Professional Documents

Culture Documents

RA-02 Sub

Uploaded by

Faizan SajjadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RA-02 Sub

Uploaded by

Faizan SajjadCopyright:

Available Formats

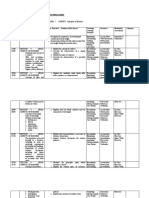

6. Are there any other covenants non-compliance of 6.

There are none non-compliances except for which

Common Terms Agreement that would require waiver has been applied.

the loan becoming payable immediately on

demand?

7. Are there any other covenants that are breached 7. No.

during the year?

8. Is there any pressure on management to overstate 8. There are no such pressures on the management.

profits to achieve results in order to be compliant

with profitability sensitive covenants?

9. Has the Company obtained any new waivers from 9. Breaches to loan covenants was waived off in letter

its lenders in respect of noncompliance of dated August 30, 2021 having validity up to

common terms agreement from 01-Jul-2021 till December 31, 2021. The new waiver in process and

30- Jun -2022? will be processed before completion of the audit.

10. No. The Company get MoR approval in last year

10. Is the Company facing any liquidity issue that and revenue streams are more than enough to meet

would lead to non-payment of interest or principal the repayment.

of loans? 11. No

11. Are there any loan restructuring plans in place?

4 Revenue and Trade Debts

1. Has the company trued up its cost with the power 1. No. but the application has filed and is under due of

purchaser? audits by NEPRA and CPPA-G.

2. No. It is recognized on MoR. Reference tariff

2. Is revenue recognized on preliminary tariff or the adjusted for exchange rate. (MoR adjustment given in

final tariff? last fiscal year)

3. Are there instances where invoices are not 3. No.

approved by CPPA-G during the year?

4. Has the Company received any amount from 4. No.

CPPA-G in respect of Late Payment Interest?

5. Are there any expectations from management 5. No

regarding overstatements of revenues to achieve

better results?

6. What is the revenue to cash realization as at 30- 6. 93%.

June-2022?

7. What is the ageing of trade receivables as at 30- 7. Aging will be provided to the team for a detailed

June-2021? review.

8. What is the management expectation of trade 8. 100% realization.

receivables realization?

9. Is there any dispute with CPPA-G with respect to 9. No

billing that will lead to issues in recoverability of

trade receivables?

5 Trade Payables and Operating Costs?

1. What is the major reason for non -settlement of project 1. Majorly payables relates to settlement with EPC

payables till 30- June-2022? contractors amounting to USD 12.1 M (under Master

Settlement Agreement and Flood Claim Settlement

Agreement). This will settlement by December 31,

2022

2. When the Company expects to settle off its other

projects and other payables? 2. By 31 Dec 2022.

3. To what extent the Company has adjusted its LD

charges against project payables during the year? 3. No LD is adjusted during the year.

4. Yes.

2

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- RA-01 SubDocument1 pageRA-01 SubFaizan SajjadNo ratings yet

- 7 Liability Recognition and Nonowner FinancingDocument69 pages7 Liability Recognition and Nonowner FinancingSysy VizirNo ratings yet

- ReSA B44 FAR Final PB Exam Questions Answers and SolutionsDocument22 pagesReSA B44 FAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- MA - Asnmnt-1 - Group - 3 - Ankita Priya - Neha Kaul - Vedant - Navendu - Nikhil PDFDocument15 pagesMA - Asnmnt-1 - Group - 3 - Ankita Priya - Neha Kaul - Vedant - Navendu - Nikhil PDFNikhil SakhardandayNo ratings yet

- Current LiabDocument24 pagesCurrent LiabSamantha Marie ArevaloNo ratings yet

- Guidelines On The Implementing The Cash Budgeting SystemDocument31 pagesGuidelines On The Implementing The Cash Budgeting SystemMaria Teresa TampisNo ratings yet

- Bonds Payable - StudentDocument3 pagesBonds Payable - StudentLOVENo ratings yet

- SG Tax Budget 2022 Key Tax ChangesDocument26 pagesSG Tax Budget 2022 Key Tax ChangesCarlo OlivarNo ratings yet

- (D) The Liability Is Payable To A Specifically Identified PayeeDocument13 pages(D) The Liability Is Payable To A Specifically Identified PayeeAngela Luz de LimaNo ratings yet

- Amendments in Schedule III of Companies Act, W.E.F. 1st April 2021Document16 pagesAmendments in Schedule III of Companies Act, W.E.F. 1st April 2021Selvi balanNo ratings yet

- Finacc5 LQ1Document6 pagesFinacc5 LQ1by ScribdNo ratings yet

- Final - Assignment 1 (Acctg. For Special Transactions)Document2 pagesFinal - Assignment 1 (Acctg. For Special Transactions)Jeryco Quijano BrionesNo ratings yet

- Quiz No. 2Document3 pagesQuiz No. 2abbyNo ratings yet

- Theories Conceptual Framework and Accouting Standards Answer KeyDocument7 pagesTheories Conceptual Framework and Accouting Standards Answer KeyEl AgricheNo ratings yet

- Module 3Document27 pagesModule 3Sajid IqbalNo ratings yet

- Thin CapitalizationDocument2 pagesThin CapitalizationnathaliaanitaNo ratings yet

- Current Liabilities Provisions and Contingencies TheoriesDocument12 pagesCurrent Liabilities Provisions and Contingencies TheoriesKristine Trisha Anne SabornidoNo ratings yet

- Quiz SolutionsDocument4 pagesQuiz SolutionsEDELYN PoblacionNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesKoko LaineNo ratings yet

- TheroyDocument6 pagesTheroyNang Phyu Sin Yadanar KyawNo ratings yet

- Module 1 Intoduction To LiabilityDocument3 pagesModule 1 Intoduction To LiabilityGab OdonioNo ratings yet

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDocument28 pagesP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahNo ratings yet

- Financial Accounting 2 ExercisesDocument6 pagesFinancial Accounting 2 ExercisesezraelydanNo ratings yet

- 2019 Real Estate Accounting Reporting WhitepaperDocument24 pages2019 Real Estate Accounting Reporting WhitepaperVironikakiaz100% (1)

- Unit Vi - Audit of Leases - Final - T11415 PDFDocument4 pagesUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesNo ratings yet

- 2019 Real Estate Accounting Reporting WhitepaperDocument24 pages2019 Real Estate Accounting Reporting Whitepaperrose querubinNo ratings yet

- Week 3Document60 pagesWeek 3AJNo ratings yet

- Toa Drill 2 (She, SFP, Sme, Lease, Govt GrantsDocument15 pagesToa Drill 2 (She, SFP, Sme, Lease, Govt GrantsROMAR A. PIGANo ratings yet

- Chapter 13Document38 pagesChapter 13Kimmy ShawwyNo ratings yet

- Current LiabilitiesDocument2 pagesCurrent LiabilitiesAvox EverdeenNo ratings yet

- Final - Assignment 1 (Acctg. For Special Transactions)Document3 pagesFinal - Assignment 1 (Acctg. For Special Transactions)Kimberly AbiaNo ratings yet

- Balance Sheet InterpretationDocument3 pagesBalance Sheet InterpretationAkanksha KadamNo ratings yet

- IA Reviewer 2Document25 pagesIA Reviewer 2Krishele G. GotejerNo ratings yet

- 07 ContractingDocument7 pages07 ContractingPratheep GsNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

- Advanced Accounts Nov21Document37 pagesAdvanced Accounts Nov21Nidhin ChandranNo ratings yet

- Accounting News en 1312Document8 pagesAccounting News en 1312Jic JicNo ratings yet

- Problem 1 Write The Letter As Well As The Entire AnswersDocument4 pagesProblem 1 Write The Letter As Well As The Entire Answerslirva cantonaNo ratings yet

- Toa-Current Labilities and ContingenciesDocument19 pagesToa-Current Labilities and ContingenciesZaira PangesfanNo ratings yet

- CB1 - September22 - EXAM - Clean ProofDocument7 pagesCB1 - September22 - EXAM - Clean ProofboomaNo ratings yet

- US Internal Revenue Service: F5500ez - 1992Document1 pageUS Internal Revenue Service: F5500ez - 1992IRSNo ratings yet

- Global Exec Update - IASB and IFRS IC Update - 24 May 2022 - v1 - ID Review - FINALDocument52 pagesGlobal Exec Update - IASB and IFRS IC Update - 24 May 2022 - v1 - ID Review - FINALPaulo Henrique Santos MacedoNo ratings yet

- 9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsDocument8 pages9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsandreamrieNo ratings yet

- Current Liabilities and ProvisionsDocument12 pagesCurrent Liabilities and ProvisionsRinkashizu TokimimotakuNo ratings yet

- CAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K MohantyDocument61 pagesCAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K Mohantybest2comeinNo ratings yet

- Reviewer 1 - 6 Intacc 2Document58 pagesReviewer 1 - 6 Intacc 2Ivory ClaudioNo ratings yet

- Final Output in Audapp1Document9 pagesFinal Output in Audapp1Ma Stephanie Kate Labro0% (1)

- Voith Mudita AgreementDocument7 pagesVoith Mudita AgreementOpen AINo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- Online Test 3 (2020)Document12 pagesOnline Test 3 (2020)mikeNo ratings yet

- Audit NotesDocument11 pagesAudit NotesNavjyoti SinghNo ratings yet

- Midterm Exam Intermediate Accounting 1Document9 pagesMidterm Exam Intermediate Accounting 111-C2 Dennise EscobidoNo ratings yet

- TheoriesDocument28 pagesTheoriesYou Knock On My DoorNo ratings yet

- Annual Report InterGlobe Aviation Limited FY 2020 21Document264 pagesAnnual Report InterGlobe Aviation Limited FY 2020 21danielxx747No ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- WEEK 11 FAR T Income Revenue Net IncomeDocument5 pagesWEEK 11 FAR T Income Revenue Net IncomeJiyong OppaNo ratings yet

- Final Term Examination. Intermediate AccountingDocument8 pagesFinal Term Examination. Intermediate AccountingOrtiz, Trisha Mae S.No ratings yet

- Current-Liab-Test-Bank-1-1 (Docx) - Course SidekickDocument7 pagesCurrent-Liab-Test-Bank-1-1 (Docx) - Course SidekickJuniel Ruadiel Jr.No ratings yet

- Basel 1Document3 pagesBasel 1RanjitNo ratings yet

- Acc-106 Sas 4Document11 pagesAcc-106 Sas 4hello millieNo ratings yet

- Intranet & Customer Assets Management: E-Commerce Lecture By: Saurabh MittalDocument15 pagesIntranet & Customer Assets Management: E-Commerce Lecture By: Saurabh Mittalagarwal4mjasola100% (1)

- Poa26 - Modul 3 - Bill of Material (Bom)Document7 pagesPoa26 - Modul 3 - Bill of Material (Bom)rizki septiaNo ratings yet

- Kryptons Singapore VCC Guide June 2021Document33 pagesKryptons Singapore VCC Guide June 2021Gilberto CalvliereNo ratings yet

- COMPREHENSIVE ACCOUNTING CYCLE PROBLEMgroup Assignemnt IDocument3 pagesCOMPREHENSIVE ACCOUNTING CYCLE PROBLEMgroup Assignemnt ITereda100% (1)

- Zara Quick Response ModelDocument7 pagesZara Quick Response ModelHaseeb AbbasiNo ratings yet

- Form 4 Pob Scheme of Work - Term III 2022Document9 pagesForm 4 Pob Scheme of Work - Term III 2022pratibha jaggan martinNo ratings yet

- Bharath's - Retail Strategy & VMDocument2 pagesBharath's - Retail Strategy & VMBratNo ratings yet

- Jose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpDocument8 pagesJose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpAngelica CastilloNo ratings yet

- Ch1 Week 1Document101 pagesCh1 Week 1harshmaroo100% (2)

- PR2 PPT-G4Document7 pagesPR2 PPT-G4Criselle Magalong GarciaNo ratings yet

- THE LAW OF PARTNERSHIPS - COURSE OUTLINEv4Document7 pagesTHE LAW OF PARTNERSHIPS - COURSE OUTLINEv4sudhirbazzeNo ratings yet

- Digital Marketing-Prof Krishanu-Session 5Document52 pagesDigital Marketing-Prof Krishanu-Session 5Shubham AroraNo ratings yet

- Marketing FinalDocument3 pagesMarketing FinalAndrew ChoiNo ratings yet

- E Commerce (Uber)Document18 pagesE Commerce (Uber)nandini swami100% (1)

- Lecture # 4: Role of IMC in Marketing ProcessDocument34 pagesLecture # 4: Role of IMC in Marketing ProcessMehak SinghNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- SpoilageDocument3 pagesSpoilageela kikayNo ratings yet

- Module 3 - Topic 3Document4 pagesModule 3 - Topic 3Moon LightNo ratings yet

- CH 1 (WWW - Jamaa Bzu - Com)Document6 pagesCH 1 (WWW - Jamaa Bzu - Com)Bayan Sharif0% (1)

- Survey of Accounting 4th Edition Edmonds Test Bank 1Document98 pagesSurvey of Accounting 4th Edition Edmonds Test Bank 1louis100% (45)

- Cooper Industries CaseDocument4 pagesCooper Industries CaseIni EjideleNo ratings yet

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansNo ratings yet

- Ocean Carriers - Case StudyDocument3 pagesOcean Carriers - Case StudyUsama Farooq0% (1)

- Aqualisa Case StudyDocument4 pagesAqualisa Case Studyeyecandy4100% (1)

- Can The Market Add and SubtractDocument6 pagesCan The Market Add and SubtractSundas ArifNo ratings yet

- Marketing Campaign For The Bicycle ShopDocument11 pagesMarketing Campaign For The Bicycle ShopH-pro TVNo ratings yet

- Assignment On IkeaDocument14 pagesAssignment On IkeaShobhitNo ratings yet

- HENKEL GLOBAL Coporate StrategiesDocument52 pagesHENKEL GLOBAL Coporate StrategiesBharat Khiara100% (1)