Professional Documents

Culture Documents

09.accenture EU Taxonomy Sustainability Banking

Uploaded by

Muntean SilvanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09.accenture EU Taxonomy Sustainability Banking

Uploaded by

Muntean SilvanaCopyright:

Available Formats

Far from perfect, but a milestone

for sustainable banking

Observations from an analysis of EU banks’

first taxonomy reporting season

Contents Management

summary

3 The beauty of the EU taxonomy for financial institutions This year‘s European Union (EU) reporting

The EU taxonomy is an initial classification of green activities, and comes with a huge appetite for data season was a particularly exciting one in terms

of non-financial information: Article 8 of the

6 Disclosed eligible exposure as a first indicator of green business Sustainable Finance Taxonomy Regulation

Disclosed eligible exposure ranges between 0% and 51.2%, depending on the business model and required that reporting banks, for the first time,

application of the methodology disclose ratios such as taxonomy-eligible

exposure, taxonomy-non-eligible exposure,

8 Reported non-eligible exposure emphasises different interpretations and exposure to entities not subject to the

of EU taxonomy KPIs Non-Financial Reporting Directive (NFRD).

Due to different interpretations of this ratio, the disclosed non-eligible exposure ranges between

3% and 92.7% To gain an understanding of the quantitative

and qualitative information provided by

10 The NFRD obligation of counterparties leads to uncertainty European banks in their sustainability reports

Poor availability of reliable counterparty data leads to the precautionary exclusion of entire portfolios or integrated reports, Accenture analysed the

and SPVs reports of a sample of 30 banks in 10 countries.

Under the currently applicable simplified

12 NACE code mapping is difficult due to insufficient detailed data reporting obligation, the first hurdle on the

NACE codes on the funding purposes of individual transactions are not yet available to most of the way to the Green Asset Ratio (GAR), which must

banks we examined, which led to the prophylactic exclusion of their transactions be published from 2024, had to be overcome.

This report sheds light on how banks have

14 The way forward achieved this.

Banks can position themselves for the long term by taking advantage of the implementation phase

and their initial experiences of reporting to anchor, within their IT and operating models, the constantly

evolving EU taxonomy and upcoming regulations

Far from perfect, but a milestone for sustainable banking 2

The beauty of the EU taxonomy

for financial institutions

The European Union’s taxonomy The ultimate goal is to build a climate-neutral

is an initial classification of green economy within the European Union. The taxonomy

is the basis for far-reaching sustainability regulations

activities, and comes with a huge

that are currently being developed, and which

appetite for data. jointly create the framework for the sustainable

transformation of the European economy.

Standardisation and transparency

The EU taxonomy for sustainable activities is a Notable examples of this include the European Green

classification system for economic activities. As the Bond Standard (EUGBS) and the Sustainable Finance

centrepiece of the European Commission’s 2021 Disclosure Regulation (SFDR), but adjustments are

Renewed Sustainable Finance Strategy, which also being made to existing regulations such as

follows on from the 2018 Action Plan on Sustainable Markets in Financial Instruments Directive II (MiFiD II).

Finance, it primarily provides a uniform and

transparent definition of which greenhouse-gas-

intensive economic activities qualify as green.

It does this by spelling out in detail the quantitative

and qualitative criteria that must be met.

Far from perfect, but a milestone for sustainable banking 3

Set of KPIs Figure 1: A schematic and simplified calculation process for determining the key figures

At the heart of the EU taxonomy stands Article 8, to be published currently, and also the GAR for future publication

in terms of which banks that are required to publish

non-financial information1 under the NFRD (to be GAR-denominator GAR-nominator

replaced by the Corporate Sustainability Reporting

Directive (CSRD)) must report information on the

taxonomy eligibility of their portfolio until the

financial year 20222 and on its taxonomy alignment

from the financial year 2023 onwards, when the

GAR must be reported. Currently, banks are required

to disclose the following seven KPIs in relation to Total

assets 1 2 3 4 Eligible exposure

their total assets3:

a. Taxonomy-eligible activities

b. Taxonomy-non-eligible activities

c. Exposure to undertakings that are not obliged

to NFRD

Determine the Exclusion of Classify into Check the eligibility Alignment check

d. Exposure to derivatives denominator of exposure from specialised and for specialised from FY23 on

e. Exposure to on-demand interbank loans the GAR the nominator general lending lending Three-step process:

Exclude exposure Exclusion of financial Refer to disclosed Exclude the non- 1. Significant

f. Exposure to trading books to central and assets held for GAR of counterparty eligible exposure Contribution

g. Exposure to central governments, central banks regional trading, derivatives, for general lending, based on the 2. Do-No-

and supranationals governments, on-demand interbank proceed to step 4 Annexes 1-6 for Significant-Harm

central banks and loans and exposures for specialised the environmental 3. Minimum

supranational to non-NFRD lending (according goals. Safeguards

When it comes to the calculation of EU taxonomy issuers. obligated to CRR definition).

eligible assets from the above categories, the undertakings.

denominator and nominator are determined step-

by-step. The approach alongside, presented in Source: Accenture illustration

a simplified form, has proven to be effective.

Far from perfect, but a milestone for sustainable banking 4

A view of our sample Need for discussion

It was noticeable right from the start that most of the

These are mostly based on proxies or information

that is not available with legal certainty but which,

banks in our study provided detailed information to in the opinion of the individual banks, better reflect

Accenture conducted a detailed analysis accompany the KPIs. This often went beyond the level their green engagement than the restrictive and

of the first round of disclosures under of qualitative information that is mandatory to disclose. conservative KPIs whose disclosure is mandated.

The great uncertainty that currently surrounds the To ensure the best possible comparability, only

Art. 8 of the Taxonomy Regulation.

regulatory framework and the intended methodology the mandatory reporting was considered for the

Half of the banks we examined felt is also apparent in the fact that half of the banks following chapters.

there is a need to underpin their own surveyed voluntarily published additional KPIs.

reporting in great detail.

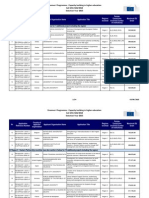

Figure 2: An overview of the banks examined for the Accenture study

Quantitative and qualitative information

Countries of residence Balance sheet totals Mandatory and voluntary disclosure

For the purpose of our analysis we took a close look

3% 3%

at banks’ reporting under Art. 8 of the Taxonomy

10%

Regulation. We used a sample of 30 European banks, 23% 20%

roughly a third of which are German-based with the

others located in Central, Southern and Northern 17% 37%

50% 50%

Europe. Our selection contained a mix of large and

small banks to reflect different business models, 23%

10%

although pure development banks and other special 33%

10% 3%

business models were not considered. The subject of 3%

3%

our investigation was the quantitative and qualitative

information provided by banks in their sustainability DACH AT CH DE < €100M < €1,000M Only mandatory disclosure

reports or integrated reports, in the context of the Nordics DK FI SE < €500M > €1.000M Additional voluntary disclosure

EU taxonomy. A distinction was made between Southern Europe IT ES

mandatory and additional voluntary reporting. Central Europe FR NL

Source: Financial, non-financial and integrated reports published by the surveyed banks

Far from perfect, but a milestone for sustainable banking 5

Disclosed eligible exposure as a first

indicator of green business

Disclosed eligible exposure ranges Conservative approach

between 0% and 51.2%, depending The international comparison shows a general

tendency towards conservative approaches. In

on the business model and application

the German market in particular, most institutions

of the methodology. tend to exclude from the eligibility quota all assets

for which the required data is unavailable with

Wide range of eligible exposure legal certainty. In other words, their approach is

Our sample revealed a range from 0% to 51.2% summarised by the motto: “When in doubt, cut it

disclosed taxonomy-eligible exposure. However, out”. Currently, this mainly concerns information

those ratios are only partially comparable as 67% on the NFRD obligation of non-financial companies,

of banks reported in relation to their total assets, but also includes nomenclature of economic

whereas 33% reported in relation to their total activities (NACE) codes for the specific financing

covered assets. In addition, 30% of the banks opted purpose of an individual transaction. Therefore, the

for a hybrid approach. The popularity of a hybrid eligibility ratio of several German banks currently

approach shows that many banks are already includes only real estate and automobile financing

preparing for future GAR reporting. The very for private households. A particularly conservative

significant variance of KPIs is caused by a multitude approach was chosen by Deutsche Bank, for

of individual factors, most of which relate to varying example, which included only residential real estate

procedures in the determination process. loans for households in its eligibility ratio of 11.79%

and excluded renovation loans and automobile

financing as well as corporate loans in general.4

Far from perfect, but a milestone for sustainable banking 6

International differences Figure 3: Disclosure of taxonomy-eligible exposure of European banks

An international comparison reveals a contrast in by country of domicile

the approaches of Spanish, French, Dutch and Italian

institutions, which tended to be less exclusionary 7 7

and consequently had higher eligibility ratios than 6 6

their German counterparts. One example is

CaixaBank from Spain, which stands out from the 3

sample with a reported eligibility of 47.12%. This rate 1

is comparatively high because, among other reasons,

0-10% 11-20% 21-30% 31-40% 41-50% 51-60%

the bank included all assets that, in its view, would

be eligible for a green bond.5 The French Groupe

AT 1

Number of banks

BPCE reported an eligibility of 46% (in relation to

total covered assets) which includes automobile CH 1

and real estate loans for private households, social DE 6 3 2

housing, and loans to local authorities – and is

therefore much more inclusive.6 DK 1 1

ES 1 2

The Northern European institutions, on the other

FR 2 1 1 1

hand, applied a similarly conservative methodology

to that of their German counterparts by including only IT 1 2

real estate financing for households. Nevertheless, NL 1 2

their ratios turned out to be comparatively high:

Danske Bank, for example, had a ratio of 25% (in SE 1

relation to total covered assets)7, Nordea 32%8 and

Svenska Handelsbanken 39.3%9. Percentage disclosed taxonomy-eligible exposure

Source: Non-financial and integrated reports published by the surveyed banks

Far from perfect, but a milestone for sustainable banking 7

Reported non-eligible exposure

emphasises different interpretations

of EU taxonomy KPIs

Due to different interpretations of Thirdly – and this is rather noteworthy with regard

this ratio, the disclosed non-eligible to the regulatory requirements – this KPI was

interpreted partly as the sum of all individual

exposure ranges between 3%

transactions of the total covered assets that were

and 92.7%. not taxonomy-eligible, and partly as an independent

item in addition to the other KPIs to be reported. In

Underlying references the first case, this ratio was interpreted as a residual

Similar to the eligibility ratio, the disclosure of sum and therefore includes exposure to undertakings

taxonomy-non-eligible activities shows extreme that are not obliged to NFRD, derivatives, on-demand

variance, while at the same time making comparisons inter-bank loans and trading books. In the second

more difficult. The disclosed ratios vary between case, the KPI contains only exposures which,

3% and 92.7% which, as with the eligibility ratio, is according to the determination process, cannot

due to the different underlying reference values be allocated to these other KPIs.

(total assets or total covered assets). Another factor

that contributes to the large variance is the generally

conservative approach in determining the KPI – this

ratio includes transactions that could potentially be

assessed as taxonomy-eligible if the corresponding

data were available.

Far from perfect, but a milestone for sustainable banking 8

Large-scale distortions Figure 4: Disclosure of taxonomy non-eligible exposure

In the forefront of the reporting season, one of the

most hotly debated issues regarding the allocation 6

of the KPIs, besides eligibility and non-eligibility, 5 5

Number of banks

was whether or not they should be treated as sub- 4

KPIs of the non-eligibility ratio in numerators and/or

denominators. The extent of the distortion caused 2 2 2

by varying interpretations of the eligibility ratio and 1 1 1 1

varying degrees of caution approaches is illustrated 0-10% 11-20% 21-30% 31-40% 41-50% 51-60% 61-70% 71-80% 81-90% 91-100% n/a

by the following example10: LBBW interpreted non-

Percentage disclosed taxonomy-eligible exposure

eligibility as an independent KPI and reported a ratio

Source: Non-financial and integrated reports published by the surveyed banks

of 10.7%, whereas Deutsche Bank formed a residual

sum and therefore published a ratio of 88.21%. If one

were to hypothetically calculate LBBW’s other reported Figure 5: Comparison of LBBW’s and Deutsche Bank’s non-eligible ratios using both

KPIs using Deutsche Bank’s residual methodology, the the residual and stand-alone methodologies

non-eligibility rate would be approximately 85.8%.

The variance would therefore be significantly lower 88.21%

85.80%

if banks’ methodologies were to be aligned, and Stand-alone method:

comparability would be much improved. Taxonomy-non-eligible activities

Residual method:

Taxonomy-non-eligible activities

Looking at it the other way round: If one were to

hypothetically apply LBBW’s stand-alone methodology Exposure to central governments,

central banks & supranationals

to Deutsche Bank’s published KPIs, the result would

be a ratio of approximately 21.71%.11 Again, the Exposure to trading book

deviation would be significantly lower due to the Exposure to on-demand inter-bank loans

established comparability and the KPIs would be Exposure to derivatives

21.71%

more meaningful overall. This, in turn, would 10.40% Exposure to undertakings not subject to NRFD

promote one of the overarching goals of the EU LBBW Deutsche Bank

taxonomy: To create transparency in the market. Source: Accenture calculation based on KPIs disclosed in the annual report of LBBW and the non-financial report of Deutsche Bank

Far from perfect, but a milestone for sustainable banking 9

The NFRD obligation of counterparties

leads to uncertainty

Poor availability of reliable counterparty FAQs published in December 2021, which explained

data leads to the precautionary that estimates are not permitted in the context of

mandatory reporting.13

exclusion of entire portfolios and

special-purpose vehicles (SPVs). Internal data as first indication

The other banks took a variety of approaches,

Improved data availability required some of which were combinations. For example,

The banks in our study also took different approaches Landesbank Hessen-Thüringen used information on

to assessing the NFRD obligation of corporate clients. the country of residence and SME-FinRep categories

On the one hand, this information is needed to for its assessment.14 One-third of the banks analysed,

determine the exposure to undertakings not subject including Crédit Agricole15 and Erste Group16,

to NFRD; on the other, the given NFRD obligation of conducted their own research using unspecified

a counterparty is also one of several prerequisites internal data and in some cases also reached out to

for an individual transaction to be included in the their customers for verification.

eligibility quota. This year, however, it was not yet

possible to fall back on this information due to the Content-wise eligible business with SPVs

first-time publication which created a severe time UBS is another bank that opted for an individual

gap.12 This resulted in the observed trend to approach, but also one that is more assertive: It

generally exclude companies from the taxonomy- assumed “that all corporate counterparties domiciled

eligible exposure due to a lack of verifiability, which in the EU meet the size criteria to be within the scope

37% of the analysed banks did. The trend towards of the NFRD”17. This created the conditions for

exclusion was reinforced by the EU Commission’s including business with SPVs. These transactions,

Far from perfect, but a milestone for sustainable banking 10

which are often taxonomy-eligible in terms of Figure 6: Overview of the selected

content and may also be aligned in the future, must approaches for determining a possible

unfortunately be excluded if the NFRD obligation NFRD obligation of the counterparty

is interpreted narrowly. This is particularly unfortunate

because this legal form is often used for companies

whose purpose is, for example, the construction of

23%

wind farms. This is why Société Générale included

SPV exposure within its eligibility ratio, as the NACE

37%

code was qualified for eligibility18. DekaBank also

emphasised this issue by pointing out that “their

purpose would be classified as taxonomy-eligible 3%

and they have their registered office in the

European Union”19.

Generally defensive approaches 3%

For all the differences in individual approaches, 33%

one thing was common to most banks: When in

doubt, they decided to classify counterparties as not Generally denied

subject to the NFRD. This conservativism regarding Orientation on FinRep categories

the NFRD obligation of counterparties could change Use of internal data

slightly as soon as the next reporting period, because Categorization of all EU companies as NFRD-obliged

the required information should be more available No further explanation

by then. One of the most relevant next steps –

especially for institutions with traditionally large Source: Non-financial and integrated reports published by the

surveyed banks

exposure to SMEs – will therefore be to generate

reliable information on the NFRD obligation of their

corporate clients to correctly include them in their

own quotas. Until then, the procedures might

continue to vary greatly.

Far from perfect, but a milestone for sustainable banking 11

NACE code mapping is difficult

due to insufficient detailed data

NACE codes on the funding Missing information on activity level

purposes of individual transactions When scanning the portfolio by means of the NACE

methodology, data gaps are the main obstacle,

are not yet available to most of

according to most of the banks. The EU taxonomy

the banks examined, which led to requires a classification according to the financing

the prophylactic exclusion of purposes, but NACE codes are usually only available

transactions. at the level of the business partner’s sector of activity.

In line with this, 17% of the banks evaluated opted

Determining economic activities for the most conservative approach possible and

Once the counterparty’s NFRD obligation has been generally denied the eligibility of the individual

approved, the next step in the process of determining transactions in question.

the eligibility ratio is to identify the financing

purposes of the individual specialized transactions.

The EU taxonomy is mainly based on the NACE

methodology, in which a comparison can be made

with the economic activities covered in the Annexes

of the Taxonomy Regulation.

Far from perfect, but a milestone for sustainable banking 12

Figure 7: Overview of the selected NACE codes of counterparty sector as If the existing NACE code were now used for the

approaches for identifying and matching first indication assessment in the context of the EU taxonomy, the

NACE codes at the level of individual In contrast, 27% of the analysed banks, including individual transaction would have to be assessed as

economic activity Société Générale20 and Monte dei Paschi di Siena21, taxonomy-non-eligible, although de facto it would

opted to use the counterparty-sector NACE codes be – and could possibly also prove to be – taxonomy-

as an initial indication of the possible taxonomy aligned. This would have a positive effect on the GAR

17% eligibility of a transaction. In future, to comply with to be reported in the future.

the methodology of the regulation, these will have

30%

to be replaced by the systematic recording of NACE As with the assessment step for the NFRD obligation,

codes on the financing purposes level. This can be the uncertainty surrounding data related to NACE

easily illustrated: A suitable example is the financing codes in most instances leads to a conservative

of a wind farm (NACE D35.11, EU taxonomy activity approach such as the exclusion of entire portfolios.

4.322) for an energy supplier subject to NFRD, which

27%

also manufactures fossil gas as its primary activity

(NACE D35.21, EU taxonomy activity 4.1323) according

13%

to the NACE code stored in the system.

3%

10%

Generally denied

Use of pre-existing NACE code for the counterparty sector

Alignment with activities without NACE codes

Consideration of real estate financing exclusively

Consideration of real estate financing for households exclusively

No further explanation

Source: Non-financial and integrated reports published by the

surveyed banks

Far from perfect, but a milestone for sustainable banking 13

The way forward

Banks can position themselves for the the reporting for financial year 2023, which requires

long term by taking advantage of the the next and final steps in the implementation of the

EU taxonomy (according to current understanding).

implementation phase and their initial

experiences of reporting to anchor, Sustainability is not a status one strives to reach;

within their IT and operating models, it is an agile process we need to adhere to and a

the constantly evolving EU taxonomy mindset we aim to adopt. This is reflected within

and upcoming regulations. the EU taxonomy: The first review of the set-out

guidelines (including technical screening criteria) is

scheduled to be finalised by June 2024. Points that

First step of a long journey are already known today are the extent to which

The importance and relevance of the EU taxonomy in exposure to central banks and central governments,

helping financial institutions to tackle the substantial as well as exposure to SMEs that are not subject to

challenges ahead of them is clear. According to the NFRD, can be integrated into the denominator of the

regulations, these institutions can benefit from an ratios24. The revision of the NFRD towards the new

introductory phase until other institutions and the CSRD and its translation into national law will bring

industry provide their taxonomy-relevant information additional momentum to reporting under Art. 8 of

as well. All six of the environmental goals have now the Taxonomy Regulation. Some banks, such as

been published, are in force, and with effect from Commerzbank, are already looking ahead and

financial year 2022 need to be reflected together anticipating the upcoming requirements25.

with all technical screening criteria. The final step

of banks publishing the GAR comes into force with

Far from perfect, but a milestone for sustainable banking 14

For financial institutions, this results in an ongoing Secondly, financial institutions must create sufficient

review of the latest eligibility criteria and alignment capacity to process the large volumes of data – which

with their existing portfolio, as well as rules for new are expected to increase along with the reporting

business. Consequently, the implementation needs obligations and individual use cases. In addition,

to be flexible enough to cover this “agile” regulation. because the structure of the data is new, they will

need to ensure that the processing of the new data

Data management is a fundamental enabler volumes is both flexible and scalable. Thirdly, a huge

The data requirements of taxonomy reporting and increase in flexibility is required in the way data is

also, more generally, of the quantification of connected. Depending on the completeness and

environmental, social and governance (ESG) availability of the required data, the data household

ambitions are characterised particularly by the must ensure stringent standardisation and

necessary granularity. This imposes very special harmonisation. This will allow the new data to be

demands on data management, which must now linked in a meaningful way, and also the added value

be established with speed and precision in order of integrating own, client-side and externally

to satisfy the massive hunger which sustainability purchased data to be realised.

regulation has for data. Three core aspects in

particular must be taken into account. Firstly,

the data household must be able to adapt with

great speed, because the regulatory target image

and the data structure that depends on it must

currently be understood as a “moving target”. The

emerging data household must have the ability to

react swiftly, consistently and from the outset to

changes in regulation, enabling timely modification

of the data architecture and data model.

Far from perfect, but a milestone for sustainable banking 15

Key learnings from the first reports They will therefore probably be asked to work with Currently limited usefulness as a steering

The fastest possible improvement in the quality their clients to set up a process for data exchange, parameter

of the key figures which must be reported can be which will ensure continuous access to more granular The informative value of the current ratios has

achieved through a massive improvement in the and higher quality source data. In combination with potential for improvement; this was acknowledged

quality of the source data. In the process, financial the announced revision of the regulatory framework by most of the banks in our study in their qualitative

institutions should also consider the availability and (see above), the taxonomy KPIs will then also be disclosures. It becomes clear that the eligibility

quality of data relating to both business partners and more comparable in the long term. ratio, and thus also the GAR in perspective, are not

individual transactions. This requires finding the suitable as (central) sustainability KPIs in their

right balance between standardisation and individual Due to the exclusion of counterparties not subject current form. Therefore, most banks stated that they

cooperation models which might be developed into to NFRD, there is currently a bias in the regulatory consider and apply the EU taxonomy as a tool in

ecosystems over time. For the former, which is framework towards banks that have a high proportion their sustainability management toolkit, but

addressed by the regulation on the “single EU access of exposure to SMEs or non-EU clients according to currently not as a leading framework.

point for company information”26, a database of their business model.27 It is clear that the taxonomy

companies’ financial and non-financial information is KPIs will only enjoy a high level of credibility if they The current design tends to incentivise more

already in the process of being developed. According adequately and realistically reflect a bank’s green earmarked business with large corporates. Optimally,

to current understanding, this will primarily be able exposure, which they currently do not do due to the green business in greenhouse-gas-intensive sectors

to eliminate uncertainty regarding the non-financial limitations described above. would be preferred as this would contribute to a

reporting obligations of European business partners. certain extent to the sustainable transformation of

For the latter, however, banks are dependent on the European economy. However, given the exclusion

the data provided by their customers. of SMEs, it would not be holistically conceived and

would therefore be limited in its impact.

Far from perfect, but a milestone for sustainable banking 16

A glimpse into the future

The EU taxonomy defines what is dark green and It would therefore make sense to temporarily

what is not, while also partly considering enabling provide additional information with the help of

and transitional activities. This primarily binary one’s own methods that do a better job of reflecting

approach (green or not green) currently specifically one’s own business model and impact than the

excludes light green and brown assets as not EU taxonomy currently does. An example of this

eligible. In view of the overriding goal of the is KfW’s environmental quota, which indicates the

exercise – the transformation of the real economy, share of annual new commitments in the promotional

which is to be financed by banks – this information business that contributes to the “environmental

is also part of the complete picture of every bank’s dimension of sustainability”30 and thus addresses the

transformational performance. Corresponding megatrend “climate change and the environment”31.

regulatory measures are currently being discussed, It is essential to ensure that the targets and metrics

such as the social taxonomy28 or a non-significant- are ambitious and scientifically sound to mitigate

impact taxonomy29. green- or transition-washing.

Far from perfect, but a milestone for sustainable banking 17

References

1

See Art. 19a, 29a of Non-Financial Reporting Directive 12

Since the EU Commission has recognised the problem of time 24

See Art. 9 (1a, b) of the Delegated Act to Art. 8 (EU)2020/852

2013/34/EU (NFRD). gaps, the regulatory system addresses this for the reporting Taxonomy Regulation.

2

In addition, qualitative information has to be provided in of the GAR. Hence, NFRD-obligated non-financial undertakings 25

See Non-financial Report of Commerzbank, p. 47

accordance with Annex XI to the Disclosures Delegated Act are already obliged to report their taxonomy alignment for the

financial year 2022. These KPIs can therefore be most likely

26

See this overview on the current plans for the single EU access

on Art. 8 of the Sustainable Finance Taxonomy Regulation. point for company information to foster financial transparency.

relied upon by the banks when they publish the GAR for the

3

See Art. 10 (3, 3a, 3b, 3c) of the Disclosures Delegated Act first time for the financial year 2023. 27

This could also have a positive impact on the KPIs of

to Art. 8 (EU)2020/852 Taxonomy Regulation. promotional banks in particular.

13

See Question 12, FAQs part 1 of the Disclosures Delegated Act

4

See Non-financial Report of Deutsche Bank, p. 19 f. under Article 8 of EU Taxonomy Regulation, p. 10. 28

See the Final Report on Social Taxonomy from the EU Platform

5

See Integrated Report of CaixaBank, p. 276 f. 14

See Integrated Report of Landesbank Hessen-Thüringen, p. 83. on Sustainable Finance.

6

See Integrated Report of Groupe BPCE, p. 49. 15

See Integrated Report of Crédit Agricole, p. 111.

29

See the Public Consultation Report on Taxonomy extension

7

See Non-financial Report of Danske Bank, p. 44. options linked to environmental objects from the EU Platform

16

See Non-financial Report of Erste Group, p. 71. on Sustainable Finance, p. 34 f.

8

See Integrated Report of Nordea, p. 91 f. 17

See Sustainability Report of UBS, p. 168. 30

See Sustainability Report of KfW, p. 67.

9

See Sustainability Report of Svenska Handelsbanken, p. 71 f. 18

See Financial Report of Société Générale, p. 296. 31

See Sustainability Report of KfW, p. 67.

10

The banks compared here, LBBW and Deutsche Bank, 19

See Sustainability Report of Deka, p. 75.

were selected because their methodologies for calculating

their eligibility-ratios are the most comparable within the

20

See Financial Report of Société Générale, p. 296.

sample analysed and not because of their business models 21

See Non-financial Report of Monte Dei Paschi Di Siena, p. 110 f.

or other criteria. 22

Economic activities performed under this Activity No. and

11

With regard to the calculation of the GAR from 2024 onwards, NACE Code may only be taxonomy-eligible if they specifically

the application of the residual method would result in a and solely include electricity generation from wind power;

methodological inconsistency. As applied here, it also includes see the EU Taxonomy Compass.

the exposure to central governments, central banks and 23

Economic activities performed under this Activity No. and NACE

supranationals. However, according to the regulations, this Code may only be taxonomy-eligible if they specifically and

exposure is to be excluded from the total covered assets (or solely include the manufacture of biogas and biofuels for use in

also total GAR assets, as they are named in Annex VI of the transport and of bioliquids; see the EU Taxonomy Compass.

