Professional Documents

Culture Documents

BAlance Sheet Nike

Uploaded by

هاني0 ratings0% found this document useful (0 votes)

46 views2 pagesNike industry balance sheet

Original Title

BAlance sheet Nike

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNike industry balance sheet

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views2 pagesBAlance Sheet Nike

Uploaded by

هانيNike industry balance sheet

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

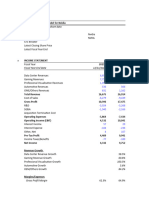

Fiscal year is June-May.

All values USD

Millions. 2021 2020 2019 2018 2017 5-year trend

Cash & Short Term Investments 13,476 8,787 4,663 5,245 6,179

Cash Only 9,889 8,348 4,466 4,249 3,808

Short-Term Investments 3,587 439 197 996 2,371

Cash & Short Term Investments -

53.36% 88.44% -15.12% -

Growth 11.10%

Cash & ST Investments / Total Assets 35.71% 28.04% 19.66% 23.27% 26.57%

Total Accounts Receivable 4,463 2,749 4,272 3,498 3,677

Accounts Receivables, Net 4,463 2,749 4,272 3,498 3,677

Accounts Receivables, Gross 4,556 2,749 4,272 3,528 3,696

Bad Debt/Doubtful Accounts (93) - - (30) (19)

Accounts Receivable Growth 62.35% -35.65% 22.13% -4.87% -

Accounts Receivable Turnover 9.97 13.61 9.16 10.40 9.32

Inventories 6,854 7,367 5,622 5,261 5,055

Finished Goods 6,854 7,367 5,622 5,261 5,055

Other Current Assets 1,498 1,653 1,968 1,130 1,150

Prepaid Expenses 338 326 333 359 311

Miscellaneous Current Assets 1,160 1,327 1,635 771 839

Total Current Assets 26,291 20,556 16,525 15,134 16,061

Net Property, Plant & Equipment 8,017 7,963 4,744 4,454 3,989

Property, Plant & Equipment - Gross 13,174 12,758 9,469 8,891 7,958

Buildings 3,365 2,442 2,445 2,195 1,564

Land & Improvements 363 345 329 331 285

Fiscal year is June-May. All values USD

Millions. 2021 2020 2019 2018 2017 5-year trend

Machinery & Equipment 3,023 2,751 - - -

Construction in Progress 311 1,086 797 641 758

Computer Software and

1,391 - - - -

Equipment

Other Property, Plant &

1,608 3,037 5,898 5,724 5,351

Equipment

Accumulated Depreciation 5,157 4,795 4,725 4,437 3,969

Total Investments and Advances 16 1 11 11 10

Other Long-Term Investments 16 1 11 11 10

Intangible Assets 511 497 437 439 422

Net Goodwill 242 223 154 154 139

Net Other Intangibles 269 274 283 285 283

Other Assets 2,905 2,325 2,000 2,498 2,777

Deferred Charges 292 360 440 371 247

Tangible Other Assets 2,613 1,965 1,560 2,127 2,530

Total Assets 37,740 31,342 23,717 22,536 23,259

Assets - Total - Growth 20.41% 32.15% 5.24% -3.11% -

Asset Turnover 1.29 - - - -

Return On Average Assets 16.58% - - - -

Liabilities & Shareholders' Equity

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraNo ratings yet

- SGR Calculation Taking Base FY 2019Document17 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- DG Khan Cement Financial StatementsDocument8 pagesDG Khan Cement Financial StatementsAsad BumbiaNo ratings yet

- PLDT Inc. PLDT Inc.: Subscribe Sign inDocument3 pagesPLDT Inc. PLDT Inc.: Subscribe Sign inGio HermosoNo ratings yet

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- Globe Telecom Financial Analysis 2017-2018Document15 pagesGlobe Telecom Financial Analysis 2017-2018Lawrence Joshua ManzoNo ratings yet

- Análisis de Estados Financieros de Starbucks (SBUXDocument7 pagesAnálisis de Estados Financieros de Starbucks (SBUXjosolcebNo ratings yet

- Finance For Non-Finance: Ratios AppleDocument12 pagesFinance For Non-Finance: Ratios AppleAvinash GanesanNo ratings yet

- Bharti Airtel Financial Statements per US GAAPDocument8 pagesBharti Airtel Financial Statements per US GAAPNitin VatsNo ratings yet

- Liquidity RatiosDocument10 pagesLiquidity RatiosOkasha AliNo ratings yet

- CHAPTER-2-3 2Document41 pagesCHAPTER-2-3 2xfmf5bk5wfNo ratings yet

- 07. Nke Model Di VincompleteDocument10 pages07. Nke Model Di VincompletesalambakirNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- Avenue SuperDocument19 pagesAvenue Superanuda29102001No ratings yet

- Trần Đức Thái AssignmentDocument38 pagesTrần Đức Thái AssignmentThái TranNo ratings yet

- Sultan Drug Corporation-CaseDocument5 pagesSultan Drug Corporation-CaseSohad ElnagarNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Chapter 2Document32 pagesChapter 2AhmedNo ratings yet

- INR Crore FY 16 FY 17 FY 18 FY 19 FY 20Document5 pagesINR Crore FY 16 FY 17 FY 18 FY 19 FY 20Shivani SinghNo ratings yet

- Particulars Notes For The Year Ended March 31, 2021 Assets Non-Current AssetsDocument14 pagesParticulars Notes For The Year Ended March 31, 2021 Assets Non-Current Assetsshambhavi joshiNo ratings yet

- DescargaDocument4 pagesDescargaNicolás Campero AcedoNo ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- Financial Accounting AssignmentDocument14 pagesFinancial Accounting AssignmentPoojith KumarNo ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Ceres exhibits balance sheet, income statement, projectionsDocument4 pagesCeres exhibits balance sheet, income statement, projectionsShaarang Begani0% (2)

- Financial Model 3 Statement Model - Final - MotilalDocument13 pagesFinancial Model 3 Statement Model - Final - MotilalSouvik BardhanNo ratings yet

- AAPL DCF ValuationDocument12 pagesAAPL DCF ValuationthesaneinvestorNo ratings yet

- Financial Statement: Statement of Cash FlowsDocument6 pagesFinancial Statement: Statement of Cash FlowsdanyalNo ratings yet

- NVDA DCFDocument7 pagesNVDA DCFSahand LaliNo ratings yet

- ($ in Millions, Unless Othrewise Denoted) : Financial StatementsDocument4 pages($ in Millions, Unless Othrewise Denoted) : Financial Statementsapi-454737634No ratings yet

- LWL Dec2021Document7 pagesLWL Dec2021Shabry SamoonNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Stanley Sir Assignment Sem 2 SagarikaDocument10 pagesStanley Sir Assignment Sem 2 SagarikaSakshi ShahNo ratings yet

- Cfas PetaDocument13 pagesCfas PetaSamantha AzueloNo ratings yet

- Accounts FinalDocument15 pagesAccounts FinalDevaashish ParmarNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Exide Pakistan Five Year Financial AnalysisDocument13 pagesExide Pakistan Five Year Financial AnalysisziaNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Ratio Analysis ExcerciseDocument12 pagesRatio Analysis Excercisegaurav makhijaniNo ratings yet

- Nidec Philippines Corporation Company ProfileDocument35 pagesNidec Philippines Corporation Company ProfileVergel MartinezNo ratings yet

- Final Report - Draft2Document32 pagesFinal Report - Draft2shyamagniNo ratings yet

- CocaCola and PepsiCo-2Document23 pagesCocaCola and PepsiCo-2Aditi KathinNo ratings yet

- Balance Sheet & P & LDocument3 pagesBalance Sheet & P & LSatish WagholeNo ratings yet

- VIB - Section2 - Group5 - Final Project - ExcelDocument70 pagesVIB - Section2 - Group5 - Final Project - ExcelShrishti GoyalNo ratings yet

- 10 - AccentureDocument21 pages10 - AccenturePranali SanasNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Inbamfi Equity CaseDocument19 pagesInbamfi Equity CaseBinsentcaragNo ratings yet

- Balance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4Document9 pagesBalance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4PylypNo ratings yet

- Gma FSDocument13 pagesGma FSMark Angelo BustosNo ratings yet

- Activity 1 - InvestmentDocument13 pagesActivity 1 - Investmentjoshua seanNo ratings yet

- Cement Ratio AnalysisDocument12 pagesCement Ratio AnalysisAreeba SheikhNo ratings yet

- Case Ahold SolutionDocument18 pagesCase Ahold Solutiondeepanshu guptaNo ratings yet

- 5 6120493211875018431Document62 pages5 6120493211875018431Hafsah Amod DisomangcopNo ratings yet

- FinShiksha Maruti Suzuki UnsolvedDocument12 pagesFinShiksha Maruti Suzuki UnsolvedGANESH JAINNo ratings yet

- 4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Document4 pages4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Jose Arturo Rodriguez AlemanNo ratings yet

- Section A - Group 9Document17 pagesSection A - Group 9AniketNo ratings yet

- Company SizeDocument3 pagesCompany SizeهانيNo ratings yet

- Nike Curretn StrategiesDocument31 pagesNike Curretn StrategiesهانيNo ratings yet

- Nike FInancial ResourceDocument2 pagesNike FInancial ResourceهانيNo ratings yet

- History of NikeDocument1 pageHistory of NikeهانيNo ratings yet

- The Concept of CollateralDocument3 pagesThe Concept of CollateralElle BadussyNo ratings yet

- The Role of Mutual Funds in Pakistan TopicDocument11 pagesThe Role of Mutual Funds in Pakistan TopicArif AmanNo ratings yet

- Equity Method Case StudyDocument3 pagesEquity Method Case StudyHAO HUYNH MINH GIANo ratings yet

- Parsons Inc Is A Publicly Owned Company The Following InformationDocument1 pageParsons Inc Is A Publicly Owned Company The Following InformationAmit PandeyNo ratings yet

- Financial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalanceDocument14 pagesFinancial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalancemotebangNo ratings yet

- ASSIGNMENT NO. 2 - Chapter 6 - Capital Gains TaxationDocument5 pagesASSIGNMENT NO. 2 - Chapter 6 - Capital Gains TaxationElaiza Jayne PongaseNo ratings yet

- Option Price Basics ExerciseDocument20 pagesOption Price Basics ExerciseVishalNo ratings yet

- Wisdom of Wyckoff2Document31 pagesWisdom of Wyckoff2ngocleasing100% (2)

- Nikhil Kapadiya - 91800323087 SIP Final ReportDocument32 pagesNikhil Kapadiya - 91800323087 SIP Final ReportNikhil kapadiyaNo ratings yet

- AC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With CommentsDocument74 pagesAC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With Comments전민건No ratings yet

- Answers and SolutionsDocument31 pagesAnswers and SolutionsKatherine Cabading InocandoNo ratings yet

- Barney SMCA4 10Document24 pagesBarney SMCA4 10Shibashish SahuNo ratings yet

- Chapter 8 Performance Measurement Evaluation Nov2020 1Document113 pagesChapter 8 Performance Measurement Evaluation Nov2020 1Question BankNo ratings yet

- Internal Rate of Return and Profitability IndexDocument21 pagesInternal Rate of Return and Profitability Indexkkv_phani_varma5396100% (1)

- The Trader Hacker's Ultimate PlaybookDocument64 pagesThe Trader Hacker's Ultimate Playbookpta123100% (1)

- CM Comprehensive AssignmentDocument2 pagesCM Comprehensive AssignmentShivamNo ratings yet

- Merchant Banking InsightsDocument78 pagesMerchant Banking InsightsorangeponyNo ratings yet

- Barbara Boland Opened A Flower Shop Business Has Been GoodDocument2 pagesBarbara Boland Opened A Flower Shop Business Has Been GoodMuhammad ShahidNo ratings yet

- QuizzerDocument30 pagesQuizzerMaeNo ratings yet

- Future Wealth Gain PDFDocument23 pagesFuture Wealth Gain PDFviswanathbobby8No ratings yet

- PT Surya Toto Indonesia Tbk Annual Report 2020 HighlightsDocument366 pagesPT Surya Toto Indonesia Tbk Annual Report 2020 HighlightsDevy RahmawatiNo ratings yet

- Debt Instrument Project PDFDocument50 pagesDebt Instrument Project PDFRohit VishwakarmaNo ratings yet

- Accounting For Shares NewDocument24 pagesAccounting For Shares NewSteve NtefulNo ratings yet

- Under Armour: Time Heals All Wounds, and UA Needs More Time Maintain HOLD, $20 PTDocument8 pagesUnder Armour: Time Heals All Wounds, and UA Needs More Time Maintain HOLD, $20 PTAnonymous Feglbx5No ratings yet

- Business Law and Regulations - CorporationDocument15 pagesBusiness Law and Regulations - CorporationMargie RosetNo ratings yet

- ACC117 Project 2Document7 pagesACC117 Project 2Aliamaisara ZahiraNo ratings yet

- Employee Stock Option PlansDocument3 pagesEmployee Stock Option PlansMukesh PunethaNo ratings yet

- FB-2015Document188 pagesFB-2015annisa lahjieNo ratings yet

- Chapter 1 Cost IDocument31 pagesChapter 1 Cost IBikila MalasaNo ratings yet

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet