Professional Documents

Culture Documents

Prohibition On Export and Import

Uploaded by

Import Export ConsultancyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prohibition On Export and Import

Uploaded by

Import Export ConsultancyCopyright:

Available Formats

PROHIBITION ON EXPORT AND IMPORT

Power to prohibit importation or exportation of goods (Section 11 of Customs Act, 1962) . –

(1) If the Central Government is satisfied that it is necessary so to do for any of the purposes specified in

sub-section (2), it may, by notification in the Official Gazette, prohibit either absolutely or subject to such

conditions (to be fulfilled before or after clearance) as may be specified in the notification, the import or

export of goods of any specified description.

(2) The purposes referred to in sub-section (1) are the following: -

(a) the maintenance of the security of India;

(b) the maintenance of public order and standards of decency or morality;

(c) the prevention of smuggling;

(d) the prevention of shortage of goods of any description;

(e) the conservation of foreign exchange and the safeguarding of balance of payments;

(f) the prevention of injury to the economy of the country by the uncontrolled import or export of gold

or silver;

(g) the prevention of surplus of any agricultural product or the product of fisheries;

(h) the maintenance of standards for the classification, grading or marketing of goods

in international trade;

(i) the establishment of any industry;

(j) the prevention of serious injury to domestic production of goods of any description;

(k) the protection of human, animal or plant life or health;

(l) the protection of national treasures of artistic, historic or archaeological value;

(m) the conservation of exhaustible natural resources;

(n) the protection of patents, trademarks 1[, copyrights, designs and geographical indications];

(o) the prevention of deceptive practices;

(p) the carrying on of foreign trade in any goods by the State, or by a Corporation owned or controlled

by the State to the exclusion, complete or partial, of citizens of India;

(q) the fulfilment of obligations under the Charter of the United Nations for the maintenance

of international peace and security;

(r) the implementation of any treaty, agreement or convention with any country;

(s) the compliance of imported goods with any laws which are applicable to similar goods produced or

manufactured in India;

(t) the prevention of dissemination of documents containing any matter which is likely to prejudicially

affect friendly relations with any foreign State or is derogatory to national prestige;

(u) the prevention of the contravention of any law for the time being in force; and

(v) any other purpose conducive to the interests of the general public.

For More Information please visit: www.avlokan.in

Toll Free No.: 1800-309-7149

Prohibited goods

Prohibited goods means goods prohibited under section 11 of the Customs Act, 1962 or under any other

law for the purpose of import and export into and from India as the case may be. The import or export of

such goods is not permitted into or from the country to meet various purposes given in Section 11 of the

Customs Act and goods can be confiscated under section 111 and 113 of the said Act.

Restricted Goods

Restricted goods mean goods whose import / export is restricted into and from India under the Customs

Act or under any other law. Import/export of such goods is permitted by the customs subject to

compliance of the restriction imposed.

In case of non-compliance of the restriction, goods are confiscated but are normally allowed to be

redeemed on payment of fine. Penalty is also imposed on the importing entity.

***************************************

For More Information please visit: www.avlokan.in

Toll Free No.: 1800-309-7149

You might also like

- Spreading Bad TheoryDocument3 pagesSpreading Bad TheoryNICK RAW50% (2)

- From Sovereign To Serf - Roger SaylesDocument19 pagesFrom Sovereign To Serf - Roger SaylesSerfsUp78% (9)

- Malaysian Studies Assignment 1Document10 pagesMalaysian Studies Assignment 1Kai Jie100% (1)

- Mearsheimer John J The False Promise of International Institutions PDF (Highlights and Notes)Document19 pagesMearsheimer John J The False Promise of International Institutions PDF (Highlights and Notes)ElaineMarçalNo ratings yet

- Official Secrets Act Guide to Classified Docs and JournalismDocument27 pagesOfficial Secrets Act Guide to Classified Docs and Journalismsamashmedi0% (1)

- Rule On Custody of Minors and Writ of Habeas CorpusDocument2 pagesRule On Custody of Minors and Writ of Habeas CorpusRaffy Roncales100% (1)

- Provisions Relating To Custom DutyDocument3 pagesProvisions Relating To Custom DutyPallavi JoshiNo ratings yet

- G - Card Question BankDocument5 pagesG - Card Question BankJaldeepNo ratings yet

- Taxation Unit 5Document35 pagesTaxation Unit 5GITANJALI MISHRANo ratings yet

- Customs Act 1962 PART IDocument8 pagesCustoms Act 1962 PART IArti GNo ratings yet

- Confiscation Penalty - Custom PDFDocument82 pagesConfiscation Penalty - Custom PDFAnil KumarNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document12 pagesThe Foreign Trade (Development and Regulation) Act, 1992Mishail BakshiNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document3 pagesThe Foreign Trade (Development and Regulation) Act, 1992Laxmi WankhedeNo ratings yet

- CM 08Document3 pagesCM 08shree varanaNo ratings yet

- Legal Dimensions of India's Foreign Trade: An Assignment Submitted To Prof. Navdeep KaurDocument19 pagesLegal Dimensions of India's Foreign Trade: An Assignment Submitted To Prof. Navdeep KaurMehak GuptaNo ratings yet

- Foreign Exchange Regulation Act 1973Document62 pagesForeign Exchange Regulation Act 1973Aditya SurekaNo ratings yet

- Detailed Study On Civil and Criminal Penalties Under The Customs Act, Prosecution and Compounding of OffencesDocument26 pagesDetailed Study On Civil and Criminal Penalties Under The Customs Act, Prosecution and Compounding of OffencesVaibhav KharateNo ratings yet

- Foreign Exchange Regulation ActDocument65 pagesForeign Exchange Regulation ActSujanya SukumarNo ratings yet

- ECL Notes Chpt1 PDFDocument6 pagesECL Notes Chpt1 PDFRitika JainNo ratings yet

- The Foreign Exchange Regulation ActDocument44 pagesThe Foreign Exchange Regulation Actsmba25No ratings yet

- The Invisible Landscape 1975Document9 pagesThe Invisible Landscape 1975Naga NagendraNo ratings yet

- Union of India v Asian Foods Industries Case AnalysisDocument11 pagesUnion of India v Asian Foods Industries Case AnalysisShreya VermaNo ratings yet

- Customs Act, Excise Duty, Travel Tax and Gift Tax - 2010-2011Document13 pagesCustoms Act, Excise Duty, Travel Tax and Gift Tax - 2010-2011Samira RahmanNo ratings yet

- Preliminary Short Title, Extent, Application and CommencementDocument25 pagesPreliminary Short Title, Extent, Application and Commencementdeepak_71No ratings yet

- Customs DutyDocument19 pagesCustoms DutySnigdha SinghNo ratings yet

- Foreign Exchange Management ActDocument23 pagesForeign Exchange Management ActvaibhavkumarsharmaNo ratings yet

- The Foreign Exchange Management Act, 1999: Legislative HistoryDocument26 pagesThe Foreign Exchange Management Act, 1999: Legislative HistoryPrince VenkatNo ratings yet

- Foreign Trade Development and Regulation Act 1992Document8 pagesForeign Trade Development and Regulation Act 1992Jayant MeshramNo ratings yet

- Foreigner Exchane Regulation Act1973Document38 pagesForeigner Exchane Regulation Act1973Ravi RanjanNo ratings yet

- Customs Act PDFDocument28 pagesCustoms Act PDFAnonymous OPix6Tyk5INo ratings yet

- Foreign Exchange Management Act 1999Document85 pagesForeign Exchange Management Act 1999ars1186No ratings yet

- Tax Law Proposition NewDocument16 pagesTax Law Proposition Newadonis teamNo ratings yet

- The Livestock Importation Act of 1898Document2 pagesThe Livestock Importation Act of 1898Sam ReddyNo ratings yet

- Fema Act 1999Document22 pagesFema Act 1999vishalllmNo ratings yet

- Customs IntroductionDocument62 pagesCustoms IntroductionJitendra VernekarNo ratings yet

- Foreign Trade Act Sections GuideDocument8 pagesForeign Trade Act Sections GuideAchal KhandelwalNo ratings yet

- Untitled CAODocument11 pagesUntitled CAOPaulo LagdaminNo ratings yet

- FOREIGN EXCHANGE ACT SUMMARYDocument27 pagesFOREIGN EXCHANGE ACT SUMMARYTapan ShroffNo ratings yet

- Unit I - Customs DutyDocument64 pagesUnit I - Customs Duty21ubha116 21ubha116No ratings yet

- 1924 Land Customs Act enDocument4 pages1924 Land Customs Act enYagnesh PatelNo ratings yet

- Authorised by The Central Government Under Section 37A )Document25 pagesAuthorised by The Central Government Under Section 37A )Balaji KondaNo ratings yet

- Customs Commissioner Appeals Ruling on Prohibited Food ImportsDocument11 pagesCustoms Commissioner Appeals Ruling on Prohibited Food ImportsBernadette PedroNo ratings yet

- UNIT 6 Part 2Document20 pagesUNIT 6 Part 2prayana smartwisetechNo ratings yet

- Abolition of Untouchability and TitlesDocument1 pageAbolition of Untouchability and TitlesAMIR RAZANo ratings yet

- Foreign Exchange Management Act, 1999Document18 pagesForeign Exchange Management Act, 1999Manoj BajpaiNo ratings yet

- The Foreign Exchange Management Act, 1999: Preliminary 1. Short Title, Extent, Application and CommencementDocument22 pagesThe Foreign Exchange Management Act, 1999: Preliminary 1. Short Title, Extent, Application and CommencementSudhir Kochhar Fema AuthorNo ratings yet

- Aaa1898 09Document3 pagesAaa1898 09Madhu DatarNo ratings yet

- Shail Sir ProjectDocument16 pagesShail Sir ProjectPreeti singhNo ratings yet

- Central Government Act: The Foreign Exchange Regulation Act, 1973Document50 pagesCentral Government Act: The Foreign Exchange Regulation Act, 1973Nilesh MandlikNo ratings yet

- Finals Reviewer - Cm2Document7 pagesFinals Reviewer - Cm2mandocdocmica55No ratings yet

- Draft Preventive Manual Vol IDocument654 pagesDraft Preventive Manual Vol Ipooram001No ratings yet

- To SaveDocument9 pagesTo SavesammiyatariqNo ratings yet

- Foreign Exchange Management ActDocument21 pagesForeign Exchange Management Actanon_370052343No ratings yet

- Abhi Fera FemaDocument13 pagesAbhi Fera FemaTalha_Khan_5518No ratings yet

- The Passport (Entry Into India) RULES, 1950Document7 pagesThe Passport (Entry Into India) RULES, 1950Aniketh kuNo ratings yet

- FEM Unit2 PDFDocument48 pagesFEM Unit2 PDFSurjan SinghNo ratings yet

- GuideDocument7 pagesGuideNayadNo ratings yet

- Foreign Exchange Management Act ExplainedDocument16 pagesForeign Exchange Management Act ExplainedevteduNo ratings yet

- GSTDocument7 pagesGSTchandannandan88No ratings yet

- Customs Act 1962Document132 pagesCustoms Act 1962scribdnacenNo ratings yet

- Custom DutyDocument14 pagesCustom DutyAnantHimanshuEkkaNo ratings yet

- Cmta As Per SyllabusDocument33 pagesCmta As Per SyllabusDowie M. MatienzoNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri Lanka Anti-Terrorism A BillDocument89 pagesParliament of The Democratic Socialist Republic of Sri Lanka Anti-Terrorism A BillLasitha VijayakumarNo ratings yet

- Overview of Cier-2010Document2 pagesOverview of Cier-2010Import Export ConsultancyNo ratings yet

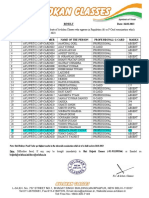

- Avlokan Classes March Exam ResultsDocument1 pageAvlokan Classes March Exam ResultsImport Export ConsultancyNo ratings yet

- Index of The Customs Act, 1962Document8 pagesIndex of The Customs Act, 1962Import Export ConsultancyNo ratings yet

- Introduction and Basic Concepts of Customs LawDocument1 pageIntroduction and Basic Concepts of Customs LawImport Export ConsultancyNo ratings yet

- Courier Imports and Exports RegulationsDocument9 pagesCourier Imports and Exports RegulationsImport Export ConsultancyNo ratings yet

- CBIC Regulation-6 Exam QuestionsDocument21 pagesCBIC Regulation-6 Exam QuestionsImport Export ConsultancyNo ratings yet

- ANSWER SHEET 5 Mar 23Document15 pagesANSWER SHEET 5 Mar 23Import Export ConsultancyNo ratings yet

- 450-Mark Regulation-6 ExamDocument15 pages450-Mark Regulation-6 ExamImport Export ConsultancyNo ratings yet

- The Monitoring and Evaluation of EmpowermentDocument72 pagesThe Monitoring and Evaluation of EmpowermentLaz KaNo ratings yet

- David Nelken 2004 Legal Culture - ANTROPOLOGI KEPOLISIANDocument26 pagesDavid Nelken 2004 Legal Culture - ANTROPOLOGI KEPOLISIANStill WhyNo ratings yet

- Original Criminal Jurisdiction and appeals-CrPC Assignment PDFDocument28 pagesOriginal Criminal Jurisdiction and appeals-CrPC Assignment PDFAmjid AfaqNo ratings yet

- This Study Resource Was: Homework Question Chapter 11Document4 pagesThis Study Resource Was: Homework Question Chapter 11hoiruNo ratings yet

- 9853 - Fact Sheet - Sex Offender Amendment Act FinalDocument1 page9853 - Fact Sheet - Sex Offender Amendment Act FinalBernewsAdminNo ratings yet

- 53 in Re Jurado (1990)Document2 pages53 in Re Jurado (1990)HNicdaoNo ratings yet

- Legal Opinion - Private Practice of ProfessionDocument3 pagesLegal Opinion - Private Practice of ProfessionPhoebe HidalgoNo ratings yet

- Evangelista v. Jarencio, 68 SCRA 99, G.R. No. L-29274 November 27, 1975Document22 pagesEvangelista v. Jarencio, 68 SCRA 99, G.R. No. L-29274 November 27, 1975Angela CanaresNo ratings yet

- Executive Order No 292 (Administrative Code of 1987)Document238 pagesExecutive Order No 292 (Administrative Code of 1987)Donnell ConstantinoNo ratings yet

- Reorganization of Barangay Development Council (BDC)Document2 pagesReorganization of Barangay Development Council (BDC)LeoGreat Madrigal ButligNo ratings yet

- Korman Letter To WSSC RE Police DepartmentDocument2 pagesKorman Letter To WSSC RE Police DepartmentAnonymous sKgTCo2No ratings yet

- Census PopulationDocument189 pagesCensus PopulationVigneshnr100% (2)

- Merchant LawDocument5 pagesMerchant LawkulsoomalamNo ratings yet

- Global Data Privacy Security Handbook 2019 PDFDocument886 pagesGlobal Data Privacy Security Handbook 2019 PDFI DeepbleuNo ratings yet

- With 45% of Indians Excluded from Food Security, It's Time to Universalise PDSDocument10 pagesWith 45% of Indians Excluded from Food Security, It's Time to Universalise PDSmansavi bihaniNo ratings yet

- UN Human Rights Commission addresses ending rape culture in VietnamDocument2 pagesUN Human Rights Commission addresses ending rape culture in VietnamNidhiNo ratings yet

- CiC - CanadaDocument7 pagesCiC - CanadahyenadogNo ratings yet

- Sop Takeover PJ SPJ PNPJDocument11 pagesSop Takeover PJ SPJ PNPJJeremie TisoyNo ratings yet

- RA 6713 - Code of Ethics Public OfficersDocument4 pagesRA 6713 - Code of Ethics Public OfficersRoji Belizar HernandezNo ratings yet

- LIMBONA Vs MANGELINDocument2 pagesLIMBONA Vs MANGELINGianna de Jesus50% (2)

- InsDocument20 pagesInsMarj BaniasNo ratings yet

- 2014 - Riddell - Does Foreign Ais Really Work. An Updated AssessmentDocument67 pages2014 - Riddell - Does Foreign Ais Really Work. An Updated AssessmentMariano AlvarezNo ratings yet

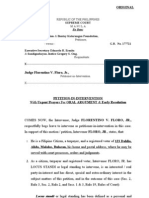

- Gregory S. Ong PETITION-IN-INTERVENTIONDocument49 pagesGregory S. Ong PETITION-IN-INTERVENTIONJudge Florentino FloroNo ratings yet

- Public International Law Case DigestsDocument57 pagesPublic International Law Case DigestsRbee C. AblanNo ratings yet