Professional Documents

Culture Documents

TaxTimeToolkit Selfeducationexpenses

Uploaded by

Gustavo Togeiro de Alckmin0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

TaxTimeToolkit_Selfeducationexpenses

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesTaxTimeToolkit Selfeducationexpenses

Uploaded by

Gustavo Togeiro de AlckminCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Self-education

expenses

It pays to learn what you can claim at tax time

To claim a deduction for work-related expenses:

You must have spent the money yourself It must directly relate to earning your You must have a record to prove it*.

and weren’t reimbursed income

* Use the myDeductions tool in the ATO app to keep a record of your expenses throughout the year.

When can you claim? When can’t you claim?

Self-education and study expenses are deductible when the course You can’t claim a deduction for self-education for a course that:

you undertake has a sufficient connection to your current work

■ relates only in a general way to your current employment

activities and:

or profession

■ maintains or improves the specific skills or knowledge you require ■ enables you to get new employment – such as moving from

in your current work activities, or

employment as a nurse to employment as a doctor.

■ results in – or is likely to result in – an increase in your income

from your current work activities.

Course expenses

If your self-education is eligible, you may be able to claim a deduction for your expenses directly related to undertaking the course.

General expenses Depreciating assets Car expenses

Some general expenses you may be able You may be able to claim a deduction for If you are undertaking a course that has a

to claim include: assets that lose value over time sufficient connection to your current

■ course and tuition fees, if paid directly (depreciating assets) such as computers employment, you can claim the cost of

by you and printers – that you have bought and daily travel from your:

■ computer consumables (for example,

use to study. ■ home to your place of education

printer cartridges) Depreciating assets that cost more than $300 and back

■ textbooks are usually claimed over the life of the asset ■ work to your place of education

■ trade, professional or academic journals

(decline in value). However, if you have a and back.

depreciating asset that cost $300 or less

■ stationery However, you can’t claim the cost of the

– you can get a deduction for the full cost of

■ home office running costs last leg of your travel from:

the asset to the extent that you used it for

■ internet usage study in the tax year you bought it. (see ■ home to your place of education, and

(excluding connection fees) Apportioning expenses). then to work

■ phone calls ■ work to your place of education, and

■ postage then to your home.

■ student services and amenities fees You can’t claim the following expenses

■ travel costs, including car expenses, related to your self-education:

between home and the place of ■ tuition fees paid by someone else,

education and between your workplace including your employer, or for which

and the place of education you were reimbursed

■ fees payable on some Higher Education ■ repayments of Higher Education Loan

Loan Program (HELP) loans, but not the Program (HELP) loans, Student Financial

loan itself. Supplement Scheme (SFSS), the

You can only claim a deduction for the portion Student Start-up Loan (SSL), VET

of these expenses that is directly related to Student Loan or the Trade Support

your eligible self-education. Loans Program (TSL)

■ home office occupancy expenses – for

example, rent, mortgage interest, rates

■ accommodation and meals – except if

you travel away from home for a short

period for study, such as to attend

residential school.

Apportioning Recording Calculating

expenses your expenses your expenses

Some expenses need to be apportioned Use our self-education expense In certain circumstances, you may have to

between private purposes and use for calculator to get an estimate of your reduce your self-education expenses by

self-education. Travel costs and self-education deductions. It also up to $250 to work out your deduction.

depreciating assets are good examples provides information on your The self-education expenses calculator

of expenses that may need to claim eligibility. works this out for you.

be apportioned. Records you need to keep may include

receipts or other documents showing

Use of equipment your self-education and study expenses

If you use equipment such as computers such as:

and printers privately and for study, you ■ course fees

must apportion the expense based on

■ textbooks

the percentage you use the equipment

for self-education. ■ stationery

■ decline in value of, and repairs to,

For example, if you use a computer 50%

depreciating assets.

of the time for study and 50% for private

purposes, you can only claim half the You must also keep receipts, documents

cost of the computer as a deduction. or diary entries for travel expenses.

(For more information on asset Use the myDeductions tool in the ATO

expenses, see Depreciating assets.) app to record your self-education

expenses throughout the year.

NAT 75044-03.2021

This is a general summary only

For more information, go to ato.gov.au/selfeducation or speak to a registered tax professional.

You might also like

- Jackie B Wells Fargo Statement AugustDocument10 pagesJackie B Wells Fargo Statement AugustUsa LotteryNo ratings yet

- Unified Payment Interface Api Technology Specifications v111Document105 pagesUnified Payment Interface Api Technology Specifications v111scribdseNo ratings yet

- Loan StatementDocument3 pagesLoan StatementNityananda SahuNo ratings yet

- Business Finance - Midterm Exams Problem 3Document2 pagesBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroNo ratings yet

- Unit 4 Expatriate CompensationDocument36 pagesUnit 4 Expatriate Compensationlizza samNo ratings yet

- BLT Business TaxesDocument10 pagesBLT Business TaxesjennyMBNo ratings yet

- GST Registration PDFDocument3 pagesGST Registration PDFRanjit MankuNo ratings yet

- Chronological Resume Template Download PDFDocument1 pageChronological Resume Template Download PDFMarion Shanne Pastor Corpuz100% (1)

- Current Account Statement TransactionsDocument2 pagesCurrent Account Statement TransactionsisabisabNo ratings yet

- Self Education 2021Document2 pagesSelf Education 2021Yul CubillaNo ratings yet

- Doctor, Specialist or Other Medical Professional,: If You're ADocument1 pageDoctor, Specialist or Other Medical Professional,: If You're AShiyeng CharmaineNo ratings yet

- TaxTimeToolkit PerformingartistDocument2 pagesTaxTimeToolkit Performingartistisaacdavis2001celloNo ratings yet

- TaxTimeToolkit AgricultureindustryDocument2 pagesTaxTimeToolkit AgricultureindustryIgnacio DalessandroNo ratings yet

- TaxTimeToolkit FitnessoorsportingIndustryDocument2 pagesTaxTimeToolkit FitnessoorsportingIndustryreginaau1989No ratings yet

- Working From Home During COVID-19: To Claim A Deduction For Work-Related ExpensesDocument2 pagesWorking From Home During COVID-19: To Claim A Deduction For Work-Related ExpensesYul CubillaNo ratings yet

- Description: Tags: Vol3Ch2Sept29Document8 pagesDescription: Tags: Vol3Ch2Sept29anon-376565No ratings yet

- Description: Tags: 0506Vol3Ch2Sept20Document8 pagesDescription: Tags: 0506Vol3Ch2Sept20anon-926461No ratings yet

- Police Officer Deductions GuidelineDocument1 pagePolice Officer Deductions Guidelinejo lamosNo ratings yet

- Case Study 2: Beemis Technical CollegeDocument5 pagesCase Study 2: Beemis Technical Collegeanon-811984No ratings yet

- Police Officer PDFDocument1 pagePolice Officer PDFAmérico FornazariNo ratings yet

- Description: Tags: 0708FSAHbkVol3Ch2finalAug7Document8 pagesDescription: Tags: 0708FSAHbkVol3Ch2finalAug7anon-98949No ratings yet

- Case Study 4: Datsun InstituteDocument5 pagesCase Study 4: Datsun Instituteanon-470348No ratings yet

- Tax Deduction ChecklistDocument5 pagesTax Deduction ChecklistkatNo ratings yet

- Case Study 5: Eagle Point State UniversityDocument6 pagesCase Study 5: Eagle Point State Universityanon-367174No ratings yet

- Education Tax Benefits 2021Document2 pagesEducation Tax Benefits 2021Finn KevinNo ratings yet

- Life Orientation Grade 10 Term 3 Week 7 - 2020Document9 pagesLife Orientation Grade 10 Term 3 Week 7 - 2020Nabeelah EbrahimNo ratings yet

- Description: Tags: 0203V6C3Document4 pagesDescription: Tags: 0203V6C3anon-324548No ratings yet

- G604a Tips On PayingDocument4 pagesG604a Tips On PayingccrjunkNo ratings yet

- Master of Science (Science and Mathematics Education) : Credit For Previous StudyDocument2 pagesMaster of Science (Science and Mathematics Education) : Credit For Previous Studytiti wahyuniNo ratings yet

- Case Study 7: Geiger State CollegeDocument7 pagesCase Study 7: Geiger State Collegeanon-194259No ratings yet

- Income Tax Planning (CH 3)Document9 pagesIncome Tax Planning (CH 3)Tenzin KungaNo ratings yet

- 24y-grad-financing-guideDocument5 pages24y-grad-financing-guideanenefrank313No ratings yet

- How Living Off-Campus Affects Your Financial Aid at Johns HopkinsDocument2 pagesHow Living Off-Campus Affects Your Financial Aid at Johns HopkinsDiane MNo ratings yet

- SNHU Tuition Reimbursement MemoDocument3 pagesSNHU Tuition Reimbursement MemoxyzNo ratings yet

- Section - 1: Chapter - 4Document22 pagesSection - 1: Chapter - 4Ahmed YoussefNo ratings yet

- Budgeting and Goal Setting 27715 20231031183226Document111 pagesBudgeting and Goal Setting 27715 20231031183226Nicolle MoranNo ratings yet

- Undergraduate Entrance Counseling - Summary - Federal Student AidDocument6 pagesUndergraduate Entrance Counseling - Summary - Federal Student AidMwangi JayNo ratings yet

- Human Capital: If You Think Education's Expensive, Try Ignorance!Document19 pagesHuman Capital: If You Think Education's Expensive, Try Ignorance!Dhawal RajNo ratings yet

- Careers Vocabulary BookDocument7 pagesCareers Vocabulary BookIlhama AliyevaNo ratings yet

- Apply for Student LoansDocument4 pagesApply for Student LoansAshleyNo ratings yet

- Unit #4 Consumer-ArithmeticDocument4 pagesUnit #4 Consumer-ArithmeticChet AckNo ratings yet

- Unit #3 Consumer-ArithmeticDocument4 pagesUnit #3 Consumer-ArithmeticChet AckNo ratings yet

- 2024-Summer-Funding-Budget-SheetDocument9 pages2024-Summer-Funding-Budget-SheetReshamNo ratings yet

- COST Benefit AnalysisDocument12 pagesCOST Benefit AnalysisMuhammad ShoaibNo ratings yet

- Tax Class Work2Document3 pagesTax Class Work2Nirvana ShresthaNo ratings yet

- 08172-Studenttoolkit 6217Document12 pages08172-Studenttoolkit 6217api-238665649No ratings yet

- Hoya Hiring Form 2017-2018Document2 pagesHoya Hiring Form 2017-2018Daniel WatkinsNo ratings yet

- Afar 1 Module On Accounting For FohDocument12 pagesAfar 1 Module On Accounting For FohJamaica DavidNo ratings yet

- Compensation HRMDocument6 pagesCompensation HRMFatema SultanaNo ratings yet

- Senior Pathways Community College Lesson 2Document6 pagesSenior Pathways Community College Lesson 2api-554973045No ratings yet

- BSBINN301 Promote Innovation in A Team Environment: Assessor WorkbookDocument38 pagesBSBINN301 Promote Innovation in A Team Environment: Assessor WorkbookAlexDriveNo ratings yet

- Transition Plan 1Document9 pagesTransition Plan 1api-700270137No ratings yet

- Description: Tags: tgrc01Document10 pagesDescription: Tags: tgrc01anon-198828No ratings yet

- Business Free Talk: Lesson 4 ReimbursementDocument10 pagesBusiness Free Talk: Lesson 4 ReimbursementAngelique HernandezNo ratings yet

- Business Free Talk: Lesson 4 ReimbursementDocument10 pagesBusiness Free Talk: Lesson 4 ReimbursementAngelique HernandezNo ratings yet

- Who Are They & How Do I Pay Them?Document9 pagesWho Are They & How Do I Pay Them?Vivek NirmalNo ratings yet

- 'PNB PRATIBHA' - Education Loan For Premier Institutes in India ObjectiveDocument1 page'PNB PRATIBHA' - Education Loan For Premier Institutes in India ObjectiveRaj KumarNo ratings yet

- College Stud Budget MiniDocument19 pagesCollege Stud Budget MiniAlejandro Jose OletianoNo ratings yet

- Interactive Tax Assistant Interview SummaryDocument2 pagesInteractive Tax Assistant Interview SummaryallisonarchitectureNo ratings yet

- Enrollment ChecklistDocument7 pagesEnrollment ChecklistCristian GonzalezNo ratings yet

- CFPB Building Block Activities GlossaryDocument16 pagesCFPB Building Block Activities GlossaryArnessa Dewi KarnaNo ratings yet

- 4th ExaminationDocument5 pages4th ExaminationJanel Yuka AokiNo ratings yet

- Cost TheoryDocument11 pagesCost TheoryramandeepkaurNo ratings yet

- Module 4Document20 pagesModule 4alithasni45No ratings yet

- Economics & Personal Finance: Course DescriptionDocument4 pagesEconomics & Personal Finance: Course Descriptionapi-238711136No ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- Chapter 8 Exclusions From Gross IncomeDocument4 pagesChapter 8 Exclusions From Gross IncomeMary Jane PabroaNo ratings yet

- W4 TaxesDocument35 pagesW4 TaxesVanessa LeeNo ratings yet

- List of Case Digest (Midterm) - Tax 1Document1 pageList of Case Digest (Midterm) - Tax 1stephclloNo ratings yet

- Account Statement 14 Jun 2023-19 Jun 2023Document4 pagesAccount Statement 14 Jun 2023-19 Jun 2023propvisor real estateNo ratings yet

- Invoice Sample 5Document1 pageInvoice Sample 5Rammohanreddy RajidiNo ratings yet

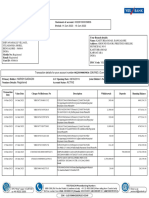

- Tax Invoice detailsDocument1 pageTax Invoice detailsPriyanka PawarNo ratings yet

- Tax 1 Matrix - Sections 23-25 NIRCDocument1 pageTax 1 Matrix - Sections 23-25 NIRCMarieNo ratings yet

- Gratuity Liability and Benefits of Group Gratuity Trust Fund by CompaniesDocument4 pagesGratuity Liability and Benefits of Group Gratuity Trust Fund by CompaniesTikaram ChaudharyNo ratings yet

- Harry Franklin Itinerary Qatar Airways Flight TicketDocument1 pageHarry Franklin Itinerary Qatar Airways Flight TicketPeter GrayNo ratings yet

- Attrition Act of 2005Document28 pagesAttrition Act of 2005Sara Andrea SantiagoNo ratings yet

- Hotel BillDocument2 pagesHotel BillDEVI SUNDARNo ratings yet

- MR Bokang Mokaka Private Bag 0022 Gaborone 0000: Page 1 of 3Document3 pagesMR Bokang Mokaka Private Bag 0022 Gaborone 0000: Page 1 of 3Bokang MokakaNo ratings yet

- Value-Added Tax and Tot NotesDocument28 pagesValue-Added Tax and Tot NotesBrooks BrookNo ratings yet

- Camera IshotDocument1 pageCamera IshotmakNo ratings yet

- HO No. 3 - Business TaxDocument4 pagesHO No. 3 - Business TaxMariella Louise CatacutanNo ratings yet

- f6744 (2018)Document208 pagesf6744 (2018)Center for Economic Progress0% (2)

- Baran-Final Exam TaxDocument3 pagesBaran-Final Exam TaxAlona JeanNo ratings yet

- ACC 4020 - SU - W3 - A2 - Moore - DDocument6 pagesACC 4020 - SU - W3 - A2 - Moore - DRosalia Anabell Lacuesta100% (1)

- Bac 302Document4 pagesBac 302mahmoudfatahabukarNo ratings yet

- Admission and General Queries - Waitlisted PDFDocument5 pagesAdmission and General Queries - Waitlisted PDFSrinivas NandikantiNo ratings yet

- Corporate Tax Planning PDFDocument152 pagesCorporate Tax Planning PDFdimple0% (1)

- Auction CatalogDocument128 pagesAuction CatalogSanjay100% (1)

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesJATIN GOYAL100% (1)