Professional Documents

Culture Documents

Q1

Uploaded by

Thảo Hương PhạmCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q1

Uploaded by

Thảo Hương PhạmCopyright:

Available Formats

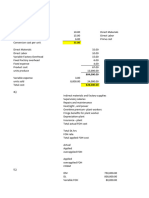

Sales volume (units) 20,000 100,000 80,000 200,000

Sales ratio (unit) 1 5 4

selling price per unit 25 15 8

Sales ratio (in £) 18.94% 56.82% 24.24% 100.00%

Costs per unit data

variable costs

Material 10 8 4

Labor 12 5 3

Contribution per unit 3 2 1

Contribution ratio (C/s ratios) 12.00% 13.33% 12.50%

Fixed costs 255,000

BE calculations

Total contribution 60,000 200,000 80,000 340,000

Weighted average CM per unit 1.70 12 marks given for student

Or (using contribution per mix) 3 10 4 17

1.7

BE in units 150,000 3 marks

BE units for each product 15,000 75,000 60,000 150,000 2 mars per product

BE in sales pounds 375,000 1,125,000 480,000 1,980,000 4 marks

Using contribution ratio (%)

weighted contribution % 2.27% 7.58% 3.03% 12.88% 2 marks for each calculation

BE in sales pounds 1,980,000 2 marks

Or

Sales revenue per bundle (mix) 25 75 32 132 3 marks

contribution per bundle (mix) 3 10 4 17 3 marks

Contribution ratio (% of sales) 12.88% 2 marks

BE sales 1,980,000 2 marks

calculate units to achieve profit of 119,000

Targeted profit 119,000

Total contribution needed 374,000 1 mark

Total units to be sold 220,000.00 1 mark

Number of each product to be sold 22,000.00 110,000.00 88,000.00 220,000.00 1 mark per product

12 marks given for student using either ways

2 mars per product

2 marks for each calculation

1 mark per product

Budget Actual Variance Budgeted rates

Volume (units) 10,000 12,800 2,800 F

Materials 105,000 132,000 27,000 A Materials

Other direct material costs 4,700 5,800 1,100 A Other DM

Direct labour 135,000 145,000 10,000 A FDL

Production overheads 96,000 105,600 9,600 A VOH

Head office recharge 26,000 32,000 6,000 A Head office rech

Total 366,700 420,400 53,700 A

Budget Flexible Actual Variance F/A Analysis of the total Production o

Volume (units) 10,000 12,800 12,800 - Volume (units)

Costs (£)

Materials 105,000 134,400 132,000 (2,400) F

Other direct material costs 4,700 6,016 5,800 (216) F

Direct labour 135,000 142,000 145,000 3,000 A

Production overheads 96,000 117,720 105,600 (12,120) F

Head office recharge 26,000 26,000 32,000 6,000 A

Total 366,700 426,136 420,400 (5,736) A

8 marks 1 mark for each variance calculated with correct F or

Briefly comment on the benefits of flexed budget

students need to point out at least 3 advantages of flexed/flexible budget that had been already addressed text book or other

10.5

0.47

110,000 VDL 2.5

2.4 FOH 87,000

26,000

ysis of the total Production overheads (fixed cost changes when vol exceeds 11,000 units)

8,000 10,000 12,000

91,200 96,000 115,800

alculated with correct F or A

ddressed text book or other learning resources

B300 T500

Selling price per unit £140.00 £99.00

Direct materials per unit £72.00 £53.00

Direct labor per unit £24.00 £12.00

Direct labor-hours per unit 2 1

Estimated annual production 20,000 80,000

Estimated manufacturing OH 1,980,000

Estimated total direct labor hours 120,000

Traditional cost assignment based on direct labor hours

overhead application rate (per direct LH) 16.50 1 mark

Allocated overhead (per unit) 33.00 16.50 2 marks

Total unit cost £129.00 £81.50 1 mark

Profit per unit £11.00 £17.50 1 mark

Profit margin 7.86% 17.68% both product are profitable (2 marks)

Activit-based costing

overhead assignment

Estimated Expected activity B300 T500

Activities and Activity Measures Activity rate

Overhead Cost

B300 T500 Total total unit cost total unit cost Total

Supporting direct labor (direct labor-hours) £ 783,600 40,000 80,000 120,000 £ 6.53 £261,200.00 £13.06 £522,400.00 £6.53 £783,600.00

Batch setups (setups) £ 495,000 200 100 300 £ 1,650.00 £330,000.00 £16.50 £165,000.00 £2.06 £495,000.00

Product sustaining (number of products) £ 602,400 1 1 2 £ 301,200.00 £301,200.00 £15.06 £301,200.00 £3.77 £602,400.00

Other £ 99,000 NA NA NA NA NA NA NA NA NA

Total manufacturing overhead cost £ 1,980,000 £892,400.00 £44.62 £988,600.00 £12.36 £1,881,000.00

3 marks Total unit cost £140.62 £77.36

5 marks 5 marks

comment on profit using ABC information

Profit per unit -£0.62 £21.64

Profit margin -0.44% 21.86%

1 mark 1 mark

3 marks B300 is not as profitable as the company thinks, in fact it is making a loss and its costs are subsidized by the profit made by T500

T500 is more profitable than was thought, its profit margin is approximately 22% not 17.68% as reported under traditional costing system

why traditional differs from ABC cost assignments (8 marks - 4 for each of point below)

The traditional and activity-based cost assignments differ for two reasons. First, the traditional system assigns all £1,980,000 of manufacturing overhead to products. The ABC system assigns only $1,881,000 of

manufacturing overhead to products. The ABC system does not assign the £99,000 of Other activity costs to products because they represent idle capacity costs.

Second, the traditional system uses one unit-level activity measure direct labor hours, to assign all overhead to the B300 and T500 product lines. Whilst the overhead costs of these products were driven by factors other than direct labor hours, at different rates

What to improve performance (5 marks)

a couple of managerial initiatives can be taken, for example

Marketing staff can (i) push the T500 productor (ii) raise the price of the B300.

Operation management should reconsider current production planning to increase the batch sizes of B300 production, currently an average of only 200 units of B300 are produced per production run that is so expensive in comparison with that of T500

You might also like

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Classic Pen Solution Cost Allocation and DriversDocument1 pageClassic Pen Solution Cost Allocation and DriversTushar DuaNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Absorption and Variable CostingDocument4 pagesAbsorption and Variable CostingShannonNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- Classic Pen Co HandoutDocument1 pageClassic Pen Co HandoutbharathtgNo ratings yet

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Garrison 14e Practice Exam - Chapter 6Document4 pagesGarrison 14e Practice Exam - Chapter 6Đàm Quang Thanh TúNo ratings yet

- Week3 With SolutionsDocument8 pagesWeek3 With SolutionsAaliya & FaizNo ratings yet

- Absorption and Marginal Costing - Additional Question With AnswersDocument14 pagesAbsorption and Marginal Costing - Additional Question With Answersunique gadtaulaNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Calculating Average Inventory, Payables and Receivables PeriodsDocument10 pagesCalculating Average Inventory, Payables and Receivables PeriodssajedulNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- See Zhao Wei U2003083 Costing AnalysisDocument5 pagesSee Zhao Wei U2003083 Costing AnalysiszhaoweiNo ratings yet

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- Classic Pen CompanyDocument6 pagesClassic Pen CompanySangtani PareshNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- Costing By-Product and Joint ProductsDocument34 pagesCosting By-Product and Joint ProductsArika KameliaNo ratings yet

- Costing Methods: Absorption vs Variable CostingDocument19 pagesCosting Methods: Absorption vs Variable CostingMah2SetNo ratings yet

- Management Information - ND2020 - Suggested - AnswersDocument4 pagesManagement Information - ND2020 - Suggested - Answerskawsar alamNo ratings yet

- Less - Cash PaymentDocument16 pagesLess - Cash PaymentEsanka FernandoNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- CH # 8 (By Product)Document10 pagesCH # 8 (By Product)Rooh Ullah KhanNo ratings yet

- Exercises With Solutions - CH0104Document17 pagesExercises With Solutions - CH0104M AamirNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- Maf201 Test 2 SS Dec19Document5 pagesMaf201 Test 2 SS Dec192022624622No ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Budget Production Cost Analysis for 8000-10000 Units"TITLE "Revised Budget Cost Per Unit for Lower Production of 60000 UnitsDocument3 pagesBudget Production Cost Analysis for 8000-10000 Units"TITLE "Revised Budget Cost Per Unit for Lower Production of 60000 UnitsJasdeep Singh Deepu0% (2)

- HKUST ACCT 521 Assignment 2 Activity Based CostingDocument4 pagesHKUST ACCT 521 Assignment 2 Activity Based CostingSilvia WongNo ratings yet

- Problem 8-41 1Document3 pagesProblem 8-41 1Jey JNo ratings yet

- Calculating GPR under different assumptionsDocument4 pagesCalculating GPR under different assumptionsLily of the ValleyNo ratings yet

- P1 Solution Dec 2018Document6 pagesP1 Solution Dec 2018Awal ShekNo ratings yet

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- Wilkerson Company Break Even Analysis for Multi-product SituationDocument5 pagesWilkerson Company Break Even Analysis for Multi-product SituationYAKSH DODIANo ratings yet

- Absorption Costing QuestionsDocument6 pagesAbsorption Costing Questions田淼No ratings yet

- Cost Behavior SolutionDocument10 pagesCost Behavior SolutionabeeraNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoNo ratings yet

- Breakeven Problems - SolutionsDocument2 pagesBreakeven Problems - Solutionsrenee Benjamin-GibbsNo ratings yet

- Marginal vs absorption costing reconciliationDocument6 pagesMarginal vs absorption costing reconciliationunique gadtaulaNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- COST ACC CPRDocument2 pagesCOST ACC CPRArissa Macapato DimangadapNo ratings yet

- Ss 3Document32 pagesSs 3Trần Nguyễn Quỳnh GiaoNo ratings yet

- Corporate Finance Management: Sumaira Riaz Test 1Document4 pagesCorporate Finance Management: Sumaira Riaz Test 1olga marnicaNo ratings yet

- Compare Q1 and Q2 productivity using partial factor productivity analysisDocument3 pagesCompare Q1 and Q2 productivity using partial factor productivity analysisDima AbdulhayNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Invisible Inventory Conundrum in RFID Equipped Supply ChainsDocument19 pagesInvisible Inventory Conundrum in RFID Equipped Supply ChainsTien Thanh DangNo ratings yet

- Joint Products and By-products Costing Case StudiesDocument3 pagesJoint Products and By-products Costing Case StudiesBhargav D.S.No ratings yet

- Cost Audit ProjectDocument23 pagesCost Audit ProjectHarshada SinghNo ratings yet

- Mock Exam 2 - ACC102Document16 pagesMock Exam 2 - ACC102Cundangan, Denzel Erick S.No ratings yet

- Sales ChannelDocument15 pagesSales ChannelNofaNo ratings yet

- Tricia Haltiwinger The President of Braam Industries Has Been ExploringDocument1 pageTricia Haltiwinger The President of Braam Industries Has Been ExploringAmit PandeyNo ratings yet

- ch08 Accounting For Receivables - StudentDocument16 pagesch08 Accounting For Receivables - StudentNhật TâmNo ratings yet

- Big Blue v11pdf PDFDocument2,380 pagesBig Blue v11pdf PDFAlfonsus W.M.No ratings yet

- GST WS1Document2 pagesGST WS1AE BarasatNo ratings yet

- A Study On Distribution Channel of Vadilal IcecreamDocument10 pagesA Study On Distribution Channel of Vadilal IcecreamIshpreet Singh Bagga0% (1)

- Mnp2601-Summary Notes PDFDocument176 pagesMnp2601-Summary Notes PDFQuentinNo ratings yet

- Chap.9 (Majotr Ethical Issues in Entrepreneurship)Document16 pagesChap.9 (Majotr Ethical Issues in Entrepreneurship)Erika Villanueva MagallanesNo ratings yet

- Installment Sales - DiscussionDocument5 pagesInstallment Sales - DiscussionJustine SorizoNo ratings yet

- Home Office at Cost (Answer Key)Document3 pagesHome Office at Cost (Answer Key)수지No ratings yet

- Home Office Supply Calculator Sales EntriesDocument6 pagesHome Office Supply Calculator Sales EntriesErika Repedro100% (2)

- Ba3 Cima Notes - GraceDocument2 pagesBa3 Cima Notes - GraceGraceNo ratings yet

- Completing The Cost Cycle and Accounting For Production LossesDocument10 pagesCompleting The Cost Cycle and Accounting For Production LossesKhai Ed PabelicoNo ratings yet

- TOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Document24 pagesTOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Sharingan ShenaniganNo ratings yet

- Asian Paints LTD.: International Business Division Presented by Group 1Document20 pagesAsian Paints LTD.: International Business Division Presented by Group 1Divya Prakash SinhaNo ratings yet

- SDM AssignmentDocument4 pagesSDM AssignmentBHOOMIKA MOHAN MBA Delhi 2022-24No ratings yet

- Test Bank CH 3Document5 pagesTest Bank CH 3Taleen TabakhnaNo ratings yet

- Derive A Customer Relationship Strategy For A Marketer Supplying A Marketing Service For A Business of Your ChoiceDocument16 pagesDerive A Customer Relationship Strategy For A Marketer Supplying A Marketing Service For A Business of Your ChoiceTinotenda Reginald ChabvongaNo ratings yet

- Invoice 24-01-23Document1 pageInvoice 24-01-23Mohan DoifodeNo ratings yet

- Consumer-Related Laws: Labeling LawDocument7 pagesConsumer-Related Laws: Labeling Lawariesha1985No ratings yet

- Pidilite Industries Limited Is The LargestDocument12 pagesPidilite Industries Limited Is The LargestrajyalakshmiNo ratings yet

- CHAPTER-11 Case StudiesDocument21 pagesCHAPTER-11 Case StudiesHate MeNo ratings yet

- Nirma Case Study SummaryDocument2 pagesNirma Case Study SummaryVanshika Srivastava 17IFT017No ratings yet

- Intermediate-Accounting Handout Chap 14Document3 pagesIntermediate-Accounting Handout Chap 14Joanne Rheena BooNo ratings yet

- Sample - Fsa Report Topic 2Document26 pagesSample - Fsa Report Topic 2HibariNo ratings yet

- 3.1 Definition of IncotermsDocument12 pages3.1 Definition of IncotermssabiliNo ratings yet