Professional Documents

Culture Documents

Capital Gains Tax Reviewer

Uploaded by

Cleah Waskin0 ratings0% found this document useful (0 votes)

20 views14 pagesReviewer on Captal gains tax

Original Title

Capital gains tax reviewer

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReviewer on Captal gains tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views14 pagesCapital Gains Tax Reviewer

Uploaded by

Cleah WaskinReviewer on Captal gains tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 14

1. In value added taxation, this is not a requirement for taxability service.

a. Consider received actually or constructively

b. Performed within or outside the Philippines

c. Supply of service is not exempt from VAT.

d. In the course of business

2. Statement 1: A taxpayer whose gross sales or receipts exceeded the amount of

P3,000,000 shall pay VAT even if he is not VAT registered, consequently, he is entitled

to input taxes.

Statement 2. importer of goods for personal use is not subject to VAT if he is not-VAT

registered.

a. Both statements are true

b. Both statements are false

c. Only statement 1 is true

d. Only statement 2 is true

3. Which statement is correct?

a. Zero rated sales are exempt from the VAT

b. A person whose sales or receipts do not exceed P 250.000 is exempt from VATand

OPT.

c. A person who issues a VAT invoice on a VAT exempt transaction is nevertheless

subject to VAT on the said transaction.

d. Entities which are exempt from income tax are also exempt from VAT

4. Which of the following is subject to VAT?

a. Sale of smoked fish

b. Sale of lechon

c. Sale of shells and coral products by a dealer.

d. Sale of newspaper.

5. The allowable transitional input tax is

a. The lower between 2% of the value of beginning inventory or actual VAT paid on such

inventory.

b. The higher between 2% of the value of beginning inventory or actual

such inventory

c. The actual VAT paid on the beginning inventory

d. 2% of the value of beginning inventory.

6. The VAT due on the sale of taxable goods, property and services by any person

whether or not he has taken the necessary steps to be registered.

a. Input tax

b. Output Tax

c. Excise tax

d. Sales tax

7. One of the following is not an activity subject to VAT

a Sale in retail of goods by a dealer

b. Sale of bamboo poles by a dealer

c. Sublease of real property in the course of business

d. Importation of ordinary feeds for poultry chicken

8. A resident citizen had the following Properties in Mexico, Pampanga Properties in Hong

Kong What is the amount subject to Philippine property tax?

a 3,500,000

b. 2,000,000

c. 1,500,000

d.0

9. Which of the following forms of escapes will more likely to result in loss of revenue to

the government?

a. Shifting

b. Capitalization

c. Transformation

d.Tax exemption

10. Tax minimization cannot be achieved by

a. Tax planning

b. Selection of transaction

c. Maximization of tax credits and loss carry-overs

d. Offsetting of losses and income of subsidiaries

11. The following are kinds of value added taxes, which is not included?

a. VAT on sale of goods or properties

b. VAT on Importation of goods

c. VAT on Importation of goods

d. VAT on exchange of foreign currencies

12. A non-VAT registered entity and whose sales for the year did not exceed VAT

threshold

a. Exempt from VAT

b. Subject to 0% VAT

c. Subject to percentage tax

d. Subject to 12% VAT

13. Which of the following statement is correct?

1. VAT maybe imposed together with other percentage tax

II. Vat maybe imposed together with excise tax

III. Vat and any percentage maybe imposed together with income tax

a. II only

b. III only

c. II and III only

d. I, II and III

14. Who among the following is not subject to VAT?

a. VAT registered person whose gross sales do not exceed P3.000.000

b. A non-resident lessor or foreign licensor who is not VAT registered

c. Any person wo is required to rgister under the VAT system but failed to

register

d. None of the above

15. Which of the following taxes describes the valued-added tax?

a. Income tax

b. Sales tax

c. Indirect tax

d. Personal tax

16. Baldo is certified public accountant. He applied for work and was hired by Bruno

Corporation which is engaged in Business Process Outsourcing (BPO) handling

accounting work for US entities. He was paid for his services. How should Baldo treat

such payment for business tax purposes?

a. Subject to 12% VAT

b. Subject to percentage tax

c. Exempt from VAT and Percentage tax

d. It is a zero-rated transaction

17. As to tax rate, value-added tax is an example of

a. Graduated tax

b. Progressive tax

c. Regressive tax

d. Proportional tax

18. Hanep is a manufacturer of fermented liquors. In making sales, all taxes on the products

and transactions are passed on to the buyers. For purposes of the value added tax, which

of the following taxes below that he pays forms part of the gross selling price?

a. Excise tax

b. Value-added tax

c. Percentage tax

d. None of the above

19. The following shall be allowed as deductions from gross selling price, which is not?

a. Discounts determined and granted at the time of sales

b. Sales returns and allowances

c. Freight-out

d. None of the above

20. Under the Tax Code, the following are major internal revenue business taxes,

which one is not?

a. Excise tax

b. Income tax

c. Value-added tax

d. Other percentage tax

21. Which among the following is correct?

a. A taxpayer who is subject to percentage tax on his gross receipts will also be

subject to income tax on his net income

b. All VAT-exempt taxpayers shall be subject of other percentage taxes

c. Both "a" and b"

d. Neither "a" and "b"

22. If the VAT is not billed separately in the document of sale, the selling price or the

consideration therein shall be deemed

a. Exclusive of VAT

b. Inclusive of VAT

c. VAT exempt

d. Zero rate

23. What does the acronym VAT stand for?

a. Value And Tax

b. Variety Added Tax

c. Property

d. Acquisition/spending

24. VAT is a tax on

a. Income

b. Company profit

c. Property

d. Acquisition/spending

25. What kind of tax Is VAT

a. Depends upon the types of goods or services

b. Direct tax

c. Indirect tax

d. None of the above

26. It is a tax on the purchase/sale of a good or service

a. Income tax

b. Estate tax

c. Value added tax

d. Excise tax

27. Which statement is wrong?

a. There is a transitional input tax from purchase of goods or properties

b. There is a transitional input tax from purchases of services

c. There is a transitional input tax from purchases of materials

d. There is a transitional input tax from purchases of supplies.

28. When to file a VAT return?

a. Monthly

b. Quarterly

c. Semi annually

d. Annually

29. Sale of orchids by a flower shop which raises its flower in Tagaytay City is

subject to

a. 12% VAT

b. 0% VAT

c. Exempted from VAT

d. None of the above

30. Which statement is correct about value-added tax on goods or properties sold?

a. It is based on gross sales and not on net sales

b. May be due even if the goods or properties were not actually sold.

c. Does not cover good exported

d. It forms part of selling expense of the trader

1. The following are kinds of

value added taxes, which is

not included?

a. VAT on sale of goods or

properties

b. VAT on importation of

goods

c. VAT on sale of

services/use or lease of

properties

d. VAT on exchange of

foreign currencies

2. A non-VAT registered

entity and whose sales for

the year did not exceed VAT

threshold

a. Exempt from VAT

b. Subject to 0% VAT

c. Subject to percentage tax

d. Subject to 12% VAT

3. Which of the following

statement is correct?

I. VAT maybe imposed

together with other

percentage tax

II. Vat maybe imposed

together with excise tax

III. Vat and any percentage

maybe imposed together

with income tax

a. II only

b. III only

c. II and III only

d. I, II and III

4. Who among the

followidng is not subject to

VAT?

a. VAT registered person

whose gross sales do not

exceed P3,000,000

b. A non-resident lessor or

foreign licensor who is not

VAT registered

c. Any person wo is required

to rgister under the VAT

system but failed to

register

d. None of the above

5. Which of the following

taxes describes the valued-

added tax?

a. Income tax

b. Sales tax

c. Indirect tax

d. Personal tax

6. Baldo is certified public

accountant. He applied for

work and was hired by

Bruno Corporation which is

engaged in Business Process

Outsourcing (BPO)

1. The following are kinds of

value added taxes, which is

not included?

a. VAT on sale of goods or

properties

b. VAT on importation of

goods

c. VAT on sale of

services/use or lease of

properties

d. VAT on exchange of

foreign currencies

2. A non-VAT registered

entity and whose sales for

the year did not exceed VAT

threshold

a. Exempt from VAT

b. Subject to 0% VAT

c. Subject to percentage tax

d. Subject to 12% VAT

3. Which of the following

statement is correct?

I. VAT maybe imposed

together with other

percentage tax

II. Vat maybe imposed

together with excise tax

III. Vat and any percentage

maybe imposed together

with income tax

a. II only

b. III only

c. II and III only

d. I, II and III

4. Who among the

followidng is not subject to

VAT?

a. VAT registered person

whose gross sales do not

exceed P3,000,000

b. A non-resident lessor or

foreign licensor who is not

VAT registered

c. Any person wo is required

to rgister under the VAT

system but failed to

register

d. None of the above

5. Which of the following

taxes describes the valued-

added tax?

a. Income tax

b. Sales tax

c. Indirect tax

d. Personal tax

6. Baldo is certified public

accountant. He applied for

work and was hired by

Bruno Corporation which is

engaged in Business Process

Out

You might also like

- 2018 Sav1455 RedemptionDocument5 pages2018 Sav1455 Redemptiondouglas jonesNo ratings yet

- Estate TaxDocument19 pagesEstate TaxCleah WaskinNo ratings yet

- A. Domestic Consumption: CHAPTER 1-Introduction To Consumption Taxes MULTIPLE CHOICE - Theory Part 1Document16 pagesA. Domestic Consumption: CHAPTER 1-Introduction To Consumption Taxes MULTIPLE CHOICE - Theory Part 1Carlo Baculo87% (15)

- Statement of Financial Position BALANCE SHEETDocument28 pagesStatement of Financial Position BALANCE SHEETCleah WaskinNo ratings yet

- Project Report ON Comparative Analysis of Financial Performance of Zomato: A Ratio Analysis ApproachDocument49 pagesProject Report ON Comparative Analysis of Financial Performance of Zomato: A Ratio Analysis Approachsudhanshu jeevtani100% (5)

- VAT Exam Review QuestionsDocument4 pagesVAT Exam Review QuestionsLovenia Magpatoc100% (7)

- Multiple Choice Questions On TreasuryDocument8 pagesMultiple Choice Questions On Treasuryparthasarathi_in100% (1)

- BUSTAX: Understanding Philippine Business TaxesDocument29 pagesBUSTAX: Understanding Philippine Business TaxesGianJoshuaDayrit67% (3)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Income Taxation Chapter 5Document2 pagesIncome Taxation Chapter 5Misherene MagpileNo ratings yet

- Bustax Final ExamDocument13 pagesBustax Final Examshudaye100% (3)

- Question Bank VatDocument14 pagesQuestion Bank VatLeonard Cañamo90% (10)

- Donor's Tax Exam ReviewerDocument4 pagesDonor's Tax Exam ReviewerCleah WaskinNo ratings yet

- TAXATION 2 Chapter 10 Value Added TaxDocument7 pagesTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Final Tax PDFDocument34 pagesFinal Tax PDFMary Denize100% (4)

- Possible Questions For Outline DefenseDocument1 pagePossible Questions For Outline DefenseCleah WaskinNo ratings yet

- VAT Quiz for Accounting 17 Taxation ClassDocument6 pagesVAT Quiz for Accounting 17 Taxation ClassKevin James Sedurifa Oledan86% (7)

- Chapter 3Document21 pagesChapter 3Carlo Baculo50% (4)

- PrefinalDocument7 pagesPrefinalLeisleiRagoNo ratings yet

- Summatve 4 - TaxDocument8 pagesSummatve 4 - TaxkmarisseeNo ratings yet

- MIDTERM EXAMINATION IN TAXATIONDocument13 pagesMIDTERM EXAMINATION IN TAXATIONAdriana Del rosarioNo ratings yet

- Accounting Cycle For Merchandising BusinessDocument46 pagesAccounting Cycle For Merchandising BusinessShaRey100% (1)

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- BAM 208 - P2 Quiz #2Document4 pagesBAM 208 - P2 Quiz #2trishaNo ratings yet

- MIDTERM LONG QUIZ TAX2Document10 pagesMIDTERM LONG QUIZ TAX2sam uyNo ratings yet

- Chapter 3Document21 pagesChapter 3Carlo BaculoNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- Business TaxationDocument6 pagesBusiness TaxationMandy BloomNo ratings yet

- Quiz #1: SEMI-FINAL: Answer KeyDocument3 pagesQuiz #1: SEMI-FINAL: Answer KeyAngel MaghuyopNo ratings yet

- PRELIM LONG QUIZ TAX2Document10 pagesPRELIM LONG QUIZ TAX2sam uyNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationMystic LoverNo ratings yet

- 3rdyr 1stF BusinessTax 2324Document43 pages3rdyr 1stF BusinessTax 2324zaounxosakubNo ratings yet

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- QuizDocument5 pagesQuizRomaica Ella AmbidaNo ratings yet

- Chapter 9 Tax 2 (9-5) ND 9-6Document2 pagesChapter 9 Tax 2 (9-5) ND 9-6Elai grace FernandezNo ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- Business Taxation and Consumption TaxesDocument93 pagesBusiness Taxation and Consumption TaxesTrixie Ann MenesesNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- Tax Chapter 1 Tax - CompressDocument12 pagesTax Chapter 1 Tax - CompressElaiza RegaladoNo ratings yet

- Allowed Deductions From Gross IncomeDocument8 pagesAllowed Deductions From Gross Incomealliahbilities currentNo ratings yet

- Business TaxDocument26 pagesBusiness Taxanor.aquino.upNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- IntroBusTax QuestsDocument9 pagesIntroBusTax QuestsTwish BarriosNo ratings yet

- Intro to Consumption Taxes Multiple ChoiceDocument12 pagesIntro to Consumption Taxes Multiple ChoiceCJ TinNo ratings yet

- Vat BRRT BRRT Ver 2Document3 pagesVat BRRT BRRT Ver 2Renz CastroNo ratings yet

- BT - Sq1 VatDocument4 pagesBT - Sq1 VatTherese Janine HetutuaNo ratings yet

- Tax Chapter 7 G5 QUESTIONSDocument25 pagesTax Chapter 7 G5 QUESTIONSWerpa PetmaluNo ratings yet

- Business Taxation Chapter 7 - Business Taxes (Group 5) : A. Gross Selling PriceDocument25 pagesBusiness Taxation Chapter 7 - Business Taxes (Group 5) : A. Gross Selling PriceDizon Ropalito P.No ratings yet

- Tax 2 Valencia Chapter 10 MLTPL Choice 3-4Document3 pagesTax 2 Valencia Chapter 10 MLTPL Choice 3-4NervianeX HaleNo ratings yet

- Business and Transfer Taxation Test BankDocument186 pagesBusiness and Transfer Taxation Test Bankprettyboiy19No ratings yet

- Quiz 4 Vat Business Tax 1322 - CompressDocument3 pagesQuiz 4 Vat Business Tax 1322 - CompressChris MartinezNo ratings yet

- JPIA Review S3 Installment 2 (Business Tax)Document30 pagesJPIA Review S3 Installment 2 (Business Tax)rylNo ratings yet

- vat-examination-test-bank_compressDocument8 pagesvat-examination-test-bank_compressLenson NatividadNo ratings yet

- TAX ReviewerDocument77 pagesTAX ReviewerMark AloysiusNo ratings yet

- Exercise DrillDocument6 pagesExercise DrillAbigail Ann PasiliaoNo ratings yet

- Answer: D. All of The AboveDocument19 pagesAnswer: D. All of The AboveJomarNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Business and Transfer Taxation - Multiple ChoiceDocument7 pagesBusiness and Transfer Taxation - Multiple ChoiceEuli Mae SomeraNo ratings yet

- VAT AND OPT Monthly EXAMDocument20 pagesVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNo ratings yet

- Long QuizDocument14 pagesLong QuizMaritesNo ratings yet

- Input VAT Deductions ExplainedDocument7 pagesInput VAT Deductions ExplainedJustin TempleNo ratings yet

- Tax Review Activity No. 2 1Document12 pagesTax Review Activity No. 2 1Rachell PabionaNo ratings yet

- Chapter 10Document17 pagesChapter 10kochanay oya-oyNo ratings yet

- Statement-of-Assets-and-Liabilities-SALN-Form-Revised-January-2015 (1)Document3 pagesStatement-of-Assets-and-Liabilities-SALN-Form-Revised-January-2015 (1)Cleah WaskinNo ratings yet

- Community-TaxDocument4 pagesCommunity-TaxCleah WaskinNo ratings yet

- Auhtorization-Letter-1Document55 pagesAuhtorization-Letter-1Cleah WaskinNo ratings yet

- Updated-Index-CardsDocument4 pagesUpdated-Index-CardsCleah WaskinNo ratings yet

- Student Intern Data Sheet BsbaDocument1 pageStudent Intern Data Sheet BsbaCleah WaskinNo ratings yet

- APPOINTMENT (1)Document2 pagesAPPOINTMENT (1)Cleah WaskinNo ratings yet

- Hard Bound - Table of Contents FinalDocument11 pagesHard Bound - Table of Contents FinalCleah WaskinNo ratings yet

- Request-LetterDocument1 pageRequest-LetterCleah WaskinNo ratings yet

- Gantt-Chart-Template-ISO-RequirementDocument2 pagesGantt-Chart-Template-ISO-RequirementCleah WaskinNo ratings yet

- Mandatory CSR Drives SustainabilityDocument5 pagesMandatory CSR Drives SustainabilityCleah WaskinNo ratings yet

- Hard Bound - Table of Contents FinalDocument11 pagesHard Bound - Table of Contents FinalCleah WaskinNo ratings yet

- INTRAMURALS-LETTERS (7)Document11 pagesINTRAMURALS-LETTERS (7)Cleah WaskinNo ratings yet

- Fifo MethodDocument3 pagesFifo MethodCleah WaskinNo ratings yet

- Case Study (Sweetheart)Document4 pagesCase Study (Sweetheart)Cleah WaskinNo ratings yet

- Request cancellation and refund for property booking in SamalDocument1 pageRequest cancellation and refund for property booking in SamalCleah WaskinNo ratings yet

- Estate Tax - Review QuestionnaireDocument17 pagesEstate Tax - Review QuestionnaireCleah WaskinNo ratings yet

- Communicating with Millennials in the WorkplaceDocument6 pagesCommunicating with Millennials in the WorkplaceCleah WaskinNo ratings yet

- Portable Vegetable SprayerDocument21 pagesPortable Vegetable SprayerCleah WaskinNo ratings yet

- Estate and Transfer Tax Concepts ExplainedDocument19 pagesEstate and Transfer Tax Concepts ExplainedCleah WaskinNo ratings yet

- Syllabus - ACCBP 100 CompleteDocument10 pagesSyllabus - ACCBP 100 CompleteCleah WaskinNo ratings yet

- Home and Branch Accounting General ProceduresDocument30 pagesHome and Branch Accounting General ProceduresCleah WaskinNo ratings yet

- Yacapin Legal Services Adjusted Trial BalanceDocument3 pagesYacapin Legal Services Adjusted Trial BalanceCleah WaskinNo ratings yet

- Big data competitive advantages businessesDocument2 pagesBig data competitive advantages businessesDeeana SioufiNo ratings yet

- ACC101 BASIC ACCOUNTING CONCEPTS PRACTICEDocument6 pagesACC101 BASIC ACCOUNTING CONCEPTS PRACTICETimileyin AjibadeNo ratings yet

- PLD Lectures OldDocument343 pagesPLD Lectures OldVarunNo ratings yet

- ASHLOKDocument4 pagesASHLOKevolve energyNo ratings yet

- Unemployment in IndiaDocument9 pagesUnemployment in IndiaKhushiNo ratings yet

- Jio Oct-23Document1,714 pagesJio Oct-23Mohit KhatriNo ratings yet

- 2020 Property Investor Sentiment SurveyDocument27 pages2020 Property Investor Sentiment SurveyYC TeoNo ratings yet

- Galaxy Surfactants Limited: Niranjan Arun KetkarDocument41 pagesGalaxy Surfactants Limited: Niranjan Arun KetkarparthchillNo ratings yet

- Risk and ReturnDocument43 pagesRisk and ReturnRochelle Anne BaclayNo ratings yet

- When One Plus One Doesn't Make Two - Asad UmarDocument20 pagesWhen One Plus One Doesn't Make Two - Asad UmarSinpaoNo ratings yet

- IndustrialDocument18 pagesIndustrialKarthickrajaNo ratings yet

- David Ricardo's theory of comparative advantageDocument5 pagesDavid Ricardo's theory of comparative advantageTeodora NicuNo ratings yet

- Sindh Waste To Energy Policy (Swep) 2021Document20 pagesSindh Waste To Energy Policy (Swep) 2021Sadaqat islamNo ratings yet

- HLF735 ChecklistRequirementsInitialFinalRetail V01 3Document8 pagesHLF735 ChecklistRequirementsInitialFinalRetail V01 3Kyzer Calix LaguitNo ratings yet

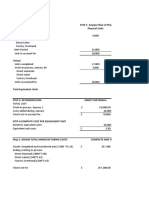

- Quickly Track Budget vs Actual SpendingDocument13 pagesQuickly Track Budget vs Actual SpendingMichelle PadillaNo ratings yet

- AkuntansuDocument36 pagesAkuntansusuryati hungNo ratings yet

- Assignment 1: Research On Economic Downfall of EnronDocument5 pagesAssignment 1: Research On Economic Downfall of EnronM Wasi Ullah KhanNo ratings yet

- CRM PresentationDocument16 pagesCRM PresentationNikita SabharwalNo ratings yet

- Monopolistic Competition and Oligopoly: ©2002 South-Western College PublishingDocument42 pagesMonopolistic Competition and Oligopoly: ©2002 South-Western College PublishingAisa Castro ArguellesNo ratings yet

- Corporate Strategy Grupo ÉxitoDocument14 pagesCorporate Strategy Grupo ÉxitoJuan EstebanNo ratings yet

- AC316 Assessment Module 8Document2 pagesAC316 Assessment Module 8Lalaine De JesusNo ratings yet

- Infosys - Q4FY22 - Result Update - Investor ReportDocument10 pagesInfosys - Q4FY22 - Result Update - Investor ReportSavil GuptaNo ratings yet

- Secretary's Certificate (AUB)Document1 pageSecretary's Certificate (AUB)Gerard Nelson ManaloNo ratings yet

- 3899 Indian Stock DetailsDocument624 pages3899 Indian Stock DetailsB.R Singh100% (1)

- Managerial Economics case study report price controls challengesDocument5 pagesManagerial Economics case study report price controls challengesDeepthi VishwanathanNo ratings yet

- Chapter 8 ChannelDocument23 pagesChapter 8 ChannelMuhamed SeidNo ratings yet