Professional Documents

Culture Documents

Accounting

Uploaded by

windell arth MercadoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting

Uploaded by

windell arth MercadoCopyright:

Available Formats

_____1.

Which of the following errors will cause trial balance to be “out of balance”

a. When the entire journal entry was not posted

b. When Journal entry is doubly posted

c. When a debit entry in the journal was credited

d. All of the

______2. 2/10 n/30 discount term means a 2% discount if paid within 10 days

a. From the invoice date c. before the invoice date

b. After the invoice date d. none of these

_____3. Which of the following is “cost”?

a. Merchandize Inventory End c. freight - in

b. It depends upon shipping term d. freight – out

_____4. The normal balance of account Sales is-

a. Debit balance b. Credit balance c. in-balance d. out balance

_____5. The merchandise left on hand and unsold at the end of the period

a. Merchandise Inventory End c. Cost of Good Available for Sale

b. Merchandise Inventory Beg d. Cost of Sales

_____6. When is physical inventory count usually conducted?

a. At the end of any given period c. semi-annually

b. At the start of the year d. quarterly

_____7. A company buys merchandise costing 25,000 and returned 5,000 cost of merchandise. If discount term is 2/10

N/30 and the company pays within the discount period, how much amount should pay to seller?

a. 19,600 b. 20,000 c. 21,000 d. 24,500

_____8. The entry to record the return of goods previously purchase on account due to bad order will include

a. Debit to accounts payable c. debit to Purchase Ret. & Allowances

b. Credit to accounts payable d. A debit to Purchase Discount

_____9. R. Alicayos Superstore sold merchandise on account for 37,000 and received cash payment of 35,705 after

deducting the sales discount. What was the percent of sales discount?

a. 2% b. 2.5% c. 3% d. 3.5%

_____10. On July 9, 20A Leomar Virador Co. collects its sales on account from Rebecca Dalagan Grocery Store in the

amount of 48,750 after giving a discount term of 2.5/10 N/30. The journal entry on June 30, 20A tor record the sales on

account will include

a. Debit, Accounts Receivable 48, 750 c. Debit, Accounts Receivable 50,000

b. Credit, Sales, 48750 d. Credit, Cash 50,000 filler

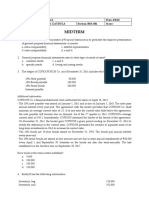

MERCADO TRUCKING SERVICES

TRIAL BALANCE

JUNE 30, 2012

Account Titles Debit Credit

Cash in Bank P 1,020,000

Petty Cash Fund 1,000

Accounts Receivable 120,000

Unused Supplies 15,0000

Prepaid Insurance 8,5000

Prepaid Rent 30,000

Delivery Truck 1,500,000

Acc. Depreciation – Delivery Truck P 250,000

Accounts Payable 130,000

W. Mercado Capital 1,819,700

W. Mercado Drawing 50,000

Trucking Income 935,000

Taxes and Licenses 10,000

Repairs and Maintenance Expense 27,000

Retainer Fees 25,000

Salaries and Wages Expense 320,000

Utilities Expense 8,200

TOTAL P 3,134,700 P 3,134,7000

Required:

a. Adjusting Entry

b. An 8 Column Worksheet

c. Balance Sheet

d. Income Statement

e. Statement of Changes in Equity

You might also like

- Unexpired Insurance: Furniture and FixtureDocument1 pageUnexpired Insurance: Furniture and FixtureFucio, Mark JeroldNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- BAC 111 Final Exams With QuestionsDocument8 pagesBAC 111 Final Exams With Questionsjanus lopezNo ratings yet

- Junior Philippine Institute of AccountantsDocument10 pagesJunior Philippine Institute of AccountantsJuan paoloNo ratings yet

- Luyong - 4TH Q - Fabm1Document3 pagesLuyong - 4TH Q - Fabm1Jonavi LuyongNo ratings yet

- Test Bank 3 - Ia 1Document25 pagesTest Bank 3 - Ia 1JEFFERSON CUTE100% (1)

- Indicate Whether The Statement Is True or FalseDocument6 pagesIndicate Whether The Statement Is True or Falseae zeinNo ratings yet

