Professional Documents

Culture Documents

600 157150 PDF

Uploaded by

Martins MartinsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

600 157150 PDF

Uploaded by

Martins MartinsCopyright:

Available Formats

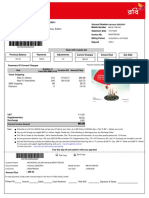

República Democrática de Timor-Leste

Autoridade Tributária

Rua Aitarak Laran Dili,Ministeriu das Financas, Pezu 8, Telf. 74002070/74002071

Personal Details

Month Year TIN Tax Payer Name Establishment Name

jan 2023 1350699 Filomeno Martins SEINARU RAFAEL UNIPESSOAL LDA

1.Wages Income Tax

Total Gross Wages Paid during the month Total Wages Income Tax

$600.00 $60.00

2.Witholding Tax

Witholding Type LN Gross Payment Rate LN Witholding Tax Calculation

2.1 - Prizes and Lotteries 45 $0.00 10% 50 $0.00

2.2 - Royalties 55 $0.00 10% 60 $0.00

2.3 - Rent land and Buildings 65 $0.00 10% 70 $0.00

2.4 - Construction and Building Activities 75 $0.00 2% 80 $0.00

2.5 - Construction Consulting Services 85 $0.00 4% 90 $0.00

2.6 - Mining and Mining Support Services 95 $0.00 4.5% 100 $0.00

2.7 - Transportation Air and Sea 105 $0.00 2.64% 110 $0.00

2.8 - Non Resident Without PE 115 $0.00 10% 120 $0.00

Total Witholding Tax $0.00

3. Service Tax

Hotel Services Restaurant and Bar Services Telecommunication Services Total Sales Service Payable Tax

$0.00 $0.00 $0.00 $0.00 $0.00

4. Annual Income Tax Installment

Total Turnover Rate Total Turnover by 0.5%

$0.00 0.05% $0.00

Submitted at 2023-02-02 page 1 of 2 Generated at 2023-02-02

República Democrática de Timor-Leste

Autoridade Tributária

Rua Aitarak Laran Dili,Ministeriu das Financas, Pezu 8, Telf. 74002070/74002071

5.Payment Advice - Summary of Payment

TIN Month/Fulan Tinan/year

1350699 jan 2023

Tax Type Total Bank Account

1.Wages Income Tax $60.00 A/C 286442.10.001

2.Witholding Tax $0.00 A/C 286830.10.001

3. Service Tax $0.00 A/C 286636.10.001

4. Annual Income Tax Installment $0.00 AC/ 286539.10.001

Total Taxes paid $60.00

Important Notice

For taxpayers that have payment in bank, please be aware that you need to make the payment within

the allowed days (before 15 of the following month) after you have submitted the form online. You

need to print this form with you and have it paid in the designated Bank. Once you have paid, have it

scanned and upload it to e-services portal as the evidence of payment

Important Notice about P24 Payment

For taxpayers that have made payment in P24 ATM, please be aware that you must pay additional

$.50 cent fee for each of tax type (each transaction on each tax type). This is directly surcharged

for the fee of using P24 ATM Machine. You can declare these fees at the end of the year in the Annual

Income Tax form as other tax deductible expenses

Details of official who made the payment at the Bank

Complete Name Date Signature

Submitted at 2023-02-02 page 2 of 2 Generated at 2023-02-02

You might also like

- Data Book 1609842354604 - DuplicateInvoice - 923325488809Document7 pagesData Book 1609842354604 - DuplicateInvoice - 923325488809AbdulSattarNo ratings yet

- Statement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacDocument1 pageStatement of Account: Dap-Dap Blk-40 Lot-32 Anupul Bamban TarlacJoyce Gregorio ZamoraNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohanNo ratings yet

- Statement For Ufone # 03366662059: Account DetailsDocument3 pagesStatement For Ufone # 03366662059: Account DetailsWasif MehmoodNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohan100% (1)

- Statement of Account: Christ The King Subd. Phase 1 B10 L8 Talon Kuatro Las Pi-As Metro ManilaDocument1 pageStatement of Account: Christ The King Subd. Phase 1 B10 L8 Talon Kuatro Las Pi-As Metro ManilaJessaNo ratings yet

- Account Summary: Total Due $670.47Document4 pagesAccount Summary: Total Due $670.47Susan Stanley100% (4)

- Soa 0020230786687 (3525)Document1 pageSoa 0020230786687 (3525)Ave de GuzmanNo ratings yet

- Íæ"N %$ K# B 3çféî Ìç ! Î: Total Due R 1,999.70Document4 pagesÍæ"N %$ K# B 3çféî Ìç ! Î: Total Due R 1,999.70Grenville Rusteberg40% (5)

- 2 Feb 2018 20 Feb 2010 - 31 Jan 2018 1.15661852: Your BillDocument3 pages2 Feb 2018 20 Feb 2010 - 31 Jan 2018 1.15661852: Your BillumlzoneNo ratings yet

- LBP Form No.Document119 pagesLBP Form No.Cecille JimenezNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Ask X A PDFDocument251 pagesAsk X A PDFHammad AhmedNo ratings yet

- WifiDocument4 pagesWifibobbyNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- July 2020 - ACCTG CEP 24362280Document2 pagesJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNo ratings yet

- Income Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483Document2 pagesIncome Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483DanielWildSheepZaninNo ratings yet

- Statement For Contract # 1000050644: Faisal Safdar KhanDocument2 pagesStatement For Contract # 1000050644: Faisal Safdar KhanFaisal KhanNo ratings yet

- Pimpri Chinchwad Municipal Corporation, Pimpri, Pune-411 018Document2 pagesPimpri Chinchwad Municipal Corporation, Pimpri, Pune-411 018Manoj SinghNo ratings yet

- Financial Accounting #1Document12 pagesFinancial Accounting #1Wallace TamNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument31 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byMoidutty NuchiyadNo ratings yet

- Bill 1687106571Document29 pagesBill 1687106571sheblkarim16No ratings yet

- Statement of Account: 33 Azure St. Sss Village Concepcion Dos - Marikina Metro ManilaDocument1 pageStatement of Account: 33 Azure St. Sss Village Concepcion Dos - Marikina Metro ManilaEmrechJhon BubanNo ratings yet

- Statement of Account: Vicente Compound Lourdes ST Paranaque Metro ManilaDocument1 pageStatement of Account: Vicente Compound Lourdes ST Paranaque Metro ManilaMark JocsingNo ratings yet

- Basavaraju S CDocument32 pagesBasavaraju S Cproject mailNo ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument42 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- 1 (1) 23359934Document12 pages1 (1) 23359934alpesh ramaniNo ratings yet

- Safari - 3 Oct. 2019 À 12:47Document1 pageSafari - 3 Oct. 2019 À 12:47Fabrice BenardNo ratings yet

- Statement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaDocument1 pageStatement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaYsiad LlantosNo ratings yet

- FY20 Proposed BudgetDocument61 pagesFY20 Proposed BudgetAnonymous KcgtbPNo ratings yet

- Ahmad Saiful Ridzwan Bin JaharuddinDocument1 pageAhmad Saiful Ridzwan Bin JaharuddinAhmad Saiful Ridzwan JaharuddinNo ratings yet

- Attachment 2 Guidance For AssessmentDocument5 pagesAttachment 2 Guidance For Assessmentultimatecombat92No ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- JULY 31 BofA 07 20 Statement PDFDocument4 pagesJULY 31 BofA 07 20 Statement PDFhomanNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)shimmmNo ratings yet

- Accountancy (STI College) : Studocu Is Not Sponsored or Endorsed by Any College or UniversityDocument2 pagesAccountancy (STI College) : Studocu Is Not Sponsored or Endorsed by Any College or UniversityJefferry Gerome FerryNo ratings yet

- File 2Document2 pagesFile 2comaideNo ratings yet

- SCC Comunicados Pi Batch0100151116c5897dc2c75000Document4 pagesSCC Comunicados Pi Batch0100151116c5897dc2c75000Thomas StanyardNo ratings yet

- 21Document4 pages21jazzrockstarNo ratings yet

- RP 395,040 28 Jan 2021: Bagus Aqumaddin Mojokerto Jawa Timur 11000 Rt05Rw02, Glatik, Ngoro, MojokertoDocument3 pagesRP 395,040 28 Jan 2021: Bagus Aqumaddin Mojokerto Jawa Timur 11000 Rt05Rw02, Glatik, Ngoro, MojokertoBagus Aqu0% (1)

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Your TELUS Mobility Bill: Account SummaryDocument10 pagesYour TELUS Mobility Bill: Account SummaryHarold KumarNo ratings yet

- March Bill PDFDocument2 pagesMarch Bill PDFRaman kumarNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103Document2 pagesNotice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103aalampathan76No ratings yet

- Econ Math ProjectDocument14 pagesEcon Math ProjectAndy ChiuNo ratings yet

- Arjun Desai 2 St. Vincent Street West Dublin Dublin Co. DublinDocument4 pagesArjun Desai 2 St. Vincent Street West Dublin Dublin Co. DublinarjunNo ratings yet

- AssessmentDocument1 pageAssessmentCamia Mae MalabananNo ratings yet

- SVFSDFDocument1 pageSVFSDFK JayNo ratings yet

- ScribedDocument2 pagesScribedDavid PylypNo ratings yet

- Printech Accessories House-20, Block-KA Pisci Culture Housing, Adabor 1207 Dhaka, Bangladesh 1207Document8 pagesPrintech Accessories House-20, Block-KA Pisci Culture Housing, Adabor 1207 Dhaka, Bangladesh 1207Jubayet BariNo ratings yet

- NEDA-Acct#653716583-SOA July2020Document6 pagesNEDA-Acct#653716583-SOA July2020Pe Anthony NoricoNo ratings yet

- Muna Noor - OCEC Payment Plan InvoiceDocument1 pageMuna Noor - OCEC Payment Plan InvoiceMaryamsam SamNo ratings yet

- FCD Westpac Business Bank Savings StatementDocument3 pagesFCD Westpac Business Bank Savings StatementMadison MooreNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- How Much Do You Owe? Your Account Summary Previous BillDocument3 pagesHow Much Do You Owe? Your Account Summary Previous BillEzzeddineNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Bronjong Cassa3Document1 pageBronjong Cassa3Martins MartinsNo ratings yet

- Bronjong Cassa Boq - pdf2Document1 pageBronjong Cassa Boq - pdf2Martins MartinsNo ratings yet

- Chack List Inspection OPDocument1 pageChack List Inspection OPMartins MartinsNo ratings yet

- Naskah Publikasi Hendry Tri Wibowo PDFDocument6 pagesNaskah Publikasi Hendry Tri Wibowo PDFKriswantoWisanggeniNo ratings yet

- Technical Proposal BNCTL OECUSSEDocument26 pagesTechnical Proposal BNCTL OECUSSEMartins MartinsNo ratings yet

- Azazaz 2Document1 pageAzazaz 2Martins MartinsNo ratings yet

- Left Elev.: Manutensaun Edificio DnrsDocument1 pageLeft Elev.: Manutensaun Edificio DnrsMartins MartinsNo ratings yet

- Democratica de Timor Leste: Approved by Checked byDocument1 pageDemocratica de Timor Leste: Approved by Checked byMartins MartinsNo ratings yet

- Tecnico: Full Partition WorksDocument1 pageTecnico: Full Partition WorksMartins MartinsNo ratings yet

- Data Sheet Width Flange BeamDocument32 pagesData Sheet Width Flange BeamIrvan IskandarNo ratings yet

- Letter HeadDocument1 pageLetter Headmelvin bautistaNo ratings yet

- Standard & Poors Outlook On GreeceDocument10 pagesStandard & Poors Outlook On GreeceEuronews Digital PlatformsNo ratings yet

- Addis Ababa University College of Development StudiesDocument126 pagesAddis Ababa University College of Development StudieskindhunNo ratings yet

- Concept Paper (Revised)Document6 pagesConcept Paper (Revised)MarkNo ratings yet

- Quicknotes - Partnership, Estate, - TrustDocument7 pagesQuicknotes - Partnership, Estate, - TrustTwish BarriosNo ratings yet

- Eclectica Agriculture Fund Feb 2015Document2 pagesEclectica Agriculture Fund Feb 2015CanadianValueNo ratings yet

- GeM BidDocument7 pagesGeM BidVipul MishraNo ratings yet

- 5d6d01005f325curriculum MPSM LatestDocument51 pages5d6d01005f325curriculum MPSM LatestMostafa ShaheenNo ratings yet

- Week 10-11-Tutorial Questions Answers - RevisedDocument5 pagesWeek 10-11-Tutorial Questions Answers - RevisedDivya chandNo ratings yet

- Case Study On Consumer Protection ActDocument2 pagesCase Study On Consumer Protection ActNeha Chugh100% (4)

- DPR For Walnut ProcessingDocument74 pagesDPR For Walnut ProcessingMohd touseefNo ratings yet

- Adverbial ClauseDocument3 pagesAdverbial ClausefaizzzzzNo ratings yet

- IV Sem MBA - TM - Strategic Management Model Paper 2013Document2 pagesIV Sem MBA - TM - Strategic Management Model Paper 2013vikramvsuNo ratings yet

- Final Report11Document28 pagesFinal Report11suvekchhya76% (17)

- GMCLDocument12 pagesGMCLGMCL NorthNo ratings yet

- Conferring Rights On Citizens-Laws and Their Implementation: Ijpa Jan - March 014Document11 pagesConferring Rights On Citizens-Laws and Their Implementation: Ijpa Jan - March 014Mayuresh DalviNo ratings yet

- O&SCM Introduction & Operations Strategy - PPSXDocument60 pagesO&SCM Introduction & Operations Strategy - PPSXRuchi DurejaNo ratings yet

- Sop PDFDocument15 pagesSop PDFpolikopil0No ratings yet

- Case Study Assignment - Neha Nair 26021Document3 pagesCase Study Assignment - Neha Nair 26021NEHA NAIRNo ratings yet

- Alternative Investment Funds in Ifsc09122020071200Document2 pagesAlternative Investment Funds in Ifsc09122020071200SanyamNo ratings yet

- A Comparative Study of E-Banking in Public andDocument10 pagesA Comparative Study of E-Banking in Public andanisha mathuriaNo ratings yet

- Ans: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementDocument3 pagesAns: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementAsma HatamNo ratings yet

- Starbucks MissionDocument2 pagesStarbucks MissionMine SayracNo ratings yet

- Vinamilk Corporate GovernanceDocument4 pagesVinamilk Corporate GovernanceLeeNNo ratings yet

- Sales Executive Business Development in Boston MA Resume Martin LairdDocument2 pagesSales Executive Business Development in Boston MA Resume Martin LairdMartinLairdNo ratings yet

- Butchery Business Plan-1Document12 pagesButchery Business Plan-1Andrew LukupwaNo ratings yet

- Smart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesSmart Manufacturing Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Managing Brands GloballyDocument13 pagesManaging Brands GloballySonam SinghNo ratings yet

- Cash Flow Question Paper1Document10 pagesCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- MCD Vs Burger KingDocument9 pagesMCD Vs Burger KingABHISHEK KHURANANo ratings yet