your MusicjanezslovenacNo ratings yet

- Research CaseDocument3 pagesResearch Casenotes.mcpu100% (1)

- Web & Apps PortfolioDocument34 pagesWeb & Apps PortfolioirvingNo ratings yet

- The Self in Western and Eastern ThoughtDocument15 pagesThe Self in Western and Eastern ThoughtJOHN REY CANTE BUFA100% (1)

- Strategic Human Resources Management: What Are Strategies?Document11 pagesStrategic Human Resources Management: What Are Strategies?fabyunaaaNo ratings yet

- Business Plan Highlights for Salon Beauty VenusDocument20 pagesBusiness Plan Highlights for Salon Beauty VenusEzike Tobe ChriszNo ratings yet

- Introducing Bill Evans: Nat HentoffDocument2 pagesIntroducing Bill Evans: Nat HentoffSeda BalcıNo ratings yet

- THE Teacher and The School: Learning Guide 2Document46 pagesTHE Teacher and The School: Learning Guide 2Vince Jorey VillarNo ratings yet

- RVUN's Role in Power Generation in RajasthanDocument126 pagesRVUN's Role in Power Generation in Rajasthanvenka07No ratings yet