Professional Documents

Culture Documents

ABSTRAK

ABSTRAK

Uploaded by

Wardhani0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageABSTRAK

ABSTRAK

Uploaded by

WardhaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

Effect of Profitability and Liquidity on Firm Value

[Empl Sud On oud and aecage Compania ited On The densa Sek xchange)

Dede Hertinat”), Muhamad Erwin Wardani®, Zilzaimi”,

*).2.9 Widyetama University, Bandung, Indonesia

\comsondng ator dee rina gytams 28

unarmed. eingdyeame ac ig zalmpwajtara sid

ABSTRACT

‘This study alms to explain and determine the effect of Profitability and

Liquidity on firm value jointly or partially and to determine the variables

that have a dominant influence on flim value in food and beverage

companies listed on the Indonesia Stock Exchange. Hypothesis testing

sed in this research is normally test, multicollinearity test, multiple linear

regression test, and hypothesis testing which is divided into f test and t

test. The results of the study stated that the profitability and liquidity

variables had a positive effect but not too dominant because the

hypothesis test was not accepted because it did not meet the minimum

requirements for F and T tables. The F-count is emaller than the F-table

value (0.923 < 4.76) and the significance value has a number > 0.05 (0.456

<0.05,

Keywords : Profitability, Liquidity and Firm Value

Introduction

Companies engaged in the food and beverage industry are part of

a business that continues to increase, With the passage of time, the

population in Indonesia is Increasing, the high demand for food and

Beverages will also continue to grow. Residents in Indonesia tond 10

prefer to eat fast food and drinks, this is what has resulted in the growth

of new companies in the food and beverage sector. So they assume

that the food and beverage Industry sector has promising or proftable

Prospects. This promising prospect attracts investors to invest their

shares in food and beverage companies. The more investors who invest

their shares in a company, the higher the value of the company.

According to Sudana, LM (2009:8), the value of the company is the

present value of the income or cash flows thot are expected to be

received in the future. High company value is the desire of the owners

of the company, because with high company value it will be followed by

high shareholder prosperity (Brigham, 2010: 7). Factors that can affect

firm value include profitability, liquidity and capital structure. Some of

these factors have a relationship and influence on the value of the

company. Profitability and liquidity are benchmarks for people's

decision making related to company value. The higher the value of

Profitability and liquidity, the higher the value of the company.

Profitability and liquidity is also a measure of the success of the

company's management. The first fector that affects firm value is

profitability. According to Sartono (2018:122) profitability is the

company's ability to eatn profits in relation to sales, total assets and

own capital. Then according to Harahap (2015: 404) profitability is the

company's ability to eern profits through all existing capabilities and

sources such as sales activities, cash, capital, number of employees,

number of branches, and so on. The second factor that affects firm

value is liquidity, According to Riyanto (2014 : 25) liquidity is the ability

of @ company to meet short-term obligations. This capability is the

company's ability to continue its operations when the company is

required to pay off its obligations which will reduce operational funds

Then according to Subramanyam (2017 43) liquicty is to evaluate the

ability to meet short-term obligations. The third factor that affects the

value of the company is the capital structure. The capital structure is an

lilustration of the form of the company's financial proportions, namely

between owned capital originating from long-term abilities and

shareholder's equity which is a source of financing for a company

(Fahmi, 2011: 106). Kusumajaya (2011:40) reveals that the capital

structure is a balance or comparison between the amount of long-term

dobt with its own capital

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- SuratDocument2 pagesSuratWardhaniNo ratings yet

- INVOICE#1024Document1 pageINVOICE#1024WardhaniNo ratings yet

- CBUS MuhammadlDocument9 pagesCBUS MuhammadlWardhaniNo ratings yet

- ANKAKKDocument1 pageANKAKKWardhaniNo ratings yet

- PB EditDocument1 pagePB EditWardhaniNo ratings yet

- LollllloDocument1 pageLollllloWardhaniNo ratings yet

- CantikkkkkkkkkkkkkkDocument19 pagesCantikkkkkkkkkkkkkkWardhaniNo ratings yet

- Pengurus Kabupaten Lombok TimurDocument3 pagesPengurus Kabupaten Lombok TimurWardhaniNo ratings yet

- MED Uli 51421120116Document6 pagesMED Uli 51421120116WardhaniNo ratings yet

- Kota Bima-1Document2 pagesKota Bima-1WardhaniNo ratings yet

- STRUCTURDocument2 pagesSTRUCTURWardhaniNo ratings yet

- UAS Muhammad Erwin Wardani 51421120116 Organizational Culture ChangDocument6 pagesUAS Muhammad Erwin Wardani 51421120116 Organizational Culture ChangWardhaniNo ratings yet

- USULANDocument3 pagesUSULANWardhaniNo ratings yet

- UNDANGAN 10 BesarDocument1 pageUNDANGAN 10 BesarWardhaniNo ratings yet

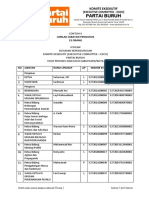

- Pengurus Exco Kab DompuDocument2 pagesPengurus Exco Kab DompuWardhaniNo ratings yet

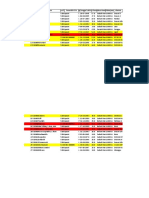

- Cek List Kesesuaian Exco Kecamatan Sipol PB - 280722Document106 pagesCek List Kesesuaian Exco Kecamatan Sipol PB - 280722WardhaniNo ratings yet

- Wa0127.Document3 pagesWa0127.WardhaniNo ratings yet

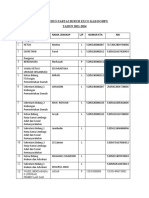

- Exco LotimDocument3 pagesExco LotimWardhaniNo ratings yet

- Skripsi Hamidah-1504110045-DikonversiDocument136 pagesSkripsi Hamidah-1504110045-DikonversiWardhaniNo ratings yet

- Muhammad Erwin WardaniDocument1 pageMuhammad Erwin WardaniWardhaniNo ratings yet

- Akuntansi BiayaDocument13 pagesAkuntansi BiayaWardhaniNo ratings yet

- Risiko Dan PengembalianDocument35 pagesRisiko Dan PengembalianWardhaniNo ratings yet

- Pengantar Filsafat (Materi Nafas Hmi)Document36 pagesPengantar Filsafat (Materi Nafas Hmi)WardhaniNo ratings yet

- CEK IPK Dan SKLDocument14 pagesCEK IPK Dan SKLWardhaniNo ratings yet

- SKL Genap 2020 2021 Febi EditDocument1 pageSKL Genap 2020 2021 Febi EditWardhaniNo ratings yet

- Bukti Serah Terima Skripsi Mei Jiadah FarhanDocument2 pagesBukti Serah Terima Skripsi Mei Jiadah FarhanWardhaniNo ratings yet

- 064 - Undangan Rapat TerbatasDocument1 page064 - Undangan Rapat TerbatasWardhaniNo ratings yet

- Buku SAKUDocument17 pagesBuku SAKUWardhaniNo ratings yet

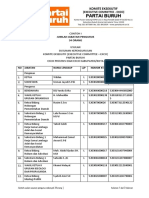

- Exco DompuDocument2 pagesExco DompuWardhaniNo ratings yet

- Exco - Kab. Lombok BaratDocument2 pagesExco - Kab. Lombok BaratWardhaniNo ratings yet