Professional Documents

Culture Documents

George Dobanzi Economisire en

George Dobanzi Economisire en

Uploaded by

Maftean Mirela FlorinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

George Dobanzi Economisire en

George Dobanzi Economisire en

Uploaded by

Maftean Mirela FlorinaCopyright:

Available Formats

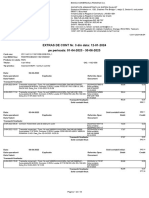

Interest rates as of 06.02.

2023

for the Current account and Savings products for Private Individuals

RON TERM DEPOSITS WITH FIXED INTEREST RATE (% per year), MINIMUM AMOUNT 500 RON*

Interest rate with bonus included

Term considering the terms and conditions Standard interest rate level

*

3 month 6,80 5,80

6 months 7,20 6,20

12 months 8,00 7,00

Maxiplus 24 months 8,00 7,00

* The interest level for deposits in RON set up by Internet Banking/Mobile Banking channel includes an interest bonus of 1%

above the standard interest level, bonus granted for the period in which the client collects the income (salary/pension) in their

BCR account. For the salary clients with term deposits with 3 months maturity, the bonus applies only to newly opened deposits

starting with 03.06.2022. At the automatic prolongation, the standard interest rate displayed on the date of the prolongation

will be applied, with the bonus being granted or not, depending on BCR's commercial policy on the date of the automatic

prolongation. The standard interest level applies to: (1) deposits made in banking units and (2) to deposits made through any

channel for customers whom does not collect their income in an BCR account.

TERM DEPOSITS IN EUR WITH FIXED INTEREST RATE, MINIMUM AMOUNT EUR 200 (% per year)

Interest rate with bonus included

Term Standard interest rate level

considering the terms and conditions **

3 month 1.00 0.50

6 month 1.25 0.75

12 month 1.50 1,00

TERM DEPOSITS IN USD WITH FIXED INTEREST RATE, MINIMUM AMOUNT USD 200 (% per year)

Interest rate with bonus included

Term considering the terms and conditions Standard interest rate level

**

3 luni 1.50 1.00

6 luni 1.75 1.25

12 luni 2.00 1.50

**The interest rate for deposits in EUR and USD, set up by Internet Banking/Mobile Banking channel includes an interest

bonus of 0.5%, above the standard interest rate, bonus granted for the period in which the client collects income

(salary/pension) in their BCR account. For customers who collect their salary, the bonus is granted only to newly opened

deposits starting from 06.02.2023. At the automatic prolongation, the standard interest rate displayed on the date of the

extension will be applied, with the bonus being granted or not, depending on BCR's commercial policy on the date of the

automatic prolongation.

The standard interest rate is granted to: (1) deposits made in banking units and (2) deposits made through any channel for

customers who do not collect income in their BCR account.

Savings account (MAXICONT) with variable interest rate (% per year)

Currency RON EUR USD

Minimum

≥1.00 RON ≥250 EUR ≥250 USD

balance

Interest

2.00 0.10 0.10

Rate

BCR SAVINGS PLAN OPENED AT THE BANK’S COUNTER, WITH FIXED INTEREST RATE (% per year)

KIDS ADULTS

Minimum monthly deposits RON 40 RON 50

Standard Interest Rate 7.30* 6.80

During the period the monthly

Standard interest rate minus 1.00 Standard interest rate minus 0.55

deposits are not paid

Interest bonus 0,20 when extending the plan under the conditions of meeting the schedule

The interest applicable to the amounts that exceed the maximum amount accumulated throughout a tenor is 0.10

* composed of the interest rate applied to savings plan for adults plus 0.50 interest rate bonus for kids

SIGHT RESOURCES INTEREST RATE (% per year)

0% p.a., applicable to the current accounts, to the current account packages, to the term deposits and savings plans

liquidated before the maturity date and to savings accounts if the minimum balance is not maintained for at least 1

month (RON) or 3 months (EUR / USD), and to the collateral deposits for Prima Casă loan.

Products in the client’s portfolio, withdrawn from the bank offer

TERM DEPOSITS WITH FIXED INTEREST RATE (% per year)

Term RON EUR USD

1 month* 0.01 0.01 0.01

2 months 0.01 0.01 0.01

9 months 6.20 0.75 1.25

12 months

- 0.01 0.01

(monthly interest)

18 months - 0.01 0.01

24 months (sem. 0.55

0.01 0.01

interest) In case of liquidation before maturity date: 0.10%

Maxiplus 24

- 0.01 -

months

36 months (sem.

- 0.01 0.01

interest)

Savings Plan 12

- 0.05 -

months**

Savings Plan 24

0.55 0.05 -

months**

Other currencies CHF GBP **- In case the monthly forecasted balance is not fulfilled. from the last due

date and until the date the forecasted balance is met. the interest rate applied

3 months 0.01 0.01 is calculated as the standard interest rate minus 0.55% (RON). respectively

minus 0.05% (EUR)

6 months 0.01 0.01 - The interest applicable to the amounts that exceed the maximum amount

accumulated throughout a tenor: RON: 0.10%. EUR: 0.05%.

- Interest Rate bonus of 0.20% for RON Savings Plans at the prolongation

12 months 0.01 0.01

date. if the forecasted balance is met

*Interest rate applicable also for collateral deposits for loans (except Prima Casa). credit cards and letters of guarantee new

opened or for which the interest rate expires starting 06.01.2014.

RON TERM DEPOSITS WITH VARIABLE INTEREST RATE (% per year)

Term Interest

1 – 3 months 0.01 The interest rates are applied irrespective of the amount

6- 36 months 0.01

Banca Comercială Română is part of the Deposit Guarantee Fund in the Romanian Banking System. being included in the list of

participant credit institutions. By payment of compensations. its depositors have their deposits guaranteed. within the limit of the

ceiling periodically established. which on the date of signing this Contractual Documentation is worth EUR 100.000. in RON

equivalent. per depositor. per bank. This list can be consulted by the Client directly on the webpage www.fgdb.ro of the Deposit

Guarantee Fund in the Romanian Banking System.

You might also like

- EuPlatesc DocumentatieDocument7 pagesEuPlatesc DocumentatieciumonkNo ratings yet

- Major CompaniesDocument364 pagesMajor CompaniesNicolae BaciuNo ratings yet

- 04.02.2015my UniCredit Banking PDFDocument6 pages04.02.2015my UniCredit Banking PDFcristeadanielaNo ratings yet

- Terms ConditionsDocument3 pagesTerms ConditionsArdenNo ratings yet

- Deposit Rate: For Individual Clients Personal AccountsDocument4 pagesDeposit Rate: For Individual Clients Personal AccountsMehedi HasanNo ratings yet

- Chill Make Money TNCDocument6 pagesChill Make Money TNCAi suuNo ratings yet

- Presentation On CGTMSE and Upcoming OpportunitiesDocument16 pagesPresentation On CGTMSE and Upcoming OpportunitiesAkshay JainNo ratings yet

- Deposit Rate - 20.03.2020 PDFDocument5 pagesDeposit Rate - 20.03.2020 PDFChinmoy SarkerNo ratings yet

- IDFC Bank Interest RateDocument6 pagesIDFC Bank Interest RateA BNo ratings yet

- Online Certificate of Deposit Terms & Charges DisclosureDocument3 pagesOnline Certificate of Deposit Terms & Charges DisclosureDaniel Smart OdogwuNo ratings yet

- Retail Personal loan-KFS-English-F-newDocument3 pagesRetail Personal loan-KFS-English-F-newTwimukye MarkNo ratings yet

- Foreclosure LetterDocument3 pagesForeclosure LetterabinayaNo ratings yet

- Branch Telephone CD TcsDocument3 pagesBranch Telephone CD TcsacescamerNo ratings yet

- Kotak Advance Fee-OnlineDocument1 pageKotak Advance Fee-Onlinejay.kumNo ratings yet

- Consumer Deposit Rates: Rates in Effect As ofDocument1 pageConsumer Deposit Rates: Rates in Effect As ofvijayarajindNo ratings yet

- Interest RatesDocument28 pagesInterest RatesFarha TexeiraNo ratings yet

- Schedule Interest Rates Personal AccountsDocument2 pagesSchedule Interest Rates Personal Accountskobibailey123okNo ratings yet

- New Adb Plans Wef Nov-2012Document4 pagesNew Adb Plans Wef Nov-2012B.S. RawatNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailYashaswi SharmaNo ratings yet

- Corporate Loan Products Auto - Various VariationsDocument13 pagesCorporate Loan Products Auto - Various VariationsArunNo ratings yet

- Andhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsDocument6 pagesAndhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsAbhishek OjhaNo ratings yet

- SG Esaver TNCDocument4 pagesSG Esaver TNChjwhtfvttrvakjjchoNo ratings yet

- FM Report - Group 2 - Section EDocument7 pagesFM Report - Group 2 - Section EVenkateswaran SNo ratings yet

- Rate Schedule - American Airlines Credit UnionDocument2 pagesRate Schedule - American Airlines Credit UnionJonathan Seagull LivingstonNo ratings yet

- 07239190235420260013Document2 pages07239190235420260013Arianne AguadoNo ratings yet

- Current and Savings Account Interest Rate: Personal AccountsDocument2 pagesCurrent and Savings Account Interest Rate: Personal AccountsMd.Rashidul Alam Sorker RifatNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1Kareena KapoorNo ratings yet

- QC For Biz PowerPoint PresentationDocument7 pagesQC For Biz PowerPoint PresentationSamuel BeekaNo ratings yet

- Balance Transfer Special Rate - HomeDocument2 pagesBalance Transfer Special Rate - Hometech.filnipponNo ratings yet

- Lender 1cqhdubbv - 478333Document45 pagesLender 1cqhdubbv - 478333DGLNo ratings yet

- Personal Account Interest Rate: (Golden Benefits)Document4 pagesPersonal Account Interest Rate: (Golden Benefits)Md Ashikur RahmanNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- Foreclosure 12 24 05Document3 pagesForeclosure 12 24 05Sunil LaygudeNo ratings yet

- BT Credit Card Summary BoxDocument2 pagesBT Credit Card Summary BoxDawoodd10No ratings yet

- Latest Deposit Rate - Website - 01.12.2022Document1 pageLatest Deposit Rate - Website - 01.12.2022Kazi ShohanNo ratings yet

- IL masterTnC Single Ibs enDocument10 pagesIL masterTnC Single Ibs enyimo0122No ratings yet

- Bank of IndiaDocument57 pagesBank of IndiaPramila PalNo ratings yet

- DCU Rate Sheet PrintableDocument7 pagesDCU Rate Sheet PrintableVadim ShabelnikovNo ratings yet

- Short TRMDocument2 pagesShort TRMCarolis SilvaNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailManvith B YNo ratings yet

- Proiect FinanciaraDocument8 pagesProiect FinanciarafynbogdanNo ratings yet

- Twoinstallments PDFDocument1 pageTwoinstallments PDFAlender TongiNo ratings yet

- Foreclosure Letter 20-05-40Document3 pagesForeclosure Letter 20-05-40G Pavan KumarNo ratings yet

- Financial Markets and Instruments: Assignment - 1Document3 pagesFinancial Markets and Instruments: Assignment - 1Navya MohankaNo ratings yet

- Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesCard Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croressatyajit_manna_2No ratings yet

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDocument4 pagesInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 Croresgolagani praveenkumarNo ratings yet

- Credit and CommoditiesDocument3 pagesCredit and CommoditiesSubG 08No ratings yet

- CPL MidDocument7 pagesCPL MidMinhas ArshadNo ratings yet

- UOB PromotionsDocument8 pagesUOB PromotionsAnonymous dwPTJOhsNo ratings yet

- Interest Rate RetailDocument4 pagesInterest Rate RetailRajender Singh DeepakNo ratings yet

- DCU Rate Sheet PrintableDocument4 pagesDCU Rate Sheet PrintableMaltro ChooNo ratings yet

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Foreclosure 14 07 11Document3 pagesForeclosure 14 07 11Muhammed Yazeen PMNo ratings yet

- Grand Videoke TKR-373MP SongbookDocument2 pagesGrand Videoke TKR-373MP Songbooktikki0219No ratings yet

- Page 1 of 3 Statement Summary June 2022 Statement Period 6/1/2022 - 6/30/2022Document3 pagesPage 1 of 3 Statement Summary June 2022 Statement Period 6/1/2022 - 6/30/2022ola sucreNo ratings yet

- Sbac Interest RatesDocument3 pagesSbac Interest Ratestasnuva rahmanNo ratings yet

- Banking and Insurance of BangladeshDocument25 pagesBanking and Insurance of BangladeshAbul HasnatNo ratings yet

- Schedule of Charges Revised 01052022Document19 pagesSchedule of Charges Revised 01052022Chandra MohanNo ratings yet

- Latest Deposit Rate - Website - 19.10.2023Document1 pageLatest Deposit Rate - Website - 19.10.2023cvjgdjkkbmncnnNo ratings yet

- CCPL MidDocument7 pagesCCPL Midshmirza2009No ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Pe Perioada: 01-02-2023 - 28-02-2023 EXTRAS DE CONT Nr. 1 Din Data: 28-02-2023Document5 pagesPe Perioada: 01-02-2023 - 28-02-2023 EXTRAS DE CONT Nr. 1 Din Data: 28-02-2023alinmarian0730No ratings yet

- Raicu Cristina Radu Stefania Radoi Mihaela Savu Oana Scaunas AlexandruDocument24 pagesRaicu Cristina Radu Stefania Radoi Mihaela Savu Oana Scaunas AlexandruSavu Oana Ramona ElenaNo ratings yet

- Registration Form - Synergies in Communication - 6th Edition - 2017-Drobot AnaDocument3 pagesRegistration Form - Synergies in Communication - 6th Edition - 2017-Drobot AnaAna IrinaNo ratings yet

- CASE OF TEMEȘAN V ROMANIA - 230620 - 135620Document9 pagesCASE OF TEMEȘAN V ROMANIA - 230620 - 135620Ioan-Octavian OvacNo ratings yet

- Pe Perioada: 01-08-2021 - 31-08-2021 EXTRAS DE CONT Nr. 54 Din Data: 28-10-2021Document6 pagesPe Perioada: 01-08-2021 - 31-08-2021 EXTRAS DE CONT Nr. 54 Din Data: 28-10-2021Distriqt StudioNo ratings yet

- Pe Perioada: 01-09-2022 - 13-09-2022 EXTRAS DE CONT Nr. 1 Din Data: 13-09-2022Document3 pagesPe Perioada: 01-09-2022 - 13-09-2022 EXTRAS DE CONT Nr. 1 Din Data: 13-09-2022Daria DaiaNo ratings yet

- Pe Perioada: 01-01-2023 - 31-01-2023 EXTRAS DE CONT Nr. 2 Din Data: 08-02-2023Document3 pagesPe Perioada: 01-01-2023 - 31-01-2023 EXTRAS DE CONT Nr. 2 Din Data: 08-02-2023elenaNo ratings yet

- Pe Perioada: 20-12-2023 - 05-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 05-01-2024Document5 pagesPe Perioada: 20-12-2023 - 05-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 05-01-2024Miki CristinaNo ratings yet

- Pe Perioada: 01-11-2023 - 21-12-2023 EXTRAS DE CONT Nr. 2 Din Data: 21-12-2023Document3 pagesPe Perioada: 01-11-2023 - 21-12-2023 EXTRAS DE CONT Nr. 2 Din Data: 21-12-2023Mureșan ȘtefanNo ratings yet

- Statement 20221020 154516Document1 pageStatement 20221020 154516Andrei DumitrescuNo ratings yet

- BCRDocument13 pagesBCRAnca MahaleanNo ratings yet

- Extras de Cont - 20221028 - 110021Document2 pagesExtras de Cont - 20221028 - 110021Cosma ElenaNo ratings yet

- Számlakivonat 20221102 180854Document2 pagesSzámlakivonat 20221102 180854cristina kerekesNo ratings yet

- Pe Perioada: 01-01-2023 - 15-01-2023 EXTRAS DE CONT Nr. 1 Din Data: 15-01-2023Document4 pagesPe Perioada: 01-01-2023 - 15-01-2023 EXTRAS DE CONT Nr. 1 Din Data: 15-01-2023Purdel Claudiu-ConstantinNo ratings yet

- Banks Owned by IsraelDocument8 pagesBanks Owned by IsraelVrabie FlorinNo ratings yet

- Extras de Cont - 20221215 - 100127Document3 pagesExtras de Cont - 20221215 - 100127Vpn nou100% (1)

- Pe Perioada: 01-02-2023 - 15-02-2023 EXTRAS DE CONT Nr. 2 Din Data: 15-02-2023Document3 pagesPe Perioada: 01-02-2023 - 15-02-2023 EXTRAS DE CONT Nr. 2 Din Data: 15-02-2023Alex Nicolaie IvanNo ratings yet

- Registru Persoane JuridiceDocument19 pagesRegistru Persoane JuridiceMaria BalanNo ratings yet

- Extortion Legal Fees Notary FeeesDocument9 pagesExtortion Legal Fees Notary FeeesAdrian BirdeaNo ratings yet

- Sign OutDocument8 pagesSign Outvladutneagu824No ratings yet

- Gmail - Direct - 401 Erorr - 1028 Bit Incyption-Legal SizeDocument11 pagesGmail - Direct - 401 Erorr - 1028 Bit Incyption-Legal SizeAdrian BirdeaNo ratings yet

- Romania 2013Document11 pagesRomania 2013Emilia StoicaNo ratings yet

- CV - Europass EN PDFDocument5 pagesCV - Europass EN PDFAna RosuNo ratings yet

- 01 Anexa TCGA v22 08june2021Document117 pages01 Anexa TCGA v22 08june2021RobertNo ratings yet

- Extras de Cont - 20240112 - 090547Document18 pagesExtras de Cont - 20240112 - 090547Ivan MihaiNo ratings yet

- Statement 20181206917750Document2 pagesStatement 20181206917750Raluca N CosminaNo ratings yet

- Marketing Mix in A Services Company - BCR - Simion&Todor - 1752Document16 pagesMarketing Mix in A Services Company - BCR - Simion&Todor - 1752George IlieNo ratings yet