Professional Documents

Culture Documents

Operational Fintech Outline

Uploaded by

Sana Arif0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

operational fintech outline

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesOperational Fintech Outline

Uploaded by

Sana ArifCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

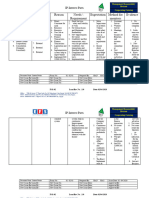

Regulatory & Operational Environment for FinTech’s

Sr Main Topics Subtopics Duration Trainer Expertise

No

1 Export 1. Customer Due Diligence (CDD) of 2 hours From SBP

Regulations Exporters.

2. Retention period of Export Proceeds

with Authorized Dealers upon

Realization.

3. Export of Software.

4. Exports under Pakistan Single

Window (PSW)

5. Export of Services.

6. Retention of a part of incremental

export earnings.

7. Business-to-Consumer (B2C) E-

Commerce Exports.

8. Utilization of Funds held in Exporters’

Special Foreign Currency Account.

2 Commercial 1. Acquisition of Services from Abroad 1 hour From SBP

Remittances 2. Remittance of Royalty/Franchise and

Technical Service Fees.

3. Business Processes Outsourcing

(BPO) for Non-Core Activities.

4. Remittances to Digital Service

Provider Companies.

5. Remittances by Information

Technology Sector.

6. Payment of Dividend to Non-

Resident Shareholders.

3 Investments 1. Establishment of subsidiary/branch 1 hour From SBP

office abroad by export-oriented

companies/firms for promoting

exports.

2. Establishment of Holding Company

(HoldCo) abroad by residents for

raising capital from abroad.

3. Investment abroad by resident

companies/firms for expansion of

business.

4. Investment abroad by Resident

Individuals.

4 Account 1. Local currency accounts. 1.5 hours Banker

opening 2. Foreign currency accounts.

Sr Main Topics Subtopics Duration Trainer Expertise

No

3. Special foreign currency accounts.

4. Non-resident rupee accounts.

5. Documents and information

required for opening of account.

5 Banking 1. Accounts. 1 hour Banker

Products 2. Loans.

3. Trade (L/C, LG etc).

4. Authorized dealers.

5. Remittances.

6. Regulatory Approval System (RAS)

6 High level 1. Fit and Proper Test of BoD, 1 hour From SBP/Banker

license Management and CEO.

requirement for 2. Responsibilities of the Board of

setting up a EMI Directors & management

3. Capital requirements

7 Outsourcing 1. Material outsourcing. 1.5 hours From SBP

Regulations 2. Responsibilities of the board of

directors & management

3. Risk management in outsourcing

arrangements.

4. Outsourcing outside Pakistan.

5. Group outsourcing.

6. Collaboration with Fintechs.

7. Information technology outsourcing.

8. Activities to Cloud Service Providers

(CSP)

9. Activities cannot be outsourced.

8 Other 1. Mobile Applications (Apps) Security 3 hours From SBP

important Guidelines.

Regulations 2. Regulations for Digital On-Boarding

of Merchants.

3. Regulations for Payment Card

Security.

4. Prepaid card regulations.

5. Electronic fund transfers regulations.

6. RAAST peer-to-peer payments

9 AML/CFT 1. Risk based approach to AML/ CFT. 2 hours Banker

regulations 2. Customer due diligence (CDD)

3. Sanctions.

4. AML Systems.

5. Internal controls.

Sr Main Topics Subtopics Duration Trainer Expertise

No

6. Employee due diligence.

7. Training

10 Know Your 1. SBP. 1.5 hours Banker

Regulators 2. SECP.

3. FBR.

11 Legal Structure 1. Court Systems 1 hour Lawyer

in Pakistan 2. Contracts

12 Establishing a 1. Company Registration Process. 2 hours Lawyer

company in 2. Registration Portal.

Pakistan 3. Returns.

4. Companies Act.

Learning hours = 18.5 hours

Learning Days = 3 days

You might also like

- Forensic Report 1 - ABC Private LimitedDocument28 pagesForensic Report 1 - ABC Private LimitedMeena BhagatNo ratings yet

- Pgcworking Capital Assessment PDFDocument39 pagesPgcworking Capital Assessment PDFChandani DesaiNo ratings yet

- Sample Report II - Card System Forensic Audit ReportDocument24 pagesSample Report II - Card System Forensic Audit ReportArif AhmedNo ratings yet

- VDA Volume Assessment of Quality Management Methods Guideline 1st Edition November 2017 Online-DocumentDocument36 pagesVDA Volume Assessment of Quality Management Methods Guideline 1st Edition November 2017 Online-DocumentR JNo ratings yet