Delegated Act to Art. 8 (EU)2020/852 Taxonomy Regulation)

and thus from the denominator of the GAR.

Far from perfect, but a milestone for sustainable banking 18

Authors Sample banks and their reports About Accenture

Friederike Stradtmann The selection of banks for this sample was based on Accenture is a global professional services company

Managing Director total assets in a European comparison for the purpose with leading capabilities in digital, cloud and security.

Sustainable Banking Lead DACH of representativeness. For the German banks in Combining unmatched experience and specialized

particular, different business models were included. skills across more than 40 industries, we offer Strategy

and Consulting, Technology and Operations services

ABN Amro Erste Group and Accenture Song—all powered by the world’s

Jürgen Hagedorn BBVA Groupe BPCE largest network of Advanced Technology and Intelligent

Sustainable Banking Operations centers. Our 710,000 people deliver on

Banca Monte dei Paschi Hamburg Commercial

di Siena (Italian only) Bank the promise of technology and human ingenuity

every day, serving clients in more than 120 countries.

Banco Santander ING Group

We embrace the power of change to create value and

Bayerische Landesbank Intesa Sanpaolo shared success for our clients, people, shareholders,

Sophie-Therese Rieke BNP Paribas La Banque Postale partners and communities. Visit us at accenture.com.

Sustainable Banking (French only)

CaixaBank

Landesbank Berlin

Commerzbank

(German only)

Crédit Agricole

Landesbank Hessen-

Danske Bank Thüringen (German only)

DekaBank LBBW

Contributors

Deutsche Apotheker- Nordea

und Ärztebank This document is intended for general informational purposes only and

Felix Rossmann Rabobank

(German only) does not take into account the reader’s specific circumstances, and may

Dr. Christopher Hols Société Générale not reflect the most current developments. Accenture disclaims, to the

Deutsche Bank fullest extent permitted by applicable law, any and all liability for the

accuracy and completeness of the information in this presentation and for

Svenska Handelsbanken

Deutsche any acts or omissions made based on such information. Accenture does

not provide legal, regulatory, audit or tax advice. Readers are responsible

Pfandbriefbank UBS for obtaining such advice from their own legal counsel or other licensed

professionals. This document makes descriptive reference to trademarks

DZ Bank UniCredit Group that may be owned by others. The use of such trademarks herein is not an

assertion of ownership of such trademarks by Accenture and is not intended

Copyright © 2022 Accenture. All rights reserved. to represent or imply the existence of an association between Accenture

Accenture and its logo are registered trademarks of Accenture. and the lawful owners of such trademark.

You might also like

- Triodos Bank Eu Taxonomy Reporting Methodology Fy2022Document12 pagesTriodos Bank Eu Taxonomy Reporting Methodology Fy2022RaghunathNo ratings yet

- EY Insights On 2020 Expected Credit Losses: A Benchmark Across European BanksDocument35 pagesEY Insights On 2020 Expected Credit Losses: A Benchmark Across European BanksAsghar AliNo ratings yet

- En ANGELINI 15 Novembre 2022Document16 pagesEn ANGELINI 15 Novembre 2022MicheleNo ratings yet

- 36-Enablon & WK - IB - What To Expect Under The New Corporate Sustainability Reporting Directive - 2022Document6 pages36-Enablon & WK - IB - What To Expect Under The New Corporate Sustainability Reporting Directive - 2022huss fuzzNo ratings yet

- Business Responsibility and Sustainability Reporting by Listed EntitiesDocument10 pagesBusiness Responsibility and Sustainability Reporting by Listed EntitiesMohammad AamirNo ratings yet

- Enhancing Financial Reporting Disclosures by UK Credit InstitutionsDocument64 pagesEnhancing Financial Reporting Disclosures by UK Credit InstitutionsjariouNo ratings yet

- Capital FlowsDocument56 pagesCapital FlowsNancy MaribelNo ratings yet

- In The Loop - Make No Mistake Global ESG Regulations Will Impact US CompaniesDocument5 pagesIn The Loop - Make No Mistake Global ESG Regulations Will Impact US CompaniesAnthony ChanNo ratings yet

- IMF Role in SDRDocument60 pagesIMF Role in SDREmiliaNo ratings yet

- A Business Case For Environment & Society: The GRI PerspectiveDocument4 pagesA Business Case For Environment & Society: The GRI PerspectiveYi-liang ChenNo ratings yet

- European Systemic Risk Board, Report On Commercial Real Estate and Financial Stability in The EU, December 2015Document77 pagesEuropean Systemic Risk Board, Report On Commercial Real Estate and Financial Stability in The EU, December 2015hulei1114No ratings yet

- The EU Taxonomy Puzzle - Key Insights For BanksDocument14 pagesThe EU Taxonomy Puzzle - Key Insights For BanksappleNo ratings yet

- Principal Adverse Impacts ReportingDocument19 pagesPrincipal Adverse Impacts ReportingDenzCruzNo ratings yet

- CFO-Forum MCEV Basis For Conclusions April 2016Document40 pagesCFO-Forum MCEV Basis For Conclusions April 2016apluNo ratings yet

- IFRS 4 Phase II and Solvency IIDocument8 pagesIFRS 4 Phase II and Solvency IIAidellediANo ratings yet

