Professional Documents

Culture Documents

Does Globalisation Shape Income Inequality

Uploaded by

Hriidaii ChettriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Does Globalisation Shape Income Inequality

Uploaded by

Hriidaii ChettriCopyright:

Available Formats

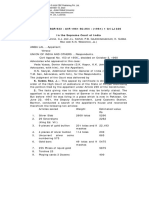

Does Globalisation Shape Income Inequality?

Empirical Evidence from Selected

Developing Countries

Author(s): Mirajul Haq, Iftikhar Badshah and Iftikhar Ahmad

Source: The Pakistan Development Review , 2016, Papers and Proceedings: The 32nd

Conference of the Pakistan Society of Development Economists, December 13 - 15, 2016,

Islamabad (2016), pp. 251-270

Published by: Pakistan Institute of Development Economics, Islamabad

Stable URL: https://www.jstor.org/stable/44986487

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

is collaborating with JSTOR to digitize, preserve and extend access to The Pakistan

Development Review

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Papers and Proceedings

pp. 251-270

Does Globalisation Shape Income Inequality?

Empirical Evidence from Selected

Developing Countries

MlRAJUL HAP, IFTIKHAR BADSHAH, and IFTIKHAR AHMAD

As economies of the world are getting more and more interdependent, hence, a large

segment of economic literature investigated the impact of globalisation on income inequality.

However, the empirical investigations on the impacts of globalisation on income distribution

are still inconclusive. Keeping in view the inconclusiveness, in this study we investigated the

relationship between globalisation and income inequality using five different proxies of

globalisation. The empirical analysis estimates five empirical models by using a panel data

approach for a set of 44 developing countries spanning from 1980-2014. Considering the

nature of data set, the empirical estimation has been carried out through GMM estimation

technique. The findings of the study reveal that overall globalisation cannot explain income

inequality; however, we found insights for the positive relationship between economic

globalisation and income inequality in the sample countries. In addition, the findings of the

study also indicate that average, and effective tariff rates explain negatively income inequality

in the sample countries. Based on study findings, it is safely concluded that economic

globalisation and income inequality move parallel in the sample countries.

JEL Classification: F01, 015, F13, C23

Keywords : Globalisation, Income Inequality, Tariff Rates, Panel Data

1. INTRODUCTION

1980s was the favourable era for trade liberalisation, as most of the dev

countries replaced its restrictive and import substitution policies with export

and import liberalisation policies. The primary objective of the developing co

to integrate with developed countries in order to enhance the pace of econom

through technological diffusion. As a result, in the last decade of the 20th cen

trade flows is significantly increased, and the diffusion of technology is rap

across the globe. However, with the advent of World Trade Organisati

globalisation and its impacts on income distribution got space as a heated issu

economists and policy-makers. Despite the fact that, the distributional

globalisation is one of the appealing research subjects, though empirical literat

away from consensus.

Mirajul Haq <haqmirajeco@gmail.com> is Assistant Professor, International Institute

Economics, International Islamic University, Islamabad. Iftikhar Badshah <iftikhar.badshah@

MPhil scholar at International Institute of Islamic Economics, International Islamic Universi

Iftikhar Ahmad <iftikhar@pide.org.pk> is Assistant Professor, Pakistan Institute of Developme

Islamabad.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

252 Haq, Badshah, and Ahmad

For instance, some studies have an optimistic view

reducing income inequality in both developed and develop

[DeadrofF and Stern (1994); Sylwester (2005); Ciaessens an

argued that the integration of developing economies with

developing countries, which increases economic grow

distribution of income in the developing countries. Th

conclusion that, in the presence of sound financial instit

liberalisation of capital account provides accessibility o

resources. Accessibility to finance enhancing their capaci

accumulation, hence income gap between skill and uns

other studies, for instance Boltho (1975) argue that

governess Japan and South Korea have achieved higher gr

trade policies without negative impact on the distri

recipients.

Some empirical studies came with pessimistic view, that globalisation always

widening income gap. These studies also justified their claim in trade inflow, and argued

that globalisation integrates developing countries with developed countries as result in

developing countries flow of capital goods, machinery, and technology increases.

However, as, most of the developing countries have relatively scarcity of skilled labours,

as a result demand for skilled labours increase that intern widen the wage gap increases

between skilled and unskilled workers [Basu and Guariglia (2007); Celik and Basdas

(2010)]. Considering the negative impact of globalisation on distribution of income in

developing countries, Lundberg and Squire (2003) emphasised on those trade

liberalisation policies, which creates an employment opportunity for the low-income

class to mitigate the wage gap between skilled and unskilled labours in the developing

countries. Keeping in view this inconclusiveness, in this study we investigated the

relationship between globalisation and income inequality using five different proxies of

globalisation.

In past a number of studies have been carried out on the distributional impact of

globalisation. However, most of the existing studies analysed the impact of overall

globalisation, or economic globalisation. However, we believe that the distributional

impact of globalisation deserves further investigation. Hence, unlike previous studies in

this study we investigated the distributional impact of globalisation more rigorously using

five different proxies of globalisation. 1 In this association an empirically analysis have

been carried out in case of 44 developing countries with time span from 1980-2014.

The remaining of the study is organised as follows. Section 2 presents some

relevant literature on the topic. Section 3 consists of methodology including empirical

model, data, and data sources, sample, and estimation technique. Section 4 comprises

empirical analyses along with robustness check. The study concludes with Section 5.

2. LITERATURE REVIEW

As this study is exploring the relationship between globalisation

inequality, hence this section of the study is devoted to review the existing l

Tive proxies of globalisation have been used; Overall Globalisation, Economic Globalis

GDP Ratio, Average T ariff Rate, and Effective Tariff Rate.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 253

have linked globalisation with income inequality. Studies on the link be

globalisation and income inequality broadly fall into three groups. First, stud

argued for the negative effect of globalisation on income distribution. For instan

their standard trade model Stolper and Samuelson (1941) showed that wage gap m

reduce due to trade openness between skilled and unskilled workers in the develo

countries. The predication of this standard trade model is empirically verified by

recent studies, for instance, Reuveny and Li (2003); Grossman and Rossi-Han

(2008) among others.

The earlier work of Stolper and Samuelson (1941); Rybczinsky (1955);

Mundell (1957), hold the claim that trade openness prove beneficial for inc

distribution in developing countries; as developing countries have relatively abun

unskilled labour, therefore its exports mostly embodied with labour inten

commodities that in turn increase wages of unskilled labour.

With trade liberalisation policies, country can harvest the potential gai

resource endowments. Such strategies may enhance pace of economic growth that i

decline the dispersion of unequal income distribution in the developing coun

According to the findings of Dollar and Kraay (2001a) in 1990s the average per ca

income of the liberalised developing countries increased by 5.0 percent, dev

countries by 2.2 percent, and developing countries that have not liberalised

increased by 1.4 percent. Similarly, in country specific study Wei and Wu (2001)

that, most of the Chinese cities participated in the liberalisation process in

therefore economy become more integrated with the rest of world, as a result, i

inequality gap reduced significantly between rural-urban regions.

Besides, several studies Borjas and Ramey, (1994); Francois and Nelson (1

found that with expansion of trade, wage inequality declined in the US econ

Whereas, number of studies found a significant and positive relationship be

openness and income inequality in the developing countries such as Sachs an

(1996); Barro (2000); Lundberg and Squire (2003). These studies explained their

in the growth and employment impact of globalisation, and argued that t

liberalisation in developing countries enhanced pace of economic growth and

created employment opportunities. However, they hypothesised that, as the bene

economic growth are not equally distributed, hence poor segment of population c

get the potential benefit of globalisation, as a result income gap between skil

unskilled labours has increased. The empirical findings of Christiaensen, et al. (20

World Bank (2006) concluded that, economic growth is further skewed due to ope

whereas, its benefits has not been equally distributed within Sub-Saharan A

countries.

Rising regional inequality within a nation is a serious concern to quantify li

standards among different regions in the world. Some empirical studies sho

significant positive relationship between trade openness and regional income ineq

For instance, in country specific study Daumal (2013) found that, trade openness

positive impact on regional income inequality among the Indian states, whereas, r

regional inequality in case of Brazil. In addition, he found that FDI inflows r

regional income inequalities in both Indian and Brazilian economies. Explaini

findings, he argued that as India started trade liberalisation policies in mid 1980s

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

254 Haq, Badshah, and Ahmad

in the post-liberalisation period (1991-2005), regional

correlation coefficient is equal to 0.96. On the other h

openness reduced regional inequality in the same period,

equal to -0.75. Kanbur and Zhang (1999) of rising regio

from 0.19 to 0.26 in the post liberalization period of 1985

similar results. Supplement Kanbur and Zhang (1999) find

argued that, income inequality is worsens in the cros

economies in case of China. In similar line, Zhang and Zh

liberalization improves regional income inequality in China

Furthermore, several studies found that, with glo

skilled labour is growing faster than the premium of un

countries. For example, Robbins (1996) estimated the effe

wages premium in Colombia with the time span from

conclusion that wage dispersion has increased in liberalise

one. In addition, Robbins and Gindling (1999) found same

Green, et al. (2001) examined that, on average, openness ha

skilled qualified workers. Whereas, the opposite results o

non-educated workers in case of Brazil. Similarly, Beyer, e

positive relationship between trade liberalisation and wage

in Chile within the time span of 1960-1996.

A reasonable number of empirical studies have inv

between globalisation and income distribution in case

instance, Spilimbergo, et al. (1999) argued for a positi

openness and income inequality in skill-abundant dev

several other studies assert a significant positive relations

and inequality in the developed countries [Borjas, et

(1992); Karoly and Klerman (1994); Pritchett (1997); Be

and Leichenko (2004)]. Atkinson (2003) in his empirica

globalisation income inequalities has increased in the OEC

and Gaston (2008) explored the relationship between glob

using industrial wage inequality and household income in

of openness of the time span 1970-2000, they concluded th

in the OECD countries.

The empirical literature on the subject depicts a non-linear relationship between

globalisation and income distribution, for instance, in country specific study Jalil (2012)

find that in case of China, at the start income inequality increases with the expense of

openness, however, it falls after a certain level of openness. Similarly, using data set of

18 Latin American countries, Dodson and Ramlogan (2009) argued for the inverted U-

Shaped relationship between trade openness and income inequality. Based on the study

findings, they concluded that along with liberalisation policies governments also have to

prompt the re-distribution policies, hence to mitigate the negative effects of trade

liberalisation on income distribution.

Some of the empirical evidence predicts a differential impact of trade openness on

wage inequality. For instance, Wood (1997) examined that wage inequality is reduced

from 1970s to 1980s in the East Asian economies, because of trade liberalisation, which

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 255

reduces the wage gap between skilled and unskilled workers. Whereas, in case of

American economies wage inequality is increased in 1990s. In addition, some

found an inconclusive relationship between globalisation and income inequalit

example, Hennighausen (2014) examined the relationship between trade openn

capital movements with income inequality in OECD countries. The study fou

evidences of the correlation between openness and capital mobility. Similarly, Do

Kraay (2001b) came with the conclusion that globalisation have no impact on the

shares of the poorest quintiles in a cross-sectional studies. Similarly, Higg

Williamson (1999), Bowles (2001), and Edwards (1997) used more sophist

estimation techniques and came with the conclusion that trade openness cannot e

income inequality.

3. EMPIRICAL ANALYSES

Our objective is to analyse the income distributional effect of globalisat

meet the objective, we work with panel data set of 44 developing countri

from 1980-2014. We start our estimation with the following base-line model.

INCIit = ß0 + ßiGBit -I- ß2Xit + [ii + vt + sit ... ... ... (1)

Income inequality INCIit is our dependent variable; Globalisation ( GBu ) is

variable of interest that further classified in five different variables namely, over

globalisation, economic globalisation, trade openness, average tariff rate, and effect

tariff rate: Xu is the vector of control variables namely, per capita real GDP, depend

ratio, human capital, inflation rate and government size. Whereas fit and vt de

unobserved cross-sectional and time specific effects respectively, t is the error term.

3.2. Definition and Construction of Variables under Consideration

The dependent variable is income inequality, a number of methods have been

developed to measure income inequality. The one well standard measure of income

inequality is GINI Coefficient developed by Corrado Gini (1912). The value of GINI

coefficient lies between zero and one, value closer to zero indicates equal

distribution, whereas, value closer to one indicates an unequal distribution of income.

Most of the empirical literature captured income inequality with GINI coefficient and

used the Luxembourg Income Study (LIS) data base of GINI coefficient. However,

this data set has two major limitations. First, the dataset is just developed for thirty

richest economies of the world; second, the data set have a short time span that just

start from 1990.

In this study, we used a SWIID income inequality data set, which has created by

Solt (2014). This data set have some advantage over LIS data set. First, the data set is

developed for a large number of countries. Second, the data set have a long time span,

last but not the least, the data set is the comparison of different components of inequality,

hence it is very easy to check the robustness of three different inequality approaches

(consumption, income and gross income).

Among explanatory variables, the variable of interest is globalisation, which

defines as, "the integration of regional and national economies across the boarders

through economic, political, social, and cultural changes, and with the exchange of

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

256 Haq, Badshah, and Ahmad

goods, services and capital with rest of the world econom

globalisation is the sub-index of economic, social, and political

Whereas, the index of economic globalisation exhibits the

the national economy with rest of the world through the way

technological spill over and exchange of goods and servic

globalisation index is taken from the KOF index of globalisati

are average tariff rate ( ATRit ) and effective tariff rate ( ET

prominent policy variables to measure the degree of openness.

using to represent the inflow of imported goods. The received

Dobson and Ramlogan (2009) shows that, ATRit is relatively be

then TOPENjt, because, the trade ratio is highly correlat

technological innovation and macroeconomic fluctuations, data

taken from World Development Indicators (World Bank).4

Effective Tariff Rate ( ETRit ) is the ratio of tariff revenue

and Zhang (2005)], which measures complete pattern of product

addition, it measures the overall effect of tariffs on value added

industry, when both intermediate and final goods are imported

we choose a set of control variables, keeping in view its im

distribution determinant, and its potential in the affecting of i

of globalisation. In control variables, we have economic growth

and across countries. A number of studies have investigated a

relationship between economic growth and income inequali

benefits of an increase in economic growth cannot receive by

population. In most of the developing economies, economic gr

gap between rich and poor peoples [Bourguignon (1981); L

(2000)]. Furthermore, several studies explored a negative relat

GDP and income inequality [Persson and Tabellini (1994);

(2008)]. In this study, we use growth per capita real GDP inste

real GDP, as it is highly correlated with inflation and fin

(2010)]. The data is taken from World Development Indicator (

Our next explanatory variable is dependency ratio, which

population age is younger than 15 years and its age is above 65

than 15 and above 65 is taken as a percentage of working age

ratio also varies both overtime, and across countries. The d

Development Indicator (WDI), of the World Bank. Inflati

persistence and continued increase in the general price level o

literature Cutler and Katz (1992), and Clarke, et al. (2006) sign

of inflation rate on income inequality, and argued that higher

wages as a result employment opportunity is created, which af

used GDP deflator as a proxy of inflation, the data is taken f

Bank.

2The detailed list of all variable is provided by Dreher, et al. (2008).

Available at http://globalization.kof.ethz.ch/query/

4http://econ. worldbank.org/WBSITE/EXTERNAL/EXTDEC/EXTRESEA

044- pagePK: 642 1 4825 -piPK: 642 1 4943 -theS itePK : 4693 82, 00. html

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 257

Human capital means level of education, job, and fitness expression of workers

[Salvatore (2011) p. 141]. Broadly, human capital comprises into four ingredients that

embodied in human namely skill, experience, education, and intelligence. In this stud

we used secondary school gross enrolment as a proxy of human capital. The variable s

of government represents an actual state of an economy. The government size may aff

income inequality with the allocation of public goods, interference in the market pla

and redistributive expenditures [Dreher, et al (2008)]. The renewed literature Ru

(2004), Lim and McNelis (2014) signifies the positive impact of government spending

income inequality. In this study, we use government final consumption expenditure

proxy of government size.

3.3. Data and Data Sources

To examine the impact of globalisation on income inequality, we used dataset o

forty four developing countries spanning from 1980-2014.5 The data is collected fro

secondary sources, that average tariff rate and effective tariff rate are taken from W

Development Indicator (WDI), of the World Bank. The data for economic globalisatio

and overall globalisation are taken from KOF index of globalisation,6 and the G

coefficient (income inequality) is from Standardised World Income Inequality Databa

(SWIID), which is developed by Solt (2014).

3.4. Estimation Technique

As our data set is panel in nature, hence in the first stage empirical mode

estimated with pooled OLS. However, the results of pooled OLS is inefficient as the

hypothesis of Breusch-Pagan (1979) test 5U2 = 0 cannot accepted for all specification

indicates that intercept values are not remain the same across cross section;7 w

directed us for Random Effect. Next, we applied the Hausman (1978) test to ma

choice between Random and Fixed effects. The null hypothesis of Hausman t

H0'" fixed effects are not efficient estimates ". In all cases, the null hypothesis of Hau

test is rejected, which indicate for fixed effects.8 Next, we have used Redundant Fi

Effects test to make a choice among cross section, time effect and both cross section

time effects. In all three cases the null hypothesis H0: " There is no fixed effect" is rej

for all our specifications, which indicate the existence of fixed effect.9 The last bu

the least, we applied the Serial Correlation (LM)Test, as, the null hypothesis H0 : " n

serial correlation "10 is rejected in all specifications. Keeping in view the result

safely concluded that our model is dynamic in nature; hence, we used the Generalis

Method of Moments (GMM) developed by Arellano and Bond (1991) to estimate

dynamic model of panel data.

5In Appendix D Table 1 presents the complete list of developing countries.

Available athttp://globalization.kof.ethz.ch/query/

The results of Bruesch-Pagan specification test are presented m Appendix C Table 1.

8The results of Hausman specification test is presented in Appendix "C' Table 2.

9The results of Redundant Fixed Effects tests are presented in Appendix "C" Tables 3, 4 and 5, w

direct us for the existence of fixed effects.

In Appendix "C" Table 6 has the results of LM test, which direct us the existence of serial correlat

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

258 Haq, Badshah, and Ahmad

In dynamic panel data models, GMM have some advantages

First, GMM allows estimation under those restrictions, which a

theory, hence supplementary assumption are not required. Seco

maintains serial correlation, GMM taking into account the seria

provides efficient estimations even with additional moment c

estimators control the unobserved effects through differencing

4. EMPIRICAL FINDINGS AND INTERPRETATION

The empirical findings have been carried out through GMM techniques

five different proxies of globalisation. The GMM estimator is providing con

significant results in case of dynamic model. As presented earlier that, w

specifications which contains different proxies of globalisation. In specificat

variable of interest is overall globalisation ( OGit ) enters the model with ne

which is not statistically significant. This may be due to the reason t

globalisation is the composite index of three sub-indices economic, social and

globalisations. Among these, social and political globalisations have less

income inequality. Our findings are in line with the findings of Bergh and N

that came up with the conclusion that political and social globalisations cann

income distribution in the developing countries.

In model (2), the overall globalisation is replaced with economic glo

( EG¡ ,), which enters the model with positive sign that is statistically signi

percent. The result indicates that economic globalisation worsen the unequal

of income in the selected developing countries. There are two possible ju

First, as developing countries enhance its trade ties with developed one

imports of capital goods (machinery, and new technology) increases, that inte

demand for skill labour increased. However, as developing countries have ab

unskilled labours, hence large segment of labour force cannot harvest the b

result are in line with some of the existing studies [Gopinath and Chen (20030

(2006); Basu and Guariglia (2007); Celik and Basdas (2010)]. Second,

developing countries mostly facilitated the capitalist and richest segment of

hence a large segment of population cannot harvest the potential gain of FD

is in line with the findings of IMF (2007), which lend support to the cla

increase income inequality as it support richest class of the developing coun

result is also supported by the findings of Zhang and Zhang (2003) and Jaum

(2013) argued that, capital inflow into developing countries increase wage ga

skilled and unskilled workers, as, developed countries mostly invested FDI a

sectors in the developing countries. 11

In specification 3 (column 4) trade openness TOPENit hold positive s

signifying a positive impact of trade openness on income inequality. This resu

with previous empirical findings of Marjit, et al. (2004), and Asteriou, et al.

MFor instance, several empirical studies [Kanbur and Zhang (1999); Zhang and Kanbur (

that, economy of China is liberalised in the decade of 1980s and become the second largest re

whereas, income inequality is worsens since from the last three decades. In this connection, Kra

(2016) argued that, globalisation provide more potential benefits to the rich class instead of lowe

developing countries.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 259

following are some possible justification of the result. Liberalisation of trade pro

opportunity to domestic manufacturing in international market, hence to m

requirements of international market demand manufacturing sector of dev

countries adopt international quality standard in the manufacturing process

increase demand for skilled labour and therefore increases wages of skilled labour.1

In specifications 4 (column 5), and 5 (column 6) the variable of int

globalisation is captured with average tariff rate ATRit, and effective rate

respectively. Both variables enter the models with negative signs (-0.046) and (-0.

respectively that are statistically significant. The results indicate that, an increase

tariff rates decline income inequality in the developing countries. The one

justification is that, an increase in the tariff rates decline integration of dev

countries with rest of the world. The result supplements our previous findin

economic globalisation and trade openness expand income inequality in deve

countries.

Moreover, when we compare the magnitude of estimated coefficients of TO

and ATRjt, the coefficient value of TOPENit is lower than ATRit. This result are

with some of the existing studies Edwards(1997); Higgins and Williamson (

Ravallion (2001); Zhou, et al (201 1) explained that, as TOPENit is highly correlate

skill premium between skilled and unskilled workers, hence not properly explain i

inequality.

Almost our control variables appear in the base line specifications with expected

signs. For instance, growth of GDP per capita (PCGDPit) holds positive sign and is

statistically significant, denoting it's worsen impact on income inequality. This may be

due to the fact that a large segment of population cannot harvest the benefits of economic

growth in developing countries. Theresults are in line with previous findings of [Kaldor

(1956); Bourguignon (1981); Li and Zou (1998); Forbes (2000)].13

The sign of our subsequent variable dependency ratio (ADRit) is positive, which is

significant at one percent level in most of the specifications, indicates that dependency

ratio explain income inequality positively. As the number of dependents in a household

increases, this will increase income gap between employed and unemployed workers in

the developing countries. Our findings are in line with the empirical findings of Dreher,

et al (2008) and Bergh and Nilsson (2010). Similarly, inflation holds positive sign that is

significant at one percent level in most of the specifications. Similar findings have been

carried out by [Cutler and Katz (1992); Clarke, et al (2006)], which show that, higher

inflation negatively affect the distribution of income in the developing countries. The

monetary instability has an adverse effect on income distribution, as higher inflation

reduces real wages that creates an employment opportunity.

Human capital (SSEGit) on the other hand carries a negative coefficient which is

significant at one percent level indicating their positive impact on income inequality. Our

findings are in line with the empirical findings of Borensztein, et al (1998); Ciaessens

and Perotti (2007) that found a negative relationship between investment in human

12In similar lines, Zhu and Trefler (2005) found that, most of the Latin American countries adopted

export-led strategy in the decade of 1980s, hence, export level and wage inequality move in the same direction.

,3In addition, Jalil (2012) argue that emerging economy of China achieve higher economic growth in

the South Asian region, whereas, income inequality is increased with same proportion as with the increase in

economic growth.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

260 Haq, Badshah, and Ahmad

capital and income inequality. They argued that poor peopl

financial resources due to capital account liberalisation, th

capacity to invest in human capital accumulation. Gourdon, et

conclusion that, economic globalisation declines income inequa

which has at least primary educated labour force.

Similarly, Gregorio and Lee (2002) and Atif, et al. (201

education expenditure is a prominent policy variable that

finding of Wood (1997) and Bensidoun, et al. (2011) indicat

possess more educated labour force, take more benefits from

most important is the reduction of income inequality. Ou

signifying the impact of governments size (EXPit) on income i

countries. The following are some possible justifications of th

by World Bank (2006); Banerjee and Somanathan (2007); Kh

that in developing countries large portion of public exp

infrastructure, and telecom sector, which enhances the overall

however have worsened the income distribution. Second, the re

with rent seeking environment of developing countries as in

Wong (2016).

To test the consistency of the estimators we apply three di

Shapiro-Wilk (1965) test of normality, which null hypoth

distributed ". Results of Shapiro-Wilk test presented in T

specifications the W statistics is positive and is closer to

normally distributed. The second, test examines whether the e

model (Equation 1) is serially correlated or not. Results presen

that the P-value is greater than 0.05 in all specifications, hen

serial correlation " is not rejected, which support the dynamic

to check the validity of instrumental variables we used the S

Sargan test is greater than 0.05 in all specification, hence,

identifying restrictions are valid ' is not rejected, which

instrumental variables.

5. CONCLUSION

Rising income inequality in the developing countries through the integ

world economies is a controversial issue since 1980s. However; empirical

the impact of globalisation on income inequality is still inconclusive. Keeping

inconclusiveness, in this study we revisit the basic question that "Does

shape income inequality in developing countries". In this association, w

different proxies of globalisation using data set of 44 developing countries f

1980-2014.

Our empirical findings reveal that overall globalisation is not associated with

income inequality; however, economic globalisation has worsened impact on income

inequality. In addition, our estimates indicate that, average and effective tariff rates

improve income distribution in the sample countries. Thus our results provides evidences

to the worsen impact of economic globalisation on income inequality in the selected

developing countries.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 26 1

Table 4.1

Empirical Findings (Dependent Variable is Income Inequality)

Variables

PCGDPjt

(2.55)** (2.59)** (8.14)*** (3.00)*** (3.20)***

ADRu .020 .028 .021 .071 .037

(3.12)*** (3.90)*** (1.31) (1.55) (2.56)**

INFit .010 .011 .011 .011 .071

(11.79)*** (12.40)*** (8.64)*** (2.44)** (9.96)***

SSEGit -.003 -.009 -.018 .011 -.036

(-1.86)* (-4.20)*** (-4.83)*** (1.51) (-5.17)***

EXPit -.026 -.018 .037 .073 -.012

(-1.21) (-0.75) (1.45) (1.78)* (-0.96)

OGi, -.007 -

(-1.61)

EG* - .012

(4.06)***

TOPENit - - .004

(2.94)***

MR* - -.046

(-2.34)**

ETRit - - - -.062

(-11.18)***

Lag Dep .892 0.89 .741 .491 .841

(28.70)*** (25.09)*** (16.83)*** (9.52)*** (42.84)***

Noof Obs 490 490 583 204 170

Number of 41 41 71 63 32

Instruments

Shapiro Wilk Test 0.99 0.99 0.90 0.64 0.96

Serial 0.09 0.07 0.90 0.21 0.07

Correlation

SarganTest 29.23 24.85 25.01 17.60 24.33

P-Value

Note: ***,

statistics

inequality

Wilk and

APPENDIX A

Table Al

Descriptive Statistics of Variables under Consideration

Variables Obs

INCIit 1167 44.30 6.35 27.32 63.51

PCGDPjt 1435 7.32 1.05 4.95 9.62

ADR« 1496 73.50 16.77 36.04 112.77

INFit 1448 16.64 27.7 -27.05 265.20

HQt 1055 54.973 25.37 5.12 109.62

GSIZit 1422 12.935 4.34 2.05 31.82

OGi, 1434 45.81 12.16 15.86 79.31

EGi, 1434 45.63 15.17 9.75 85.15

TOPENi, 1403 63.41 33.95 13.18 199.36

ATRit 745 15.68 12.99 1.4 106.5

ETRj,

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

262 Haq, Badshah, and Ahmad

APPENDIX B

Table B1

Pooled OLS Estimation Results

Variables Model 1 Model 2 Model 3 Model 4 Model 5

PCGDPj, 1.87*** 1.57*** 2.06*** 2.17*** 2.06***

(5.85) (5.12) (4.73) (6.25) (4.73)

ADRit .090 *** .087*** .063** .136*** .063**

(5.06) (5.06) (2.50) (5.66) (2.50)

INF¡, .026 *** .029*** .055** .025*** .055**

(3.14) (3.51) (2.02) (2.67) (2.02)

SSEGit -.013 -.014 -.015*** -.004 -.015

(-1.34) (-1.52) (-1.17) (-0.33) (-1.17)

EXPi, .289*** .256*** .387*** .251*** .387***

(5.04) (4.47) (4.26) (3.11) (4.26)

OGit .062** -

(2.21)

EGit - .083*** -

(4.32)

TOPENit - - -.171**

(-2.61)

ATRit - -.059**

(-2.53)

ETRi, - -.171**

(-2.6

BP test 31.42 37.76 4.38 7.24 4.38

Prob 0.00 0.00 0.036 0.007 0.036

No of Obs 759 759 308 411 308

SE of Reg .027 .019 .065 .023 .065

Note: ***, **, *presents level of significance at 1 percent

statistics are in parenthesis. The dependent variable is in

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 263

Table B2

Fixed Effects Estimation Results

Variables Model 1 Model 2 Model 3 Model 4 Model 5

PCGDPit 8.18*** 7.87*** 7.181** 5.54*** -5.25**

(11.56) (12.34) (2.04) (7.22) (-2.31)

ADRit .071*** .079*** .101 .055** .277***

(3.15) (3.86) (1 58) (2.10) (4.30)

INFj, .021*** .029*** .025** .011** -.009

(3.74) (3.56) (2.55) (2.18) (-0.47)

SSEGit -.015 -0.019 -0.025 -0.052** .007

(-1.01) (-1.41) (-0.39) (-2.39) (0.19)

EXPit .121** .119** .111 .204*** . 439 ***

(2.23) (2.21) (1.38) (3.25) (2.82)

OGit -.092*** -

(-2.86)

EGit - -0.089*** -

(-3.59)

TOPEN« - - -.017

(-0.88)

ATRit - -O.026*

(-1.87)

ETR¡, - -0.187***

(-2.63

BP test 31.42 37.76 23.40 7.24 4.38

P-values 0.00 0.00 0.00 0.007 0.03

No of Obs 759 759 759 411 178

SE of Reg 0.032 0.022 0.019 0.014 0.071

HausmanTest 33.33 35.06 46.06 12.81 21.07

P-values 0.00 0.00 0.00 0.04 0.001

Note: ***, ♦*, *presents level of significance at 1

statistics are in parenthesis. The dependent varia

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

264 Haq, Badshah, and Ahmad

Table B3

Random Effects Estimation Results

Variables Model 1 Model 2 Model 3 Model 4 Model 5

PCGDPit 5.92*** 6.02*** 5.33*** 4.03*** 3.64***

(10.04) (n-01> (9-74) (6-43) (42°)

ADRj, .084*** .079*** .098*** .063** .183***

(3.80) (3.98) (5.16) (251) (4.44)

rNFit .019*** .018*** .023*** .011** .016

(3.54) (3.33) (4.25) (2 og) (0 g6)

SSEGj, -.004 -.003 -.003 -.035* .045***

(-0.28) (-0.23) (-0.26) (-1.80) (3 03)

EXPit .092* .096* .099* .188*** .093

(1.71) (1.80) (1.88) (3 03) (1.04)

OGit -.042 -

(-1.39)

EGit - -.059*** -

(-2.75)

TOPENi, - - -.007

(-0.82)

ATRit - -.035***

(-2.6)

ETRit - -.052

(-0.9

BP test 31.42 37.76 23.40 7.24 4.38

P-values 0.00 0.00 0.00 0.007 0.03

No of Obs 759 759 759 411 308

SE of Reg .031 .022 .008 .013 .057

HausmanTest 33.33 35.06 46.06 12.81 21.07

P-values 0.00 0.00 0.00 0.04 0.001

Note: ***, **, *presents level of significance a

statistics are in parenthesis. The dependent v

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 265

APPENDIX C: SPECIFICATION TESTS RESULTS

Table CI

Bruesch and Pagan Test Results

H0: Constant Variance

Probability 0.00

Table C2

Hausman Test Results

Null Hypothesis: Fixed-Effects are not effective estimates

Chai2

P-Values

Table C3

Redundant Cross-Sectional Fixed Effects Test

Null Hypothesis: No Fixed Effects

F-Values 16.07 15.87 16.09 11.53 7.47

P- Values 0.000

Table C4

Redundant Period Fixed Effects Test

Null Hypothesis: No Fixed Effects

F-Values 22.75 18.70 21.89 15.23 5.37

P-Values

Table C5

Redundant Cross Sectional and Period Fixed Effects Test

Null Hypothesis : No Fixed Effects

F-Values 17.92 16.31 19.87 12.32 6.66

P-Values

Table C6

Serial Correlation (LM) Test

HO: No First Order Autocorrelation

Model 1 Model 2 Model 3 Model 4 Model 5

"F 179.244 180.653 159.087 107.528 97.718

P-values 0.000 0.000 0.000 0.000 0.000

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

266 Haq, Badshah, and Ahmad

APPENDIX: D

Table D1

List of Sampling Countries

Argentina Bangladesh Barbados Bolivia

Botswana Brazil Cameroon Chile

China Colombia Costa Rica Ecuador

Egypt, Arab Rep El Salvador Fiji Ghana

Guatemala Guyana Haiti Honduras

India Indonesia Iran, Islamic Rep Jamaica

Kenya Malaysia Mali Mexico

Mozambique Pakistan Panama Paraguay

Peru Philippines Senegal Sierra Leone

Sri Lanka Thailand Turkey Uganda

Uruguay Venezuela, RB Zambia Zimbabwe

REFERENCES

Aghion, P., P. Howitt, M. Brant-Collett, and C. García-Peñalosa (1998)

Growth Theorym. MIT Press.

Ang, J. B. (2010) Finance and Inequality: The Case of India. Southern Econom

76:3,738-761.

Arellano, M. and S. Bond (1991) Some Tests of Specification for Panel Data: Monte

Carlo Evidence and an Application to Employment Equations. Review of Economic

Studies 58, 277-97.

Asteriou, D., S. Dimelis, and A. Moudatsou (2014) Globalisation and Income Inequality:

A Panel Data Econometric Approach for the EU27 Countries. Economic Modelling

36, 592-599.

Atif, S. M., M. Srivastav, M. Sauytbekova, and U. K. Arachchige (2012) Globalisation

and Income Inequality: A Panel Data Analysis of 68 Countries. University of Sydney

Press.

Atkinson, A. B. (2003) Income Inequality in OECD Countries: Data and Explanations.

CESifo Economic Studies 49:4, 479-5 13.

Banerjee, A. and R. Somanathan (2007) The Political Economy of Public Goods: Some

Evidence from India. Journal of Development Economics 82:2, 287-314.

Barro, R. J. (2000) Inequality and Growth in a Panel of Countries. Journal of Economic

Growth 5:1,5-32.

Basu, P. and A. Guariglia (2007) Foreign Direct Investment, Inequality, and Growth.

Journal of Macroeconomics 29:4, 824-839.

Bensidoun, I., S. Jean, and A. Sztulman (2011) International Trade and Income

Distribution: Reconsidering the Evidence. Review of World Economics 147:4, 593-

619.

Bergh, A. and T. Nilsson (2010) Do Liberalisation and Globalisation Increase Income

Inequality? European Journal of Political Economy 26:4, 488-505.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 267

Bernard, A. B. and J. B. Jensen (2000) Understanding Increasing and Decreasing W

Inequality: The Impact of International Trade on Wages (pp. 227-268). Universit

Chicago Press.

Beyer, H., P. Rojas, and R. Vergara (1999) Trade Liberalisation and Wage Ineq

Journal of Development Economics 59:1, 103-123.

Boltho, A. (1975) Japan , an Economic Survey , 1953-1973. Oxford University Pre

Borensztein, E., J. De Gregorio, and J.-W. Lee (1998) How does Foreign

Investment affect Economic Growth? Journal of International Economics 45:1,

135.

Borjas, G. J. and V. A. Ramey (1994) Time-series Evidence on the Sources of Tren

Wage Inequality. The American Economic Review 84:2, 10-16.

Borjas, G. J., R. B. Freeman, and L. F. Katz (1992) On the Labour Market Eff

Immigration and Trade. Immigration and the Workforce: Economic Conseq

for the United States and Source Areas (pp. 213-244). University of Chicago Pre

Bourguignon, F. (1981) Pareto Superiority of Unegalitarian Equilibria in Stiglitz' M

of Wealth Distribution with Convex Saving Function. Econometrica: Journal of

Econometric Society 1469-1475.

Bowles, S., H. Gintis, and M. Osborne (2001) The Determinants of Earni

Behavioral Approach. Journal of Economic Literature 39:4, 1 137-1 176.

Breusch, T. S. and A. R. Pagan (1979) A Simple Test for Heteroscedasticity and Ra

Coefficient Variation. Econometrica: Journal of the Econometric Society 1287-

Breusch, T. S. and A. R. Pagan (1980) The Lagrange Multiplier Test and Its Applica

to Model Specification in Econometrics. The Review of Economic JStudies 47:1,

253.

Çelik, S. and U. Basdas (2010) How does Globalisation Affect Income Inequa

Panel Data Analysis. International Advances in Economic Research 16:4, 358-370

Cheng, F., X. Zhang, and F. Shenggen (2002) Emergence of Urban Pover

Inequality in China: Evidence from Household Survey. China Economic Review

430-443.

Christiaensen, L. J., L. Demery, and S. Paternostro (2002) Growth, Distribution and

Poverty in Africa: Messages from the 1990s (Vol. 614). World Bank Publications.

Ciaessens, S. and E. Perotti (2007) Finance and Inequality: Channels and Evidence.

Journal of Comparative Economics 35:4, 748-773.

Clarke, G. R., L. C. Xu, and H.-F. Zou (2006) Finance and Income Inequality: What do

the Data Tell Us? Southern Economic Journal 578-596.

Cutler, D. M. and L. F. Katz (1992) Rising Inequality? Changes in the Distribution of

Income and Consumption in the 1980s: National Bureau of Economic Research.

Daumal, M. (2013) The Impact of Trade Openness on Regional Inequality: The Cases of

India and Brazil. The International Trade Journal 27:3, 243-280.

Deardorff, A. V. and R. M. Stern (1994) The Stolper-Samuelson Theorem: A Golden

Jubilee : University of Michigan Press.

Dobson, S. and C. Ramlogan (2009) Is there an Openness Kuznets Curve? Kyklos 62:2,

226-238.

Dollar, D. (2001b) Globalisation, Inequality, and Poverty since 1980. Washington, DC:

World Bank.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

268 Haq, Badshah, and Ahmad

Dollar, D. and A. Kraay (2001a) Trade, Growth, and Poverty

Research Group, Macroeconomics and Growth.

Dreher, A. and N. Gaston (2008) Has Globalisation Incr

International Economics 16:3, 516-536.

Dreher, A., N. Gaston, and P. Martens (2008) Measurin

Consequences : Springer Science and Business Media. E

261-286.

Edwards, S. (1997) Trade policy, Growth, and Income Distribution. The American

Economic Review 87:2, 205-210.

Feenstra, R. C. and G. H. Hanson (1997) Foreign Direct Investment and Relative Wages:

Evidence from Mexico's Maquiladoras. Journal of International Economics 42:3,

371-393.

Figini, P. and H. Gorg (2006) Does Foreign Direct Investment Affect Wage Inequality?

An Empirical Investigation. University of Nottingham Research Paper (2006/29).

Forbes, K. J. (2000) A Reassessment of the Relationship between Inequality and Growth.

American Economic Review 869-887.

Francois, J. and D. Nelson (1998) Trade, Technology, and Wages: General Equilibrium

Mechanics. The Economic Journal 108:450, 1483-1499.

Glomm, G. and M. Kaganovich (2008) Social Security, Public Education and the

Growth - Inequality Relationship. European Economic Review 52:6, 1009-1034.

Gopinath, M. and W. Chen (2003) Foreign Direct Investment and Wages: A Cross-

country Analysis. Journal of International Trade and Economic Development 12:3,

285-309.

Gourdon, J., N. Maystre, and J. De Melo (2008) Openness, Inequality and Poverty:

Endowments Matter. Journal of International Trade and Economic Development

17:3, 343-378.

Green, F., A. Dickerson, and J. S. Arbache (2001) A Picture of Wage Inequality and the

Allocation of Labor through a Period of Trade Liberalisation: The Case of Brazil.

World Development 29:11, 1923-1939.

Gregorio, J. D. and J. W. Lee (2002) Education and Income Inequality: New Evidence

from Cross-country Data. Review of Income and Wealth 48:3, 395-416.

Grossman, G. M. and E. Rossi-Hansberg (2008) External Economies and International

Trade Redux. National Bureau of Economic Research.

Gupta, S., and M. Verhoeven, et al. (1999) Does Higher Government Spending Buy

Better Results in Education and Health Care? International Monetary Fund.

Hausman, J. A. (1978) Specification Tests in Econometrics. Econometrica: Journal of

the Econometric Society 125 1-1271 .

Helmighausen, T. (2014) Globalisation and Income Inequality: The Role of Transmission

Mechanisms. (LIS Working Paper Series).

Higgins, M. and J. G. Williamson (1999) Explaining Inequality the World Round: Cohort

Size, Kuznets Curves, and Openness: National Bureau of Economic Research.

IMF (2007) World Economic Outlook: Globalisation and Inequality, October, IMF,

Washington, DC.

Jalil, A. (2012) Modeling Income Inequality and Openness in the Framework of Kuznets

Curve: New Evidence from China. Economic Modelling 29:2, 309-315.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

Does Globalisation Shape Income Inequality? 269

Jaumotte, F., S. Lall, and C. Papageorgiou (2013) Rising Income Inequ

Technology, or Trade and Financial Globalisation and Quest. IMF Economic

61:2,271-309.

Kaldor, N. (1955) Alternative Theories of Distribution. The Review of Economic S

23:2, 83-100.

Kanbur, R. and X. Zhang (1999) Which Regional Inequality? The Evolution o

Urban and Inland-Coastal Inequality in China from 1983 to 1995. Journa

Comparative Economics 27:4, 686-701.

Kanbur, R. and X. Zhang (2005) Fifty Years of Regional Inequality in China: A Jo

through Central Planning, Reform, and Openness. Review of Development Econo

9:1,87-106.

Karoly, L. A. and J. A. Klerman (1994) Using Regional Data to Reexami

Contribution of Demographic and Sectoral Changes to Increasing US

Inequality. The Journal of Developing Areas, 31:1,210-224.

Khandker, S. R. and G. B. Koolwal (2007) Are Pro-growth Policies Pro-poor? E

from Bangladesh. The World Bank. (Manuscript).

Kratou, H. and M. Goaied (2016) How Can Globalisation Affect Income Distri

Evidence from Developing Countries. The International Trade Journal 30:

158.

Lee, E. and M. Vivarelli (2006) The Soqial Impact of Globalisation in the Deve

Countries. International Labour Review 145:3, 167-184.

Levy, F. and R. J. Murnane (1992) US Earnings Levels and Earnings Inequa

Review of Recent Trends and Proposed Explanations. Journal of Economic Lite

30:3, 1333-1381.

Li, H. and H. F. Zou (1998) Income Inequality is not Harmful for Growth: The

Evidence. Review of Development Economics 2:3, 318-334.

Lim, G. C. and P. D. McNelis (2014) Income Inequality, Trade and Financial Op

World Development 77, 129-142.

Lundberg, M. and L. Squire (2003) The Simultaneous Evolution of Grow

Inequality. The Economic Journal 1 13:487, 326-344.

Ma, Y. and F. Dei (2009) Product Quality, Wage Inequality, and Trade Liberal

Review of International Economics 1 7 :2, 244-260.

Machin, S. and J. Van Reenen (1998) Technology and Changes in Skill Stru

Evidence from Seven OECD Countries. Quarterly Journal of Economics 1215-12

Marjit, S., H. Beladi, and A. Chakrabarti (2004) Trade and Wage Inequa

Developing Countries. Economic Inquiry 42:2, 295-303.

Meschi, E. and M. Vivarelli (2007) Trade Openness and Income Inequali

Developing Countries. World Development 34:1, 130-142.

Meschi, E. and M. Vivarelli (2009) Trade and Income Inequality in Deve

Countries. World Development 37:2, 287-302.

Mundeil, R. A. (1957) International Trade and Factor Mobility. The American Econ

Review 47:3,321-335.

Persson, T. and G. Tabellini (1994) Is Inequality Harmful for Growth? The A

Economic Review 600-621 .

Pritchett, L. (1997) Divergence, Big Time. The Journal of Economic Perspectives 1 1 :3, 3-17.

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

270 Haq, Badshah, and Ahmad

Ravallion, M. (2001) Growth, Inequality and Poverty: Look

Development 29:11, 1803-1815.

Reuveny, R. and Q. Li (2003) Economic Openness, Dem

an Empirical Analysis. Comparative Political Studies 36:

Robbins, D. and T. H. Gindling (1999) Trade Liberalisat

More- Skilled Workers in Costa Rica. Review of Developm

Robbins, D. J. (1996) Evidence on Trade and Wages in

American Economic Review 84:3, 219-234.

Rudra, N. (2004) Openness, Welfare Spending, and Inequal

International Studies Quarterly 48:3 , 683-709.

Rybczyński, T. M. (1955) Factor Endowment and

Economica 22:88, 336-341.

Sachs, J. D. and H. J. Shatz (1996) US Trade with Dev

Inequality. The American Economic Review 86:2, 234-23

Salvatore, D. (201 1) Introduction to International Econom

Shapiro, S. S. and M. B. Wilk (1965) An Analysis of V

(complete samples). Biometrika 52:(3/4), 591-61 1 .

Silva, J. A. and R. M. Leichenko (2004) Regional Incom

Trade.

Solt, F. (2009) Standardising the World Income Inequ

Quarterly 90:2, 231-242.

Spilimbergo, A. and J. L. Londoño, and M. Székely (19

Endowments, and Trade Openness. Journal of Developme

Stolper, W. F. and P. A. Samuelson (1941) Protection a

Economic Studies 9:1, 58-73.

Sylwester, K. (2005) Foreign Direct Investment, Growth

Developed Countries. International Review of Applied E

Wei, S.-J. and Y. Wu (2001) Globalisation and Inequality:

Wong, M. (2016) Globalisation, Spending and Income Ineq

of Comparative Asian Development 15:1, 1-18.

Wood, A. (1997) Openness and Wage Inequality in De

American Challenge to East Asian Conventional Wisdom

Review 11:1, 33-57.

World Bank (2006). World Development Indicators

Washington, D.C., US.

Zhang, X. and K. H. Zhang (2003) How Does Globalisat

within a Developing Country? Evidence from China. Jo

39:4, 47-67.

