Professional Documents

Culture Documents

Ok E54c3-12 Current Affairs December 2022

Uploaded by

Manu Manvik0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

Ok e54c3-12 Current Affairs December 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesOk E54c3-12 Current Affairs December 2022

Uploaded by

Manu ManvikCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

o It is a technique to detect individuals who are prepared to accept a bribe, or another inducement, to act corruptly

by doing something that they are required to do in their position.

• Legal and Regulatory reforms: Legal and administrative reformation to ensure that discretionary powers are

minimized and there are clear accountability systems for civil servants.

o This includes development of governance systems and regulations which are citizen centric in nature.

• Institutional reforms: Strengthening the law enforcement agencies such as the CBI, CVC, Courts, and Lokpal among

others. This includes removing external pressures of these institutions such as political pressure, financial

dependencies etc.

• Enhancing the use of technology: The use of technology such as blockchain, AI, and e-governance can help to reduce

opportunities for corruption by increasing transparency and accountability in government operations.

• Performance evaluation and management: Regularly evaluating and managing the performance of civil servants can

help to identify corrupt practices. This will create active deterrence for corruption among civil servants.

• Responsibilities of Citizens: Corruption is not an act in isolation but is executed as part of a system which involves

citizens and businesses along with civil servants. In this light, it is important that they are sensitized regarding the ill

effects of corruption and actively discouraged from

partaking it.

Conclusion

In the long run, Prevention of corruption can only be

eliminated if corruption can be made culturally

unacceptable. For reformation of the culture, it is

important to uphold, imbibe and nurture the right

values among Civil Servants.

120 www.visionias.in ©Vision IAS

10. SCHEMES IN NEWS

10.1. REMISSION OF DUTIES AND TAXES ON EXPORTED PRODUCTS (RODTEP)

SCHEME

Why in news?

Recently, Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme has been extended to include Chemicals,

Pharmaceuticals and Articles of Iron and Steel.

Objectives Salient features

• To support domestic • It is a flagship export promotion scheme of the Ministry of Commerce and being implemented

industry and make it by Department of Revenue.

more competitive in o RoDTEP was announced in September 2019 to replace the export incentive scheme

the international Merchandise Exports from India (MEIS) scheme.

markets. • The Scheme covers all indirect Central & State taxes that are not reimbursed in any existing

• The Scheme's scheme.

objective is to refund, • The RoDTEP Scheme aims to refund all the hidden taxes and levies paid by exporters, For

currently un- example:

refunded: o Central & state taxes on the fuel

o Duties/ taxes/ (Petrol, Diesel, CNG, PNG, and coal

levies, at the cess etc.) used for transportation

Central, State & of export products.

local level, borne o The duty levied by the state on

on the exported electricity used for manufacturing.

product, o Mandi tax levied by APMCs.

including prior o Toll tax & stamp duty on the

stage cumulative import-export documentation. etc.

indirect taxes on • All exporters of goods are eligible to

goods & services take benefit under this scheme.

used in o Such exporter may either be the

production of merchant or manufacturer

the exported exporter. However, such goods

product, and should have been directly exported

o Such indirect by such person.

Duties/ taxes/ • Under RoDTEP, all sectors, including

levies in respect the textiles products which are not covered under the RoSCTL, are covered, to ensure uniformity

of distribution of across all areas.

exported o Rebate of State and Central Taxes and Levies (RoSCTL) Scheme was introduced by the

products. Ministry of Textiles.

o It aims to rebate all embedded State and Central Taxes and Levies on garments and made

ups to enhance competitiveness of these sectors.

• RoDTEP support will be available to eligible exporters at a notified rate as a percentage of Freight

on Board (FOB) value.

o FOB stands for “free on board” or “freight on board” and is a designation that is used to

indicate when liability and ownership of goods is transferred from a seller to a buyer.

• Rebate on certain export products is subject to value cap per unit of the exported product.

• Rebates will be issued in the form of a transferable duty credit/electronic scrip (e-scrip) which

will be maintained in an electronic ledger by the Central Board of Indirect Taxes and Customs

(CBIC).

• It is a World Trade Organisation (WTO) compliant Scheme and follows the global principle that

the taxes/duties should not be exported.

o They should be either exempted or remitted to exporters, to make the goods competitive in

the global market.

