0% found this document useful (0 votes)

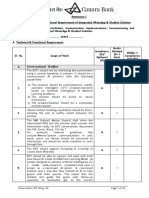

292 views19 pagesAccounting Procedures for CA Firms

Here are the key issues with filing TDS returns for the firm:

- The firm has a large number of clients from whom TDS is deducted every quarter. Manually compiling the details from various documents and filing separate returns for each client is a tedious and time-consuming task.

- There is a risk of missing the filing due dates if the returns are prepared manually close to the due date, which can attract late fees.

- Reconciling TDS amounts deducted from clients and amounts deposited with the tax department is challenging without an automated system. Any discrepancies can lead to notice from the department.

- Storing paper documents with TDS details poses issues of lost or misplaced records over time.

Uploaded by

Kunvar MattewalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

292 views19 pagesAccounting Procedures for CA Firms

Here are the key issues with filing TDS returns for the firm:

- The firm has a large number of clients from whom TDS is deducted every quarter. Manually compiling the details from various documents and filing separate returns for each client is a tedious and time-consuming task.

- There is a risk of missing the filing due dates if the returns are prepared manually close to the due date, which can attract late fees.

- Reconciling TDS amounts deducted from clients and amounts deposited with the tax department is challenging without an automated system. Any discrepancies can lead to notice from the department.

- Storing paper documents with TDS details poses issues of lost or misplaced records over time.

Uploaded by

Kunvar MattewalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd