Professional Documents

Culture Documents

Grayscale One Pager August 2020 Closed PDF

Uploaded by

Micheal GroveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grayscale One Pager August 2020 Closed PDF

Uploaded by

Micheal GroveCopyright:

Available Formats

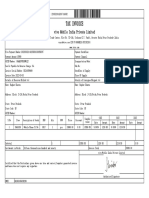

Grayscale®

Investment Products

Grayscale Investments, LLC (“Grayscale”) is the world’s largest digital currency asset

manager, with more than $5.2B in assets under management, as of July 31, 2020.1

Grayscale provides secure access to the digital currency asset class for accredited

investors2 through its single-asset and diversified investment products. Shares of

Grayscale’s investment products (the “Products”) are titled securities and IRA-eligible.

Grayscale believes that the Shares represent a cost-effective and convenient way to gain

digital asset exposure relative to a direct investment in digital assets.

NET PERFORMANCE

AS OF 7/31/20203

Inception Annual Digital Asset Minimum OTC Trailing Since

Date Fees Holdings Investment Markets 12 Months Inception

SINGLE-ASSET PRODUCTS (millions)4 Symbol5

Grayscale Bitcoin Trust 09/25/2013 2.0% $4,411.2 $50,000 GBTC 11.5% 7,571.4%

Grayscale Bitcoin Cash Trust 03/01/2018 2.5% $16.8 $25,000 BCHG* -12.3% -77.8%

Grayscale Ethereum Trust 12/14/2017 2.5% $633.7 $25,000 ETHE 54.8% -55.6%

Grayscale Ethereum Classic Trust 04/24/2017 3.0%6 $86.4 $25,000 ETCG 20.3% 75.9%

Grayscale Horizen Trust 08/06/2018 2.5% $3.4 $25,000 -- 14.1% -66.4%

Grayscale Litecoin Trust 03/01/2018 2.5% $13.5 $25,000 LTCN* -40.9% -73.9%

Grayscale Stellar Lumens Trust 12/06/2018 2.5% $0.6 $25,000 -- 12.0% -28.4%

Grayscale XRP Trust 03/01/2018 2.5% $6.2 $25,000 -- -24.2% -74.3%

Grayscale Zcash Trust 10/24/2017 2.5% $12.2 $25,000 -- 3.9% -69.0%

Inception Annual Digital Asset Minimum OTC Trailing Since

Date Fees Holdings Investment Markets 12 Months Inception

DIVERSIFIED PRODUCTS (millions) Symbol5

Grayscale Digital Large Cap Fund** 02/01/2018 3.0% $44.4 $50,000 GDLC 10.9% -31.9%

*There will be no trading volume in the Products’ public quotation until shares complete the process to satisfy The Depository Trust Company (DTC) eligibility criteria. For

additional information, see the OTC Markets website at www.otcmarkets.com.

**The Grayscale Digital Large Cap Fund private placement is offered on a periodic basis throughout the year and is currently closed. Any Product currently offering share

creations is referred to herein as an “Offered Product.”

For more information, please contact info@grayscale.co or (212) 668-1427

Grayscale® Investment Products

SERVICE PROVIDERS

SINGLE-ASSET PRODUCTS

Sponsor Grayscale Investments, LLC

Index Provider TradeBlock, Inc.

Custodian Coinbase Custody Trust Company, LLC

Auditor Friedman LLP

Legal Counsel Davis Polk & Wardwell LLP

Delaware Statutory Trustee Delaware Trust Company

Transfer Agent Continental Stock Transfer & Trust Company

Distribution and Marketing Agent Genesis Global Trading, Inc.

Authorized Participant Genesis Global Trading, Inc.

OTCQX Advisor (GBTC, ETHE, ETCG) Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

DIVERSIFIED PRODUCTS

Manager Grayscale Investments, LLC

Reference Rate Provider TradeBlock, Inc.

Custodian Coinbase Custody Trust Company, LLC

Auditor Friedman LLP

US Legal Counsel Davis Polk & Wardwell LLP

Cayman Islands Legal Counsel Maples and Calder

Transfer Agent Continental Stock Transfer & Trust Company

Distribution and Marketing Agent Genesis Global Trading, Inc.

Authorized Participant Genesis Global Trading, Inc.

OTCQX Advisor Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

1. Grayscale Products issue shares on a continuous basis or periodic basis. Investments in the Products are speculative investments that involve high degrees of risk, including a partial or total loss of invested

funds. Grayscale Products are not suitable for any investor that cannot afford loss of the entire investment. The information herein is only provided with respect to shares purchased directly from the Products,

and prospective investors are not to construe the contents of this document as a recommendation to purchase the shares of the Products on any secondary market, including, without limitation, the OTCQX.

