Professional Documents

Culture Documents

0165 20230101 165215100002336 2301010014391036 T844964 PDF

Uploaded by

apeksha baleshgolOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0165 20230101 165215100002336 2301010014391036 T844964 PDF

Uploaded by

apeksha baleshgolCopyright:

Available Formats

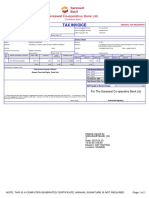

TAX INVOICE ORIGINAL FOR RECEIPIENT

Reverse Charge :N Date of Supply/Service : 01 Jan 2023

Invoice No. : 2301010014391036 Place of Supply/Service : Maharashtra

Invoice Date : 01 Jan 2023 CBS Trasaction No : T844964

State : Maharashtra State Code :27

Details of Receiver Details of Bank

Name : APEKSHA M BALESHGOL Branch : SHASTRI CHOWK (AKJ)

Address : A 11 PVP IT STAFF QTRS BEHIND BUDHGAON COLLEGE Address : 1024 A2 Shastri Chowk STStand Road Sangli-416416

MALBHA BUDHGAON Maharashtra

GSTIN : PAN : GSTIN : 27AABAT4497Q1ZK PAN : AABAT4497Q

Customer Account No. : 165215100002336

State : Maharashtra State Code : 27 State : Maharashtra

Sr. Name of Product / Service HSN / SAC Amount Less : Taxable Value CGST SGST IGST Total

No. Discount

Rate(%) Amount Rate(%) Amount Rate(%) Amount

1 Sms Banking Charges 997112 1.00 0.00 1.00 9.00 0.09 9.00 0.09 0.00 0.00 1.18

Total : 1.00 0.00 1.00 0.09 0.09 0.00 1.18

All Amount in Rupees Only.

Total Invoice Amount in Words : Total Amount Before Tax 1.00

Rupees One And Eighteen Paise Only Add : CGST 0.09

Add : SGST 0.09

Add : IGST 0.00

Tax Amount : GST 0.18

Total Amount After Tax 1.18

GST Payable on Reverse Charge 0.00

For The Saraswat Co-operative Bank Ltd

"I / We hereby declare that though our aggregate turnover in any preceding financial year from 2017 - 18 onwards is more

than the aggregate turnover notified under sub - rule(4) of rule 48, we are not required to prepare an invoice in terms of the

provisions of the said sub-rule."

(Bank Seal) Authorised Signatory

Digitally signed by

SARASWATBANK_GS

T

Date: 2023.02.23

16:37:02 +05:30

Reason: GST INVOICE

Location: MUMBAI

NOTE: THIS IS A COMPUTER GENERATED CERTIFICATE, MANUAL SIGNATURE IS NOT REQUIRED Page 1 of 1

You might also like

- 0196 20230101 196200100009856 2301010014504232 T958990 PDFDocument1 page0196 20230101 196200100009856 2301010014504232 T958990 PDFPooja JadhavNo ratings yet

- Tax Invoice: For The Saraswat Co-Operative Bank LTDDocument1 pageTax Invoice: For The Saraswat Co-Operative Bank LTDrajas narkarNo ratings yet

- BMS Invoice 4166834839Document1 pageBMS Invoice 4166834839BAD BOYSNo ratings yet

- InvoiceDocument1 pageInvoiceMohit JoshiNo ratings yet

- TRALKR8 - GST - Invoic. LgkyDocument1 pageTRALKR8 - GST - Invoic. LgkystafgshxhcjggidNo ratings yet

- TJAVCZK GST InvoiceDocument1 pageTJAVCZK GST InvoiceWRIKSUPREME GAMINGNo ratings yet

- APRC015J5EPXZJ GST InvoiceDocument1 pageAPRC015J5EPXZJ GST InvoiceASHMIT MADHOK 12INo ratings yet

- Tyaggf4 GST InvoiceDocument1 pageTyaggf4 GST InvoicePushpendu RoyNo ratings yet

- WMCC6MJ GST InvoiceDocument1 pageWMCC6MJ GST InvoiceVIJAY SAININo ratings yet

- InvoiceDocument1 pageInvoiceDevansh SinghNo ratings yet

- TSA8FAM GST InvoiceDocument1 pageTSA8FAM GST InvoiceAarif khanNo ratings yet

- Wr576q2 GST InvoiceDocument1 pageWr576q2 GST Invoicealeenareji659No ratings yet

- Book My Show InvoiceDocument1 pageBook My Show InvoicerahulfatnaniNo ratings yet

- BMS Invoice 3616328858Document1 pageBMS Invoice 3616328858ojas bajpaiNo ratings yet

- W7MUTWP GST InvoiceDocument1 pageW7MUTWP GST InvoiceShan ShrNo ratings yet

- BMS Invoice 4133568020Document1 pageBMS Invoice 4133568020kavivivek88No ratings yet

- Ashanet InvoiceDocument1 pageAshanet Invoicedinesh makwanaNo ratings yet

- Galx 00bae7 029fba GST InvoiceDocument1 pageGalx 00bae7 029fba GST Invoicenakul kumar sahuNo ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- BMS Invoice 3902383498Document1 pageBMS Invoice 3902383498Dip DasNo ratings yet

- WPDCBFQ GST InvoiceDocument1 pageWPDCBFQ GST InvoiceRana BiswasNo ratings yet

- BMS Invoice 3463864220Document1 pageBMS Invoice 3463864220siddhesh yewaleNo ratings yet

- WPQB4CK GST InvoiceDocument1 pageWPQB4CK GST InvoicemansukerohanNo ratings yet

- KSTR00FW5B9PUS GST InvoiceDocument1 pageKSTR00FW5B9PUS GST Invoicekannanmohanlal2002No ratings yet

- Wmzl4xn GST InvoiceDocument1 pageWmzl4xn GST InvoicedeonkrobyNo ratings yet

- Movie DebitDocument1 pageMovie Debit20CS080 JEKEEL SHAHNo ratings yet

- BMS Invoice 3330420936Document1 pageBMS Invoice 3330420936AchalNo ratings yet

- Tax Invoice: Gstin PAN Drug Licence No FssaiDocument1 pageTax Invoice: Gstin PAN Drug Licence No FssaiAayush SinghNo ratings yet

- BMS Invoice 3989485142Document1 pageBMS Invoice 3989485142vardaan.batra3107No ratings yet

- BMS Invoice 3876023270Document1 pageBMS Invoice 3876023270arkojitdas1512No ratings yet

- InvoiceDocument1 pageInvoicePajiNo ratings yet

- TPAYDFF GST InvoiceDocument1 pageTPAYDFF GST InvoiceShan ShrNo ratings yet

- WF3FF7D GST InvoiceDocument1 pageWF3FF7D GST InvoicewordscriptNo ratings yet

- T5AAEMN GST InvoiceDocument1 pageT5AAEMN GST InvoiceVenkataramana SarellaNo ratings yet

- Arun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017Document2 pagesArun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017AshokNo ratings yet

- WCAR94Z GST InvoiceDocument1 pageWCAR94Z GST Invoicepavan reddyNo ratings yet

- Battary TesterDocument1 pageBattary TesterSeshagiri DeenadayaluNo ratings yet

- Invoice Finolex Feb-2023Document1 pageInvoice Finolex Feb-2023deeptimayee pattanayakNo ratings yet

- WBWB8YG GST InvoiceDocument1 pageWBWB8YG GST InvoiceJ MANJUSREENo ratings yet

- SHHY012WREJEWR GST InvoiceDocument1 pageSHHY012WREJEWR GST InvoiceanuragthumalapallyNo ratings yet

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaNo ratings yet

- publicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287Document1 pagepublicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287firoze pkNo ratings yet

- SZ Dap 0000150756Document1 pageSZ Dap 0000150756paramessh666No ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceBSCPLCHDNo ratings yet

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument6 pagesMobile Services: Your Account Summary This Month'S ChargesNAMIT TOMARNo ratings yet

- Un Registered 37AABCT0088P1ZU: Transmission Corporation of Andhrapradesh LimitedDocument2 pagesUn Registered 37AABCT0088P1ZU: Transmission Corporation of Andhrapradesh LimitedADE MRTNo ratings yet

- WKMR8KP GST InvoiceDocument1 pageWKMR8KP GST InvoiceJohn vivianNo ratings yet

- 01681d-039afa GST InvoiceDocument1 page01681d-039afa GST Invoice9423352601No ratings yet

- Fb63a1d1 A4e3 4aeb 88fa 5ea07fe780e4 RecVoucher 2Document1 pageFb63a1d1 A4e3 4aeb 88fa 5ea07fe780e4 RecVoucher 2prakashNo ratings yet

- 62 - PW - Karan RibbonDocument1 page62 - PW - Karan RibbonPinkesh NakawalaNo ratings yet

- Bill No 559Document1 pageBill No 559GLOBUS CYBERNo ratings yet

- AVDM0000052206 GST InvoiceDocument1 pageAVDM0000052206 GST Invoicepraveenkanugula21No ratings yet

- 83 - PW - Karan RibbonDocument1 page83 - PW - Karan RibbonPinkesh NakawalaNo ratings yet

- 66 - PW - Karan RibbonDocument1 page66 - PW - Karan RibbonPinkesh NakawalaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: MaharashtraDocument2 pagesTax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: MaharashtraAslamShikalgarNo ratings yet

- RAMC00E30KTBP4 GST InvoiceDocument1 pageRAMC00E30KTBP4 GST InvoiceNikhil DhokeNo ratings yet

- Sutd0001186886 GST InvoiceDocument1 pageSutd0001186886 GST Invoicemalliexpress99No ratings yet

- A50 6g PDFDocument1 pageA50 6g PDFAashish Kumar VardhaniyaNo ratings yet

- SMART MONEY ORDE BLOC EditedDocument9 pagesSMART MONEY ORDE BLOC Editedtawhid anam86% (7)

- 8bdd63fe-cc05-4f8d-ba46-4ae5a96d5582Document248 pages8bdd63fe-cc05-4f8d-ba46-4ae5a96d5582Sahil AttriNo ratings yet

- Development and Development ParadigmsDocument49 pagesDevelopment and Development ParadigmsroblagrNo ratings yet

- Mem IntuneDocument5,061 pagesMem IntuneJosé Adail MaiaNo ratings yet

- Pro Forma Invoice: Chemxo Trading FZEDocument1 pagePro Forma Invoice: Chemxo Trading FZErmautomobiles.dhkNo ratings yet

- Summary of The Madrid Agreement Concerning The International Registration of Marks (1891) and The Protocol Relating To That Agreement (1989)Document5 pagesSummary of The Madrid Agreement Concerning The International Registration of Marks (1891) and The Protocol Relating To That Agreement (1989)Gilbert John LacorteNo ratings yet

- Consolidated Civil Law QQR 1 PDFDocument33 pagesConsolidated Civil Law QQR 1 PDFMarcelino CasilNo ratings yet

- Assignment Of: International Business ManagementDocument20 pagesAssignment Of: International Business Managementalaina zamirNo ratings yet

- INFO. FOR COMPANY INCORPORATION Legaldev (1) 23Document4 pagesINFO. FOR COMPANY INCORPORATION Legaldev (1) 23shrishyamassociates678No ratings yet

- Starbuck's Case - CRM - Jonas KocherDocument3 pagesStarbuck's Case - CRM - Jonas Kocherleni thNo ratings yet

- BNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleDocument36 pagesBNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleBrainNo ratings yet

- 1Q2223 CE195-2 B71 CS04 Sunga Josiah-KingDocument1 page1Q2223 CE195-2 B71 CS04 Sunga Josiah-Kinghello whelloNo ratings yet

- Impact of Urbanisation and Encroachment in Wetlands, A Case Study of Ganga Riparian Wetlands, Patna Impacts of Urbanization and Encroachment in Urban Wetlands, A Case Study of Gang..Document8 pagesImpact of Urbanisation and Encroachment in Wetlands, A Case Study of Ganga Riparian Wetlands, Patna Impacts of Urbanization and Encroachment in Urban Wetlands, A Case Study of Gang..Abdul QuadirNo ratings yet

- Submission of List of All Recognized School Co-Curricular and Extra-Curricular Clubs and OrganizationsDocument5 pagesSubmission of List of All Recognized School Co-Curricular and Extra-Curricular Clubs and OrganizationsCHAPEL JUN PACIENTENo ratings yet

- Multidrug Resistant Gram Negative BacteriaDocument6 pagesMultidrug Resistant Gram Negative BacteriaAniAliciaOrtizCastleNo ratings yet

- Tender To Be Opened (15 06 2017) )Document1 pageTender To Be Opened (15 06 2017) )MANOJNo ratings yet

- 13 Synopsis PDFDocument12 pages13 Synopsis PDFBrhanu GebreslassieNo ratings yet

- What Tourism Managers Need To KnowDocument82 pagesWhat Tourism Managers Need To KnowjocoNo ratings yet

- 2016 India Safety Status1Document75 pages2016 India Safety Status1AnanthNo ratings yet

- IGCSE Year 8 Geography: Unit 3Document7 pagesIGCSE Year 8 Geography: Unit 3WONG KA YANNo ratings yet

- Rededication Ceremonies For LeadersDocument4 pagesRededication Ceremonies For LeadersFritchie GinoNo ratings yet

- What If - Liam GillickDocument3 pagesWhat If - Liam GillickemprexNo ratings yet

- Clockwork Dominion Core RulebookDocument330 pagesClockwork Dominion Core RulebookJason Roe60% (5)

- Classical and Human Relations Approaches To ManagementDocument10 pagesClassical and Human Relations Approaches To ManagementDhanpaul OodithNo ratings yet

- Human Resources Manager in Orlando FL Resume Lloyd TaylorDocument1 pageHuman Resources Manager in Orlando FL Resume Lloyd TaylorLloydTaylorNo ratings yet

- (Palgrave Readers in Economics) Hercules E. Haralambides - Port Management-Palgrave Macmillan (2015)Document387 pages(Palgrave Readers in Economics) Hercules E. Haralambides - Port Management-Palgrave Macmillan (2015)Mihaela TNo ratings yet

- Lesson 7 Study of Philippine ValuesDocument15 pagesLesson 7 Study of Philippine ValuesAlma Yumul BaltazarNo ratings yet

- A Living SacrificeDocument8 pagesA Living Sacrificeonwuzuam100% (1)

- In Re: Booth 3 Wis. 1 (1854)Document39 pagesIn Re: Booth 3 Wis. 1 (1854)Adam ChabchoubNo ratings yet