Professional Documents

Culture Documents

Selam Assignment

Uploaded by

Desalegn Bezuneh0 ratings0% found this document useful (0 votes)

11 views6 pages1) The transactions journalize and post the July transactions for a company using a general journal and three-column accounts.

2) Cash accounts show payments for supplies, equipment, insurance, salaries, and dividends as well as cash receipts.

3) Revenue and expense accounts track service revenue, supplies expense, gasoline expense, and depreciation expense.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The transactions journalize and post the July transactions for a company using a general journal and three-column accounts.

2) Cash accounts show payments for supplies, equipment, insurance, salaries, and dividends as well as cash receipts.

3) Revenue and expense accounts track service revenue, supplies expense, gasoline expense, and depreciation expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesSelam Assignment

Uploaded by

Desalegn Bezuneh1) The transactions journalize and post the July transactions for a company using a general journal and three-column accounts.

2) Cash accounts show payments for supplies, equipment, insurance, salaries, and dividends as well as cash receipts.

3) Revenue and expense accounts track service revenue, supplies expense, gasoline expense, and depreciation expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

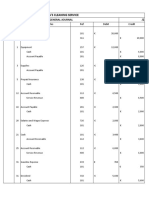

a) Journalize and post the July transactions.

Use page J1 for the journal and the three-column form

of account.

General Journal Page: J1

Post/

Date Description Debit Credit

Ref.

July 01 Cash 101 €20,000 00

Share Capital-Ordinary 311 €20,000 00

To record shareholders’ investment

01 Equipment 160 €12,000 00

Cash 101 €4,000 00

Accounts Payable 201 €8,000 00

To record purchasing of used truck

03 Supplies 126 €2,100 00

Accounts Payable 201 €2,100 00

To record supplies on account

05 Prepaid Insurance 130 €3,600 00

Cash 101 €3,600 00

To record cash paid for 1 year insurance

12 Accounts Receivable 112 €5,900 00

Service Revenue 400 €5,900 00

To record cleaning service performed

18 Accounts Payable 201 €2,900 00

Cash 101 €2,900 00

To record cash paid for amount owed

20 Salaries and Wage Expense 726 €4,500 00

Cash 101 €4,500 00

To record cash paid for employee salaries

21 Cash 101 €4,400 00

Accounts Receivable 112 €4,400 00

To record cash receipt from customers

25 Accounts Receivable 112 €9,400 00

Service Revenue 400 €9,400 00

To record cleaning service performed

31 Gasoline Expense 633 €400 00

Cash 101 €400 00

To record cash paid for gasoline bill

31 Dividends 332 €1,200 00

Cash 101 €1,200 00

To record cash paid for dividend

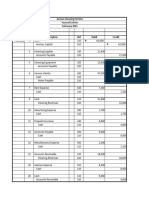

Posting the transaction on three-column form of account

Account Name: Cash Account No.: 101

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 01 €20,000 00 €20,000 00

01 €4,000 00 16,000 00

05 3,600 00 12,400 00

18 2,900 00 9,500 00

20 4,500 00 5,000 00

21 4,400 00 9,400 00

31 400 00 9,000 00

31 1,200 00 7,800 00

Account Name: Accounts Receivable Account No.: 112

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 12 €5,900 00 €5,900 00

21 €4,400 00 1,500 00

25 9,400 00 10,900 00

Account Name: Supplies Account No.: 126

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 03 €2,100 00 €2,100 00

Account Name: Prepaid Insurance Account No.: 130

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 05 €3,600 00 €3,600 00

Account Name: Equipment Account No.: 157

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 01 €12,000 00 €12,000 00

Account Name: Accumulated Depreciation-Equipment Account No.: 158

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 01 Balance €0 00 €0 00

Account Name: Accounts Payable Account No.: 201

Post/

Date Item Debit Credit Balance (Cr.)

Ref.

July 01 €8,000 00 €8,000 00

03 2,100 00 10,100 00

18 €2,900 00 7,200 00

Account Name: Salaries and Wages Payables Account No.: 212

Post/

Date Item Debit Credit Balance (Cr.)

Ref.

July 31 Balance €0 00 €0 00

Account Name: Share Capital-Ordinary Account No.: 311

Post/

Date Item Debit Credit Balance (Cr.)

Ref.

July 01 €20,000 00 €20,000 00

Account Name: Retained Earnings Account No.: 320

Post/

Date Item Debit Credit Balance (Cr.)

Ref.