- The Ripple Effect of EU Disclosures Regulation in Financial Services SectorDocument7 pagesThe Ripple Effect of EU Disclosures Regulation in Financial Services SectorBOHR International Journal of Business Ethics and Corporate GovernanceNo ratings yet

- NT - Thematic Review 2022 - May 2022Document2 pagesNT - Thematic Review 2022 - May 2022mccloudtanNo ratings yet

- Pra Decision Notice CitigroupDocument44 pagesPra Decision Notice CitigroupBokulNo ratings yet

- Credit Delivery and Financial Inclusion: AadhaarDocument7 pagesCredit Delivery and Financial Inclusion: Aadhaarbose3508No ratings yet

- UNJSPF Report March8Document53 pagesUNJSPF Report March8nur ainiNo ratings yet

- Abbl Brochure Capital Markets UnionDocument20 pagesAbbl Brochure Capital Markets Unionpfakas1977No ratings yet

- FCA cp19-32Document95 pagesFCA cp19-32MA ONo ratings yet

- Ecb Op292 092b778aa8 enDocument25 pagesEcb Op292 092b778aa8 enShweta AgarwalNo ratings yet

- Covid ImpactDocument43 pagesCovid Impactmichaele gobezieNo ratings yet

- Bank of Englands Approach To Assessing Resolvability PsDocument92 pagesBank of Englands Approach To Assessing Resolvability PsTarun AhujaNo ratings yet

- The COVID-19 Crisis and Banking System Resilience: Simulation of Losses On Non-Performing Loans and Policy ImplicationsDocument52 pagesThe COVID-19 Crisis and Banking System Resilience: Simulation of Losses On Non-Performing Loans and Policy ImplicationsFungsional PenilaiNo ratings yet

- FaC ProjectDocument20 pagesFaC ProjectPaula RamosNo ratings yet

- EnochDocument20 pagesEnochSmbb Gghss MirpurkhasNo ratings yet

- Sustainable Finance Faqs: Esg, Climate Regulation and DisclosureDocument22 pagesSustainable Finance Faqs: Esg, Climate Regulation and DisclosureFrancesco CistarillNo ratings yet

- SRB Operational Guidance For Fmi Contingency PlansDocument28 pagesSRB Operational Guidance For Fmi Contingency Plansrendy sitinjakNo ratings yet

- Overview of The Greek Financial System: January 2017 B GDocument53 pagesOverview of The Greek Financial System: January 2017 B GVenture ConsultancyNo ratings yet

- June 23 - Fighting ML & TFDocument6 pagesJune 23 - Fighting ML & TFcyberflame2kNo ratings yet

- Full Disclosure 2021-3 - Reform of The EU Non-Financial Reporting DirectiveDocument5 pagesFull Disclosure 2021-3 - Reform of The EU Non-Financial Reporting DirectiveBaiq AuliaNo ratings yet

- Romania Country Strategy: Approved by The Board of Directors On 23 April 2020Document25 pagesRomania Country Strategy: Approved by The Board of Directors On 23 April 2020Henry DubonNo ratings yet

- Basel Committee On Banking Supervision: Capitalisation of Bank Exposures To Central CounterpartiesDocument26 pagesBasel Committee On Banking Supervision: Capitalisation of Bank Exposures To Central CounterpartiesChandan KumarNo ratings yet

- Co-Chairs' Summary Note For The CPSS-IOSCO Principles For FinancialDocument8 pagesCo-Chairs' Summary Note For The CPSS-IOSCO Principles For FinancialMarketsWikiNo ratings yet

- RAPORT FSB Privind Intermedierea NebancaraDocument89 pagesRAPORT FSB Privind Intermedierea NebancaraAlex JrrNo ratings yet

- EBA Action Plan On Sustainable FinanceDocument22 pagesEBA Action Plan On Sustainable FinanceKrit YodpraditNo ratings yet

- Alternative Investment 2020Document42 pagesAlternative Investment 2020David Sandoval Flores100% (1)

- Ey Enterprise ResilienceDocument20 pagesEy Enterprise ResilienceDwdroo DiwokNo ratings yet

- Perspectives On The Indian BankingDocument9 pagesPerspectives On The Indian BankingSahil KumarNo ratings yet

- Policy Trends in Environmental Due DiligenceDocument6 pagesPolicy Trends in Environmental Due DiligenceAdel EdjarNo ratings yet

- Uc Integrato 2021 EngDocument192 pagesUc Integrato 2021 EngPataki PéterNo ratings yet

- A Roadmap Towards Mandatory Climate Related DisclosuresDocument14 pagesA Roadmap Towards Mandatory Climate Related DisclosuresComunicarSe-ArchivoNo ratings yet

- DTTL Fsi Uk Fs Future Bank Treasury Management PDFDocument16 pagesDTTL Fsi Uk Fs Future Bank Treasury Management PDFRakshana SrikanthNo ratings yet

- iGAAP in Focus - IFRS S1 IFRS S2Document14 pagesiGAAP in Focus - IFRS S1 IFRS S2Josué MartínezNo ratings yet

- Moscariello Etal 2014Document21 pagesMoscariello Etal 2014Jenn AtidaNo ratings yet

- EU Taxonomy in 2023 8 Steps To Compliance WHITEPAPER 6 PDFDocument24 pagesEU Taxonomy in 2023 8 Steps To Compliance WHITEPAPER 6 PDFDavid LloretNo ratings yet

- The Evolution of Central Bank Monetary PolicyDocument27 pagesThe Evolution of Central Bank Monetary PolicyRaju KaliperumalNo ratings yet

- CFAS Chapter 2 Problem 4Document1 pageCFAS Chapter 2 Problem 4jelou ubagNo ratings yet

- MAB Article 75536 en 1Document15 pagesMAB Article 75536 en 1Siddhartha SharmaNo ratings yet

- Business Continuity Plan and Disaster Management in BanksDocument5 pagesBusiness Continuity Plan and Disaster Management in BanksVenkatesh MudgerikarNo ratings yet

- Risk Assessment Model For Assessing NBFCsAsset FiDocument11 pagesRisk Assessment Model For Assessing NBFCsAsset FiNishit RelanNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- Regional Growth Plan: Essex CountyDocument7 pagesRegional Growth Plan: Essex Countyinfo5946No ratings yet

- The Impact of COVID-19 On Financial Statements ResDocument11 pagesThe Impact of COVID-19 On Financial Statements Reswadzanai chambaraNo ratings yet

- Fostering Regional Cooperation and Integration for Recovery and Resilience: Guidance NoteFrom EverandFostering Regional Cooperation and Integration for Recovery and Resilience: Guidance NoteNo ratings yet

- IFRS News Supplement Oct06Document6 pagesIFRS News Supplement Oct06georgepNo ratings yet

- Second Quarter 2021 Results: Credit SuisseDocument38 pagesSecond Quarter 2021 Results: Credit SuisseVu HoangNo ratings yet

- en 20211110Document39 pagesen 20211110chaky212100% (1)

- Integrated Management Systems Manual enDocument26 pagesIntegrated Management Systems Manual enasdNo ratings yet

- Defense Planning Guidance 1992Document12 pagesDefense Planning Guidance 1992Jim1302No ratings yet

- Guidance: On Due Diligence For Eu Businesses To Address The Risk of Forced Labour in Their Operations and Supply ChainsDocument14 pagesGuidance: On Due Diligence For Eu Businesses To Address The Risk of Forced Labour in Their Operations and Supply ChainsComunicarSe-ArchivoNo ratings yet

- Road To 2040 07 - 2021Document23 pagesRoad To 2040 07 - 2021erioNo ratings yet

- Curriculum Vitae From Ricardo Abreu (EN)Document7 pagesCurriculum Vitae From Ricardo Abreu (EN)Ricardo AbreuNo ratings yet

- Chapter 7 PDFDocument50 pagesChapter 7 PDFjosesajayNo ratings yet

- Klasiranje Sampinjona - Standardi EUDocument5 pagesKlasiranje Sampinjona - Standardi EUDalibor MudricNo ratings yet

- SJ Salomon International - Lagarde Predicts Recovery For Europe Late 2021Document2 pagesSJ Salomon International - Lagarde Predicts Recovery For Europe Late 2021PR.comNo ratings yet

- Motivation Letter - Master Mind ScholarshipDocument2 pagesMotivation Letter - Master Mind Scholarshipllord6235No ratings yet

- Child Safety Regulations StandardsDocument52 pagesChild Safety Regulations StandardstealfrontNo ratings yet

- EURObiz 10th Issue Sept OctoDocument60 pagesEURObiz 10th Issue Sept Octoperico1962No ratings yet

- Goverscience Seminar On Inclusive Risk GovernanceDocument44 pagesGoverscience Seminar On Inclusive Risk GovernancedmaproiectNo ratings yet

- EIS2017 Main ReportDocument100 pagesEIS2017 Main Reportdinu_adercaNo ratings yet

- AR2003Document276 pagesAR2003Cvijet IslamaNo ratings yet

- Written Questions Answers Statements Daily Report Commons 2017 04 26Document130 pagesWritten Questions Answers Statements Daily Report Commons 2017 04 26yasmen bazNo ratings yet

- Eplus - Call EAC - A04 - 2014 Selection Year 2015Document14 pagesEplus - Call EAC - A04 - 2014 Selection Year 2015simonamemetNo ratings yet

- New Regulation 10-2011-EC Plastic Materials and Articles in Contact With FoodDocument89 pagesNew Regulation 10-2011-EC Plastic Materials and Articles in Contact With Foodebarre1No ratings yet

- EN ISO 13857 (2008) (E) CodifiedDocument5 pagesEN ISO 13857 (2008) (E) CodifiedAlcivone Colet0% (1)

- IRU Model Highway InitiativeDocument24 pagesIRU Model Highway InitiativeIRUNo ratings yet

- March2010 32713 PDFDocument80 pagesMarch2010 32713 PDFguardian12No ratings yet

- Smurfit Kappa Sustainable Development Report 2013Document104 pagesSmurfit Kappa Sustainable Development Report 2013edienewsNo ratings yet

- TheEconomist 2023 03 25Document342 pagesTheEconomist 2023 03 25Breno CostaNo ratings yet

- The Translator As Terminologist enDocument23 pagesThe Translator As Terminologist enMariana Musteata100% (1)

- International Cooperation Among NationsDocument32 pagesInternational Cooperation Among NationsAishwarya Murukesan0% (1)

- Economic Survey 2018 Vol 1Document137 pagesEconomic Survey 2018 Vol 1bhargavNo ratings yet

- 1887 3249815-2021 Chapter Verdun in TheEuropeanUnionSStrategicPartDocument348 pages1887 3249815-2021 Chapter Verdun in TheEuropeanUnionSStrategicPartİbrahim TutkunNo ratings yet

- Fsre 2020-21 Online FullDocument500 pagesFsre 2020-21 Online FullstellaNo ratings yet

- QF EheaDocument200 pagesQF Eheajose_dias_58No ratings yet

- La Difference' Is Stark in EU, U.S. Privacy LawsDocument17 pagesLa Difference' Is Stark in EU, U.S. Privacy LawsNicholasFCheongNo ratings yet