Professional Documents

Culture Documents

Business Environment - Classification of Cost

Uploaded by

anurabi7960 ratings0% found this document useful (0 votes)

3 views12 pagesClassification of cost in accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentClassification of cost in accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views12 pagesBusiness Environment - Classification of Cost

Uploaded by

anurabi796Classification of cost in accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

CLASSIFICATION OF COST

Dr. RAVI JAIN (Visiting)

Faculty of Management,

Subject: Business Environment (MBA CSM 2nd Sem)

SoS in CSM, Jiwaji University, Gwalior

Classification of Costs on The Basis of Their

Common Characteristics are:

By Nature or Elements

By Functions

By Identifiably

By Variability

By Controllability

By Normality

Other Costs

1. BY NATURE OR ELEMENT

MATERIAL: COST Cost of materials used for the manufacture of a product, a particular work

order, or provision of a service.

Example: Cloth for making a dress, stores used for maintaining machines and buildings such

as lubricants, cotton waste, bricks etc.

LABOUR COST: Labour cost is defined as the total Expenditure borne by employers in order to

employ workers. Labour costs include the direct costs linked to remuneration for work

carried out such as direct remuneration, bonuses and ex gratia payments not paid at each pay

period, payments for days not worked, severance pay, benefits in kind. They also include

indirect costs linked to employees, independently of the remuneration paid by the employer,

such as direct social benefits, vocational training

EXPENSES: Expense is defined as money expended or cost incurred in a firm's efforts to generate

revenue, representing cost of doing business. They may be in the form of actual cash payments

(such as wages and salaries), a computed 'expired' portion (depreciation) of an asset, or an

amount taken out of the firm's earnings (such as bad debts).

Whereas all expenses are costs, not all costs (such as those incurred in acquisition of

income generating assets) are expenses.

By Functions

PRODUCTION COST: The cost of the sequence of operations which begins with supplying materials, labour and services and

ends with primary packing of the product. Thus it includes the cost of direct materials, direct labour, direct expenses and

factory overheads.

SELLING COST: The cost seeking to create and stimulate demand (sometimes termed „marketing‟) and of securing

orders.

DISTRIBUTION COST: The cost of the sequence of operations which begins with making the packed product available for

dispatch and ends with making the reconditioned returned empty package, if any available for re-use.

It also includes expenditure incurred in transporting articles to central or local storage as well as in moving articles to and

from prospective customers as in case of goods on sale or return basis. In gas, electricity and water industry distribution

means pipes, mains and services which may be regarded as the equivalent of packing and transportation.

ADMINISTRATIVE COST: The Cost of formulating the policy, directing the organization and controlling the operations of an

undertaking which is not related directly to a production, selling and distribution, research or development activity or function.

RESEARCH COST: The cost of researching for new or improved products, new applications of materials, or improved methods.

DEVELOPMENT COST: The cost of the process which begins with the implementation of a decision to produce a new or improved

product or to employ a new or improved method and ends with commencement of formal production of that product or by that

method.

PRE-PRODUCTION COST: The part of development cost incurred in making a trial production run preliminary to formal product.

This term is sometimes used to cover all activities prior to production including Research & Development, but in such cases the

usage should be made clear in the context

CONVERSION COST: The sum of direct wages, direct expenses and overhead cost of converting raw materials to the finished

stage or converting a material from one stage of production to the next.

In some cases this also includes any excess material cost or loss of material incurred at the particular stage of production.

PRODUCT COST: These are inventoriable cost. These are the costs which are assigned to the product. Under marginal costing

variable manufacturing cost and under absorption costing, total manufacturing cost constitutes product cost.

By Identifiably

DIRECT COST: The expenses on material and labour economically and

easily traceable to a product, service or job are considered as

direct costs. In the process of manufacture or production of

articles, materials are purchased, labourers are employed and the wages

are paid to them, certain other expenses are also incurred directly. Since all

these take an active and direct part in the manufacture of a particular

commodity, hence are called direct costs.

Example: Cost of meat in a burger

INDIRECT COST: The expenses incurred on those items which are not

directly chargeable to production are known as indirect costs. Example: In

production, salaries of timekeepers, storekeepers, foremen are paid,

certain expenses for running the administration are incurred. All of

these cannot be conveniently allocated to production and hence are called

indirect costs

By Variability

FIXED COST: The cost which does not vary but remains constant within a given period of time and range of activity

in spite of the fluctuations in production, is known as fixed cost. Example: rent, insurance of factory buildings etc.

remain the same for different levels of production.

VARIABLE COST: These costs tend to vary with the volume of output. Any increase in the

volume of production results in an increase in the variable cost and vice versa.