July 31 Balance €0 00 €0 00

Account Name: Dividends Account No.: 332

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 31 €1,200 00 €1,200 00

Account Name: Income Summary Account No.: 350

Post/ Balance (Dr.

Date Item Debit Credit

Ref. /Cr.)

July 31 Balance €0 00 €0 00

Account Name: Service Revenue Account No.: 400

Post/

Date Item Debit Credit Balance (Cr.)

Ref.

July 12 €5,900 00 €5,900 00

25 9,400 00 15,300 00

Account Name: Gasoline Expense Account No.: 633

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 31 €400 00 €400 00

Account Name: Supplies Expense Account No.: 631

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 01 Balance €0 00 €0 00

Account Name: Depreciation Expense Account No.: 711

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 01 Balance €0 00 €0 00

Account Name: Insurance Expense Account No.: 722

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 31 Balance €0 00 €0 00

Account Name: Salaries & Wages Expense Account No.: 726

Post/

Date Item Debit Credit Balance (Dr.)

Ref.

July 20 €4,500 00 €4,500 00

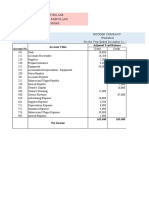

b) & (c) Prepare a trail balance at July 31 on a worksheet, enter the adjustments and complete the worksheet.

Unadjusted Trail Adjusted Trail

Adjustments Income Statement Balance Sheet

No. Account Title Balance Balance

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

101 Cash €7,800 €7,800 €7,800

112 Accounts Receivable €10,900 (1)3,300 €14,200 €14,200

126 Supplies €2,100 (4)1,540 €560 €560

130 Prepaid Insurance €3,600 (3)300 €3,300 €3,300

157 Equipment €12,000 €12,000 €12,000

158 Accumulated Depreciation-Equip. €0 (2)500 €500 €500

201 Accounts Payable €7,200 €7,200 €7,200

212 Salaries & Wages Payable €0 (5)2,200 €2,200 €2,200

311 Share Capital-Ordinary €20,000 €20,000 €20,000

320 Retained Earnings €0 €0 €0

332 Dividends €1,200 €1,200 €1,200

350 Income Summary €0 €0 €0 €0

400 Service Revenue €15,300 (1)3,300 €18,600 €18,600

631 Supplies Expense €0 (4)1,540 €1,540 €1,540

633 Gasoline Expense €400 €400 €400

711 Depreciation Expense €0 (2)500 €500 €500

722 Insurance Expense €0 (3)300 €300 €300

726 Salaries & Wages Expense €4,500 (5)2,200 €6,700 €6,700

€42,500 €42,500 €7,840 €7,840 €48,500 €48,500 €9,440 €18,600 €39,060 €29,900

Net Income or Loss €9,160 -- -- €9,160

€18,600 €18,600 €39,060 €39,060

d) Prepare the income statement and retained earnings statement for July and a classified statement of

financial position at July 31.

Callebaut Cleaning Service, AG

Income Statement

For the month ended July 31, 2017

Revenue

Service Revenue €18,600.00

Expenses

Supplies Expense €1,540.00

Gasoline Expense €400.00

Depreciation Expense €500.00

Insurance Expense €300.00

Salaries and Wage Expense €6,700.00

Total Expenses €9,440.00

Net Income or Loss €9,160.00

Callebaut Cleaning Service, AG

Retained Earnings Statement

For the month ended July 31, 2017

Retained Earnings, as of July 1, 2017 €0.00

Add: Prior year adjustments €0.00

Net Income for the month 9,160.00 9,160.00

Sub total €9,160.00

Less: Dividends 1,200.00

Retained Earnings, as of July 31,2017 €7,960.00

Callebaut Cleaning Service, AG

Statement of Financial Position

July 31, 2017

Assets

Current Assets

Cash €7,800

Accounts Receivable 14,200

Supplies 560

Prepaid Insurance 3,300

Total Current Assets €25,860

Plant, Property and Equipment

Equipment €12,000

Accumulated Depreciation-Equipment (500)

Total Plant, Property and Equipment 11,500

Total Assets €37,360

Liabilities and Shareholder’s Equity

Liability

Current Liabilities

Accounts Payable €7,200

Salaries & Wages Payable 2,200

Total Current Liabilities €9,400

Long-term Liability 0.00

Total Liabilities €9,400

Shareholder’s Equity

Share Capital-Ordinary €20,000

Retained Earnings 7,960

Total Shareholder’s Equity 27,960

Total Liabilities & Shareholder’s Equity €37,360

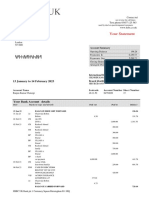

e) Prepare a post-closing trail balance at July 31.

