Professional Documents

Culture Documents

Audit Procedures

Uploaded by

Okasha AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Procedures

Uploaded by

Okasha AliCopyright:

Available Formats

Analyze the Cutoff

The auditors will examine your procedures for halting any further receiving into the warehouse or

shipments from it at the time of the physical inventory count, so that extraneous inventory items

are excluded. They typically test the last few receiving and shipping transactions prior to the

physical count, as well as transactions immediately following it, to see if you are properly

accounting for them.

Observe the Physical Inventory Count

The auditors want to be comfortable with the procedures you use to count the inventory. This

means that they will discuss the counting procedure with you, observe counts as they are being

done, test count some of the inventory themselves and trace their counts to the amounts recorded

by the company's counters, and verify that all inventory count tags were accounted for. If you have

multiple inventory storage locations, they may test the inventory in those locations where there

are significant amounts of inventory. They may also ask for confirmations of inventory from the

custodian of any public warehouse where the company is storing inventory.

Observe Cycle Counts

If the company uses cycle counts instead of a physical count, the auditors can still use the

procedures related to a physical count. They simply do so during one or more cycle counts, and can

do so at any time; there is no need to only observe a cycle count that occurs at the end of the

reporting period. Their tests may also evaluate the frequency of cycle counts, as well as the quality

of the investigations conducted by counters into any variances found.

Reconcile the Inventory Count to the General Ledger

They will trace the valuation compiled from the physical inventory count to the company's general

ledger, to verify that the counted balance was carried forward into the company's accounting

records.

Test High-Value Items

If there are items in the inventory that are of unusually high value, the auditors will likely spend

extra time counting them in inventory, ensuring that they are valued correctly, and tracing them

into the valuation report that carries forward into the inventory balance in the general ledger.

Test Error-Prone Items

If the auditors have noticed an error trend in prior years for specific inventory items, they will be

more likely to test these items again.

Test Inventory in Transit

There is a risk that you have inventory in transit from one storage location to another at the time

of the physical count. Auditors test for this by reviewing your transfer documentation.

Test Item Costs

The auditors need to know where purchased costs in your accounting records come from, so they

will compare the amounts in recent supplier invoices to the costs listed in your inventory

valuation.

Review Freight Costs

You can either include freight costs in inventory or charge it to expense in the period incurred, but

you need to be consistent in your treatment - so the auditors will trace a selection of freight

invoices through your accounting system to see how they are handled.

Test for Lower of Cost or Market

The auditors must follow the lower of cost or market rule, and will do so by comparing a selection

of market prices to their recorded costs.

Analyze Finished Goods Costs

If a significant proportion of the inventory valuation is comprised of finished goods, then the

auditors will want to review the bill of materials for a selection of finished goods items, and test

them to see if they show an accurate compilation of the components in the finished goods items,

as well as correct costs.

Analyze Direct Labor

If direct labor is included in the cost of inventory, then the auditors will want to trace the labor

charged during production on time cards or labor routings to the cost of the inventory. They will

also investigate whether the labor costs listed in the valuation are supported by payroll records.

Analyze Overhead

If you apply overhead costs to the inventory valuation, then the auditors will verify that you are

consistently using the same general ledger accounts as the source for your overhead costs,

whether overhead includes any abnormal costs (which should be charged to expense as incurred),

and test the validity and consistency of the method used to apply overhead costs to inventory.

Test Work-in-Process

If you have a significant amount of work-in-process (WIP) inventory, the auditors will test how you

determine the percentage of completion for WIP items.

Review Inventory Allowances

The auditors will determine whether the amounts you have recorded as allowances for obsolete

inventory or scrap are adequate, based on your procedures for doing so, historical patterns,

"where used" reports, and reports of inventory usage (as well as by physical observation during the

physical count). If you do not have such allowances, they may require you to create them.

Review Inventory Ownership

The auditors will review purchase records to ensure that the inventory in your warehouse is

actually owned by the company (as opposed to customer-owned inventory or inventory on

consignment from suppliers).

Review Inventory Layers

If you are using a FIFO or LIFO inventory valuation system, the auditors will test the inventory

layers that you have recorded to verify that they are valid.

