Professional Documents

Culture Documents

List of Prices and Services Germany 6yuuude Iban English

Uploaded by

BbOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of Prices and Services Germany 6yuuude Iban English

Uploaded by

BbCopyright:

Available Formats

Solarisgroup.

com

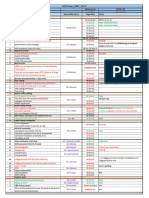

List of Prices and Services

This List of Prices and Services applies for certain services within the contractual relationship between Solaris SE

(hereinafter the „Bank“) and the customer.

The prices for basic services in connection with the customer's account management are agreed between the cooperation

partner of the Bank and the customer. As the case may be, the cooperation partner of the Bank may release the customer

of positions listed in this List of Prices and Services or allows the customer drawing limits that diverge from the limits

listed in this List of Price and Services. The contract between the customer and the cooperation partner of the Bank is

decisive for this.

1. GENERAL INFORMATION ABOUT THE BANK .......................................................................................................2

2. DEPOSIT FEE .......................................................................................................................................................3

A. GENERAL PROVISION .................................................................................................................................................... 3

B. GENERAL AMOUNTS OF EXEMPTION AND FEES ................................................................................................................... 4

C. SPECIAL AMOUNTS OF EXEMPTION AND FEES ..................................................................................................................... 4

3. OVERDRAFT .......................................................................................................................................................5

4. PRICES FOR SPECIAL SERVICES IN BUSINESS TRANSACTIONS WITH CUSTOMERS ................................................6

A. TRANSACTIONS ........................................................................................................................................................... 6

B. SHIPPING SERVICES ....................................................................................................................................................... 6

C. SPECIAL SERVICES ......................................................................................................................................................... 6

D. SECURITIES BROKERAGE ................................................................................................................................................. 6

E. CARD TRANSACTIONS DOMESTIC AND ABROAD BY PRIVATE CUSTOMERS .................................................................................. 7

F. CARD TRANSACTIONS DOMESTIC AND ABROAD BY BUSINESS CUSTOMERS ................................................................................. 7

5. CUT-OFF AND EXECUTION PERIODS ...................................................................................................................8

A. EXECUTION PERIOD FOR PAYMENTS AS A RESULT OF CARD TRANSACTIONS MADE BY THE CUSTOMER .............................................. 8

B. EXECUTION PERIODS FOR TRANSACTIONS WITHIN THE EURO ZONE .......................................................................................... 8

6. ANNEXES............................................................................................................................................................9

Version: 3.1, Stand: 01.01.2023 1/9

Solarisgroup.com

1. General Information about the Bank

Name and address of the Solaris SE

Bank Cuvrystraße 53

10997 Berlin

Communication with the Inquiries from the customer should generally be

Bank addressed to the cooperation partner who has

arranged the customer relationship with the Bank.

The Bank shall communicate the relevant addresses

or other communication addresses of the Bank for

the business relationship separately.

Internal complaints office The customer may file a complaint with the following

within the Bank contact point of the Bank:

Solaris SE

Customer Support

Cuvrystraße 53

10997 Berlin

E-Mail: support@Solarisgroup.com

Competent supervisory Europäische Zentralbank

authority Sonnemannstraße 20

60314 Frankfurt am Main

Bundesanstalt für Finanzdienstleistungsaufsicht

Bereich Bankenaufsicht & Versicherungsaufsicht

Graurheindorfer Straße 108

53117 Bonn

Internet: www.bafin.de

Entry in the Commercial The Bank is registered in the commercial register of

Register the Charlottenburg District Court (Amtsgericht)

under the commercial register number

HRB 248259 B.

Version: 3.1, Stand: 01.01.2023 2/9

Solarisgroup.com

2. Deposit Fee

a. General Provision

Insofar as the Euro-denominated current accounts, overnight money accounts or subaccounts (excluding savings

deposits) of the account holder show a credit balance, the Bank shall hold this credit balance in safe custody on behalf of

the account holder. The Bank shall be entitled to charge a deposit fee for this safekeeping of deposits on current accounts,

overnight money accounts or subaccounts in accordance with the following provisions. This price component applies to

private and business accounts. For private accounts it only applies to accounts opened on or after 01.02.2020 or for

which a deposit fee has been expressly agreed separately.

All customers benefit from an amount of exemption. An amount of exemption is an amount that reduces the calculation

basis. If the amount of exemption is exceeded, interest is not calculated on the entire balance but only on that part of the

balance that exceeds the amount of exemption.

Up to an amount of exemption specified in section 2.b no deposit fee is charged (general amount of exemption). For

customers who have opened accounts through certain cooperation partners of the Bank, an amount of exemption

different from the general amount of exemption may apply, as shown below in section 2.c (special amounts of exemption

for certain cooperation partners).

To determine whether such relevant amount of exemption has been reached, the amount of all current and deposit

accounts (including overnight money accounts or subaccounts but excluding savings deposits) are added together. The

credit balance is determined on the basis of the daily end-of-day balance, which is determined without error. The end-of-

day balance includes all account movements valued by the end of the respective day in accordance with the value date

regulations. If the relevant amount of exemption is exceeded, a deposit fee is charged on the deposits exceeding the

relevant amount of exemption.1 Unless otherwise agreed, the amount of the relevant deposit fee for these services is

determined by this List of Prices and Services.

If a fee for account management has been agreed, this shall not be affected by the deposit fee. If a current account,

overnight money account or subaccount is overdrawn, the account holder may not derive any claims against the Bank

from this. The deposit fee shall be paid by debiting the account for which the deposit fee is due.

1

The fees are variable and are based on prevailing market conditions and can be adjusted.

Version: 3.1, Stand: 01.01.2023 3/9

Solarisgroup.com

b. General Amounts of Exemption and Fees

The following rule shall apply to the custody fee: For balances on current accounts, overnight money accounts or

subaccounts, a deposit fee of 0.5% p.a. on the deposits exceeding the general amount of exemption shall be charged for

the custody of the deposits if the total amount of all current accounts and deposit accounts (including overnight money

accounts and subaccounts but excluding savings deposits) exceeds EUR 250,000 for private customers and

EUR 100,000 for business customers.2

Deposits3 below EUR 250.000 free of charge (for private accounts)

Deposits3 below EUR 100.000 free of charge (for business accounts)

From deposits3 of EUR 250.000 for the credit balance above this amount 0.5% p.a. (for

private accounts)

From deposits3 of EUR 100.000 for the credit balance above this amount 0.5% p.a. (for

business accounts)

c. Special Amounts of Exemption and Fees

Special amounts of exemption for customer of certain cooperation partners might apply. Such special amounts of

exemption are listed, if applicable, in the respective Annex: Prices for Special Services in relation to the Cooperation

Partner.

2

If not agreed upon differently, for private customers this price component only applies for private customers to accounts opened after

01.02.2020 or for which a deposit fee has been expressly agreed separately.

3

On current accounts and deposit accounts (including overnight money and subaccounts but excluding savings deposits).

Version: 3.1, Stand: 01.01.2023 4/9

Solarisgroup.com

3. Overdraft

If customers are granted a tolerated or granted overdraft, the applicable debit interest rate in relation to the cooperation

partner is listed in the respective Annex: Prices for Special Services in relation to the Cooperation Partner:

Version: 3.1, Stand: 01.01.2023 5/9

Solarisgroup.com

4. Prices for Special Services in Business Transactions with customers

a. Transactions Price

Express transactions (PRIOR1)4 EUR 10.00

b. Shipping services Price

Fixed rate for shipping EUR 3.00

Shipment of account statement EUR 3.00

c. Zusatzleistungen Price

Issue of tax certificate complimentary

Issue of certificate o floss (on demand) complimentary

Issue of an account confirmation EUR 10.00

Legitimate refusal to redeem an authorized direct debit due to insufficient EUR 1.00

account balance

Arrears fee per dunning letter5 EUR 5.00

Table of proceeds EUR 10.00

Issue of duplicates EUR 10.00

Change of transaction6, call back of transaction6 , per transaction EUR 10.00

Pledging EUR 10.00

Bank inquiry – domestic EUR 10.00

Bank inquiry – abroad EUR 10.00

Additional conformation of balance EUR 10.00

Account blocking EUR 10.00

Hourly rate for individual processing EUR 50.00

(especially inquiries, processing of legacy, address inquiry) 7

Creation of a loss certificate (on demand) complimentary

d. Securities Brokerage Price

Brokerage of buying and selling in stocks, ETFs and funds via the stock complimentary

exchange gettex (Munich Stock Exchange)

Execution of savings plans complimentary

4

The fee will not apply for bookings not initiated by the customer.

5

The customer reserves the right to prove that in each individual case no or only minor damage was caused.

6

The fee will only apply after the delivery of the transfer order at the Bank and only if the Bank is not responsible for the circumstances

leading to the change/ call back of the transaction.

7

The fee will only apply if the Bank is not responsible for the circumstances leading to the individual processing.

Version: 3.1, Stand: 01.01.2023 6/9

Solarisgroup.com

e. Card transactions domestic and abroad by private customers

The applicable limits on card transactions will be included in the terms and conditions of the respective cooperation

partner or can be set by the private customer in the Frontend if this feature is offered by the cooperation partner.

f. Card transactions domestic and abroad by business customers

The applicable limits on card transactions will be included in the terms and conditions of the respective cooperation

partner or can be set by the business customer in the Frontend if this feature is offered by the cooperation partner.

Version: 3.1, Stand: 01.01.2023 7/9

Solarisgroup.com

5. Cut-Off Time and Execution Periods

a. Execution period for payments as a result of card transactions made by the customer

The Bank is obliged to ensure that the card payment amount reaches the beneficiary’s payment services provider

at the latest by the end of the following periods:

Card payments in EUR within the European Economic Area (EEA)1 max. 3 business days*

Card payments within the EEA1 in EEA currencies other than EUR2 max. 3 business days *

Card payments outside the EEA1 The card payment is processed as

quickly as possible.

* “Business day“ is any day on which the payment service provider involved in the execution of a payment transaction carries out the

business operations required for the execution of payment transactions. The Bank carries out the business operations required for the

execution of payment transactions on all working days in the federal state of Berlin, with the exception of: Saturdays, Christmas Eve

(24 December) and New Year’s Eve (31 December).

1

The European Economic Area is currently composed of the EU member states

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France (including French Guiana,

Guadeloupe, Martinique, Mayotte, La Réunion), Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta,

the Netherlands, Poland, Portugal (including the Azores and Madeira), Romania, Slovakia, Slovenia, Spain (including the Canary

Islands), Sweden, together with

- Liechtenstein, Norway and Iceland.

2

The following currencies are currently EEA currencies: Euro, Bulgarian Leva, Czech Koruny, Danish Kroner, Hungarian Forint,

Icelandic Kronur, Estonian Kroon, Norwegian Kroner, Polish Zlotych, Romanian Lei, Swedish Kroner.

b. Execution periods for transactions within the Euro zone

Cut-off time by 2:30 p.m. on bank business days*.

Execution period† The bank is obliged to ensure that the transfer amount is received by the payee’s

payment service provider within one business day* at the latest.

* “Business day“ see above.

† The execution period starts with the end of the bank business day on which the transaction order is placed at the Bank within the cut-

off time, insofar as the requirements set out in the Terms and Conditions for Credit Transfers are being met.

Version: 3.1, Stand: 01.01.2023 8/9

Solarisgroup.com

6. Annexes

Additional fees for special services the Bank offers together with cooperation partners might apply. Such additional fees

are listed, if applicable, in the respective Annex: Prices for Special Services in relation to the Cooperation Partner.

