Professional Documents

Culture Documents

HW MACROECONOMICS TUẦN 1 E10

Uploaded by

NGÂN NGUYỄN THỊ HOÀNG0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

HW MACROECONOMICS TUẦN 1 E10.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesHW MACROECONOMICS TUẦN 1 E10

Uploaded by

NGÂN NGUYỄN THỊ HOÀNGCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

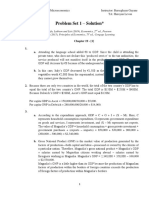

1.

a. Components of GDP: Consumption. Because the refrigerator is the durable

good

b. Components of GDP: Investment. Because buying a new house is one type

of household spending category

c. Components of GDP: Investment and Consumption. Because a Mustang is

an inventory so the investment is fall and the one who buys the Mustang can

make the consumption increase. So it does not contribute any change in

GDP.

d. Components of GDP: Consumption. Because Pizza is a non-durable good

and it makes consumption increases.

e. Components of GDP: Government purchases. Because repaving Highway

101 is the public work

f. Components of GDP: Consumption and Net exports. Consumption increases

because the bottle is a good purchased by a household, but net export

decrease because a bottle of French wine was imported

g. Components of GDP: Investment. Because new structures equipment were

built then investment increases.

3.

If GDP included goods that are resold, it would make GDP a less informative

measure of economic well-being because it double-counts goods that were sold

more than once. GDP just indicates the market value, that has been created inside a

specific territory during a specific time frame. Reselling never creates new value

for the economy hence excluded from the GDP calculation.

4.

a)

2010: Nominal GDP= 200, real GDP= 200

2011: Nominal GDP= 400, real GDP= 400

2012: Nominal GDP= 800, real GDP= 400

GDP deflator:

2011: ($200/$200)x100= 100

2011: ($400/$400)x100= 100

2011: ($800/$400)x100= 200

b)

_ Percentage change in nominal GDP in 2011 = [($400 – $200)/$200] × 100 =

100%.

Percentage change in nominal GDP in 2012 = [($800 – $400)/$400] × 100 = 100%

_ Percentage change in real GDP in 2011 = [($400 – $200)/$200] × 100 = 100%.

Percentage change in real GDP in 2012 = [($400 – $400)/$400] × 100 = 0%.

_ Percentage change in the GDP deflator in 2011 = [(100 – 100)/100] × 100 = 0%.

Percentage change in the GDP deflator in 2012 = [(200 – 100)/100] × 100 = 100%.

_ Prices did not change from 2010 to 2011. Thus the percentage change in the

GDP deflator is zero. Quantity did not change from 2011 to 2012. This means that

the percentage change in real GDP is zero.

c) Economic well-being rose more in 2011 than in 2012, since real GDP rose in

2011 but not in 2012. In 2011, real GDP rose but prices did not. In 2012, real GDP

did not rise but prices did.

6.

a. Growth rate of nominal GDP = 100 x [(14,256/9,353)1/10-1]= 4,30%

b. Growth rate of GDP deflator = 100 x [(109.8/86.8)-1] = 26,5%

c. Real GDP = nominal GDP / GDP deflator * 100

1999: Real GDP = 9,353 / 86,8 *100 = $ 10,77 billions

2009: Real GDP = 14,256/109.8 *100= $ 12,98 billions

d. The growth rate of real GDP= (12,98-10,77/10,77)* 100= 20.52%

e. The growth rate of real GDP is

f. The growth rate of nominal GDP is

8.

a. GDP= $180 because bread is the final good to the customers

b. Value added

+ By farmer: $100

+ By miller: $150- $100= $50

+ By baker: $180-$150=$30

c. Total value added = $100 + $50 + $30 = $180.

The total value added by the three individuals is the same as the economy’s GDP.

The value added method is another method that can be used to determine the value

of GDP of a country. All things equal, the value added method should equal the

GDP of the country.

11.

a. GDP= $400

b. NNP= GDP- Depreciation = $400-$50= $350

c. National income= NNP-indirect tax= $350-30=$320

d. Personal Income= National income – Retained earnings – Indirect business taxes

= $320 – $100 = $220.

e. Disposable personal income = personal income – personal income tax = $220 –

$70 = $150.

You might also like

- GSLC 1Document6 pagesGSLC 1Jennifer CarliseNo ratings yet

- MACROECONOMICS HOMEWORK GDPDocument7 pagesMACROECONOMICS HOMEWORK GDPNGÂN ĐẶNG HOÀNGNo ratings yet

- Measuring A Nation'S Income: Questions For ReviewDocument4 pagesMeasuring A Nation'S Income: Questions For ReviewNoman MustafaNo ratings yet

- CHAPTER 23 - MicroeconomicsDocument5 pagesCHAPTER 23 - MicroeconomicsPhúc Nguyên HồNo ratings yet

- Topic 1 - Practice Questions - Measuring A Nation's IncomeDocument5 pagesTopic 1 - Practice Questions - Measuring A Nation's Incomeparaschhikara3No ratings yet

- The Four Components of Gross Domestic Product Are Personal Consumption, Business Investment, Government Spending, and Net Exports. For Example: - Good, ServiceDocument6 pagesThe Four Components of Gross Domestic Product Are Personal Consumption, Business Investment, Government Spending, and Net Exports. For Example: - Good, ServiceMinh TuấnNo ratings yet

- Tugas Problem Set 2Document3 pagesTugas Problem Set 2Nur Rahmi PitaNo ratings yet

- Chapter 23Document4 pagesChapter 23Tin ManNo ratings yet

- Principles ProblemSet8Document4 pagesPrinciples ProblemSet8Bernardo BarrezuetaNo ratings yet

- 104practice1 2017sDocument23 pages104practice1 2017srashid744No ratings yet

- Solutions - Quiz and ApplicationsDocument9 pagesSolutions - Quiz and ApplicationsElectron I'mNo ratings yet

- Solution Macroeconomics For Chapter 23 - 3th Editon - Mankiw - Measuring A Nation's IncomeDocument6 pagesSolution Macroeconomics For Chapter 23 - 3th Editon - Mankiw - Measuring A Nation's IncomeQuý Trần100% (8)

- Economics 161 FALL 2003 E. Mcdevitt Study Questions-Set #2Document2 pagesEconomics 161 FALL 2003 E. Mcdevitt Study Questions-Set #2farid ahmedNo ratings yet

- Macro - Chapter 5 - Recommended Problems - SolutionsDocument3 pagesMacro - Chapter 5 - Recommended Problems - SolutionsLaylaNo ratings yet

- BMACRO B LE2 Estares JohnReyDocument7 pagesBMACRO B LE2 Estares JohnReyJohnRey EstaresNo ratings yet

- Eco 102 Review Questions 1Document4 pagesEco 102 Review Questions 1Ahmed DahiNo ratings yet

- Tong Hop MacDocument62 pagesTong Hop Macduyenmap07No ratings yet

- Department of Business Studies Bachelor of Business Year 1 Principles of Macroeconomics ECO102 Tutorial QuestionDocument51 pagesDepartment of Business Studies Bachelor of Business Year 1 Principles of Macroeconomics ECO102 Tutorial QuestionWan HuiNo ratings yet

- Measuring A Nation's Income: Solutions To Textbook ProblemsDocument8 pagesMeasuring A Nation's Income: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- The Inflation Rate in 2011 S Using The CPI IsDocument2 pagesThe Inflation Rate in 2011 S Using The CPI IsBiplove hamalNo ratings yet

- Assignment 2: I. Complete All Problems and Applications at The End of Chapter 23Document6 pagesAssignment 2: I. Complete All Problems and Applications at The End of Chapter 23Phước Đào QuangNo ratings yet

- Macro Tut 1Document7 pagesMacro Tut 1Nguyễn XuânNo ratings yet

- Questions National Income Accounting With KeyDocument6 pagesQuestions National Income Accounting With Keyaditi shuklaNo ratings yet

- ECO121 - Nguyen Ngoc Thuy Tien - SS171273Document5 pagesECO121 - Nguyen Ngoc Thuy Tien - SS171273Nguyen Ngoc Thuy Tien (K17 HCM)No ratings yet

- Assignment 05Document21 pagesAssignment 05Harris AzharNo ratings yet

- Problem Set 1 - SolutionDocument8 pagesProblem Set 1 - SolutionH ENGNo ratings yet

- Chapter-2Document10 pagesChapter-2Yasin IsikNo ratings yet

- Macro Tut 1Document8 pagesMacro Tut 1Hằng HàNo ratings yet

- TUTMACDocument63 pagesTUTMACThùy Dương NguyễnNo ratings yet

- Homework 1Document5 pagesHomework 1MaiaOshakmashviliNo ratings yet

- Macroeconomics RevisionDocument17 pagesMacroeconomics RevisionTrường XuânNo ratings yet

- C. Why Do Wages Differ Across Industries?Document9 pagesC. Why Do Wages Differ Across Industries?Dương Phạm Thị ThùyNo ratings yet

- EcoDev SumDocument9 pagesEcoDev SumEllaine DannugNo ratings yet

- Chapter 11Document3 pagesChapter 11Marvin StrongNo ratings yet

- Individual ECODocument9 pagesIndividual ECOTran Thi Thu HuyenNo ratings yet

- Measuring a Nation's IncomeDocument48 pagesMeasuring a Nation's IncomeThuỳ PhạmNo ratings yet

- Macro Tut 1Document6 pagesMacro Tut 1TACN-2M-19ACN Luu Khanh LinhNo ratings yet

- Problem Session-1 - 02.03.2012Document72 pagesProblem Session-1 - 02.03.2012dewiNo ratings yet

- Introduction To Macroeconomics Unit 1 National Income and National OutputDocument5 pagesIntroduction To Macroeconomics Unit 1 National Income and National OutputNordia BrysonNo ratings yet

- Understanding GDP and NNPDocument7 pagesUnderstanding GDP and NNPIndivineNo ratings yet

- ECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedDocument6 pagesECO121 - Test 01 - Individual Assignment 01 - PQM UpdatedNguyen Thi Thu Phuong (K16HL)No ratings yet

- Number of Un Employed Labor ForceDocument4 pagesNumber of Un Employed Labor ForceNajma HusseinNo ratings yet

- GDP components and transactionsDocument7 pagesGDP components and transactionsAndreea Criclevit100% (1)

- JA MacroEcon GDP 3Document1 pageJA MacroEcon GDP 3mobinil1No ratings yet

- Solution Manual For Macroeconomics Canadian 5Th Edition Mankiw Scarth 1464168504 9781464168505 Full Chapter PDFDocument36 pagesSolution Manual For Macroeconomics Canadian 5Th Edition Mankiw Scarth 1464168504 9781464168505 Full Chapter PDFlinda.legendre519100% (14)

- Tutorial 12 SolutionsDocument3 pagesTutorial 12 SolutionsWHNo ratings yet

- 10 MEP PracticeMCQsDocument12 pages10 MEP PracticeMCQsDevansh JainNo ratings yet

- Solution Manual For Macroeconomics Canadian 5Th Edition Blanchard Johnson 0132164361 9780132164368 Full Chapter PDFDocument20 pagesSolution Manual For Macroeconomics Canadian 5Th Edition Blanchard Johnson 0132164361 9780132164368 Full Chapter PDFlinda.legendre519100% (14)

- 5.2 - Inflation, GDP Practice Questions AKDocument6 pages5.2 - Inflation, GDP Practice Questions AKKathryn BourneNo ratings yet

- Macro Tutorial 1 (Jan 10, 2018)Document4 pagesMacro Tutorial 1 (Jan 10, 2018)shashankNo ratings yet

- Problem Set 2 Chapter 2: Measuring A Nation's IncomeDocument5 pagesProblem Set 2 Chapter 2: Measuring A Nation's IncomeĐoàn UyênNo ratings yet

- MacroDocument15 pagesMacroYasin IsikNo ratings yet

- ECON 203 Midterm1 2012WDocument13 pagesECON 203 Midterm1 2012WexamkillerNo ratings yet

- Nation's Income ExerciseDocument3 pagesNation's Income ExerciseMaybeline Lee100% (1)

- Macro AssignmentDocument17 pagesMacro AssignmentImran UmarNo ratings yet

- Chapter 2 - Data of MacroeconomicsDocument23 pagesChapter 2 - Data of MacroeconomicsBenny TanNo ratings yet

- Year # of Hkust Freshmen Price (Tuition: HK$) Nominal GDP Real GDP (In 1990 $) Real GDP (In 2000 $)Document4 pagesYear # of Hkust Freshmen Price (Tuition: HK$) Nominal GDP Real GDP (In 1990 $) Real GDP (In 2000 $)Vianna NgNo ratings yet

- MacroeconomicDocument9 pagesMacroeconomicAhmed KhalifaNo ratings yet

- Repport Btech FinalDocument49 pagesRepport Btech FinalSuzelle NGOUNOU MAGANo ratings yet

- Bismillah Skripsi Herlina Rozaaaa-1Document57 pagesBismillah Skripsi Herlina Rozaaaa-1Saidi NetNo ratings yet

- ISO 9000 Standards Guide Quality Systems InternationallyDocument12 pagesISO 9000 Standards Guide Quality Systems InternationallyArslan Saleem0% (1)

- CUMSUM Process ControlDocument6 pagesCUMSUM Process Controljess fantonalgoNo ratings yet

- KPW FSO Yetagun Presentation 250713Document36 pagesKPW FSO Yetagun Presentation 250713muhamadrafie1975No ratings yet

- Bizagi Licensing Explained ENGDocument7 pagesBizagi Licensing Explained ENGGuidoNo ratings yet

- Belotero Intense LidocaineDocument7 pagesBelotero Intense LidocaineAnnaNo ratings yet

- Lesson 2: Weaving A Mannahatta Muir WebDocument2 pagesLesson 2: Weaving A Mannahatta Muir WebTamas SzamosfalvyNo ratings yet

- Ejc-M13 - FN953205Document203 pagesEjc-M13 - FN953205JoséNo ratings yet

- Script of Cca Eim EditedDocument4 pagesScript of Cca Eim EditedMhen Maugan100% (1)

- Gauss Jordan MethodDocument6 pagesGauss Jordan MethodnNo ratings yet

- Forum Ex 2 2Document5 pagesForum Ex 2 2Didan EnricoNo ratings yet

- T e 2552674 Percy Polls Peculiar Plants Fiction Year 5 Reading Comprehension - Ver - 5Document20 pagesT e 2552674 Percy Polls Peculiar Plants Fiction Year 5 Reading Comprehension - Ver - 5mariam osamaNo ratings yet

- OnScreen B2 Quiz 2ADocument2 pagesOnScreen B2 Quiz 2ALaura B.100% (1)

- CAPS LESSON PLAN, KAHOOT QUIZ, PPT VIDEODocument3 pagesCAPS LESSON PLAN, KAHOOT QUIZ, PPT VIDEOMandisa MselekuNo ratings yet

- XFARDocument14 pagesXFARRIZA SAMPAGANo ratings yet

- Customer Satisfaction in Maruti SuzukiDocument31 pagesCustomer Satisfaction in Maruti Suzukirajesh laddha100% (1)

- Vaping in Preganacy A Systematic ReviewDocument8 pagesVaping in Preganacy A Systematic ReviewMia LouwNo ratings yet

- MIT LL. Target Radar Cross Section (RCS)Document45 pagesMIT LL. Target Radar Cross Section (RCS)darin koblickNo ratings yet

- ATI, West Bengal: ATI Training Management Information SystemDocument11 pagesATI, West Bengal: ATI Training Management Information SystemNarayanaNo ratings yet

- Orca Share Media1463138182934 PDFDocument167 pagesOrca Share Media1463138182934 PDFJhon Raphael JimenezNo ratings yet

- Linkstar RCST Installation Guide: Version DDocument56 pagesLinkstar RCST Installation Guide: Version Djorge_chavez01No ratings yet

- Weap - ModflowDocument20 pagesWeap - Modflowguive3No ratings yet

- Arpèges de Trois Notes: Arpeggios in TripletsDocument3 pagesArpèges de Trois Notes: Arpeggios in TripletspanapapakNo ratings yet

- Sustainability - Research PaperDocument18 pagesSustainability - Research PapermrigssNo ratings yet

- Australian Institute For Teaching and School Leadership - AITSLDocument5 pagesAustralian Institute For Teaching and School Leadership - AITSLYu LiNo ratings yet

- Gender Essay Outline Eng102Document3 pagesGender Essay Outline Eng102Ella BobsNo ratings yet

- Jim Dunlop Rotovibe Owners ManualDocument2 pagesJim Dunlop Rotovibe Owners ManualRick RingNo ratings yet

- Mordaunt Short ms907w User ManualDocument12 pagesMordaunt Short ms907w User ManualiksspotNo ratings yet

- Delays in Endoscope Reprocessing and The Biofilms WithinDocument12 pagesDelays in Endoscope Reprocessing and The Biofilms WithinHAITHM MURSHEDNo ratings yet