Zhang, X., and R. Kanbur (200-1) What Difference Do Pol

Application to China. Journal of Development Studies 3

Zhou, X. and K. -W. Li. (2011) Inequality and Develop

Parametric Estimation with Panel Data. Economics Lett

Zhu, S. C. and D. Trefler (2005) Trade and Inequality in D

Equilibrium Analysis. Journal of International Econom

This content downloaded from

103.59.198.110 on Mon, 06 Mar 2023 15:24:14 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Impact of Globalization and Economic Growth On Income Distribution: A Case Study of PakistanDocument28 pagesImpact of Globalization and Economic Growth On Income Distribution: A Case Study of PakistanZahid Iqbal ZahidNo ratings yet

- MPRA Paper 74248Document33 pagesMPRA Paper 74248Aisha RizwanNo ratings yet

- Global FinancialDocument39 pagesGlobal FinancialBiruk Ayalew Wondem PhDNo ratings yet

- When Does Export Diversification Improve Economic Growth? A Comparative Analysis of Sub-Saharan African CountriesDocument15 pagesWhen Does Export Diversification Improve Economic Growth? A Comparative Analysis of Sub-Saharan African CountriesyuniNo ratings yet

- Globalization and Its Impact On Poverty and InequalityDocument21 pagesGlobalization and Its Impact On Poverty and InequalityfarkhundaNo ratings yet

- Globalization and Economic GrowthDocument8 pagesGlobalization and Economic GrowthHiromi YukiNo ratings yet

- Final Version - Chin pp12-24Document13 pagesFinal Version - Chin pp12-24EdwardNo ratings yet

- Ardl PakDocument50 pagesArdl PakBilal SattarNo ratings yet

- IncomeDocument15 pagesIncomeibsaNo ratings yet

- Development Impacts of Globalization and Education: Evidence From The Asia-Pacific CountriesDocument20 pagesDevelopment Impacts of Globalization and Education: Evidence From The Asia-Pacific CountriesSmritiNo ratings yet

- Dimensions of Globalization and Their Effects On Economic Growth and Human Development IndexDocument13 pagesDimensions of Globalization and Their Effects On Economic Growth and Human Development IndexeditoraessNo ratings yet

- Trade Growth and Poverty: A Case of Pakistan: Pak. J. Commer. Soc. SciDocument13 pagesTrade Growth and Poverty: A Case of Pakistan: Pak. J. Commer. Soc. SciRana ToseefNo ratings yet

- Impact of Globalization On Income Inequality in Asian Emerging EconomiesDocument15 pagesImpact of Globalization On Income Inequality in Asian Emerging EconomiesPamela QuinteroNo ratings yet

- Globalization 5Document3 pagesGlobalization 5Yram GambzNo ratings yet

- EthicsDocument3 pagesEthicsJam TelanNo ratings yet

- Causal Interactions Between FDI, and Economic Growth: Evidence From Dynamic Panel Co-IntegrationDocument15 pagesCausal Interactions Between FDI, and Economic Growth: Evidence From Dynamic Panel Co-IntegrationABDOULIE FAALNo ratings yet

- Financial DisintegrationDocument15 pagesFinancial Disintegrationaftab aliNo ratings yet

- Research PaperDocument6 pagesResearch PaperAsif KakakhailNo ratings yet

- This Content Downloaded From 39.40.73.247 On Sun, 09 Jan 2022 18:10:38 UTCDocument31 pagesThis Content Downloaded From 39.40.73.247 On Sun, 09 Jan 2022 18:10:38 UTCjawad azeezNo ratings yet

- Academic Writing Assigment 1st Attempt of Lit. ReviewDocument6 pagesAcademic Writing Assigment 1st Attempt of Lit. ReviewAhmed EmadNo ratings yet

- Managing The Impact of Globalization and Technology On InequalityDocument27 pagesManaging The Impact of Globalization and Technology On InequalityJunel JovenNo ratings yet

- Economic Integration and Growth: Shawn Cole Silvana TenreyoDocument3 pagesEconomic Integration and Growth: Shawn Cole Silvana TenreyoPhạm Thu XuânNo ratings yet

- An Analysis of The Economic Convergence Process in The Transition CountriesDocument47 pagesAn Analysis of The Economic Convergence Process in The Transition CountriesR. Ranjan MishraNo ratings yet

- APSDJ Vol.25 No.1 - pp57-84Document28 pagesAPSDJ Vol.25 No.1 - pp57-84rhizelle19No ratings yet

- Conditional Convergence: Student Name Institution Affiliation Course Name Instructor DateDocument5 pagesConditional Convergence: Student Name Institution Affiliation Course Name Instructor Datehen maryNo ratings yet

- Trade and Employment - G01Document3 pagesTrade and Employment - G01Natalia Wong PerezNo ratings yet

- Research Paper On Economic Growth in Developing CountriesDocument12 pagesResearch Paper On Economic Growth in Developing Countriesgvzph2vhNo ratings yet

- Impact of Foreign Direct Investment On Economic Growth: Do Host Country Social and Economic Conditions Matter?Document39 pagesImpact of Foreign Direct Investment On Economic Growth: Do Host Country Social and Economic Conditions Matter?pingzhangckNo ratings yet

- Globalization and Human DevelopmentDocument18 pagesGlobalization and Human DevelopmentCly DeNo ratings yet

- Income Inequality, Globalization, and Country Risk A Cross-Country AnalysisDocument26 pagesIncome Inequality, Globalization, and Country Risk A Cross-Country Analysistonechit92No ratings yet

- Research Method II - Final VersionDocument19 pagesResearch Method II - Final Versionanelya360067No ratings yet

- ReasearchPaper MaqboolDocument21 pagesReasearchPaper MaqboolKanij Fatema BithiNo ratings yet

- 1052-Article Text-2076-1-10-20200529Document10 pages1052-Article Text-2076-1-10-20200529Nguyễn Thiên PhúNo ratings yet

- Testing The Higher Education-Led Growth HypothesisDocument16 pagesTesting The Higher Education-Led Growth Hypothesismeshael FahadNo ratings yet

- Analysis of Human Development, Economic Growth and Income Inequality in SAARC CountryDocument9 pagesAnalysis of Human Development, Economic Growth and Income Inequality in SAARC CountryIhsan Ullah HimmatNo ratings yet

- 10 3790 SCHM 137 1 2 173Document20 pages10 3790 SCHM 137 1 2 173HuykuteLùnTèNo ratings yet

- IJMRES 1 Paper 91 2019Document7 pagesIJMRES 1 Paper 91 2019International Journal of Management Research and Emerging SciencesNo ratings yet

- The Relationship Between Aid and FDI and Its Effect On Economic GrowthDocument52 pagesThe Relationship Between Aid and FDI and Its Effect On Economic GrowthahmedNo ratings yet

- 08-How Does Income Inequality Affects Economic Growth at Different Income LevelsDocument22 pages08-How Does Income Inequality Affects Economic Growth at Different Income LevelsKristine Romero ManzonNo ratings yet

- Ayesha SiddiqaDocument10 pagesAyesha SiddiqaayeshaNo ratings yet

- CBE Assignment 2Document12 pagesCBE Assignment 2Abdullah HassanNo ratings yet

- Issues in Development TheoryDocument18 pagesIssues in Development TheoryAboubaker S.A. BADINo ratings yet

- How Globalization Affects Developed Countries: Nicolas PologeorgisDocument8 pagesHow Globalization Affects Developed Countries: Nicolas PologeorgisFarooq KhanNo ratings yet

- ContemporaryDocument12 pagesContemporaryZoiro MorutaNo ratings yet

- Agricultural Exports and Economic Growth in Developing Countries: A Panel Cointegration ApproachDocument20 pagesAgricultural Exports and Economic Growth in Developing Countries: A Panel Cointegration ApproachRICHMOND GYAMFI BOATENGNo ratings yet

- Impact of Trade Openness On GDP Growth: Does TFP Matter?Document37 pagesImpact of Trade Openness On GDP Growth: Does TFP Matter?MehrajNo ratings yet

- Growth and Policy in Developing Countries: A Structuralist ApproachFrom EverandGrowth and Policy in Developing Countries: A Structuralist ApproachNo ratings yet

- Econ 325 22-11Document13 pagesEcon 325 22-11siyanda mgcelezaNo ratings yet

- Background of The StudyDocument4 pagesBackground of The StudyAnonymous 8vDTNINjNo ratings yet

- World on the Move: Consumption Patterns in a More Equal Global EconomyFrom EverandWorld on the Move: Consumption Patterns in a More Equal Global EconomyNo ratings yet

- Published Remittanceand ExchangeratesDocument19 pagesPublished Remittanceand ExchangeratessoorajoofNo ratings yet

- Q38157167 PDFDocument11 pagesQ38157167 PDFRohitNo ratings yet

- Capital Goods Imports, Physical Capital Formation and Economic Growth in Sub-Saharan Africa CountriesDocument11 pagesCapital Goods Imports, Physical Capital Formation and Economic Growth in Sub-Saharan Africa CountriesaijbmNo ratings yet

- The Linkages Among Economic Growth, Foreign Direct Investment, Capital Formation and Trade Openness: Investigation Based On VecmDocument16 pagesThe Linkages Among Economic Growth, Foreign Direct Investment, Capital Formation and Trade Openness: Investigation Based On VecmHusnaanaNo ratings yet

- Research ProposalDocument13 pagesResearch ProposalMohaiminul IslamNo ratings yet

- Does Financial Development Contribute To Poverty Reduction. Journal of Development Studies, 41 (4), 636-656.Document21 pagesDoes Financial Development Contribute To Poverty Reduction. Journal of Development Studies, 41 (4), 636-656.SKNo ratings yet

- Foreign Capital Inflow Fiscal Policies ADocument30 pagesForeign Capital Inflow Fiscal Policies ASakhibakshNo ratings yet

- Woman in Management-GlobalizationDocument50 pagesWoman in Management-GlobalizationHemanthaJayamaneNo ratings yet

- Mid Term Examinations Sociology Course Instructor: Bhavneet KaurDocument6 pagesMid Term Examinations Sociology Course Instructor: Bhavneet KaurHriidaii ChettriNo ratings yet

- May 2014 1400155571 f3d33 41Document2 pagesMay 2014 1400155571 f3d33 41Hriidaii ChettriNo ratings yet

- Brown and Halley - Introduction - Left Legalism Left CritiqueDocument37 pagesBrown and Halley - Introduction - Left Legalism Left Critiquekabir kapoorNo ratings yet

- Mediation Round Problem - 2023Document3 pagesMediation Round Problem - 2023Himanshu MukimNo ratings yet

- Amba Lal V Union of IndiaDocument7 pagesAmba Lal V Union of IndiaHriidaii ChettriNo ratings yet

- Baxi, Rationalist and Hedonist TeachersDocument1 pageBaxi, Rationalist and Hedonist TeachersHriidaii ChettriNo ratings yet

- Critique HandoutDocument1 pageCritique HandoutHriidaii ChettriNo ratings yet

- Globalisation and Climate ChangeDocument32 pagesGlobalisation and Climate ChangeHriidaii ChettriNo ratings yet

- This Content Downloaded From 103.59.198.110 On Mon, 06 Mar 2023 15:20:07 UTCDocument27 pagesThis Content Downloaded From 103.59.198.110 On Mon, 06 Mar 2023 15:20:07 UTCHriidaii ChettriNo ratings yet

- Internal Assessment - Property LawDocument5 pagesInternal Assessment - Property LawHriidaii ChettriNo ratings yet

- Globalisation and Social JusticeDocument15 pagesGlobalisation and Social JusticeHriidaii ChettriNo ratings yet

- .Stephens - 2018 - The Politics of Muslim Rage Secular Law and Religious Sentiment in Late Colonial India The Politics of Muslim Rage SDocument21 pages.Stephens - 2018 - The Politics of Muslim Rage Secular Law and Religious Sentiment in Late Colonial India The Politics of Muslim Rage SHriidaii ChettriNo ratings yet

- National Strategic Development Plan (NSDP) 2006-2010 (Eng)Document154 pagesNational Strategic Development Plan (NSDP) 2006-2010 (Eng)Chou ChantraNo ratings yet

- Erste Bank Research Euro 2012Document10 pagesErste Bank Research Euro 2012Wito NadaszkiewiczNo ratings yet

- Worksheet 5-PopulationDocument6 pagesWorksheet 5-PopulationrizNo ratings yet

- Bangladesh: Most Populous Country in The World, With A PopulationDocument7 pagesBangladesh: Most Populous Country in The World, With A PopulationAMNo ratings yet

- National Income Accounting: Economics, 7 Edition Boyes and Melvin Houghton Mifflin Company, 2008Document26 pagesNational Income Accounting: Economics, 7 Edition Boyes and Melvin Houghton Mifflin Company, 2008Asad NaseerNo ratings yet

- Retail Foods - Rangoon - Burma - Union of - 9-21-2018Document17 pagesRetail Foods - Rangoon - Burma - Union of - 9-21-2018muthiaNo ratings yet

- Role of SMEs Export Growth in BangladeshDocument19 pagesRole of SMEs Export Growth in BangladeshAsad ZamanNo ratings yet

- Powerasprestige - Ia .KhongDocument24 pagesPowerasprestige - Ia .Khongkate dimaandalNo ratings yet

- Essay On Society Eco PDFDocument338 pagesEssay On Society Eco PDFaditya188No ratings yet

- National Income Final PPT Full Including PYQDocument69 pagesNational Income Final PPT Full Including PYQSathish KumarNo ratings yet

- OECD PSE Manual (2010) PDFDocument178 pagesOECD PSE Manual (2010) PDFkolyanzzzzNo ratings yet

- Question Bank 2012 Class XIIDocument179 pagesQuestion Bank 2012 Class XIINitin Dadu100% (1)

- 2011Document494 pages2011aman.4uNo ratings yet

- Final Jan 2020 1Document8 pagesFinal Jan 2020 1Vaibhav MandhareNo ratings yet

- Marketing Management AssignmentDocument16 pagesMarketing Management Assignmentkashif aliNo ratings yet

- European Construction Sector Observatory: Country Profile FranceDocument29 pagesEuropean Construction Sector Observatory: Country Profile France코리나No ratings yet

- MSMEDocument8 pagesMSMERakshit BhardwajNo ratings yet

- Macroeconomics Canadian 7th Edition Abel Test BankDocument13 pagesMacroeconomics Canadian 7th Edition Abel Test Banksinapateprear4k100% (26)

- The Greek Economy Under Reform: Turning The TideDocument16 pagesThe Greek Economy Under Reform: Turning The TideNicholas VentourisNo ratings yet

- Q2 2022-23 GDP EstimatesDocument8 pagesQ2 2022-23 GDP EstimatesRepublic WorldNo ratings yet

- Dristi Economic and Social Development SampleDocument16 pagesDristi Economic and Social Development Samplelegal accNo ratings yet

- (Answer) Revision 2 - Topics 1, 2, 3 (MCQ)Document5 pages(Answer) Revision 2 - Topics 1, 2, 3 (MCQ)yang maNo ratings yet

- Financial Mail Budget Edition 2018Document29 pagesFinancial Mail Budget Edition 2018Tiso Blackstar GroupNo ratings yet

- Unit 8 - Lesson 4 - Business CycleDocument18 pagesUnit 8 - Lesson 4 - Business Cycleapi-260512563No ratings yet

- Presented by:18BBA005 18BBA013 18BBA030 18BBA048 18BBA085 18BBA087 18BBA098 18BBA088Document11 pagesPresented by:18BBA005 18BBA013 18BBA030 18BBA048 18BBA085 18BBA087 18BBA098 18BBA088JAY SolankiNo ratings yet

- Trinidad and Tobago National Budget 2022Document60 pagesTrinidad and Tobago National Budget 2022brandon davidNo ratings yet

- Asian Monetary Integration: A Japanese PerspectiveDocument36 pagesAsian Monetary Integration: A Japanese PerspectiveADBI PublicationsNo ratings yet

- SPFDocument31 pagesSPFscrivner1No ratings yet

- Future of Mining in Canada's NorthDocument96 pagesFuture of Mining in Canada's NorthksweeneyNo ratings yet

- India 2020 KalamDocument294 pagesIndia 2020 KalamVishnu SharmaNo ratings yet