Professional Documents

Culture Documents

MMishra ACRJ 172 Dec2013

Uploaded by

VISHAL MISHRACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MMishra ACRJ 172 Dec2013

Uploaded by

VISHAL MISHRACopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/263876296

Bajaj Auto Limited: Synergizing Product Engineering and Market Engineering

Initiatives

Article in Asian Case Research Journal · February 2014

DOI: 10.1142/S0218927513500144

CITATIONS READS

0 8,631

2 authors, including:

Manit Mishra

International Management Institute, Bhubaneswar

38 PUBLICATIONS 246 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Published in the journal Paradigm (SAGE) View project

Research in progress View project

All content following this page was uploaded by Manit Mishra on 25 July 2018.

The user has requested enhancement of the downloaded file.

ASIAN CASE RESEARCH JOURNAL, VOL. 17, issue 2, 305–338 (2013)

acrj

Bajaj Auto Limited: Synergizing

This case was prepared by

Assistant Professor Manit Product Engineering and Market

Mishra

Management

of International

Institute, Engineering Initiatives

Gothapatna, Bhubaneswar,

India and Professor S. C.

Sahoo of Mahendra Institute

of Management & Technical INTRODUCTION

Studies, Bhubaneswar, India

as a basis for class discussion

rather than to illustrate Any mention of the brand “Bajaj” to an Indian consumer

either effective or ineffective evokes a range of associations. The depth and diversity of

handling of an administrative

or business situation. these brand associations underscore the many different ways

Please send all corre-

in which Bajaj, an iconic brand, has touched the lives of the

spondence to Assistant common people in India. This case brings to light the trials

Professor M. Mishra, IMI

Bhubaneswar – 751003,

and tribulations of Bajaj in its crusade against obsolescence

Odisha, India. E-mail: through innovation in product engineering and market

manitmishra@rediffmail.com

engineering. It is always a difficult proposition to create a

customer-centered company through synergistic assimila-

tion of innovations in product engineering skills and market

engineering acumen. Innovation, through product engi-

neering, is vital to enhance the prospects of an organization;

but is it reliable and compatible with existing consump-

tion patterns of the target market? Understanding the needs

of consumers, through market engineering, is indispens-

able; but is the consumer always explicit? The top man-

agement of any organization often faces this kind of a

dilemma and has to make a decision regarding whether

or not to commercialize an innovative idea. This is the pre-

dicament that demands greater synergy between product

engineering and market engineering initiatives. Integration

between these two vital domains establishes a viable fit

between the benefits offered by the innovation and consumer

requirements, ultimately leading to a faster rate of diffusion.

© 2013 by World Scientific Publishing Co. DOI: 10.1142/S0218927513500144

S0218927513500144.indd 305 20/1/2014 2:20:38 PM

306 ACRJ

However, for any organization, achieving such a synergy is

easier said than done. Bajaj was no exception.

In the backdrop of product and market engineering

perspective, the history of the two-wheeler industry in India

can be segregated into two phases:

1. Phase I (pre-1985): This phase was marked by limited

effort on the part of major industry players towards product

or market engineering initiatives. The two-wheeler industry

comprised of scooter, motorcycle and moped manufacturers.

There were only two prominent scooter manufacturers —

Bajaj Auto which manufactured Vespa in technical col-

laboration with Piaggio and Automobile Products of India

which sold Lambretta. The motorcycle industry comprised of

Royal Enfield, Ideal Jawa and Escorts offering 350cc Bullet,

Yezdi and Rajdoot, respectively. The moped brands avail-

able were Suvega from Moped India Ltd. and Luna from

Kinetic Engineering. Subsequently, TVS Motor Company

(TVS) and Hero joined the moped segment in 1978 and 1980,

respectively.

Scooter was the vehicle of choice for a large majority of

middle-class consumers. Motorcycle was perceived as rugged

but raw whereas moped had a proletarian association. During

this phase, an archaic licensing regime prevented free entry

of new players or additions in manufacturing capacities of

existing players without a supplementary license. The entry

of foreign players was restricted and therefore, the transfer of

technology was minimal. The Indian two-wheeler manufac-

turers lacked in technological competence but were fortunate

to have a readily available market, irrespective of the quality

of offering. As a result, Indian consumers had a few techno-

logically obsolescent options to choose from and the Indian

market remained underserved by a huge margin. In such

a seller-dominated market, the two-wheeler manufacturers

had modest resources and meager motivation to engage in

extensive product or market engineering.

Bajaj was the largest-selling two-wheeler brand with

huge demand and limited competition. The company’s order

book exceeded its annual production capacity by a huge

margin. Product engineering initiatives were restricted to

S0218927513500144.indd 306 20/1/2014 2:20:38 PM

bajaj auto limited 307

indigenization of components and marketing engineering was

an alien concept. In fact, in 1982, Rahul Bajaj, the Chairman

of Bajaj Auto, is reported to have remarked: “My marketing

department? I don’t require it. I have a dispatch department. I don’t

go from house to house to sell.”1

2. Phase II (post-1985): This phase commenced with the entry

of the world’s leading two-wheeler manufacturers as a result

of liberalization of economic policies by the Government of

India. The initial period was characterized by effective

product engineering initiatives but comparatively lesser market

engineering endeavors. The foreign players pitched in with

technology and manufacturing, whereas the Indian partners

assisted in terms of local knowledge, sales and distribution.

The era saw the introduction of India’s first 100cc motor-

cycle (Ind-Suzuki) by TVS, first 100cc 4-stroke motorcycle

(CD 100) by Hero Honda Motors Ltd. (Hero Honda), first

switch-start gearless scooter (Kinetic Honda 100) by Kinetic

Engineering, and first 4-stroke scooter (Legend) by Bajaj,

among other innovations. The products were fuel efficient

and user friendly. A long era of restrictions during Phase I

ensured a huge pent up demand for two-wheelers. The

demand outnumbered supply and therefore, while product

engineering was in full swing, market engineering was as

yet a concept in infancy. However, as competition intensi-

fied, the two-wheeler companies started giving more attention

to market engineering: at first in isolation and thereafter in

integration with product engineering.

At the beginning of this phase, Bajaj emphasized on

product engineering. Bajaj was still the dominant scooter

manufacturer and leading two-wheeler manufacturer but the

challenge, initially from LML and later from Hero Honda

was getting intense. The competition forced Bajaj to engage in

extensive product engineering but it was not enough. Conse-

quently, Bajaj lost its two-wheeler market leadership to Hero

Honda in 2002. For the FY 2001-02, Bajaj sold 1,198,296 units

(market share 27.7%) against Hero Honda’s 1,425,302 units

(market share 33%)2.

This was a watershed in the history of Bajaj which

could have become its Waterloo. Bajaj was at the crossroads.

S0218927513500144.indd 307 20/1/2014 2:20:38 PM

308 ACRJ

Hero Honda had taken the lead while TVS was breathing

down its neck. Scooter, the product category in which Bajaj

had pioneer and product engineering advantage, had lost its

charm. Motorcycle, which was a relatively new area for Bajaj,

had captured the Indian consumers’ imagination. The changes

and challenges, concerns and constraints posed serious ques-

tions before Rahul and later Rajiv Bajaj, the Chairman and

Managing Director of Bajaj, respectively. Should Bajaj con-

tinue to focus on scooter in the hope of favorable consumer

sentiments in future or reinforce its motorcycle manufac-

turing capabilities in accordance with changing consumer

preference? What market engineering acumen would enable

Bajaj to sense the pulse of Indian consumers? Which product

engineering skills would facilitate Bajaj to respond appropri-

ately to the stated and unstated needs of consumers? How

should the market engineering acumen be integrated with the

product engineering skills so as to create, communicate and

deliver superior value to consumers?

TWO-WHEELER MARKET IN INDIA

Current Scenario

The Indian two-wheeler industry reported double digit

growth rate for six consecutive years till 2006–07 on the

back of rising disposable income and easy availability of

consumer finance3. India was the second largest manufac-

turer of 2-wheelers in the world in 2008–094 and witnessed

a compounded annual growth rate (CAGR) of 7% during

the period 2004–095. In the year 2009–10, India’s two-wheeler

sales crossed the 10 million mark for the first time by selling

10.5 million vehicles6. The two-wheeler market has achieved

an almost 100% growth, in terms of units, between the

period 2003–04 and 2009–107 (Exhibit 1). The industry land-

scape though has evolved in terms of competitive intensity

and consumption preferences since its humble beginning.

The leading two-wheeler manufacturers have adopted a cali-

brated approach against such changing market paradigms.

They repositioned products and realigned their portfolios,

S0218927513500144.indd 308 20/1/2014 2:20:38 PM

bajaj auto limited 309

created products to serve new market segments, and placed

greater emphasis on the rural and semi-urban consumers to

achieve growth8. A deep commitment and huge investment

in R&D and marketing research resulted in augmentation of

product engineering skills and market engineering acumen,

respectively. While product engineering culminating in new

product introductions at regular intervals rejuvenated con-

sumer interest; market engineering resulting into new market

creation ensured sustained growth for the manufacturers.

Market Segmentation

The demanding nature of Indian consumers has forced the

two-wheeler manufacturers to perennially look for means

to enhance the customer delivered value. Traditionally,

the 2-wheeler market in India has been segmented on the

basis of product features across three prominent product

categories — Scooter, Motorcycle and Moped (Exhibit 2).

Even though features of a product and benefits from a

product are like two sides of the same coin, a benefit-based

segmentation provides more diagnostic information and is

a better reflection of the consumer value system9. A benefit

segmentation of two-wheeler market is an upshot of what fea-

tures are of importance to consumers and how they perceive

different two-wheelers to be performing on these features.

Thus, a focus on benefits brings to the fore not just “what”

consumers see, but also “how” they perceive it. It is vital to

understand the varying consumer needs since there is sub-

stantial heterogeneity in the perceived importance of different

attributes offered by different two-wheeler products. Research

suggests that even as most people would like as many

benefits as possible, the relative importance they attach to

individual benefits can vary significantly10.

Until 2000, the two-wheeler market was segmented

on the basis of whether the benefit sought was utilitarian or

value-expressive. Most of the two-wheelers (scooters, mopeds

and even motorcycles, e.g., Escort’s Rajdoot, Hero Honda’s

Splendor and Bajaj’s 4S Champion) provided the former

benefit while a few motorcycle brands (Royal Enfield’s Bullet,

S0218927513500144.indd 309 20/1/2014 2:20:38 PM

310 ACRJ

Ideal Java’s Yezdi and later Hero Honda’s CBZ) satiated the

latter benefit. Post-2000, the increasing traffic on road and

rising fuel prices divided the consumers seeking utilitarian

benefit into convenience-seekers (in terms of ease of driving)

and performance-seekers (in terms of fuel efficiency), respec-

tively. Thus, the three dominant benefits sought by Indian

two-wheeler consumers’ post-2000 have been convenience

(provided by gearless scooters e.g. Honda’s Activa and TVS’s

Scooty), performance (provided by motorcycles, e.g., Hero

Honda’s Splendor, Bajaj’s Discover and TVS’s Star) and value-

expression (provided by motorcycles e.g. Royal Enfield’s

Thunderbird, Hero Honda’s Karizma and Bajaj’s Pulsar).

Competition and consumers have forced the two-wheeler

players to have a footprint in every possible segment. It is the

performance segment that influences volumes, while the con-

venience and value-expressive segments drive value for the

manufacturers. The incessantly evolving consumer preference

is mainly responsible for this periodic segment redefinition of

India’s two-wheeler market.

Evolving Contours of Consumer Preference

The Indian consumers’ preference has gradually shifted from

an inclination towards scooter to a predilection for motor-

cycle. Until the middle of the 1980s, the scooter was the tra-

ditional war-horse of a middle-class Indian consumer. The

ubiquitous scooter was in demand for its ability to carry pas-

sengers as well as freight. Scooter was perceived as a conve-

nient family vehicle which offered functional value such as

spacious seat, bigger storage space and comfortable drive.

Accordingly, the sales pitch emphasized upon reliability,

price, comfort and utilitarian value of the product. However,

over the last two-and-half decades, and in synchronization

with the commencement of Phase II of product and market

engineering, the consumer preference gradually veered away

from scooter and to motorcycle. The new-age motorcycles

embodied seamless integration of advanced technology,

fuel economy and aesthetic appeal. While longer wheelbase,

better ground clearance and superior suspension made riding

S0218927513500144.indd 310 20/1/2014 2:20:38 PM

bajaj auto limited 311

smoother on pot-hole infested Indian roads, frequent product

engineering leading to ergonomically designed attributes

made riding a pleasure. Its superior style quotient contrib-

uted towards attracting eye balls for the rider. Furthermore,

decreasing price difference between motorcycle and scooter,

and relatively significant resale value also added to the con-

sumers’ preference for motorcycle. In a nutshell, it provided

great value for money to the transformed Indian consumers

for whom acceleration and styling had become as important

as comfort and utility.

The success of motorcycle as a product category

rested on the manufacturers’ ability to assimilate market

engineering with product engineering. By offering more

perceived-value-for-money products, motorcycle manufac-

turers were able to attract the next level of urban price sensi-

tive buyers while at the same time captured the fast growing

rural market. Unlike motorcycles from Phase I era, the motor-

cycles in Phase II were not just a product but an extension of

the rider’s personality. The dominance of motorcycle in the

two-wheeler industry was finally established in 2000 when it

overtook scooter in terms of volume of sale. The number of

motorcycles sold in 1999–2000 was 1,612,895 units as against

1,357,483 units of scooters (Exhibit 3). In 2010, this dominance

has taken the shape of hegemony as motorcycles comprised

approximately 80% of the two-wheeler market. The number

of motorcycles sold in 2009–10 was 8,446,591 units as against

1,542,507 units of scooters (Exhibit 3).

Notwithstanding the supremacy of motorcycle, there

was a gradual amelioration in the popularity of gearless

scooter vis-à-vis geared scooter (Exhibit 4). The convenience

of driving a gearless scooter in an increasingly congested

urban India made it an attractive option, more so for niches

with special requirements, e.g., women and the elderly.

Overall, in 2009–10, 80% of the two-wheeler market share

belonged to motorcycles; gearless scooters contributed around

15% while the rest (5%) belonged to mopeds and others. This

is in complete contrast with the scenario in 1994–95 when

motorcycles had only 24% market share against a formidable

52% market share of scooters and a respectable 25% market

share of mopeds and others (Exhibit 3). Indeed, Indian

S0218927513500144.indd 311 20/1/2014 2:20:38 PM

312 ACRJ

consumers’ preferences have evolved. However, this meta-

morphosing consumer behavior is a manifestation of not just

availability of product-oriented options, but also of several

market-oriented determinants.

The demographic factors have contributed their bit

towards this shift. India has a demographic profile with an

average age of 25 years which is 9, 12 and 19 years younger

than China, USA and Japan, respectively. Around 33% of

India’s population of 1.2 billion in 2011 belongs to the age

bracket of 20–40 years. In this age group, the population of

males (key target market for motorcycle) is estimated to be

206 million whereas the population of females (key target

market for gearless scooter) is estimated to be 189 million11.

These demographics have aided in generating a sustainable

demand for two-wheelers.

The socio-economic factors have ensured that the

two-wheeler consumption cycle is replicable. The number

of households in India having income between Rs. 200,000

(US$4000 approx.) and Rs. 500,000 (US$10000 approx.) is esti-

mated to have increased to 22 million in 2009–10, as com-

pared to approximately 9 million in 2001–0212. India’s per

capita disposable income in 2015 vis-à-vis 2011 is expected

to rise by 106%13. It is the increasing income that has fuelled

demand for even high-end two-wheelers14. The process was

further facilitated by software boom and coming of age of a

generation that had grown up watching western materialistic

culture on satellite television15.

The political factors too have contributed their bit.

The Government of India displayed an inclination towards

liberalization of economic policies in the 1980s and thus,

brought about a fresh wave of joint-venture companies with

minority foreign participation (Exhibit 5). These players

enlightened the Indian consumers to the possibility of con-

veyance using a fuel-efficient, hassle-free and elegantly built

100cc motorcycle. At the same time, a sales tax rationaliza-

tion in 2001 led to rise in duties on geared scooters and even-

tually affected its price16. The price of scooters was rendered

further unattractive by environmental norms that forced

scooter manufacturers to install catalytic converters while most

motorcycles were already in accordance with these norms.

S0218927513500144.indd 312 20/1/2014 2:20:38 PM

bajaj auto limited 313

The shift towards acquisition of a motorcycle as a

personalized transport was hastened by an overcrowded

and unreliable urban mass transport system. The area

occupied by roads in Class I cities (having a population

of more than 100,000) in India is only 16.1% of the total

developed area whereas the corresponding figure for USA

is 28.19%. The peak hour speed in central areas of many

major cities in India is as low as 4–5 km per hour17. For the

harassed commuter, a two-wheeler is the only recourse as it

needs less road space and can make its way forward through

the traffic jams. The increased potential of the rural market is

also owed to abysmal transport infrastructure. India’s total

road length is 3.3 million km, of which 2.65 million km (more

than 80%) is constituted by village roads18. These village

roads are a huge labyrinth providing accessibility in the vast

hinterlands of India. The rural consumer, therefore, demands

two-wheelers with larger wheel base and greater mileage.

To their credit, the motorcycle manufacturers encour-

aged consumption by making available fuel-efficient and low-

maintenance models with tangible features and intangible

associations.

MOTORCYCLE INDUSTRY IN INDIA

If the motorcycle gained the attention of Indian consumers

by the mid 1980s, post economic liberalization the atten-

tion got converted into inclination. The challenges before

motorcycle manufacturers were many and multifarious. The

motorcycle industry, by its very nature, is capital intensive.

In addition, India has some of the world’s most stringent

emission norms19; relatively expensive fuel when compared

to the cost of living; constant pricing pressure on manufac-

turers; and consumer expectations of high quality durable

vehicles. Experts have categorized the Indian motorcycle

industry products either on the basis of price or engine

capacity. On the basis of price, motorcycles have been catego-

rized into “entry segment” (price of up to US$800 approxi-

mately); “executive segment” (price between US$800 to

US$1100 approximately) and the “premium segment” (price

S0218927513500144.indd 313 20/1/2014 2:20:38 PM

314 ACRJ

of US$1100 approximately and above). Categorization on the

basis of engine capacity results into three segments: 75–125cc;

125–250cc; and > 250cc. However, there is frequent attempt by

players to redraw categories and redefine competition.

The three leading players — Hero Honda, Bajaj and

TVS — have significant presence across different engine

capacities and price points within the motorcycle market. The

intensity of the competition between the “Big Three” of the

Indian two-wheeler industry has led to innovation, thereby

providing greater benefit to Indian consumers. Together, the

three companies command a highly respectable 80% market

share in the two-wheeler industry (Exhibit 6). Even as Hero

Honda enjoys market leadership, Bajaj has made every effort

to narrow down the gap. A comparison of the market share

of Bajaj vis-à-vis the market leader Hero Honda during 2008–

0920 and 2009–1021 (Exhibit 6) substantiates this notion. The

rivals, though, are not on a head-on collision course with

each other. A competitive brand mapping of the product mix

(Exhibit 7) revealed that while Hero Honda targeted volume

driven entry segment and Bajaj offered multiple options in

the premium segment, the honors were equitably shared in

the executive segment. It is pertinent to mention here that

Bajaj was the leading player in the executive segment with a

commendable market share of 45.9% in 2009–1022.

BAJAJ

“All of our innovations are directed at supporting our unique busi-

ness model, which rests on selling specialized brands at the front

end, derived from flexible platforms at the back end.”

— Rajiv Bajaj23

Bajaj has been a flag-bearer of the 2-wheeler market in

terms of brand equity and consumer satisfaction. The stra-

tegic product and market engineering outputs delivered by

Bajaj over its six-decade long life are described in the form

of a Timeline (Exhibit 8). A review of the Timeline indicates

that Bajaj was the leading player in the Indian two-wheeler

S0218927513500144.indd 314 20/1/2014 2:20:38 PM

bajaj auto limited 315

industry until 2002. A combination of pioneer advantage

and patriotic brand associations (e.g., Hamara Bajaj) contrib-

uted towards significant brand recognition and brand recall

on the part of Indian consumers for the brand “Bajaj”. Bajaj

communicated to its consumers through a sentimental nation-

alistic tone which harped upon the consumer’s sense of iden-

tification with India24. It retained its dominant position in the

Indian 2-wheeler industry for more than three decades owing

to the reliability and durability of its products, which also

contributed towards its brand identity and brand equity. The

downfall came in 2002 when Bajaj lost its leadership position

to Hero Honda in the two-wheeler market. It is noteworthy

that in 1999, for the first time, market share of motorcy-

cles (34.6%) exceeded those of geared scooters (32.7%) in

India25. As if on a cue, in 2002, Bajaj, the vanguard of scooter

industry, lost the number 1 position in the two-wheeler

industry to Hero Honda, the harbinger of motorcycle revolu-

tion. Bajaj could not adapt to the changing times. Marketing

myopia blinded Bajaj towards the structural shift in consumer

demand. The market share of scooter started diminishing

from 1994 onwards; until in 1999 the motorcycle overtook

the scooter as the largest contributor to the two-wheeler

industry sales. However, the top management continued to

repose its faith in the ability of the scooter to attract Indian

consumers’ share of mind, heart and wallet. This was evident

when Rahul Bajaj, the Chairman of Bajaj posited in 2000, “A

country of a billion people shall always have enough families

who will begin their motoring lives with traditional, low-cost

scooters,”26 and then again in 2002, “I should be pardoned for

being sentimental about scooters.”27 In this intervening period

of two years the market share of scooter as a percentage of

the two-wheeler market declined from 25.9% in FY 1999–2000

to a mere 12.3% during the FY 2001–200228.

Even as the sellers’ market changed into buyers’

market (in its heydays in the 1980s, the waiting period for a

Bajaj Chetak scooter was 10 years29), complacency had set in

and Bajaj was sluggish in reacting to the changes in the

market. The new product development process was slow and

inadequate. The consumer orientation was shifting towards

S0218927513500144.indd 315 20/1/2014 2:20:38 PM

316 ACRJ

motorcycles and Hero Honda was capitalizing on it but until

the mid-1990s Bajaj was dependent only on Bajaj RTZ and 4S

Champion for its motorcycle sales (see Exhibit 8). Its response

to the onslaught of rivals in the gearless scooters market was

also feeble. The only product in the product portfolio of Bajaj

in the 1990s which made its mark was the refurbished 100cc,

4-stroke Bajaj Boxer commercialized in 1999.

The saga of Bajaj’s product and market engineering ini-

tiatives can be effectively divided into pre-2000 and post-2000

eras. The pre-2000 era is not short on product engineering

initiatives. Bajaj is credited with launching Vespa in technical

collaboration with Piaggio, Italy. The first scooter developed

indigenously for Indian consumers was Bajaj Chetak launched

in 1972. Bajaj launched its first motorcycle KB100 in 1986. It

offered its first 4-stroke motorcycle in the form of 4S Cham-

pion. It also launched India’s first 4-stroke geared scooter

Bajaj Legend. However, in the 1990s there emerged a gap

between innovation and diffusion due to insufficient attention

being paid to market engineering.

In the post-2000 era, Bajaj gradually moved towards

greater synergy between product innovation and market

requirement. It not only engineered new products but also

engineered new markets. Bajaj commenced the process of

transformation in 2001 and started focusing on motorcycles.

Successful product innovations such as Bajaj Pulsar were

launched. The product line upward stretching was carried

out by offering Bajaj Eliminator, a 175cc, 4-stroke chopper

with 5-speed gear box. The product performance was also

upgraded by technological inventions, e.g., DTSi (Digital

Twin Spark ignition). The extensiveness of product portfolio

was enhanced by products like CT 100 (entry segment), 125cc

Discover DTSi (executive segment) and Bajaj Pulsar 150cc/

180cc (premium segment).

During 2001–05, Bajaj was simultaneously treading

two distinct paths. On one hand, it came out with new

power brands (e.g., Pulsar, which was ranked 1st in the “Top

30 automobile brands of India” by the 4Ps Power Brand

Awards30) in the motorcycle category and practiced ingre-

dient branding (through DTSi); while on the other hand,

S0218927513500144.indd 316 20/1/2014 2:20:38 PM

bajaj auto limited 317

it continued manufacturing scooters in the hope of revival.

It was only in the year 2006 that Bajaj finally stopped

manufacturing the iconic Bajaj Chetak which had, by then,

sold 10 million units. It signaled the end of an era, the era

of Hamara Bajaj. Post-2005, the thrust on product and market

innovations and emphasis on their synergy continued. In

2007 and 2008, line modernization was the key strategy. Bajaj

leveraged its brand equity to the maximum through astute

use of sub-branding and modifiers (e.g., DTSi, DTS-Fi, and

DTS-Si). It not only distinguished different offerings but also

associated the Bajaj brand name with continuous techno-

logical up-gradation. In order to emphasize on its stature in

the two-wheeler industry, Bajaj changed its brand essence to

“Distinctly Ahea”31 meant to act as an effective lexicographic

heuristics.

The year 2009 brought the best out of Bajaj stable

in the form of XCD 135 DTS-Si, Pulsar 150 DTS-Si, Pulsar

180 DTS-Si, Pulsar 220 DTS-Si and 100cc Discover DTS-Si.

Bajaj concentrated on providing a ladder to the consumers

by making available Discover (100cc, 125cc), XCD (125cc,

135cc), and Pulsar (135cc, 150cc, 180cc and 220cc). The latest

additions to the Bajaj stable have been Discover 100 and

Pulsar 135. For example, Bajaj DTS-Si 100cc is a kaleidoscope

of contrasts. On one hand, it offered value to the aspiring

urban market through its high style quotient at optimum

price; while on the other hand, it offered the rural market

rational value through its features and price (Exhibit 8). No

wonder, it achieved a diffusion rate of 500,000 in just six

months after its launch. A comparative assessment of Dis-

cover 100cc against its closest rival Passion Plus from Hero

Honda (Exhibit 7) divulges a clear picture of its competitive

advantage (Exhibit 9).

The achievement of Bajaj post-2000 indicates that even

though the core competency of Bajaj was technology and

innovation, success came only when it combined its R&D

effort with its marketing research endeavors. Bajaj finally suc-

ceeded in synergizing its product engineering and market

engineering initiatives.

S0218927513500144.indd 317 20/1/2014 2:20:38 PM

318 ACRJ

PRODUCT ENGINEERING INITIATIVES

The competitiveness in the motorcycle market shortened the

product life cycle (PLC) catapulting the ability to offer new

models to meet fast changing consumer preferences into a

category point-of-parity. Instead of a lackadaisical approach

towards R&D, a calibrated initiative leading to forward

thinking and actionable insight was the need of the day. The

industry as a whole responded positively to such a call. The

cumulative R&D expenses of 10 major players32 in the auto-

mobile and ancillary industry during the period 2004–2008

increased at a CAGR of 47% from Rs. 4.3 billion to Rs. 20

billion and the average R&D expenditure during the period

as a percentage of net sales also went up from 1.2% to 2.1%33,

a good step forward by India Inc.

The Government of India also pitched in with a com-

prehensive Indian Auto Policy34 in March 2002. As per

the policy guidelines, the manufacturers were entitled to

a rebate on the applicable excise duty for every 1% of the

gross turnover of the company spent on R&D. Subsequently,

a weighted tax deduction of up to 150% for in-house R&D

activities was permitted35. To promote the use of environment

friendly low-emission auto fuel technology, adequate fiscal

incentives were proposed. In a nutshell, the policy encour-

aged R&D into product development, production and genera-

tion of environment-friendly auto fuel technology (Exhibit 10).

This fillip towards innovation was essential since his-

torically, the Indian two-wheeler industry has always looked

either East or West for technology. The three main modes of

transfer of technology have been joint ventures and technical

collaborations; foreign direct investment (FDI); and, 100%

owned subsidiary route. Bajaj has leveraged the technological

alliance route to augment its product engineering strategies

(Exhibit 11). The tie-up with Kawasaki Heavy Industries36 in

1986 resulted in many state-of-the-art two wheelers for the

Indian market such as KB series, 4S, 4S Champion, Boxer, the

Caliber series, and Wind125. Bajaj leveraged its core compe-

tency of R&D prowess to attain competitive advantage.

In 2003, Bajaj unveiled the Digital Twin Spark igni-

tion (DTSi) engine with a promise that these engines would

S0218927513500144.indd 318 20/1/2014 2:20:38 PM

bajaj auto limited 319

deliver higher power, better fuel consumption and lower

emissions. The technology was first implemented in the

Pulsar model. Bajaj also introduced technologies such as

Exhaust TEC (Exhaust Torque Expansion Chamber), LED Tail

Lamps, LCD Display, innovative spare parts (Tubeless tires,

rear disk brakes), etc. Products like Boxer, Eliminator and the

Pulsar, all three winning products in their own right, show-

cased Bajaj’s technological competence and product designing

capabilities.

Bajaj continued with its quest during 2009–10 by cre-

ating facilities for timely execution of product engineering

initiatives. Not just the technology developed, but also the

cradle where these technologies were under gestation was

modernized. All the Bajaj manufacturing facilities have been

awarded as “TPM (Total Productive Maintenance) Excellence

Category — 1” winners by JIPM (Japan Institute of Plant

Maintenance). A world-class NVH (Noise, Vibration and

Harshness) laboratory was commissioned in 2010 for further

research. With an eye towards harnessing alternative tech-

nology, Bajaj partnered with Enegtek37 for technology that

would enable 2-wheelers to run on natural gas instead of

gasoline38.

The objective at Bajaj to produce Japanese-quality

motorcycles at Indian cost was ably supported by its inno-

vative manufacturing process which endeavored to “build

technology inside but parts outside”. Bajaj outsourced the

manufacturing of non-critical parts to a core group of trusted

suppliers capable of providing quality input. This core group

was reduced from 800 to a mere 180 so as to ensure greater

control over quality and adherence to timely supply norms.

It is indeed remarkable that just 15 vendors supplied 75%

of the components used at its Pantnagar facility whereas

in the Chakan facility, only 50 suppliers catered to its 100%

parts requirement. This strategic change in the production

process ensured a reduction in depreciation cost; cut down

on its variable cost component and improved manpower pro-

ductivity by five times in the period 2002–2010. A compar-

ison between 2000–01 and 2008–09 makes the success of the

strategy evident. While on 31 March 2001, the firm’s annual

capacity was approximately 2.32 million vehicles and the

S0218927513500144.indd 319 20/1/2014 2:20:38 PM

320 ACRJ

depreciation cost was Rs. 177 crore (approx. US$35.4 million),

by 31 March 2009 the capacity had increased to approxi-

mately 4 million even as depreciation cost decreased to

Rs. 130 crore (approx. US$26 million)39.

The recognition and appreciation received by Bajaj’s

products Pulsar, Discover and Kawasaki Ninja at different

platforms during 2009–10 vindicate its holistic thrust upon

product engineering (Exhibit 12).

MARKET ENGINEERING INITIATIVES

As a pioneer and market leader for more than five decades,

Bajaj built a reputation for itself as manufacturer of affordable

products wherein “affordability” meant the monthly cost of

ownership of a two-wheeler adjusted for its resale value. The

endeavor by Bajaj to identify latent markets and create new

markets gained momentum in the 1990s. In 1998, it launched

India’s first 4-stroke geared scooter to satisfy the needs of

environmentally conscious consumers who wanted greater

mileage. Thereafter, in 2001 Bajaj Eliminator was offered for

the niche Indian motorcycle rider market looking for a cruiser

bike at an affordable price. The brand essence “Distinctly

Ahead” was introduced and one of the brand elements — the

logo was altered in 2007, to make it look more contemporary

and representative of its changing business philosophy. In

relation to segmentation of the market, Bajaj adopted an inge-

nious approach by classifying the Indian motorcycle market

as “commuter standard”, “commuter deluxe” and “sporty”.

An assessment of the resulting product lines revealed the

competitive scope of each of the brands of Bajaj vis-à-vis its

respective competitors in each segment (Exhibit 13).

At the same time, not all efforts at market engi-

neering in the last decade have been equally successful. Bajaj

launched the utility versions of Chetak and Super in order to

revive the sagging geared scooter market. However, despite

all efforts, the production of Chetak had to be stopped in

2006 when scooters contributed a mere 0.3% to the total

two-wheeler market. In the entry segment of the motorcycle

market, Bajaj had a market share of 49% in 2004–05 when it

S0218927513500144.indd 320 20/1/2014 2:20:38 PM

bajaj auto limited 321

decided to move away from this segment citing low oper-

ating margins. The decision resulted in lack of footprint in the

volume-based entry segment. Bajaj continued to believe that

the segment is unprofitable and declining and therefore, it is

not of any concern if it lost share in a market that does not

seem to have a future. This strategic blunder resulted in the

decline in the overall market share of Bajaj40.

However, Bajaj was quick to learn from its mistakes. It

reentered into the 100cc entry segment with a bang when it

launched Discover DTS-Si 100cc in 2009 (Exhibit 8). The posi-

tioning as an aesthetically endowed bike for “discovering

India” appealed to the urban markets while a larger wheel

base and greater mileage attracted the rural markets. In con-

trast to segmenting the motorcycle market, Bajaj carried out

counter-segmentation to create a super-segment of those users

who looked for both, style and performance. Similarly, by

launching Pulsar 150cc and Pulsar 135cc a completely new

“sporty-commuter” segment was created. This was not some-

thing new to Bajaj. Even in 2007, Bajaj had launched XCD 125

DTS-Si which had the best of all the worlds — 150cc features,

125cc performance and 100cc mileage.

Even as Bajaj offered a rich product portfolio, the price

points were chosen so as to minimize overlap and maximize

the range, thereby reducing the chance of cannibalization. An

analysis of the product portfolio pricing revealed that Bajaj

offered products at distinctive price points. On one hand,

there was kamikaze pricing in case of Platina, whereas on the

other hand, there was perceived value pricing as in the case

of Pulsar 220 (Exhibit 14).

Bajaj adopted a very effective branding strategy con-

gruent to the overall corporate strategy that focused on

highlighting the brand identity of individual offerings while

understating the “Bajaj” corporate identity41. Bajaj attempted

to separate its name from its models to ensure greater accept-

ability not just locally but even in overseas markets such as

Europe and the US. The decision was on the basis of strength

of its two brands “Pulsar” and “Discover” which dominated

its product portfolio by contributing 70% to its total two-

wheeler sales. Pulsar was positioned as a performance ori-

ented motorcycle with a heavy dose of style thrown into it,

S0218927513500144.indd 321 20/1/2014 2:20:38 PM

322 ACRJ

serving mostly the younger buyers. Discover, on the contrary,

was positioned as a fuel efficient bike targeted at those con-

sumers who looked for high mileage and lower maintenance

cost along with aesthetics. Bajaj, in association with its Euro-

pean partner KTM, 42 practiced the principle of sharply posi-

tioning a brand as opposed to promoting a rather diffused

brand.

The logic for promoting individual brand names at the

cost of the family name was also based on two additional

reasons. First, Pulsar and Discover had a loyal customer base

and no longer needed the support of “Bajaj” the umbrella

brand; and secondly, even though the strength of Bajaj’s

brand identity was undeniable, its equity was not focused.

Rajiv Bajaj was assured about the success of this rebranding

strategy when he said, “Today if you talk to people … they

say that they wish to buy a ‘Hero Honda’ but when it comes

to Bajaj the buyer will say that he wishes to buy a ‘Pulsar’ or

‘Discover’; he won’t say I want to buy a ‘Bajaj’. This tells me

we have succeeded in separating and specializing.”43

Bajaj also generated tremendous amount of symbi-

osis between its marketing and distribution strategies. The

rebranding exercise included all consumer touch points.

Fitch44 was roped in for ensuring consistency and upgrading

aesthetics at Bajaj showrooms across the country. To enhance

its market presence in tier 2 and tier 3 cities, Bajaj increased

the number of dealers and service centers to a more respect-

able figure of 600 and 1100, respectively. Bajaj endeavored to

build a responsive supply chain as opposed to a rigid one45.

The market engineering efforts have reinforced Bajaj’s

image as a customer-centric organization. The honors

received by Bajaj and its various marketing initiatives at

different platforms validate its quest towards innovation

through market engineering (Exhibit 15).

COMPETITORS’ PRODUCT AND MARKET

ENGINEERING STRATEGIES

The two-wheeler market in India, for last two decades, has

been dominated by Bajaj, Hero Honda and TVS. The product

S0218927513500144.indd 322 20/1/2014 2:20:38 PM

bajaj auto limited 323

and market engineering strategies of all these three players is

intertwined to a great extent, thereby influencing each other’s

fortune. Therefore, Bajaj’s strategies need to be analyzed in

view of the product and market engineering strategies of

Hero Honda and TVS.

Hero Honda

The Hero Group and Honda Motor of Japan set up the

joint-venture Hero Honda in 1984. When the joint-venture

company was established, the scooter was the most popular

two-wheeler in the country. Therefore, it is to the credit of

Hero Honda that it created a market where none existed.

Hero Honda turned out to be way ahead of its competitors

in terms of integrating the product and market engineering

initiatives. In 1985, it launched its first motorcycle CD 100.

It was a 4-stroke, 100cc motorcycle which set the benchmark

for fuel efficiency (80 km/liter), quality, pollution control

and low maintenance cost46. The CD 100 came as a blessing

for the aspiring and existing two-wheeler owners who were

burdened with myriad liabilities, e.g. low fuel efficiency, poor

performance, negligible aesthetics and non-existent ergo-

nomics. CD 100 went on to sell 1 lakh (0.1 million) units in

two years after its launch47. The moment of truth for Hero

Honda, however, arrived in 1994 with the launch of the iconic

brand Splendor. The right proportion of performance and

aesthetics caught the imagination of Indian consumers. The

brand essence, “fill it, shut it, forget it” struck a chord with

millions of riders. In 2000, Splendor became the largest selling

motorcycle model in the world. Splendor firmly established

Hero Honda as the largest two-wheeler manufacturer in

India. In accordance with the evolving consumer preferences

towards high-end aesthetic bikes, Hero Honda launched

its heavy-duty yet stylish CBZ. Hrithik Roshan, the Indian

movie star who is highly popular for his super-human roles,

was roped in to reinforce the knowledge structure of the

brand in the minds of consumers as young and energetic. In

recent times, Hero Honda also attempted to associate patriotic

feelings with the corporate brand through its tagline “Hero

S0218927513500144.indd 323 20/1/2014 2:20:38 PM

324 ACRJ

Honda — Desh ki dhadkan” (Hero Honda — Heartbeat of

India). A synergistic assimilation of product and market engi-

neering skills ensured the dominance of Hero Honda48 in the

two-wheeler industry over the last decade (Exhibit 6).

TVS

The TVS Motor Company is the third largest two-wheeler

manufacturer in India49. The company enjoys a strong rep-

utation for its product engineering capabilities. It has a

product engineering team of 400 engineers and spends about

2.5–3% of its turnover on R&D every year50. It is credited

with offering TVS 50 in 1980, India’s first indigenously built

two-seater moped. The joint-venture of TVS and Suzuki

Motors is credited with offering India’s first 5-speed, 140cc

motorcycle — Suzuki Shaolin. In 2002, TVS received the

National Award for Successful Commercialization of Indige-

nous Technology from Technology Board, Ministry of Science

and Technology, Government of India for the indigenously

developed TVS Victor GL 110cc motorcycle. TVS Victor was

also awarded the best two-wheeler in the Rs. 30,000–40,000

price range by BBC in 2003.

The ultimate paradigm of symbiotic integration

between product engineering and market engineering on the

part of TVS was Scooty. Such has been the craze and satis-

faction of consumers, primarily female consumers that the

name “Scooty” is often treated as a verb to refer to all brands

of gearless scooters in India. Evidently, it is the leading gear-

less scooter brand in India. Likewise, TVS offered the moped

TVS XL Heavy Duty to satisfy the needs of self-employed

working class individuals (e.g., vegetable vendors) in terms

of a two-wheeler having power and durability to transport

human beings as well as goods. TVS has endeavored to sup-

plement its established reputation in product engineering

with out-of-box thinking in market engineering. Unlike its

competitors, TVS emphasized upon building fun-filled emo-

tional connection through its tag line “More smiles per hour.”

A marketing masterstroke was achieved when TVS signed the

cricket legend Sachin Tendulkar as its brand ambassador. For

S0218927513500144.indd 324 20/1/2014 2:20:38 PM

bajaj auto limited 325

millions of Indians, Sachin personifies confidence, trust, sin-

cerity and humility, and these are precisely the associations

that TVS wanted to be identified with. To enhance the cus-

tomer experience at every touch point, the company laid

down standing orders on how employees should interact

with customers. The showrooms were refurbished in terms of

design and color so as to ventilate a unique but shared cor-

porate identity51. Indeed, TVS epitomized Trust, Value and

Service.

CONCLUSION

Bajaj ensured that innovation in terms of product engi-

neering and market engineering, unlike in its early years,

are not carried out in isolation of each other. The competi-

tion from Hero Honda and TVS necessitated it. The evolving

consumer preference demanded it. Hence, synergies were

sought and resources were leveraged to create competitive

advantage vis-à-vis its more proactive rivals. Bajaj integrated

its front-end and back-end operations to augment symbiosis.

It did not clutter the consumer’s mind with a complicated

brand-mix. Rather, it kept the front-end simple with just two

brands catering to two broad segments of Indian consumers.

Bajaj banked upon Pulsar to cater to the “Sporty” segment

whereas Discover catered to the “Commuter” segment.

Emphasis on just two versions kept even the back-end, com-

prising designing, manufacturing and product development,

rather simple. While on one hand Bajaj covered the needs and

desires of Indian consumers in terms of performance and aes-

thetics; on the other hand, the symbiosis between the offer-

ings at the back-end ensured greater profitability. The launch

of variants of Bajaj Pulsar and Discover (e.g. 100cc Discover

and 135cc Pulsar) further ensured windfalls52.

In terms of product engineering, Bajaj focused its R&D

machinery on three main areas: fuel economy, environmental

compliance, and performance. In terms of market engineering

Bajaj focused on fulfillment of aspirations of a young India,

urban as well as rural. According to Rajiv Bajaj, “The road

ahead for next few years is to keep our eyes absolutely

S0218927513500144.indd 325 20/1/2014 2:20:38 PM

326 ACRJ

focused on the motorcycle industry.”53 The entire saga of

Bajaj exemplified the continuous endeavor towards product

and market engineering either through anticipation or

through assessment of consumer wants. Bajaj, the pedigreed

but plodding pioneer finally rediscovered its sublime touch

and in the process, earned the distinction of catering t

hrough its products to both — Bharat54 as well as India.

REFERENCES

1. Harish, R., 2011. Bajaj auto: From Chetak to Pulsar and beyond.

The IUP Journal of Marketing Management, February.

2. Ibid.

3. Ghosh, A., Ray, S. and Makkar, J., 2010. Indian two-wheeler

industry: Back on growth path. ICRA Rating Feature — February.

4. Automobile industry in India — Two-wheeler segment in India.

http://india-reports.in, February 20, 2010.

5. Revving up! Indian automotive industry — A perspective.

http://www.ibef.org, 2009.

6. Harish R., op. cit.

7. http://www.siamindia.com/scripts/domestic-sales-trend.aspx.

8. Ghosh, A., Ray, S. and Makkar, J., op. cit.

9. Bhatnagar, A. and Ghose, S., 2004. A latent class segmentation

analysis of e-shoppers. Journal of Business Research, Vol. 57,

pp. 758–767.

10. Haley, R. I., 1968. Benefit segmentation: A decision-oriented

research tool. Journal of Marketing, Vol. 32, pp. 30–35.

11. Kanojia, A. K., 2011. Analyzing the state of competition in the

Indian two-wheeler industry. Report submitted to Competition

Commission of India, New Delhi on July 8. http://www.

cci.gov.in/images/media/ResearchReports/AnujInt200711.pdf,

p. 23.

12. Ibid., p. 21.

13. Ibid., p. 7.

14. http://indiamicrofinance.com/mckinsey-report-urban-india-

2030-projections-statistics.html.

15. Prasuna, D. G., 2001. Indian two-wheeler industry: Changing

gears. The Analyst, March.

16. Ibid.

17. Singh, S. K., 2005. Review of urban transportation in India.

Journal of Public Transportation, Vol. 8, No. 1, pp. 79–97.

S0218927513500144.indd 326 20/1/2014 2:20:38 PM

bajaj auto limited 327

18. Anantaram, R., 2010. Developing India’s surface transport

capability: The case of road infrastructure (ARI).

http://www.realinstitutoelcano.org/wps/portal/rielcano_eng/

Content? WCM_GLOBAL_ CONTEXT=/ elcano/elcano_in/zonas_in/

ari37-2010, 25 February.

19. http://www.siamindia.com/scripts/technicalregulations.aspx.

20. Chakraborty, B. and Gupta, V., 2009. Bajaj Auto Limited’s

business strategy: From market leader to follower. Case Folio,

October 2009, pp. 40–55.

21. Baggonkar, S., 2011. Life without Bajaj. Business Standard — The

Strategist, 24 January 2011, p. 4.

22. Bhattacharyya, A., 2011. Most respected companies 2011: Sector

winners: Two wheelers — A strategic plan for success. http://

www.businessworld.in/bw/2011_02_04_A_Strategic_Plan_For_

Success.html, 9 February.

23. “Rajiv Bajaj” is the Managing Director of Bajaj Auto Ltd. He

is believed to be the major contributor towards Bajaj’s perfect

alignment of branding and production strategies.

24. Bruce de Pyssler, 1992. The cultural and political economy of

the Indian two-wheeler. Advances in Consumer Research, Vol. 19,

pp. 437–442.

25. Bajaj Auto Ltd. Annual report, 2002–2003.

26. Ibid., 1999–2000.

27. Ibid., 2001–2002.

28. Ibid., 2002–2003.

29. http://en.wikipedia.org/wiki/Rahul_Bajaj.

30. http://www.bajajauto.com/bajaj_awards_08-07.asp.

31. The “Distinctly Ahead” vision was released in 2007 and

communicated in an aggressive manner with one 220 Pulsar

DTS-Fi morphing into many other Pulsar 220′s and racing against

each other. The visualization and lyrics — “Alag Andaaz, Alag

hai khoj, Rakhe Aage, Hamari soch” — clearly conveyed that

Bajaj sets its own standards and competes only with itself.

32. The ten major players are: Tata Motors; Mahindra and Mahindra;

Bajaj Auto; TVS Motors; Eicher Motors; Ashok Leyland; Maruti

Suzuki; Hero Honda; Bosch; Bharat Forge.

33. See Ref. 5.

34. http://www.dhi.nic.in/autopolicy.htm.

35. See Ref. 5.

36. “Kawasaki Heavy Industries” is a Fortune 500 MNC with a

turnover of US$10 billion. It has business interests in ATVs,

motorcycles, utility vehicles and personal watercraft.

37. “Energtek” is involved in development and commercialization of

Absorbed Natural Gas (ANG).

S0218927513500144.indd 327 20/1/2014 2:20:38 PM

328 ACRJ

38. Bajaj Auto Ltd. Annual report, 2009–2010.

39. Sheth, S., 2010. Bajaj Auto gains from outsourced non-critical

manufacturing. http://www.livemint.com, April 13.

40. Doyal, P., 2008. Bike market: Bajaj trails Hero Honda. http://

timesofindia.indiatimes.com/business/india-business/Bike-

market-Bajaj-trails-Hero-Honda/articleshow/3369408.cms#

ixzz0yHy0rFVH, August 16.

41. Gopalan, M., 2010. Bajaj to ride on Pulsar, Discover

Brand Identities. http://www.blonnet.com/2010/11/20/stories/

2010112053280200.htm, November 19.

42. “KTM” is an Austria-based auto company where Bajaj Auto

holds 38% stake through a subsidiary.

43. Baggonkar, S., op. cit.

44. “Fitch” is a global design consultancy and is part of the WPP

Company.

45 . Narasimhan, L., 2010. Learning from emerging markets:

An interview with Bajaj Auto’s Rajiv Bajaj. http://www.

mckinseyquarterly.com, September.

46. Samanta, S., 2004. The Indian two-wheeler industry: A long ride

to freedom. Executive Decision, IUP Publication, April.

47. The Analyst 2011. Hero-Honda split: End of a legend. IUP

Publication, January.

48. “Hero” and “Honda” parted ways in December 2010 to pursue

independent operations in India.

49. Shah, S. and Bhaskar, A. S., 2011. Suppliers to dealers:

Stakeholders’ Management at TVS Motor Company Ltd. The IUP

Journal of Supply Chain Management, March.

50. Samanta, S., op. cit.

51. Madhav, P., 2003. Marketing Motorcycles: Exploring emotional

connections. Marketing Mastermind, April.

52. Gopalan, M., 2010. http://www.blonnet.com/2010/01/12/

stories/2010011250130300.htm, January 11.

53. Doval, P., 2009. Bajaj shifts gears to motorbikes. http://

timesofindia.indiatimes.com, June 24.

54. “Bharat” is the other name for India in Hindi, the national

language of India. It symbolizes the great Indian middle class as

opposed to the upper strata of the Indian social system.

S0218927513500144.indd 328 20/1/2014 2:20:38 PM

bajaj auto limited 329

Exhibit 1

Growth in Sale of Two-Wheelers

Year 2003–04 2004–05 2005–06 2006–07 2007–08 2008–09 2009–10

Number of 5,364,249 6,209,765 7,052,391 7,872,334 7,249,278 7,437,619 9,371,231

Units Sold

Source: Society of Indian Automobile Manufacturers.

Exhibit 2

Segment Share in Two-Wheelers (2008–09)

Type of Vehicle Market Share (%)

Motorcycle 80.6

Scooters 13.9

Moped 5.2

Electric vehicles 0.3

Source: Society of Indian Automobile Manufacturers.

Exhibit 3

Shift in India’s Two-Wheeler Market from Scooters to Motorcycles

Year Sale (In Units/Percentage of Total Sales)

Motorcycles Scooters Mopeds and Total

Step-Throughs Two-Wheelers

Units Percent Units Percent Units Percent Units

1994–95 528,043 24 1,130,248 51 549,940 25 2,208,231

1999–00 1,612,895 43 1,357,483 36 806,341 21 3,776,719

2004–05 5,217,996 80 983,097 15 351,169 05 6,552,262

2009–10 8,446,591 80 1,542,507 15 522,686 05 10,511,784

Source: Society of Indian Automobile Manufacturers.

S0218927513500144.indd 329 20/1/2014 2:20:38 PM

330 ACRJ

Exhibit 4

Shift in India’s Scooter Market from Geared Scooters to Gearless Scooters

Year Sale (In Units)

Geared Scooters Gearless Scooters Total Scooters

2000–01 592,411 408,261 1,000,672

2001–02 531,179 410,260 941,439

2002–03 335,917 532,410 868,327

Source: Society of Indian Automobile Manufacturers.

Exhibit 5

Joint Ventures in India’s Two-Wheeler Industry

Sl. Year of Indian Foreign Company Product Engineering Outputs

No. JV Company

1. 1983 TVS Motors Suzuki Motors, Japan Ind-Suzuki motorcycle

2. 1984 Hero Motors Honda Motor Co., Japan CD 100 motorcycle

3. 1984 LML Piaggio, Italy Vespa scooter

4. 1985 Escorts Yamaha Motor Co., Japan Yamaha RX 100 motorcycle

5. 1985 Kinetic Motors Honda Motor Co., Japan Kinetic Honda 100 gearless scooter

Source: Compiled by authors.

Exhibit 6

Market Share (%) by Volume

2008–09 2009–10

Company Motorcycle Industry Two-Wheeler Industry Two-Wheeler Industry

Hero Honda 52.8 48.95 44.23

Bajaj 28.3 17.29 20.68

TVS 9.4 15.28 15.20

Total 90.5 81.52 80.11

Source: Society of Indian Automobile Manufacturers and http://autos.sify.com.

S0218927513500144.indd 330 20/1/2014 2:20:38 PM

bajaj auto limited 331

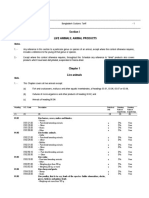

Exhibit 7

ExhibitBrand Mapping

7: Brand — Bajaj

Mapping vs. Hero

- Bajaj vs.Honda

Hero Honda

PULSAR 220*KARIZMA**

PULSAR 180*

US $1100 PULSAR 150* CBZ XTREME**

PULSAR 135*

SUPER SPLENDOR**

PASSION PRO**

P

R DISCOVER DTS‐Si 100* PASSION +**

I US $800 SPLENDOR +**

C SPLENDOR NXG**

E CD DELUXE**

PLATINA*

CD DAWN**

US $600

*: BAJAJ 75cc 125cc 250cc

**: HERO HONDA ENGINE CAPACITY

Source: Compiled by authors.

Source: Compiled by authors

Exhibit 8: Timeline of events at Bajaj Auto Ltd.

Year Event Remarks

1945 Kamalnayan Bajaj established BTCL – Bachraj Trading Corporation Ltd

1960 Bajaj Auto founded

Technical collaboration with Piaggio and introduced Vespa

1960 Akurdi First scooter production facility

1972 Bajaj Chetak Launched

Year Event Remarks

1976 Bajaj Super Launched

1984 Waluj Second scooter production facility

1986 Technical collaboration with Kawasaki Heavy Industries Ltd.

KB 100 Launched

1990 Bajaj Sunny Launched

1994 Bajaj Classic Launched

1997 Bajaj Boxer Launched

1998

S0218927513500144.indd 331 Bajaj Caliber 111-cc, 4-stroke motorcycle launched 20/1/2014 2:20:38 PM

332 ACRJ

Exhibit 8

Timeline of Events at Bajaj Auto Ltd.

Year Event Remarks

1945 Kamalnayan Bajaj established BTCL — Bachraj Trading Corporation Ltd

1960 Bajaj Auto founded

Technical collaboration with Piaggio and introduced Vespa

1960 Akurdi First scooter production facility

1972 Bajaj Chetak Launched

1976 Bajaj Super Launched

1984 Waluj Second scooter production facility

1986 Technical collaboration with Kawasaki Heavy Industries Ltd.

KB 100 Launched

1990 Bajaj Sunny Launched

1994 Bajaj Classic Launched

1997 Bajaj Boxer Launched

1998 Bajaj Caliber 111-cc, 4-stroke motorcycle launched

Bajaj Spirit 60cc model launched

Bajaj Legend India’s first 4-stroke geared scooter launched

1986–97 Bajaj RTZ 02-stroke motorcycle launched

4S Champion Launched

A. 1999: Motorcycles (34.7%) overtook scooters (32.7%) as bigger contributor to 2-wheeler sales

2000 Saffire/Sunny Spice Gearless scooters launched

B. 2001: Started the process of transformation

2001 Bajaj Eliminator 175cc, 4-stroke chopper with 5-speed gearbox

launched

2002 Bajaj Pulsar 150cc and 180cc launched

Bajaj BYK Launched

C. In 2002 Bajaj became market leader in entry and premium segments due to success of Bajaj BYK and

Bajaj Pulsar.

2003 DTSi (Digital Twin Spark Ignition) Higher power, better fuel consumption,

lower emissions engine introduced

S0218927513500144.indd 332 20/1/2014 2:20:38 PM

bajaj auto limited 333

Year Event Remarks

D. Sales 2002–03 = Rs. 47.44 billion

2004 CT 100 Entry segment bike launched

125cc Discover DTSi Bike of the year 2005

Best indigenous design of the year 2005 in the

Executive segment

(Awarded by Overdrive magazine)

E. Sales 2003–04 = Rs. 54.18 billion; Market share in motorcycle segment = 23.7%

2003–04 market share in entry segment = 34.7% (Hero Honda’s market share = 43.8%)

F. 2004–05 market share in entry segment = 49% (Impact of launch of CT 100)

2005 Rajiv Bajaj appointed MD

G. Reduced focus on entry segment citing low operating margins even though entry segment accounted

for 50% of sales volume.

2006 Stopped production of Bajaj Chetak 10 million units sold so far

2006 100cc Bajaj Platina Entry segment bike launched

H. 2005–06 sales = Rs. 85.5 billion

2007 Pulsar 220 DTS-Fi (Digital Twin Indian motorcycle of the year 2008

Spark Fuel Injected)

DTS-Si 125cc engine Mileage of 109 km/liter

XCD 125 DTS-Si Best of all worlds — 150cc features/125cc

performance/100cc mileage

“Distinctly Ahead” campaign Launched

2009 XCD 135 DTS-Si Launched

Pulsar — 150 DTS-Si/180 DTS-Si/

220 DTSi

2009 100cc Discover DTS-Si Launched

Product engineering: Market engineering:

DTS-Si/Nitrox suspension Not seen as a 100cc bike

Longest wheelbase/5-speed gear Value for money

Maintenance free battery Suitable for long distance driving

Source: Adapted and tabulated from “Bajaj Auto Limited’s Business Strategy from Market Leader to Follower” Case Folio,

October 2009, pp. 48–55.

S0218927513500144.indd 333 20/1/2014 2:20:38 PM

334 ACRJ

Exhibit 9

Bajaj Discover DTS-Si 100 vs. Hero Honda Passion Plus

Brand Displacement Power Torque Engine Wheel- Mileage Brand

(cc) (bhp) (Nm) Type base Essence

(mm)

Discover 94.38 7.70 7.85 DTS-Si 1305 85 km per Discover

DTS-Si liter India

100cc

Passion 92.70 7.50 7.50 4-Stroke 1235 60 km per A Whole

Plus OHC liter New World

of Style

Source: Compiled by authors from respective websites: http://www.bajajauto.com and http://www.herohonda.com/.

Exhibit 10

Technologies for Meeting the Emission Norms for Spark Ignited Vehicles

Level of Emission 2-Stroke Technology 4-Stroke Technology

Euro I/India 2000 Intake, exhaust, combustion 4-stroke engine technology

optimization catalytic converter

Euro II/Bharat Stage II Secondary air injection catalytic Hot tube secondary air injection

converter

Euro III/Bharat Stage III Fuel injection catalytic converter Fuel injection carburetor +

catalytic

Euro IV/Bharat Stage IV To be developed Lean burn fuel injection +

catalytic converter

Source: “National Auto Fuel Policy,” http://pib.nic.in/archieve/1re1eng/1yr2003/roct2003/06102003/r0610200313.html,

03 October 2003.

S0218927513500144.indd 334 20/1/2014 2:20:38 PM

bajaj auto limited 335

Exhibit 11

Technological Alliances

Company Product

Kawasaki Heavy Industries, Japan Motorcycles

Tokya R&D Co. Ltd., Japan Two-wheelers

Kubota Corp., Japan Diesel Engine

Source: Adapted from Indian Two-wheeler industry — ICRA Sectoral Analysis — 2005 quoting INGRES.

Exhibit 12

Awards Received in FY 2009–10 for Product Engineering

Awarded For Awarded To Awarding Body Award

Product & Pulsar 135 LS ET Now — Zigwheels Bike of the Year

Technology

ET Now — Zigwheels Technology of the

Year — 4 Valve

UTV Bloomberg — Auto Car Bike of the Year

UTV Bloomberg — Auto Car Viewer’s Choice Bike of

the Year

Discover DTS-Si ET Now — Zigwheels 100cc Bike of the Year

ET Now — Zigwheels Most Value for Money

Bike of the Year

NDTV Profit — Car India & Motorcycle of the Year —

Bike India Up to 125cc

Kawasaki Ninja IMOTY 2010 Indian Motorcycle of the

250 R Year

ET Now — Zigwheels 2009 250cc Bike of the Year

NDTV Profit — Car India & Motorcycle of the Year

Bike India 201 up to 250cc

NDTV Profit — Car India & Two-wheeler of the Year

Bike India 2010

CNBC — Overdrive 2010 Bike of the Year

Business Standard Motoring Bike of the Year

Source: Bajaj Auto Ltd., Annual Report 2009–10.

S0218927513500144.indd 335 20/1/2014 2:20:39 PM

336 ACRJ

Exhibit 13

Bajaj and Its Competitors

Segment Bajaj Hero Honda TVS

Commuter standard Platina CD series Star

Commuter Deluxe Discover Splendor, Passion, Glamour Fiero

Sports Pulsar CBZ, Hunk, Karizma Apache

Source: Compiled by Authors.

Exhibit 14

Product Portfolio Pricing

Model Engine Capacity (in cc) Price (in Indian Rs.)

Platina AW 100 37,595

Platina 125 125 40,140

Discover DTS-Si 100 41,470–43,570

Discover 150 48,977

Pulsar 135 135 55,780

Pulsar 150 150 64,663

Pulsar 180 180 68235–68644

Avenger 220 75,342

Pulsar 220 220 79,510–80,050

Source: Compiled by Authors — Price Ex-showroom at Bhubaneswar, Orissa, India as on 01 March 2011.

S0218927513500144.indd 336 20/1/2014 2:20:39 PM

bajaj auto limited 337

Exhibit 15

Awards Received in FY 2009–10 for Market Engineering

Awarded For Model Awarding Body Award

Brand & Communication Bajaj Auto Global Youth Marketing Most Popular

Forum 2010 Two-Wheeler among

Youth

Brand Equity 2nd Most Trusted

Brand for Auto Two

Wheelers

Discover NDTV Profit — Car India Best Integrated

DTS-Si & Bike India Campaign —

Two-Wheelers

CNBC Overdrive 2010 Storyboard Auto

Commercial of the

Year — Bike

Auto India Best Advertising

Pulsar Effie Silver Effie for

Pulsar Mania ad

(Category: Consumer

Durables)

ABBY Best Film in Auto

Category for the

‘Fastest Indian’.

Pulsar AME 2010 Award for Effective

Mania use of Branded

Content: Pulsar MTV

Stunt Mania

XCD 135 ABBY Best Film in Auto

Category for ‘Twisted

Sisters’.

Source: Bajaj Auto Ltd., Annual Report 2009–10.

S0218927513500144.indd 337 20/1/2014 2:20:39 PM

338 ACRJ

Exhibit 16

Achievements in the Year 2009–10

Product Product Engineering Market Engineering

Pulsar 220F Enhanced power More affordable performance bike

Reduced fuel consumption

Pulsar 180UG Features/style Expanded >150cc segment

Pulsar 150UG Powerful engine Best seller in its category

Clip on handle bars

Tank flaps

Pulsar 135LS 4V DTSi engine Performance and fuel economy

Discover DTS-Si DTS-Si engine blended twin Fuel economy with crisp throttle response

plug ignition with swirl motion

Source: Compiled and adapted by authors.

S0218927513500144.indd

View publication stats 338 20/1/2014 2:20:39 PM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elevating Manila To Become A Global CityDocument3 pagesElevating Manila To Become A Global CityI'm YouNo ratings yet

- Cleft Sentences It or What Key Grammar Guides 24959Document2 pagesCleft Sentences It or What Key Grammar Guides 24959Phương NguyễnNo ratings yet

- Succession Bar Exam Question 2Document8 pagesSuccession Bar Exam Question 2Anne sherly Odevilas100% (1)

- MCQ On Fiscal Policy - 25409066 - 2024 - 04 - 03 - 17 - 20Document20 pagesMCQ On Fiscal Policy - 25409066 - 2024 - 04 - 03 - 17 - 20VISHAL MISHRANo ratings yet

- Production Systems BBA 6th Sem 7 12 r93OLsHZSkDocument21 pagesProduction Systems BBA 6th Sem 7 12 r93OLsHZSkVISHAL MISHRANo ratings yet

- Plant Location - BBA-6th Sem EfdoyEzIyeDocument26 pagesPlant Location - BBA-6th Sem EfdoyEzIyeVISHAL MISHRANo ratings yet

- Plant Layout - BBA-6th Sem 5iPknN5OgODocument13 pagesPlant Layout - BBA-6th Sem 5iPknN5OgOVISHAL MISHRANo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Acharya 2014 Preparing For Motherhood A Role ForDocument3 pagesAcharya 2014 Preparing For Motherhood A Role ForAsish DasNo ratings yet

- Unit 4: Life in The Past: A. VocabularyDocument7 pagesUnit 4: Life in The Past: A. VocabularyHà NguyễnNo ratings yet

- Ametralladora Dillon - 2Document2 pagesAmetralladora Dillon - 2Luis Giankarlo Chévez SoberónNo ratings yet

- Good and Evil Dichotomy EssayDocument5 pagesGood and Evil Dichotomy EssayBenjamin BurtonNo ratings yet

- EIL AC UPS SpecificaitonDocument465 pagesEIL AC UPS SpecificaitonRitaban R. BanerjeeNo ratings yet

- Early Childhood Development - UNICEF Vision For Every ChildDocument32 pagesEarly Childhood Development - UNICEF Vision For Every ChildYakubu Abdul sommedNo ratings yet

- Mandada DesignsDocument39 pagesMandada Designsapi-280928962100% (1)

- Getting Started With Bug Bounty PDFDocument15 pagesGetting Started With Bug Bounty PDFmojoxeNo ratings yet

- Why Do Youth Join Gangs?Document9 pagesWhy Do Youth Join Gangs?Alexandra KeresztesNo ratings yet

- F7-2015-Past Exam - June 2015Document15 pagesF7-2015-Past Exam - June 2015Yulia Melentii0% (1)

- Westermo Ug 6623-22905 Ibex-Rt-630 ReveDocument30 pagesWestermo Ug 6623-22905 Ibex-Rt-630 ReveJuan PerezNo ratings yet

- XRP ExchangesDocument2 pagesXRP ExchangesGaindesec snNo ratings yet

- Dennis Bratcher: Prophets Today?Document4 pagesDennis Bratcher: Prophets Today?Jan Paul Salud LugtuNo ratings yet

- Pure Monopoly: Why Monopolies AriseDocument6 pagesPure Monopoly: Why Monopolies AriseRyanNo ratings yet

- FirstNations MChigeeng 20july2011Document2 pagesFirstNations MChigeeng 20july2011EcologyOttawaNo ratings yet

- BCT 2019 2020Document356 pagesBCT 2019 2020alam123456No ratings yet

- SAP S4 HANA Enterprise Managment Configuraiton MM and Material Ledger SetupDocument53 pagesSAP S4 HANA Enterprise Managment Configuraiton MM and Material Ledger Setupbrcrao100% (2)

- Jio New Product DevelopmentDocument6 pagesJio New Product Developmentsharath kumarNo ratings yet

- Easment Agreement InfoDocument4 pagesEasment Agreement InforichardaverillNo ratings yet

- Unit Iv-PomDocument14 pagesUnit Iv-PomAliyaNo ratings yet

- EVIDENCE Case DoctrinesDocument2 pagesEVIDENCE Case DoctrinesHimura KenshinNo ratings yet

- A Study On Consumer Buying Behavior of LG BrandDocument84 pagesA Study On Consumer Buying Behavior of LG BrandNarvijay RajputNo ratings yet

- Pepsi in Burma - FinalDocument10 pagesPepsi in Burma - Finalmichellebaileylindsa50% (2)