Professional Documents

Culture Documents

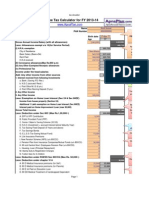

Computation of Income

Computation of Income

Uploaded by

NATIONAL FARMERS PRODUCER COMPANY0 ratings0% found this document useful (0 votes)

4 views4 pagesThis document contains details of an individual's income computation for the financial year ending March 31. It lists sources of income including salary, house property, and other sources. It then details deductions claimed under sections 80C, 80CCC, 80CCD(1), and 80CCD(1B) for items like insurance, provident funds, housing loan repayment, pension schemes, and more. It calculates total taxable income after deductions, tax payable, and any tax liability or refund after accounting for TDS and rebates.

Original Description:

Original Title

671907_20230119175021_computation_of_income

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains details of an individual's income computation for the financial year ending March 31. It lists sources of income including salary, house property, and other sources. It then details deductions claimed under sections 80C, 80CCC, 80CCD(1), and 80CCD(1B) for items like insurance, provident funds, housing loan repayment, pension schemes, and more. It calculates total taxable income after deductions, tax payable, and any tax liability or refund after accounting for TDS and rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views4 pagesComputation of Income

Computation of Income

Uploaded by

NATIONAL FARMERS PRODUCER COMPANYThis document contains details of an individual's income computation for the financial year ending March 31. It lists sources of income including salary, house property, and other sources. It then details deductions claimed under sections 80C, 80CCC, 80CCD(1), and 80CCD(1B) for items like insurance, provident funds, housing loan repayment, pension schemes, and more. It calculates total taxable income after deductions, tax payable, and any tax liability or refund after accounting for TDS and rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

Name

PAN

Date of Birth

Computation of Income as on 31st March

Income From Salary

Gross Salary

Less : HRA

Less : Standard Deduction

Less : Professional Tax

Income from House Property

Income from Other Sources

Sec 80TTA

Saving Bank interest

Term Bank Deposit Interest

NSC Interest for the year limit upto

Post office deposit 10000

Dividend & Others

Less : Deduction under chapter VI A

Sec 80 C

Life insurance

Provident Fund

Public Provident Fund

NSC investment + Accrued interest

Housing loan principal repayment

Sukanya Samriddhi Account

Tuition fees for 2 children

Tax Saving Fixed deposit in Bank limit upto

Tax Saving Bonds & Others 150000

Sec 80CCC

Annuity plan of LIC or other insurer towards Pension Scheme

80CCD(1)

Pension Scheme of Central Government

80CCD(1B)

Payments made to Pension Scheme of Central Government, limit upto

excluding deduction claimed under 80CCD (1) 50000

Total Taxable Income

Tax Payable

Less : Rebate u/s 87A

Tax Payable after rebate

Add : Surcharge

Add : Education + Health Cess

Total Tax Liability

Less : TDS from Salary

Less : TDS from Bank on Interest

Tax Payable / (Refundable)

Financial Year

Assesment Year

March

You might also like

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Aviva I LifeDocument13 pagesAviva I LifeSatyendra KumarNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- The Financial Kaleidoscope - Feb 2021 (Eng)Document9 pagesThe Financial Kaleidoscope - Feb 2021 (Eng)MdNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Document4 pagesAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862No ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Instruments of Tax SavingDocument10 pagesInstruments of Tax Savinganilpipaliya117No ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- ITR SectionsDocument6 pagesITR SectionsRohan SharmaNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- Shreha Shah (Ba LLB Vii)Document7 pagesShreha Shah (Ba LLB Vii)Shreha VlogsNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- 5 Simple Ways To Save Income TaxDocument2 pages5 Simple Ways To Save Income TaxHemant RasamNo ratings yet

- New Section Introduced in Income Tax Act 2011Document5 pagesNew Section Introduced in Income Tax Act 2011Sandy AgrawalNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Tax UpdateDocument149 pagesTax UpdateJamz LopezNo ratings yet

- IT Declaration Form 2020-21Document1 pageIT Declaration Form 2020-21Akshay AcchuNo ratings yet

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- GIT - Total Income Exam QP - 18-3-2020Document18 pagesGIT - Total Income Exam QP - 18-3-2020geddadaarunNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Deductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Document37 pagesDeductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Subiksha LakshNo ratings yet

- Indian Income Tax DeductionsDocument4 pagesIndian Income Tax DeductionsDivyanshu ShekharNo ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- Various Sections For Tax SavingsDocument3 pagesVarious Sections For Tax SavingsJayakrishnan MarangattNo ratings yet

- Previous Employer Income and Investment Declarations HarshadDocument2 pagesPrevious Employer Income and Investment Declarations HarshadAmi LengadeNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Income Tax ConsultationDocument15 pagesIncome Tax Consultation21BCO058 Tharun B KNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- Gols E-Learning Portal Live Virtual Classroom (LVC)Document24 pagesGols E-Learning Portal Live Virtual Classroom (LVC)Lokesh manglaNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Income Tax InfDocument15 pagesIncome Tax InfAman GujralNo ratings yet

- Income Tax2022 GuidelinesDocument4 pagesIncome Tax2022 GuidelinesSANDEEP SAHUNo ratings yet

- Income Tax Deductions Under Section 80C To 80UDocument12 pagesIncome Tax Deductions Under Section 80C To 80UKrish GoelNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Deduction Under Section 80Document8 pagesDeduction Under Section 80gaureshbandalNo ratings yet

- Cash Flow Statement FormatDocument1 pageCash Flow Statement FormatNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- PL Bs FormatDocument782 pagesPL Bs FormatNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- Ratio WorkDocument6 pagesRatio WorkNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- Board Resolution For Loan From Body CorporateDocument1 pageBoard Resolution For Loan From Body CorporateNATIONAL FARMERS PRODUCER COMPANY100% (2)

- QuotationDocument2 pagesQuotationNATIONAL FARMERS PRODUCER COMPANYNo ratings yet