Professional Documents

Culture Documents

OLPROFE01

Uploaded by

Red Mariee0 ratings0% found this document useful (0 votes)

3 views1 pagePartner A and B each own 60% and 40% of the partnership respectively. The partnership has total assets of $710,000 consisting of cash, accounts receivable, inventory, and buildings, with total liabilities of $110,000. Partner A's capital account is $330,000 but based on their 60% ownership, their minimum required capital is $405,000, so Partner A needs to contribute an additional $75,000 in cash to the partnership.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPartner A and B each own 60% and 40% of the partnership respectively. The partnership has total assets of $710,000 consisting of cash, accounts receivable, inventory, and buildings, with total liabilities of $110,000. Partner A's capital account is $330,000 but based on their 60% ownership, their minimum required capital is $405,000, so Partner A needs to contribute an additional $75,000 in cash to the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageOLPROFE01

Uploaded by

Red MarieePartner A and B each own 60% and 40% of the partnership respectively. The partnership has total assets of $710,000 consisting of cash, accounts receivable, inventory, and buildings, with total liabilities of $110,000. Partner A's capital account is $330,000 but based on their 60% ownership, their minimum required capital is $405,000, so Partner A needs to contribute an additional $75,000 in cash to the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

OLPROFE01 - Activity 1

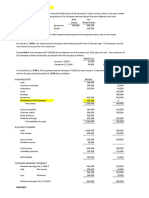

a. Compute for the adjusted balance in the partner’s capital counts

A B Partnership

Cash 200,000 - 200,000

Accounts Receivable 60,000 - 60,000

Inventory 160,000 - 160,000

Building(240k-50k)

Total 420,000 290,000 710,000

Notes Payable Net 90,000 90,000

(120K- 30K)

Mortgage Payable- 20,000 20,000

land

A. Capital 330,000 330,000

B. Capital 270,000 270,000

Total 420,000 290,000 710,000

b. Assume that a partner’s capital shall be increased accordingly by contributing additional

cash to bring the partner’s capital balance proportionate to their profit or loss ratio.

Which partner should provide additional cash and how much is the additional cash

contribution?

A’s Capital 330,000

Divided by: Profit(loss) sharing ratio of A 60%

Total 550,000

Multiply by: B’s Profit loss sharing ratio of B 40%

Minimum capital requirement of B 220,000

B’s Capital 270,000

Deficiency on B’s Contribution -

B’s Capital 270,000

Divided by: Profit(loss) sharing ratio OF A 40%

Total 675,000

Multiply by: A’s Profit loss sharing ratio 60%

Minimum capital requirement of A 405,000

A’s Capital 330,000

Deficiency on A’s Contribution 75,000

You might also like

- Partnership Formation: Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Formation: Name: Date: Professor: Section: Score: QuizWenjun100% (3)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- P3.5 Different Forms of Business CombinationDocument8 pagesP3.5 Different Forms of Business CombinationAgnes CahyaNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Activities On Module 1 - Partnership AccountingDocument4 pagesActivities On Module 1 - Partnership AccountingANDI TE'A MARI SIMBALANo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionNahwi KimpaNo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionYam SondayNo ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Final Grading Exam Key Answers PDFDocument35 pagesFinal Grading Exam Key Answers PDFLeslie Mae Vargas ZafeNo ratings yet

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- Partnership Dissolution - 2Document27 pagesPartnership Dissolution - 2Trisha GarciaNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- Partnership DissolutionDocument5 pagesPartnership DissolutionJae Nathaniel Arroyo OronanNo ratings yet

- Assignment Chap 13 FARDocument2 pagesAssignment Chap 13 FARHedjara CalacaNo ratings yet

- ANSWER Assessment ExamDocument21 pagesANSWER Assessment ExamJazzy Mercado100% (1)

- ICCT Colleges Foundation, Inc.: Profe01-Accounting For Special TransactionsDocument3 pagesICCT Colleges Foundation, Inc.: Profe01-Accounting For Special Transactionsbbrightvc 一ไบร์ทNo ratings yet

- 001 - Partnership Formation - Summary NotesDocument3 pages001 - Partnership Formation - Summary NotesJñelle Faith Herrera SaludaresNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationAbc xyzNo ratings yet

- Partnership Dissolution - 2Document20 pagesPartnership Dissolution - 2Xiu MinNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- ACC 311 Ass#2Document7 pagesACC 311 Ass#2Justine Reine CornicoNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- Bab 2 MateriDocument4 pagesBab 2 MateriAndikaNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Reviewer in Partnership: SolutionsDocument14 pagesReviewer in Partnership: SolutionsCasper John Nanas MuñozNo ratings yet

- Partnership Dissolution - AssignmentDocument3 pagesPartnership Dissolution - AssignmentCathleen TenaNo ratings yet

- Partnership 1 PDFDocument12 pagesPartnership 1 PDFShane TorrieNo ratings yet

- BSA 315 Accounting For Business CombinationDocument5 pagesBSA 315 Accounting For Business CombinationJeth MahusayNo ratings yet

- Partnership Accounting: FormationDocument6 pagesPartnership Accounting: FormationLee SuarezNo ratings yet

- DIY LiquidationDocument27 pagesDIY LiquidationJOYCE C ANDADORNo ratings yet

- Acc 102Document9 pagesAcc 102Roy ArguellesNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationJessica C. Dela CruzNo ratings yet

- 01 Control Premium and StepDocument15 pages01 Control Premium and StepANGELI GRACE GALVANNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationCathleen TenaNo ratings yet

- Installment LiquidationDocument5 pagesInstallment LiquidationChristian PaulNo ratings yet

- Lec 3Document7 pagesLec 3ahmedgalalabdalbaath2003No ratings yet

- Solution-Dissolution and LiquidationDocument8 pagesSolution-Dissolution and LiquidationRejay VillamorNo ratings yet

- Solutions and ExplanationsDocument30 pagesSolutions and Explanationsandrea.huerto0730No ratings yet

- Partnership OperationsDocument27 pagesPartnership OperationsAbc xyzNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- Accounting For Partnership DissolutionDocument49 pagesAccounting For Partnership DissolutionTULIO, Jeremy I.No ratings yet

- Lesson 2. Partnership FormationDocument6 pagesLesson 2. Partnership Formationangelinelucastoquero548No ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Partnership Formation Problem No. 1Document8 pagesPartnership Formation Problem No. 1tide podsNo ratings yet

- MEDINA - Homework 3 Nos. 6, 7, 8, & 14Document12 pagesMEDINA - Homework 3 Nos. 6, 7, 8, & 14Von Andrei MedinaNo ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- Advanced Accounting 1 1Document11 pagesAdvanced Accounting 1 1zeline petallanoNo ratings yet

- Solution:: 500,000 Cash 500,000 - 800,00 800,000Document3 pagesSolution:: 500,000 Cash 500,000 - 800,00 800,000belle crisNo ratings yet

- AE 112 Midterm QUIZ 2 - SolutionsDocument10 pagesAE 112 Midterm QUIZ 2 - SolutionsAllondra DapengNo ratings yet

- Activity 1Document1 pageActivity 1Cris TineNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Owl Co. and Owlet Co. - NCI in Net AssetsDocument11 pagesOwl Co. and Owlet Co. - NCI in Net AssetsKristine Esplana ToraldeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- OLPROFE01 - Activity 9 II AtaDocument1 pageOLPROFE01 - Activity 9 II AtaRed MarieeNo ratings yet

- Olprofe01 - Activity 8Document1 pageOlprofe01 - Activity 8Red MarieeNo ratings yet

- OLPROFE01 - Activity 7Document1 pageOLPROFE01 - Activity 7Red MarieeNo ratings yet

- Olprofe01 - Activity 9 IDocument1 pageOlprofe01 - Activity 9 IRed MarieeNo ratings yet

- Olprofe01 - Activity 9 IIDocument1 pageOlprofe01 - Activity 9 IIRed MarieeNo ratings yet

- OLPROFE01 - Activity 6 Sol 2Document2 pagesOLPROFE01 - Activity 6 Sol 2Red MarieeNo ratings yet

- Monthly AllowanceDocument1 pageMonthly AllowanceRed MarieeNo ratings yet

- OLPROFE02 - Activity 1Document2 pagesOLPROFE02 - Activity 1Red MarieeNo ratings yet

- OLPROFE01 - Activity 5 SolDocument1 pageOLPROFE01 - Activity 5 SolRed MarieeNo ratings yet

- Olprofe02 - Activity 2Document1 pageOlprofe02 - Activity 2Red MarieeNo ratings yet

- AnswerDocument1 pageAnswerRed MarieeNo ratings yet

- Profe03 Act4Document1 pageProfe03 Act4Red MarieeNo ratings yet

- Profe03 Act3Document1 pageProfe03 Act3Red MarieeNo ratings yet

- Profe03 Act#2Document2 pagesProfe03 Act#2Red MarieeNo ratings yet

- Profe03 Act 1Document2 pagesProfe03 Act 1Red MarieeNo ratings yet

- Ollite Activity 5Document1 pageOllite Activity 5Red MarieeNo ratings yet

- Ollite Activity 7Document1 pageOllite Activity 7Red MarieeNo ratings yet

- Ollite Activity 6Document1 pageOllite Activity 6Red MarieeNo ratings yet