2. As defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). For natural persons, annual income in excess of $200,000 for the last two years (or $300,000

together with spouse) or net worth in excess of $1 million, excluding the value of primary residence and certain indebtedness secured by such primary residence.

3. Past performance is not indicative of future returns. Performance is based on each Product’s Digital Asset Holdings (as defined below). Because each Product does not currently operate a redemption

program, there can be no assurance that the value of such Product’s shares will approximate the value of the assets held by such Product, less such Product’s expenses and other liabilities, and the shares of

such Product, if traded on any secondary market, may trade at a substantial premium over, or a substantial discount to, such value.

4. Each Product’s Digital Asset Holdings is the aggregate U.S. Dollar value of the Product’s digital assets, calculated based on the applicable TradeBlock Index or reference rate for the Product’s underlying

digital asset(s) (the “Digital Asset Reference Rate”), at 4 p.m., New York time, less the U.S. Dollar value of the Product’s liabilities and expenses.

5. Eligible shares are quoted on the OTCQX® making it possible to buy or sell shares continuously through the trading day at prices established by the market.

6. In order to promote the growth and development of the Ethereum Classic network, Grayscale intends, but is not obligated, to direct up to one-third of the annual fee of Grayscale Ethereum Classic Trust

towards the Ethereum Classic Cooperative, whose initiatives support development, marketing, and community activities of the Ethereum Classic network. For more information, visit www.etccooperative.org.

Carefully consider each Product’s investment objectives, risk factors, fees and expenses before investing. This and other information can be found in each Product’s private placement memorandum, which

may be obtained by visiting the Grayscale Investment Platform and, for each Product listed on the OTC Markets and/or registered with the SEC, such Product’s annual report, which may be obtained by visiting

the SEC’s website for Grayscale Bitcoin Trust (Symbol: GBTC) or the OTC Markets website for Grayscale Bitcoin Cash Trust (Symbol: BCHG), Grayscale Ethereum Trust (Symbol: ETHE), Grayscale Ethereum

Classic Trust (Symbol: ETCG), Grayscale Litecoin Trust (Symbol: LTCN) and Grayscale Digital Large Cap Fund (Symbol: GDLC). Reports on OTC Markets are not prepared in accordance with SEC requirements

and may not contain all information that is useful for an informed investment decision. Read these documents carefully before investing.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative,

educational, or informational purposes and is subject to change.

The shares of each Product are not registered under the Securities Act of 1933 (the “Securities Act”), the Securities Exchange Act of 1934 (except for Grayscale Bitcoin Trust), the Investment Company Act

of 1940, or any state securities laws. The Products are offered in private placements pursuant to the exemption from registration provided by Rule 506(c) under Regulation D of the Securities Act and are

only available to accredited investors. As a result, the shares of each Product are restricted and subject to significant limitations on resales and transfers. Potential investors in any Product should carefully

consider the long-term nature of an investment in that Product prior to making an investment decision. The shares of certain Products are also publicly quoted on OTC Markets and shares that have become

unrestricted in accordance with the rules and regulations of the SEC may be bought and sold throughout the day through any brokerage account.

The Products are distributed by Genesis Global Trading, Inc. (Member FINRA/SIPC, MSRB Registered).

© 2020 Grayscale Investments, LLC. All rights reserved. The GRAYSCALE and GRAYSCALE INVESTMENTS logos, graphics, icons, trademarks, service marks and headers are registered and unregistered

trademarks of Grayscale Investments, LLC in the United States.

You might also like

- Cryptocurrency Compliance and Operations: Digital Assets, Blockchain and DeFiFrom EverandCryptocurrency Compliance and Operations: Digital Assets, Blockchain and DeFiNo ratings yet

- DeFi Fund Fact Sheet July 2022 UpdatedDocument2 pagesDeFi Fund Fact Sheet July 2022 UpdatedCristian Morales SolisNo ratings yet

- IDAP Pitch Deck 4.1Document25 pagesIDAP Pitch Deck 4.1Awanish RajanNo ratings yet

- AIP Client ListDocument139 pagesAIP Client ListSaurabh ChauhanNo ratings yet

- Credorax DM (Mar 2021)Document29 pagesCredorax DM (Mar 2021)csh011235No ratings yet

- Savedroid (SVD) - ICO Rating and Details - ICObenchDocument15 pagesSavedroid (SVD) - ICO Rating and Details - ICObenchHosam MazawiNo ratings yet

- ATRAM Total Return Peso Bond Fund - KIIDS Dec 2022Document4 pagesATRAM Total Return Peso Bond Fund - KIIDS Dec 2022ParazolaNo ratings yet

- Troy Investor PlanDocument26 pagesTroy Investor PlanSindhu ThomasNo ratings yet

- DIWALI DHAMAKA: Infosys shares may surge 19% on strong growth outlookDocument12 pagesDIWALI DHAMAKA: Infosys shares may surge 19% on strong growth outlookGiri BabaNo ratings yet

- Stably Company Overview (October 2019)Document25 pagesStably Company Overview (October 2019)Kory HoangNo ratings yet

- One Axis Presentation June 2021Document52 pagesOne Axis Presentation June 2021Sanjay VsNo ratings yet

- Real Estate KDPDocument20 pagesReal Estate KDPProject AtomNo ratings yet

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoNo ratings yet

- Krytotech Investor Presentation V3Document21 pagesKrytotech Investor Presentation V3venkatakrishnanNo ratings yet

- PimcoCiti Fund ExplorerDocument9 pagesPimcoCiti Fund ExplorerNicky TsaiNo ratings yet

- TheLibraryofCOINgress DigitalAssetsforInstitutionsDocument17 pagesTheLibraryofCOINgress DigitalAssetsforInstitutionsGréta KovácsNo ratings yet

- Bitcoin ETFDocument5 pagesBitcoin ETFEvie LiuNo ratings yet

- Coinbase-Institutional-H1-2021-in-Review_1-7Document7 pagesCoinbase-Institutional-H1-2021-in-Review_1-7leon.camilo91No ratings yet

- REL Fact Sheet 03-18Document2 pagesREL Fact Sheet 03-18Hannes Sternbeck FryxellNo ratings yet

- WP Golddoge - Sachs WhitepaperDocument33 pagesWP Golddoge - Sachs WhitepaperAdam BurksNo ratings yet

- Secure Trust April 2020 - PTC Series ADocument17 pagesSecure Trust April 2020 - PTC Series ARohan RautelaNo ratings yet

- Coinbase-Institutional-H1-2021-in-Review_15-21Document7 pagesCoinbase-Institutional-H1-2021-in-Review_15-21leon.camilo91No ratings yet

- JEF BothSidesofthebitCoinDocument9 pagesJEF BothSidesofthebitCoinarchanaNo ratings yet

- The Toronto-Dominion Bank, Q3 2022 Earnings Call, Aug 25, 2022Document23 pagesThe Toronto-Dominion Bank, Q3 2022 Earnings Call, Aug 25, 2022Neel DoshiNo ratings yet

- Produk Dan Operasional Financial TechnologyDocument110 pagesProduk Dan Operasional Financial TechnologyAhmad Wafa MansurNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- Connecting Wealth Management WorldwideDocument18 pagesConnecting Wealth Management Worldwidenikko cortesNo ratings yet

- Covesting White PaperDocument23 pagesCovesting White PaperTrancosArgNo ratings yet

- SocGen - Blockchain, Crypto and Banks 011221v2Document49 pagesSocGen - Blockchain, Crypto and Banks 011221v2irvinkuanNo ratings yet

- Credit Swiss Pitch BookDocument39 pagesCredit Swiss Pitch Bookw_fibNo ratings yet

- BitGo Wyoming Legislative Hearing (Custody)Document21 pagesBitGo Wyoming Legislative Hearing (Custody)Chen LiangNo ratings yet

- BAM Certificate Eng One PagerDocument1 pageBAM Certificate Eng One PagerWalid El AmineNo ratings yet

- Blufolio VC Fund Fact Sheet June 2021Document2 pagesBlufolio VC Fund Fact Sheet June 2021GX BLOCKSNo ratings yet

- Interactive Brokers - PPT 2021Document16 pagesInteractive Brokers - PPT 2021rahul_madhyaniNo ratings yet

- Research and Marketing of Financial ServicesDocument26 pagesResearch and Marketing of Financial ServicesHIGGSBOSON304No ratings yet

- Welcome To... : Life Insurance in Crypto, Trade Your Life As A TokenDocument17 pagesWelcome To... : Life Insurance in Crypto, Trade Your Life As A TokenAlberto Alfaro MendozaNo ratings yet

- Tokenization Markets 1675906505Document25 pagesTokenization Markets 1675906505gustavo matosNo ratings yet

