Professional Documents

Culture Documents

Afar 2 - 2

Uploaded by

Panda ErarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afar 2 - 2

Uploaded by

Panda ErarCopyright:

Available Formats

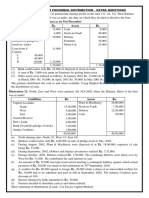

AFAR 2 – Partnership

Use the following information for items 3 and 4

A balance sheet for the partnership of T, N and D who share profits in the ratio of 2:1:1 shows the following balances just before

the liquidation.

Cash 12,000

Other assets 59,500

Liabilities 20,000

T, Capital 20,000

N, Capital 15,500

D, Capital 14,000

On the first installment of the liquidation, certain assets are sold for 32,000. Liquidation expense of 10,000 are paid and additional

liquidation expense are anticipated. Liabilities are paid amounting to 5,400 and sufficient cash is retained to ensure the payment to

creditors before making payment to partners. On the first payment to partners, T received 6,250.

1. The total cash payment to partners in the first installment is? 24,000

2. The amount of cash withheld for anticipated liquidation expense and unpaid liabilities are? 4,600

You might also like

- Afar 04Document3 pagesAfar 04yvonneNo ratings yet

- Quiz 2 SolutionsDocument5 pagesQuiz 2 SolutionsAngel Alejo AcobaNo ratings yet

- PROBLEMsDocument3 pagesPROBLEMsHancel NageraNo ratings yet

- Advac 103 Partnership and Corporate LiquidationDocument3 pagesAdvac 103 Partnership and Corporate Liquidationellie MateoNo ratings yet

- Adg8kk1) r8 Fq7''uDocument6 pagesAdg8kk1) r8 Fq7''uThe makas AbababaNo ratings yet

- 3.2 - Lecture Notes - Partnership LiquidationDocument20 pages3.2 - Lecture Notes - Partnership LiquidationKatrina Regina BatacNo ratings yet

- Torrent Downloaded FromDocument4 pagesTorrent Downloaded FromJULIUS L. LEVENNo ratings yet

- MOD 4 Partnership LiquidationDocument3 pagesMOD 4 Partnership LiquidationCharles GainNo ratings yet

- Partnership Liquidation Practice Problems - W CorrectionsDocument10 pagesPartnership Liquidation Practice Problems - W CorrectionsSarah BalisacanNo ratings yet

- Chapter-2: Partnership AccountsDocument6 pagesChapter-2: Partnership Accountsadityatiwari122006No ratings yet

- Retirement Hots and Application Based QuestionsDocument5 pagesRetirement Hots and Application Based Questionspriya longaniNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Huk 3Document2 pagesHuk 3Kharen Mae M. GulfoNo ratings yet

- Ast Discussion 4 - Partnership Liquidation For PrintDocument4 pagesAst Discussion 4 - Partnership Liquidation For PrintCHRISTINE TABULOGNo ratings yet

- St. Marry Inter CollegeDocument15 pagesSt. Marry Inter CollegeSTAR PRINTINGNo ratings yet

- 03-Partnership Liquidation Quiz2Document6 pages03-Partnership Liquidation Quiz2JiddahNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- Additional Questions-5Document14 pagesAdditional Questions-5Shivam Kumar JhaNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Module 4-Lump Sum Liquidation-Faculty VersionDocument22 pagesModule 4-Lump Sum Liquidation-Faculty VersionJan Ian Greg M. GangawanNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- HHHHDocument7 pagesHHHHleejongsukNo ratings yet

- Partnership Liquidation - Notes & Illustrative ProblemsDocument4 pagesPartnership Liquidation - Notes & Illustrative ProblemsTEOPE, EMERLIZA DE CASTRONo ratings yet

- Partnership Liquidation Q10docx 4 PDF FreeDocument1 pagePartnership Liquidation Q10docx 4 PDF FreecamillaNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationSharon AnchetaNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- Partnership ProbsDocument3 pagesPartnership Probsmartinfaith958No ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- LiquidationDocument2 pagesLiquidationMaria LopezNo ratings yet

- PartnershipDocument5 pagesPartnershipKaren GarciaNo ratings yet

- Dissolution 2024 SPCC PDFDocument66 pagesDissolution 2024 SPCC PDFdollpees01No ratings yet

- Partnership Liquidation - SeatworkDocument3 pagesPartnership Liquidation - SeatworkTEOPE, EMERLIZA DE CASTRONo ratings yet

- Piecemeal Distribution NMIMSDocument4 pagesPiecemeal Distribution NMIMSShubham ChitkaraNo ratings yet

- Admission of PartnerDocument7 pagesAdmission of Partneradarshrathore12341234No ratings yet

- Chapter - Partnership Accounts If There Is No Partnership DeedDocument8 pagesChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelNo ratings yet

- Practical Accounting 2: Theory & Practice Advanced Accounting Partnership Liquidation & IncorporationDocument41 pagesPractical Accounting 2: Theory & Practice Advanced Accounting Partnership Liquidation & Incorporationsino akoNo ratings yet

- PRTC AFAR-1stPB 05.22Document12 pagesPRTC AFAR-1stPB 05.22Ciatto SpotifyNo ratings yet

- Piecemeal - Extra QuestionsDocument4 pagesPiecemeal - Extra Questionskushgarg627No ratings yet

- Test Retirement Death Dissolution-1Document4 pagesTest Retirement Death Dissolution-1Vibhu VashishthNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- Worksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerDocument14 pagesWorksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerRica Jane LlorenNo ratings yet

- 02Document3 pages02Jodel Castro100% (1)

- Partnership-WPS OfficeDocument3 pagesPartnership-WPS OfficeRanelene CutamoraNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: First Pre-Board ExaminationDocument26 pagesAccountancy Review Center (ARC) of The Philippines Inc.: First Pre-Board ExaminationCarlo AgravanteNo ratings yet

- S Partnership LiquidationDocument2 pagesS Partnership Liquidationandzie09876No ratings yet

- Midterm Quiz 2 Partnership Dissolution Without Answer KeyDocument4 pagesMidterm Quiz 2 Partnership Dissolution Without Answer Keyaleksiyaah lexleyNo ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- Partnership Liquidation May 13 C PDFDocument3 pagesPartnership Liquidation May 13 C PDFElla AlmazanNo ratings yet

- Problems Retirement Withdrawal of A PartnerDocument4 pagesProblems Retirement Withdrawal of A PartnerMichaella ManlapazNo ratings yet

- 9 Partnership Question 4Document7 pages9 Partnership Question 4kautiNo ratings yet

- 144 - ECO-14 - ENG D18 - CompressedDocument4 pages144 - ECO-14 - ENG D18 - CompressedYzNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Afar 2 - 11Document1 pageAfar 2 - 11Panda ErarNo ratings yet

- Afar 2 - 10Document1 pageAfar 2 - 10Panda ErarNo ratings yet

- Afar 2 - Installment SalesDocument1 pageAfar 2 - Installment SalesPanda ErarNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Audit of Shareholders' EquityDocument1 pageAudit of Shareholders' EquityPanda ErarNo ratings yet

- Activity in Discounted Cash Flows MethodDocument2 pagesActivity in Discounted Cash Flows MethodPanda ErarNo ratings yet

- Quiz 8Document1 pageQuiz 8Panda ErarNo ratings yet

- UntitledDocument1 pageUntitledPanda ErarNo ratings yet

- AFAR 3 - Quiz On Intercompany TransactionsDocument1 pageAFAR 3 - Quiz On Intercompany TransactionsPanda ErarNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityPanda ErarNo ratings yet

- Problem 1Document1 pageProblem 1Panda ErarNo ratings yet

- Quiz 8Document2 pagesQuiz 8Panda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Problem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofDocument1 pageProblem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofPanda ErarNo ratings yet

- Quiz 10Document1 pageQuiz 10Panda ErarNo ratings yet

- Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnDocument1 pageProblem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnPanda ErarNo ratings yet

- Quiz 2Document1 pageQuiz 2Panda ErarNo ratings yet

- Problem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesDocument1 pageProblem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesPanda ErarNo ratings yet

- Acctg 3B Activity On PAS 20 and 23Document1 pageAcctg 3B Activity On PAS 20 and 23Panda ErarNo ratings yet

- Acctg 7 - Activity For Everybody (Joint and By-Product Costing)Document1 pageAcctg 7 - Activity For Everybody (Joint and By-Product Costing)Panda ErarNo ratings yet

- Problem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsDocument1 pageProblem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsPanda ErarNo ratings yet

- Quiz #4 - Printed VersionDocument2 pagesQuiz #4 - Printed VersionPanda ErarNo ratings yet

- Afar 2 - 4Document1 pageAfar 2 - 4Panda ErarNo ratings yet

- Afar 2 - 1Document1 pageAfar 2 - 1Panda ErarNo ratings yet

- Afar 2 - 3Document1 pageAfar 2 - 3Panda ErarNo ratings yet

- Problem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atDocument1 pageProblem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atPanda ErarNo ratings yet

- Acctg6 ABCDocument1 pageAcctg6 ABCPanda ErarNo ratings yet