121 www.visionias.in ©Vision IAS

122 www.visionias.in ©Vision IAS

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Current Affairs - Microsoft OneNote OnlineDocument30 pagesCurrent Affairs - Microsoft OneNote OnlineManu ManvikNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- 2 Indian Economy Book V Edition Vivek SinghDocument77 pages2 Indian Economy Book V Edition Vivek SinghManu ManvikNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 1 Indian Economy Book V Edition Vivek SinghDocument30 pages1 Indian Economy Book V Edition Vivek SinghManu ManvikNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- StateEnergy and ClimateIndexRoundI 10 04 2022Document128 pagesStateEnergy and ClimateIndexRoundI 10 04 2022Manu ManvikNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Psir PyqsDocument74 pagesPsir PyqsManu ManvikNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- IE 230 Seat # - Name - : Closed Book and Notes. 60 MinutesDocument5 pagesIE 230 Seat # - Name - : Closed Book and Notes. 60 MinutesManu ManvikNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Module 1, Lesson 1 - Notes INTRODUCTION TO OPERATIONS MANAGEMENTDocument14 pagesModule 1, Lesson 1 - Notes INTRODUCTION TO OPERATIONS MANAGEMENTGlaziel Anne GerapatNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Myths of Entrepreneurship, TEM, Lesson 2Document12 pagesThe Myths of Entrepreneurship, TEM, Lesson 2Jay Ann DomeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- One Summer Night: Ambrose BierceDocument7 pagesOne Summer Night: Ambrose Bierce恩洁白No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 3 - 1 Telling SuggestionDocument3 pagesChapter 3 - 1 Telling SuggestionnenengNo ratings yet

- 178 - 6 - Fun For Flyers On-Line Resources - 2017, 4th - 241pDocument241 pages178 - 6 - Fun For Flyers On-Line Resources - 2017, 4th - 241pNguyen HuyenNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Fdi Impact Iferp Ext - 14273Document4 pagesFdi Impact Iferp Ext - 14273Naresh GuduruNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- World Bank SME FinanceDocument8 pagesWorld Bank SME Financepaynow580No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Alcantara Vs de VeraDocument7 pagesAlcantara Vs de VeraRoanne May Manalo-SoriaoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word Documentsyed.abirNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Simex Entry of Illegal Items May 26, 2022Document3 pagesSimex Entry of Illegal Items May 26, 2022Maritime Pulis Gensan MarprstaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- How Am I Smart Dr. Kathy KochDocument209 pagesHow Am I Smart Dr. Kathy Kochbilla79100% (1)

- BSP Accomplishment Report SampleDocument3 pagesBSP Accomplishment Report SampleMelbourneSinisin83% (6)

- Lec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument50 pagesLec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandMsKhan0078No ratings yet

- Pump AuditDocument5 pagesPump AuditHeri SulasionoNo ratings yet

- LAND - TITLES - AND - DEEDS - REVIEWER Atty. SantiagoDocument49 pagesLAND - TITLES - AND - DEEDS - REVIEWER Atty. SantiagoJohn OrdanezaNo ratings yet

- Distance Learning Short Courses: Study Area CourseDocument3 pagesDistance Learning Short Courses: Study Area CoursetaabuNo ratings yet

- Train For The C-Suite: Certified Chief Information Security OfficerDocument10 pagesTrain For The C-Suite: Certified Chief Information Security OfficerNAGARAJU MOTUPALLINo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Thomas Plummer-Living Your DreamDocument274 pagesThomas Plummer-Living Your Dreammehr6544100% (1)

- Financial Statement Analysis at Heritage FoodsDocument83 pagesFinancial Statement Analysis at Heritage FoodsAbdul RahmanNo ratings yet

- Active Learning ConceptsDocument92 pagesActive Learning ConceptsAnh leNo ratings yet

- Liberty Mutual Rate FilingsDocument49 pagesLiberty Mutual Rate Filingsphulam146No ratings yet

- Lay Dominicans Inquirers Pamphlet - Downloadable Color-1Document8 pagesLay Dominicans Inquirers Pamphlet - Downloadable Color-1Enrico CorellaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Piling Codes of Practice in Southern AfricaDocument7 pagesPiling Codes of Practice in Southern AfricaMfanelo MbanjwaNo ratings yet

- Claridge Apartments Co. v. Commissioner of Internal RevenueDocument20 pagesClaridge Apartments Co. v. Commissioner of Internal RevenueScribd Government DocsNo ratings yet

- Foreign Words Used in Legal English: ExercisesDocument1 pageForeign Words Used in Legal English: ExercisesShubham SarkarNo ratings yet

- Term Paper Presentation - GlobalizationDocument11 pagesTerm Paper Presentation - GlobalizationOlalekan ObadaNo ratings yet

- ART 14 OutlineDocument15 pagesART 14 Outlinesan_leonoraNo ratings yet

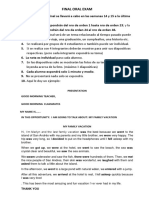

- Final Oral Exam 10 KDocument2 pagesFinal Oral Exam 10 KJose CastroNo ratings yet

- Form AOC-4 HelpDocument30 pagesForm AOC-4 HelpAnandNo ratings yet

- The Little Match Girl Short StoryDocument2 pagesThe Little Match Girl Short StoryTin AcidreNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)