Callebaut Cleaning Service, AG

Post-closing Trail Balance

July 31, 2017

No. Account Title Debit Credit

101 Cash €7,800

112 Accounts Receivable €14,200

126 Supplies €560

130 Prepaid Insurance €3,300

157 Equipment €12,000

158 Accumulated Depreciation-Equip. €500

201 Accounts Payable €7,200

212 Salaries & Wages Payable €2,200

311 Share Capital-Ordinary €20,000

320 Retained Earnings €7,960

Total €37,860 €37,860

You might also like

- Akun Pengantar Jurnal Ledger Neraca SaldoDocument13 pagesAkun Pengantar Jurnal Ledger Neraca SaldoAdi Al HadiNo ratings yet

- Anya's Cleaning ServiceDocument22 pagesAnya's Cleaning ServiceArya HerdiansyahNo ratings yet

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- Accounting Cycle SampleDocument7 pagesAccounting Cycle Samplejosedvega178No ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Perilla Geriqjoedn 1Document20 pagesPerilla Geriqjoedn 1Geriq Joeden PerillaNo ratings yet

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Guimbungan, Core Competency Module 1 - Part 3 PDFDocument11 pagesGuimbungan, Core Competency Module 1 - Part 3 PDFSharlyne K. GuimbunganNo ratings yet

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument3 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditRezekiro IrmNo ratings yet

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- Date Account & Explanation F Debit CreditDocument7 pagesDate Account & Explanation F Debit CreditCindy Claire Pilapil88% (8)

- Cae 1Document4 pagesCae 1stonefiona6No ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- KIESODocument21 pagesKIESOMuhammad Faris100% (2)

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- C Martin-JournalDocument2 pagesC Martin-JournalGenuine SmileNo ratings yet

- Date Description PR Debit Credit 2019Document12 pagesDate Description PR Debit Credit 2019Gina Calling DanaoNo ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- Practice Problem in General Accounting Ytac, Bacalso, MajaduconDocument25 pagesPractice Problem in General Accounting Ytac, Bacalso, Majaduconeunice demaclid100% (1)

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- Perpetual AccountingDocument12 pagesPerpetual AccountingNovelyn Gamboa100% (1)

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- Problem 1-1Document3 pagesProblem 1-1Frencess Mae MayolaNo ratings yet

- Karima Sabilla Al HaqDocument2 pagesKarima Sabilla Al HaqNorazlina FitriahNo ratings yet

- Tugas LAT P2-21 Oktober 2021 - Pengantar Akutansi 1Document10 pagesTugas LAT P2-21 Oktober 2021 - Pengantar Akutansi 1Sher KurniaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- 04PT1Document9 pages04PT1christinemagbanua46No ratings yet

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Problem 1Document8 pagesProblem 1HazeNo ratings yet

- Chap7 QuizDocument7 pagesChap7 QuizGracey DoyuganNo ratings yet

- HW CH2Document3 pagesHW CH2Hà HoàngNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Date Information Ref Debit Credit: Kara Shin General Journal 31-MayDocument5 pagesDate Information Ref Debit Credit: Kara Shin General Journal 31-MayNada AmaliaNo ratings yet

- Emanuel Swedenborg Menny Es PokolDocument7 pagesEmanuel Swedenborg Menny Es PokolImre VíghNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- E 17Document1 pageE 17hieuluu.31221023224No ratings yet

- ACR4.3 Cindy QaaniaDocument4 pagesACR4.3 Cindy QaaniaIndrian Sibi todingNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- Assignment 2 Acct 201 1 1Document5 pagesAssignment 2 Acct 201 1 1Minyoung ChaNo ratings yet

- Comp 2 Activity 5Document13 pagesComp 2 Activity 5Jhon Lester MagarsoNo ratings yet

- Jawaban No 3 A Dan BDocument6 pagesJawaban No 3 A Dan BAndi Rahmat HidayatNo ratings yet

- Tugas 5. Siklus Akuntansi-Ricky Andrian K. RumereDocument66 pagesTugas 5. Siklus Akuntansi-Ricky Andrian K. RumererickyNo ratings yet

- Bookkeeping Cycle, Leonor Creations and Wash&clean LaundryDocument18 pagesBookkeeping Cycle, Leonor Creations and Wash&clean LaundryNadzma Pawaki Hashim100% (1)

- Sample ProblemDocument6 pagesSample ProblemKen Ashley100% (1)

- Day 2 Assignment (HW CHP 3-2) - M Farhan I (29120616) YP64CDocument3 pagesDay 2 Assignment (HW CHP 3-2) - M Farhan I (29120616) YP64Cfarhan izharuddinNo ratings yet

- Washy Wash Inc. Acctg For Already Existing BusinessDocument20 pagesWashy Wash Inc. Acctg For Already Existing BusinessmapapashishsasarapNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Nama: Risma Sugiarti Kuncoro Nim: 4112001066 Kelas: Akuntansi Manajerial IC PagiDocument5 pagesNama: Risma Sugiarti Kuncoro Nim: 4112001066 Kelas: Akuntansi Manajerial IC PagiRisma Sugiarti RismaNo ratings yet

- Solutions To Chapter 9Document10 pagesSolutions To Chapter 9Luzz Landicho100% (1)

- Inventory ManagementDocument17 pagesInventory ManagementRyan RodriguesNo ratings yet

- Tutorial 2 Actg Equation QDocument7 pagesTutorial 2 Actg Equation QHazim YusoffNo ratings yet

- Chapter 1 - Statement of Financial PositionDocument33 pagesChapter 1 - Statement of Financial PositionAbyel Nebur78% (9)

- Effect of Internet On EntrepreneurshipDocument2 pagesEffect of Internet On EntrepreneurshipShoumik Mahmud0% (1)

- Format Import Daftar AkunDocument3 pagesFormat Import Daftar AkunTarisya PermatasariNo ratings yet

- Bahan Presentasi - Kelompok 3 - Supply ChainDocument46 pagesBahan Presentasi - Kelompok 3 - Supply ChainpuutNo ratings yet

- 6-3B SolutionDocument2 pages6-3B SolutionAnish AdhikariNo ratings yet

- Balance SheetDocument7 pagesBalance SheetKashyap PandyaNo ratings yet

- Chapter 4, 5, 6 AssignmentDocument23 pagesChapter 4, 5, 6 AssignmentSamantha Charlize VizcondeNo ratings yet

- CH 6 Classpack With SolutionsDocument20 pagesCH 6 Classpack With SolutionsjimenaNo ratings yet

- Accounting EquationDocument24 pagesAccounting EquationRahul Badlani100% (1)

- Omnichannel Supply Chain in FocusDocument17 pagesOmnichannel Supply Chain in FocusalejandrosantizoNo ratings yet

- Paklaring SecurityDocument4 pagesPaklaring Securitydavidnainggolann7No ratings yet

- MBBcurrent 564548147990 2022-05-31 PDFDocument11 pagesMBBcurrent 564548147990 2022-05-31 PDFAdeela fazlinNo ratings yet

- Periodic Inventory PDFDocument33 pagesPeriodic Inventory PDF48pgcw62kkNo ratings yet

- Cash&BankDocument2 pagesCash&Bankκrιvαn mατιυsNo ratings yet

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- PDF Prac Acc Chapter 15 16docxdocx DDDocument37 pagesPDF Prac Acc Chapter 15 16docxdocx DDBetty SantiagoNo ratings yet

- 2023-02-13 - Ranjon Kumar ChatargiDocument4 pages2023-02-13 - Ranjon Kumar ChatargiMOHAMMAD NAZRUL ISLAMNo ratings yet

- N I Ri: Account StatementDocument2 pagesN I Ri: Account StatementUjang Gembok0% (1)

- Bank StatementDocument24 pagesBank StatementJames PeterNo ratings yet

- 1114-Article Text-1759-1-10-20190318 PDFDocument10 pages1114-Article Text-1759-1-10-20190318 PDFSiti Dhetia AgustianiNo ratings yet

- Asset AccountingDocument60 pagesAsset AccountingNirav PandyaNo ratings yet

- Lesson 6 - Operating Cycle of A Merchandising BusinessDocument5 pagesLesson 6 - Operating Cycle of A Merchandising BusinessMayeng MonayNo ratings yet

- Movement TypesDocument57 pagesMovement TypesAlex RomeroNo ratings yet

- 06 - SCM Academy - Purchasing Overview-EditedDocument15 pages06 - SCM Academy - Purchasing Overview-Editedalice.9No ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- ReportTransactionStatement - Do - 1522Document4 pagesReportTransactionStatement - Do - 1522Shaikh Hassan AtikNo ratings yet