Professional Documents

Culture Documents

AMRIT KALASH - DEPOSIT FOR 400 Days

Uploaded by

Aryan aOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AMRIT KALASH - DEPOSIT FOR 400 Days

Uploaded by

Aryan aCopyright:

Available Formats

eCircular

Department: PBU-LIABILITIES/INVESTMENT

PRODUCTS-MASS AFFLUENT

Sl.No.: 1304/2022 - 23

Circular No.: NBG/PBU/LIMA-TD/28/2022 - 23

Date: Tue 14 Feb 2023

Chief General Manager

State Bank of India

All Circles/ CAG/CCG/SARG etc.

Madam / Dear Sir,

‘AMRIT KALASH’

SCHEME UNDER DOMESTIC RETAIL TERM DEPOSITS INCLUDING NRI RUPEE

TERM DEPOSITS

In order to give boost to deposit mobilization efforts in retail segment it has been

decided to introduce new Retail Term Deposit scheme of specific tenor with benefit in

terms of rate of interest. Salient features of the Scheme are as under:

1. Scheme ‘AMRIT KALASH’

2. Period 15.02.2023 to 31.03.2023

3. Period of Deposit 400 Days

4. Eligible Deposits i) Domestic Retail Term Deposits including NRI

Rupee Term Deposits (< Rs 2 crore)

ii) New and Renewal Deposits

iii) Term Deposit and Special Term Deposit only

Exclusions:

i) Other products i.e., Recurring Deposit, Tax

Savings Deposits, Annuity Deposits, MACAD, Multi

Option Deposits (MODs), Capital Gains Scheme etc.

ii) NRI Deposits of Staff and Senior Citizens.

5. Interest Rate 7.10%

Senior Citizens, Staff and Staff Pensioners are

eligible for additional interest rate applicable to

them.

6. Payment of Interest i) Term Deposits – At monthly/ quarterly/half yearly

intervals

Special Term Deposits- On maturity

ii) Interest, net of TDS, shall be credited to

Customer’s Account

7. TDS At applicable rate as per Income-tax Act

8. Premature Withdrawal i) For Retail Term Deposits up to Rs.5 lacs the

penalty for premature withdrawal will be 0.50% (all

tenors).

ii) For Retail Term Deposits above Rs.5 lacs but

below Rs. 2 Crores, applicable penalty will be 1%

(all tenors).

iii) There is no discretion for reduction/waiver of

penalty for premature withdrawal of term deposits.

iv) The interest shall be 0.50% or 1% below the rate

applicable at the time of deposit for the period

Deposit remained with the Bank or 0.50% or 1%

below the contracted rate, whichever is lower for

Retail Term Deposits up to Rs. 5.00 lacs and above

Rs. 5.00 lacs respectively.

However, no interest will be paid on deposits which

remain for a period of less than 7 days.

v) No premature penalty will be levied on Staff and

SBI Pensioners Deposits. Interest rate to be paid on

premature withdrawal of Term Deposits by Staff and

SBI Pensioners will be same as applicable for the

period the Deposit has remained with the Bank.

9. Loan Facility Available

10. Available through Branch/INB/YONO Channels

11. Others a) Opening of AMRIT KALASH deposit account with

backdate is not allowed after closure of scheme i.e.,

from 01.04.2023

b) No separate product codes are required for

AMRIT KALASH Deposit.

c) All other terms and conditions shall remain

unchanged.

Please bring the contents of this Circular to the knowledge of all operating functionaries

concerned and give wide publicity to the scheme.

Yours faithfully,

(Aditya Kumar Sengar)

Chief General Manager (PB)

You might also like

- Reg 114339Document35 pagesReg 114339Western CPENo ratings yet

- Screenshot 2022-10-02 at 7.02.48 PMDocument121 pagesScreenshot 2022-10-02 at 7.02.48 PMVaishali ChaudharyNo ratings yet

- HIST311 Answer Key 7Document5 pagesHIST311 Answer Key 7Mey TysonNo ratings yet

- Cyber Café and Xerox Lamination: Profile No.: 143 NIC Code: 63992Document11 pagesCyber Café and Xerox Lamination: Profile No.: 143 NIC Code: 63992Shivam SyalNo ratings yet

- Abhijeet Das - Application AdminDocument5 pagesAbhijeet Das - Application AdminAshreetha ShettyNo ratings yet

- Government of Jammu and Kashmir,: Services Selection Board, Zum Zum Building Rambagh, Srinagar (WWW - Jkssb.nic - In)Document161 pagesGovernment of Jammu and Kashmir,: Services Selection Board, Zum Zum Building Rambagh, Srinagar (WWW - Jkssb.nic - In)Stage StageNo ratings yet

- Parte 03Document100 pagesParte 03Pâmella PicançoNo ratings yet

- PreviewpdfDocument65 pagesPreviewpdfAfita RizkiNo ratings yet

- Combined Past PapersDocument149 pagesCombined Past PapersdyrdyrtfyufNo ratings yet

- FY2022 Asheville Regional Airport Authority Financial AuditDocument82 pagesFY2022 Asheville Regional Airport Authority Financial AuditChristian SmithNo ratings yet

- KTrade 2023 Strategy Report - Where To Invest in 2023Document51 pagesKTrade 2023 Strategy Report - Where To Invest in 2023Amir MarwatNo ratings yet

- Lubricantes 495HRDocument4 pagesLubricantes 495HRMiguel Angel RodriguezNo ratings yet

- PEDESTRIANIZATIONEVALUATIONTOOLVER220210614 FinalDocument21 pagesPEDESTRIANIZATIONEVALUATIONTOOLVER220210614 FinalAditi AiswaryaNo ratings yet

- Lesson 6 QuizDocument3 pagesLesson 6 Quizkings zeusNo ratings yet

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNo ratings yet

- PLC and SCADA Based Automation of Textile Industry": A Seminar OnDocument39 pagesPLC and SCADA Based Automation of Textile Industry": A Seminar OnYogesh HadpadNo ratings yet

- DR Ganesh Patil Medical StatisticsDocument77 pagesDR Ganesh Patil Medical StatisticsKaushal PatelNo ratings yet

- Assignment 2 Brief: ScenarioDocument21 pagesAssignment 2 Brief: ScenarioMinh HoàngNo ratings yet

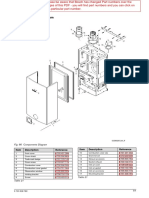

- Interior Components Diagram and Parts ListDocument6 pagesInterior Components Diagram and Parts ListSoluciones Tecnicas GastronomicasNo ratings yet

- Bộ Đề Tự Kiểm Tra 4 Kĩ Năng Tiếng Anh 7 Tập 2Document168 pagesBộ Đề Tự Kiểm Tra 4 Kĩ Năng Tiếng Anh 7 Tập 2Chou ChouNo ratings yet

- Mathrubhumi Yearbook 2019 Digital Update November 2018Document21 pagesMathrubhumi Yearbook 2019 Digital Update November 2018Bimal MadathilNo ratings yet

- ALTTC Project Report FullDocument24 pagesALTTC Project Report FullKrishna ShahNo ratings yet

- Ansys Discovery - Quantifying The ROI in Simulation Led Design ExplorationDocument13 pagesAnsys Discovery - Quantifying The ROI in Simulation Led Design ExplorationA LettristeNo ratings yet

- Die Maintenance. Die Repair.Document9 pagesDie Maintenance. Die Repair.zfrlNo ratings yet

- MR 159 - GFSR Nigeria Rice StudyDocument59 pagesMR 159 - GFSR Nigeria Rice StudyJason Wolfe100% (2)

- Rbi Irac Norms Circular PDFDocument138 pagesRbi Irac Norms Circular PDFCA Nikhil BazariNo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- Breast Cancer Prediction Using Machine LearningDocument9 pagesBreast Cancer Prediction Using Machine LearningIJRASETPublicationsNo ratings yet

- Pin DuoduoDocument20 pagesPin DuoduoMohit AgrawalNo ratings yet

- Blockchain Assignment 2 Group 6Document17 pagesBlockchain Assignment 2 Group 6gaikwadatNo ratings yet

- Review of Laser Doping and Its Applications in Silicon Solar CellsDocument12 pagesReview of Laser Doping and Its Applications in Silicon Solar CellsJIJIN KNo ratings yet

- US9460695Document19 pagesUS9460695Hamide LitimeNo ratings yet

- Axial Piston Variable Pump (A) A10VSO Series 31: AmericasDocument48 pagesAxial Piston Variable Pump (A) A10VSO Series 31: AmericasPaulo Roberto Ferreira LopesNo ratings yet

- Module Six Lesson One Notes Guided NotesDocument10 pagesModule Six Lesson One Notes Guided NotesJazmyn DavisNo ratings yet

- PMJDY FAQs: Everything You Need to KnowDocument6 pagesPMJDY FAQs: Everything You Need to Knowashlice201No ratings yet

- ABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Document36 pagesABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Jm JuanillasNo ratings yet

- 1896-Article Text-7540-1-10-20220308Document13 pages1896-Article Text-7540-1-10-20220308International Health ReviewNo ratings yet

- World Records in AthleticsDocument52 pagesWorld Records in Athleticssisay gebremariam100% (1)

- Dulegaunda Lamagaun 20 TH November 2018Document132 pagesDulegaunda Lamagaun 20 TH November 2018Deepak YadavNo ratings yet

- Living Abroad: Lesson 1Document72 pagesLiving Abroad: Lesson 1Jojos JansNo ratings yet

- India - Relief Features - Study MaterialDocument7 pagesIndia - Relief Features - Study MaterialramanaNo ratings yet

- Appendix A Example 10 - Sign Structure Foundation Design: General InformationDocument14 pagesAppendix A Example 10 - Sign Structure Foundation Design: General InformationSabreena NasrinNo ratings yet

- 03 291 - Jugovic SchiozziDocument14 pages03 291 - Jugovic SchiozziNećeš SadaNo ratings yet

- 2023 01 20 63ca400b3a6a44c651df2dd1Document6 pages2023 01 20 63ca400b3a6a44c651df2dd1V AntoNo ratings yet

- Eight Questions About Brain Drain: John Gibson and David MckenzieDocument22 pagesEight Questions About Brain Drain: John Gibson and David Mckenzieminh voNo ratings yet

- Min of Shipping Annual ReportDocument103 pagesMin of Shipping Annual ReportAkhil UnnikrishnanNo ratings yet

- 104 CompileDocument20 pages104 CompileWestley RubinoNo ratings yet

- Corporate finance quizDocument43 pagesCorporate finance quizPriyanka MahajanNo ratings yet

- Owner'S Manual: Signals. A Little Practice Is Required To Understand When and HowDocument20 pagesOwner'S Manual: Signals. A Little Practice Is Required To Understand When and HowMama SpittaNo ratings yet

- Infineon CYW43439 DataSheet v03 - 00 ENDocument88 pagesInfineon CYW43439 DataSheet v03 - 00 ENDenes MarschalkoNo ratings yet

- D-11 Colorado Springs Voter GuideDocument5 pagesD-11 Colorado Springs Voter GuideCPR DigitalNo ratings yet

- IFC-Based 4D Construction Management Information Model of Prefabricated Buildings and Its Application in Graph DatabaseDocument26 pagesIFC-Based 4D Construction Management Information Model of Prefabricated Buildings and Its Application in Graph DatabaseBenz CivilNo ratings yet

- Memorial - On - Behalf - of - Respondent - Naman NayakDocument31 pagesMemorial - On - Behalf - of - Respondent - Naman NayakBharat Bhushan ShuklaNo ratings yet

- TF Workbook Part 2Document21 pagesTF Workbook Part 2Siddhartha SinhaNo ratings yet

- Infusing Supply Chain Knowledge Into ZimbabweDocument8 pagesInfusing Supply Chain Knowledge Into ZimbabweJoel GwatsvairaNo ratings yet

- Certificate of EmploymentDocument1 pageCertificate of EmploymentYanih BarrettoNo ratings yet

- Moto G10/G20: Lenovo Moto G10/G20 Level 2 - Service and Repair ManualDocument129 pagesMoto G10/G20: Lenovo Moto G10/G20 Level 2 - Service and Repair ManualGabriel Nathan RistowNo ratings yet

- Manage Hotel Bookings with Pay-as-You-Go PlatformDocument5 pagesManage Hotel Bookings with Pay-as-You-Go PlatformShafana OsmanNo ratings yet

- (2013 Pattern) April 2017 (001-129) PDFDocument129 pages(2013 Pattern) April 2017 (001-129) PDFPranab BordoloiNo ratings yet

- 140223 Amrit KalashDocument1 page140223 Amrit Kalashnimesh_vermaNo ratings yet

- HBR Customers as Innovators Article SummaryDocument16 pagesHBR Customers as Innovators Article SummaryGargi TiwariNo ratings yet

- Ugc Good PracticesDocument21 pagesUgc Good PracticesIngryd Lo TierzoNo ratings yet

- Prisoner of ZendaDocument27 pagesPrisoner of ZendaSauban AhmedNo ratings yet

- Community Health Assessment Form 1 2Document4 pagesCommunity Health Assessment Form 1 2Vrent Mica SilotNo ratings yet

- Marginal TeacherDocument19 pagesMarginal TeacherAndy AcuinNo ratings yet

- Material For Upper Advanced and TOEFLDocument132 pagesMaterial For Upper Advanced and TOEFLNadia ChavezNo ratings yet

- Tan Vs ZanduetaDocument2 pagesTan Vs ZanduetaPearl Deinne Ponce de LeonNo ratings yet

- Henry VIII, Act of Supremacy (1534) by Caroline BarrioDocument4 pagesHenry VIII, Act of Supremacy (1534) by Caroline BarriocarolbjcaNo ratings yet

- Tracking DepEd Division Funds for Disaster MonitoringDocument2 pagesTracking DepEd Division Funds for Disaster MonitoringMamad Tomara BatingoloNo ratings yet

- TC Moscow Embassy Trade Counsellor Russia Fruit Vegetable Trade FirmsDocument54 pagesTC Moscow Embassy Trade Counsellor Russia Fruit Vegetable Trade FirmsPsikoNo ratings yet

- Gokuldham Marathi Prelim 2023Document8 pagesGokuldham Marathi Prelim 2023Aarushi GuptaNo ratings yet

- Chapter V Compensation and BenefitsDocument44 pagesChapter V Compensation and BenefitsJeoven Izekiel RedeliciaNo ratings yet

- Reminder Letter For Requisie Documents For MonitoringDocument1 pageReminder Letter For Requisie Documents For MonitoringFarah RoyNo ratings yet

- DRRM School Memo No. 7Document5 pagesDRRM School Memo No. 7Mime CarmleotesNo ratings yet

- CSS - 2 2 2023 CSS - 2Document1 pageCSS - 2 2 2023 CSS - 2Nirmal GeorgeNo ratings yet

- Achievement Gaps Mindset Belonging FeedbackDocument4 pagesAchievement Gaps Mindset Belonging FeedbackResearchteam2014No ratings yet

- From Vision To Reality: GebizDocument10 pagesFrom Vision To Reality: Gebizmaneesh5100% (1)

- The Thief of AmsterdamDocument2 pagesThe Thief of AmsterdamBlagitsa Arizanova ShopovNo ratings yet

- New Ford Endeavour Brochure Mobile PDFDocument13 pagesNew Ford Endeavour Brochure Mobile PDFAnurag JhaNo ratings yet

- Micro and Macro Environment of NestleDocument2 pagesMicro and Macro Environment of Nestlewaheedahmedarain56% (18)

- American Political Parties: Republicans vs. DemocratsDocument60 pagesAmerican Political Parties: Republicans vs. DemocratsSchmetterling TraurigNo ratings yet

- Tata Teleservices Limited.: Project ConnectDocument28 pagesTata Teleservices Limited.: Project ConnectshekarNo ratings yet

- 12 Characteristics of Highly Qualified TeachersDocument9 pages12 Characteristics of Highly Qualified TeachersHazel Clemente CarreonNo ratings yet

- Constitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsDocument13 pagesConstitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsAdrian AlamarezNo ratings yet

- Báo cáo cuối kì môn thực hành an ninh mạngDocument5 pagesBáo cáo cuối kì môn thực hành an ninh mạngDương Thành ĐạtNo ratings yet

- EAD 513 Kirk Summers Cultural Functions in PracticeDocument6 pagesEAD 513 Kirk Summers Cultural Functions in PracticeKirk Summers100% (1)

- General Provisions On ContractsDocument5 pagesGeneral Provisions On ContractsyoursHAHAHANo ratings yet

- Letter Sa Mga Panel Inag FinalsDocument7 pagesLetter Sa Mga Panel Inag FinalsCHENNY BETAIZARNo ratings yet

- The Climate of War Violence Warfare and Climatic Reductionism - David N LivingstoneDocument8 pagesThe Climate of War Violence Warfare and Climatic Reductionism - David N LivingstoneMadisson CarmonaNo ratings yet

- Entering and Developing A Service Network: Sheena Leek and Louise CanningDocument10 pagesEntering and Developing A Service Network: Sheena Leek and Louise CanningTanisha KrunalNo ratings yet