Professional Documents

Culture Documents

Profe03 Act4

Profe03 Act4

Uploaded by

Red Mariee0 ratings0% found this document useful (0 votes)

6 views1 pageThe document provides accounting information from the consolidation of Bass Co. and Guitar Co. as of December 31, 20x1. It summarizes that:

- Goodwill from the acquisition is $40,000

- Consolidated total assets are $1,958,000

- Non-controlling interest in Guitar Co. is $116,500

- Consolidated retained earnings are $489,500

- Consolidated total equity is $1,546,000

Original Description:

Original Title

PROFE03 ACT4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides accounting information from the consolidation of Bass Co. and Guitar Co. as of December 31, 20x1. It summarizes that:

- Goodwill from the acquisition is $40,000

- Consolidated total assets are $1,958,000

- Non-controlling interest in Guitar Co. is $116,500

- Consolidated retained earnings are $489,500

- Consolidated total equity is $1,546,000

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageProfe03 Act4

Profe03 Act4

Uploaded by

Red MarieeThe document provides accounting information from the consolidation of Bass Co. and Guitar Co. as of December 31, 20x1. It summarizes that:

- Goodwill from the acquisition is $40,000

- Consolidated total assets are $1,958,000

- Non-controlling interest in Guitar Co. is $116,500

- Consolidated retained earnings are $489,500

- Consolidated total equity is $1,546,000

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

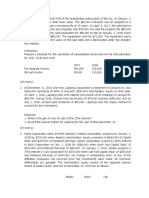

PROFE03 ACCOUNTING FOR BUSINESS COMBINATIONS

ACTIVITY CHAPTER 4

1. What amount of goodwill is presented in the consolidated statement of financial

position on December 31, 20x1?

a. 40,000 b. 35,000 c. 20,000 d. 15,000

ANS : A. 40 000

2. How much is the consolidated total assets as of December 31, 20x1?

a. 1,867,000 b. 1,907,000 c. 1,958,000 d. 1,974,000

ANS: C. 1,958,000

Other assets, Bass Co. 1 372 000

Other assets, Guitar Co. 496 000

Difference in FV of Building rent 50 000

Goodwill 40 000

Consolidated total assets 1 958 000

3. How much is the non-controlling interest in the net assets of the subsidiary on

December 31, 20x1?

a. 106,500 b. 116,500 c. 136,500 d. 146,500

ANS: 116,500

NCI on acquisition 100,000

Net income of guitar (376,000-320,000) 56,000

Amortization (60,000/6) 10,000

Total 66,000

NCI rate 25% 16,500

NCI as of 12/31/20x1 116,500

4. How much is the consolidated retained earnings on December 31, 20x1?

a. 489,500 b.498,500 c. 534,500 d.543,500

ANS: 489,500

Retained earnings, Bass 440,000

Shared in the net income of Guitar (26,000 x 75%) 49,500

Consolidated retained earnings 489,500

5. How much is the consolidated total equity on December 31, 20x1?

a. 1,546,000 b.1,564,000 c.1,642,000 d. 1,624,000

ANS: 1,546,000

Share in capital, Bass 940,000

Consolidated retained earnings 489,000

Consolidated total equity 1,546,000

You might also like

- Prior PeriodDocument14 pagesPrior PeriodHarvey Dienne Quiambao100% (6)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)Document3 pagesConsolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)mhar lon100% (2)

- INVESTMENTS ReviewerDocument35 pagesINVESTMENTS ReviewerRyze100% (1)

- College of Accountancy Final Examination Acctg 206A InstructionsDocument4 pagesCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganNo ratings yet

- Maria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)Document14 pagesMaria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)maria evangelistaNo ratings yet

- Activity - Consolidated Financial Statement Part 1Document10 pagesActivity - Consolidated Financial Statement Part 1PaupauNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Quiz 2 KeysDocument15 pagesQuiz 2 KeysLeslieCastro100% (1)

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaan50% (2)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Activity - Consolidated Financial Statement, Part 1 (REVIEWER MIDTERM)Document12 pagesActivity - Consolidated Financial Statement, Part 1 (REVIEWER MIDTERM)Paupau0% (1)

- FAR-02 Retained EarningsDocument5 pagesFAR-02 Retained EarningsKim Cristian MaañoNo ratings yet

- Quiz Chapter-11 She-Part-2 2021Document5 pagesQuiz Chapter-11 She-Part-2 2021Salma B. AbdullahNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Chapter 4 - Assigment 2Document4 pagesChapter 4 - Assigment 2Kryzzel Anne JonNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Drills Acc 106Document2 pagesDrills Acc 106brmo.amatorio.uiNo ratings yet

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Importing Transaction - Exposed Liability PositionDocument1 pageImporting Transaction - Exposed Liability Positionmaria ronoraNo ratings yet

- Assessment 2 2024 FAR - 1Document6 pagesAssessment 2 2024 FAR - 1ARBYLESA JUNIONo ratings yet

- Accountinf 101675824567Document3 pagesAccountinf 101675824567elsana philipNo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- Accounting Review QuestionsDocument34 pagesAccounting Review Questionsjoyce KimNo ratings yet

- Answer Key - Importing and ExportingDocument4 pagesAnswer Key - Importing and Exportingmaria ronoraNo ratings yet

- CFAS2Document7 pagesCFAS2kaji cruzNo ratings yet

- Investment Reviewer With Answer SolutionsDocument39 pagesInvestment Reviewer With Answer SolutionsYmmymmNo ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- Nama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionsDocument6 pagesNama: Christian Candra Wijaya NIM: F0321067 Kelas: C: InstructionswijayaNo ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- Angelica Condeno - Current Assets and Liabilities q1Document4 pagesAngelica Condeno - Current Assets and Liabilities q1Angelica CondenoNo ratings yet

- Prelim Quiz 1-Problem SolvingDocument3 pagesPrelim Quiz 1-Problem SolvingPaupauNo ratings yet

- Finals Part 1 Answers May 2019Document5 pagesFinals Part 1 Answers May 2019edwin_dauzNo ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Revision Questions 1Document13 pagesRevision Questions 1Vivian WongNo ratings yet

- 102 Quiz 1 She 2020Document6 pages102 Quiz 1 She 2020Eunice MartinezNo ratings yet

- Intercompany Sale of PropertyDocument6 pagesIntercompany Sale of PropertyClauie BarsNo ratings yet

- Abc 6Document4 pagesAbc 6Kath LeynesNo ratings yet

- Aud Activity 1Document10 pagesAud Activity 1sethdrea officialNo ratings yet

- Assignment 2 Bus ComDocument22 pagesAssignment 2 Bus ComFaithful FighterNo ratings yet

- AP 1st Monthly AssessmentDocument6 pagesAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- Accounting For Business Combinations Final Term ExaminationDocument3 pagesAccounting For Business Combinations Final Term ExaminationJasper LuagueNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- QUIZSIGNMENTDocument3 pagesQUIZSIGNMENTTILAR ALEXANDRA NICOLENo ratings yet

- Examination About Investment 3Document2 pagesExamination About Investment 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- Ex 2-3 PPT: Prepare The Necessary Journal Entries in Klaus AG's Book From The Above InformationDocument4 pagesEx 2-3 PPT: Prepare The Necessary Journal Entries in Klaus AG's Book From The Above InformationBryan LukeNo ratings yet

- BUSI 1001/1004 - Financial Accounting Sample Final ExaminationDocument19 pagesBUSI 1001/1004 - Financial Accounting Sample Final ExaminationThe oneNo ratings yet

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- OLPROFE01 - Activity 9 II AtaDocument1 pageOLPROFE01 - Activity 9 II AtaRed MarieeNo ratings yet

- OLPROFE01Document1 pageOLPROFE01Red MarieeNo ratings yet

- Olprofe01 - Activity 9 IIDocument1 pageOlprofe01 - Activity 9 IIRed MarieeNo ratings yet

- Olprofe01 - Activity 8Document1 pageOlprofe01 - Activity 8Red MarieeNo ratings yet

- OLPROFE01 - Activity 7Document1 pageOLPROFE01 - Activity 7Red MarieeNo ratings yet

- OLPROFE01 - Activity 6 Sol 2Document2 pagesOLPROFE01 - Activity 6 Sol 2Red MarieeNo ratings yet

- OLPROFE01 - Activity 5 SolDocument1 pageOLPROFE01 - Activity 5 SolRed MarieeNo ratings yet

- Olprofe02 - Activity 2Document1 pageOlprofe02 - Activity 2Red MarieeNo ratings yet

- OLPROFE02 - Activity 1Document2 pagesOLPROFE02 - Activity 1Red MarieeNo ratings yet

- Olprofe01 - Activity 9 IDocument1 pageOlprofe01 - Activity 9 IRed MarieeNo ratings yet

- AnswerDocument1 pageAnswerRed MarieeNo ratings yet

- Profe03 Act#2Document2 pagesProfe03 Act#2Red MarieeNo ratings yet

- Profe03 Act 1Document2 pagesProfe03 Act 1Red MarieeNo ratings yet

- Profe03 Act3Document1 pageProfe03 Act3Red MarieeNo ratings yet

- Monthly AllowanceDocument1 pageMonthly AllowanceRed MarieeNo ratings yet

- Ollite Activity 5Document1 pageOllite Activity 5Red MarieeNo ratings yet

- Ollite Activity 7Document1 pageOllite Activity 7Red MarieeNo ratings yet

- Ollite Activity 6Document1 pageOllite Activity 6Red MarieeNo ratings yet