Version: 3.1, Stand: 01.01.2023 9/9

You might also like

- BearingsDocument52 pagesBearingsrahul singhNo ratings yet

- Banking TermsDocument20 pagesBanking Termsdeepakgarg1No ratings yet

- Banking Law and OperationsDocument35 pagesBanking Law and OperationsViraja GuruNo ratings yet

- 8 Extraordinary Qi VesselsDocument6 pages8 Extraordinary Qi VesselsRiccardo Lautizi100% (1)

- Relationship Between Banker and CustomerDocument9 pagesRelationship Between Banker and CustomerLaw LawyersNo ratings yet

- First Responder ManualDocument69 pagesFirst Responder ManualCristina Joy Vicente Cruz100% (3)

- Rights and Obligations of BankerDocument3 pagesRights and Obligations of BankerMoinuddin Khan Kafi100% (1)

- BANKING Terms-1Document17 pagesBANKING Terms-1Monika Choudhary100% (1)

- Complete List of Banking Terms With DefiDocument28 pagesComplete List of Banking Terms With DefiSneha BhartiNo ratings yet

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- Difference Between Trust and Retention Account and Escrow AccountDocument12 pagesDifference Between Trust and Retention Account and Escrow Accountrao_gmail67% (6)

- Factoring, Forfaiting & Bills DiscountingDocument3 pagesFactoring, Forfaiting & Bills DiscountingkrishnadaskotaNo ratings yet

- Firm C7 Workshop One (Banking)Document22 pagesFirm C7 Workshop One (Banking)MUBANGIZI ABBYNo ratings yet

- Lecture 5 - Banker AcceptancesDocument14 pagesLecture 5 - Banker AcceptancesYvonneNo ratings yet

- Firm C6 Workshop 1 Banking Term 3Document29 pagesFirm C6 Workshop 1 Banking Term 3MUBANGIZI ABBYNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Grade-9 (1st)Document42 pagesGrade-9 (1st)Jen Ina Lora-Velasco GacutanNo ratings yet

- Banker-Customer RelationshipDocument17 pagesBanker-Customer RelationshipAdharsh VenkatesanNo ratings yet

- List of Prices and Services Germany de Iban English v2.8.1 CleanDocument11 pagesList of Prices and Services Germany de Iban English v2.8.1 CleanThomas LemoyneNo ratings yet

- List of Prices and Services: Solarisbank - deDocument10 pagesList of Prices and Services: Solarisbank - dehaniaNo ratings yet

- FINO Payments Bank Citizen's Charter FINO Payments Bank Citizen's CharterDocument7 pagesFINO Payments Bank Citizen's Charter FINO Payments Bank Citizen's Chartershriyanshuswain909No ratings yet

- Ba311 Week1112Document11 pagesBa311 Week1112Patrick SolomonNo ratings yet

- Bank Final TheissDocument17 pagesBank Final TheissfaizanvaidaNo ratings yet

- Termination of Bank-Customer RelationshipDocument5 pagesTermination of Bank-Customer Relationshipmuggzp100% (1)

- Lml4807 Examination PackDocument43 pagesLml4807 Examination Packkarabo MkhontoNo ratings yet

- 3relation Between Banker and CastomerDocument12 pages3relation Between Banker and Castomertanjimalomturjo1No ratings yet

- Client Information According To Art. 246b German Introductory Act To The German Civil Code ("EGBGB")Document6 pagesClient Information According To Art. 246b German Introductory Act To The German Civil Code ("EGBGB")rangelcesarNo ratings yet

- General Business Terms and Conditions of Erste Bank Der Oesterreichischen Sparkassen AGDocument9 pagesGeneral Business Terms and Conditions of Erste Bank Der Oesterreichischen Sparkassen AGnicoletaNo ratings yet

- General Terms and Conditions of Business GTCDocument96 pagesGeneral Terms and Conditions of Business GTCRABBIT - FortniteNo ratings yet

- BankingDocument1 pageBankingsarahmelgamilNo ratings yet

- Working Capital ManagementDocument4 pagesWorking Capital ManagementSundeep SinghNo ratings yet

- Bla503: Legal Aspects of BankingDocument10 pagesBla503: Legal Aspects of BankingShubham SrivastavaNo ratings yet

- Bulletin 3 Closure of Bank Accounts Final 30.01.2018Document6 pagesBulletin 3 Closure of Bank Accounts Final 30.01.2018Tahir DestaNo ratings yet

- Hell YeahDocument14 pagesHell YeahNedjm EddineNo ratings yet

- Ser General Business Conditions AGDocument8 pagesSer General Business Conditions AG101010anastasiaNo ratings yet

- ICLDocument7 pagesICLPuneeta AroraNo ratings yet

- Types of BankingDocument2 pagesTypes of BankingplmokmNo ratings yet

- Tariff Sme Corpo 01 06 2022Document40 pagesTariff Sme Corpo 01 06 2022zygimantasgasiunasNo ratings yet

- Banker Customer RelationshipDocument7 pagesBanker Customer Relationshipvivekananda RoyNo ratings yet

- Account Terms Business Relationship enDocument15 pagesAccount Terms Business Relationship enBrigitte HigazieNo ratings yet

- Framework Agreement For Banking Services For Physical Persons Available From June 2022 enDocument59 pagesFramework Agreement For Banking Services For Physical Persons Available From June 2022 enRobertNo ratings yet

- LAON Recovery-management-Of Andhra BankDocument87 pagesLAON Recovery-management-Of Andhra Banklakshmikanth100% (1)

- Banking and Insurance NotesDocument10 pagesBanking and Insurance NotesRaj BaraiNo ratings yet

- 2.1 Types and Procedures of Opening and Operating Bank Deposit AccountsDocument6 pages2.1 Types and Procedures of Opening and Operating Bank Deposit AccountswalterNo ratings yet

- Mark Vincent N. Angeles 3AA Assignment in Special Commercial LawDocument3 pagesMark Vincent N. Angeles 3AA Assignment in Special Commercial LawMarkee Nepomuceno AngelesNo ratings yet

- Debt Recovery Management of SBIDocument12 pagesDebt Recovery Management of SBIDipanjan DasNo ratings yet

- Ecredit 01202021Document4 pagesEcredit 01202021Dj BacudNo ratings yet

- Advance Against Book Debts UpdatedDocument4 pagesAdvance Against Book Debts Updatedstarvindsouza91100% (1)

- Sub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptDocument20 pagesSub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptAmitKumarNo ratings yet

- Banking and Marketing TermsDocument17 pagesBanking and Marketing TermsVigya JindalNo ratings yet

- Acca Fundamentals of Accounting (FA1)Document24 pagesAcca Fundamentals of Accounting (FA1)Paredes FlozerenziNo ratings yet

- Faqs: Final Cip RuleDocument10 pagesFaqs: Final Cip RuleANILNo ratings yet

- Traditional Banking Activities: GovernmentDocument14 pagesTraditional Banking Activities: GovernmentamitkumaraxnNo ratings yet

- 69, Siddhant Raj, Banking LawDocument13 pages69, Siddhant Raj, Banking LawSiddhant RajNo ratings yet

- EAST WEST - Ewb Bills Collect 08302018Document3 pagesEAST WEST - Ewb Bills Collect 08302018Junior MiicNo ratings yet

- General Terms and ConditionsDocument27 pagesGeneral Terms and Conditionssohazee1993No ratings yet

- Group Assignment A201 H3 PDFDocument8 pagesGroup Assignment A201 H3 PDFdini sofiaNo ratings yet

- 15 Bank Management and Funds Transfer PricingDocument23 pages15 Bank Management and Funds Transfer PricingCalebNo ratings yet

- Customer Compensation PolicyDocument20 pagesCustomer Compensation PolicyShivam SuryawanshiNo ratings yet

- Asgment BankingDocument7 pagesAsgment Bankingkiena1991No ratings yet

- English For International Trade - 2022 - Condori Deolinda Sofia BelenDocument17 pagesEnglish For International Trade - 2022 - Condori Deolinda Sofia BelenSofia CondoriNo ratings yet

- Chapter-01 Accounting For Banking CompanyDocument26 pagesChapter-01 Accounting For Banking CompanyRabbi Ul Apon100% (1)

- Compensation Policy 28 03 2019Document10 pagesCompensation Policy 28 03 2019Arnab MitraNo ratings yet

- BankingDocument9 pagesBankingIshaanKapoorNo ratings yet

- Week 1Document15 pagesWeek 1Jamaica AlejoNo ratings yet

- Present Tenses RevisionDocument1 pagePresent Tenses RevisionJasmina LatinovicNo ratings yet

- Advertising & SALES PROMOTIONAL-AirtelDocument78 pagesAdvertising & SALES PROMOTIONAL-AirtelDasari AnilkumarNo ratings yet

- Organ TransplantationDocument36 pagesOrgan TransplantationAnonymous 4TUSi0SqNo ratings yet

- Data Coding SchemesDocument26 pagesData Coding SchemesJovanie CadungogNo ratings yet

- Information Processing 2Document6 pagesInformation Processing 2Owen RamiscalNo ratings yet

- Faculty of Education: Dr. Ghanshyam Singh P.G. College, Soyepur, Lalpur, VaranasiDocument4 pagesFaculty of Education: Dr. Ghanshyam Singh P.G. College, Soyepur, Lalpur, VaranasiRajeshKumarJainNo ratings yet

- GST Compensation CessDocument2 pagesGST Compensation CessPalak JioNo ratings yet

- Laws Releated To Honour KillingDocument2 pagesLaws Releated To Honour KillingMukul Singh RathoreNo ratings yet

- East Coast Yacht's Expansion Plans-06!02!2008 v2Document3 pagesEast Coast Yacht's Expansion Plans-06!02!2008 v2percyNo ratings yet

- U59cbu5f97u897fu5c71u5bb4u904au8a18-U6307u5b9au6587u8a00u7d93u5178u7cbeu7de8u53c3u8003u7b54u6848.docx - 1 10 (Document1 pageU59cbu5f97u897fu5c71u5bb4u904au8a18-U6307u5b9au6587u8a00u7d93u5178u7cbeu7de8u53c3u8003u7b54u6848.docx - 1 10 (Yo YuuiNo ratings yet

- Capto: 3 Good Reasons To Use The Capto For Handling Heavy FabricsDocument2 pagesCapto: 3 Good Reasons To Use The Capto For Handling Heavy FabricsgustirizkiawanNo ratings yet

- Practice Paper 1 Class X Social Science Time 3 Hrs. M.M 80 General InstructionsDocument6 pagesPractice Paper 1 Class X Social Science Time 3 Hrs. M.M 80 General Instructionsvvs .b.s1453No ratings yet

- Identify The Industry - Case 5Document2 pagesIdentify The Industry - Case 5yuki_akitsu0% (1)

- Timeline of My Exposure To Traditional and New Media - Justine Sheen Gay-12 ABM-BDocument16 pagesTimeline of My Exposure To Traditional and New Media - Justine Sheen Gay-12 ABM-Bapi-389627320No ratings yet

- Present Status of Advertising Industry in IndiaDocument25 pagesPresent Status of Advertising Industry in IndiaMeenal Kapoor100% (1)

- Solar Geometry FinalDocument17 pagesSolar Geometry Finalsarvesh kumarNo ratings yet

- 6to Present Continuous AllDocument1 page6to Present Continuous AllEliana VogtNo ratings yet

- Indira Gandhi Apprentice FormDocument3 pagesIndira Gandhi Apprentice FormDevil Gamer NeroNo ratings yet

- Anatomy and Physiology Outline PDFDocument2 pagesAnatomy and Physiology Outline PDFHampson MalekanoNo ratings yet

- Johannes KepplerDocument2 pagesJohannes KepplermakNo ratings yet

- Job Offer Electrical EngineerDocument3 pagesJob Offer Electrical EngineerAbner ZaldivarNo ratings yet

- Marxist - Political Science IGNOUDocument15 pagesMarxist - Political Science IGNOUDesi Boy100% (2)

- Hidden FiguresDocument4 pagesHidden FiguresMa JoelleNo ratings yet

- 5990200Document551 pages5990200Basit Ahmad bhat0% (1)