Professional Documents

Culture Documents

DA Problems With Answers

Uploaded by

MANOJ KUMAR SHUKLACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DA Problems With Answers

Uploaded by

MANOJ KUMAR SHUKLACopyright:

Available Formats

QAM-III

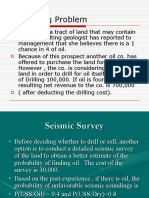

Problem Sheet 3: Decision Analysis

Problem 1. Suppose that you want to invest $10,000 in the stock market by buying shares in one of two companies:

A and B. Shares in Company A are risky but could yield a 50% return on investment during the next year

in a rising market (i.e. ``bull'' market). If the stock market conditions are not favorable i.e,``bear''

market), the stock may lose 20% of its value. Company B provides safe investments with 15% return in a

``bull'' market and only 5% in a ``bear'' market. All the publications you have consulted are predicting a

60% chance for a ``bull'' market and 40% for a ``bear'' market. Where should you invest your money

according to the EMV Criterion? Further, instead of solely relying on the publications, suppose you

have the option to consult your friend who has a great experience of stock market. The friend offers the

general opinion of ``for" or ``against" investment. This opinion is further quantified in the following

manner: If it is a ``bull" market, there is a 90% chance that vote will be ``for". If it is a ``bear" market, the

chance of a ``for" vote is 50%. Construct the complete decision tree and tell how do you make use of

this additional information?

Answer. EMV = 2200, EV|PI = 3200, EVPI = 1000, EV|SI = 2491, EVSI = 291, ENGE = 291

Problem 2. A TV Co. is considering the development of a new collection of programs. The co. has the following

options.

Decide immediately whether to produce the series

Produce and test market a single pilot in several representative market cities, to gauge the

audience response to the show before making the decision whether to produce the complete

series.

Pay a professional marketing group to assess the likely outcome of the proposed series.

The program may be successful or not successful. Successful programs generate an average of $18m in

revenue, where as unsuccessful one’s generate $4m Revenue. P(S) = 0.34

Production cost is given to be $10m. A pilot costs 1m to produce but will be used as the one show in the

series, if the complete series is marketed using this strategy, this pilot cost is included in the 10m.

86% of the successful series had favorable survey findings on their pilots. However, 15% of the failed

series also received favorable surveys based on their pilots.

The professional market survey approach will cost 0.5m. In the past 62% of the series that were given

favorable reports by thus co. were successful. This co. has written unfavorable surveys in 51% of the

cases that they have served as consultants.

Answer. EMV = 0, EV|PI = 2.72, EVPI = 2.72,

For Test Market: EV|SI = 2.13, EVSI = 2.13, ENGE = 1.13

For Professional Help: EV|SI = 1.313, EVSI = 1.313, ENGE = 0.813

Problem 3. If an athlete is tested for a certain type of drug usage, then the test result will be either +ve or –ve.

However these tests are never perfect. Some athletes who are drug free test +ve and some who are

drug users test –ve. 5% of all athletes use drugs, 3% of all tests on drug free athletes yield false +ve and

7% of all tests on drug users yield false –ve. There are some difficulties in performing the tests.

The benefit B (=25) from correctly identifying a drug user and barring him/her from sports.

The cost C1 (=1) of the test for a single athlete.

The cost C2 (= 50) of falsely accusing a non-user and barring him/her from sports.

The cost C3 (= 20) of not identifying a drug user. (either by not testing or by obtaining a false –

ve.)

The cost C4 (= 2) of violating a non users privacy by performing the test.

Answer. EMV = -1

You might also like

- SEMINAR QUESTIONS PROBABILITY ANALYSISDocument3 pagesSEMINAR QUESTIONS PROBABILITY ANALYSISLadislaus Amani100% (1)

- Ie426 HW5Document2 pagesIe426 HW5fulmanti deviNo ratings yet

- Statistics Activity SheetDocument4 pagesStatistics Activity SheetVijayananda JagannathaNo ratings yet

- Review1 AnswersDocument10 pagesReview1 AnswersMarock RajwinderNo ratings yet

- Lectures 5 & 7 - Easy Exercises - Attempt ReviewDocument17 pagesLectures 5 & 7 - Easy Exercises - Attempt ReviewHeidi DaoNo ratings yet

- Oil Drilling Problem: Best Decision for CompanyDocument13 pagesOil Drilling Problem: Best Decision for Companyagoswami_12No ratings yet

- Practise Problem3Document6 pagesPractise Problem3vish750% (1)

- QBUS6320 S1 2021 Individual Assignment 1Document4 pagesQBUS6320 S1 2021 Individual Assignment 1刘文雨杰No ratings yet

- 2nd Re-Exam in Finance - Questions 2015Document4 pages2nd Re-Exam in Finance - Questions 2015mrdirriminNo ratings yet

- Risk and Return Practice QuestionDocument5 pagesRisk and Return Practice QuestionWajid WajidNo ratings yet

- Lcture 3 and 4 Risk and ReturnDocument4 pagesLcture 3 and 4 Risk and ReturnSyeda Umaima0% (1)

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocument18 pages04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElNo ratings yet

- SECOND EXAM Attempt ReviewDocument13 pagesSECOND EXAM Attempt Reviewmvlg26No ratings yet

- Midterm 2021Document10 pagesMidterm 2021miguelNo ratings yet

- 1667750572final Assignment - ME06 BatchDocument8 pages1667750572final Assignment - ME06 BatchCalvin ManNo ratings yet

- Decision TheoryDocument11 pagesDecision TheoryKevin KoNo ratings yet

- Tutorial 1 QuestionsDocument27 pagesTutorial 1 QuestionsHuyền Tống NgọcNo ratings yet

- Groebner Tif Ch04Document17 pagesGroebner Tif Ch04luqman078No ratings yet

- QuizDocument8 pagesQuizReynante Dap-ogNo ratings yet

- Discounted Cashflow Valuation Problems and SolutionDocument54 pagesDiscounted Cashflow Valuation Problems and SolutionJang haewonNo ratings yet

- Practice SetDocument4 pagesPractice SetamritaNo ratings yet

- Tutorial Questions On Fundamrntal of Investment Analysis 2024Document10 pagesTutorial Questions On Fundamrntal of Investment Analysis 2024Blaise KrisNo ratings yet

- Model Exam - Economics - AAUDocument20 pagesModel Exam - Economics - AAUrami assefa91% (11)

- Final Exam Questions Portfolio ManagementDocument9 pagesFinal Exam Questions Portfolio ManagementThảo Như Trần NgọcNo ratings yet

- Sample Final S12010Document7 pagesSample Final S12010Danielle CasamentoNo ratings yet

- Exam Prep for:: Lebanon Labor Laws and Regulations Handbook: Strategic Information and Basic LawsFrom EverandExam Prep for:: Lebanon Labor Laws and Regulations Handbook: Strategic Information and Basic LawsNo ratings yet

- Sample PaperDocument29 pagesSample PaperhulvaNo ratings yet

- Lectures 5 & 7 - Intermediate Exercises - Attempt ReviewDocument18 pagesLectures 5 & 7 - Intermediate Exercises - Attempt ReviewHeidi DaoNo ratings yet

- Investment ManagementDocument15 pagesInvestment ManagementsamgoshNo ratings yet

- Naa Ni Siyay TablesDocument25 pagesNaa Ni Siyay TablesJhon Ray RabaraNo ratings yet

- Exam 2 KeyDocument8 pagesExam 2 KeyTaylor SteeleNo ratings yet

- Latihan Soal Persiapan UTS Dan Jawaban-1Document7 pagesLatihan Soal Persiapan UTS Dan Jawaban-1DedeNo ratings yet

- QuizDocument12 pagesQuizPiyush RathiNo ratings yet

- Risk and ReturnDocument3 pagesRisk and ReturnPiyush RathiNo ratings yet

- 313 Practice Exam III 2015 Solution 2Document9 pages313 Practice Exam III 2015 Solution 2Johan JanssonNo ratings yet

- MFA All Exam PDFDocument104 pagesMFA All Exam PDFTon Vossen0% (1)

- Section A: Multiple Choice Questions - Single OptionDocument25 pagesSection A: Multiple Choice Questions - Single OptionKenny HoNo ratings yet

- Sample ExamDocument3 pagesSample ExamRJ DianaNo ratings yet

- 313 Practice Exam IV 2015 Solution 2 2Document10 pages313 Practice Exam IV 2015 Solution 2 2Johan JanssonNo ratings yet

- Random Variables, Sampling, Hypothesis TestingDocument6 pagesRandom Variables, Sampling, Hypothesis Testingvarunsmith0% (11)

- Lcture 3 and 4 Risk and ReturnDocument8 pagesLcture 3 and 4 Risk and ReturnNimra Farooq ArtaniNo ratings yet

- Decision Support Models handout exercises modeling uncertaintyDocument3 pagesDecision Support Models handout exercises modeling uncertaintyManel AmaralNo ratings yet

- HW5 S10Document6 pagesHW5 S10danbrownda0% (1)

- BUS173 Assignment #1 Hypothesis Testing & Confidence IntervalsDocument1 pageBUS173 Assignment #1 Hypothesis Testing & Confidence IntervalsFarhan Israq AhmedNo ratings yet

- 2011 - 1st ExamDocument10 pages2011 - 1st ExamcataNo ratings yet

- Name: Suresh Basic Statistics (Module - 4 ( - 2) )Document8 pagesName: Suresh Basic Statistics (Module - 4 ( - 2) )suresh avaduthaNo ratings yet

- SIE 321 Probabilistic Models in OR Homework 5: Problem 1Document2 pagesSIE 321 Probabilistic Models in OR Homework 5: Problem 1sherryy619No ratings yet

- Lectures 5 & 7 - Hard Exercises - Attempt ReviewDocument11 pagesLectures 5 & 7 - Hard Exercises - Attempt ReviewHeidi DaoNo ratings yet

- FTCP Seminar 5 Answers (6) XSXSXSXDocument5 pagesFTCP Seminar 5 Answers (6) XSXSXSXLewis FergusonNo ratings yet

- 2012 ZaDocument4 pages2012 ZaShershah KakakhelNo ratings yet

- Practical Management Science 5th Edition Winston Test BankDocument11 pagesPractical Management Science 5th Edition Winston Test Bankdiemdac39kgkw100% (26)

- FM SD20 Examiner's ReportDocument17 pagesFM SD20 Examiner's ReportleylaNo ratings yet

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Document26 pagesSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNo ratings yet

- Economics (030) Set 58 c2 Marking Scheme Comptt 2020Document12 pagesEconomics (030) Set 58 c2 Marking Scheme Comptt 2020Mayank RajNo ratings yet

- Jun18l1-Ep04 QaDocument23 pagesJun18l1-Ep04 Qajuan100% (1)

- Intro To StatsDocument2 pagesIntro To StatsMath NerdNo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- Queue - Ans 2Document9 pagesQueue - Ans 2MANOJ KUMAR SHUKLANo ratings yet

- Cu SD'N-D: Opt Oauhr IsDocument1 pageCu SD'N-D: Opt Oauhr IsMANOJ KUMAR SHUKLANo ratings yet

- Cu SD'N-D: Opt Oauhr IsDocument1 pageCu SD'N-D: Opt Oauhr IsMANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- Queue - Ans 2Document9 pagesQueue - Ans 2MANOJ KUMAR SHUKLANo ratings yet

- Cu SD'N-D: Opt Oauhr IsDocument1 pageCu SD'N-D: Opt Oauhr IsMANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- Cu SD'N-D: Opt Oauhr IsDocument1 pageCu SD'N-D: Opt Oauhr IsMANOJ KUMAR SHUKLANo ratings yet

- Queue - Ans 2Document9 pagesQueue - Ans 2MANOJ KUMAR SHUKLANo ratings yet

- Information 11 00574Document19 pagesInformation 11 00574MANOJ KUMAR SHUKLANo ratings yet

- 3 Solving IPDocument8 pages3 Solving IPMANOJ KUMAR SHUKLANo ratings yet

- Guidelines For Session 7Document3 pagesGuidelines For Session 7MANOJ KUMAR SHUKLANo ratings yet

- MergedDocument2 pagesMergedMANOJ KUMAR SHUKLANo ratings yet

- 3 Solving IPDocument8 pages3 Solving IPMANOJ KUMAR SHUKLANo ratings yet

- Queue - Ans 2Document9 pagesQueue - Ans 2MANOJ KUMAR SHUKLANo ratings yet

- 6 Decision AnalysisDocument32 pages6 Decision AnalysisMANOJ KUMAR SHUKLANo ratings yet

- CMAPDocument15 pagesCMAPMANOJ KUMAR SHUKLANo ratings yet

- QAM Sonia Quiz 1Document4 pagesQAM Sonia Quiz 1MANOJ KUMAR SHUKLANo ratings yet

- 4 Ip B&BDocument19 pages4 Ip B&BMANOJ KUMAR SHUKLANo ratings yet

- 5 Knapsack+BinPack+TSPDocument11 pages5 Knapsack+BinPack+TSPMANOJ KUMAR SHUKLANo ratings yet

- PHD 23034Document1 pagePHD 23034MANOJ KUMAR SHUKLANo ratings yet

- 1 Formulation IntegerDocument2 pages1 Formulation IntegerMANOJ KUMAR SHUKLANo ratings yet

- HRM Assignment PhD23034Document1 pageHRM Assignment PhD23034MANOJ KUMAR SHUKLANo ratings yet

- Goal of Employer BrandingDocument1 pageGoal of Employer BrandingMANOJ KUMAR SHUKLANo ratings yet

- Group - 5 - Evolution of Visual CommunicationDocument12 pagesGroup - 5 - Evolution of Visual CommunicationMANOJ KUMAR SHUKLANo ratings yet

- Quiz - Limits and ContinuityDocument3 pagesQuiz - Limits and ContinuityAdamNo ratings yet

- Fault ModelingDocument21 pagesFault ModelingRamarao ChNo ratings yet

- Bizagi Licensing Explained ENGDocument7 pagesBizagi Licensing Explained ENGGuidoNo ratings yet

- HackSpace - June 2021Document116 pagesHackSpace - June 2021Somnath100% (1)

- Lyrics: Original Songs: - JW BroadcastingDocument56 pagesLyrics: Original Songs: - JW BroadcastingLucky MorenoNo ratings yet

- Chapter 6 Physics LabDocument3 pagesChapter 6 Physics Labraquelloveswow0% (1)

- Tugas 3vDocument4 pagesTugas 3vRomie SyafitraNo ratings yet

- Business Letter WritingDocument13 pagesBusiness Letter WritingAlex Alexandru100% (1)

- Data Sheet Ads1292rDocument69 pagesData Sheet Ads1292rKaha SyawalNo ratings yet

- Vocabulario Ingles 3 EsoDocument6 pagesVocabulario Ingles 3 EsoPatri ParrasNo ratings yet

- Duane Grant, A099 743 627 (BIA Sept. 9, 2016)Document12 pagesDuane Grant, A099 743 627 (BIA Sept. 9, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Qualitative Research On Vocabulary and Spelling Skills of A Student Chapters I IIIDocument23 pagesQualitative Research On Vocabulary and Spelling Skills of A Student Chapters I IIIarniza blazoNo ratings yet

- 337 686 1 SMDocument8 pages337 686 1 SMK61 ĐOÀN HỒ GIA HUYNo ratings yet

- Gray Iron Castings: Standard Specification ForDocument6 pagesGray Iron Castings: Standard Specification Forsafak kahramanNo ratings yet

- SP Manual Addendum For OS 3 - 03Document2 pagesSP Manual Addendum For OS 3 - 03kevmac88No ratings yet

- Forum Ex 2 2Document5 pagesForum Ex 2 2Didan EnricoNo ratings yet

- Improve Product Packaging at Annual Board MeetingDocument9 pagesImprove Product Packaging at Annual Board Meetingizzat89% (9)

- Texto en inglesDocument5 pagesTexto en inglesJesus Andres Lopez YañezNo ratings yet

- Beowulf The Monsters and The Critics SevDocument20 pagesBeowulf The Monsters and The Critics SevNirmala GaneshNo ratings yet

- Arpèges de Trois Notes: Arpeggios in TripletsDocument3 pagesArpèges de Trois Notes: Arpeggios in TripletspanapapakNo ratings yet

- PariharaDocument2 pagesPariharahrvNo ratings yet

- Understanding Arthrogyposis Multiplex Congenita and Muscular DystrophiesDocument38 pagesUnderstanding Arthrogyposis Multiplex Congenita and Muscular DystrophiessmrutiptNo ratings yet

- E46 Climate ControlDocument40 pagesE46 Climate Controltykunas100% (3)

- Lembar Jawaban Skillab Evidence Based Medicine (Ebm) Nama: Rafika Triasa NIM: 040427223270003Document11 pagesLembar Jawaban Skillab Evidence Based Medicine (Ebm) Nama: Rafika Triasa NIM: 040427223270003Yahya Darmais FaridNo ratings yet

- Large Generators WEBDocument16 pagesLarge Generators WEBMaycon MaranNo ratings yet

- Hatsun Supplier Registration RequestDocument4 pagesHatsun Supplier Registration Requestsan dipNo ratings yet

- Prob StatDocument1 pageProb StatSerenity VertesNo ratings yet

- Crash of Air France ConcordeDocument11 pagesCrash of Air France ConcordeAhmad Aimi SafuanNo ratings yet

- 6 Thinking Hats Detailed Model - UpdatedDocument32 pages6 Thinking Hats Detailed Model - Updatedgeetanshi mittalNo ratings yet

- Rate of ChangeDocument22 pagesRate of ChangeTrisha MariehNo ratings yet