Professional Documents

Culture Documents

Fig. 2.3

Fig. 2.3

Uploaded by

Cyruss MeranoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fig. 2.3

Fig. 2.3

Uploaded by

Cyruss MeranoCopyright:

Available Formats

Figure 2.

3 Comparison of accumulation of nonperforming loans at public banks and private

banks after adverse shock

a. All economies b. Advanced economies c. Emerging economies

0.20 0.20 0.20

Average difference in NPLs

Average difference in NPLs

Average difference in NPLs

0.15 0.15 0.15

0.10 0.10 0.10

0.05 0.05 0.05

0 0 0

–0.05 –0.05 –0.05

–0.10 –0.10 –0.10

ye r

+3 ars

+4 ars

+5 ars

s

ye r

+3 ars

+4 ars

+5 ars

ye r

+3 ars

+4 ars

+5 ars

+1 ck

+1 ck

+1 ck

+2 e a

+2 y e a

+2 e a

ar

ar

ar

o

o

ye

ye

ye

ye

ye

ye

ye

ye

ye

y

y

Sh

Sh

Sh

Coefficient estimate 90% confidence interval

Source: WDR 2022 team, based on Panizza (2021).

Note: The graphs plot for three groups of economies the differential response of state-owned and private banks to a given

GDP growth shock over the five years following the shock. A positive coefficient indicates that state-owned banks accumu-

late higher nonperforming loans after such a shock. GDP = gross domestic product; NPLs = nonperforming loans.

You might also like

- Reconciliation Process FlowchartDocument9 pagesReconciliation Process Flowchartzahoor80No ratings yet

- 07a) Income Elasticity of DemandDocument3 pages07a) Income Elasticity of DemandMohamed YasserNo ratings yet

- The Guitar of Merle Travis Taught by Marcel Dadi PDFDocument41 pagesThe Guitar of Merle Travis Taught by Marcel Dadi PDFThibault RlndNo ratings yet

- Revelator Eyes ScoreDocument17 pagesRevelator Eyes ScoreEinar UtreraNo ratings yet

- ChitsDocument1 pageChitsCanal do TucanoNo ratings yet

- The Sulu Zone, 1768-1898-National University of Singapore Press (1981)Document412 pagesThe Sulu Zone, 1768-1898-National University of Singapore Press (1981)Margo AwadNo ratings yet

- Imp Polar GraphsDocument2 pagesImp Polar GraphsKUSUMITA PALNo ratings yet

- TParcial 1Document1 pageTParcial 1Jefferson Quispe PaicoNo ratings yet

- Generation of Signals Aim:: All AllDocument5 pagesGeneration of Signals Aim:: All AllVishnu BalanNo ratings yet

- Form Kosong KPI-Mei2021Document64 pagesForm Kosong KPI-Mei2021indah paramitaNo ratings yet

- Fictitious ForcesDocument2 pagesFictitious ForcesTeddy BearNo ratings yet

- Ninja Vs RobotDocument1 pageNinja Vs RobotJ. VickeryNo ratings yet

- Balanceo - RedoxDocument9 pagesBalanceo - RedoxMariana Verónica BelliniNo ratings yet

- You Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterDocument1 pageYou Created This PDF From An Application That Is Not Licensed To Print To Novapdf PrinterEdward Sosa CoriNo ratings yet

- 4cc Testpage HighDocument1 page4cc Testpage HighRumen StoychevNo ratings yet

- Annie Laurie (Sky Guitar #11) L1 (TAB)Document1 pageAnnie Laurie (Sky Guitar #11) L1 (TAB)wictorg40No ratings yet

- 07a) Income Elasticity of DemandDocument3 pages07a) Income Elasticity of DemandMohamed YasserNo ratings yet

- El Lago-TrianaDocument2 pagesEl Lago-TrianaRafael SanchezNo ratings yet

- PDF C-Sec PDFDocument30 pagesPDF C-Sec PDFmurli shahNo ratings yet

- CMYK Label Test Print Form 240 X 240 MMDocument1 pageCMYK Label Test Print Form 240 X 240 MMWatcharapon WiwutNo ratings yet

- CMYK Label Test Print Form 240 X 240 MMDocument1 pageCMYK Label Test Print Form 240 X 240 MMmstrkoskiNo ratings yet

- Chemistry of WaterDocument3 pagesChemistry of Waternewton100% (2)

- Arpegios y AcordesDocument3 pagesArpegios y Acordesjhon laraNo ratings yet

- Com MóveisDocument158 pagesCom MóveisDaniel MestradoUNBNo ratings yet

- Rodas Das Tabuadas 1-12Document3 pagesRodas Das Tabuadas 1-12Bárbara VidalNo ratings yet

- Nuclear Medicine: Spect and PetDocument72 pagesNuclear Medicine: Spect and PetMSNo ratings yet

- Cardinality 1Document4 pagesCardinality 1Gitsril SuganobNo ratings yet

- Earl Scruggs - Will The Circle Be UnbrokenDocument1 pageEarl Scruggs - Will The Circle Be UnbrokenJonathan BrunoNo ratings yet

- Sandy Trapp James Pond StatmentDocument1 pageSandy Trapp James Pond Statmentkirsten_hallNo ratings yet

- R&P Guitar Grade 2 - Session Skills SamplesDocument3 pagesR&P Guitar Grade 2 - Session Skills SamplesAnkit SappalNo ratings yet

- Combine x-1Document1 pageCombine x-1mustafa.shalaby03No ratings yet

- Astro ChakraDocument1 pageAstro ChakraAmarprit RaenooNo ratings yet

- Classical-Soul - Oscar-LopezDocument2 pagesClassical-Soul - Oscar-Lopez范范No ratings yet

- Binibini (Zack Tabudlo) - Guitar TabsDocument8 pagesBinibini (Zack Tabudlo) - Guitar TabsHappy GuyNo ratings yet

- Number Zero TracingDocument1 pageNumber Zero TracingFariha Muhammad AliNo ratings yet

- XRV Compressor Package - Maintenance Schedule: RemarksDocument1 pageXRV Compressor Package - Maintenance Schedule: RemarksfrigoremontNo ratings yet

- Iterated IntegralsDocument2 pagesIterated IntegralsDương Nguyễn Tùng PhươngNo ratings yet

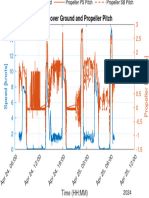

- Speed Over Ground and Propeller PitchDocument1 pageSpeed Over Ground and Propeller Pitchkunal.n.tiwariNo ratings yet

- RéseauxDocument1 pageRéseauxJulesNo ratings yet

- Olah GrafikDocument2 pagesOlah GrafikAdam MalikNo ratings yet

- Module Math2Document2 pagesModule Math2Camille CapuleNo ratings yet

- Balancing Equations Phet Simulation LabDocument5 pagesBalancing Equations Phet Simulation Labxxberserker019xxNo ratings yet

- 5ef4fb56419ba949e05ea0ca Fuller+BluesDocument2 pages5ef4fb56419ba949e05ea0ca Fuller+BluesmidnightNo ratings yet

- 5ef4fb56419ba949e05ea0ca Fuller+BluesDocument2 pages5ef4fb56419ba949e05ea0ca Fuller+BluesmidnightNo ratings yet

- Human Anatomy & Physiology I Lab 2 Graphing Styles & Interpreting GraphsDocument11 pagesHuman Anatomy & Physiology I Lab 2 Graphing Styles & Interpreting Graphsjake andersonNo ratings yet

- Record To ReportDocument4 pagesRecord To ReportcaranjeetprajapatiNo ratings yet

- Statbook Varsity 2009-2010Document20 pagesStatbook Varsity 2009-2010hinchcliffe4262No ratings yet

- PastificationDocument8 pagesPastificationrahmaNo ratings yet

- Consumer Buying BehaviorDocument19 pagesConsumer Buying BehaviorSumeet DasNo ratings yet

- Vault Dweller Personal Record FFDocument1 pageVault Dweller Personal Record FFdavidilies38No ratings yet

- NH3 PDFDocument1 pageNH3 PDFvi văn tâmNo ratings yet

- Cycle GraphDocument1 pageCycle Graphkunal.n.tiwariNo ratings yet

- Evaluation Sheet Adults - Tito Castillo. Term 8Document2 pagesEvaluation Sheet Adults - Tito Castillo. Term 8Argenis EviezNo ratings yet

- Derby Players Guide 2021Document38 pagesDerby Players Guide 2021justinNo ratings yet

- Complex Analysis PracticalsDocument15 pagesComplex Analysis PracticalsChitparaNo ratings yet

- PENG 219 - Production Engineering: Vahid AtashbariDocument45 pagesPENG 219 - Production Engineering: Vahid AtashbariGilbertNo ratings yet

- Class OneDocument2 pagesClass OneDB BhandariNo ratings yet

- Coastal Construction Control Line - Madeira On Marco Island CondominiumDocument1 pageCoastal Construction Control Line - Madeira On Marco Island CondominiumOmar Rodriguez OrtizNo ratings yet

- Metodo Fuerzas20201 GBDocument114 pagesMetodo Fuerzas20201 GBSandy Hernández MalcaNo ratings yet

- Fig. 5.1Document1 pageFig. 5.1Cyruss MeranoNo ratings yet

- Fig. 2A.2Document1 pageFig. 2A.2Cyruss MeranoNo ratings yet

- Fig. S2.1.1Document1 pageFig. S2.1.1Cyruss MeranoNo ratings yet

- Fig. 2A.3Document1 pageFig. 2A.3Cyruss MeranoNo ratings yet

- Fig. 2.6Document1 pageFig. 2.6Cyruss MeranoNo ratings yet

- Fig. 2A.1Document1 pageFig. 2A.1Cyruss MeranoNo ratings yet

- Fig. 2.5Document1 pageFig. 2.5Cyruss MeranoNo ratings yet

- Fig. 2.4Document1 pageFig. 2.4Cyruss MeranoNo ratings yet

- Solution:: Indirect Labor Hours Indirect Labor CostDocument1 pageSolution:: Indirect Labor Hours Indirect Labor CostCyruss MeranoNo ratings yet

- Fig. 2.1Document1 pageFig. 2.1Cyruss MeranoNo ratings yet

- Fig. 2.2Document1 pageFig. 2.2Cyruss MeranoNo ratings yet

- Total Job CostDocument2 pagesTotal Job CostCyruss MeranoNo ratings yet

- Probability 9.21.2019Document20 pagesProbability 9.21.2019Cyruss MeranoNo ratings yet

- Summary Measures: DF SS MS F P-ValueDocument3 pagesSummary Measures: DF SS MS F P-ValueCyruss MeranoNo ratings yet

- Activity 8 NomenclatureDocument2 pagesActivity 8 NomenclatureCyruss MeranoNo ratings yet

- Matter ExcerciseDocument3 pagesMatter ExcerciseCyruss MeranoNo ratings yet

- Principles of Microeconomics, 8e (Case/Fair) Chapter 6: Household Behavior and Consumer ChoiceDocument66 pagesPrinciples of Microeconomics, 8e (Case/Fair) Chapter 6: Household Behavior and Consumer ChoiceCyruss MeranoNo ratings yet

- Taiwan Travel (Updated)Document2 pagesTaiwan Travel (Updated)PatOcampoNo ratings yet

- GHANADocument10 pagesGHANAsheila fayeNo ratings yet

- Pharma FT T&DDocument5 pagesPharma FT T&DAastha JainNo ratings yet

- Steel Shear StrengthDocument12 pagesSteel Shear StrengthShekh Muhsen Uddin AhmedNo ratings yet

- Summative Test Earth and Life Science Module 1: NAME: - GRADE & SECTIONDocument8 pagesSummative Test Earth and Life Science Module 1: NAME: - GRADE & SECTIONMira Lei MarigmenNo ratings yet

- List of Wire Manufacturer WorldDocument13 pagesList of Wire Manufacturer WorldSANGHVI OVERSEASNo ratings yet

- University ElectivesDocument31 pagesUniversity Electivesandiespencer14No ratings yet

- AradialPresentation-WifiDocument69 pagesAradialPresentation-WifiKolea MtcNo ratings yet

- Application Constitutive Model Swelling RockDocument7 pagesApplication Constitutive Model Swelling RocksuperwxrNo ratings yet

- Heart Healthy Grocery ListDocument2 pagesHeart Healthy Grocery Liststephene velezNo ratings yet

- Mathematical Literacy P1 Feb-March 2017 Memo EngDocument14 pagesMathematical Literacy P1 Feb-March 2017 Memo EngANo ratings yet

- All MAR17Document1,571 pagesAll MAR17mkromelNo ratings yet

- ME3331 Discussion1Document1 pageME3331 Discussion1daggyfNo ratings yet

- P3 50x50 D125 40 M GrafDocument2 pagesP3 50x50 D125 40 M GrafGilmar BastidasNo ratings yet

- Crompton Fan SoundDocument1 pageCrompton Fan SoundrafeekNo ratings yet

- Science, Technology and SocietyDocument4 pagesScience, Technology and SocietyNeil Geraldizo Dagohoy100% (1)

- Reputation Management: A Framework For Measurement and ValuationDocument43 pagesReputation Management: A Framework For Measurement and ValuationHamzaNo ratings yet

- 10 Famous SpillDocument11 pages10 Famous SpillherikNo ratings yet

- Beginner Triathlon Races Triathlon Events For BDocument1 pageBeginner Triathlon Races Triathlon Events For BLeilaniNo ratings yet

- Core Java Oops Concepts Inheritance, Abstraction, Encapsulation, Polymorphism PPT PDF - Java Faqs Material PDF DownloadsDocument3 pagesCore Java Oops Concepts Inheritance, Abstraction, Encapsulation, Polymorphism PPT PDF - Java Faqs Material PDF DownloadsAmar Lal BhartiNo ratings yet

- Metro Produce Distributors, Inc. v. City of Minneapolis Et Al - Document No. 9Document7 pagesMetro Produce Distributors, Inc. v. City of Minneapolis Et Al - Document No. 9Justia.comNo ratings yet

- Power System Analysis in GridDocument25 pagesPower System Analysis in GridMamta Mrjn100% (1)

- Lack and Jouissance in Hegemonic Discourse of Identification With The StateDocument20 pagesLack and Jouissance in Hegemonic Discourse of Identification With The StateMariana CostaNo ratings yet

- Add A Wall LightDocument4 pagesAdd A Wall Lightcelmic84No ratings yet

- Installation Work Instructions For Mechanical SealDocument2 pagesInstallation Work Instructions For Mechanical SealAnees Ud DinNo ratings yet

- Ic 34Document37 pagesIc 34PankajaNo ratings yet

- Negotiable InstrumentsDocument23 pagesNegotiable InstrumentssanalkarollilNo ratings yet

- RPCPPE June 30, 2022Document23 pagesRPCPPE June 30, 2022Early RoseNo ratings yet

- KL Upl Environmental - 2Document12 pagesKL Upl Environmental - 2udanto2530No ratings yet