Professional Documents

Culture Documents

07-Cuyo2021 Part1-Auditor's Report

Uploaded by

Kebe VajionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07-Cuyo2021 Part1-Auditor's Report

Uploaded by

Kebe VajionCopyright:

Available Formats

REGIONAL OFFICE NO.

IV-B

PROVINCE OF PALAWAN

PROVINCIAL SATELLITE AUDITING OFFICE

Brgy. Santa Monica, Puerto Princesa City

Office of the Auditor – Audit Team No. R4B-06

INDEPENDENT AUDITOR’S REPORT

HON. MARK L. DELOS REYES

Municipal Mayor

Cuyo, Palawan

Qualified Opinion

We have audited the financial statements of Municipal Government of Cuyo, Palawan,

which comprise the statement of financial position as at December 31, 2021, and the

statement of financial performance, statement of changes in net assets/equity, statement of

cash flows and statement of comparison of budget and actual amounts for the year then

ended and notes to the financial statements, including a summary of significant accounting

policies.

In our opinion, except for the effects of the matter described in the Basis for Qualified

Opinion section of our report, the accompanying financial statements present fairly in all

material respects, the financial position of the Municipal Government of Cuyo, Palawan as

at December 31, 2021, and its financial performance, its cash flows, and its statement of

comparison of budget and actual amounts for the year then ended in accordance with

International Public Sector Accounting Standards (IPSASs).

Basis for Qualified Opinion

1. The balance of Cash and Cash Equivalents as of December 31, 2021 amounting to

₱133,951,276.41 could not be relied upon due to unrecorded bank debits and credits

amounting to ₱1,379,198.13 and ₱9,241,296.17, respectively, contrary to Paragraph 27

of the International Public Sector Accounting Standards (IPSAS) No. 1; and

2. The existence, completeness and valuation of properties and equipment with a

combined carrying amount ₱27,741,738.94 as of December 31, 2021 could not be

ascertained due to continued failure of the Inventory Committee to conduct an annual

physical count and the non-maintainance of property cards.

We conducted our audit in accordance with International Standards of Supreme Audit

Institutions (ISSAIs). Our responsibilities under those standards are further described in

the Auditor’s Responsibilities for the Audit of the Financial Statements section of our

report. We are independent of the agency in accordance with the ethical requirements that

are relevant to our audit of the financial statements, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe that the audit evidence

we have obtained is sufficient and appropriate to provide a basis for our qualified opinion.

Key Audit Matters

Except for the matter described in the Basis for Qualified Opinion section, we have

determined that there are no other key audit matters to communicate in our report.

Responsibilities of Management and Those Charged with Governance for the

Financial Statements

Management is responsible for the preparation and fair presentation of these financial

statements in accordance with IPSASs, and for such internal control as management

determines is necessary to enable the preparation of financial statements that are free from

material misstatement, whether due to fraud or error.

Those charged with governance are responsible for overseeing the LGU’s financial

reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements

as a whole are free from material misstatement, whether due to fraud or error, and to issue

an auditor’s report that includes our opinion. Reasonable assurance is a high level of

assurance but is not a guarantee that an audit conducted in accordance with ISSAIs will

always detect a material misstatement when it exists. Misstatements can arise from fraud

or error and are considered material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users taken on the basis of

these financial statements.

COMMISSION ON AUDIT

By:

IRISH JAY Q. PASAMONTE

OIC - Audit Team Leader

May 18, 2022

You might also like

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- 05 RoxasCity2019 Part1 Auditor's ReportDocument2 pages05 RoxasCity2019 Part1 Auditor's ReportkQy267BdTKNo ratings yet

- 07 IsabelaCityWaterDistrict2021 - Part1 IARDocument2 pages07 IsabelaCityWaterDistrict2021 - Part1 IARBaliv MozamNo ratings yet

- 05-CaloocanCity2021 Part1-Auditor's ReportDocument6 pages05-CaloocanCity2021 Part1-Auditor's ReportRuffus TooqueroNo ratings yet

- 05-Balasan2022 Part1 Auditors ReportDocument2 pages05-Balasan2022 Part1 Auditors ReportEi Mi SanNo ratings yet

