Professional Documents

Culture Documents

RA-01 Sub

Uploaded by

Faizan SajjadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RA-01 Sub

Uploaded by

Faizan SajjadCopyright:

Available Formats

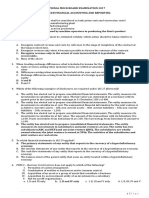

Inquiries from Management

Name of interviewee

Designation CFO/ Manager Accounts & Finance

GT Representatives

S. Description Management response

No.

1 Property, Plant and Equipment

1. Are all the costs required to be capitalized as per the 1. Yes, all directly attributable cost which needs

Project Plan capitalized till 30 June 2022? capitalization are capitalized, further capitalization

only relates to translation of outstanding financing

and other land improvements from time to time.

2. If the cost is still in CWIP, reason for not 2. All costs are transferred from CWIP to operating

capitalizing? fixed assets along with O&M building which was

completed during the year.

3. How the management has determined that PPE is 3. Based on NPV (discounting of future cash flows),

not impaired at the reporting date? we determine the PPE is not impaired.

4. What are the significant milestones not achieved till 4. All milestones related to project was achieved.

30 June 2022 and when the management expects to

complete it?

5. What is the status of O and M building under 5. The building is completed and transferred during

construction? the year. Further expenditure of Rs. 82 M is

incurred during the year.

6. Are there any changes to useful life of PPE, 6. No change.

depreciation policy and or depreciation method?

2 IFRS 16

1. Has the company entered into any new rent 1. No.

agreement or other agreement that could

potentially attract the provisions of IFRS 16? 2. No.

2. Is there any change to lease term, discount factor,

escalation frequency or other means of lease

modification that would require adjustment to

IFRS 16?

3 Long Term Loan

1. Has the Company entered into any new Long 1. No.

Term Loan facilities or subordinated debt?

2. Are there any changes to the existing loans 2. No. There are no changes except repayment

agreements terms, conditions, interest rates, schedules which incorporates the effects of 7th

repayment schedules etc.? disbursement received during the year.

3. Has the Company received any new disbursements 3. Yes. 7th and final disbursement was received during

from its existing facilities during the year? the year.

4. Is the Company complied with payments of 4. Yes

installments along with markup as per repayment

schedule agreed with the lenders?

5. Are there any breaches by the Company to the 5. There are certain breaches of loan covenants but

terms of Section 9 and Schedule 5 of the Common extent of such breaches are not significant against

Terms Agreement that would lead to event of which financing becomes immediately repayable.

default and consequently loan becoming This is no such communication from Intercreditor

immediately payable on demand? Agent. Further waiver has been applied and will be

obtained in meanwhile.

You might also like

- Van Halen Rising by Greg Renoff PDFDocument372 pagesVan Halen Rising by Greg Renoff PDFAdrian ReynosoNo ratings yet

- Perseus, Mars and The Figurae Magicae of PGM XXXVIDocument27 pagesPerseus, Mars and The Figurae Magicae of PGM XXXVILloyd GrahamNo ratings yet

- KATO Design Manual HighDocument98 pagesKATO Design Manual HighJai Bhandari100% (1)

- Chapter 18: Audit of Long-Term Liabilities: Review QuestionsDocument11 pagesChapter 18: Audit of Long-Term Liabilities: Review Questionstrixia nuylesNo ratings yet

- Contract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalFrom EverandContract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalNo ratings yet

- PM Speed Adjusting Motor For PSGDocument2 pagesPM Speed Adjusting Motor For PSGFathima Regin100% (2)

- IFRS 9 ProposalDocument12 pagesIFRS 9 ProposalMuhammad Shahbaz KhanNo ratings yet

- Project Finance 2 1Document377 pagesProject Finance 2 1Ishant TeotiaNo ratings yet

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Chapter 18 (Answers)Document3 pagesChapter 18 (Answers)arnel gallarteNo ratings yet

- Inc. Magazine - 09.2022Document172 pagesInc. Magazine - 09.2022Aman SharmaNo ratings yet

- A5E43455517 6 76 - MANUAL - SITOP Manager - en USDocument252 pagesA5E43455517 6 76 - MANUAL - SITOP Manager - en USdasdNo ratings yet

- Surat PLN EPI Penyampaian Tanggapan Pertanyaan Peserta Kualifikasi ClustersDocument49 pagesSurat PLN EPI Penyampaian Tanggapan Pertanyaan Peserta Kualifikasi ClustersFerlianto Dwi PutraNo ratings yet

- STM - Merck Case AnswersDocument2 pagesSTM - Merck Case AnswersreetayanNo ratings yet

- RA-02 SubDocument1 pageRA-02 SubFaizan SajjadNo ratings yet

- CAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K MohantyDocument61 pagesCAIIB - Financial Management - MODULE C - RATIO ANALYSIS R K Mohantybest2comeinNo ratings yet

- Publication - CARO2020Document9 pagesPublication - CARO2020BSJollyNo ratings yet

- Capital BudgetDocument24 pagesCapital Budgetathulya pNo ratings yet

- Status of Implementation of Prior Years' Audit Recommendations 13Document14 pagesStatus of Implementation of Prior Years' Audit Recommendations 13Angel BacaniNo ratings yet

- Bank Branch AuditDocument7 pagesBank Branch Auditjoinsandeh1301100% (2)

- CFAS Quiz 1 Final ADocument5 pagesCFAS Quiz 1 Final ADesiree Angelique RebonquinNo ratings yet

- Funding Strategy Bali-Mandara Toll Road Rest Area Investment PlanDocument8 pagesFunding Strategy Bali-Mandara Toll Road Rest Area Investment PlanSatria IstanaNo ratings yet

- CFAP 6 Winter 2021Document10 pagesCFAP 6 Winter 2021os96529No ratings yet

- IndasDocument6 pagesIndasVishnu TejaNo ratings yet

- Chapter 15 Audit of Other Items of Statement of Financial PositionDocument13 pagesChapter 15 Audit of Other Items of Statement of Financial PositionMiaNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Theories Conceptual Framework and Accouting Standards Answer KeyDocument7 pagesTheories Conceptual Framework and Accouting Standards Answer KeyEl AgricheNo ratings yet

- Amendments in Schedule III of Companies Act, W.E.F. 1st April 2021Document16 pagesAmendments in Schedule III of Companies Act, W.E.F. 1st April 2021Selvi balanNo ratings yet

- 1, 2, Pas1Document7 pages1, 2, Pas1LOUISSE LEXYNE MAHUSAY BACULIONo ratings yet

- Study Session 8 - Long Lived Assets - SharedDocument55 pagesStudy Session 8 - Long Lived Assets - SharedIhuomacumehNo ratings yet

- Queries - Project Logistic Tarahan - MY - GENDocument3 pagesQueries - Project Logistic Tarahan - MY - GENAnonymous DQ4wYUmNo ratings yet

- Lesson Plan in Business FinanceDocument9 pagesLesson Plan in Business FinanceEmelen VeranoNo ratings yet

- Voith Mudita AgreementDocument7 pagesVoith Mudita AgreementOpen AINo ratings yet

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TNo ratings yet

- Problem 1-5 Multiple Choice (IAA)Document2 pagesProblem 1-5 Multiple Choice (IAA)jayNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementakshaysureshofficialNo ratings yet

- Chapter 5 CPFDocument15 pagesChapter 5 CPFSara NegashNo ratings yet

- Nfjpia Mockboard 2011 ToaDocument12 pagesNfjpia Mockboard 2011 ToaKaguraNo ratings yet

- 2009 Winter SolutionsDocument5 pages2009 Winter SolutionsSaadat AkhundNo ratings yet

- 07 ContractingDocument7 pages07 ContractingPratheep GsNo ratings yet

- Structured and Project Finance at Ex-Im BankDocument10 pagesStructured and Project Finance at Ex-Im BankNaresh LuharukaNo ratings yet

- 2020 - 0409 Geo-Tech Conference by GeotechDocument12 pages2020 - 0409 Geo-Tech Conference by GeotechShrey SaxenaNo ratings yet

- LC Application FormDocument4 pagesLC Application FormHiJackNo ratings yet

- GIC Housg Loan Scheme 2012Document20 pagesGIC Housg Loan Scheme 2012gulafsha1No ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- Current Liabilities, Provisions, and Contingencies: Chapter Learning ObjectivesDocument43 pagesCurrent Liabilities, Provisions, and Contingencies: Chapter Learning Objectivesannedanyle acabadoNo ratings yet

- Module 3Document27 pagesModule 3Sajid IqbalNo ratings yet

- Current LiabDocument24 pagesCurrent LiabSamantha Marie ArevaloNo ratings yet

- Toa-Current Labilities and ContingenciesDocument19 pagesToa-Current Labilities and ContingenciesZaira PangesfanNo ratings yet

- 07-01 Issues Paper - IAS 1 Amendments Board 7-07-2021Document5 pages07-01 Issues Paper - IAS 1 Amendments Board 7-07-2021sambokNo ratings yet

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDocument11 pagesNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteNo ratings yet

- MFRS137 - Prov, CL & CADocument14 pagesMFRS137 - Prov, CL & CAAkai GunnerNo ratings yet

- Capital Budgeting and Time Value of MoneyDocument35 pagesCapital Budgeting and Time Value of MoneyJiyaNo ratings yet

- A Look at Current Financial Reporting Issues: in DepthDocument26 pagesA Look at Current Financial Reporting Issues: in Depthhur hussainNo ratings yet

- Indian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsDocument11 pagesIndian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsSarathNo ratings yet

- Xtra CreditDocument4 pagesXtra CreditKristine Lirose BordeosNo ratings yet

- Chapter Four CPFDocument28 pagesChapter Four CPFtame kibruNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

- MCQsDocument8 pagesMCQsRandy ManzanoNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Finacc5 LQ1Document6 pagesFinacc5 LQ1by ScribdNo ratings yet

- Audit of Other Items of Statement of Financial PositionDocument13 pagesAudit of Other Items of Statement of Financial PositionArlyn Pearl PradoNo ratings yet

- Capital Project FundDocument7 pagesCapital Project FundmeseleNo ratings yet

- Chapter 1 - Ia3Document10 pagesChapter 1 - Ia3Eyra MercadejasNo ratings yet

- Ishida Checkweigher Scotraco PDFDocument6 pagesIshida Checkweigher Scotraco PDFchrissNo ratings yet

- What Is Research: Presented By: Anam Nawaz CheemaDocument13 pagesWhat Is Research: Presented By: Anam Nawaz CheemamahiftiNo ratings yet

- Unit Plan Lesson 1 - 3Document16 pagesUnit Plan Lesson 1 - 3api-547362187No ratings yet

- Nabin Bhusal Oracle Developer (1)Document6 pagesNabin Bhusal Oracle Developer (1)HARSHANo ratings yet

- English 9 Determiners PDF CbseDocument9 pagesEnglish 9 Determiners PDF CbseAarav SakpalNo ratings yet

- Acalypha Indica and Curcuma Longa Plant Extracts Mediated ZNS Nanoparticles PDFDocument9 pagesAcalypha Indica and Curcuma Longa Plant Extracts Mediated ZNS Nanoparticles PDFRabeea NasirNo ratings yet

- Profile of Tele Phone IndustryDocument5 pagesProfile of Tele Phone IndustryRavi JoshiNo ratings yet

- 1975 - Shen - Science Literacy PDFDocument5 pages1975 - Shen - Science Literacy PDFRoberta Proença0% (1)

- Nandana Varusha PanchangamDocument49 pagesNandana Varusha Panchangamsangeethac11No ratings yet

- Polycab Pricelist 21-01-2019Document5 pagesPolycab Pricelist 21-01-2019KULDEEP TRIPATHINo ratings yet

- Tutima Catalog 2020-1Document112 pagesTutima Catalog 2020-1lpstutterheimNo ratings yet

- Imaginefx How To Draw and Paint Anatomy Volume 2Document116 pagesImaginefx How To Draw and Paint Anatomy Volume 2tofupastaNo ratings yet

- The PotometerDocument6 pagesThe PotometerRonald Deck Yami100% (1)

- JCB Case StudyDocument2 pagesJCB Case Studysbph_iitm0% (1)

- Good Practice Guide No. 120: Avoidance of Corrosion in Plumbing SystemsDocument16 pagesGood Practice Guide No. 120: Avoidance of Corrosion in Plumbing SystemsMochamad Irvan MaulanaNo ratings yet

- Strength Training For Young Rugby PlayersDocument5 pagesStrength Training For Young Rugby PlayersJosh Winter0% (1)

- Sergey Kojoian Graph Theory NotesDocument11 pagesSergey Kojoian Graph Theory NotesSergey KojoianNo ratings yet

- JLG Skytrak Telehandler 6042 Operation Service Parts ManualsDocument22 pagesJLG Skytrak Telehandler 6042 Operation Service Parts Manualschristyross211089ntz100% (133)

- 9ER1 Question BookletDocument16 pages9ER1 Question BookletCSC TylerNo ratings yet

- 7.1.4 Environment For The Operation of ProcessesDocument2 pages7.1.4 Environment For The Operation of ProcessesGVS RaoNo ratings yet

- Week 1Document27 pagesWeek 1Bawa BoyNo ratings yet

- The Use of Salicylaldehyde Phenylhydrazone As An Indicator For The Titration of Organometallic ReagentsDocument2 pagesThe Use of Salicylaldehyde Phenylhydrazone As An Indicator For The Titration of Organometallic ReagentsLuca PeregoNo ratings yet

- "Universal Asynchronous Receiver and Transmitter" (UART) : A Project Report OnDocument24 pages"Universal Asynchronous Receiver and Transmitter" (UART) : A Project Report Ondasari himajaNo ratings yet