Professional Documents

Culture Documents

Know Our Bank English

Uploaded by

Honey SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Know Our Bank English

Uploaded by

Honey SharmaCopyright:

Available Formats

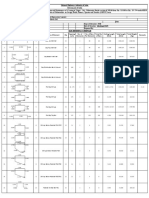

*EEAtr.

lrfF stlsr

@ Cenfiol Bank of lndia

rel1*+<aofiq+frs cEiaTRAL TO YOU SlltcE t9tI

atfi6rqldq,q-fl561 CENTRAL OFFICE. CHANDER MUKHI

+trcfrfe,ffi-rooozr NARIMAN POINT, MUMBAI . 4OO 02I

BUDGETING PERFORMANCE PLANNING & REVIEW DEPARTMENT

INFORMATION CIRCULAR NO:3467 Date : 31st January, 2023

FILE NO. : 05 fr6 Deptt. Running No. : 63

All Branches/Offices

Sub: KNOW OUR BANK- DECEMBER4022

(a in Crore

SR MARCH NOVEMBER DECEMBER

NO UNI'I' (31.03.20221 (30.11.20221 |'31.12.2022)-

I BRANCHES IN INDIA (*) No. 4528 4504 4493

l.l Rural No. 1 604 1600 1600

1 330 'r 330 1 330

1.2 Semi-Urban No.

1.3 Urban No. 783 775 769

1.4 Metropolitan No. 811 799 794

, SATEI,LIl'O OFFICES No. 10 10 10

,|

3 EXTENSION COUNTERS No. 1 1

4 SIZEWISE BRANCHES No. 4528 4504 4493

4,I ELB No. 22 22 22

4.2 vLB No. 550 547 547

4.3 l-arge Branches No. 1637 1628 1626

4.4 Medium Bmnches No. 2296 2284 zltJ

4.5 Small Branches No. 0 0 0

4.6 Specialised Branches (**) No. 23 23 23

5 ACGREGATE DEPOSITS Rs. 341036 340905 343771

5.1 Current Rs. 16515 16027 16661

5.2 Savings Rs. 1 55965 157685 159420

5.3 Time Rs. 168556 1671 93 167690

5.4 lnstitutional Deposits Rs 7989 9173 9347

5.5 Public Deposits Rs. 333047 331732 334424

5.6 Inter Bank Deposits Rs. 1656 1 053 1076

5.7 Total Deposits (including Inter Bank) Rs 342692 341958 344847

6 SIIARE OF CBI lN SCBs (DEPOSITS) .^ 2.04 't .95 1.92

7 PER BRANCH DEPOSITS Rs 7 5.32 75.69 76.51

8 AVERAGE DEPOSIl'S Rs 332282 338871 339001

9 GRO\\'TH OVER PREVIOUS N,IARCH

9.1 Aggregate Deposits

I % 3.70 -0.04 0.80

9.2 Public Deposits % 3.35 -0.39 0.41

9.3 Institutional Deposits 20.83 14.82 17.00

9.4 Average Deposits % 3.87 1.98 2.02

9.5 Total Deposits (including lnter Bank) % -o.21 0.63

l0 POIr-T TO POINT ACG.DEP-CROWTH .h 3.70 2.15 2.00

ll CRR:- a)Obligator1 GO.l2.2022l Rs. 13712 15608 1s666

b) Acaual (Average) (30.12.2022) Rs, 13729 15621 15680

t2 SLR! a)Obligatory O0.12.2022) Rs 61865 6243'l 62725

I l3 b)Actual (30.12.2022)

cAsH tN HAND (30.t2.2022)

Rs

Rs.

121598

1493

97804

1520

95365

1477

1.1 BALANCE WtT BANKS IN INDIA (30.12.2022) Rs 49 53 36

l5 BALANCE WITH RBI (Last reporting Friday) Rs 1327 5 15950 168s0

(*) Total No. of Branches exclude satellite offices. No. of Branches revised as per RBI Branch categorisation guidelines.

(**) Specialised Branches includes CFBs/SAMs/ARB/NIC

""'v' al Markel and Treesurv Branch

2

DECENIBER - 2022

(t in Crore)

SR MARCH NOVEMBER OECEMBER

NO t\n (31.03.2022\ (30.11.20221 (31.12.20221

l6 INVESTNIENT Rs 146759 142410 140383

II l6.l Govemment Securities

l6-2 Other Approved Securities

lls

Rs

105842

0

100747

0

100559

0

II 16.3 Other Non SLR Securities

16.3.1 CPs

lls

Rs

40s17

342

41663

3'15

39824

315

I 16.3.2 Debentues Rs. 5860 5065 4781

II 16.3.3 PSU Bonds

16.3.4 Shares - Jt.\/niSubs'ry (lnland)

Rs.

Rs

28736

258

28539

258

28559

670

II 16.3.5 Shares ofJoint Ventures (Forcign)

16.3.6 Others

Rs

Rs.

0

7486

0

5499

0

l1 l-ENDING (Call Market) Rs- 464 4045 0

l8 NET CREDIT (Excl. Credit to Bank) Rs. 189712 201026 208921

ADJUSTED NET BANK CREDIT (ANBC)(Incl. RJDF)# Rs 167s98 178308 178308

l9 TOTAL CREDIT ra Rs. 1897't2 201026 204921

l9.l l'ood Rs. 1696 1572 1745

19.2 Non Food Rs. 188016 199454 207176

19.3 Priority Sector (*) Rs. 93887 97315 100299

19.3.1 Agriculture (Total) (*) Rs. 38635 39796 40641

19.3.2 Micro, Small and Medium Entemrises(MSME) Rs 34139 JO44J 38182

19.3.3 Others 21113 21076 21474

19.4 Non-Priorin Rs. 95826 103711 108622

20 SHARE OF CBI IN SCBs(CRllDlT) 1.53 1.52 1.54

2l PER BRANCH AD\TANCES Rs 41.90 44.63 46.s0

,) AVE,RAGE CREDIT Rs. 175184 191285 192803

23 EXPORT CREDIT Rs 4388 4208 4248

24 CROWTH OVER PREVIOUS MARCH

II 24.1 Total Credit

24.2 Net Credit

%

%

7

7

.23

.23

5.96

5.96

10.13

10.13

II 24.3 Food Credit

24.4 Non-Food Credit %

-4.46

6.08

2.89

10.19

II 24.5 Prioritv Sec.Credit

2,1.6 Expon Credit

%

%

6.42

-1.30

3.6s

-4.10

6.83

-2.28

POINT TO POINT CREDIT GROWTH 7.23 15.61 14.73

GROWTH:CB! VIS.A.VIS SCBS

26

AS ON 30.12.2022 OVER MAR-22 (25.03.2022)

26.1 Aggregate Deposit CBI 01,

3.04 0.48 1.52

SCBs % 8.94 5.04 7 .71

26.2 Total Credit CBI % 0.92 8.67 12.43

SCBs 8.60 8.88 1 1.88

26.3 Non-Food Credit CBI % 0.98 8.91 12.60

SCBs % 8.70 8.95 1 '1.95

21 27.1 CREDIT : DEPOSIT RATIO (30.12.2022)

CBI % 54.11 58.52 59.92

SCBs % 72.22 74.86 75.O2

27.2 NON-FOOD CR:DEPOStT (30.12.2022)

CtsI 53.56 58.06 59.41

SCBs % 7'l .88 74.56 74.72

27.3 Share of Priority Sector in Adj.Net Credit (incl. RIDF) % 48.35 54.88

27.4 Share ofAgriculture in Adj. Net Credit (lncl. RIDF) % 21.30 21 .62 22.08

27.5 Idle Cash: Aggrcgate Deposits vo 0.44 0.45 0.43

27.6 ldle Assets: Aggegate DeDosits on 0.45 0.46 o.44

27.7 Investment: Aggegate Deposits % 43.03 41.77 40.84

* Prio ty Sector and its segrnentwise Advances are excluding of RIDF and PSLC amount and the 7o to ANBC is computed after considering

RIDF and PSLC.

- SCBs figures as of 30.12.2022

# ANBC for DECEMBER-2022 shown is as of DECEMBER -2021.

\)L==

_.,==-(8&qJEsH MEHRA )

DEPUTX IEN.MANAC ER (BPPR)

\

You might also like

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Besi BetonnnnDocument3,879 pagesBesi Betonnnnhalo windaNo ratings yet

- Live Account STT - Mar 22Document2 pagesLive Account STT - Mar 22Sharad ChafleNo ratings yet

- 1 - Pipe Blasting & Painting CostDocument1 page1 - Pipe Blasting & Painting CostVaibhav Sawant100% (1)

- Financial Regulations - I P ODocument37 pagesFinancial Regulations - I P ObeelzebubsibmNo ratings yet

- Ext. NCR Int. NCR SOR: Row LabelsDocument1 pageExt. NCR Int. NCR SOR: Row LabelskkhafajiNo ratings yet

- Tamilnadu: Petroproclucts LimiteclDocument3 pagesTamilnadu: Petroproclucts Limitecljagdish cbeNo ratings yet

- Category 4 Lottery Post ShuffleDocument7 pagesCategory 4 Lottery Post Shufflehp laptopNo ratings yet

- Kitchen Counter Plot 6 and 7Document3 pagesKitchen Counter Plot 6 and 7RomeoNo ratings yet

- Table 22: Statewise Distribution of Number of Operational Holdings and Area Operated - Scheduled TribesDocument5 pagesTable 22: Statewise Distribution of Number of Operational Holdings and Area Operated - Scheduled Tribesravi kumarNo ratings yet

- Ring Frame: Linc ConerDocument16 pagesRing Frame: Linc ConerLalit KashyapNo ratings yet

- Dealer Name: Drip India Irrigation PVT LTDDocument7 pagesDealer Name: Drip India Irrigation PVT LTDmahantesh muralNo ratings yet

- Bit Data Ubl-D.6: Hole Section (In) 36 26Document49 pagesBit Data Ubl-D.6: Hole Section (In) 36 26Naisee KilLNo ratings yet

- All Gasket QuotationsDocument11 pagesAll Gasket Quotationspafohes840No ratings yet

- 100+123 MJB Pier Cap.Document12 pages100+123 MJB Pier Cap.SOUMYA BHATTNo ratings yet

- QuotationDocument6 pagesQuotationRakshit JainNo ratings yet

- CicadacabinetDocument1 pageCicadacabinetapi-3727858No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Speed PredictionDocument27 pagesSpeed PredictionEsther Dreyy PermatasariNo ratings yet

- Not Needed Annual Report 2017 VBL SubsidiariesDocument121 pagesNot Needed Annual Report 2017 VBL SubsidiariesRAJAN SHAHINo ratings yet

- Datasheet DIN - 200809 1Document4 pagesDatasheet DIN - 200809 1Ramiro FelicianoNo ratings yet

- Standalone & Consolidated Financial Results For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Cantidad de Mangas 2022-08-23Document12 pagesCantidad de Mangas 2022-08-23Ernesto Jimenez FerminNo ratings yet

- 5Document1 page5brian richardoNo ratings yet

- LD TempDocument1 pageLD Tempeetlc kdpNo ratings yet

- DG Service FormatDocument2 pagesDG Service FormatSandeep NikhilNo ratings yet

- Mittal NC F1.1 Round BarDocument7 pagesMittal NC F1.1 Round BarDominic LeeNo ratings yet

- SPL Western Tower: Store Report For The Month of February 2010Document42 pagesSPL Western Tower: Store Report For The Month of February 2010arctusharNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Pier Cap BBSDocument3 pagesPier Cap BBSbeing PahadiNo ratings yet

- Raghu House Estimate at Subhash Nagar 20.07.22Document12 pagesRaghu House Estimate at Subhash Nagar 20.07.22sravan kumarNo ratings yet

- Trimmer (TR5010) : 19 April 2006Document23 pagesTrimmer (TR5010) : 19 April 2006Jesus Mack GonzalezNo ratings yet

- Concrete Design PracticeDocument11 pagesConcrete Design PracticeKeanu ReyesNo ratings yet

- Storage Capacity - FOI Data RequestDocument1 pageStorage Capacity - FOI Data RequestRudy LangiNo ratings yet

- LC Buliders Later PadDocument2 pagesLC Buliders Later PadAtish Kumar ChouhanNo ratings yet

- Consumer Price List WEF 01-08-2023Document3 pagesConsumer Price List WEF 01-08-2023masifprcNo ratings yet

- Project: Residential Building, Dhobighat. Interplot and Miscellaneous Works S.N Details AmountDocument7 pagesProject: Residential Building, Dhobighat. Interplot and Miscellaneous Works S.N Details AmountNishan GajurelNo ratings yet

- SL No. Tank Details Description Amount (BDT) : Mechanical Material Mechanical ConstructionDocument11 pagesSL No. Tank Details Description Amount (BDT) : Mechanical Material Mechanical ConstructionSADMAN AOWALNo ratings yet

- JUSPAY Analytics Data Set - PM InternshipDocument3 pagesJUSPAY Analytics Data Set - PM Internshipnitish menteNo ratings yet

- 1A92EB35-B58F-4330-97FE-2B7607BFD30F.xlsxDocument7 pages1A92EB35-B58F-4330-97FE-2B7607BFD30F.xlsxNikhil JainNo ratings yet

- Manpower CostDocument1 pageManpower Cost2CWisnu KristiantoNo ratings yet

- Mixing Klp1Document2 pagesMixing Klp1Sabil BileNo ratings yet

- Galaxy Stone Measurements & Granite Work RatesDocument10 pagesGalaxy Stone Measurements & Granite Work RatesBANDARPALLY PRABHAKARNo ratings yet

- Principal of ManagementDocument19 pagesPrincipal of ManagementfalconsidNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 55D MN Single Stage Mast: Arts ManualDocument15 pages55D MN Single Stage Mast: Arts ManualRonaldo Alves de MedeirosNo ratings yet

- 12.1 Scheduled Banks Operating in Pakistan: 12. BankingDocument6 pages12.1 Scheduled Banks Operating in Pakistan: 12. Bankingh4hasnainNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 120.121.125 SeriesDocument2 pages120.121.125 SeriesAhad VavdiwalaNo ratings yet

- Formulas Charts and TablesDocument56 pagesFormulas Charts and TablesRodolfo MendezNo ratings yet

- Consumers Price List WEF 05-06-2023Document3 pagesConsumers Price List WEF 05-06-2023Talha Alam KhanNo ratings yet

- Colliers Labour Old BillsDocument7 pagesColliers Labour Old BillsGokul KannanNo ratings yet

- PDF ExamenDocument2 pagesPDF ExamenJimena Gonzales MejiaNo ratings yet

- SnageDocument5 pagesSnageAleksandar Suzana DjordjevicNo ratings yet

- Spare Part Catalogue: Lokotrack LT200HP SN 73175Document443 pagesSpare Part Catalogue: Lokotrack LT200HP SN 73175Jorge YaipenNo ratings yet

- Supplier Improvement StrategyDocument20 pagesSupplier Improvement StrategyMohit Singh100% (1)

- HERZ - Water StrainerDocument12 pagesHERZ - Water StrainerKyriakos MichalakiNo ratings yet

- Bore Record Extruder 16 NovDocument9 pagesBore Record Extruder 16 NovMasyhar WahyuNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- BDO V Equitable BankDocument18 pagesBDO V Equitable BankKresnie Anne BautistaNo ratings yet

- Kieso Ifrs Test Bank Ch17Document45 pagesKieso Ifrs Test Bank Ch17FaradibaNo ratings yet

- Reliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)Document486 pagesReliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)lavNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2018Document8 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2018jad NasserNo ratings yet

- IIFL Project 2010Document112 pagesIIFL Project 2010695269100% (3)

- BTPNDocument3 pagesBTPNNidaNo ratings yet

- Invoice 120296574733Document1 pageInvoice 120296574733nurashenergyNo ratings yet

- Applicability of Free Cash Flow To Equity Model For Equity Valuation Evidence From Pakistan Tobacco Company LimitedDocument15 pagesApplicability of Free Cash Flow To Equity Model For Equity Valuation Evidence From Pakistan Tobacco Company LimitedTaleya FatimaNo ratings yet

- Chapter 4 - The Revenue Cycle Sales To Cash CollectionsDocument5 pagesChapter 4 - The Revenue Cycle Sales To Cash CollectionsHads LunaNo ratings yet

- Shorter Life Expectancy Gives UK Pensions An Unexpected Windfall - Financial TimesDocument4 pagesShorter Life Expectancy Gives UK Pensions An Unexpected Windfall - Financial TimesAleksandar SpasojevicNo ratings yet

- LP Laboratories CaseDocument4 pagesLP Laboratories CaseAkash GuptaNo ratings yet

- Arf7 Glossary PDFDocument8 pagesArf7 Glossary PDFPendi AgarwalNo ratings yet

- BCBP - GREENHILLS EAST - Financial Report - DEC - 2021Document109 pagesBCBP - GREENHILLS EAST - Financial Report - DEC - 2021Angelo ManlangitNo ratings yet

- Chapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsDocument7 pagesChapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsdmangiginNo ratings yet

- Orange County Case StudyDocument6 pagesOrange County Case StudyPiyush Dhar DwivediNo ratings yet

- Imad A. Moosa: Department of Accounting and Finance Mortash UniversityDocument6 pagesImad A. Moosa: Department of Accounting and Finance Mortash UniversitySamina MahmoodNo ratings yet

- Monetise Your Idle Asset To Fund Your SuccessDocument7 pagesMonetise Your Idle Asset To Fund Your Successrenugadevi_dNo ratings yet

- No Voucher No Surat BLN Pelayanan Jenis Pasien No. KwitansiDocument6 pagesNo Voucher No Surat BLN Pelayanan Jenis Pasien No. Kwitansidodi kusumaNo ratings yet

- Ajay YadavDocument146 pagesAjay Yadav9415697349No ratings yet

- The Abcs of Abs: Portfolio Strategy ResearchDocument20 pagesThe Abcs of Abs: Portfolio Strategy ResearchYusuf Utomo100% (2)

- Acct Statement - XX3940 - 09082023 (1) - LDocument22 pagesAcct Statement - XX3940 - 09082023 (1) - LTHE CAMBRIDGENo ratings yet

- Reference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixDocument2 pagesReference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixMie CuarteroNo ratings yet

- Syndicate Assignment: Case Study: Letting Go of Lehman BrothersDocument6 pagesSyndicate Assignment: Case Study: Letting Go of Lehman BrothersJane Tito100% (1)

- Module 5A CBO Corporate Banking Topic 1Document17 pagesModule 5A CBO Corporate Banking Topic 1RajabNo ratings yet

- Africa Fintech Rising SummitDocument15 pagesAfrica Fintech Rising Summitace187No ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- What Does REHABILITATION MeanDocument23 pagesWhat Does REHABILITATION MeanMaLizaCainapNo ratings yet

- LIC 'S Jeevan Arogya (Table No 904) : Mode Number of Members Principle Insured Term RiderDocument6 pagesLIC 'S Jeevan Arogya (Table No 904) : Mode Number of Members Principle Insured Term RiderKamala KannanNo ratings yet

- Macro Mid 1 SolutionDocument4 pagesMacro Mid 1 SolutionMd. Sakib HossainNo ratings yet

- Rizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)Document2 pagesRizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)faheemNo ratings yet