Professional Documents

Culture Documents

Exam Solution 111022 Bsa 403

Exam Solution 111022 Bsa 403

Uploaded by

Sarah TarasonaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam Solution 111022 Bsa 403

Exam Solution 111022 Bsa 403

Uploaded by

Sarah TarasonaCopyright:

Available Formats

Ma. Jemina Sarah P.

Tarasona

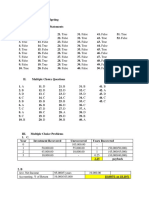

Computation:

7-9.

Resident Non-resident

I. 2,000,000 II. 200,000

II. 200,000 III. 1,000,000

III. 1,000,000 IV. 355,000

IV. 355,000 V. 482,000

V. 482,000 2,037,000

VI. 335,000 II. 200,000

VII. 603,000 III. 1,000,000

4,975,000 1,200,000

23. 4,880,000 – 1,960,000 = 2,870,000 + 52,000,000 + 54,970,000 x

12% = 6,584,400

26. 1,900,000 x 12% = 228,000

28-29.

VAT ZERO RATED EXEMPT

(PH TO PH) (PH TO FC) (FC TO PH)

MNL to Ceb 2,300,000

Ceb to MNL 7,460,000

MNL to Dav 8,490,000

Dav to MNL 5,900,000

MNL to Seoul 6,060,000

Seoul to MNL 5,870,000

MNL to Tokyo 4,550,000

Tokyo to MNL 5,650,000

Total 24,150,000 10,610,000 11,520,000

Multiply: VAT 12% 0% -________

OUTPUT VAT 2,898,000 - -

You might also like

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- BE Operation Question and AnswerDocument5 pagesBE Operation Question and AnswerJhanella Faith FagarNo ratings yet

- Years Operating Cost Benefit Depreciation Net Benefit Old NewDocument8 pagesYears Operating Cost Benefit Depreciation Net Benefit Old NewBilal AhmedNo ratings yet

- Prob1 Afar QuizDocument7 pagesProb1 Afar Quizryan rosalesNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Manolong, Denise Lea Jean, ODocument2 pagesManolong, Denise Lea Jean, ODenise Ortiz ManolongNo ratings yet

- ACTIVITY 1 Capital BudgetingDocument12 pagesACTIVITY 1 Capital BudgetingkmarisseeNo ratings yet

- Engg. Economics ProjectDocument13 pagesEngg. Economics ProjectkawtharNo ratings yet

- Lecture 1. Basic Costing CVP AnswersDocument9 pagesLecture 1. Basic Costing CVP AnswersTân NguyênNo ratings yet

- CH 9 Capital Budgeting PayongayongDocument5 pagesCH 9 Capital Budgeting PayongayongNadi Hood100% (1)

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Ama Tut 5Document4 pagesAma Tut 5Đỗ Kim ChiNo ratings yet

- TAX SolutionsDocument24 pagesTAX SolutionsJerome MadrigalNo ratings yet

- Calculating The Operating Cash Flow Each YearDocument5 pagesCalculating The Operating Cash Flow Each YearViệt Hoàng QuốcNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Overheads Part 1 SolutionsDocument25 pagesOverheads Part 1 Solutionsdoshiviraj77No ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Tugas Ke 5 Ade Hidayat Kelas 1a MMDocument4 pagesTugas Ke 5 Ade Hidayat Kelas 1a MMadeNo ratings yet

- Budget SolutionDocument19 pagesBudget Solutionmohammad bilalNo ratings yet

- Dahon CompanyDocument2 pagesDahon CompanyPrankyJellyNo ratings yet

- Cristina - BA4008QA Business Decison MakingDocument15 pagesCristina - BA4008QA Business Decison MakingmunnaNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Corporate Finance: Capital BudgetingDocument29 pagesCorporate Finance: Capital BudgetingPigeons LoftNo ratings yet

- PROJECT REPORT ON HitachiDocument11 pagesPROJECT REPORT ON HitachiRaju SvNo ratings yet

- Actual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IDocument2 pagesActual Results Flexible-Budget Variances Flexible Budget Sales - Variances Static Budget Unit Rev V.C C.M FC O.IReem Hani JabariNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Eva StatisticsDocument3 pagesEva StatisticsBaron Mumo MuiaNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- Project Report For Computer CenterDocument11 pagesProject Report For Computer Centernaveen krishnaNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776No ratings yet

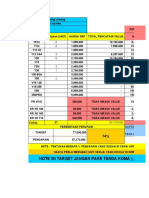

- Target: Note Isi Target Jangan Pake Tanda Koma (,)Document2 pagesTarget: Note Isi Target Jangan Pake Tanda Koma (,)MarcoNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- Finance 1 Hertentamen UitwerkingenDocument6 pagesFinance 1 Hertentamen UitwerkingenThomasGeisslerNo ratings yet

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Cost and Manafement Accounting For Planning and Control Assgn 1Document3 pagesCost and Manafement Accounting For Planning and Control Assgn 1Fungai MajuriraNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Midterm Quiz - Answer KeyDocument17 pagesMidterm Quiz - Answer KeyCatherine Joy VasayaNo ratings yet

- NPV Lesson 2 Workings - Class BDocument6 pagesNPV Lesson 2 Workings - Class BBarack MikeNo ratings yet

- Solutions and DiscussionsDocument4 pagesSolutions and DiscussionsChryshelle LontokNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Answer c22Document3 pagesAnswer c22Võ Huỳnh BăngNo ratings yet

- Lab 9 - What To Invest inDocument16 pagesLab 9 - What To Invest inbegum.ozturkNo ratings yet

- Model Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleDocument11 pagesModel Scheme IS CFS Fcfe BS Irr Coc NPV/DCF Development ScheduleMilind VatsiNo ratings yet

- Sample Muscovado CTMDDocument29 pagesSample Muscovado CTMDJan ryanNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet