Professional Documents

Culture Documents

CAMELS Rating System Explained

Uploaded by

Rnzljy CnnynOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAMELS Rating System Explained

Uploaded by

Rnzljy CnnynCopyright:

Available Formats

Bukidnon State University

College of Business

CAMELS RATING SYSTEM OF BANKING OPERATIONS

SUBMITTED BY: CANUNAYON, RANZEL JOY S.

SECTION CODE: B381

SUBMITTED TO: DR. JESUS JUEVESANO

CAMELS RATING SYSTEM OF BANKING OPERATIONS

Financial institutions are rated by bank supervisory bodies using the CAMELS

method, which is a widely accepted international rating system. Each bank is given a

grade on a scale by the supervisory authorities. For each factor, a rating between one

and five is regarded as the best and the worst.High-quality financial institutions are

defined as those with an average score of under two. A bank is deemed to be less-than-

satisfactory if it receives a score of three or higher. "Capital adequacy, Asset quality,

Management, Earnings, Liquidity, and Sensitivity" (CAMELS) is the abbreviation for

these six factors.

Let us talk first the six factors of CAMELS. First is the Capital Adequacy, through

capital trend analysis, examiners determine if institutions have adequate capital.

Examiners also look for compliance with laws governing risk-based net worth criteria at

institutions. Institutions must follow regulations governing interest and dividend

payments in order to receive a good capital adequacy rating. Other elements that go

into rating and evaluating an institution's capital sufficiency include its expansion plans,

the overall state of the economy, its capacity to manage risk, and the concentrations of

its loans and investments.

Second is the Asset Quality, it is the quality of an institutional loan that is

determined by its asset quality, which shows the institution's profitability. Rating

investment risk variables that the bank might encounter and weighing them against the

bank's capital profits are both necessary steps in assessing asset quality. This

demonstrates the bank's stability when exposed to specific dangers. Examinators also

look at how corporations are impacted by the difference between the book value of

investments at the bank and the fair market value of investments. The effectiveness of

an institution's investment rules and procedures is a final indicator of asset quality.

Third is the Management, If a company can respond to financial hardship in a

suitable manner depends on management assessment. This component assessment is

based on the management's capacity to identify, quantify, monitor, and manage risks

associated with the institution's everyday operations. It encompasses management's

capacity to guarantee the institution operates safely while adhering to the pertinent and

necessary internal and external regulations.

Fourth is the Earnings, one of the fundamental criteria used to determine a bank's

long-term survival is its capacity to generate enough revenue to support its operations,

grow, and maintain its competitiveness. In order to do so, examiners consider the

bank's earnings, growth in earnings, stability of earnings, valuation allowances, net

margins, level of net worth, and the caliber of the bank's current assets.

Fifth is the Liquidity, examiners consider the sensitivity of a bank's interest rate risk,

the presence of easily convertible assets, the reliance on unstable short-term financial

resources, and the technical proficiency when determining a bank's liquidity.

Lastly is the Sensitivity, it refers to the potential impact on institutions of specific

risk exposures. By observing how credit concentrations are managed, inspectors can

gauge how sensitive a given institution is to market risk. Examiners can thus see the

effects of lending to particular industries on an institution in this way. Among these loans

are those for the energy sector, credit cards, agriculture, and medicine. The rating of a

company's market risk sensitivity also takes into account the exposure to commodities,

equities, derivatives, and foreign exchange.

The CAMEL grading system is unquestionably a vital instrument for determining a

bank's strengths and flaws by assessing the bank's overall financial status and

recommending any necessary remedial steps. Results of the CAMELS testing can

assist regulators in instructing management of impacted banks to develop policy and

strategic initiatives for the enhancement of their bank profitability. Moreover, it is a

minimal statutory reserve that banks are required to maintain and serves as a vital gauge of a

bank's financial viability. It gives depositors the assurance that the bank can cover any

additional capital requirements without causing business delays.

Reference:

•Kagan, J. (2022, September 27). Camels rating system: What it is, how it is calculated.

Investopedia. Retrieved January 23, 2023, from

https://www.investopedia.com/terms/c/camelrating.asp#:~:text=CAMELS%20is%20an

%20international%20rating,%2C%20Liquidity%2C%20and%20Sensitivity.%22

•Insight #bigcompconvo : How strong are your camels? . (n.d.). Retrieved January 23, 2023,

from https://www.int-comp.org/insight/2020/february/04/camels-analysis/

You might also like

- Due Diligence TechGuide ENGDocument58 pagesDue Diligence TechGuide ENGWulan Daryoco BetrisNo ratings yet

- Lufthansa Annual Report 2011 PDFDocument264 pagesLufthansa Annual Report 2011 PDFphilippe8brunoNo ratings yet

- Internal Credit Risk Rating Model by Badar-E-MunirDocument53 pagesInternal Credit Risk Rating Model by Badar-E-Munirsimone333No ratings yet

- Camel Framework in Banks - Indian ScenarioDocument3 pagesCamel Framework in Banks - Indian Scenarioanjusawlani86No ratings yet

- Pearl and CamelDocument5 pagesPearl and CamelJean Javier AbillarNo ratings yet

- CRM 1Document41 pagesCRM 1Arjun PadmanabhanNo ratings yet

- ISO14327 2004resistanceweldingDocument20 pagesISO14327 2004resistanceweldingEdNo ratings yet

- Camels RatingDocument12 pagesCamels RatingImtiaz AhmedNo ratings yet

- SWOT Analysis of TATA MotorsDocument15 pagesSWOT Analysis of TATA MotorsSresth VermaNo ratings yet

- Avi Thesis Final Credit Risk Management in Sonali Bank LTDDocument20 pagesAvi Thesis Final Credit Risk Management in Sonali Bank LTDHAFIZA AKTHER KHANAMNo ratings yet

- Sales ContractDocument3 pagesSales ContractLY LE THI CAM100% (2)

- Camel Rating FrameworkDocument3 pagesCamel Rating FrameworkAmrita GhartiNo ratings yet

- What is the CAMELS Rating SystemDocument2 pagesWhat is the CAMELS Rating SystemEvita Rafaela GabineteNo ratings yet

- CAMELS Rating System ExplainedDocument11 pagesCAMELS Rating System ExplainedpoojaNo ratings yet

- Camels ReportDocument5 pagesCamels ReportMATIN SINDHINo ratings yet

- CB AssignmentDocument6 pagesCB AssignmentVaishnavi khotNo ratings yet

- Unit 5Document28 pagesUnit 5Mohammad ShahvanNo ratings yet

- Final ProjectDocument90 pagesFinal ProjectdgpatNo ratings yet

- CAMELS Rating System for Islamic BanksDocument54 pagesCAMELS Rating System for Islamic BanksElmelki AnasNo ratings yet

- Lecture 4Document17 pagesLecture 4Mona GavaliNo ratings yet

- Methodology For Rating Banks: Quantitative FactorsDocument3 pagesMethodology For Rating Banks: Quantitative FactorspawanNo ratings yet

- Final Ok Work1111Document33 pagesFinal Ok Work1111Ramu KhandaleNo ratings yet

- Commercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IEDocument7 pagesCommercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IERohit GambhirNo ratings yet

- Camel RatingDocument12 pagesCamel RatingRaquibul HasanNo ratings yet

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Document12 pagesAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirNo ratings yet

- CamelDocument21 pagesCamelSiva SankariNo ratings yet

- Credit Rating ProjectDocument10 pagesCredit Rating Projectnaman_s7028No ratings yet

- Bank SupervisionDocument91 pagesBank Supervisionabdalla osmanNo ratings yet

- Oriental Bank of Commerce,: Head Office, DelhiDocument32 pagesOriental Bank of Commerce,: Head Office, DelhiAkshat SinghalNo ratings yet

- CAMELS' financial health frameworkDocument4 pagesCAMELS' financial health frameworkWaseem KhanNo ratings yet

- Ncua Letter To Credit Unions: CAMEL Background. The CAMEL Rating System Was Adopted by NCUA inDocument20 pagesNcua Letter To Credit Unions: CAMEL Background. The CAMEL Rating System Was Adopted by NCUA insaurabhagrawal_1989No ratings yet

- Credit Risk Management and Performance of Banks in GhanaDocument8 pagesCredit Risk Management and Performance of Banks in GhanaHeber A.No ratings yet

- CAMELSDocument3 pagesCAMELSImjamul HassanNo ratings yet

- The Effect of Client Appraisal On The Efficiency of Micro Finance BankDocument13 pagesThe Effect of Client Appraisal On The Efficiency of Micro Finance BankaijbmNo ratings yet

- CAMELS Analysis - Breaking Down FinanceDocument3 pagesCAMELS Analysis - Breaking Down FinanceOlmedo FarfanNo ratings yet

- Supervisory Process For Community Banking OrganizationsDocument12 pagesSupervisory Process For Community Banking OrganizationsxaionNo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- How Regulators Monitor BanksDocument4 pagesHow Regulators Monitor BanksEhsanul HamidNo ratings yet

- F Dic Manual ExaminationDocument24 pagesF Dic Manual ExaminationAmir ShaikNo ratings yet

- SynopsisDocument12 pagesSynopsisPraveen Sehgal50% (2)

- Banking Sector Transformation and Emergence of Credit Rating Agencies in IndiaDocument13 pagesBanking Sector Transformation and Emergence of Credit Rating Agencies in IndiaMegha ChhabraNo ratings yet

- Statement of Purspoe of The ReasearchDocument5 pagesStatement of Purspoe of The ReasearchSatyendra Kumar SinghNo ratings yet

- Everest Bank Limited ProjectDocument8 pagesEverest Bank Limited ProjectRakesh Shah67% (3)

- Performance Evaluation of JP Morgan Chase Bank: Sadia ZamanDocument17 pagesPerformance Evaluation of JP Morgan Chase Bank: Sadia ZamanAjith VNo ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument11 pagesEconomic and Political Weekly Economic and Political WeeklyjayaNo ratings yet

- Financial Risk Management Assignment-RahulDocument4 pagesFinancial Risk Management Assignment-Rahul05550No ratings yet

- Performance Evaluation of A Bank (CBM)Document34 pagesPerformance Evaluation of A Bank (CBM)Vineeth MudaliyarNo ratings yet

- The Concept of Credit RatingDocument2 pagesThe Concept of Credit RatingDrKalyan DasNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument20 pagesRisk Management Systems in Banks Genesis, Significance and Implementationrajajee43No ratings yet

- Research Paper On Credit Risk Management in BanksDocument7 pagesResearch Paper On Credit Risk Management in BanksafnhinzugpbcgwNo ratings yet

- Thesis On Credit Risk Management in Ghanaian BanksDocument6 pagesThesis On Credit Risk Management in Ghanaian Banksafktmcyddtthol100% (1)

- BM 5 Bank Fund ManagementDocument11 pagesBM 5 Bank Fund ManagementKawsar Ahmed BadhonNo ratings yet

- The Influence of Credit Risk ManagementDocument26 pagesThe Influence of Credit Risk ManagementPia CallantaNo ratings yet

- Module III: Credit Management: Chapter 6: Credit Risk and RatingDocument25 pagesModule III: Credit Management: Chapter 6: Credit Risk and Ratingsagar7No ratings yet

- CAMELS Rating SystemDocument13 pagesCAMELS Rating SystemAbdu MohammedNo ratings yet

- What is RBC and how does it protect firmsDocument3 pagesWhat is RBC and how does it protect firmsDilawar Kamran-17No ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- A Study On CAMEL Concept of The Co Operative Bank SoceityDocument31 pagesA Study On CAMEL Concept of The Co Operative Bank SoceityJustin AyersNo ratings yet

- Dissertation Project Report On Risk Management in BanksDocument38 pagesDissertation Project Report On Risk Management in BanksKelly HamiltonNo ratings yet

- The_Impact_of_Credit_Risk_Management_onDocument7 pagesThe_Impact_of_Credit_Risk_Management_onNirvana CélesteNo ratings yet

- Camels Rating System Appendix ADocument12 pagesCamels Rating System Appendix AMuhammad AlsabriNo ratings yet

- Asset Quality Management in BankDocument13 pagesAsset Quality Management in Bankswendadsilva100% (4)

- Topic: Credit Rating Agencies Section: H and I Year: 3 RD, 6 SemesterDocument29 pagesTopic: Credit Rating Agencies Section: H and I Year: 3 RD, 6 SemesterShama parbinNo ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet

- Investment Banker ResumeDocument1 pageInvestment Banker ResumeJerry PasaribuNo ratings yet

- Andert Egger Hanggi Leitner City DirectoriesDocument52 pagesAndert Egger Hanggi Leitner City Directoriesapi-327987435No ratings yet

- Award Notice - 2021-04-28T112001.527Document3 pagesAward Notice - 2021-04-28T112001.527Bilel MarkosNo ratings yet

- L&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Document15 pagesL&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Tejas GaubaNo ratings yet

- Commune/Sangkat Fund and Local Development Case of CambodiaDocument7 pagesCommune/Sangkat Fund and Local Development Case of Cambodiahayatudin jusufNo ratings yet

- Copper Price Increase Amid Declining Scrap Supplies - May 2021Document3 pagesCopper Price Increase Amid Declining Scrap Supplies - May 2021Ritesh MauryaNo ratings yet

- WRSX External Environment - Phase 1 Produced by Andy Carnelley, WRSX Business AnalystDocument4 pagesWRSX External Environment - Phase 1 Produced by Andy Carnelley, WRSX Business AnalystQuinn Tavious TaylorNo ratings yet

- Offer N AcceptanceDocument21 pagesOffer N Acceptancearsheedbashir9No ratings yet

- Forecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixDocument9 pagesForecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixMathew UsfNo ratings yet

- Russell 2000 Membership List 2013Document23 pagesRussell 2000 Membership List 2013jeetNo ratings yet

- Bomcpe11,+Journal+Manager,+87 99Document13 pagesBomcpe11,+Journal+Manager,+87 99ayoub oumouhNo ratings yet

- Private Capital MobilizationDocument486 pagesPrivate Capital MobilizationHallo SunshineNo ratings yet

- AA 5-Exercise 3 Page 91Document8 pagesAA 5-Exercise 3 Page 91Gil Diane AlcontinNo ratings yet

- Homelessness Research PaperDocument2 pagesHomelessness Research Paperapi-509652744No ratings yet

- Ch-5 MONEYDocument6 pagesCh-5 MONEYYoshita ShahNo ratings yet

- STRAMA 3 - External AssessmentDocument36 pagesSTRAMA 3 - External AssessmentElsha DamoloNo ratings yet

- Role Leader Achieve Employee PerformanceDocument5 pagesRole Leader Achieve Employee PerformanceMohammad ErwanNo ratings yet

- Final Exam Study GuideDocument9 pagesFinal Exam Study GuideDognimin Aboudramane KonateNo ratings yet

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 998422 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 998422 GJSutariya KapilNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument3 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureAbhiraj SinghNo ratings yet

- Financial Derivatives Assignment Option StrategiesDocument27 pagesFinancial Derivatives Assignment Option StrategiesVAIBHAV WADHWANo ratings yet

- Goods & Services Tax Invoice Insurance Invoice (Labour)Document1 pageGoods & Services Tax Invoice Insurance Invoice (Labour)Deepak SharmaNo ratings yet

- You Have Recently Been Hired by Goff Computer Inc GciDocument2 pagesYou Have Recently Been Hired by Goff Computer Inc GciAmit PandeyNo ratings yet

- Portfolio Selection Using Markowitz PrinciplesDocument15 pagesPortfolio Selection Using Markowitz PrinciplesNadea Fikrah RasuliNo ratings yet

- 01 Pojmy Filmove Teorie 3Document10 pages01 Pojmy Filmove Teorie 3Maki DefaceNo ratings yet

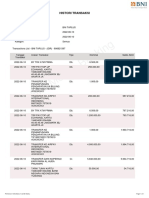

- BNI TAPLUS Transactions - June 10Document1 pageBNI TAPLUS Transactions - June 10Webi SuprayogiNo ratings yet