Professional Documents

Culture Documents

Tax Invoice: For The Saraswat Co-Operative Bank LTD

Uploaded by

rajas narkarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Invoice: For The Saraswat Co-Operative Bank LTD

Uploaded by

rajas narkarCopyright:

Available Formats

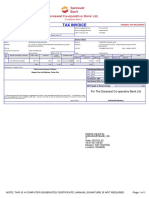

TAX INVOICE ORIGINAL FOR RECEIPIENT

Reverse Charge :N Date of Supply/Service : 01 Jan 2023

Invoice No. : 2301010014129406 Place of Supply/Service : Maharashtra

Invoice Date : 01 Jan 2023 CBS Trasaction No : T581424

State : Maharashtra State Code :27

Details of Receiver Details of Bank

Name : RAJAS M NARKAR Branch : C.S.T.

Address : JARIWALA CHAWL SANE GURUJI MARG TARDEO Address : Taj Bldg Gr Floor Amrit Keshav Nayak MargNear Excelsior Cinema

Fort Mumbai-400001 Maharashtra

GSTIN : PAN : GSTIN : 27AABAT4497Q1ZK PAN : AABAT4497Q

Customer Account No. : 058203100000801

State : Maharashtra State Code : 27 State : Maharashtra

Sr. Name of Product / Service HSN / SAC Amount Less : Taxable Value CGST SGST IGST Total

No. Discount

Rate(%) Amount Rate(%) Amount Rate(%) Amount

1 Sms Banking Charges 997112 3.22 0.00 3.22 9.00 0.29 9.00 0.29 0.00 0.00 3.80

Total : 3.22 0.00 3.22 0.29 0.29 0.00 3.80

All Amount in Rupees Only.

Total Invoice Amount in Words : Total Amount Before Tax 3.22

Rupees Three And Eighty Paise Only Add : CGST 0.29

Add : SGST 0.29

Add : IGST 0.00

Tax Amount : GST 0.58

Total Amount After Tax 3.80

GST Payable on Reverse Charge 0.00

For The Saraswat Co-operative Bank Ltd

"I / We hereby declare that though our aggregate turnover in any preceding financial year from 2017 - 18 onwards is more

than the aggregate turnover notified under sub - rule(4) of rule 48, we are not required to prepare an invoice in terms of the

provisions of the said sub-rule."

(Bank Seal) Authorised Signatory

Digitally signed by

SARASWATBANK_GS

T

Date: 2023.02.23

13:53:36 +05:30

Reason: GST INVOICE

Location: MUMBAI

NOTE: THIS IS A COMPUTER GENERATED CERTIFICATE, MANUAL SIGNATURE IS NOT REQUIRED Page 1 of 1

You might also like

- 0165 20230101 165215100002336 2301010014391036 T844964 PDFDocument1 page0165 20230101 165215100002336 2301010014391036 T844964 PDFapeksha baleshgolNo ratings yet

- 0196 20230101 196200100009856 2301010014504232 T958990 PDFDocument1 page0196 20230101 196200100009856 2301010014504232 T958990 PDFPooja JadhavNo ratings yet

- InvoiceDocument1 pageInvoiceMohit JoshiNo ratings yet

- WMCC6MJ GST InvoiceDocument1 pageWMCC6MJ GST InvoiceVIJAY SAININo ratings yet

- APRC015J5EPXZJ GST InvoiceDocument1 pageAPRC015J5EPXZJ GST InvoiceASHMIT MADHOK 12INo ratings yet

- TSA8FAM GST InvoiceDocument1 pageTSA8FAM GST InvoiceAarif khanNo ratings yet

- WTNQPPH GST InvoiceDocument1 pageWTNQPPH GST Invoicegt.siddNo ratings yet

- T5AAEMN GST InvoiceDocument1 pageT5AAEMN GST InvoiceVenkataramana SarellaNo ratings yet

- Wmzl4xn GST InvoiceDocument1 pageWmzl4xn GST InvoicedeonkrobyNo ratings yet

- 01681d-039afa GST InvoiceDocument1 page01681d-039afa GST Invoice9423352601No ratings yet

- BMS Invoice 3330420936Document1 pageBMS Invoice 3330420936AchalNo ratings yet

- BMS Invoice 3989485142Document1 pageBMS Invoice 3989485142vardaan.batra3107No ratings yet

- SHHY012WREJEWR GST InvoiceDocument1 pageSHHY012WREJEWR GST InvoiceanuragthumalapallyNo ratings yet

- TRALKR8 - GST - Invoic. LgkyDocument1 pageTRALKR8 - GST - Invoic. LgkystafgshxhcjggidNo ratings yet

- WQZ2Q97 GST Invoice PDFDocument1 pageWQZ2Q97 GST Invoice PDFAnand KumarNo ratings yet

- Book My Show InvoiceDocument1 pageBook My Show InvoicerahulfatnaniNo ratings yet

- WPQB4CK GST InvoiceDocument1 pageWPQB4CK GST InvoicemansukerohanNo ratings yet

- WPDCBFQ GST InvoiceDocument1 pageWPDCBFQ GST InvoiceRana BiswasNo ratings yet

- BMS Invoice 3616328858Document1 pageBMS Invoice 3616328858ojas bajpaiNo ratings yet

- Galx 00bae7 029fba GST InvoiceDocument1 pageGalx 00bae7 029fba GST Invoicenakul kumar sahuNo ratings yet

- TPAYDFF GST InvoiceDocument1 pageTPAYDFF GST InvoiceShan ShrNo ratings yet

- T8ACJCT GST InvoiceDocument1 pageT8ACJCT GST Invoices.harshgangavane14No ratings yet

- Ttarhcg GST InvoiceDocument1 pageTtarhcg GST InvoiceJivan PathadeNo ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- Ws2d6fg GST InvoiceDocument1 pageWs2d6fg GST InvoiceSarath KumarNo ratings yet

- BMS Invoice 3876023270Document1 pageBMS Invoice 3876023270arkojitdas1512No ratings yet

- WF3FF7D GST InvoiceDocument1 pageWF3FF7D GST InvoicewordscriptNo ratings yet

- BMS Invoice 4133568020Document1 pageBMS Invoice 4133568020kavivivek88No ratings yet

- BMS Invoice 4166834839Document1 pageBMS Invoice 4166834839BAD BOYSNo ratings yet

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaNo ratings yet

- W38W7TV GST InvoiceDocument1 pageW38W7TV GST InvoiceJ MANJUSREENo ratings yet

- Svml00b1cpmkh5 GST InvoiceDocument1 pageSvml00b1cpmkh5 GST InvoiceSankar VarmaNo ratings yet

- WKMR8KP GST InvoiceDocument1 pageWKMR8KP GST InvoiceJohn vivianNo ratings yet

- KSTR00FW5B9PUS GST InvoiceDocument1 pageKSTR00FW5B9PUS GST Invoicekannanmohanlal2002No ratings yet

- Taco 0105946082700004Document1 pageTaco 0105946082700004Mohit KukadiaNo ratings yet

- WMRDH9H GST InvoiceDocument1 pageWMRDH9H GST InvoicepratapsinghgurvinderNo ratings yet

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaNo ratings yet

- W7MUTWP GST InvoiceDocument1 pageW7MUTWP GST InvoiceShan ShrNo ratings yet

- BMS Invoice 3902383498Document1 pageBMS Invoice 3902383498Dip DasNo ratings yet

- Indigo Denim Work Order SiemensDocument1 pageIndigo Denim Work Order SiemensAadya In StyleNo ratings yet

- Tyaggf4 GST InvoiceDocument1 pageTyaggf4 GST InvoicePushpendu RoyNo ratings yet

- publicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287Document1 pagepublicInvoicePrintInvoiceIndividual Phpvals 3697105&Dd 7287firoze pkNo ratings yet

- TJAVCZK GST InvoiceDocument1 pageTJAVCZK GST InvoiceWRIKSUPREME GAMINGNo ratings yet

- InvoiceDocument1 pageInvoicePajiNo ratings yet

- MovieDocument1 pageMoviekiran chNo ratings yet

- WRJXS8C GST InvoiceDocument1 pageWRJXS8C GST InvoiceSuresh BagdiNo ratings yet

- Tjalc9d GST InvoiceDocument1 pageTjalc9d GST InvoiceAnirudha KumbharNo ratings yet

- Sutd0001186886 GST InvoiceDocument1 pageSutd0001186886 GST Invoicemalliexpress99No ratings yet

- Wf2xsjx GST InvoiceDocument1 pageWf2xsjx GST Invoiceisha RNo ratings yet

- Wr576q2 GST InvoiceDocument1 pageWr576q2 GST Invoicealeenareji659No ratings yet

- Gstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Document2 pagesGstin: 08cympg9536p1z9 BG01189: Amichand Saini (11885729)Subhash SainiNo ratings yet

- WCAR94Z GST InvoiceDocument1 pageWCAR94Z GST Invoicepavan reddyNo ratings yet

- 956962BF GST InvoiceDocument1 page956962BF GST InvoiceKesavaNo ratings yet

- Wg6qb6t GST InvoiceDocument1 pageWg6qb6t GST InvoiceIndian ArmyNo ratings yet

- ODJtNXFuM09rSUY4SDlsMGZ2ZVJTQT09 InvoiceDocument2 pagesODJtNXFuM09rSUY4SDlsMGZ2ZVJTQT09 Invoiceomkar daveNo ratings yet

- WBWB8YG GST InvoiceDocument1 pageWBWB8YG GST InvoiceJ MANJUSREENo ratings yet

- RAMC00E30KTBP4 GST InvoiceDocument1 pageRAMC00E30KTBP4 GST InvoiceNikhil DhokeNo ratings yet

- BMS Invoice 3539915061Document1 pageBMS Invoice 3539915061Om NomNo ratings yet

- Arun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017Document2 pagesArun Motors: TAX INVOICE, Issued Under Rule 46 of CGST/SGST Rules, 2017AshokNo ratings yet

- Sam's Club Acquisition Landing PageDocument1 pageSam's Club Acquisition Landing PageNisarNo ratings yet

- HBL HBL HBL: Minhaj University Minhaj University Minhaj UniversityDocument1 pageHBL HBL HBL: Minhaj University Minhaj University Minhaj UniversityUmar Jutt100% (1)

- Renewal Notice: Policy No.P/131112/01/2019/007048Document1 pageRenewal Notice: Policy No.P/131112/01/2019/007048mkm969No ratings yet

- Ch08 Donor's TaxDocument8 pagesCh08 Donor's TaxHazel CruzNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit SagarNo ratings yet

- My - Bill - 16 Feb, 2023 - 15 Mar 2023, 2023Document10 pagesMy - Bill - 16 Feb, 2023 - 15 Mar 2023, 2023RJIO NAGPURNo ratings yet

- E-Filling of Income Tax Return: A Case Study of Individual AssesseeDocument63 pagesE-Filling of Income Tax Return: A Case Study of Individual AssesseepraveenNo ratings yet

- BAM 127 Day 3 - TGDocument14 pagesBAM 127 Day 3 - TGPaulo BelenNo ratings yet

- Long Quiz Fund. of AcctngDocument5 pagesLong Quiz Fund. of AcctngLorraine DomantayNo ratings yet

- Registration Form: Delta (Module One) June 2018Document2 pagesRegistration Form: Delta (Module One) June 2018Walid WalidNo ratings yet

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Ads 2223 485683 PDFDocument3 pagesAds 2223 485683 PDFHarsh PatelNo ratings yet

- Md. Mir Hossen 01922512579: La-Riba Islamic Credit Card Payment SlipDocument17 pagesMd. Mir Hossen 01922512579: La-Riba Islamic Credit Card Payment SlipHossen M MNo ratings yet

- 000 Citibank, N. A. Citibank Client Services PO Box 769013 013 San Antonio, TX 78245-9013Document4 pages000 Citibank, N. A. Citibank Client Services PO Box 769013 013 San Antonio, TX 78245-9013giaNo ratings yet

- Income Tax - Guidelines Financial Year 2022-23Document13 pagesIncome Tax - Guidelines Financial Year 2022-23Pradeep KVKNo ratings yet

- Tax InvoiceDocument8 pagesTax Invoicetayalan.manoharanNo ratings yet

- Seminar Workshop On The Updating of Municipal Revenue CodeDocument37 pagesSeminar Workshop On The Updating of Municipal Revenue CodeOren Estabillo Mendoza100% (1)

- Cashless KowsalyaDocument58 pagesCashless KowsalyaGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Import ProcurementDocument23 pagesImport ProcurementGirish Raj100% (1)

- P and L - Dabur IndiaDocument2 pagesP and L - Dabur IndiaRaja NatarajanNo ratings yet

- CBK Power Co. Ltd. v. CIR, G.R. Nos. 198729-30Document15 pagesCBK Power Co. Ltd. v. CIR, G.R. Nos. 198729-30BernsNo ratings yet

- Module 1 Introduction To TaxationDocument47 pagesModule 1 Introduction To TaxationFlameNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- The Impact of GST On IndiaDocument8 pagesThe Impact of GST On Indiasahil khanNo ratings yet

- Group 5 HandoutDocument11 pagesGroup 5 HandoutKarla Marie TumulakNo ratings yet

- CHAPTER 6 TaxDocument24 pagesCHAPTER 6 TaxVencint LaranNo ratings yet

- 2010-11 PAYG - FN Tax TablesDocument12 pages2010-11 PAYG - FN Tax Tablescyclops4569No ratings yet

- Chapter 3 Introduction To Business TaxationDocument27 pagesChapter 3 Introduction To Business TaxationHazel Jane Esclamada100% (1)

- PayflowGateway GuideDocument238 pagesPayflowGateway Guiderobert2370No ratings yet