AUDITOR OBJECTIVES IN REVIEWING PURCHASING

e

s

a

h

rc

u

p

E

S

A

H

C

R

U

O

P

g

in

You might also like

- Basic Con Trol Sup Erv Iso Ry Cont Ro L Int Erna L Check Int Erna L AuditDocument3 pagesBasic Con Trol Sup Erv Iso Ry Cont Ro L Int Erna L Check Int Erna L AuditKaleem AhmadNo ratings yet

- ESG ChecklistDocument51 pagesESG ChecklistBUDI GINANJARNo ratings yet

- Material ManagementDocument4 pagesMaterial ManagementSimranjeet SinghNo ratings yet

- F&B Controls-BAsic PoliciesDocument7 pagesF&B Controls-BAsic Policiesdafni fernandesNo ratings yet

- Doc3 PDFDocument13 pagesDoc3 PDFibadali2000No ratings yet

- Planta Nivel 1: Horn o DW DW DWDocument1 pagePlanta Nivel 1: Horn o DW DW DWMiguel Angel Gonzalez DiazNo ratings yet

- TAWAL - SUPPLIER PORTAL - DS.030 (v1.0)Document10 pagesTAWAL - SUPPLIER PORTAL - DS.030 (v1.0)nahlaNo ratings yet

- Fluids Lab Buoyant ForceDocument3 pagesFluids Lab Buoyant ForceSandeep BadigantiNo ratings yet

- Ejercicio Delineacion CuencaDocument1 pageEjercicio Delineacion CuencaDiego PullesNo ratings yet

- Recognizing Expenses When Incurred Rather Than When PaidDocument2 pagesRecognizing Expenses When Incurred Rather Than When PaidNath BongalonNo ratings yet

- Pancake: Jump To Navigation Jump To SearchDocument5 pagesPancake: Jump To Navigation Jump To SearchJonahNo ratings yet

- Pusat Pendidikan Dan Pelatihan Industri Sekolah Menengah Kejuruan - Smak Bogor Laboratorium Tempat Uji Kompetensi (Tuk) SmakboDocument1 pagePusat Pendidikan Dan Pelatihan Industri Sekolah Menengah Kejuruan - Smak Bogor Laboratorium Tempat Uji Kompetensi (Tuk) SmakboRahmah WulanNo ratings yet

- En AX22u-4Document2 pagesEn AX22u-4YakupovNo ratings yet

- 10 PPMDocument2 pages10 PPMDamar RukmanaNo ratings yet

- TH 50AS670 EnglishDocument24 pagesTH 50AS670 EnglishDavidNo ratings yet

- Timetable For B.Tech III Yr II Sem Mar 2022 ExamsDocument4 pagesTimetable For B.Tech III Yr II Sem Mar 2022 ExamsHari ChennaNo ratings yet

- Spectra Notes Labor Relations 2016 - Topic 1-4Document49 pagesSpectra Notes Labor Relations 2016 - Topic 1-4Charlie MagneNo ratings yet

- NRHD, COVID-19 Epi Curve, 1 Aug - 1 Dec, by Week of Onset or Lab Collection DateDocument6 pagesNRHD, COVID-19 Epi Curve, 1 Aug - 1 Dec, by Week of Onset or Lab Collection DatePat ThomasNo ratings yet

- .Co .In/: Ias Prelims Exam 2015Document38 pages.Co .In/: Ias Prelims Exam 2015vgasNo ratings yet

- Img 0003Document3 pagesImg 0003Shayan AbagnaleNo ratings yet

- 2 Oracle Database 12c PLSQL Fundamentals Activity Guide PDFDocument120 pages2 Oracle Database 12c PLSQL Fundamentals Activity Guide PDFTreasureNo ratings yet

- Home - Privacy - Disclaimer - About Us - Report Error - Free Listing - Contact UsDocument3 pagesHome - Privacy - Disclaimer - About Us - Report Error - Free Listing - Contact UsVineet YadavNo ratings yet

- PSAT & Columbus DayDocument3 pagesPSAT & Columbus Dayp998uy9034No ratings yet

- ISPcontract 30012020Document13 pagesISPcontract 30012020Martin MutuaNo ratings yet

- Census Book of KathiharDocument1,020 pagesCensus Book of Kathiharrahul kumarNo ratings yet

- Flying King Air ReprintDocument9 pagesFlying King Air ReprintVinicius AckermannNo ratings yet

- Case Study How Using The Right Raw Materials Can Help You Keep Your Customer Promise - r1Document2 pagesCase Study How Using The Right Raw Materials Can Help You Keep Your Customer Promise - r1Mehedi HasanNo ratings yet

- 徐重QAY800 原理图-17Document1 page徐重QAY800 原理图-17Andre SantosNo ratings yet

- 0BZ Bosa Britalia 10Document1 page0BZ Bosa Britalia 10genesisbarrockNo ratings yet

- Chlorine Files Weekly Water Slide ScheduleDocument1 pageChlorine Files Weekly Water Slide Schedulekirsten_hallNo ratings yet

- South American Rivers: Ci Fi CDocument70 pagesSouth American Rivers: Ci Fi CestarianNo ratings yet

- Paper CuttingDocument1 pagePaper CuttingYogesh SonawaneNo ratings yet

- The Holy Bible, Containing The Old and New Tes-Taments: ... 1775Document3 pagesThe Holy Bible, Containing The Old and New Tes-Taments: ... 1775otumfoba77No ratings yet

- Republic of The Philippines Manila First Division: Supreme CourtDocument4 pagesRepublic of The Philippines Manila First Division: Supreme CourtJames Estrada CastroNo ratings yet

- JKT3 New Construction Project: Submittal FormDocument2 pagesJKT3 New Construction Project: Submittal FormMulya SitanggangNo ratings yet

- Jeni Garisan PDFDocument1 pageJeni Garisan PDFRAJA AZIZU BIN RAJA YUNUS MoeNo ratings yet

- Plaza 125 Greenwich - Amenity S&R Sheet 2 As of 05-16-23Document1 pagePlaza 125 Greenwich - Amenity S&R Sheet 2 As of 05-16-23sanketNo ratings yet

- Sci-Hub - Making Uncommon Knowledge CommonDocument1 pageSci-Hub - Making Uncommon Knowledge CommonhatemaaNo ratings yet

- WWW Acte in AWS Training in HyderabadDocument18 pagesWWW Acte in AWS Training in Hyderabadsophiamerlin1996No ratings yet

- Eaw CatalogDocument20 pagesEaw CatalogalwiNo ratings yet

- BJT Small Signal Configurations Cheat SheetDocument1 pageBJT Small Signal Configurations Cheat SheetAdi SaggarNo ratings yet

- D80190GC20 AgDocument144 pagesD80190GC20 AgRevankar B R ShetNo ratings yet

- Seniority List of Provincial Public Management Assistant Service - Supra GradeDocument2 pagesSeniority List of Provincial Public Management Assistant Service - Supra Gradenpgovlk100% (2)

- Juan Tuno James Pond StatmentDocument1 pageJuan Tuno James Pond Statmentkirsten_hallNo ratings yet

- LZDZ Issue 3 2017 PDFDocument32 pagesLZDZ Issue 3 2017 PDFLEDOMNo ratings yet

- Fauquier Open Space 2-2017Document1 pageFauquier Open Space 2-2017Fauquier Now100% (1)

- Kromatogram HPLC (SMPL)Document2 pagesKromatogram HPLC (SMPL)Sabina ShafaNo ratings yet

- Vocabulary ActivitiesDocument15 pagesVocabulary ActivitiesESTHER AVELLANo ratings yet

- App Drafttrans NPDocument4 pagesApp Drafttrans NPCONDOR C8No ratings yet

- Raiser Candidate PathDocument4 pagesRaiser Candidate PathHasmik GhazaryanNo ratings yet

- Module 1 Revision - ChemistryDocument10 pagesModule 1 Revision - ChemistryIdris MohammedNo ratings yet

- RT 31Document27 pagesRT 31Cali JaveNo ratings yet

- Zacharie AMELI TCHOUALA (frzack@yahooฺcom) has a non-transferable license to use this Student GuideฺDocument324 pagesZacharie AMELI TCHOUALA (frzack@yahooฺcom) has a non-transferable license to use this Student GuideฺNainika KedarisettiNo ratings yet

- LR BLT DD Salur 9 CengkalsewuDocument3 pagesLR BLT DD Salur 9 CengkalsewutopangantengNo ratings yet

- WASA Drainage A3 NewDocument1 pageWASA Drainage A3 Newzeeshn chauhdryNo ratings yet

- 2 Waq FedDocument17 pages2 Waq FedVulebg VukoicNo ratings yet

- PDF Pioneer British Level B1plus Tests CompressDocument64 pagesPDF Pioneer British Level B1plus Tests Compresstramites y fianzas 18No ratings yet

- Bv-Dao TienDocument1 pageBv-Dao TienTùng PhạmNo ratings yet

- Handbook AiAX Coatings EngDocument20 pagesHandbook AiAX Coatings EngfinhasNo ratings yet

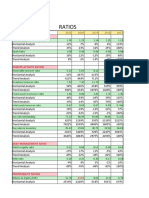

- Working Capital BrighamDocument9 pagesWorking Capital BrighamOkasha AliNo ratings yet

- Risk, Return & Opportunity Cost of CapitalDocument19 pagesRisk, Return & Opportunity Cost of CapitalOkasha AliNo ratings yet

- Optimal Capital StructureDocument29 pagesOptimal Capital StructureOkasha AliNo ratings yet

- Shell AnalysisDocument21 pagesShell AnalysisOkasha AliNo ratings yet

- ContentDocument1 pageContentOkasha AliNo ratings yet

- Liquidity RatiosDocument10 pagesLiquidity RatiosOkasha AliNo ratings yet

- FRM Final ProjectDocument5 pagesFRM Final ProjectOkasha AliNo ratings yet

- ICMO 2024 Form ConstructionDocument2 pagesICMO 2024 Form Constructionjonathankarta.hdkNo ratings yet

- Pengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitDocument10 pagesPengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitDiwan HYNo ratings yet

- Definition of WagesDocument8 pagesDefinition of WagesCorolla SedanNo ratings yet

- Ruka CompleteDocument121 pagesRuka CompletePhelix O DaniyanNo ratings yet

- 2223-Article Text-10843-1-10-20230721Document17 pages2223-Article Text-10843-1-10-20230721aptvirtualkpknlmksNo ratings yet

- Ma Security Company Profile 2Document6 pagesMa Security Company Profile 2api-233290339No ratings yet

- Annual Report 2014Document249 pagesAnnual Report 2014BETTY ELIZABETH JUI�A QUILACHAMINNo ratings yet

- HR Demand and SupplyDocument29 pagesHR Demand and SupplyYasser AbdallaNo ratings yet

- A) Maximum and Minimum PricesDocument4 pagesA) Maximum and Minimum PricesNicole MpehlaNo ratings yet

- E - General Terms and Conditions For Cloud ServicesDocument10 pagesE - General Terms and Conditions For Cloud ServicesUlysse TpnNo ratings yet

- Marketing Function and How It Interacts With Other Function. NGHI - (09!06!2021)Document7 pagesMarketing Function and How It Interacts With Other Function. NGHI - (09!06!2021)Lê NghiNo ratings yet

- TSmunt BM 711 Ch2 HandoutDocument3 pagesTSmunt BM 711 Ch2 HandoutShelbyNo ratings yet

- PP Presentation Q 15 ADocument8 pagesPP Presentation Q 15 ARita LakhsmiNo ratings yet

- HR PRACTICES Marriott - 23027 - RMDocument13 pagesHR PRACTICES Marriott - 23027 - RMMahak Sharma100% (1)

- Isilon Product FamilyDocument7 pagesIsilon Product FamilyrejnanNo ratings yet

- Lokesh Punj Cvdec2018Document11 pagesLokesh Punj Cvdec2018LOKESH PUNJNo ratings yet

- Engineering EconomicspreboardDocument2 pagesEngineering EconomicspreboardNUCUP Marco V.No ratings yet

- EFFECT OF SUSTAINABLE PROCUREMENT PRACTICES ON OPERATIONAL PERFORMANCE - CASE STUDY GHANA GRID COMPANY LIMITED (GRIDCo)Document69 pagesEFFECT OF SUSTAINABLE PROCUREMENT PRACTICES ON OPERATIONAL PERFORMANCE - CASE STUDY GHANA GRID COMPANY LIMITED (GRIDCo)Korkor Nartey100% (1)

- PM REFX IntegrationDocument3 pagesPM REFX IntegrationVuppala VenkataramanaNo ratings yet

- MDP Cust Exp Session 3Document10 pagesMDP Cust Exp Session 3Leo Bogosi MotlogelwNo ratings yet

- Chapter 1-Introduction To Accounting and Business: True/FalseDocument3 pagesChapter 1-Introduction To Accounting and Business: True/FalseChloe Gabriel Evangeline ChaseNo ratings yet

- 19llb082 - Banking Law Project - 6th SemDocument25 pages19llb082 - Banking Law Project - 6th Semashirbad sahooNo ratings yet

- Checklist - FF (New) (Blad) - NvoccDocument1 pageChecklist - FF (New) (Blad) - NvoccUnicargo Int'l ForwardingNo ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- The Governance ContinuumDocument3 pagesThe Governance Continuumnathan_lawler4416No ratings yet

- Practice of ArchitectureDocument13 pagesPractice of ArchitectureLaurence Caraang CabatanNo ratings yet

- Selecta Fortified MilkDocument40 pagesSelecta Fortified MilkRochelle TyNo ratings yet

- PACEDocument5 pagesPACEJoanne DawangNo ratings yet

- Manual For Discounting Oil and Gas IncomeDocument9 pagesManual For Discounting Oil and Gas IncomeCarlota BellésNo ratings yet

- India 2023 Agrifood Investment ReportDocument34 pagesIndia 2023 Agrifood Investment ReportANKUSH SINHANo ratings yet