Professional Documents

Culture Documents

Exercise Business Combination

Uploaded by

Abbygail PantorillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise Business Combination

Uploaded by

Abbygail PantorillaCopyright:

Available Formats

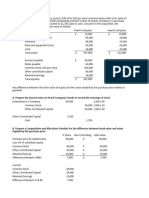

PROBLEM 1. On January 1, 2021, Rose Corporation purchased 80% of the common stock of Mary Co.

Separate balance sheet data for the companies at the combination date are given below:

Rose Mary

Cash P 24,000 P 206,000

Accounts Receivable 144,000 26,000

Inventory 132,000 38,000

Land 68,000 32,000

Plant assets 700,000 300,000

Accum. Depreciation ( 240,000 ) ( 60,000

Investment in Lapp 392,000

Total assets P 1,230,000 P 542,000

Accounts payable P 206,000 P 142,000

Capital stock 800,000 300,000

Retained earnings 224,000 100,000

Total liabilities & equities P 1,230,000 P 542,000

At the date of combination, the book values of Mary’s net assets were equal to the fair value except for Mary’s

inventory, which had a fair value of P60,000. NCI is measured at fair value. Determine below what the consolidated

balance would be for each of the requested accounts.

3. What amount of Inventory will be reported?

4. What amount of Goodwill will be reported?

5. What amount of total liabilities will be reported?

6. What is the reported amount for the noncontrolling interest?

7. What is the amount of consolidated Retained Earnings?

8. What is the amount of total assets?

You might also like

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- ACCTSPTRANS Quiz Corp LiquidationDocument2 pagesACCTSPTRANS Quiz Corp LiquidationShailene DavidNo ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Firda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3Document2 pagesFirda Arfianti - LC53 - CONSOLIDATION BALANCE SHEET Exercise 3-3FirdaNo ratings yet

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Stock Acquisition (PARTIAL) - Practice ProblemsDocument2 pagesStock Acquisition (PARTIAL) - Practice ProblemsCorin Ahmed CorinNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- FEU Quiz 2 Conso SY DocxDocument6 pagesFEU Quiz 2 Conso SY DocxBryle EscosaNo ratings yet

- ACSTRAN - Realization and LiquidationDocument4 pagesACSTRAN - Realization and LiquidationDheine MaderazoNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- ReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Soal Akuntansi LanjutanDocument2 pagesSoal Akuntansi LanjutanDion Bonaventura ManaluNo ratings yet

- Brief Exercises - Formation: Jose Rizal University ACC C102 - Financial Accounting and ReportingDocument3 pagesBrief Exercises - Formation: Jose Rizal University ACC C102 - Financial Accounting and ReportingAngeline SanchezNo ratings yet

- Corporate Liquidation Practical ExercisesDocument3 pagesCorporate Liquidation Practical ExercisesRoderica RegorisNo ratings yet

- CORPORATION LIQUIDATION - AcctnfDocument2 pagesCORPORATION LIQUIDATION - AcctnfJewel CabigonNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Acc 112 - Partnership LiquidationDocument19 pagesAcc 112 - Partnership LiquidationJIYAN BERACISNo ratings yet

- Buscom For 2nd QuizDocument4 pagesBuscom For 2nd QuizSantiago BuladacoNo ratings yet

- Cla 6Document2 pagesCla 6Von Andrei MedinaNo ratings yet

- AFE3691 Tutorial QuestionsDocument29 pagesAFE3691 Tutorial QuestionsPetrinaNo ratings yet

- Asset AcquisitionDocument3 pagesAsset AcquisitionMerliza JusayanNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 3Document5 pagesTania Maharani - C1C019071 - Tugas AKL 3Tania MaharaniNo ratings yet

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- For 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableDocument3 pagesFor 18 - 25: Deficiency of Liquid Assets. On July 1, 2020, The Following Information Was AvailableExzyl Vixien Iexsha LoxinthNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- Chapter 1 - Teacher's Manual - Afar Part 1-1Document10 pagesChapter 1 - Teacher's Manual - Afar Part 1-1Mayeth BotinNo ratings yet

- Basic Finance Exercice 2Document3 pagesBasic Finance Exercice 2Kazia PerinoNo ratings yet

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- Consolidated Financial Statement Excercise 3-3Document2 pagesConsolidated Financial Statement Excercise 3-3Winnie TanNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- Exercises - Corporate LiquidationDocument2 pagesExercises - Corporate LiquidationJason RadamNo ratings yet

- Quiz 1 - Corporate Liquidation ReorganizationDocument4 pagesQuiz 1 - Corporate Liquidation ReorganizationJane GavinoNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet