Professional Documents

Culture Documents

KHP - One Pager - Edge - 05112018-2-1

Uploaded by

Ashok JhamerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KHP - One Pager - Edge - 05112018-2-1

Uploaded by

Ashok JhamerCopyright:

Available Formats

Kotak Health Premier General Insurance

Plan: Edge^

The fast paced world we live in and the constant race against time, we generally tend to overlook our health. With our comprehensive health insurance policy , we not

only secure your health but also reward you for your healthy behavior. Now you can earn reward points for being fit & healthy and redeem these points against various

health related services (For more details on terms of redemption please refer to the policy wordings which are available on the website of the company).

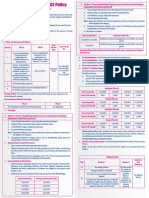

Plan Highlights

Health and Rewards Restoration Benefit No Reduction in Cumulative Bonus# Zone based pricing Annual Health Check-up Value Added benefits

Plan USP’s

Ÿ Cover for 405 Day Care Treatments.

Ÿ Restoration of 100% of Base Sum Insured:

Ÿ In case if Sum Insured gets insufficient for future unrelated illness.

Ÿ Immediate restoration in case of accident related claims.

Ÿ Cataract-Upto 10% of base Sum Insured & max of `1,00,000 per eye per policy period.

Ÿ Value added benefits like doctor's appointment, Online pharmacy, diagnostic tests and other health/wellness offering etc.

Ÿ Ambulance charges per policy basis.

Ÿ Second E-opinion is available.

Ÿ Wide Range of optional covers to opt from like Compassionate Visit, Air Ambulance, Critical Illness etc.

Plan Details

1 In-patient Treatment Upto Base Sum Insured

2 Day Care Treatment 405 Named Day-care Surgeries & Procedures

Pre-Hospitalization Medical Expenses 60 days

3

Post-Hospitalization Medical Expenses 90 days

4 Ambulance Cover Upto ` 20000 per year

5 Organ Donor Cover Upto Base Sum Insured

6 Alternative Treatment Upto Base Sum Insured

7 Domiciliary Hospitalisation Upto Base Sum Insured

8 Annual Health Check-up For each Insured Person above 18 years of Age, each Policy Year for specified tests

9 Restoration Benefit Additional Sum Insured equivalent to Base Sum Insured

10 Cumulative Bonus# 10% of the Base Sum Insured, upto a maximum of 100% for each claim free year,

No reduction in case of claim

11 Second E-Opinion Cover Available

12 Health and Rewards Available

13 Value Added Benefits Available

14 Hospital Daily Cash `1000 per day for minimum 3 days of hospitalization subject to maximum of 10 days

15 Convalescence Benefit `15,000 (minimum hospitalisation of 10 days)

16 Home Nursing Benefit Upto `3,000 per day for a maximum of 15 days after completion of number of days under post

hospitalisation cover for the medical services of a nurse at your residence.

17 Daily Cash for Accompanying an `1000 per day for minimum 3 days of hospitalization subject to maximum of 10 days

Insured Child

18 Compassionate Visit Optional Cover

Upto `20,000

19 Maternity Benefit* Optional Cover

(with 3 year waiting period) Upto ` 25,000 for Normal and 35,000 Cesarean

20 New Born Baby Cover* Optional Cover

(with 3 year waiting period) Within Maternity Benefit Sum Insured

21 Vaccination Expenses* Optional Cover

(with 3 year waiting period) Upto `5,000

22 Air Ambulance Cover Optional Cover

Upto 10% of Base Sum Insured and subject to a maximum of 5 lacs

23 Critical Illness Cover Optional Cover

(Available for Age 18 years and above) Additional Sum Insured equivalent to Base Sum Insured and subject to a maximum of 10 lacs

24 Personal Accident Cover Optional Cover

Additional Sum Insured equivalent to Base Sum Insured and subject to a maximum of 25 lacs

25 Policy Type Individual and Floater both are available.

26 Waiting period for PED Option to reduce waiting period to 36 months on payment of additional premium

* You need to opt for Maternity Benefit, New Born Baby Cover, Vaccination Expenses together.

Medical Grid-List of Tests Required

Sum Insured 5 / 7.5 Lacs 10 Lacs 15 / 20 Lacs

Age 56 Years & Above 56 Years & Above 56 Years & Above

CBC CBC CBC

ECG Urine Routine Urine Routine

SGPT /SGOT ECG ECG

Serum Creatinine SGPT / SGOT SGPT / SGOT

Serum Cholesterol Serum Creatinine Serum Creatinine

Blood Glucose-Fasting Lipid Profile Lipid Profile

Applicable Medical Examination Report HbA1c HbA1c

Tests TMT 2D Echo

USG Abdomen USG Abdomen

Blood Glucose-Fasting TMT

Medical Examination Report HbsAg

Blood Glucose-Fasting

Medical Examination Report

TSH for females and PSA for Males

Note: For Medical grid pertaining to other Sum Insured please get in touch with the Company’s Representative.

Waiting Period/Exclusions

For a smooth and hassle-free claims experience, it is important to understand the exclusions/waiting period in your policy.

30 Day Waiting Period

This includes any illness contracted or medical expenses incurred within 30 days of commencement of the policy unless due to an accident. This exclusion also doesn’t

apply to the renewal of policy with us or to anyone whose policy has been accepted under the portability benefit.

2 year Waiting Period

This includes medical expenses incurred for certain specified illnesses or conditions like Hernia, Fissures/Fistula, Arthritis, Gout etc. during the first 2 consecutive years

of the commencement of the policy.

Pre-existing Disease Waiting Period

Any Pre-Existing Disease will not be covered until waiting period as per Plan opted for as elapsed.

The waiting period will be reduced by number of continuous preceding years of coverage under existing health insurance policy or as per portability benefit.

Permanent Exclusions

Injury or Illness due to intoxicating drugs, alcohol, mental Illness; intentional self-injury; aesthetic treatment, cosmetic surgery; Experimental, unproven or

non-standard treatment; claim related to criminal acts are permanently excluded under the policy. For a complete list of permanent exclusions, please refer to the policy

wordings which are available on the website of the company.

Kotak Mahindra General Insurance Company Ltd. Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400051. Maharashtra, India. Toll Free No: 1800 266 4545, Email: care@kotak.com,

Website: www.kotakgeneralinsurance.com. CIN: U66000MH2014PLC260291. IRDAI Regn. No 152. Trade logo displayed above belongs to Kotak Mahindra Bank Ltd. and is used under license. The advertisement contains only

an indication of the covers offered. For more details on risk factors, terms, conditions, coverages and exclusions, please read the sales brochure carefully before concluding a sale. ^For other plans offered under Kotak Health Premier,

please get in touch with the company’s representative. *Optional covers are available on payment of additional premium. Advt. ref. no: KGI/18-19/II/P-BC/343. Kotak Health Premier UIN: KOTHLIP19063V021819.

Statutory warning: Section 41 of the Insurance Act, 1938 states (1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of

any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy

accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

(2) Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to `1,000,000/-

You might also like

- Care Senior BrochureDocument4 pagesCare Senior Brochuresatishch27No ratings yet

- L2-Care Global-1Document18 pagesL2-Care Global-1Become CreatorNo ratings yet

- Care Senior LeafletDocument4 pagesCare Senior Leaflet2307pradeepNo ratings yet

- CIGNA TTK PROHEALTH INSURANCE POLICY SUMMARYDocument10 pagesCIGNA TTK PROHEALTH INSURANCE POLICY SUMMARYV MADHUSUDHANNo ratings yet

- Care Freedom For DiabtiesDocument25 pagesCare Freedom For DiabtiesAgile ServicesNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Free Yourself From The Worries of Healthcare.: FreedomDocument8 pagesFree Yourself From The Worries of Healthcare.: Freedomsanjay4u4allNo ratings yet

- Care Freedom (Health Insurance Product) - BrochureDocument8 pagesCare Freedom (Health Insurance Product) - BrochureSunjay NairNo ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- Care Freedom One Pager-1Document2 pagesCare Freedom One Pager-1kkNo ratings yet

- CHI - One Pager - Version 1.3 - September 2021Document1 pageCHI - One Pager - Version 1.3 - September 2021ShihbNo ratings yet

- Bandhan Bank Health Plus Portability 050723Document2 pagesBandhan Bank Health Plus Portability 050723goelrajivgNo ratings yet

- Criticare Brochure SS v10Document2 pagesCriticare Brochure SS v10Phunsukh WangduNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- A Heart Surgery Will Not Stop You From Getting A Health InsuranceDocument8 pagesA Heart Surgery Will Not Stop You From Getting A Health Insurancepriyanka shahNo ratings yet

- PDF Document Icici Midi ClamDocument48 pagesPDF Document Icici Midi Clam3sanjaypatilNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Or Brochure Revision v2Document8 pagesOr Brochure Revision v2arijit mukhkerjeeNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- CHI One PagerDocument1 pageCHI One PagerPOS-ADSR TrackingNo ratings yet

- I-Great Medi Care: Your Hassle-Free Personal Medical CareDocument24 pagesI-Great Medi Care: Your Hassle-Free Personal Medical Carenrlyn_mduNo ratings yet

- Young Star Insurance Policy ParametersDocument1 pageYoung Star Insurance Policy ParametersVivek Sharma100% (1)

- CignaTTK ProHealth Vs Religare CareDocument9 pagesCignaTTK ProHealth Vs Religare Caremaakabhawan26No ratings yet

- CignaTTK ProHealth Vs ICICI Lombard CHIDocument9 pagesCignaTTK ProHealth Vs ICICI Lombard CHImaakabhawan26No ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- New Products Launch by New IndiaDocument52 pagesNew Products Launch by New IndiaNewindia assuranceNo ratings yet

- Sbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessDocument12 pagesSbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessYOGESHNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Healthy You One Pager - 21-04-20Document2 pagesHealthy You One Pager - 21-04-20Anu PriyaNo ratings yet

- "A Plan That Gives Me & My Family... ": No Matter What The Actual Bill IsDocument12 pages"A Plan That Gives Me & My Family... ": No Matter What The Actual Bill IsShashank BisenNo ratings yet

- HFFP-2015 Revised ProspectusDocument25 pagesHFFP-2015 Revised Prospectuspooja singhalNo ratings yet

- YSI One Pager Version 1.0 Feb 21Document2 pagesYSI One Pager Version 1.0 Feb 21Prasad.MNo ratings yet

- (CFP) Coop Family Plan-GuidelinesDocument8 pages(CFP) Coop Family Plan-GuidelinesLLOYD NER GACES BONGALOSNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithursvinciNo ratings yet

- HEALTH INFINITY Plan ONE PagerDocument3 pagesHEALTH INFINITY Plan ONE PagerVikas SharmaNo ratings yet

- Care Supreme Plan Benifit1Document1 pageCare Supreme Plan Benifit1BMD DBMNo ratings yet

- View Maxima Product Deck SlideDocument17 pagesView Maxima Product Deck SlideSandeep MalhotraNo ratings yet

- CignaTTK ProHealth Vs Max Bupa HeartBeatDocument9 pagesCignaTTK ProHealth Vs Max Bupa HeartBeatmaakabhawan26No ratings yet

- AROGYA RAKSHAK-one PagerDocument1 pageAROGYA RAKSHAK-one PagerRaktim PujariNo ratings yet

- Diabetes Safe BrochureDocument3 pagesDiabetes Safe BrochurenitinNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalNo ratings yet

- Specific Disease Plans: Group MembersDocument17 pagesSpecific Disease Plans: Group MembersSheshadri HkNo ratings yet

- FHO - One Pager - Version 1.0 - Oct 2020Document2 pagesFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- FHO One Pager Version 1.0 Oct 2020Document2 pagesFHO One Pager Version 1.0 Oct 2020Darsh TalwadiaNo ratings yet

- Berhampur Division Arogya Rakshak Plan Value Contract DetailsDocument26 pagesBerhampur Division Arogya Rakshak Plan Value Contract DetailsPRALAYA KUMAR NAYAKNo ratings yet

- LIC Health Plus BrochureDocument7 pagesLIC Health Plus Brochureroy_vijayNo ratings yet

- Compare & Buy Health, Life, Motor Insurance Online - RenewBuyDocument8 pagesCompare & Buy Health, Life, Motor Insurance Online - RenewBuyGideon DassNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Protect your family's health with Chola HealthlineDocument3 pagesProtect your family's health with Chola Healthlinearaban datesNo ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- PolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayDocument3 pagesPolicyBazaar Health Insurance - Cover Rs.5 Lac @rs. 10 - DayAshish PatelNo ratings yet

- GSH Zcard Proof2Document2 pagesGSH Zcard Proof2RyanNo ratings yet

- 20190719164557Document5 pages20190719164557Shailendra Singh ChouhanNo ratings yet

- Walks With You Throughout Your Life's Journey.: MedicalDocument16 pagesWalks With You Throughout Your Life's Journey.: MedicalYap Wen GieNo ratings yet

- Textbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersFrom EverandTextbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersNo ratings yet

- 360 Degree Postural Medicine and Diabetes Type 1 & 2From Everand360 Degree Postural Medicine and Diabetes Type 1 & 2No ratings yet

- Vision - Guardian Benefit Summary - VWG - 7.26.22Document5 pagesVision - Guardian Benefit Summary - VWG - 7.26.22Shiendra HalipaNo ratings yet

- Missing Middle Extending Health Insurance Coverage in IndiaDocument11 pagesMissing Middle Extending Health Insurance Coverage in IndiaIJRASETPublicationsNo ratings yet

- Insurance Claim DocsDocument4 pagesInsurance Claim Docshai nguyenNo ratings yet

- Financing Health ServicesDocument16 pagesFinancing Health ServicesMahdi SwaidanNo ratings yet

- Waiver Sss DanoDocument1 pageWaiver Sss Danotwentyseve100% (1)

- PFP T5Document7 pagesPFP T5JennieNo ratings yet

- UntitledDocument2 pagesUntitledSarah Jane UsopNo ratings yet

- Care Classic Vs Star FHODocument13 pagesCare Classic Vs Star FHOUmangtarangNo ratings yet

- Broschuere Sie Fragen Wir Antworten eDocument17 pagesBroschuere Sie Fragen Wir Antworten epkanduri.altNo ratings yet

- How to claim a medical refund under nascareDocument2 pagesHow to claim a medical refund under nascareBrian Matu PessieNo ratings yet

- Basics of Medical Billing: TrainingDocument11 pagesBasics of Medical Billing: TrainingmairyuNo ratings yet

- Allen Et Al 2017 - Barriers To Care and Health Care UtilizationDocument8 pagesAllen Et Al 2017 - Barriers To Care and Health Care UtilizationtrisnaNo ratings yet

- COVID 19 Uninsured Group FlyerDocument1 pageCOVID 19 Uninsured Group FlyerAmanNo ratings yet

- Magma Claim FormDocument4 pagesMagma Claim FormAbhinav JaganaNo ratings yet

- Case Digest Philippine Health Insurance Corporation vs. Urdaneta Sacred Hearth Hospital FactsDocument2 pagesCase Digest Philippine Health Insurance Corporation vs. Urdaneta Sacred Hearth Hospital FactsmarvinNo ratings yet

- Information For International Students: WWW - Immigration-Quebec - Gouv.qc - Ca WWW - Cic.gc - CaDocument1 pageInformation For International Students: WWW - Immigration-Quebec - Gouv.qc - Ca WWW - Cic.gc - CaAlessandro VelascoNo ratings yet

- UB04 Instruction GuideDocument14 pagesUB04 Instruction GuideDragana100% (1)

- NCM 104-CHN1Document4 pagesNCM 104-CHN1Kyla VillamorNo ratings yet

- Star Health Insurance Endorsement ChangeDocument2 pagesStar Health Insurance Endorsement ChangesyamprasadNo ratings yet

- Policy Memo 1 1Document6 pagesPolicy Memo 1 1api-488942224No ratings yet

- Test Bank For Understanding Health Insurance 13th Edition by GreenDocument14 pagesTest Bank For Understanding Health Insurance 13th Edition by Greenpatriciajonesewrkbtsnfg100% (14)

- Understanding The Australian Health Care System 3rd Edition Willis Test BankDocument5 pagesUnderstanding The Australian Health Care System 3rd Edition Willis Test BankMichelleReynoldsyqajz95% (19)

- National Fundraising AgenciesDocument9 pagesNational Fundraising AgenciesJomz Arvesu0% (1)

- Quiz 5 - CH 11 & 12Document48 pagesQuiz 5 - CH 11 & 12Sahar HamzehNo ratings yet

- Family Feud ScriptdspDocument9 pagesFamily Feud ScriptdspRazzel Mae PeroteNo ratings yet

- A Good Thesis Statement For Health Care ReformDocument5 pagesA Good Thesis Statement For Health Care Reformfc2b5myj100% (2)

- FDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115Document4 pagesFDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115arjunNo ratings yet

- SBI General Arogya Plus Policy BrochureDocument8 pagesSBI General Arogya Plus Policy Brochureyashmpanchal3330% (1)

- Definition of Insurance Code and TypesDocument2 pagesDefinition of Insurance Code and TypesKoko LaineNo ratings yet

- Instill Health Consciousness Among ThemDocument2 pagesInstill Health Consciousness Among ThemKyleusthéticNo ratings yet