Professional Documents

Culture Documents

PRTC MAS 1stPB - 10.21

PRTC MAS 1stPB - 10.21

Uploaded by

Luna VOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRTC MAS 1stPB - 10.21

PRTC MAS 1stPB - 10.21

Uploaded by

Luna VCopyright:

Available Formats

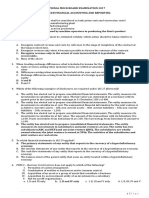

Manila * Cavite * Laguna * Cebu * Cagayan De Oro * Davao

Since 1977

MAS TRINIDAD/ALENTON

FIRST PRE-BOARD EXAMINATION AUGUST 01, 2021

Multiple Choice. Select the letter that corresponds to the best answer. This examination

consists of 70 items (please ignore the extra answer options in the answer sheet

after number 70) and the exam is good for three (3) hours. Good luck!

1. Which of the following characteristics does not relate to management accounting?

a. Accounting reports may include non-monetary information

b. It is subject to restrictions imposed by GAAP.

c. Reports are often based on estimates and are seldom useful for anything other than

the purpose for which they are prepared.

d. It provides data for internal users within the business organization.

2. A position in an organization that is directly concerned of achieving the basic objectives

of the entity:

a. Controller

b. Chief financial officer

c. A staff position

d. A line position

3. Which statement about the degree of detail in a report is true?

a. It depends on the level of the manager receiving the report.

b. It may depend on the frequency of the report.

c. It depends on the type of manager receiving the report.

d. All of the above.

4. Management accounting is concerned of the following, except

a. Future results

b. Quantitative and non-quantitative information

c. Decision analysis and implementation

d. External financial reporting

5. Which cost is LEAST likely to be direct to a particular product?

a. Salaries of salespeople who sell all of the company's products.

b. Advertising of the product.

c. License fees paid to the designer of the product.

d. Cost of materials used to make the product.

6. A committed fixed cost

a. can never be eliminated.

b. can be eliminated in the short-term and in the long-term.

c. can be eliminated in the long-term, but not in the short-term.

d. can be eliminated in the short-term, but not in the long-term.

7. Assuming costs are represented on the vertical axis and volume of activity on the

horizontal axis, which of the following costs would be represented by a line that starts

at the origin and reaches a maximum value beyond which the line is parallel to the

horizontal axis?

a. total direct material costs

Page 1 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

b. a consultant paid P100 per hour with a maximum fee of P2,000

c. employees who are paid P15 per hour and guaranteed a minimum weekly wage of

P300

d. rent on exhibit space at a convention.

8. Since Anytime Pan is open 24 hours a day, its oven is constantly on and is, therefore,

always using natural gas. However, when there is no pan in the oven, the oven

automatically lowers its flame and reduces its natural gas usage by 70%. The cost of

natural gas would best be described as a:

a. fixed cost d. step-variable cost

b. mixed cost e. true variable cost

c. step-fixed cost

9. The degree of operating leverage (DOL) is

a. A measure of the change in earnings available to common stockholders associated

with a given change in operating earnings.

b. A measure of the change in operating income resulting from a given change in

sales.

c. Lower if the degree of total leverage is higher, other things held constant.

d. Higher if the degree of total leverage is lower, other things held constant.

10. Which of the following is a true statement about sales mix?

a. Profits may decline with an increase in total peso sales if the sales mix shifts to

sell more of the high contribution margin product.

b. Profits may decline with an increase in total peso sales if the sales mix shifts to

sell more of the lower contribution margin product

c. Profits will remain constant with an increase in total peso sales if the total sales in

units remains constant.

d. Profits will remain constant with a decrease in total peso sales if the sales mix also

remains constant.

11. If fixed costs decrease while variable cost per unit remains constant, the contribution

margin will be

a. unchanged c. lower

b. higher d. indeterminate

12. The margin of safety would be negative if a company('s)

a. was presently operating at a volume that is below the break-even point.

b. present fixed costs were less than its contribution margin.

c. Variable costs exceeded its fixed costs.

d. degree of operating leverage is greater than 100.

13. A company using very tight (high) standards in a standard cost system should expect

that

a. no incentive bonus will be paid

b. most variances will be unfavorable

c. employees will be strongly motivated to attain the standards

d. costs will be controlled better than if lower standards were used

14. For fixed manufacturing overhead, there is no

a. spending variance c. flexible-budget variance

b. efficiency variance d. production-volume variance

Page 2 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

15. A favorable fixed overhead volume variance for a manufacturing company could

indicate

a. the creation of excess inventory.

b. the actual overhead exceeded the budgeted overhead.

c. sales exceeded production.

d. variable overhead costs were less than fixed overhead costs.

16. The flexible budget contains

a. budgeted amounts for actual output.

b. budgeted amounts for planned output.

c. actual costs for actual output.

d. actual costs for planned output.

17. What is the effect on manager’s bonus if it is tied to operating income using variable

costing and absorption costing respectively?

a. INCREASE INCREASE

b. DECREASE DECREASE

c. NO EFFECT INCREASE

d. INCREASE NO EFFECT

18. Using absorption costing, fixed manufacturing overhead costs are best described as

a. Direct period costs. c. Direct product costs.

b. Indirect period costs. d. Indirect product costs.

19. __________ method(s) expense(s) variable marketing costs in the period incurred.

a. Variable costing

b. Absorption costing

c. Throughput costing

d. All of these answers are correct.

20. Both Company Y and Company Z produce similar products that need negligible

distribution costs. Their assets operation and accounting are very similar in all

respects except that Company Y uses direct costing and Company Z uses absorption

costing.

a. Co. Y would report a higher inventory value than Co. Z for the years in which

production exceeds sales

b. Co. Y would report a higher inventory value than Co. Z for the years in which

production exceeds the normal or practical capacity

c. Co. Z would report a higher inventory value than Co. Y for the years in which

production exceeds sales

d. Co. Z would report a higher net income than Co. Y for the years in which production

equals sales

21. The decision to employ a resource in a specific way implies giving up the returns from

other possible uses of the same resource. Such returns are considered costs of the

alternative chosen as they are profits of the alternative forgone. These costs must be

evaluated by the decision-maker and they are called

a. Opportunity costs c. Standard costs

b. Incremental costs d. Manufacturing costs

22. The following items are the same for the flexible budget and the master budget except

a. the same variable cost per unit.

b. the same total fixed costs.

c. the same units sold.

Page 3 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

d. the same sales price per unit.

23. Each organization plans and budgets its operations for slightly different reasons. Which

one of the following is not a significant reason for planning?

a. Providing a basis for controlling operations.

b. Forcing managers to consider expected future trends and conditions.

c. Ensuring profitable operations.

d. Checking progress toward the objectives of the organization.

24. A firm develops an annual cash budget in order to

a. Support the preparation of its cash flow statement for the annual report.

b. Ascertain which capital expenditure projects are feasible and which capital

expenditure projects should be deferred.

c. Determine the opportunity costs of alternative sales and production strategies.

d. Avoid the opportunity costs of noninvested excess cash and minimize the cost of

interim financing.

25. Which of the following represents the normal sequence in which the indicated budgets

are prepared?

a. Direct Materials, Cash, Sales

b. Production, Cash, Income Statement

c. Sales, Balance Sheet, Direct Labor

d. Production, Manufacturing Overhead, Sales

26. ROI is most appropriately used to evaluate the performance of:

a. cost center managers.

b. revenue center managers.

c. profit center managers.

d. investment center managers.

27. Which of the following ratios would be least helpful in appraising the liquidity of current

assets?

a. Accounts Receivable turnover

b. Current Ratio

c. Days’ sales in inventory

d. Days’ sales in accounts receivable

28. Which of the following is an inventory cushion against delivery problems?

a. Anticipation inventory c. Theoretical inventory

b. Safety stock d. Transit stock

29. Which of the following is not a capital component when calculating the weighted

average cost of capital (WACC) for use in capital budgeting?

a. Long-term debt. d. Common stock.

b. Accounts payable. e. None of the above

c. Retained earnings.

30. The discount rate that equates the present value of the expected cash flows with the

cost of the investment is the

a. Net present value

b. Accounting rate of return

c. Internal rate of return

d. Payback period.

Page 4 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

31. Dwarf Company currently leases a delivery truck from David Enterprises for a fee of

P25,000 per month plus P40 per mile. Management is evaluating the desirability of

switching to a modern, fuel-efficient truck, which can be leased from Goliath, Inc., for

a fee of P60,000 per month plus P5 per mile. All operating costs and fuel are included

in the rental fees. In general, a lease from

a. Goliath, Inc., is economically preferable to a lease from David Enterprises regardless

of the monthly use.

b. David Enterprises is economically preferable below 1,000 miles per month.

c. David Enterprises is economically preferable to a lease from Goliath, Inc.,

regardless of the monthly use.

d. David Enterprises is economically preferable above 1,000 miles per month.

32. The following summations are available:

Sum of hours 860

Sum of costs 4,120

Sum of hours x cost 890,000

Sum of hours squared 187,000

Number of months analyzed 4

Using the “least squares method” for splitting a semi-variable cost, what is the

variable rate per hour?

Variable rate per hour Fixed cost

a. P3 P500

b. P2 P600

c. P2 P500

d. P4 P600

33. Fixed cost per unit is P9 when 20,000 units are produced and P6 when 30,000 units

are produced. What is the total fixed cost when nothing is produced?

a. P120,000

b. P270,000

c. P15

d. P180,000

e. P0

34. Northridge, Inc., uses the high-low method to analyze cost behavior. The company

observed that at 20,000 machine hours of activity, total maintenance costs averaged

P10.50 per hour. When activity jumped to 24,000 machine hours, which was still within

the relevant range, the average total cost per machine hour was P9.75. On the basis

of this information, the company's fixed maintenance costs were:

a. P24,000 c. P210,000

b. P90,000 d. P234,000

35. Domino Company’s operating percentages were as follows:

Revenues 100%

Cost of goods

sold

Variable 50%

Fixed 10% 60%

Gross profit 40%

Other operating

expenses

Variable 20%

Page 5 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

Fixed 15% 35%

Operating 5%

income

Domino’s sales totaled P2 million. At what revenue level would Domino break-even?

a. P1,900,000 c. P1,250,000

b. P1,666,667 d. P 833,333

36. Levina Corporation had sales of P120,000 for the month of May. It has a margin of

safety ratio of 25 percent, and an after-tax return on sales of 9 percent. The company

assumes its sales being constant every month. If the tax rate is 40 percent, how much

is the monthly fixed cost?

a. P54,000 c. P32,400

b. P648,000 d. P388,800

37. Larz Company produces a single product. It sold 25,000 units last year with the

following results:

Sales P625,000

Variable costs P375,000

Fixed costs 150,000 525,000

Net income before P100,000

taxes

Income taxes 40,000

Net income P 60,000

In an attempt to improve its product in the coming year, Larz is considering replacing

a component part in its product that has a cost of P2.50 with a new and better part

costing P4.50 per unit. A new machine will also be needed to increase plant capacity.

The machine would cost P18,000 with a useful life of 6 years and no salvage value. If

Larz wishes to maintain the same contribution margin ratio after implementing the

changes, what selling price per unit of product must it charge next year to cover the

increase in material costs?

a. P27.00 c. P32.50

b. P25.00 d. P28.33

38. The following information pertains to the Duffy Company’s three products:

A B C

Unit sales per year 500 800 500

Selling price per unit P3.00 P4.00 P3.00

Variable costs per unit 1.20 3.00 3.30

Unit contribution margin P1.80 P1.00 P(0.30)

Contribution margin ratio 60% 25% (10)%

Assume that the selling price of product C is increased to P3.50 with a reduction in

annual sales to 350 units. Annual profits will

a. increase by P45. c. increase by P150.

b. increase by P70. d. increase by P220.

39. Tomas Corporation produces skincare products for men and women. An incredibly

smooth moisturizing cream has come to the market that the company is anxious to

produce and sell. Enough capacity exists in the company’s plant to produce 40,000

units of the cream each month. Variable costs to manufacture and sell one unit would

be P3.50, and fixed costs associated with the cream would total P340,000 per month.

The company’s Marketing Department predicts that demand for the new cream will

Page 6 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

exceed the 40,000 units that the company is able to produce. Additional manufacturing

space can be rented from another company at a fixed cost of P14,000 per month.

Variable costs in the rented facility would total P4.00 per unit, due to somewhat less

efficient operations than in the main plant. The new cream will sell for P12.00 per unit.

The monthly break-even point for the new cream in units is:

a. 41,750 d. 43,111

b. 41,647 e. 44,250

c. 40,000

40. Gardiner Furniture Company produces two kinds of chairs: an oak model and a

chestnut wood model. The oak model sells for P60 and the chestnut wood model sells

for P100. The variable expenses are as follows:

Oak Chestnut

Variable production costs per unit P30 P35

Variable selling & admin. expenses per 6 5

unit

Expected sales in units next year are: 5,000 oak chairs and 1,000 chestnut chairs.

Fixed expenses are budgeted at P135,000 per year. The company's overall

contribution margin ratio for the expected sales mix is:

A. 40%. C. 50%.

B. 45%. D. 60%.

41. The following information relates to Yellow Corporation:

Sales at the break-even point P312,500

Total fixed expenses P250,000

Net operating income P150,000

What is Yellow's margin of safety?

a. P62,500 c. P100,000

b. P187,500 d. P212,500

42. Recent economic conditions are forcing Mega Corporation to drop its price from P50 to

P40 per unit, but the company expects its sales to rise from 600,000 to 750,000 units.

The company's current cost of production is P38 per unit. Suppose Mega Corporation

would like to maintain a 16% target operating income on its sales revenue. To achieve

this target, the company must lower its cost of production by:

a. P2.00 per unit

b. P33.60 per unit

c. P4.40 per unit

d. P6.40 per unit

43. The most recent income statement for OPMACO COMPANY appears below:

OPMACO Company

Income Statement

For the Year Ended December 31

Sales [45,000 units @ P10] P450,000

Less: Cost of goods sold

Direct materials P90,000

Direct labor 78,300

Manufacturing overhead 98,500 266,800

Gross margin 183,200

Less: Operating expenses

Page 7 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

Selling expenses:

Variable:

Commissions P27,000

Shipping 5,400 32,400

Fixed advertising and 120,000

salaries

Administrative:

Variable 1,800

Fixed 48,000 202,200

Net loss P(19,000)

All variable expenses in the company vary in terms of unit sold, except for sales

commissions, which are based on peso sales. Variable manufacturing overhead is

P0.30 per unit. There was no beginning or ending inventories. OPMACO Company’s

plant has a capacity of 75,000 units per year. The company has been operating at a

loss for several years. Management is studying several possible courses of action to

determine what should be done to make next year profitable.

The company has been approached by an overseas distributor who wants to purchase

9,500 units on a special price basis. There would be no sales commission on these

units. However, shipping costs would be increased by 50% and variable administrative

costs would be reduced by 25%. In addition, a P5,700 special insurance fee would

have to be paid by OPMACO Company to protect the goods in transit. Regular business

would not be disturbed by this special order. What unit price would have to be quoted

on the 9,500 units by OPMACO Company to allow the company to earn a profit of

P14,250 on total operations?

a. P8.35 c. P7.35

b. P6.35 d. P9.35

44. Noli Company applies overhead on a direct labor hour basis. Each unit of product

requires 5 direct labor hours. Overhead is applied on a 30 percent variable and 70

percent fixed basis; the overhead application rate is P16 per hour. Standards are

based on a normal monthly capacity of 5,000 direct labor hours. During September,

Noli produced 1,010 units of product and incurred 4,900 direct labor hours. Actual

overhead cost for the month was P80,000. What is budgeted fixed overhead cost for

the month?

a. P56,000 c. P56,560

b. P672,000 d. P678,720

45. The following direct manufacturing labor information pertains to the manufacture of

Product B.

Time required to make one unit 2 direct labor hours

Number of direct workers 50

Number of productive hours per week, per worker 40

Weekly wages, per worker P500

Workers’ benefits treated as direct manufacturing labor costs20% of wages

What is the standard direct manufacturing labor cost per hour?

a. P30 c. P24

b. P15 d. P12

46. JKL Co. has total budgeted fixed costs of P75,000. Actual production of 19,500 units

resulted in a P3,000 favorable volume variance. What normal capacity was used to

determine the fixed overhead rate?

a. 18,750 c. 17,590

b. 20,313 d. 16,500

Page 8 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

47. Smith Company uses a standard cost system. The following information pertains to

direct labor costs for the month of June.

Standard direct labor rate per hour P10.00

Actual direct labor rate per hour P9.00

Labor rate variance P12,000 favorable

Actual output 2,000 units

Standard hours allowed for actual production 10,000 hours

How many actual labor hours were worked during March for Smith Company?

a. 10,000 d. 12,000

b. 2,000 e. 1,000

c. 1,200

48. Paw-Paw Products produces and sells flannel covered dog beds. In the current year,

Paw-Paw had expected to sell 8,000 beds but actually produced and sold 8,500 beds.

The following information is available regarding the standard cost to produce a single

dog bed:

Direct materials: 5 yards at P1.50 per yard

Direct labor: 40 minutes at P.20 per minute

In the current year, 44,000 yards of material were purchased and used at a cost of

P1.60 per yard and 365,500 direct labor minutes were incurred at a cost of P.23 per

minute. The company's direct labor efficiency variance for the current year was:

a. P5,100 U c. P5,865 F

b. P9,100 U d P20,065 F

49. Fixed manufacturing overhead was budgeted at P500,000 and 25,000 direct labor

hours were budgeted. If the fixed overhead volume variance was P12,000 favorable

and the fixed overhead spending variance was P16,000 unfavorable, fixed

manufacturing overhead applied must be

a. P516,000 c. P512,000

b P488,000 d. P496,000

50. Mayo Company that uses standard cost system in accounting for the cost of production

of its only product, Product A, had the following standards:

Direct materials 10 feet of Rubber at P0.75 per foot and 3 feet of Wood

at P1 per foot.

Direct labor 4 hours at P3.50 per hour

Overhead Applied at 150% of standard direct labor costs.

There was no inventory on hand at the beginning of the year. Materials price variances

are isolated at the time of recording the purchase. Following is a summary of costs

and related data for the production of Product A during the year:

100,000 feet of Rubber were purchased at P0.78 per foot.

30,000 feet of Wood were purchased at P0.90 per foot.

8,000 units of Product A were produced which required 78,000 feet of Rubber;

26,000 feet of Wood; and 31,000 hours of direct labor at P3.60 per hour.

6,000 units of Product A were sold.

If all standard variances are prorated to inventories and cost of goods sold, the amount

of material usage variance for Wood to be prorated to raw materials inventory would

be

a. P500 debit c. P333 debit

b. P333 credit d. P0

Page 9 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

51. The Glass Shop, a manufacturer of large windows, is experiencing a bottleneck in its

plant. Setup time at one of its workstations has been identified as the culprit. A

manager has proposed a plan to reduce setup time at a cost of P72,000. The change

will result in 8,000 additional windows. The selling price per window is P18, direct labor

costs are P3 per window, and the cost of direct materials is P5 per window. Assume

all units produced can be sold. The change will result in an increase in the throughput

contribution of:

a. P104,000

b. P80,000

c. P32,000

d. P8,000

52. A company had an income of P50,000 using direct costing for a given month.

Beginning and ending inventories for the month are 13,000 units and 18,000 units,

respectively. Ignoring income tax, if the fixed overhead application rate was P2 per

unit, what was the income using absorption costing?

a. P40,000 c. P60,000

b. P50,000 d. P70,000

53. Highland Corp. uses a standard cost system. The standard cost per unit of one of its

products are as follows:

Direct Materials P5.00

Direct labor 8.00

Factory overhead

Variable 4.00

Fixed (based on a normal capacity of 3.00

10,000 units)

Total 20.00

Beginning inventory 4,000 units

Production 9,000 units

Units sold (selling price P60) 10,000 units

Actual costs:

Direct materials P 53,000

Direct labor 75,000

Variable overhead 38,000

Fixed overhead 32,000

Variable selling and administrative 48,000

Fixed selling and administrative 60,000

Variances are closed to cost of sales monthly. How much are the net income under

absorption costing and variable costing methods?

Absorption Variable

a. P277,000 P274,000

b. 143,000 144,000

c. 144,000 142,000

d. 274,000 277,000

Page 10 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

54. The Chip Division of Supercomp Corp. produces a high-quality computer chip. Unit

production costs (based on capacity production of 100,000 units per year) follow:

Direct material P50

Direct labor 20

Overhead (20% variable) 10

Other information:

Sales price 100

SG&A costs (40% variable) 15

Assume that the Chip Division is producing and selling at capacity. What is the

minimum selling price that the division would consider on a "special order" of 1,000

chips on which no variable period costs would be incurred?

a. P100 c. P81

b. P72 d. P94

Use the following information for the next two questions.

Berol Company, which plans to sell 200,000 units of finished product in July and

anticipates a growth rate in sales of 5% per month. The desired monthly ending inventory

in units of finished product is 80% of the next month's estimated sales. There are 150,000

finished units in inventory on June 30. Each unit of finished product requires 4 pounds of

direct materials at a cost of P1.20 per pound. There are 800,000 pounds of direct materials

in inventory on June 30.

55. Berol Company's production requirement in units of finished product for the 3-month

period ending September 30 is

a. 712,025 units. c. 638,000 units.

b. 630,500 units. d. 665,720 units.

56. Assume Berol Company plans to produce 600,000 units of finished product in the 3-

month period ending September 30, and to have direct materials inventory on hand

at the end of the 3-month period equal to 25% of the use in that period. The estimated

cost of direct materials purchases for the 3-month period ending September 30 is

a. P2,200,000. c. P2,640,000.

b. P2,400,000 d. P2,880,000.

Use the following information for the next three questions.

The company starts the month of October with following account balances.

Cash P26,000

Accounts receivable 80,000

Prepaid expenses 12,000

Merchandise inventory 30,000

Accounts payable 50,000

Accrued expenses 8,000

The company expected to have prepaid expenses of P20,000 and accrued expenses,

P12,000 by October 31.

The budgeted sales, all on credit, and purchases for the month are P400,000 and

P280,000, respectively. Operating expenses to be recognized during October are

P115,000. Sales are uniformly collected, 60% during the month of sales and the remainder

the following month. Accounts payable on purchase of merchandise is paid 50 percent at

month of purchase and the other half in the first month.

Page 11 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

57. The amount of cash from sales is

a. P240,000 c. P288,000

b. P320,000 d. P272,000

58. The accounts payable on purchase of goods to be paid during October is

a. P190,000 c. P218,000

b. P140,000 d. P162,000

59. Total cash disbursements for October are

a. P301,000 c. P325,000

b. P309,000 d. P305,000

60. The following information is available for the Gabriel Products Company for the month

of July:

Static Budget Actual

Units 5,000 5,100

Sales revenue P60,000 P58,650

Variable manufacturing costs P15,000 P16,320

Fixed manufacturing costs P18,000 P17,000

Variable marketing and administrative expenseP10,000 P10,500

Fixed marketing and administrative expense P12,000 P11,000

The total sales-volume variance for the month of July would be

a. P2,550 U c. P700 F

b. P1,350 U d. P100 F

61. Sales for Kallas Company, a retail store, were P300,000. Net operating income totaled

P50,000 and cost of goods sold was P132,000. If Kallas Company's contribution margin

equals P120,000, total variable selling and administrative expenses must equal:

a. P70,000. c. P118,000.

b. P180,000. d.P48,000.

62. A company manufactures a single product for its customers by contracting in advance

of production. Thus, the company produces only units that will be sold by the end of

each period. For the last period, the following data were available:

Sales P40,000

Direct materials 9,050

Direct labor 6,050

Rent (9/10 factory, 1/10 office) 3,000

Depreciation on factory equipment 2,000

Supervision (2/3 factory, 1/3 office) 1,500

Salespeople’s salaries 1,300

Insurance (2/3 factory, 1/3 office) 1,200

Office supplies 750

Advertising 700

Depreciation on office equipment 500

Interest on loan 300

The gross profit margin percentage (rounded) was

a. 34% c. 44%

b. 41% d. 46%

63. Brown & Sons recently reported sales of P100 million, and net income equal to1 P5

million. The company has P70 million in total assets. Over the next year, the company

is forecasting a 20 percent increase in sales. Since the company is at full capacity, its

assets must increase in proportion to sales. The company also estimates that if sales

Page 12 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

increase 20 percent, spontaneous liabilities will increase by P2 million. If the company’s

sales increase, its profit margin will remain at its current level. The company’s dividend

payout ratio is 40 percent. Based on the AFN formula, how much additional capital must

the company raise in order to support the 20 percent increase in sales?

a. P 2,000,000 c. P 8,400,000

b. P 6,000,000 d. P 9,600,000

64. A hospital records the number of floral deliveries its patients receive each day. For a

one-week period, the records show the following deliveries.

Day Number Deliveries

1 15

2 27

3 26

4 24

5 18

6 21

7 26

Using exponential smoothing with a smoothing constant of 0.4 to forecast the number

of deliveries, calculate the forecast of deliveries in the third day. Assume the forecast

for day 1 are 15 deliveries.

a. 19.8 c. 26.4

b. 22.2 d. 26.6

65. Division X makes a part that it sells to customers outside of the company. Data

concerning this part appear below:

Selling price to outside customers P75

Variable cost per unit P50

Total fixed costs P400,000

Capacity in units 25,000

Division Y of the same company would like to use the part manufactured by Division

X in one of its products. Division Y currently purchases a similar part made by an

outside company for P70 per unit and would substitute the part made by Division X.

Division Y requires 5,000 units of the part each period. Division X can already sell all

of the units it can produce on the outside market. What should be the lowest

acceptable transfer price from the perspective of Division X?

a. P75 c. P16

b. P66 d. P50

66. Vest Industries manufactures 40,000 components per year. The manufacturing cost

of the components was determined as follows:

Direct materials P 75,000

Direct labor 120,000

Variable manufacturing

45,000

overhead

Fixed manufacturing

60,000

overhead

Total P300,000

An outside supplier has offered to sell the component for P12.75. What is the effect

on income if Vest Industries purchases the component from the outside supplier?

a. P270,000 decrease

b. P270,000 increase

c. P30,000 decrease

d. P30,000 increase

Page 13 of 14 www.teamprtc.com.ph MAS.1stPB10.21

EXCEL PROFESSIONAL SERVICES, INC.

67. The following information is available for ABC Company.

Current ratio 3.5

Acid test ratio 3.0

Inventory turnover 8.0

Year-end current liabilities P600,000

Beginning inventory P500,000

How much is the cost of sales during the year?

a. P1,600,000 c. P2,400,000

b. P3,200,000 d. P6,400,000

68. The following information pertains to material X that is used by Sage Co.:

Annual usage in units 20,000

Working days per year 250

Safety stock in units 800

Normal lead time in working 30

days

Units of material X will be required evenly throughout the year. The order point is

a. 800 c. 2,400

b. 1,600 d. 3,200

69. Brown, Inc. has an outstanding issue of perpetual preferred stock with an annual

dividend of P7.50 per share. If the required return on this preferred stock is 6.5%, at

what price should the stock sell?

a. P104.27 c. P109.69

b. P106.95 d. P115.38

70. CC Company invested in a project which required an investment of P10,000 with a

salvage value of P1,000 at the end of its 3 year life. The annual net income after

income taxes are as follows:

Year 1 P3,000

2 4,800

3 7,200

What is the payback period?

a. 1.385 yrs. c. 1.513 yrs

b. 1.487 yrs. d. 1.897 yrs.

End of Examination

(Pleases ignore the extra answer options in the answer sheet after number 70)

Thank you for participating in

Team PRTC Nationwide Online First Pre-Board Examination!

Page 14 of 14 www.teamprtc.com.ph MAS.1stPB10.21

You might also like

- FAR-1stPB 10.22Document8 pagesFAR-1stPB 10.22Harold Dan AcebedoNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Ifrs 9 Financial InstrumentsDocument8 pagesIfrs 9 Financial InstrumentsBella ChoiNo ratings yet

- Chapter 3 Cost Accounting Cycle Multiple Choice - TheoriesDocument36 pagesChapter 3 Cost Accounting Cycle Multiple Choice - TheoriesAyra Pelenio100% (2)

- HshshjaaDocument6 pagesHshshjaaPaula Villarubia0% (1)

- ReSA B43 AFAR First PB Exam Questions, Answers & SolutionsDocument22 pagesReSA B43 AFAR First PB Exam Questions, Answers & SolutionsBella Choi100% (1)

- Module 13 - BusCom - Forex. - StudentsDocument13 pagesModule 13 - BusCom - Forex. - StudentsLuisito CorreaNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Mockboard ExaminationDocument10 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Mockboard ExaminationJudy TotoNo ratings yet

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Document5 pagesFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvNo ratings yet

- MAS Exam Reviewer - 060502Document44 pagesMAS Exam Reviewer - 060502Clay MaaliwNo ratings yet

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDocument8 pagesNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezNo ratings yet

- Past CPA Board On MASDocument5 pagesPast CPA Board On MASzee abadillaNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFAbigail Faye RoxasNo ratings yet

- Afar 1stpb Exam-5.21Document7 pagesAfar 1stpb Exam-5.21Emmanuel TeoNo ratings yet

- 09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingDocument8 pages09 X07 C Responsibility Accounting and TP Variable Costing & Segmented ReportingJonailyn YR PeraltaNo ratings yet

- Responsibility Acctg, Transfer Pricing & GP AnalysisDocument21 pagesResponsibility Acctg, Transfer Pricing & GP AnalysisGelyn CruzNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- PRTC 1stPB - 05.22 Key AnswersDocument6 pagesPRTC 1stPB - 05.22 Key AnswersCiatto SpotifyNo ratings yet

- PRTC 1stPB - 05.22 Sol MASDocument6 pagesPRTC 1stPB - 05.22 Sol MASCiatto SpotifyNo ratings yet

- AUD B41 Final Pre-Board Exam (Questions - Answers)Document13 pagesAUD B41 Final Pre-Board Exam (Questions - Answers)Joanna MalubayNo ratings yet

- Aud Final PBDocument7 pagesAud Final PBFloriza Cuevas Ragudo100% (1)

- Nfjpia Frontliners RFBT 2019Document19 pagesNfjpia Frontliners RFBT 2019Risalyn BiongNo ratings yet

- ICARE - FAR - PreWeek - Batch 4Document15 pagesICARE - FAR - PreWeek - Batch 4john paulNo ratings yet

- Operation Arising From Its Effective PortionDocument14 pagesOperation Arising From Its Effective PortionShey INFTNo ratings yet

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- BSA 3102 Management Accounting PRELIMS PDFDocument20 pagesBSA 3102 Management Accounting PRELIMS PDFRyzel BorjaNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Joint Arrangement HandoutDocument5 pagesJoint Arrangement HandoutClyde SaulNo ratings yet

- Government Accounting Theory Cpar PDFDocument4 pagesGovernment Accounting Theory Cpar PDFGeneGrace Zolina Tasic100% (1)

- ICARE - MAS - PreWeek - Batch 4Document18 pagesICARE - MAS - PreWeek - Batch 4john paulNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Document15 pagesManila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Bella Choi100% (1)

- Panduan Slide Presentation Crew EnrichmentDocument23 pagesPanduan Slide Presentation Crew EnrichmentMaret JahanamNo ratings yet

- Mas Bobadilla 01 Activity Based CostingDocument11 pagesMas Bobadilla 01 Activity Based CostingEdi wow WowNo ratings yet

- This Study Resource Was: FAR Ocampo/Cabarles/Soliman/Ocampo Quiz No. 3 Set A OCTOBER 2019Document3 pagesThis Study Resource Was: FAR Ocampo/Cabarles/Soliman/Ocampo Quiz No. 3 Set A OCTOBER 2019ChjxksjsgskNo ratings yet

- AFAR FinalMockBoard BDocument11 pagesAFAR FinalMockBoard BCattleyaNo ratings yet

- ICare First Preboard Examination-MSDocument14 pagesICare First Preboard Examination-MSLeo M. SalibioNo ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Icare Mockboard - FARDocument25 pagesIcare Mockboard - FARDaniel TayobanaNo ratings yet

- D14Document12 pagesD14YaniNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleDocument16 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleFeelingerang MAYoraNo ratings yet

- RFBT Answer Key Final PreboardDocument1 pageRFBT Answer Key Final PreboardjoyhhazelNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsJeric RebandaNo ratings yet

- CEBU CPAR CENTER - 1st PreboardDocument24 pagesCEBU CPAR CENTER - 1st PreboardMary Alcaflor BarcelaNo ratings yet

- Mas 9000 EconomicsDocument10 pagesMas 9000 EconomicsAljur SalamedaNo ratings yet

- 3 4Document5 pages3 4RenNo ratings yet

- MAS-FinPB 05.22+Document11 pagesMAS-FinPB 05.22+Luis Martin PunayNo ratings yet

- TTTDocument6 pagesTTTAngelika BalmeoNo ratings yet

- AFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedDocument5 pagesAFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedSophia PerezNo ratings yet

- ICARE - AT - PreWeek - Batch 4Document19 pagesICARE - AT - PreWeek - Batch 4john paulNo ratings yet

- Team PRTC SOL-1stPB - 10.21Document44 pagesTeam PRTC SOL-1stPB - 10.21Bella ChoiNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- RFBT Final Preboard QuestionairesDocument18 pagesRFBT Final Preboard QuestionairesMABI ESPENIDONo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- 03 Gross Profit AnalysisDocument5 pages03 Gross Profit AnalysisJunZon VelascoNo ratings yet

- Preboard Exam - AuditDocument10 pagesPreboard Exam - AuditLeopoldo Reuteras Morte IINo ratings yet

- The Operating Results in Summarized Form For A Retail ComputerDocument1 pageThe Operating Results in Summarized Form For A Retail ComputerAmit PandeyNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsEstudyante100% (2)

- Mas Drills Weeks 1 5Document28 pagesMas Drills Weeks 1 5Hermz ComzNo ratings yet

- Subjects Icare Resa: MAS FAR Afar TOA TAX RFBT AT APDocument14 pagesSubjects Icare Resa: MAS FAR Afar TOA TAX RFBT AT APlloydNo ratings yet

- Answer2 TaDocument13 pagesAnswer2 TaJohn BryanNo ratings yet

- AFAR Assessment 2Document5 pagesAFAR Assessment 2JoshelBuenaventuraNo ratings yet

- Midterm Examination - MAS REVIEWDocument7 pagesMidterm Examination - MAS REVIEWFrancis MateosNo ratings yet

- Strategic Cost Management Quiz No. 1Document5 pagesStrategic Cost Management Quiz No. 1Alexandra Nicole IsaacNo ratings yet

- Encircle The Letter of The Correct Answer.: Practice SetDocument3 pagesEncircle The Letter of The Correct Answer.: Practice SetShei FortinNo ratings yet

- Team PRTC SOL-1stPB - 10.21Document44 pagesTeam PRTC SOL-1stPB - 10.21Bella ChoiNo ratings yet

- Data Structures & Algorithms: SummativeDocument16 pagesData Structures & Algorithms: SummativeBella ChoiNo ratings yet

- Instructions: Please Make A Copy of This Chart. Thoroughly Complete The Chart Below and AddDocument4 pagesInstructions: Please Make A Copy of This Chart. Thoroughly Complete The Chart Below and AddBella ChoiNo ratings yet

- Affidavit of Quitclaim and Desistance 42Document2 pagesAffidavit of Quitclaim and Desistance 42Bella ChoiNo ratings yet

- Intermediate Accounting 3: Name: Date: Professor: Section: ScoreDocument21 pagesIntermediate Accounting 3: Name: Date: Professor: Section: ScoreBella ChoiNo ratings yet

- Perforated Materials, Inc., Et Al. v. DiazDocument2 pagesPerforated Materials, Inc., Et Al. v. DiazBella ChoiNo ratings yet

- Sample Abstract Influence of Continuing Professional Education (Cpe) Compliance On The Competence of Accounting FacultyDocument2 pagesSample Abstract Influence of Continuing Professional Education (Cpe) Compliance On The Competence of Accounting FacultyBella ChoiNo ratings yet

- Grades LatinDocument4 pagesGrades LatinBella ChoiNo ratings yet

- Sidings & Front Cover of Undegraduate Thesis-1Document1 pageSidings & Front Cover of Undegraduate Thesis-1Bella ChoiNo ratings yet

- Training Program 2Document10 pagesTraining Program 2Bella ChoiNo ratings yet

- Auditing Theory 1 Pre Boards (May 2021) (Set A) : Limited Assurance FileDocument6 pagesAuditing Theory 1 Pre Boards (May 2021) (Set A) : Limited Assurance FileBella ChoiNo ratings yet

- Paket January MPDocument4 pagesPaket January MPIT MPSAFINNo ratings yet

- Copr P6-6 - FifoDocument2 pagesCopr P6-6 - Fifolaurentinus fikaNo ratings yet

- AFAR H01 Cost Accounting PDFDocument7 pagesAFAR H01 Cost Accounting PDFhellokittysaranghaeNo ratings yet

- F5.1 Lý Thuyết Tiếng ViệtDocument147 pagesF5.1 Lý Thuyết Tiếng ViệtTrần Diễm QuỳnhNo ratings yet

- Lecture 22-1Document21 pagesLecture 22-1Kumar SamreshNo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- Ace Hdwe Lucena InventoryDocument6 pagesAce Hdwe Lucena InventorySamiracomputerstation Kuya MarvsNo ratings yet

- Accounting 204 and 205 - Q1 AnswersDocument1 pageAccounting 204 and 205 - Q1 Answersrowilson reyNo ratings yet

- Long-Run Cost: The Production FunctionDocument11 pagesLong-Run Cost: The Production FunctionPUBG LOVERSNo ratings yet

- Cost Output Relationship in The Short RunDocument5 pagesCost Output Relationship in The Short RunpratibhaNo ratings yet

- PEM GTU Study Material Presentations Unit-2 29012020031306AMDocument62 pagesPEM GTU Study Material Presentations Unit-2 29012020031306AMNand kotNo ratings yet

- ACCY121MidtermExamStudyGuidePPTSlidesonchs2 3 4 5 7 8 PDFDocument218 pagesACCY121MidtermExamStudyGuidePPTSlidesonchs2 3 4 5 7 8 PDFShareyld De GuiaNo ratings yet

- CHAP20 Managerial AccountingDocument4 pagesCHAP20 Managerial AccountingAdilene AcostaNo ratings yet

- Roura ProjMgtExer1Document1 pageRoura ProjMgtExer1Irish Nicole RouraNo ratings yet

- Talk 06. Inventory ManagementDocument23 pagesTalk 06. Inventory ManagementPhuc LinhNo ratings yet

- Business Pricing JzelDocument25 pagesBusiness Pricing JzelGina AquinoNo ratings yet

- Sap Fi Gen FinperformanceDocument14 pagesSap Fi Gen FinperformanceRavi Chandra LNo ratings yet

- Profit Maximization and Competitive SupplyDocument99 pagesProfit Maximization and Competitive Supplymuhammadtaimoorkhan100% (2)

- Chapter 6 Theory of Firm and Market Structure - PART 1Document36 pagesChapter 6 Theory of Firm and Market Structure - PART 1hidayatul raihanNo ratings yet

- Microeconomic Theory Basic Principles and Extensions 11th Edition Nicholson Solutions ManualDocument16 pagesMicroeconomic Theory Basic Principles and Extensions 11th Edition Nicholson Solutions Manualairpoiseanalyzernt5t100% (21)

- Ace Corporation: Names of Students: RENION, GABRIELA M. Section: BSA601 Date Activity NDocument3 pagesAce Corporation: Names of Students: RENION, GABRIELA M. Section: BSA601 Date Activity NGoose ChanNo ratings yet

- Equivalent Units and Cost Per Equivalent UnitDocument14 pagesEquivalent Units and Cost Per Equivalent UnitIqra AbbasNo ratings yet

- Principles of Microeconomics 2Nd Edition Mateer Test Bank Full Chapter PDFDocument57 pagesPrinciples of Microeconomics 2Nd Edition Mateer Test Bank Full Chapter PDFRobertMooreyikr100% (9)

- Erratum - Activities - Process CostingDocument4 pagesErratum - Activities - Process CostingRoselyn LumbaoNo ratings yet

- Production Function - What and WhyDocument21 pagesProduction Function - What and WhyteshomeNo ratings yet

- Ecn Production CostDocument9 pagesEcn Production CostMark AminNo ratings yet

- Cost FunctionDocument19 pagesCost FunctionSanam KhanNo ratings yet

- ManEconChap5-test BankDocument29 pagesManEconChap5-test Bankmrivera101802No ratings yet