- Commission On Audit Local Government Sector: Republic of The PhilippinesDocument2 pagesCommission On Audit Local Government Sector: Republic of The PhilippinesJonson PalmaresNo ratings yet

- Part I - Financial StatementsDocument4 pagesPart I - Financial StatementsJoshuaBalabboNo ratings yet

- Part I - Audited Financial StatementsDocument3 pagesPart I - Audited Financial StatementsAlicia NhsNo ratings yet

- FORMAT-Revised IAR - QualifiedDocument2 pagesFORMAT-Revised IAR - QualifiedGier Rizaldo BulaclacNo ratings yet

- 06-OVP2020 Part1-Auditor's ReportDocument3 pages06-OVP2020 Part1-Auditor's ReportRuffus ToqueroNo ratings yet

- Part I - Financial StatementsDocument3 pagesPart I - Financial StatementsEG ReyesNo ratings yet

- Commission On Audit: Mayor Joseph Ejercito EstradaDocument3 pagesCommission On Audit: Mayor Joseph Ejercito EstradaViancx M. PallarcoNo ratings yet

- Independent Auditor'S Report The Honorable Mayor: Management's Responsibility For The Consolidated Financial StatementsDocument2 pagesIndependent Auditor'S Report The Honorable Mayor: Management's Responsibility For The Consolidated Financial Statementsdemos reaNo ratings yet

- Commission On Audit: Dr. Josephine B. SabandoDocument3 pagesCommission On Audit: Dr. Josephine B. SabandoNikolai Avery NorthNo ratings yet

- 05 PUP2020 Part1 Auditor's ReportDocument3 pages05 PUP2020 Part1 Auditor's ReportMiss_AccountantNo ratings yet

- 04-BLGUManamtam2022-Independent Auditor's ReportDocument3 pages04-BLGUManamtam2022-Independent Auditor's ReportGilbert D. AfallaNo ratings yet

- Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesDocument4 pagesRepublic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesJan Carlo SanchezNo ratings yet

- 04 BLGUMabuslo 2022 AAR Independent Auditor's ReportDocument3 pages04 BLGUMabuslo 2022 AAR Independent Auditor's ReportGilbert D. AfallaNo ratings yet

- 06-CNU2021 Part1-Auditor's ReportDocument4 pages06-CNU2021 Part1-Auditor's ReportMiss_AccountantNo ratings yet

- Independent Auditor'S Report: Mayor Rexlon T. GatchalianDocument3 pagesIndependent Auditor'S Report: Mayor Rexlon T. GatchalianAbigail BautistaNo ratings yet

- 05 COA2017 Part1 Auditor's ReportDocument2 pages05 COA2017 Part1 Auditor's ReportjoevincentgrisolaNo ratings yet

- Commission On Audit: Qualified OpinionDocument3 pagesCommission On Audit: Qualified OpinionMubarrach MatabalaoNo ratings yet

- Auditor's Responsibilities For The Audit of The Financial Statements Section of Our Report. We AreDocument3 pagesAuditor's Responsibilities For The Audit of The Financial Statements Section of Our Report. We Arearellano lawschoolNo ratings yet

- 05-MMDA2022 Part1-Auditor's ReportDocument3 pages05-MMDA2022 Part1-Auditor's ReportRonna FererNo ratings yet

- 05 PUP2017 Part1 Auditors ReportDocument3 pages05 PUP2017 Part1 Auditors ReportLet it beNo ratings yet

- 2017 Internal Auditor ReportDocument3 pages2017 Internal Auditor ReportMicka EllahNo ratings yet

- 05-MalabonCity2018 Part1-Auditor's ReportDocument3 pages05-MalabonCity2018 Part1-Auditor's ReportJuan Uriel CruzNo ratings yet

- Commission On Audit National Government Sector Cluster 1 - Executive OfficesDocument2 pagesCommission On Audit National Government Sector Cluster 1 - Executive OfficesEmosNo ratings yet

- Adverse Audit ReportDocument2 pagesAdverse Audit ReportJoody CatacutanNo ratings yet

- 06-WVSU2021 Part1-Auditor's ReportDocument3 pages06-WVSU2021 Part1-Auditor's ReportMiss_AccountantNo ratings yet

- 06 DRT2019 Part1 Auditor's ReportDocument2 pages06 DRT2019 Part1 Auditor's ReportGiovanni MartinNo ratings yet

