Professional Documents

Culture Documents

Afar 2 - 10

Uploaded by

Panda Erar0 ratings0% found this document useful (0 votes)

5 views1 pageAFAR

Original Title

AFAR 2 - 10

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAFAR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageAfar 2 - 10

Uploaded by

Panda ErarAFAR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

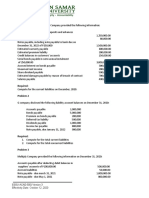

AFAR 2 – PARTNERSHIP OPERATION

Problem 1: On October 31, 2021, Z and J formed a partnership by investing cash of 300,000 and 200,000, respectively. The

partners agreed to receive an annual salary allowance of 360,000 and to give Z a bonus of 20% of net income after partner’s

salaries, the bonus being treated as an expense. If the profits after salaries and bonus are to be divided equally, and the profits on

December 31, 2021 after partners’ salaries but before bonus of Z is 360,000, how much is the share of Z in the profit?

270,000

You might also like

- Fixed and Flucuating Capital AccountDocument3 pagesFixed and Flucuating Capital AccountArun AroraNo ratings yet

- AFAR II - Partnership Operation Problem SolvingDocument2 pagesAFAR II - Partnership Operation Problem SolvingAvianne VillanuevaNo ratings yet

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriNo ratings yet

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- The Partners Elect To Use The Bonus Method To Record The Admission. Any Bonus Should Be Divided in The Old Ratio of 4:6Document1 pageThe Partners Elect To Use The Bonus Method To Record The Admission. Any Bonus Should Be Divided in The Old Ratio of 4:6Fucio, Mark JeroldNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- Finals ProblemsDocument9 pagesFinals Problemsr3gjc.nfjpia2223No ratings yet

- 2 Partnership OperationDocument2 pages2 Partnership OperationMichael CayabyabNo ratings yet

- Assignment - Principles of Acct. - Ii PDFDocument3 pagesAssignment - Principles of Acct. - Ii PDFbereket nigussieNo ratings yet

- Problem 3Document11 pagesProblem 3Charmaine Kaye OndoyNo ratings yet

- Partnership Accounts Fundamentals of Partnershi1Document16 pagesPartnership Accounts Fundamentals of Partnershi1ramandeep kaur100% (1)

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Drill 2 Partnership OperationDocument1 pageDrill 2 Partnership OperationcpacpacpaNo ratings yet

- Bac 204Document4 pagesBac 204mahmoudfatahabukarNo ratings yet

- Practice Sheet CH - Fundamentals (IOC & IOD)Document3 pagesPractice Sheet CH - Fundamentals (IOC & IOD)vaibhavbananiNo ratings yet

- Parcor 3Document3 pagesParcor 3Joana Mae BalbinNo ratings yet

- Partnership Mock ExamDocument4 pagesPartnership Mock ExamCleo Meguel AbogadoNo ratings yet

- Acc 201 CH 10Document16 pagesAcc 201 CH 10Trickster TwelveNo ratings yet

- 15 May Accounts TestDocument1 page15 May Accounts TestPrashantu MerNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Ch1 AssignmentDocument3 pagesCh1 AssignmentRachit JainNo ratings yet

- Partnership Installment Sales Problem Quiz 1Document5 pagesPartnership Installment Sales Problem Quiz 1Jeric TorionNo ratings yet

- 17 Questions Investment in Associate 1Document2 pages17 Questions Investment in Associate 1bernadeth.lorzanoNo ratings yet

- Partnership Q5Document2 pagesPartnership Q5Lorraine Mae RobridoNo ratings yet

- Partnership Fundamental 12 (2023)Document3 pagesPartnership Fundamental 12 (2023)Hansika SahuNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- A and B Are Partners Sharing Profits and Losses in The Ratio of 2Document2 pagesA and B Are Partners Sharing Profits and Losses in The Ratio of 2Dark SoulNo ratings yet

- ACCOUNTING 2 - ProblemsDocument6 pagesACCOUNTING 2 - ProblemsJasmin NoblezaNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- CBE June 22 - QDocument8 pagesCBE June 22 - QNguyễn Hồng NgọcNo ratings yet

- Accounts TestDocument2 pagesAccounts TestAPS Apoorv prakash singhNo ratings yet

- GCL Retirement & Death Practice Paper 1Document2 pagesGCL Retirement & Death Practice Paper 1Ananya BhargavaNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Fundamental of Partnership - Test-17-11-2023Document2 pagesFundamental of Partnership - Test-17-11-2023umangchh2306No ratings yet

- Morris - Breann - Exam #3 Fall 2020Document3 pagesMorris - Breann - Exam #3 Fall 2020Breann MorrisNo ratings yet

- Practical (TSG 2020-21)Document24 pagesPractical (TSG 2020-21)Gaming With AkshatNo ratings yet

- C8 Note PayableDocument28 pagesC8 Note PayableJoana RidadNo ratings yet

- Midterm Quiz 2 Afar2Document8 pagesMidterm Quiz 2 Afar2LJ Diane TuazonNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- Acc Sample Paper 3 Typed by DhairyaDocument5 pagesAcc Sample Paper 3 Typed by DhairyaMaulik ThakkarNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Jeremeh V Querol Bachelor of Science in Tourism ManagementDocument8 pagesJeremeh V Querol Bachelor of Science in Tourism ManagementJasmine ActaNo ratings yet

- A1C019118 Jurati Latihan7Document6 pagesA1C019118 Jurati Latihan7jurati100% (1)

- Accounting For ST - Activity 2Document8 pagesAccounting For ST - Activity 2Aretha Joi Domingo PrezaNo ratings yet

- Midterm Exams - 1ST YrDocument7 pagesMidterm Exams - 1ST YrMark Domingo MendozaNo ratings yet

- Problems Bonds-PayableDocument8 pagesProblems Bonds-PayableKezNo ratings yet

- Accounting For Special Transaction 2Document3 pagesAccounting For Special Transaction 2Nicole Gole CruzNo ratings yet

- Chapter8 Note PayableDocument24 pagesChapter8 Note PayableKristine Joy Peñaredondo BazarNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- Quiz - (Evening Class)Document4 pagesQuiz - (Evening Class)JeonNo ratings yet

- Midterm Exam - 2BSA1Document3 pagesMidterm Exam - 2BSA1joevitt delfinadoNo ratings yet

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- Quiz OperationsDocument4 pagesQuiz OperationsAngelo VilladoresNo ratings yet

- Basic Concept (Test)Document4 pagesBasic Concept (Test)Midhun PerozhiNo ratings yet

- Class XII Assignment - 3 Accounting For Partnership Firms-Fundamentals 1Document5 pagesClass XII Assignment - 3 Accounting For Partnership Firms-Fundamentals 1Lester WilliamsNo ratings yet

- Quiz 1 - Partnership Formation and OperatonDocument4 pagesQuiz 1 - Partnership Formation and OperatonMarcel BermudezNo ratings yet

- FUNDAMENTAL OF PARTNERSHIP Class 12Document1 pageFUNDAMENTAL OF PARTNERSHIP Class 12Varun HurriaNo ratings yet

- Prelim Take-Home ExamDocument8 pagesPrelim Take-Home ExamMelanie SamsonaNo ratings yet

- Audit of Liabilities - Set BDocument4 pagesAudit of Liabilities - Set BZyrah Mae Saez0% (1)

- Activity in Discounted Cash Flows MethodDocument2 pagesActivity in Discounted Cash Flows MethodPanda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Afar 2 - 11Document1 pageAfar 2 - 11Panda ErarNo ratings yet

- Quiz 8Document2 pagesQuiz 8Panda ErarNo ratings yet

- Afar 2 - Installment SalesDocument1 pageAfar 2 - Installment SalesPanda ErarNo ratings yet

- UntitledDocument1 pageUntitledPanda ErarNo ratings yet

- Audit of Shareholders' EquityDocument1 pageAudit of Shareholders' EquityPanda ErarNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityPanda ErarNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Quiz 8Document1 pageQuiz 8Panda ErarNo ratings yet

- Quiz 2Document1 pageQuiz 2Panda ErarNo ratings yet

- AFAR 3 - Quiz On Intercompany TransactionsDocument1 pageAFAR 3 - Quiz On Intercompany TransactionsPanda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Problem 1Document1 pageProblem 1Panda ErarNo ratings yet

- Problem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atDocument1 pageProblem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atPanda ErarNo ratings yet

- Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnDocument1 pageProblem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances OnPanda ErarNo ratings yet

- Problem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofDocument1 pageProblem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofPanda ErarNo ratings yet

- Acctg 3B Activity On PAS 20 and 23Document1 pageAcctg 3B Activity On PAS 20 and 23Panda ErarNo ratings yet

- Problem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsDocument1 pageProblem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsPanda ErarNo ratings yet

- Quiz 10Document1 pageQuiz 10Panda ErarNo ratings yet

- Acctg 7 - Activity For Everybody (Joint and By-Product Costing)Document1 pageAcctg 7 - Activity For Everybody (Joint and By-Product Costing)Panda ErarNo ratings yet

- Afar 2 - 4Document1 pageAfar 2 - 4Panda ErarNo ratings yet

- Quiz #4 - Printed VersionDocument2 pagesQuiz #4 - Printed VersionPanda ErarNo ratings yet

- Afar 2 - 2Document1 pageAfar 2 - 2Panda ErarNo ratings yet

- Afar 2 - 1Document1 pageAfar 2 - 1Panda ErarNo ratings yet

- Afar 2 - 3Document1 pageAfar 2 - 3Panda ErarNo ratings yet

- Problem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesDocument1 pageProblem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesPanda ErarNo ratings yet

- Acctg6 ABCDocument1 pageAcctg6 ABCPanda ErarNo ratings yet