Professional Documents

Culture Documents

Classic Pen Company

Uploaded by

Sangtani PareshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classic Pen Company

Uploaded by

Sangtani PareshCopyright:

Available Formats

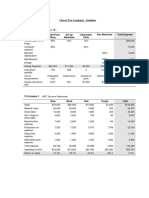

Exhibit 1 Traditional Income Statement

BLUE BLACK RED PURPLE Total

Sales $75,000 $60,000 $13,950 $1,650 $150,600

material costs 25,000 20,000 4,680 550 50,230

Direct labor 10,000 8,000 1,800 200 20,000

Overhead @300% 30,000 24,000 5,400 600 60,000

Total optg income $10,000 $8,000 $2,070 $300 $20,370

Return on Sales 13.3% 13.3% 14.8% 18.2% 13.5%

Overhead costs

Indirect labour 20,000

Fringe benefits 16,000

Computer systems 10,000

Machinery 8,000

Maintenance 4,000

Energy 2,000

Total overheads $60,000

Exhibit 2 Direct Costs and Activity Cost Drivers

BLUE BLACK RED PURPLE Total

Production sales volume 50,000 40,000 9,000 1,000 100,000

Unit selling price $1.50 $1.50 $1.55 $1.65

Materials - unit cost $0.50 $0.50 $0.52 $0.55

Direct labour - hrs/ unit 0.02 0.02 0.02 0.02 2,000

Machine hrs/ unit 0.10 0.10 0.10 0.10 10,000

Production runs 50 50 38 12 150

Setup time/run 4 1 6 4

Total setup time (hrs) 200 50 228 48 526

Parts administration 1 1 1 1 4 Cost per each

Cost allocation bases

Direct labour - hours 1,000 800 180 20 2,000 $10

Machine hours 5,000 4,000 900 100 10,000

Production runs 50 50 38 12 150

Total setup time (hrs) 200 50 228 48 526

Parts administration 1 1 1 1 4

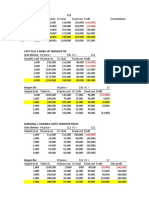

Traditional Costing report on profitability

Classic Pen Company Cost 50,000 40,000

Income statement hierarchy BLUE pens BLACK pens

Sales revenue $150,600 $75,000 $1.50 $60,000 $1.50

Direct expenses

Material cost $50,230 Unit level 25,000 0.50 20,000 0.50

Direct labour cost 20,000 Unit level 10,000 0.20 8,000 0.20

Fringe benefits to Direct labor 8,000 Unit level 4,000 0.08 3,200 0.08

Contribution 36,000 0.72 28,800 0.72

Indirect expenses

Indirect labour $20,000 Batch level 10,000 0.20 8,000 0.05

Fringe benefits 8,000 Orgn level 4,000 0.08 3,200 0.08

Computer systems 10,000 Batch level 5,000 0.10 4,000 0.10

Machinery depreciation 8,000 Batch level 4,000 0.08 3,200 0.08

Maintenance expenses 4,000 Batch level 2,000 0.04 1,600 0.04

Energy 2,000 Batch level 1,000 0.02 800 0.02

Total indirect expenses 26,000 0.52 20,800 0.52

Total expenses $130,230 65,000 $1.30 52,000 $1.30

Operating profit (EBIT) $20,370 $10,000 $0.20 $8,000 $0.20

Return on Sales 13.5% 13.3% 13.3% 13.3% 13.3%

Activity-based Costing report on profitability

Classic Pen Company Cost 50,000 40,000

Income statement hierarchy BLUE pens BLACK pens

Sales revenue $150,600 $75,000 $1.50 $60,000 $1.50

Direct expenses

Material cost $50,230 Unit level 25,000 0.50 20,000 0.50

Direct labour costs 20,000 Unit level 10,000 0.20 8,000 0.20

Fringe benefits to direct labor 8,000 4,000 0.08 3,200 0.08

Contribution $72,370 $36,000 0.72 $28,800 0.72

Indirect expenses

Indirect labour 20,000 Batch level 6,875 0.14 4,594 0.11

Fringe benefits 8,000 Orgn level 2,750 0.06 1,838 0.05

Computer systems office 10,000 Batch level 3,167 0.06 3,167 0.08

Machinery depreciation 8,000 Batch level 4,000 0.08 3,200 0.08

Maintenance expense 4,000 Batch level 2,000 0.04 1,600 0.04

Energy bills 2,000 Batch level 1,000 0.02 800 0.02

Total indirect costs 52,000 19,792 0.40 15,198 0.38

Total costs $130,230 $58,792 $1.18 $46,398 $1.16

Operating profit $20,370 $16,208 $0.32 $13,602 $0.34

Return on Sales 13.5% 21.6% 21.6% 22.7% 22.7%

Cost distribution under ABC system

Cost head Cost Proportion Amount

Nature of activities performed

Indirect labour $20,000 50% $10,000 handling pdn runs

40% $8,000 Physical changeover

10% $2,000 Maintaing records

$20,000 Indirect labor costs

Fringe benefits 8,000 100% $8,000 Paid to indirect labor

Computer systems 10,000 80% $8,000 Scheduling production runs

20% $2,000 to keep records

$18,000 Computer systems charge

Machinery 8,000 100% $8,000 Depreciation due to wear&tear

Maintenance 4,000 100% $4,000 General maintenance

Energy 2,000 100% $2,000 Electric power consumption

Total expenses $52,000 $52,000

versus traditional cost allocation

Traditional alloc - ABC allocati

Inference: manufacturing OH wa

proportion proportion proportion proportion

BLUE BLACK RED PURPLE Total

50% 40% 9% 1% 100%

Cost per each

9,000 1,000

RED pens PURPLE pen alloc rate

$13,950 $1.55 $1,650 $1.65

4,680 0.52 550 0.55

1,800 0.20 200 0.20

720 0.08 80 0.08

6,750 0.75 820 0.82

1,800 0.02 200 0.20 $10

720 0.08 80 0.08 $4

900 0.10 100 0.10 $5

720 0.08 80 0.08 $4

360 0.04 40 0.04 $2

180 0.02 20 0.02 $1

4,680 0.52 520 0.52

11,880 $1.32 1,350 $1.35

$2,070 $0.23 $300 $0.30

14.8% 14.8% 18.2% 18.2%

9,000 1,000

RED pens PURPLE pen

$13,950 $1.55 $1,650 $1.65

4,680 0.52 550 0.55

1,800 0.20 200 0.20

720 0.08 80 0.08

$6,750 0.75 $820 0.82

6,501 0.72 2,030 2.03

2,600 0.29 812 0.81

2,527 0.28 1,140 1.14

720 0.08 80 0.08

360 0.04 40 0.04

180 0.02 20 0.02

12,888 1.43 4,122 4.12

$20,088 $2.23 $4,952 $4.95

($6,138) ($0.68) ($3,302) ($3.30)

-44.0% -44.0% -200.1% -200.1%

Allocation basis BLUE BLACK RED PURPLE CA rate

Production runs 3,333 3,333 2,533 800 $66.67

Total set up time 3,042 760 3,468 730 $15.21

Number of parts 500 500 500 500 500

$6,875 $4,594 $6,501 $2,030

40% of indirect labour 2,750 1,838 2,600 812

Production runs 2,667 2,667 2,027 640 $53.33

Number of parts 500 500 500 500 500

systems charge $3,167 $3,167 $2,527 $1,140

Machine hours 4,000 3,200 720 80 $0.80

Machine hours 2,000 1,600 360 40 $0.40

Machine hours 1,000 800 180 20 $0.20

$19,792 $15,198 $12,888 $4,122

versus traditional cost allocation 26,000 20,800 4,680 520

Traditional alloc - ABC allocatio 6,208 5,602 (8,208) (3,602)

Inference: manufacturing OH was over-allocateover-alloca under-allo under-allocated

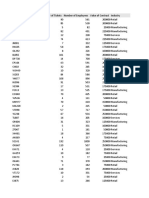

Aggregate Blue pen Black pen

Sales revenue $150,600 $75,000 $60,000

Direct expenses $70,230 $35,000 $28,000

Contribution $80,370 $40,000 $32,000

Indirect cost allocation with

one-fourth to each pdt 52,000 13,000 13,000

No. of units produced 52,000 26,000 20,800

Material cost as basis 52,000 25,881 20,705

Direct labour hours 52,000 26,000 20,800

Machine hours as basis 52,000 26,000 20,800

Production runs 52,000 17,333 17,333

Total setup time (hrs) 52,000 19,772 4,943

RED pen Purple pen

$13,950 $1,650

$6,480 $750

$7,470 $900

13,000 13,000

4,680 520

4,845 569

4,680 520

4,680 520

13,173 4,160

22,540 4,745

You might also like

- TBM Finale ReporteDocument34 pagesTBM Finale Reportei-cute83% (6)

- Balakrishnan MGRL Solutions Ch14Document36 pagesBalakrishnan MGRL Solutions Ch14Aditya Krishna100% (1)

- Case Digest - BRENT SCHOOL v. RONALDO ZAMORADocument3 pagesCase Digest - BRENT SCHOOL v. RONALDO ZAMORAAnton Ric Delos ReyesNo ratings yet

- American Apparel Case StudyDocument10 pagesAmerican Apparel Case StudyELIZABETHNo ratings yet

- Gender Diversity in Public SectorDocument21 pagesGender Diversity in Public SectorSURABHI SUSHREE NAYAKNo ratings yet

- A. Qualitative FactorsDocument39 pagesA. Qualitative FactorsSangtani PareshNo ratings yet

- Cell Name Original Value Final ValueDocument7 pagesCell Name Original Value Final ValuedebojyotiNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- Optimal Product Mix Linear Programming Apparel IndustryDocument8 pagesOptimal Product Mix Linear Programming Apparel IndustrySmriti GoelNo ratings yet

- Dave BrothersDocument6 pagesDave BrothersSangtani PareshNo ratings yet

- Dave BrothersDocument6 pagesDave BrothersSangtani PareshNo ratings yet

- Paint Application Standard No. 2Document13 pagesPaint Application Standard No. 2ceroride100% (2)

- Ch14. Target CostingDocument16 pagesCh14. Target CostingVivek AnandanNo ratings yet

- Viral Marketing and Social Media StatisticsDocument16 pagesViral Marketing and Social Media Statisticsosama haseebNo ratings yet

- Assignment On Labour Law PDFDocument11 pagesAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- Davey Brothers Watch Co. and Classic Pen Company Case AnalysisDocument4 pagesDavey Brothers Watch Co. and Classic Pen Company Case Analysisabhishek pattanayakNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Classic Pen CompanyDocument9 pagesClassic Pen Companyabhay_prakash_ranjanNo ratings yet

- The Classic Pen Company - Group 2Document23 pagesThe Classic Pen Company - Group 2Imelda HotmariaNo ratings yet

- WALTHAMDocument2 pagesWALTHAMSam SkfNo ratings yet

- IB SL Design Technology Study GuideDocument28 pagesIB SL Design Technology Study GuideSeema SainiNo ratings yet

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsDocument6 pagesExhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsSangtani PareshNo ratings yet

- Classic Pen Company: Developing An ABC ModelDocument22 pagesClassic Pen Company: Developing An ABC Modeljk kumarNo ratings yet

- Oil and Gas BrochureDocument20 pagesOil and Gas Brochureكهلان البريهيNo ratings yet

- NSB MC 2021-22Document41 pagesNSB MC 2021-22Sandeep PriyadarshiNo ratings yet

- Classic Pen Case CMADocument2 pagesClassic Pen Case CMARheaPradhanNo ratings yet

- Forecasting Demand For Food at Apollo Hospitals Case 2 Report PDF Free PDFDocument5 pagesForecasting Demand For Food at Apollo Hospitals Case 2 Report PDF Free PDFCOMBRONo ratings yet

- Vanity Fair - July 2014 USA PDFDocument120 pagesVanity Fair - July 2014 USA PDFCarlLxxNo ratings yet

- Caso Soren ChemicalsDocument8 pagesCaso Soren ChemicalsNatalia LeonNo ratings yet

- Classic Pen Company - SolutionDocument1 pageClassic Pen Company - SolutionSubrahmanyam SiriNo ratings yet

- HKUST ACCT 521 Assignment 2 Activity Based CostingDocument4 pagesHKUST ACCT 521 Assignment 2 Activity Based CostingSilvia WongNo ratings yet

- Harvard Business School Case #103-015 198117 Case Software # XLS-666Document9 pagesHarvard Business School Case #103-015 198117 Case Software # XLS-666saifrahmanNo ratings yet

- Managerial Accounting - Classic Pen Company Case: GMITE7-Group 7Document21 pagesManagerial Accounting - Classic Pen Company Case: GMITE7-Group 7bharathtgNo ratings yet

- Seminar Paper On KIIFBDocument4 pagesSeminar Paper On KIIFBAthiraNo ratings yet

- Importance of Documents in Incorporation of CompanyDocument34 pagesImportance of Documents in Incorporation of CompanyNandini TarwayNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyKate BurgosNo ratings yet

- ABC June 2008Document2 pagesABC June 2008ACCA StudentNo ratings yet

- Cost Volume ProfitDocument15 pagesCost Volume Profitprashant0071988No ratings yet

- Suzlon - RePower Case StudyDocument14 pagesSuzlon - RePower Case StudyPrince VamsiNo ratings yet

- Bellaire Clinical Labs, Inc. (A)Document6 pagesBellaire Clinical Labs, Inc. (A)VijayKhareNo ratings yet

- Report On The Coal AnalysisDocument10 pagesReport On The Coal AnalysisumerNo ratings yet

- Session 17 MBA 703 2018 BeforeclassDocument43 pagesSession 17 MBA 703 2018 BeforeclassGeeta SinghNo ratings yet

- Value Chain Analysis of GrapesDocument9 pagesValue Chain Analysis of GrapesPallaviBManeNo ratings yet

- Business Ethics in Seemabaddha MovieDocument3 pagesBusiness Ethics in Seemabaddha MoviemitulNo ratings yet

- Comparing Depreciation at Delta Air Lines and Singapore AirlinesDocument110 pagesComparing Depreciation at Delta Air Lines and Singapore AirlinesSiratullah ShahNo ratings yet

- Formation & Essentials of a Valid ContractDocument74 pagesFormation & Essentials of a Valid ContractRavikrishna NagarajanNo ratings yet

- Priya Puri&AmexDocument1 pagePriya Puri&AmexAbhijeet DashNo ratings yet

- Cost Accounting: Cia 3 Component 2 Aditya Jain 1620203 4 BBA B'Document9 pagesCost Accounting: Cia 3 Component 2 Aditya Jain 1620203 4 BBA B'Aditya JainNo ratings yet

- Inventory - Management - Vedanta, Tech MahindraDocument9 pagesInventory - Management - Vedanta, Tech MahindraBinodini SenNo ratings yet

- Section A - Group 2 - PRA 8Document5 pagesSection A - Group 2 - PRA 8sakshi agarwalNo ratings yet

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalNo ratings yet

- Classic Knitwear and Guardian - A Perfect FitDocument6 pagesClassic Knitwear and Guardian - A Perfect FitSHRUTI100% (1)

- Davey Brothers Case ScenariosDocument6 pagesDavey Brothers Case ScenariosBhavik LodhaNo ratings yet

- VMMC Gary Kaplan AnalysisDocument8 pagesVMMC Gary Kaplan AnalysisMukund KshirsagarNo ratings yet

- AnsDocument9 pagesAnsblessedman01No ratings yet

- Variance AnalysisDocument2 pagesVariance Analysisakarim23No ratings yet

- Study On Electric Mobility in India: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument63 pagesStudy On Electric Mobility in India: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofsameerNo ratings yet

- Mitti Cool Pvt. LTDDocument58 pagesMitti Cool Pvt. LTDPrince PatelNo ratings yet

- MacroEconomics Group 2 Assignment 1Document10 pagesMacroEconomics Group 2 Assignment 1Arindam MandalNo ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- Texana Petroleum Corporation HistoryDocument9 pagesTexana Petroleum Corporation HistoryDhyana Mohanty100% (1)

- School of Business and Management Christ (Deemed To Be University) BangaloreDocument8 pagesSchool of Business and Management Christ (Deemed To Be University) BangaloreMedha Singh100% (1)

- Soal Capital Budgeting Chapter 11Document1 pageSoal Capital Budgeting Chapter 11febrythiodorNo ratings yet

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanNo ratings yet

- Kanthal Activity-Based Costing 20200118 - RVADocument12 pagesKanthal Activity-Based Costing 20200118 - RVARaymon AquinoNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentRamalu Dinesh ReddyNo ratings yet

- Hajmola ReportDocument28 pagesHajmola ReportGosai JaydeepNo ratings yet

- Classic Pen IIM RohtakDocument12 pagesClassic Pen IIM RohtakHEM BANSALNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Classic Pen Solution Cost Allocation and DriversDocument1 pageClassic Pen Solution Cost Allocation and DriversTushar DuaNo ratings yet

- Particulars Group IDocument13 pagesParticulars Group ISangtani PareshNo ratings yet

- About:: Thousand-Impressions (CPM 1000 Cost/impressions) Basis, Priced at USD 100Document3 pagesAbout:: Thousand-Impressions (CPM 1000 Cost/impressions) Basis, Priced at USD 100Sangtani PareshNo ratings yet

- SP Cost/ (1-Margin %) Dealer 15% MP Gov 20 % Total Sales %Document6 pagesSP Cost/ (1-Margin %) Dealer 15% MP Gov 20 % Total Sales %Sangtani PareshNo ratings yet

- Don't Launch Insect Repellent ClothingDocument3 pagesDon't Launch Insect Repellent ClothingSangtani PareshNo ratings yet

- Baltic Group Cost Analysis and Transfer Pricing StrategiesDocument4 pagesBaltic Group Cost Analysis and Transfer Pricing StrategiesSangtani PareshNo ratings yet

- Toyota Motor ManufacturingDocument2 pagesToyota Motor ManufacturingSangtani PareshNo ratings yet

- SP Cost/ (1-Margin %) Dealer 15% MP Gov 20 % Total Sales %Document6 pagesSP Cost/ (1-Margin %) Dealer 15% MP Gov 20 % Total Sales %Sangtani PareshNo ratings yet

- FABM2121 Fundamentals of Accountancy Long Quiz 001Document6 pagesFABM2121 Fundamentals of Accountancy Long Quiz 001Christian Tero100% (1)

- Report Sample-Supplier Factory AuditDocument24 pagesReport Sample-Supplier Factory AuditCarlosSánchezNo ratings yet

- New Central Bank Act I. Creation, Responsibilities, and Corporate Powers of The Bangko Sentral NG Pilipinas (BSP)Document6 pagesNew Central Bank Act I. Creation, Responsibilities, and Corporate Powers of The Bangko Sentral NG Pilipinas (BSP)MarrenSalvadorNo ratings yet

- Assessment Task 2 BSBMGT502Document3 pagesAssessment Task 2 BSBMGT502Memay MethaweeNo ratings yet

- ANALYZING SALES OF POTATO CORNER TABACODocument25 pagesANALYZING SALES OF POTATO CORNER TABACOJane Carla BorromeoNo ratings yet

- Lecture One Introduction To Management Summarised NotesDocument14 pagesLecture One Introduction To Management Summarised NotesMburu KaranjaNo ratings yet

- Proposal - COVID19 Care CentersDocument10 pagesProposal - COVID19 Care CentersMOHD JIDINo ratings yet

- Root of All EvilDocument8 pagesRoot of All EvilKostNo ratings yet

- Mabanee Social PolicyDocument9 pagesMabanee Social PolicyMamta ShrivastavNo ratings yet

- Dell EMC ProDeploy For PowerStoreDocument14 pagesDell EMC ProDeploy For PowerStoreMohamed AddaNo ratings yet

- GeoHuddle - Community Geothermal Heating and Cooling SystemsDocument23 pagesGeoHuddle - Community Geothermal Heating and Cooling Systemssouthpolesteve6508No ratings yet

- Make Money With Real Estate - Step-By-Step Guide - by AylinDocument14 pagesMake Money With Real Estate - Step-By-Step Guide - by Aylinshubhpatil1313No ratings yet

- Introduction to Entrepreneurship FundamentalsDocument11 pagesIntroduction to Entrepreneurship FundamentalsJearim MalicdemNo ratings yet

- EQPS MAF451 - July2020Document10 pagesEQPS MAF451 - July2020Nur AthirahNo ratings yet

- CHAPTER 4 Creating and Conducting Structured InterviewsDocument3 pagesCHAPTER 4 Creating and Conducting Structured InterviewsJonah FortunaNo ratings yet

- People v. QuashaDocument3 pagesPeople v. QuashaJeunaj LardizabalNo ratings yet

- Project Charter: Wilmont's Pharmacy Drone Delivery SystemDocument2 pagesProject Charter: Wilmont's Pharmacy Drone Delivery SystemcamanjarresvNo ratings yet

- Introduction of The CompanyDocument25 pagesIntroduction of The CompanynareshNo ratings yet

- TBL 31 E 153b 001 SP 021 en 0 Commissioning ITPL Bypass Operation - 01!01!01Document12 pagesTBL 31 E 153b 001 SP 021 en 0 Commissioning ITPL Bypass Operation - 01!01!01DangolNo ratings yet

- Linear Example DataDocument7 pagesLinear Example DataSanjay S RayNo ratings yet

- First Things First (1964 & 2000)Document5 pagesFirst Things First (1964 & 2000)MarinaCórdovaAlvésteguiNo ratings yet

- Form A: Paper-setting Blank Corporate Taxation ExamDocument3 pagesForm A: Paper-setting Blank Corporate Taxation ExamIshika PansariNo ratings yet

- Free Playhouse PlansDocument1 pageFree Playhouse PlansAngel HallNo ratings yet