Professional Documents

Culture Documents

Donor

Donor

Uploaded by

Andrean Aquino0 ratings0% found this document useful (0 votes)

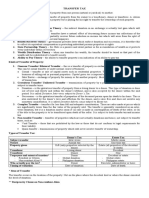

4 views1 pageDonor's Tax is imposed on living donors transferring property to others as gifts. The Estate Tax is imposed on the transmission of a decedent's estate to heirs and beneficiaries based on the fair market value at time of death, and is a tax on the privilege of transferring property after death rather than a tax on the property itself. The Estate Tax applies based on tax laws at the time of death regardless of when beneficiaries receive the estate.

Original Description:

Original Title

Donor.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDonor's Tax is imposed on living donors transferring property to others as gifts. The Estate Tax is imposed on the transmission of a decedent's estate to heirs and beneficiaries based on the fair market value at time of death, and is a tax on the privilege of transferring property after death rather than a tax on the property itself. The Estate Tax applies based on tax laws at the time of death regardless of when beneficiaries receive the estate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageDonor

Donor

Uploaded by

Andrean AquinoDonor's Tax is imposed on living donors transferring property to others as gifts. The Estate Tax is imposed on the transmission of a decedent's estate to heirs and beneficiaries based on the fair market value at time of death, and is a tax on the privilege of transferring property after death rather than a tax on the property itself. The Estate Tax applies based on tax laws at the time of death regardless of when beneficiaries receive the estate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

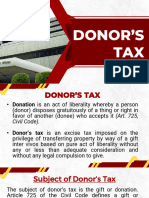

Donor’s Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of property between two or more

persons who are living at the time of the transfer. It shall apply whether the transfer is in trust or otherwise, whether

the gift is direct or indirect and whether the property is real or personal, tangible or intangible.

The estate tax is imposed on the transfer of the decedent’s estate to his lawful heirs and beneficiaries

based on the fair market value of the net estate at the time of the decedent’s death. It is not a tax on

property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The

estate tax is based on the laws in force at the time of death notwithstanding the postponement of the

actual possession or enjoyment of the estate by the beneficiary.

You might also like

- Wills Law and Contests: Writing a Valid Will, Trust Administration, and Trust Fiduciary DutyFrom EverandWills Law and Contests: Writing a Valid Will, Trust Administration, and Trust Fiduciary DutyRating: 2 out of 5 stars2/5 (1)

- Tax 2 Maniego NotesDocument32 pagesTax 2 Maniego NotesHaze Q.No ratings yet

- Estate TaxDocument19 pagesEstate TaxCleah WaskinNo ratings yet

- Estate TaxDocument141 pagesEstate TaxEldrich BulakNo ratings yet

- Estate Tax - C2Document35 pagesEstate Tax - C2Raine DeLeonNo ratings yet

- The Bible Against Slavery: Human Rights Laws Written in the Holy ScriptureFrom EverandThe Bible Against Slavery: Human Rights Laws Written in the Holy ScriptureRating: 5 out of 5 stars5/5 (1)

- Introduction To Transfer Taxation-1Document13 pagesIntroduction To Transfer Taxation-1WillowNo ratings yet

- Tax II Reviewer and NotesDocument26 pagesTax II Reviewer and NotesJett Chuaquico100% (1)

- Lecture Donors TaxDocument9 pagesLecture Donors TaxOtis MelbournNo ratings yet

- Tax - Midterm Exam ReviewerDocument12 pagesTax - Midterm Exam ReviewerMary Ann LeuterioNo ratings yet

- Estate and Donors Tax Dela CalzadaDocument12 pagesEstate and Donors Tax Dela CalzadaStephen CabalteraNo ratings yet

- Tax Reviewer 3 TRANSFER TAXDocument6 pagesTax Reviewer 3 TRANSFER TAXAlliahDataNo ratings yet

- Philippine Transfer Taxes and Value Added Tax-2011Document54 pagesPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Taxation 2Document112 pagesTaxation 2cmv mendoza100% (7)

- Estate Tax ReviewerDocument20 pagesEstate Tax ReviewerEller-JedManalacMendozaNo ratings yet

- Tax Midterms EditedDocument113 pagesTax Midterms EditedJackie CanlasNo ratings yet

- TAX With TRAIN LAW - Transfer and Business TaxDocument61 pagesTAX With TRAIN LAW - Transfer and Business TaxRamon AngelesNo ratings yet

- Lorenzo v. Posadas DigestDocument1 pageLorenzo v. Posadas Digestohmygodsun100% (1)

- UDM Tax Law Review 2017-2018 - Tax 2 Transfer Taxes, Estate and Donor's Tax Full NotesDocument53 pagesUDM Tax Law Review 2017-2018 - Tax 2 Transfer Taxes, Estate and Donor's Tax Full NotesJoan PabloNo ratings yet

- Estate and Donors TaxDocument124 pagesEstate and Donors TaxJedNo ratings yet

- Transfer Taxes and Basic Succession - 1Document8 pagesTransfer Taxes and Basic Succession - 1Jessica ParinasNo ratings yet

- Tax NotesDocument1 pageTax NotesDJabNo ratings yet

- Chapter 3 Transfer Taxes On DonationDocument1 pageChapter 3 Transfer Taxes On DonationKitem Kadatuan Jr.No ratings yet

- Transfer TaxDocument1 pageTransfer Tax33. YALUNG ABM- 12DNo ratings yet

- PLM 2019 2020 Tax 2 Part 1 Transfer Taxes Re Estate Donors Taxes Complete LectureDocument39 pagesPLM 2019 2020 Tax 2 Part 1 Transfer Taxes Re Estate Donors Taxes Complete LectureJustine DagdagNo ratings yet

- NotesDocument1 pageNotesprintzee.101No ratings yet

- Intro To Transfer TaxesDocument37 pagesIntro To Transfer TaxesErica MagbanuaNo ratings yet

- Nature of Transfer TaxesDocument2 pagesNature of Transfer TaxesColleen ArcosNo ratings yet

- Gache, Rosette L. III-BSA-1 Business TaxationDocument3 pagesGache, Rosette L. III-BSA-1 Business TaxationMystic LoverNo ratings yet

- Estate TaxDocument19 pagesEstate TaxCleah WaskinNo ratings yet

- Bam 208 Acc 123 B5Document15 pagesBam 208 Acc 123 B5zoba.padama.upNo ratings yet

- What Is An Estate TaxDocument1 pageWhat Is An Estate TaxJaypee MaganaNo ratings yet

- Estate TaxDocument14 pagesEstate TaxAnonymous YNTVcDNo ratings yet

- 04 Tax 2 PremidDocument45 pages04 Tax 2 PremidDrew RodriguezNo ratings yet

- Donors Tax 2023Document34 pagesDonors Tax 2023Stephanie AlindoganNo ratings yet

- Donors TaxDocument19 pagesDonors TaxIo AyaNo ratings yet

- AE 21 Lesson 1 Transfer Taxation Estate Tax PDFDocument68 pagesAE 21 Lesson 1 Transfer Taxation Estate Tax PDF유니스No ratings yet

- Taxation I Assignment: Chapter 2 (C To F) DefinitionsDocument4 pagesTaxation I Assignment: Chapter 2 (C To F) DefinitionsMarvin H. Taleon IINo ratings yet

- Name: Napoleon C. Lomotan Professor: Dean Cordova Year and Section: BSA-4A Date: January 23, 2019Document6 pagesName: Napoleon C. Lomotan Professor: Dean Cordova Year and Section: BSA-4A Date: January 23, 2019JenniferFajutnaoArcosNo ratings yet

- B. Donor's (Gift) Tax Definition and NatureDocument12 pagesB. Donor's (Gift) Tax Definition and Naturemariyha PalangganaNo ratings yet

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinNo ratings yet

- Estate and Donor'S Taxes: If The Net Estate IsDocument72 pagesEstate and Donor'S Taxes: If The Net Estate IsZairah Nichole PascacioNo ratings yet

- M U S: Ift and Estate: OD LE Taxe GDocument2 pagesM U S: Ift and Estate: OD LE Taxe GEl-Sayed MohammedNo ratings yet

- Transfer Tax: Marivic B. de Gracia Taxation 2Document1 pageTransfer Tax: Marivic B. de Gracia Taxation 2james reddNo ratings yet

- Estate TaxDocument5 pagesEstate TaxChrisette P. TadenaNo ratings yet

- 1 SuccessionDocument24 pages1 SuccessionClarissa Atillano FababairNo ratings yet

- Module 1 Transfer TaxDocument14 pagesModule 1 Transfer Taxcha11No ratings yet

- CARL ANDREW Assignment Tax 102Document7 pagesCARL ANDREW Assignment Tax 102Carl Andrew Aborquez Arcinal0% (1)

- Module 9 - Donor - S TaxDocument16 pagesModule 9 - Donor - S TaxJohn Russel PacunNo ratings yet

- Answer Tax Concepts RehashDocument2 pagesAnswer Tax Concepts RehashAnice YumulNo ratings yet

- Transfer Taxes and Value Added Tax: Atty. Vic C. MamalateoDocument61 pagesTransfer Taxes and Value Added Tax: Atty. Vic C. MamalateoyotatNo ratings yet

- Assignment in Tax 102 What Is Transfer?Document5 pagesAssignment in Tax 102 What Is Transfer?JenniferFajutnaoArcosNo ratings yet

- Estate TaxDocument26 pagesEstate Taxkitayroselyn4No ratings yet

- Taxation Reviewer Taxation:: Estate TaxDocument7 pagesTaxation Reviewer Taxation:: Estate TaxKit OsillosNo ratings yet

- Reviewer On Intro To TaxDocument7 pagesReviewer On Intro To Taxjulius art maputiNo ratings yet

- 03 Transfer Taxes: Clwtaxn de La Salle UniversityDocument35 pages03 Transfer Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- The Concept of Estate TaxationDocument34 pagesThe Concept of Estate TaxationAlmeera KalidNo ratings yet