- Full Download Bontragers Textbook of Radiographic Positioning and Related Anatomy 9th Edition Lampignano Test BankDocument36 pagesFull Download Bontragers Textbook of Radiographic Positioning and Related Anatomy 9th Edition Lampignano Test Bankjohn5kwillis100% (22)

- Guidelines For Internal Control System and Compliance Function For Securities BrokerDocument25 pagesGuidelines For Internal Control System and Compliance Function For Securities Brokerzubair_zNo ratings yet

- Depository System in India Needs and ProgressDocument17 pagesDepository System in India Needs and ProgressGaurav PandeyNo ratings yet

- A Report ON Financial and Accounting Analysis of Branch Expenses, Banking Process and Pay OutDocument40 pagesA Report ON Financial and Accounting Analysis of Branch Expenses, Banking Process and Pay OutSmita RoyNo ratings yet

- Depository System in India, Needs and ProgressDocument17 pagesDepository System in India, Needs and Progressjyoti667% (3)

- Branch Manager - (Adyar, Chennai)Document3 pagesBranch Manager - (Adyar, Chennai)Jayakrishnaraj AJDNo ratings yet

- RBI Internal Control GuidelinesDocument25 pagesRBI Internal Control GuidelinesVbs ReddyNo ratings yet

- Important RationalsDocument37 pagesImportant RationalsSalil JoshiNo ratings yet

- Bank AuditDocument18 pagesBank AuditPranav HariharanNo ratings yet

- Advanced Financial Accounting and Reporting: Management and Advisory ServicesDocument4 pagesAdvanced Financial Accounting and Reporting: Management and Advisory ServicesCj SernaNo ratings yet

- BA - Group 1Document40 pagesBA - Group 1Anmol ShuklaNo ratings yet

- Capt mkt1Document5 pagesCapt mkt1api-3745584No ratings yet

- Chapter 16 - Due Diligence, Investigation and Forensic AuditDocument8 pagesChapter 16 - Due Diligence, Investigation and Forensic Auditsathya_41095No ratings yet

- Incubation Policy QuestionarriesDocument1 pageIncubation Policy QuestionarriesAmol BNo ratings yet

- A Business Plan of Online Service Business Plan A Part of Financial ManagementDocument43 pagesA Business Plan of Online Service Business Plan A Part of Financial ManagementShwetang PanchalNo ratings yet

- Geo-Tech Conference v2Document11 pagesGeo-Tech Conference v2Shrey SaxenaNo ratings yet

- L045-02-Compliance in Branch Functions-Other Than AdvancesDocument42 pagesL045-02-Compliance in Branch Functions-Other Than AdvancesAbhay v.sNo ratings yet

- Kumpulan Contoh Soal Sertifikasi SAP Fundamental - Tikka's StoryDocument36 pagesKumpulan Contoh Soal Sertifikasi SAP Fundamental - Tikka's StoryJohn KarokoeNo ratings yet

- On Job Training in Branch Banking OperationDocument7 pagesOn Job Training in Branch Banking OperationAshebirNo ratings yet

- F 01-02 List of Interest PartiesDocument3 pagesF 01-02 List of Interest Partieska1onlineNo ratings yet

- Presentation Asc Insolvency Bankers Perspective On IbcDocument20 pagesPresentation Asc Insolvency Bankers Perspective On IbcnamastefinanceNo ratings yet

- First PhaseDocument7 pagesFirst PhasesameertawdeNo ratings yet

- Resume I Chanchal Jain (3) - 1Document2 pagesResume I Chanchal Jain (3) - 1GauravGupta11No ratings yet

- Chap 07 - Fraud, Internal Control, and Cash (ICA)Document9 pagesChap 07 - Fraud, Internal Control, and Cash (ICA)Aarti JNo ratings yet

- Financial Accounting AnimalDocument2 pagesFinancial Accounting Animalpaul smithNo ratings yet

- Study PlannerDocument13 pagesStudy PlannerMohammed NasserNo ratings yet

- Financial MarketsDocument30 pagesFinancial MarketsAshutosh SharmaNo ratings yet

- 01 - Overview & Customer Master MaintenanceDocument27 pages01 - Overview & Customer Master MaintenanceSreepada kNo ratings yet

- Audit of BanksDocument32 pagesAudit of BankssravankumarchinnabathiniNo ratings yet

- Changing Face of BFSI in Last 20 YearsDocument12 pagesChanging Face of BFSI in Last 20 YearsChristopher MathewsNo ratings yet

- Dld-Traditional & Vul Insurance Concepts - Final - (Edits 011022)Document233 pagesDld-Traditional & Vul Insurance Concepts - Final - (Edits 011022)Renz LanuzaNo ratings yet

- PDFFile5b2788b374f5c0 73319843Document131 pagesPDFFile5b2788b374f5c0 73319843Rajeev RaiNo ratings yet

- Private Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private EquityDocument24 pagesPrivate Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private Equity: Private EquityAnonymous kgSMlxNo ratings yet

- Endorsement/addresses Stamps Must Be Ordered: Branch District Office Main BranchDocument4 pagesEndorsement/addresses Stamps Must Be Ordered: Branch District Office Main BranchLeo AmansecNo ratings yet

- Cef Whitepaper Ver 1.0Document24 pagesCef Whitepaper Ver 1.0Wei Ping0% (1)

- BankingDocument162 pagesBankingSaloni AgrawalNo ratings yet

- Foreign Exchange Risk ManagementDocument4 pagesForeign Exchange Risk ManagementMiran shah chowdhuryNo ratings yet

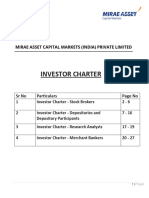

- Investor Charter - Stock Brokers: Page 1 of 5Document5 pagesInvestor Charter - Stock Brokers: Page 1 of 5Pranav SNo ratings yet

- FS Report-Donouts and Cofee Shop in Oman-20122022Document3 pagesFS Report-Donouts and Cofee Shop in Oman-20122022dprosenjitNo ratings yet

- Unit 1Document39 pagesUnit 1neeshNo ratings yet

- 731 - 740 Fa-6Document17 pages731 - 740 Fa-6738 Lavanya JadhavNo ratings yet

- Context of The OrganizationDocument1 pageContext of The OrganizationMohini Marathe100% (3)

- Finance ProjectDocument67 pagesFinance ProjectprafultayadeNo ratings yet

- Iso18295 Selection of Call CentersDocument7 pagesIso18295 Selection of Call CentersgoharhabibNo ratings yet

- Investor CharterDocument27 pagesInvestor CharterDhrumil PatelNo ratings yet

- WWW - Modelexam.in: Study Notes For Nism - Series Vi Depository Operations Certification Examination (Doce) May 2015Document24 pagesWWW - Modelexam.in: Study Notes For Nism - Series Vi Depository Operations Certification Examination (Doce) May 2015Anshu GauravNo ratings yet

- Indoworld - forwardERP Integration Implementation ProposalDocument15 pagesIndoworld - forwardERP Integration Implementation Proposaldwiretnoanggraini15No ratings yet

- ForxDocument12 pagesForxrahul857No ratings yet

- Curriculum - Nsdl-Depository Operations Module: Overview of The Capital MarketDocument3 pagesCurriculum - Nsdl-Depository Operations Module: Overview of The Capital MarketSubrat TripathiNo ratings yet

- Depository System - Company LawDocument5 pagesDepository System - Company LawPAULOMI DASNo ratings yet

- Elective Useless NotesDocument24 pagesElective Useless NotesNishadNo ratings yet

- Strategy & Structure of International Business: Unit 5Document28 pagesStrategy & Structure of International Business: Unit 5AjithNo ratings yet

- Indian Financial SystemDocument33 pagesIndian Financial SystemVanshika RajNo ratings yet

- Accounting and Its EnvironmentDocument3 pagesAccounting and Its EnvironmentEunice MartinezNo ratings yet

- Managing Financial Information in the Trade Lifecycle: A Concise Atlas of Financial Instruments and ProcessesFrom EverandManaging Financial Information in the Trade Lifecycle: A Concise Atlas of Financial Instruments and ProcessesNo ratings yet

- Initial Public Offering: An Introduction to IPO on Wall StFrom EverandInitial Public Offering: An Introduction to IPO on Wall StRating: 5 out of 5 stars5/5 (1)

- Teacher ListDocument1 pageTeacher ListSana ArifNo ratings yet

- Week 3Document4 pagesWeek 3Sana ArifNo ratings yet

- Sports Day Agenda - Sheet1Document1 pageSports Day Agenda - Sheet1Sana ArifNo ratings yet

- CUST Qual+Quant Proposal NielsenIQ 29112021Document19 pagesCUST Qual+Quant Proposal NielsenIQ 29112021Sana ArifNo ratings yet

- Communications Messages - EnglishDocument2 pagesCommunications Messages - EnglishSana ArifNo ratings yet

- Make Choices That You!Document1 pageMake Choices That You!Sana ArifNo ratings yet

- Onboarding SpecialistDocument2 pagesOnboarding SpecialistSana ArifNo ratings yet

- TBML OutlineDocument1 pageTBML OutlineSana ArifNo ratings yet

- Paper 1 9093Document8 pagesPaper 1 9093Sana ArifNo ratings yet

- Proposal WritingDocument2 pagesProposal WritingSana ArifNo ratings yet

- Paper 2 9093Document4 pagesPaper 2 9093Sana ArifNo ratings yet

- WBG Thesis SummaryDocument1 pageWBG Thesis SummarySana ArifNo ratings yet

- Molten Lava CakeDocument1 pageMolten Lava CakeSana ArifNo ratings yet

- Cheese CakeDocument1 pageCheese CakeSana ArifNo ratings yet

- Mindfulness WOrksheet 1Document2 pagesMindfulness WOrksheet 1Sana ArifNo ratings yet

- Post Work 3Document1 pagePost Work 3Sana ArifNo ratings yet

- Mindfulness WOrksheet 2Document2 pagesMindfulness WOrksheet 2Sana ArifNo ratings yet

- AlligentDocument44 pagesAlligentariNo ratings yet

- The Politics of GenreDocument21 pagesThe Politics of GenreArunabha ChaudhuriNo ratings yet

- The Hot Aishwarya Rai Wedding and Her Life.20130105.040216Document2 pagesThe Hot Aishwarya Rai Wedding and Her Life.20130105.040216anon_501746111100% (1)

- Exploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi ArabiaDocument9 pagesExploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi Arabianishu thapaNo ratings yet

- Capacitor Trip Device CTD-4Document2 pagesCapacitor Trip Device CTD-4DAS1300No ratings yet

- New Horizon Public School, Airoli: Grade X: English: Poem: The Ball Poem (FF)Document42 pagesNew Horizon Public School, Airoli: Grade X: English: Poem: The Ball Poem (FF)stan.isgod99No ratings yet

- Alexander Fraser TytlerDocument4 pagesAlexander Fraser Tytlersbr9guyNo ratings yet

- Annexure To SOW 3 STD Specification For Welding and NDT PipingDocument15 pagesAnnexure To SOW 3 STD Specification For Welding and NDT PipingASHISH GORDENo ratings yet

- Btech CertificatesDocument6 pagesBtech CertificatesSuresh VadlamudiNo ratings yet

- Review Test 1: Circle The Correct Answers. / 5Document4 pagesReview Test 1: Circle The Correct Answers. / 5XeniaNo ratings yet

- Cooperative LinuxDocument39 pagesCooperative Linuxrajesh_124No ratings yet

- Army Public School No.1 Jabalpur Practical List - Computer Science Class - XIIDocument4 pagesArmy Public School No.1 Jabalpur Practical List - Computer Science Class - XIIAdityaNo ratings yet

- Lords of ChaosDocument249 pagesLords of ChaosBill Anderson67% (3)

- Major Chnage at Tata TeaDocument36 pagesMajor Chnage at Tata Teasheetaltandon100% (1)

- Outbound Idocs Code Error Event Severity Sap MeaningDocument2 pagesOutbound Idocs Code Error Event Severity Sap MeaningSummit YerawarNo ratings yet

- EVS (Yuva)Document88 pagesEVS (Yuva)dasbaldev73No ratings yet

- Forlong - Rivers of LifeDocument618 pagesForlong - Rivers of LifeCelephaïs Press / Unspeakable Press (Leng)100% (15)

- TDS-11SH Top Drive D392004689-MKT-001 Rev. 01Document2 pagesTDS-11SH Top Drive D392004689-MKT-001 Rev. 01Israel Medina100% (2)

- Majan Audit Report Final2Document46 pagesMajan Audit Report Final2Sreekanth RallapalliNo ratings yet

- Manual ML 1675 PDFDocument70 pagesManual ML 1675 PDFSergio de BedoutNo ratings yet

- 525 2383 2 PBDocument5 pages525 2383 2 PBiwang saudjiNo ratings yet

- Test 4 MathDocument15 pagesTest 4 MathYu ChenNo ratings yet

- An Enhanced RFID-Based Authentication Protocol Using PUF For Vehicular Cloud ComputingDocument18 pagesAn Enhanced RFID-Based Authentication Protocol Using PUF For Vehicular Cloud Computing0dayNo ratings yet

- Thesis Preliminary PagesDocument8 pagesThesis Preliminary Pagesukyo0801No ratings yet

- Chapter 17 Study Guide: VideoDocument7 pagesChapter 17 Study Guide: VideoMruffy DaysNo ratings yet

- Couvade SyndromeDocument5 pagesCouvade SyndromejudssalangsangNo ratings yet

- Quiz EditedDocument6 pagesQuiz EditedAbigail LeronNo ratings yet

- An Overview of Marketing - Week 1Document7 pagesAn Overview of Marketing - Week 1Jowjie TVNo ratings yet