- Captura de Pantalla 2023-06-29 A La(s) 8.25.30 A.M.Document1 pageCaptura de Pantalla 2023-06-29 A La(s) 8.25.30 A.M.marjories.saborioNo ratings yet

- GreenSky, Inc. - Analyst - Investor Day Transcript 2021Document28 pagesGreenSky, Inc. - Analyst - Investor Day Transcript 2021Damon MengNo ratings yet

- Bonitetno Porocilo - RS - ENDocument11 pagesBonitetno Porocilo - RS - ENAgit SipkaNo ratings yet

- Coinbase Index Fund LPDocument2 pagesCoinbase Index Fund LPJean A. VasquezNo ratings yet

- Signal 2021 07 13 012302Document1 pageSignal 2021 07 13 012302Alexander Leanos (Xander)No ratings yet

- Gnosis Pitch Deck PDFDocument40 pagesGnosis Pitch Deck PDFMichaelPatrickMcSweeneyNo ratings yet

- SHIELD WhitepaperDocument20 pagesSHIELD WhitepaperDidik PrasetyaNo ratings yet

- Kraken Intelligence's Non-Fungible Tokens (NFTS) - Redefining Digital ScarcityDocument35 pagesKraken Intelligence's Non-Fungible Tokens (NFTS) - Redefining Digital ScarcityPriyanshNo ratings yet

- Kotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Document2 pagesKotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Akshat JainNo ratings yet

- MultiBank Company Profile English 2022Document24 pagesMultiBank Company Profile English 2022Anonymous CQ4rbzLVENo ratings yet

- CORRECTED TRANSCRIPT - Cloudflare, Inc. (NET US), Q3 2022 Earnings Call, 3 November 2022 5 - 00 PM ETDocument22 pagesCORRECTED TRANSCRIPT - Cloudflare, Inc. (NET US), Q3 2022 Earnings Call, 3 November 2022 5 - 00 PM ETWeiyao XiaoNo ratings yet

- Quarterly M&A ReportDocument28 pagesQuarterly M&A ReportKevin ParkerNo ratings yet

- Philippine Infrastructure Financing PotentialDocument21 pagesPhilippine Infrastructure Financing PotentialJoshua ArmeaNo ratings yet

- Late-Stage Deals MindrockDocument6 pagesLate-Stage Deals MindrockAitbay GumerovNo ratings yet

- Original 1683521375 Equity SharesDocument40 pagesOriginal 1683521375 Equity SharesJaval ChoksiNo ratings yet

- Dar Al Arkan, 6.875% 26feb2027, USDDocument14 pagesDar Al Arkan, 6.875% 26feb2027, USDshahzadahmadranaNo ratings yet

- The Path Forward For Digital Assets and Crypto in 2023Document13 pagesThe Path Forward For Digital Assets and Crypto in 2023Muhammad Riski FirdausNo ratings yet

- World of Investments - Brief OverviewDocument12 pagesWorld of Investments - Brief Overviewvishwadeep.anshuNo ratings yet

- Unlock Private Market Insights With S&P Global Market Intelligence and PreqinDocument2 pagesUnlock Private Market Insights With S&P Global Market Intelligence and PreqinRiska AgustinaNo ratings yet

- Bitcoin Network Whitepaper 1.02: WWW - Bitcoinnetworks.ioDocument15 pagesBitcoin Network Whitepaper 1.02: WWW - Bitcoinnetworks.ioGyörök PeterNo ratings yet

- Crypto Investment OutlookDocument34 pagesCrypto Investment OutlookRodrix DigitalNo ratings yet

- Mike DSR Pro Report 2023 Oct 1Document16 pagesMike DSR Pro Report 2023 Oct 1Won Seok ChoeNo ratings yet

- Deposit Guarantee Scheme Depositor Information Sheet ULST7993RIDocument4 pagesDeposit Guarantee Scheme Depositor Information Sheet ULST7993RIMicheal GroveNo ratings yet

- Megatrends 2016Document56 pagesMegatrends 2016Micheal GroveNo ratings yet

- Brochurea5 Digitaltransformation Web-1Document66 pagesBrochurea5 Digitaltransformation Web-1Micheal GroveNo ratings yet

- Bitcoin Mining Presents an Opportunity to Accelerate the Global Energy Transition to RenewablesDocument5 pagesBitcoin Mining Presents an Opportunity to Accelerate the Global Energy Transition to RenewablesRaphael Perci SantiagoNo ratings yet

- WhitePaperEnglish 3f823c76 PDFDocument26 pagesWhitePaperEnglish 3f823c76 PDFMicheal GroveNo ratings yet

- Corporate FinanceDocument10 pagesCorporate FinancePuteri Nelissa MilaniNo ratings yet

- Mohan A PDFDocument3 pagesMohan A PDFARK ArbaazNo ratings yet

- Laws Regulating Securities MarketDocument18 pagesLaws Regulating Securities MarketMNHSNo ratings yet

- Material Cost 01 - Class Notes - Udesh Regular - Group 1Document8 pagesMaterial Cost 01 - Class Notes - Udesh Regular - Group 1Shubham KumarNo ratings yet

- FM 415 - Chapter 2A PDFDocument14 pagesFM 415 - Chapter 2A PDFMarc Charles UsonNo ratings yet

- Traders EdgeDocument5 pagesTraders Edgeartus14100% (1)

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNo ratings yet

- PERCENTAGEDocument7 pagesPERCENTAGEPrakash KumarNo ratings yet

- Aviva Young Scholar Seure BrochureDocument10 pagesAviva Young Scholar Seure BrochureSiddharth PoreNo ratings yet

- CA Casualty Educational ObjectivesDocument40 pagesCA Casualty Educational ObjectiveshasupkNo ratings yet

- Unit TrustDocument23 pagesUnit TrustqairunnisaNo ratings yet

- 6 - General Valuation Concepts and PrinciplesDocument27 pages6 - General Valuation Concepts and PrinciplesKismet100% (7)

- RR Sortino A Sharper RatioDocument6 pagesRR Sortino A Sharper Ratiokostistriant30No ratings yet

- Pay Monetization ExerciseDocument1 pagePay Monetization ExerciseMalik Osama ShahabNo ratings yet

- Treasury Fixed Deposit Interest Rates RevisedDocument1 pageTreasury Fixed Deposit Interest Rates RevisedShadeedNo ratings yet

- Assessing Organizational Performance and Setting Strategic PrioritiesDocument20 pagesAssessing Organizational Performance and Setting Strategic PrioritiesMilan MisraNo ratings yet

- AF102 MAJOR ASSIGNMENT BUDGETDocument15 pagesAF102 MAJOR ASSIGNMENT BUDGETMonesh PadyachiNo ratings yet

- Outlining Period-End Closing For A Product Cost Collector: Unit 3 Lesson 1Document2 pagesOutlining Period-End Closing For A Product Cost Collector: Unit 3 Lesson 1s4hanamm 1809No ratings yet

- Cencosud Achieves Strong 1Q22 Results With Over 20% Revenue GrowthDocument44 pagesCencosud Achieves Strong 1Q22 Results With Over 20% Revenue GrowthLeonardoNo ratings yet

- IC 33 Question PaperDocument12 pagesIC 33 Question PaperSushil MehraNo ratings yet

- UGS - 119 - Petropath Fluids (India) Pvt. Ltd.Document3 pagesUGS - 119 - Petropath Fluids (India) Pvt. Ltd.Alok SinghNo ratings yet

- Bibliography (1) 3 Mcvedited EeDocument4 pagesBibliography (1) 3 Mcvedited EeAmal TP PushpanNo ratings yet

- 1109021 (1)Document1 page1109021 (1)Cms Stl CmsNo ratings yet

- Application Form Account Opening UBIDocument4 pagesApplication Form Account Opening UBIDba ApsuNo ratings yet

- Tax Invoice: Vivo Mobile India Private LimitedDocument1 pageTax Invoice: Vivo Mobile India Private LimitedRaghav SharmaNo ratings yet

- Ignite 201805051418151403288Document4 pagesIgnite 201805051418151403288Vasan GuruprasadNo ratings yet

- Project InsuranceDocument13 pagesProject InsuranceRohan Raj MishraNo ratings yet

- IU Student Bank StatementDocument1 pageIU Student Bank StatementHasnain AliNo ratings yet

- Sa Puregold, Always Panalo!: N R D C I NDocument7 pagesSa Puregold, Always Panalo!: N R D C I NTumamudtamud, JenaNo ratings yet

- Rights of Homebuyers Under IBCDocument4 pagesRights of Homebuyers Under IBCsana khanNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- How to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionFrom EverandHow to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionNo ratings yet

- Business Buyout Agreements: Plan Now for All Types of Business TransitionsFrom EverandBusiness Buyout Agreements: Plan Now for All Types of Business TransitionsNo ratings yet

- Nolo's Quick LLC: All You Need to Know About Limited Liability CompaniesFrom EverandNolo's Quick LLC: All You Need to Know About Limited Liability CompaniesRating: 4.5 out of 5 stars4.5/5 (7)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet