Professional Documents

Culture Documents

Laboratory 3. Individual Risk Estimation. Distance To Default

Uploaded by

Abigail MolnárOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Laboratory 3. Individual Risk Estimation. Distance To Default

Uploaded by

Abigail MolnárCopyright:

Available Formats

MICRO AND MACROPRUDENTIAL POLICIES IN BANKING

Laboratory 3. Individual risk estimation. Distance to Default

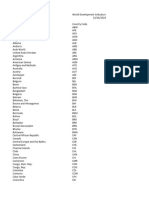

This exercise is based on the Stata file “GSIBs.dta”.

Requirements:

1. Compute the Z-score indicator for the sample of GSIBs.

2. Provide a table with descriptive statistics for Z-score for the whole sample, by year, and

by region. Interpret the results.

3. Provide a graph with the Z-score evolution by year. Interpret the graph.

4. Provide a graph with the Z-score evolution by year & region. Interpret the graph.

5. Display the scatter plot between Z-score and profitability (ROAE), and between Z-score

and capitalization (Tier 1 ratio). Interpret the graph.

6. Calculate the sample correlation coefficients between Z-score and ROAE, and between

Z-score and capitalization. Display the significance level of the correlation coefficient.

Interpret the outcomes.

7. Compute the following control variables (if they are not already defined in the database):

size, Loan Loss Reserve to Gross Loans, investment ratio, loans to deposits ratio

8. Calculate the sample correlation coefficients between Z-score and control variables (size,

Loan Loss Reserve to Gross Loans, investment ratio, loans to deposits ratio). Display the

significance level of the correlation coefficient. Interpret the outcomes.

9. Provide a table with descriptive statistics for Z-score, the main determinants and the

control variables. Interpret the outcomes.

You might also like

- Week 4 Project: Case StudyDocument2 pagesWeek 4 Project: Case StudytrishanuNo ratings yet

- Attribution of Portfolio Performance Relative To An IndexDocument16 pagesAttribution of Portfolio Performance Relative To An IndexhaginileNo ratings yet

- Curriculum Module 2 QuestionsDocument21 pagesCurriculum Module 2 QuestionsEmin SalmanovNo ratings yet

- CaseDocument4 pagesCaseRaghuveer ChandraNo ratings yet

- ProblemSet01 PDFDocument5 pagesProblemSet01 PDFMashiat Mutmainnah0% (1)

- Assignment 2 DMDocument5 pagesAssignment 2 DMshadow modeNo ratings yet

- Math 533 ProjectDocument4 pagesMath 533 ProjectNot listingNo ratings yet

- 2 - Quiz 3 Instructions - Set O Group of 4hDocument3 pages2 - Quiz 3 Instructions - Set O Group of 4hKimberly IgnacioNo ratings yet

- GSB 2 PDFDocument3 pagesGSB 2 PDFshjn96No ratings yet

- The Sharpe RatioDocument19 pagesThe Sharpe RatiopetefaderNo ratings yet

- Exam4135 2005 SolutionsDocument9 pagesExam4135 2005 SolutionsWilmerfredNo ratings yet

- Econometrics ExerciseDocument15 pagesEconometrics ExerciseLetitia VarneyNo ratings yet

- Trading Data AvailabilityDocument10 pagesTrading Data AvailabilityMichael OlaleyeNo ratings yet

- Modeling Loss Given Default in SASSTATDocument9 pagesModeling Loss Given Default in SASSTATDidi BaciuNo ratings yet

- Effects of Agency and Transaction Costs On Dividend Payout Ratios - Further Evidence of The Agency-Transaction Cost HypothesisDocument5 pagesEffects of Agency and Transaction Costs On Dividend Payout Ratios - Further Evidence of The Agency-Transaction Cost HypothesishhhhhhhNo ratings yet

- Regression and CorrelationDocument12 pagesRegression and CorrelationAbdul RehmanNo ratings yet

- Pes1ug22cs841 Sudeep G Lab1Document37 pagesPes1ug22cs841 Sudeep G Lab1nishkarshNo ratings yet

- Assignment - Evening StudentsDocument3 pagesAssignment - Evening StudentsBimal KrishnaNo ratings yet

- SSPSS Data Analysis Examples Poisson RegressionDocument34 pagesSSPSS Data Analysis Examples Poisson RegressionAhmad YangNo ratings yet

- Data Analysis - Using RDocument5 pagesData Analysis - Using RSatyendraSrivastavaNo ratings yet

- Risk and ReturnDocument59 pagesRisk and ReturnErin GamerNo ratings yet

- Daniel Di Benedetto, Leimin Gao, Yiwei Huang, Neha Sharma and Dongying WangDocument11 pagesDaniel Di Benedetto, Leimin Gao, Yiwei Huang, Neha Sharma and Dongying WangSrinidhi Adya0% (1)

- Chapter 2: Types, Sources and Collection of Data: What Is Your Gender ?Document62 pagesChapter 2: Types, Sources and Collection of Data: What Is Your Gender ?PradeepNo ratings yet

- 2010 10 06 NJ MezrichDocument26 pages2010 10 06 NJ Mezrichxy053333No ratings yet

- Banking Sector Profitability Analysis: Decision Tree ApproachDocument7 pagesBanking Sector Profitability Analysis: Decision Tree ApproachMirjana Pejic BachNo ratings yet

- Homework 2 AssignmentDocument6 pagesHomework 2 AssignmentKellieLeon0% (2)

- Gra 65151 - 201820 - 06.12.2018 - QPDocument6 pagesGra 65151 - 201820 - 06.12.2018 - QPHien NgoNo ratings yet

- International Institute For Higher Education in MoroccoDocument7 pagesInternational Institute For Higher Education in MoroccoNakonoaNo ratings yet

- Week2 Excel Problem Statement Real Estate-1Document2 pagesWeek2 Excel Problem Statement Real Estate-1Sandeep VishwakarmaNo ratings yet

- Forecasting Bank Loans Loss-Given-Default: Jo Ao A. BastosDocument16 pagesForecasting Bank Loans Loss-Given-Default: Jo Ao A. Bastosits4krishna3776No ratings yet

- Stat 101 4th ExamDocument4 pagesStat 101 4th ExamMarteCaronoñganNo ratings yet

- Chapter 6 Project ExampleDocument8 pagesChapter 6 Project Exampleapi-292360568No ratings yet

- Intended Thesis - Explanation in StepsDocument15 pagesIntended Thesis - Explanation in StepsanaskashafNo ratings yet

- FINAL QT PROJECT v1.1Document8 pagesFINAL QT PROJECT v1.1Harsh DuaNo ratings yet

- Score: Analysing Potential Bankruptcy Threat Using Altman Z-Score: Study of Randomly Selected Borrowers From Psu BanksDocument8 pagesScore: Analysing Potential Bankruptcy Threat Using Altman Z-Score: Study of Randomly Selected Borrowers From Psu BanksHarsh DuaNo ratings yet

- Aizam QuaestionDocument2 pagesAizam Quaestion171173No ratings yet

- MGT555 OCT2022 ICEPS Individual AssignmentDocument1 pageMGT555 OCT2022 ICEPS Individual AssignmentAfiq Najmi RosmanNo ratings yet

- Module 2 Part 1 - Types of Forecasting Models and Simple Linear RegressionDocument71 pagesModule 2 Part 1 - Types of Forecasting Models and Simple Linear Regressionhello hahahNo ratings yet

- 18CS72 - Module 5 NotesDocument53 pages18CS72 - Module 5 Notesprajna.sg241No ratings yet

- Credit Risk Project, Installment 2: Indian School of BusinessDocument2 pagesCredit Risk Project, Installment 2: Indian School of BusinessAmar ParulekarNo ratings yet

- FIN 534 Week 8 Homework Set 4Document7 pagesFIN 534 Week 8 Homework Set 4SandraecokerNo ratings yet

- FIN 534 Week 8 Homework Set 4Document7 pagesFIN 534 Week 8 Homework Set 4BarbaracriosNo ratings yet

- Assignment SI Dr. Javed Iqbal Fall 21 NewDocument7 pagesAssignment SI Dr. Javed Iqbal Fall 21 Newح ی د رNo ratings yet

- Take Home Test MEI 2014Document3 pagesTake Home Test MEI 2014மோகனா KarunakaranNo ratings yet

- Dan Gode-Affect CocDocument32 pagesDan Gode-Affect CocShanti PertiwiNo ratings yet

- Interbank Comparison: Some Important KeywordsDocument8 pagesInterbank Comparison: Some Important KeywordsAvneet ChawlaNo ratings yet

- FDS Iat-2 Part-BDocument4 pagesFDS Iat-2 Part-BBadri NarayananNo ratings yet

- Forecasting Debt Paydown Among Leveraged EquitiesDocument30 pagesForecasting Debt Paydown Among Leveraged EquitiesGABRIEL SALONICHIOSNo ratings yet

- Motherhood University, (Roorkee) Faculty of Commerce and Business Studies AssignmentDocument26 pagesMotherhood University, (Roorkee) Faculty of Commerce and Business Studies AssignmentShipra HadaNo ratings yet

- Descriptive StatisticsDocument27 pagesDescriptive StatisticsSaravjeet SinghNo ratings yet

- Cash Flow Analysis AngusDocument10 pagesCash Flow Analysis AngusInformation should be FREENo ratings yet

- Assignment FIN205 S2 - 2017Document4 pagesAssignment FIN205 S2 - 2017Japheth CapatiNo ratings yet

- Predicting Bankruptcy Using Financial IndicatorsDocument4 pagesPredicting Bankruptcy Using Financial IndicatorsIjbmm JournalNo ratings yet

- Assessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsDocument9 pagesAssessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsUmar AliNo ratings yet

- Lab 2 WorksheetDocument3 pagesLab 2 WorksheetPohuyistNo ratings yet

- Correlation and RegressionDocument2 pagesCorrelation and Regressionalekhyakaruturi333No ratings yet

- Workshop: R For Statistical AnalysisDocument16 pagesWorkshop: R For Statistical AnalysisOmeet HannahNo ratings yet

- Mathematical EquationDocument8 pagesMathematical EquationGoyobodNo ratings yet

- Reading 36 Using Multifactor Models - AnswersDocument23 pagesReading 36 Using Multifactor Models - Answersdhanh.bdn.hsv.neuNo ratings yet

- Portfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationFrom EverandPortfolio and Investment Analysis with SAS: Financial Modeling Techniques for OptimizationRating: 3 out of 5 stars3/5 (1)

- API FP - CPI.TOTL - ZG DS2 en Excel v2 5994828Document80 pagesAPI FP - CPI.TOTL - ZG DS2 en Excel v2 5994828Abigail MolnárNo ratings yet

- Linear Vs Logisitic RegressionDocument16 pagesLinear Vs Logisitic RegressionAbigail MolnárNo ratings yet

- III. 2. Unit Root TestsDocument41 pagesIII. 2. Unit Root TestsAbigail Molnár100% (1)

- Public EconomicsDocument8 pagesPublic EconomicsAbigail MolnárNo ratings yet

- Cooperatives (Coops) and Investor Owned Firms (Iofs)Document4 pagesCooperatives (Coops) and Investor Owned Firms (Iofs)Abigail MolnárNo ratings yet