- 01-LapulapuCity2012 Audit ReportDocument83 pages01-LapulapuCity2012 Audit ReportnelggkramNo ratings yet

- FORMAT-Revised IAR - QualifiedDocument2 pagesFORMAT-Revised IAR - QualifiedGier Rizaldo BulaclacNo ratings yet

- Opinion 2021Document3 pagesOpinion 2021Micaela VillanuevaNo ratings yet

- Commission On Audit: Mayor Robert C. EusebioDocument3 pagesCommission On Audit: Mayor Robert C. EusebioKathleen Mae Amada - TorresNo ratings yet

- 2018 - COA-Audited-Financial Statements PDFDocument66 pages2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezNo ratings yet

- 06 PuertoPrincesaCity2019 Part1 Auditor's ReportDocument3 pages06 PuertoPrincesaCity2019 Part1 Auditor's ReportkQy267BdTKNo ratings yet

- 04-BLGUBarat2022-Independent Auditor's ReportDocument3 pages04-BLGUBarat2022-Independent Auditor's ReportGilbert D. AfallaNo ratings yet

- New Auditors Report 2022Document4 pagesNew Auditors Report 2022Sattaki RoyNo ratings yet

- Unmodified Audit ReportDocument2 pagesUnmodified Audit ReportJoody CatacutanNo ratings yet

- Independent Auditor'S Report: Commission On Audit Office of The Regional DirectorDocument2 pagesIndependent Auditor'S Report: Commission On Audit Office of The Regional DirectorEG ReyesNo ratings yet

- 116 - Audit ReportDocument5 pages116 - Audit ReportJoebinNo ratings yet

- 2022 Financial StatementsDocument35 pages2022 Financial StatementsfredrickcourcheneNo ratings yet

- Part I - Audited Financial StatementsDocument3 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- Makati City 2018 Auditor's ReportDocument2 pagesMakati City 2018 Auditor's ReportCarla MarieNo ratings yet

- 05-DepEd2019 Part1-Auditor's ReportDocument3 pages05-DepEd2019 Part1-Auditor's ReportdunscotusNo ratings yet

- Regional District of Central Kootenay SOFI 2021Document65 pagesRegional District of Central Kootenay SOFI 2021Lex AckerNo ratings yet

- Audit ReportDocument13 pagesAudit ReportKien Saimon JabilloNo ratings yet

- Disclaimer Audit ReportDocument2 pagesDisclaimer Audit ReportJoody CatacutanNo ratings yet

- Audit Report. Borromeo - Acp 314 - 591Document3 pagesAudit Report. Borromeo - Acp 314 - 591borromeonielbenjhonNo ratings yet

- ISA 700 705 706 Audit Report UpdatedDocument28 pagesISA 700 705 706 Audit Report UpdatedAshraf Uz ZamanNo ratings yet

- 04 BLGUAbinganan 2022 AAR Independent Auditor's ReportDocument3 pages04 BLGUAbinganan 2022 AAR Independent Auditor's ReportGilbert D. AfallaNo ratings yet

- BPI Invest World Technology Feeder FundDocument22 pagesBPI Invest World Technology Feeder FundLexter Renzo RamosNo ratings yet

- Regional District of Central Kootenay Financial Statements For 2022Document27 pagesRegional District of Central Kootenay Financial Statements For 2022Lex AckerNo ratings yet

- 06-DFA2022 Part1-Auditor's ReportDocument5 pages06-DFA2022 Part1-Auditor's ReportjoevincentgrisolaNo ratings yet

- Escalante - Final Requirement - Audit Report - ACP314 (1409)Document3 pagesEscalante - Final Requirement - Audit Report - ACP314 (1409)Patricia Ann C EscalanteNo ratings yet

- Cyrine Miwa V. Rodriguez Certified Public Accountant: Independent Auditor'S ReportDocument2 pagesCyrine Miwa V. Rodriguez Certified Public Accountant: Independent Auditor'S ReportCyrine Miwa RodriguezNo ratings yet

- LiquidDocument2 pagesLiquidSheu ShekoniNo ratings yet

- Regional District of Central Kootenay SOFI 2020Document40 pagesRegional District of Central Kootenay SOFI 2020Lex AckerNo ratings yet

- Part I - Audited Financial StatementsDocument3 pagesPart I - Audited Financial StatementsAlicia NhsNo ratings yet

- 40 Days of ProsperityDocument97 pages40 Days of ProsperityGodson100% (3)

- MCQ Social Medicine 2012-2013Document6 pagesMCQ Social Medicine 2012-2013Tamanna MadaanNo ratings yet

- TX Citizen 5.1.14Document16 pagesTX Citizen 5.1.14TxcitizenNo ratings yet

- New Banking Value ChainDocument10 pagesNew Banking Value Chainapi-276166864No ratings yet

- Deped Format of A Project Proposal For Innovation in SchoolsDocument6 pagesDeped Format of A Project Proposal For Innovation in SchoolsDan Joven BriñasNo ratings yet

- Kartilla NG Katipuna ReportDocument43 pagesKartilla NG Katipuna ReportJanine Salanio67% (3)

- Power of The Subconscious MindDocument200 pagesPower of The Subconscious Mindapi-26248282100% (2)

- Cases:-: Mohori Bibee V/s Dharmodas GhoseDocument20 pagesCases:-: Mohori Bibee V/s Dharmodas GhoseNikhil KhandveNo ratings yet

- Chandrababu NaiduDocument4 pagesChandrababu NaiduSneha More PandeyNo ratings yet

- Apostrophes QuizDocument5 pagesApostrophes QuizLee Ja NelNo ratings yet

- Vol 1 CLUP (2013-2022)Document188 pagesVol 1 CLUP (2013-2022)Kristine PiaNo ratings yet

- CresumeDocument2 pagesCresumeapi-315133081No ratings yet

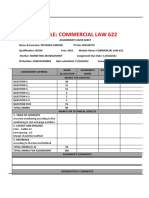

- Claw 622 2022Document24 pagesClaw 622 2022Priyanka GirdariNo ratings yet

- Introduction To The Philosophy of The Human Person Lesson 3 - The Human PersonDocument5 pagesIntroduction To The Philosophy of The Human Person Lesson 3 - The Human PersonPaolo AtienzaNo ratings yet

- Cost-Effective Sustainable Design & ConstructionDocument6 pagesCost-Effective Sustainable Design & ConstructionKeith Parker100% (2)

- Upstream Pre B1 Unit Test 9Document3 pagesUpstream Pre B1 Unit Test 9Biljana NestorovskaNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Investment Phase of Desire EngineDocument21 pagesInvestment Phase of Desire EngineNir Eyal100% (1)

- Kinds of Sentences - Positives.Document20 pagesKinds of Sentences - Positives.Vamsi KrishnaNo ratings yet

- Project Proposal - Tanya BhatnagarDocument9 pagesProject Proposal - Tanya BhatnagarTanya BhatnagarNo ratings yet

- Wohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Document30 pagesWohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Simon Graf von BrühlNo ratings yet

- Practice On TensesDocument2 pagesPractice On TensesLinh ĐanNo ratings yet

- Đề thi thử no.14 GDDT NAM DINH 2018-2019Document4 pagesĐề thi thử no.14 GDDT NAM DINH 2018-2019Dao Minh ChauNo ratings yet

- TEST 8th Grade (Had Better+needn't)Document2 pagesTEST 8th Grade (Had Better+needn't)anacincaNo ratings yet

- Department of Education: Republic of The PhilippinesDocument6 pagesDepartment of Education: Republic of The PhilippinesJojo Ofiaza GalinatoNo ratings yet

- Compiled Reports From 57th JCRC AY1314Document44 pagesCompiled Reports From 57th JCRC AY1314keviiagm1314No ratings yet

- JHCSC Dimataling - Offsite Class 2 Semester 2021 Summative TestDocument1 pageJHCSC Dimataling - Offsite Class 2 Semester 2021 Summative TestReynold TanlangitNo ratings yet

- SSL-VPN Service: End User GuideDocument19 pagesSSL-VPN Service: End User Guideumer.shariff87No ratings yet

- University of Rajasthan Admit CardDocument2 pagesUniversity of Rajasthan Admit CardKishan SharmaNo ratings yet

- AEF3 Files1-5 ProgTestBDocument6 pagesAEF3 Files1-5 ProgTestBnayra100% (1)