Example: cost of material, cost of labour etc.

Semi-variable Cost: The cost which does not vary proportionately but simultaneously cannot remain stationery at all

times is known as semi variable cost. It can also be called as semi-fixed cost.

Example: Depreciation, repairs etc.

STEP COSTS: Fixed cost can be further classified into committed fixed costs and discretionary fixed costs.

• Committed fixed costs are unavoidable in the short term if the organization has to function. Examples are depreciation,

rent, pay etc,

• Discretionary fixed costs are those which are set at a fixed amount for specific time periods by management . Examples

are research and development costs, advertisement and market research expenses

Certain costs remain fixed over a range of activity and then jump to a new level as activity changes. Such costs are

treated as “Step Costs”.

Example: A foreman is in a position to supervise a given number of employees. Beyond this number it will be necessary to

hire a second then a third and so on.

By Controllability

CONTROLLABLE COSTS: These are the costs which can be

influenced by the action of a specified member of an

undertaking. A business organization is usually divided into a

number of responsibility centres and each centre is headed by an

executive. The executive can thus control the costs incurred in that

particular responsibility centre.

UNCONTROLLABLE COSTS: Costs which cannot be

influenced by the action of a specified member of an undertaking.

Example: Expenditure incurred by the tool room is controllable

by the foreman in charge of that section but the share of the tool

room expenditure which is apportioned to a machine shop is not to

be controlled by the machine shop foreman.

By Normality

NORMAL COSTS: It is the cost which is normally incurred at a

given level of output under the conditions in which that level of

output is normally attained.

ABNORMAL COST: It is the cost which is not normally incurred

at a given level of output in the conditions in which that level of

output is normally attained. This is charged to Costing P&L A/c

Other Cost

Product Costs and Period Costs

Decision making Costs and Accounting Costs

Relevant and Irrelevant Costs

Shutdown and Sunk Costs

Avoidable / Escapable and Unavoidable / Inescapable

Imputed or Hypothetical Costs

Differential, Incremental or Decremental Cost

Out of Pocket Costs

Opportunity Cost

Traceable, Untraceable Costs

Joint Costs and Common Costs

PRODUCT COSTS: Costs which become part of the cost of the product rather than an expense of the period in which they are incurred

are called as “Product Costs”. In financial statements such costs are treated as assets until the goods they are assigned to are sold. They

become an expense at that time. These costs may be fixed as well as variable.

Example: Cost of raw materials and direct wages, depreciation on plant & equipment etc.

PERIOD COSTS: Costs which are not associated with production are called “Period Costs”. They are treated as an expense of the period

in which they are incurred. They may also be fixed as well as variable. Such costs include General Administration costs, Salesman

salaries and commission, depreciation on office facilities etc. They are charged against the revenue of the relevant period.

DECISION MAKING COSTS: These are special purpose costs that are applicable only in the situation in which they are compiled. They

have no universal application. They need not tie into routine financial accounts. They do not and should not conform to the accounting rules.

ACCOUNTING COSTS: These costs are compiled primarily from financial statements. They have to be altered before they can be used

for decision making. Moreover they are historical costs and show what has happened under an existing set of circumstances, while decision

making costs are future costs.

Example: Accounting costs may show the cost of the product when the operations are manual, while decision making costs might be

calculated to show the costs when the operations are mechanised.

RELEVANT & IRRELEVANT COST: Relevant costs are those costs which would be changed by the managerial decision, while irrelevant

costs are those which would not be affected by the decision.

Example: If a manufacturer is considering closing down of an unprofitable retail sales shop, wages payable to the workers of the shop are

relevant in this connection since they will disappear on closing down of the shop. But prepaid rent for the shop or unrecovered costs of any

equipment which will have to be scrapped, will be irrelevant costs which must be ignored.

SHUTDOWN COSTS: A manufacturer or an organization rendering service may have to suspend its operations for a period on

account of some temporary difficulties such as shortage of raw materials, non availability of labour etc. During this period though no work

is done yet certain fixed costs such as rent and insurance of buildings, depreciation etc. for the entire plant will have to be

incurred. Such costs of the idle plant are known as shut down costs.

SUNK COSTS: These are costs which have been created by a decision that was made in the past that cannot be changed by any decision

that will be made in the future. Investment in plant & machinery are prime examples of such costs. Since sunk costs cannot be altered by later

decisions, they are irrelevant for decision making.

IMPUTED OR HYPOTHETICAL COSTS: These are costs which do not involve any cash outlay. They are not included in cost accounts but are

important for taking into consideration while making management decisions.

Examples: Interest on internally generated funds, salaries of the proprietor or partner of a partnership firm, rented value of company‟s own property etc.

When two projects require unequal outlays of cash, the management must take into consideration interest on capital for judging the relative profitability of the

projects though the company may use internally generated funds for the purpose.

DIFFERENTIAL COSTS: The difference in total costs between two alternatives is termed as „differential costs‟. In case the choice of an alternative results in

increase in total costs, such increase in costs is known as „incremental costs.‟ In case the choice results in decrease in total costs, such decrease in total

costs is termed as „decremental costs‟. While assessing the profitability of a proposed change the incremental costs are matched with incremental revenue and

vice versa. The proposed change is taken only when it is profitable.

OUT-OF-POCKET COST: This means the present or future cash expenditure regarding a certain decision which varies depending upon the nature of

decision made.

Example: A company has its own trucks for transporting raw materials and finished products from one place to another. It seeks to replace these trucks by

employment of public carrier of goods. In making this decision of course , the depreciation of the trucks is not to be considered, but the management

must take into account the present expenditure on fuel, salary to drivers and maintenance. Such costs are termed as out- of-pocket expenses.

OPPORTUNITY COST: This cost refers to the advantage, in measurable terms, which has been foregone on account of not using the facilities in the manner

originally planned.

Example: If an owned building is proposed to be utilized for housing a new project plant, the likely revenue which the building could fetch if rented

out is the opportunity cost which should be taken into account while evaluating the profitability of the

TRACEABLE OR UNTRACEABLE COSTS: Costs which can be easily identified with a department, process or product are termed as traceable costs.

Example: the cost of direct material, direct labour etc. Costs which cannot be so identified are termed as untraceable or common costs.

In other words common costs are costs incurred collectively for a number of cost centres and are to be suitably apportioned for determining the

cost of individual cost centres. Example: overheads incurred for a factory as a whole etc.

JOINT COSTS: These are a sort of common costs. When two or more products are produced out of one and the same material or process, the costs of such

material or process are called joint costs.

Example: When cotton seeds and cotton fibre are produced from the same raw materials, the cost incurred till split off or separation point will be joint

costs.

COMMON COSTS: Common costs are those which are incurred for more than one product, job, territory or any other specific costing unit. They are not

capable of being identified with individual product, and are therefore apportioned on a suitable basis.

Example: Rent, lighting and supervision costs are common costs to all departments located in the factory.

THANKS

You might also like

- Classification of Cost 20230303164639Document9 pagesClassification of Cost 20230303164639Singapore tripNo ratings yet

- Classification of Cost PPT-2Document51 pagesClassification of Cost PPT-2Ashi AhmedNo ratings yet

- Classification of Cost PDFDocument49 pagesClassification of Cost PDFPresident DyosaNo ratings yet

- Session 2Document51 pagesSession 2Deepanshu SharmaNo ratings yet

- Classification of CostsDocument51 pagesClassification of CostssaloniNo ratings yet

- Classification of Costs - TutorialDocument1 pageClassification of Costs - TutorialAnimesh MayankNo ratings yet

- Cost Concepts AND Classification: By: Amar Raveendran Debasis BeheraDocument7 pagesCost Concepts AND Classification: By: Amar Raveendran Debasis BeheraAmar RaveendranNo ratings yet

- Recognize Cost TypesDocument40 pagesRecognize Cost TypesShubham Saurav SSNo ratings yet

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- Cost AccountingDocument4 pagesCost AccountingClarivelle NonesNo ratings yet

- Cost Classification and Procedures ReportDocument11 pagesCost Classification and Procedures Reportreyman rosalijosNo ratings yet

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanNo ratings yet

- Cost Accounting IntroductionDocument47 pagesCost Accounting IntroductionAkanksha GuptaNo ratings yet

- Managerial Accounting: Cost TerminologyDocument18 pagesManagerial Accounting: Cost TerminologyHibaaq Axmed100% (1)

- Cost Concepts.-RDocument17 pagesCost Concepts.-RSanjay MehrotraNo ratings yet

- Topic 1Document4 pagesTopic 1Jane Luna RueloNo ratings yet

- Costing in BriefDocument47 pagesCosting in BriefRezaul Karim TutulNo ratings yet

- AFRICA INTERNATIONAL UNIVERSITY COST CLASSIFICATIONDocument6 pagesAFRICA INTERNATIONAL UNIVERSITY COST CLASSIFICATIONJemima wanjiruNo ratings yet

- Reporting - Cost AccountingDocument2 pagesReporting - Cost AccountingElyza MarquilleroNo ratings yet

- Managerial Accounting - Chapter3Document27 pagesManagerial Accounting - Chapter3Nazia AdeelNo ratings yet

- Cost Concepts & ClassificationDocument24 pagesCost Concepts & ClassificationAbhishek MishraNo ratings yet

- Cost ClassificationDocument12 pagesCost ClassificationAjay VatsavaiNo ratings yet

- CostDocument33 pagesCostversmajardoNo ratings yet

- Cost ClassificationDocument27 pagesCost ClassificationPooja Gupta SinglaNo ratings yet

- Costing: Prepared By: Dr. B. K. MawandiyaDocument26 pagesCosting: Prepared By: Dr. B. K. MawandiyaNamanNo ratings yet

- FM 6 Elements of Cost 8 MDocument27 pagesFM 6 Elements of Cost 8 MRajiv SharmaNo ratings yet

- Hum 2217 (Acc) CostingDocument6 pagesHum 2217 (Acc) CostingNourin TasnimNo ratings yet

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroNo ratings yet

- Session Objectives:: Different Basis For Classification ofDocument12 pagesSession Objectives:: Different Basis For Classification ofOmkar Reddy PunuruNo ratings yet

- Cost Classification: by Nature of ExpensesDocument4 pagesCost Classification: by Nature of ExpensesLovenika GandhiNo ratings yet

- Cost ClassificationsDocument20 pagesCost ClassificationswdsNo ratings yet

- cost-sheet-analysisDocument37 pagescost-sheet-analysismanjeetkumar93544No ratings yet

- IPCC Costing Theory Formulas ShortcutsDocument57 pagesIPCC Costing Theory Formulas ShortcutsCA Darshan Ajmera86% (7)

- Assignment For Introduction To Cost AccountingDocument11 pagesAssignment For Introduction To Cost AccountingSolomon Mlowoka100% (1)

- Costing Theory Formulas ShortcutsDocument57 pagesCosting Theory Formulas ShortcutsCA Darshan Ajmera100% (1)

- Cost ConceptsDocument32 pagesCost Conceptsamira samirNo ratings yet

- Unit - 3 Cost Accounting PDFDocument19 pagesUnit - 3 Cost Accounting PDFShreyash PardeshiNo ratings yet

- Costing: - Chapter 01 - Cma Intermediate - MacampusDocument5 pagesCosting: - Chapter 01 - Cma Intermediate - MacampusRaja NarayananNo ratings yet

- DSFDFJM LLKDocument27 pagesDSFDFJM LLKDeepak R GoradNo ratings yet

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyNo ratings yet

- Jyoti CA AsignmtDocument17 pagesJyoti CA AsignmtjyotirbkgmailcomNo ratings yet

- Chap 2 The-Manager-and-Management-AccountingDocument11 pagesChap 2 The-Manager-and-Management-Accountingqgminh7114No ratings yet

- BBA211 Vol2 CostTerminologiesDocument13 pagesBBA211 Vol2 CostTerminologiesAnisha SarahNo ratings yet

- Costing Theory & Formulas & ShortcutsDocument58 pagesCosting Theory & Formulas & ShortcutsSaibhumi100% (1)

- Classification of Cost AccountingDocument12 pagesClassification of Cost Accountingprachi agrawalNo ratings yet

- Cost Accounting ClassificationDocument3 pagesCost Accounting ClassificationVernie N. PiamonteNo ratings yet

- Financial Vs Management AccountingDocument16 pagesFinancial Vs Management AccountingNishant SinghNo ratings yet

- Introduction To Cost AccountingDocument26 pagesIntroduction To Cost AccountingParamveer KhosaNo ratings yet

- Cost Control Apparel IndustryDocument20 pagesCost Control Apparel IndustryjitinsharmanewNo ratings yet

- Theory of CostDocument13 pagesTheory of CostBLOODy aSSault100% (1)

- Cost & Management Accounting - Lec 2Document30 pagesCost & Management Accounting - Lec 2Agnes JosephNo ratings yet

- (2330) M Abdullah Amjad BCOM (B)Document9 pages(2330) M Abdullah Amjad BCOM (B)Amna Khan YousafzaiNo ratings yet

- Managerial Cost Concepts ExplainedDocument10 pagesManagerial Cost Concepts ExplainedLaisa RarugalNo ratings yet

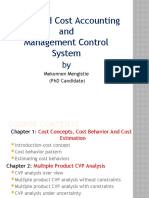

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNo ratings yet

- Module 2 - Introduction To Cost ConceptsDocument51 pagesModule 2 - Introduction To Cost Conceptskaizen4apexNo ratings yet

- Costing ConceptsDocument16 pagesCosting ConceptskrimishaNo ratings yet

- Costing Theory by Indian AccountingDocument48 pagesCosting Theory by Indian AccountingIndian Accounting0% (1)

- 1 Basic Concepts - M1Document20 pages1 Basic Concepts - M1sukeshNo ratings yet

- Business Strat Analysis - Costs Concepts and ClassificationsDocument37 pagesBusiness Strat Analysis - Costs Concepts and Classificationskristelle0marisseNo ratings yet

- Justin Gray - Employment Agreement - 4-13-21Document15 pagesJustin Gray - Employment Agreement - 4-13-21Matt BrownNo ratings yet

- Youth 2011Document438 pagesYouth 2011Polska2030No ratings yet

- A Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1Document5 pagesA Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1vyoung1988No ratings yet

- Verka Milk PlantDocument80 pagesVerka Milk PlantVarun JainNo ratings yet

- Economical Impact of Event (Chat GPT)Document2 pagesEconomical Impact of Event (Chat GPT)esa arimbawaNo ratings yet

- TPPDDocument2 pagesTPPDLeah Mae Liampo Caliway100% (1)

- Francis BelloDocument3 pagesFrancis BelloPrincess MagpatocNo ratings yet

- RMG Industry AnalysisDocument35 pagesRMG Industry AnalysisSanjana TehjibNo ratings yet

- Regarding - Empanelment of Consultants For Preparation of Zonal Development Plans, Othr Planning Services and Project.Document43 pagesRegarding - Empanelment of Consultants For Preparation of Zonal Development Plans, Othr Planning Services and Project.Raval ShivamNo ratings yet

- Dissertation Leena MaxinDocument137 pagesDissertation Leena MaxinMehedi HasanNo ratings yet

- Manwani TutorialsDocument3 pagesManwani TutorialsMukesh ManwaniNo ratings yet

- 10 Brotherhood Labor Unity Movement of The Philippnes vs. ZamoraDocument5 pages10 Brotherhood Labor Unity Movement of The Philippnes vs. ZamoraaudreyNo ratings yet

- HR Associate - DBL Pharmaceuticals Ltd. (A Concern of DBL Group)Document5 pagesHR Associate - DBL Pharmaceuticals Ltd. (A Concern of DBL Group)S.M. MohiuddinNo ratings yet

- Quality Manager Job DescriptionDocument8 pagesQuality Manager Job Descriptionqualitymanagement246No ratings yet

- JK PrawnManufacfuringCorporationDocument47 pagesJK PrawnManufacfuringCorporationAlmadin KeñoraNo ratings yet

- Flexible Working PolicyDocument24 pagesFlexible Working PolicyAmrAlaaEldinNo ratings yet

- Risk Management Process Implementation in Mauritian Manufacturing CompaniesDocument6 pagesRisk Management Process Implementation in Mauritian Manufacturing CompaniesBhakhoa DoolshanNo ratings yet

- Impactof Multinational Corporationson Developing CountriesDocument18 pagesImpactof Multinational Corporationson Developing CountriesRoman DiuţăNo ratings yet

- Peñaranda Vs BagangaDocument1 pagePeñaranda Vs BagangachugamiNo ratings yet

- Guide On Disability Mainstreaming and Social EconomyDocument66 pagesGuide On Disability Mainstreaming and Social EconomymodalisNo ratings yet

- Agra Final PaperDocument21 pagesAgra Final PaperMacy Jesienne OuanoNo ratings yet

- QmatminitestDocument3 pagesQmatminitestKatarina BluhmNo ratings yet

- XI ENGLISH SET 1Document4 pagesXI ENGLISH SET 1aashirwad2076No ratings yet

- Python Development Hands-On Training ProgramDocument16 pagesPython Development Hands-On Training Programbhaiyahello15No ratings yet

- Historical OSH Legislation in MalaysiaDocument14 pagesHistorical OSH Legislation in MalaysiaPutra HermanNo ratings yet

- (7-3) Meco Manning vs. CuyosDocument7 pages(7-3) Meco Manning vs. CuyosJan Carlo SanchezNo ratings yet

- Factors Income ApproachDocument4 pagesFactors Income ApproachYuri PamaranNo ratings yet

- Factors Affecting Retention of Call Centre Agents: February 2017Document48 pagesFactors Affecting Retention of Call Centre Agents: February 2017treasure ROTYNo ratings yet

- Business Ethics SLM 1 Marjonel B. Vargas 1Document25 pagesBusiness Ethics SLM 1 Marjonel B. Vargas 1Mariel RiveraNo ratings yet