Professional Documents

Culture Documents

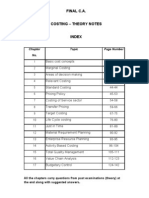

Cost Accounting and Cost Classification Guide

Uploaded by

Marvelin Muring0 ratings0% found this document useful (0 votes)

7 views1 pageCost accounting measures and classifies costs for decision making and financial reporting. Costs are classified according to management function into manufacturing costs incurred in production and non-manufacturing costs like selling and administrative expenses. Costs are also classified as direct if traceable to a specific object or indirect if not traceable. Additionally, costs are classified as product costs if inventoriable or period costs if immediately expensed. Costs also vary according to activity as variable, fixed, or mixed costs. Finally, costs differ in relevance to decisions as relevant, standard, opportunity, sunk, or controllable costs and according to time frame as committed or discretionary costs.

Original Description:

Original Title

Cost Accounting Cost Classification

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost accounting measures and classifies costs for decision making and financial reporting. Costs are classified according to management function into manufacturing costs incurred in production and non-manufacturing costs like selling and administrative expenses. Costs are also classified as direct if traceable to a specific object or indirect if not traceable. Additionally, costs are classified as product costs if inventoriable or period costs if immediately expensed. Costs also vary according to activity as variable, fixed, or mixed costs. Finally, costs differ in relevance to decisions as relevant, standard, opportunity, sunk, or controllable costs and according to time frame as committed or discretionary costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageCost Accounting and Cost Classification Guide

Uploaded by

Marvelin MuringCost accounting measures and classifies costs for decision making and financial reporting. Costs are classified according to management function into manufacturing costs incurred in production and non-manufacturing costs like selling and administrative expenses. Costs are also classified as direct if traceable to a specific object or indirect if not traceable. Additionally, costs are classified as product costs if inventoriable or period costs if immediately expensed. Costs also vary according to activity as variable, fixed, or mixed costs. Finally, costs differ in relevance to decisions as relevant, standard, opportunity, sunk, or controllable costs and according to time frame as committed or discretionary costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

COST ACCOUNTING AND COST CLASSIFICATION

Cost Accounting - is a part of the accounting system that measures costs for decisions-making and

financial reporting purposes.

Cost – is the value foregone or sacrifice of resources for achieving some economic benefit, which will

promote the profit-making ability of the firm.

Cost refers the monetary measure of the amount of resources given up or used for some specified purpose.

It is the value the goods or services expended to obtain current or future benefits.

Classification of Costs

According to Management Function

1. Manufacturing costs - incurred in the factory to convert raw materials into finished goods. It includes

cost of raw materials used (direct materials), direct labor, and factory overhead.

2. Nonmanufacturing costs - not incurred in transforming materials to finished goods. These include

selling expenses (such as advertising costs, delivery expense, salaries and commission of salesmen)

and administrative expenses (such as salaries of executives and legal expenses).

According to Ease of Traceability

1. Direct costs - those that can be traced directly to a particular object of costing such as a particular

product, department, or branch. Examples include materials and direct labor. Some operating

expenses can also be classified as direct costs, such as advertising cost for a particular product.

2. Indirect costs - those that cannot be traced to a particular object of costing. They are also called

common costs or joint costs. Indirect costs include factory overhead and operating costs that benefit

more than one product, department, or branch.

According to Timing of Charge against Revenue

1. Product costs - are inventoriable costs. They form part of inventory and are charged against

revenue, i.e. cost of sales, only when sold. All manufacturing costs (direct materials, direct labor, and

factory overhead) are product costs.

2. Period costs - are not inventoriable and are charged against revenue immediately. Period costs include

non-manufacturing costs, i.e. selling expenses and administrative expenses.

According to Behavior in Accordance with Activity

1. Variable costs - vary in total in proportion to changes in activity. Examples include direct materials,

direct labor, and sales commission based on sales.

2. Fixed costs - costs that remain constant regardless of the level of activity. Examples include rent,

insurance, and depreciation using the straight line method.

3. Mixed costs - costs that vary in total but not in proportion to changes in activity. It basically includes

a fixed cost potion plus additional variable costs. An example would be electricity expense that

consists of a fixed amount plus variable charges based on usage.

According to Relevance to Decision Making

1. Relevant cost - cost that will differ under alternative courses of action. In other words, these costs

refer to those that will affect a decision.

2. Standard cost - predetermined cost based on some reasonable basis such as past experiences,

budgeted amounts, industry standards, etc. The actual costs incurred are compared to standard costs.

3. Opportunity cost - benefit forgone or given up when an alternative is chosen over the other/s.

Example: If a business chooses to use its building for production rather than rent it out to tenants, the

opportunity cost would be the rent income that would be earned had the business chose to rent out.

4. Sunk costs - historical costs that will not make any difference in making a decision. Unlike relevant

costs, they do not have an impact on the matter at hand.

5. Controllable costs - refer to costs that can be influenced or controlled by the manager. Segment

managers should be evaluated based on costs that they can control.

According to a Time-frame Perspective

1. Committed cost – cost that is inevitable consequence of a previous commitment

2. Discretionary cost - cost for which the size or the time of incurrence is a matter of choice.

You might also like

- Topic 1Document4 pagesTopic 1Jane Luna RueloNo ratings yet

- FM 6 Elements of Cost 8 MDocument27 pagesFM 6 Elements of Cost 8 MRajiv SharmaNo ratings yet

- Managerial Cost Concepts ExplainedDocument10 pagesManagerial Cost Concepts ExplainedLaisa RarugalNo ratings yet

- Hum 2217 (Acc) CostingDocument6 pagesHum 2217 (Acc) CostingNourin TasnimNo ratings yet

- Cost Concepts and ClassificationsDocument15 pagesCost Concepts and ClassificationsMae Ann KongNo ratings yet

- Cost Concepts.-RDocument17 pagesCost Concepts.-RSanjay MehrotraNo ratings yet

- Costing in BriefDocument47 pagesCosting in BriefRezaul Karim TutulNo ratings yet

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- Cost Accounting: Managerial Emphasis NotesDocument9 pagesCost Accounting: Managerial Emphasis NotesMayNo ratings yet

- Ca Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreDocument143 pagesCa Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreB GANAPATHY100% (1)

- Costing Theory by Indian AccountingDocument48 pagesCosting Theory by Indian AccountingIndian Accounting0% (1)

- Managerial Accounting - Chapter3Document27 pagesManagerial Accounting - Chapter3Nazia AdeelNo ratings yet

- Managerial Accounting: Cost TerminologyDocument18 pagesManagerial Accounting: Cost TerminologyHibaaq Axmed100% (1)

- DSFDFJM LLKDocument27 pagesDSFDFJM LLKDeepak R GoradNo ratings yet

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanNo ratings yet

- Cost Concepts and ClassificationsDocument3 pagesCost Concepts and ClassificationsCONCORDIA RAFAEL IVANNo ratings yet

- Module 1 - Overview of Cost AccountingDocument7 pagesModule 1 - Overview of Cost AccountingMae JessaNo ratings yet

- Cost Accounting Chapter 1: Introduction To Cost AccountingDocument4 pagesCost Accounting Chapter 1: Introduction To Cost AccountingSinclair Faith GalarioNo ratings yet

- Hotel Costing NotesDocument23 pagesHotel Costing NotesShashi Kumar C GNo ratings yet

- Chap 2 The-Manager-and-Management-AccountingDocument11 pagesChap 2 The-Manager-and-Management-Accountingqgminh7114No ratings yet

- Unit 2 - Classification of CostDocument4 pagesUnit 2 - Classification of Costavinal malikNo ratings yet

- IPCC Costing Theory Formulas ShortcutsDocument57 pagesIPCC Costing Theory Formulas ShortcutsCA Darshan Ajmera86% (7)

- Understand Cost ConceptsDocument10 pagesUnderstand Cost ConceptsQuenn NavalNo ratings yet

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingClarivelle NonesNo ratings yet

- CostDocument33 pagesCostversmajardoNo ratings yet

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyNo ratings yet

- 2017 Course 28 Module 5 Basic Cost ConceptsDocument10 pages2017 Course 28 Module 5 Basic Cost ConceptsPushpendra Singh ShekhawatNo ratings yet

- Costing Theory Formulas ShortcutsDocument57 pagesCosting Theory Formulas ShortcutsCA Darshan Ajmera100% (1)

- Cost Accounting - Different Kinds of CostsDocument3 pagesCost Accounting - Different Kinds of CostsPam Alem Caval PlarisanNo ratings yet

- Cost Classification: by Nature of ExpensesDocument4 pagesCost Classification: by Nature of ExpensesLovenika GandhiNo ratings yet

- Cost Objectives, Drivers & Behaviors ExplainedDocument5 pagesCost Objectives, Drivers & Behaviors ExplainedMaria AkpoduadoNo ratings yet

- Cost Concepts AND Classification: By: Amar Raveendran Debasis BeheraDocument7 pagesCost Concepts AND Classification: By: Amar Raveendran Debasis BeheraAmar RaveendranNo ratings yet

- Cost Concepts & Classification ShailajaDocument30 pagesCost Concepts & Classification ShailajaPankaj VyasNo ratings yet

- Cost Terminology and Classification ExplainedDocument8 pagesCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNo ratings yet

- Cost Accounitng NotesDocument17 pagesCost Accounitng NotesDarlene JoyceNo ratings yet

- Null 2Document10 pagesNull 2siddharthsonar9604No ratings yet

- Understanding the different types of costsDocument3 pagesUnderstanding the different types of costsRishi ShibdatNo ratings yet

- Understanding Cost Terms and ClassificationsDocument14 pagesUnderstanding Cost Terms and ClassificationsalyNo ratings yet

- Period Cost Is Related To Level of Production and SaleDocument6 pagesPeriod Cost Is Related To Level of Production and SaleMd. Saiful AlamNo ratings yet

- Cost Classification and Procedures ReportDocument11 pagesCost Classification and Procedures Reportreyman rosalijosNo ratings yet

- Unit 2. Costs Concepts and ClassificationsDocument10 pagesUnit 2. Costs Concepts and ClassificationsWoodsville HouseNo ratings yet

- Unit 1 Lesson 3Document4 pagesUnit 1 Lesson 3avan4052asNo ratings yet

- Classification of Cost AccountingDocument12 pagesClassification of Cost Accountingprachi agrawalNo ratings yet

- LH - 02 - CAC - Cost Concepts and ClassficationDocument16 pagesLH - 02 - CAC - Cost Concepts and ClassficationDexter CanietaNo ratings yet

- Classification of Costs - TutorialDocument1 pageClassification of Costs - TutorialAnimesh MayankNo ratings yet

- Cost Accounting Systems and ClassificationsDocument45 pagesCost Accounting Systems and ClassificationsracabrerosNo ratings yet

- Financial, Cost, Management AccountingDocument3 pagesFinancial, Cost, Management AccountingSanta-ana Jerald JuanoNo ratings yet

- Cost Classification and TerminologyDocument13 pagesCost Classification and TerminologyHussen AbdulkadirNo ratings yet

- Managerial Economic Unit-Iii, Topic - I, Ii, Iii, Iv, VDocument10 pagesManagerial Economic Unit-Iii, Topic - I, Ii, Iii, Iv, VYashfeen FalakNo ratings yet

- Bgteu v2s60Document15 pagesBgteu v2s60maye dataelNo ratings yet

- Basic Cost Management ConceptsDocument4 pagesBasic Cost Management ConceptsElvie Abulencia-BagsicNo ratings yet

- Business Environment - Classification of CostDocument12 pagesBusiness Environment - Classification of Costanurabi796No ratings yet

- Cost ConceptsDocument32 pagesCost Conceptsamira samirNo ratings yet

- CostDocument14 pagesCostSaurabhNo ratings yet

- ACT121 - Topic 2Document2 pagesACT121 - Topic 2Juan FrivaldoNo ratings yet

- Purchasing Management Unit 3Document30 pagesPurchasing Management Unit 3DEREJENo ratings yet

- 20 AIS 044 (Tonmoy Debnath), AIS 4101, Cost ClassificationsDocument5 pages20 AIS 044 (Tonmoy Debnath), AIS 4101, Cost Classificationstanmoydebnath474No ratings yet

- University of Sydney DRRM PlanDocument40 pagesUniversity of Sydney DRRM PlanChristian Robert NalicaNo ratings yet

- R Sivakumar: MSC (Textiles)Document5 pagesR Sivakumar: MSC (Textiles)Siva KumarNo ratings yet

- Material Ledger Postings RCGCDocument19 pagesMaterial Ledger Postings RCGCSyed Zain ul Abdin ShahNo ratings yet

- User GuideDocument7 pagesUser Guideencik retroNo ratings yet

- Quiz 3Document2 pagesQuiz 3JEANNE PAULINE OABELNo ratings yet

- Po809437 Retro SGN SignedDocument1 pagePo809437 Retro SGN SignedEddie Carvajal DiazNo ratings yet

- 30405-KZR - 6001 Guard, Eng Contl Unit - DoneDocument2 pages30405-KZR - 6001 Guard, Eng Contl Unit - DoneMiguel HernandezNo ratings yet

- Sop - Public RelationsDocument3 pagesSop - Public Relationsbella.rcvNo ratings yet

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- Project Quality Assurance: Dep SpecificationDocument42 pagesProject Quality Assurance: Dep Specificationwawan100% (3)

- Chapter 8 - Structuring OrganizationDocument36 pagesChapter 8 - Structuring OrganizationĐào Thu HiềnNo ratings yet

- Understanding Internal Control ProcessesDocument37 pagesUnderstanding Internal Control ProcessesMaria Paz GanotNo ratings yet

- Ronnie CVDocument2 pagesRonnie CVDedeepya MurathotiNo ratings yet

- Dec 2017 Activity-Based Costing and Break-Even AnalysisDocument3 pagesDec 2017 Activity-Based Costing and Break-Even AnalysisHiraya ManawariNo ratings yet

- REV AUD - Professional Standards and Auditors ResponsibilityDocument6 pagesREV AUD - Professional Standards and Auditors ResponsibilityRichard LamagnaNo ratings yet

- Revamps and Retrofits - A Path To Evergreen FacilitiesDocument3 pagesRevamps and Retrofits - A Path To Evergreen FacilitiesBramJanssen76No ratings yet

- Principles of Management ProjectDocument23 pagesPrinciples of Management ProjectghsjgjNo ratings yet

- IATA - Airport Development Reference Manual - JAN 2004Document724 pagesIATA - Airport Development Reference Manual - JAN 2004capanao100% (6)

- Daily 04-2024 Riyadh ProjectDocument6 pagesDaily 04-2024 Riyadh Projectm.usmanNo ratings yet

- Machine OperatorDocument2 pagesMachine OperatorABAYNEGETAHUN getahunNo ratings yet

- Characteristics of Rural Consumers and comparison between rural and urban consumersDocument4 pagesCharacteristics of Rural Consumers and comparison between rural and urban consumersSusti ClausNo ratings yet

- How Quality Teams and Empowerment Lead to MotivationDocument40 pagesHow Quality Teams and Empowerment Lead to MotivationJamaica Shaine O. Ramos50% (2)

- SWOT Analysis of Gildan Activewear Bangladesh LimitedDocument15 pagesSWOT Analysis of Gildan Activewear Bangladesh LimitedMd.Robiul AwalNo ratings yet

- Regular Design Services of An ArchitectDocument5 pagesRegular Design Services of An ArchitectRej SwiftNo ratings yet

- ISO 15378 - Primary Packaging Materials For Medicinal ProductsDocument92 pagesISO 15378 - Primary Packaging Materials For Medicinal ProductsmarkuslungNo ratings yet

- Activity 4 - Critical Thinking (DOUGLAS)Document4 pagesActivity 4 - Critical Thinking (DOUGLAS)sheila dougalsNo ratings yet

- RD676078-Synthesis of (R) - 5 - (2,2-Dimethyl-4h-Benzo (D) (1,3) Dioxin-6-Yl) Oxazolidin-2-OneDocument2 pagesRD676078-Synthesis of (R) - 5 - (2,2-Dimethyl-4h-Benzo (D) (1,3) Dioxin-6-Yl) Oxazolidin-2-OneNNo ratings yet

- Week 8 Addressing Competition Driving GrowthDocument26 pagesWeek 8 Addressing Competition Driving GrowthRozan FarizqyNo ratings yet

- Laporan Praktik Kerja Lapangan Divisi Pemasaran Pada Bidang Account Executive Pt. Ide Jaya KreasindoDocument55 pagesLaporan Praktik Kerja Lapangan Divisi Pemasaran Pada Bidang Account Executive Pt. Ide Jaya KreasindoSamin 1964No ratings yet

- Chapter 10Document19 pagesChapter 10sbarmodNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)