- MGMT 600 SAMPLE Midterm Exam 1Document9 pagesMGMT 600 SAMPLE Midterm Exam 1Enkhbadral UlaanhuuNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Pilot TestDocument5 pagesPilot Testkhanhhung1112004No ratings yet

- Cup 1 FA 1 and FA 2Document16 pagesCup 1 FA 1 and FA 2Thony Danielle LabradorNo ratings yet

- Intermediate Accounting 2 and 3 FinalDocument67 pagesIntermediate Accounting 2 and 3 FinalNah HamzaNo ratings yet

- Prelims I A 32021Document6 pagesPrelims I A 32021Dannah RamirezNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- FAR - Level 1 TestDocument3 pagesFAR - Level 1 TestRay Joseph LealNo ratings yet

- Intermediate Accounting 2 PHINMA Examination 1Document18 pagesIntermediate Accounting 2 PHINMA Examination 1Jenever Leo Serrano50% (6)

- Au Ia1 Midterm ExamDocument4 pagesAu Ia1 Midterm ExamCherrylane EdicaNo ratings yet

- Video Lesson Chapter 7 Fabm2 Journal and LedgerDocument27 pagesVideo Lesson Chapter 7 Fabm2 Journal and LedgerRon louise Pereyra100% (8)

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Summative Test-FABM2 2018-2019Document2 pagesSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- PretestDocument4 pagesPretestRaul Soriano CabantingNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- Midterm Exam - LUNADocument22 pagesMidterm Exam - LUNAJoyce LunaNo ratings yet

- Quiz in Basic Accounting SHSDocument3 pagesQuiz in Basic Accounting SHSTRISHA MAE ABOCNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- AP Prelim Exam AnskeyDocument9 pagesAP Prelim Exam AnskeyEdlyn LiwagNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- PHINMA Examination ACC 107 Intermediate Accounting 2Document18 pagesPHINMA Examination ACC 107 Intermediate Accounting 2Un knownNo ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument18 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreAnirban Roy ChowdhuryNo ratings yet

- AP QuizzerDocument9 pagesAP QuizzerAngel TumamaoNo ratings yet

- Chapter 2Document4 pagesChapter 2Julie Neay Afable0% (1)

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- 2 Corporate LiquidationDocument5 pages2 Corporate LiquidationSamantha0% (1)

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Ruena Mae J. Uy - ExamDocument5 pagesRuena Mae J. Uy - ExamEbookdrive BooksNo ratings yet

- Accounting For Liabilities Part 1Document5 pagesAccounting For Liabilities Part 1방탄트와이스 짱No ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Intermediate AccountingDocument7 pagesIntermediate AccountingMelissa Kayla Maniulit100% (1)

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- 2nd Summative TestDocument2 pages2nd Summative Testje-ann montejoNo ratings yet

- Quiz 2 Answers SolutionsDocument29 pagesQuiz 2 Answers SolutionsMarcus Monocay100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accounting ExercisesDocument1 pageAccounting Exerciseswindell arth MercadoNo ratings yet

- Entrep 2Document3 pagesEntrep 2windell arth MercadoNo ratings yet

- Performance Tasks 1Document5 pagesPerformance Tasks 1windell arth MercadoNo ratings yet

- Entrepreneurship QuizDocument2 pagesEntrepreneurship Quizwindell arth MercadoNo ratings yet

- Examples of Closing EntriesDocument1 pageExamples of Closing Entrieswindell arth MercadoNo ratings yet

- DLL-entrep Q2 w6Document4 pagesDLL-entrep Q2 w6windell arth Mercado100% (1)

- Measure of DispersionDocument11 pagesMeasure of Dispersionwindell arth MercadoNo ratings yet

- Summative Test I EtechDocument2 pagesSummative Test I Etechwindell arth MercadoNo ratings yet

- Day 5 - QuizizzDocument3 pagesDay 5 - QuizizzcassiopieabNo ratings yet

- 2023 GR 11 Written Report ABDocument5 pages2023 GR 11 Written Report ABfiercestallionofficial100% (1)

- CPAR - AP Solutions 1st PB-BATCH 91Document5 pagesCPAR - AP Solutions 1st PB-BATCH 91Allyson VillalobosNo ratings yet

- Law On Private Corporation (Title 4)Document10 pagesLaw On Private Corporation (Title 4)Dahyun DahyunNo ratings yet

- Project Report Rajdeep 2k16mba44Document57 pagesProject Report Rajdeep 2k16mba44Gaurav KushwahNo ratings yet

- HDFC ShareholdingDocument11 pagesHDFC ShareholdingCHINMOY PADHINo ratings yet

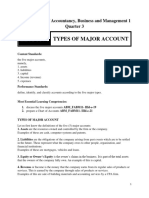

- LAS 4 Types of Major AccountDocument7 pagesLAS 4 Types of Major AccountFelicity BondocNo ratings yet

- RossCF9ce PPT Ch25Document19 pagesRossCF9ce PPT Ch25js19imNo ratings yet

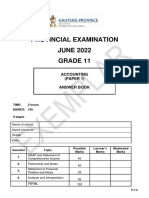

- Gr11 ACC P1 (ENG) June 2022 Answer BookDocument9 pagesGr11 ACC P1 (ENG) June 2022 Answer BooklemogangNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- Smallcap Growth StrategyDocument4 pagesSmallcap Growth StrategyyashNo ratings yet

- AssignmentDocument4 pagesAssignmentAalizae Anwar YazdaniNo ratings yet

- Keshav Khandelwal - ResumeDocument1 pageKeshav Khandelwal - Resumedeepak.sharmaNo ratings yet

- Tran Hist PdfAndXlsDocument30 pagesTran Hist PdfAndXlsWindsor AdminNo ratings yet

- Corporate Finance AssignmentDocument16 pagesCorporate Finance AssignmentHekmat JanNo ratings yet

- UntitledDocument14 pagesUntitledContra Value BetsNo ratings yet

- UBS 2023 M&A OutlookDocument21 pagesUBS 2023 M&A Outlooktan weihong7370No ratings yet

- LB DST Deposit For Future Stock SubscriptionDocument3 pagesLB DST Deposit For Future Stock SubscriptionVence EugalcaNo ratings yet

- DepEd Order No. 8 S. 2007 Canteen Report Format 1Document16 pagesDepEd Order No. 8 S. 2007 Canteen Report Format 1EUDOLFO FLORESNo ratings yet

- Bank Reconciliation Statement: Fabm 2 Mr. Denver B. BeguiaDocument19 pagesBank Reconciliation Statement: Fabm 2 Mr. Denver B. BeguiaFelice CastroNo ratings yet

- MBBsavings - 151071 010876 - 2023 05 31Document7 pagesMBBsavings - 151071 010876 - 2023 05 31Zilawati Abu HasanNo ratings yet

- Critical Thinking Assignment 2: Special NotesDocument31 pagesCritical Thinking Assignment 2: Special NotesStella KiarieNo ratings yet

- Fundamentals of Financial Accounting 4th Edition Phillips Solutions ManualDocument43 pagesFundamentals of Financial Accounting 4th Edition Phillips Solutions ManualGregoryGreenjptqd100% (14)

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Original PDF Fundamentals of Corporate Finance 3rd Australia PDFDocument41 pagesOriginal PDF Fundamentals of Corporate Finance 3rd Australia PDFgwen.garcia161100% (36)

- PT Nikko Sekuritas IndonesiaDocument71 pagesPT Nikko Sekuritas IndonesiaAnggita Puri SavitriNo ratings yet

- Managerial Accounting 5th Edition Jiambalvo Test BankDocument25 pagesManagerial Accounting 5th Edition Jiambalvo Test BankKimberlyThomasrbtz100% (39)

- Rajesh BhasinDocument2 pagesRajesh BhasinASHWANI CHAUHANNo ratings yet

- Valuation Part 2Document82 pagesValuation Part 2Dương Thu TràNo ratings yet

- Chapter 3 CLCDocument24 pagesChapter 3 CLCVăn ThànhNo ratings yet