Professional Documents

Culture Documents

Tax Form

Uploaded by

Top Cooling fanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Form

Uploaded by

Top Cooling fanCopyright:

Available Formats

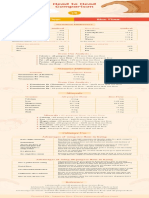

Protected B when completed

NR301

Declaration of eligibility for benefits (reduced tax) under a tax treaty for a non-resident person

(NOTE: Partnerships should use Form NR302 and hybrid entities should use Form NR303)

Use this form if you are a non-resident taxpayer resident in a country that Canada has a tax treaty with and you are eligible to receive the reduced rate of tax

or exemption provided by the treaty on all or certain income and you:

• receive income subject to Part XIII withholding tax, such as investment income, pension, annuities, royalties, and estate or trust income,

and the withholding tax rate is reduced by the tax treaty, or

• are completing forms T2062, Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property

or T2062A, Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Canadian Resource or Timber Resource

Property, Canadian Real Property (Other Than Capital Property), or Depreciable Taxable Canadian Property to request a certificate of compliance for the

disposition of treaty protected property, or

• derive income of any kind through a partnership or hybrid entity and it asks you to complete Form NR301 to support a declaration by the partnership or

hybrid entity.

Please refer to the instruction pages for more information.

Part 1. Legal name of non-resident taxpayer (for individuals: first name, last name)

Mohiuddin Shawon

Part 2. Mailing address: P.O. box, apt no., street no., street name and city

49, Buddist Temple Road, Gypsum Park View, Chittagong

State, province or territory Postal or zip code Country

Chittagong 4000 Bangladesh

Part 3. Foreign tax identification number

Part 4. Recipient type

■ Individual Corporation Trust

Part 5. Tax identification number

Enter your Canadian social insurance Enter the corporation's Canadian Enter the trust's Canadian account number,

number or Canadian individual tax business number, if it has one: if it has one:

number, if you have one:

R C T

Part 6. Country of residence for treaty purposes

Bangladesh

Part 7. Type of income for which the non-resident taxpayer is making this declaration

Interest, dividends, and/or royalties Trust income ■ Other – specify income type or indicate "all income" Business Profits

Part 8. Certification and undertaking

• I certify that the information given on this form is correct and complete.

• I certify that I am, or the non-resident taxpayer is, the beneficial owner of all income to which this form relates.

• I certify that to the best of my knowledge and based on the factual circumstances that I am, or the non-resident taxpayer is, entitled to the benefits of the tax treaty

between Canada and the country indicated in part 6 on the income listed in part 7.

• I undertake to immediately notify whoever I am submitting this form to (whether it is the payer, agent or nominee, CRA, or the partnership or hybrid entity through which the

income is derived) of any changes to the information provided on this form.

Mohiuddin Shawon Mohiuddin Shawon 2022/01/12

Signature of non-resident taxpayer Name of authorized person (print) Position/title of authorized person Telephone number Date (YYYY/MM/DD)

or authorized person

Expiry date – For Part XIII tax withholding purposes, this declaration expires when there is a change in the taxpayer's eligibility for treaty benefits or three years from

the end of the calendar year in which this form is signed and dated, whichever is earlier.

NR301 E (13) (Ce formulaire est disponible en français.)

You might also like

- IRS Form W8Document2 pagesIRS Form W8Benne JamesNo ratings yet

- Week2 - AMORTIZATION, MORTGAGE, AND INTEREST (Modular)Document59 pagesWeek2 - AMORTIZATION, MORTGAGE, AND INTEREST (Modular)angel annNo ratings yet

- W - (9) Irs FormDocument4 pagesW - (9) Irs Formjlr7776863100% (19)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationChristiney Spencer100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- STC Reimbursement GuidanceDocument8 pagesSTC Reimbursement GuidanceJhomer Claro100% (2)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Tda2689 PDFDocument1 pageTda2689 PDFChristian BaltarNo ratings yet

- Fortress Power Dealer FormDocument3 pagesFortress Power Dealer FormJuan Esteban HenaoNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- SEO Audit Report Highlights Key Issues and Recommendations for Triple Star Commercial Cleaning ServicesDocument18 pagesSEO Audit Report Highlights Key Issues and Recommendations for Triple Star Commercial Cleaning ServicesTop Cooling fanNo ratings yet

- Form W-8 Certificate of Foreign StatusDocument2 pagesForm W-8 Certificate of Foreign StatusSalaam Bey®No ratings yet

- Request W-9 Tax Form IdentificationDocument4 pagesRequest W-9 Tax Form IdentificationLogan BairdNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationapi-259574251No ratings yet

- Oyolloo B2B Proposal FinalDocument15 pagesOyolloo B2B Proposal FinalTop Cooling fanNo ratings yet

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Expense Report: Sample InvoiceDocument16 pagesExpense Report: Sample Invoice-Maichee Bella100% (1)

- W91 PDFDocument4 pagesW91 PDFPatrick LongNo ratings yet

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationaribandikNo ratings yet

- FINANCE ManualDocument123 pagesFINANCE ManualcakotyNo ratings yet

- Blockchain Unconfirmed Transaction Hack Script PDF FreeDocument2 pagesBlockchain Unconfirmed Transaction Hack Script PDF FreeHealing Relaxing Sleep Music100% (2)

- W9Document4 pagesW9James-heatha GowersNo ratings yet

- FINC 536 Case Study 2Document9 pagesFINC 536 Case Study 2karimNo ratings yet

- Financial Management by Prasanna Chandra IndexDocument1 pageFinancial Management by Prasanna Chandra IndexBhanwar Hudda40% (5)

- High-Frequency Trading Should VVVVVVVVDocument31 pagesHigh-Frequency Trading Should VVVVVVVVSrinu BonuNo ratings yet

- W 9Document4 pagesW 9Maribel JimenezNo ratings yet

- SAP Treasury and Risk Management Within SAP ERP FinancialsDocument28 pagesSAP Treasury and Risk Management Within SAP ERP FinancialsAgung Terminanto Jkt100% (4)

- Work Permit: Types of Work Permits & Work Permit ExemptionsFrom EverandWork Permit: Types of Work Permits & Work Permit ExemptionsNo ratings yet

- A comparative study of investment vs saving risks and opportunitiesDocument48 pagesA comparative study of investment vs saving risks and opportunitiesPRATEEK SINGH100% (1)

- Prudential SurrenderDocument5 pagesPrudential SurrenderBriltex IndustriesNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenNakan GantengNo ratings yet

- Edoc Profile Apr092021Document2 pagesEdoc Profile Apr092021Ryan ReidNo ratings yet

- Hubert Tagoe w9Document1 pageHubert Tagoe w9Hubert TagoeNo ratings yet

- Form 8 3 6 Interest Withholding TaxDocument4 pagesForm 8 3 6 Interest Withholding TaxAlfa BetaNo ratings yet

- W-8BENDocument1 pageW-8BENleozin ffNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationtbell_4boys!No ratings yet

- Tax W8 BENsDocument3 pagesTax W8 BENsroman tamayo Jr.No ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Titovilla Nova AjahNo ratings yet

- 2242326_W-8BENDocument1 page2242326_W-8BENalanagallvaoNo ratings yet

- W-8BEN-E: Certificate of Status of Beneficial Owner For United States Tax Withholding and Reporting (Entities)Document2 pagesW-8BEN-E: Certificate of Status of Beneficial Owner For United States Tax Withholding and Reporting (Entities)GYM VIỆT OfficialNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Tax Interview PDFDocument1 pageTax Interview PDFSazidul IslamNo ratings yet

- Form W-8BEN-E Certificate Status Beneficial OwnerDocument2 pagesForm W-8BEN-E Certificate Status Beneficial OwnerApoyo A La Cultura PicoteraNo ratings yet

- W8 Ben PDFDocument1 pageW8 Ben PDFAdina JitaruNo ratings yet

- W-8benDocument1 pageW-8bengabriel09.bNo ratings yet

- US Internal Revenue Service: f2350 - 2002Document3 pagesUS Internal Revenue Service: f2350 - 2002IRSNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- FormW8 12712Document1 pageFormW8 12712gregorio figueraNo ratings yet

- CHARLIEDocument2 pagesCHARLIEClarissa Mae ReyesNo ratings yet

- W-8BEN: Donald ChristophDocument1 pageW-8BEN: Donald ChristophpaulNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)fernandoNo ratings yet

- 6o19pyvf4g5i8z3k Yhz2dqtm4kjv395eDocument1 page6o19pyvf4g5i8z3k Yhz2dqtm4kjv395eEd LucasNo ratings yet

- FW 9Document4 pagesFW 9api-268381837No ratings yet

- Report - 2020 11 24 - 01 29 00Document1 pageReport - 2020 11 24 - 01 29 00Top Cooling fanNo ratings yet

- Welcome To Investors ClubDocument18 pagesWelcome To Investors ClubTop Cooling fanNo ratings yet

- Tax Certificate 214050511805Document1 pageTax Certificate 214050511805Top Cooling fanNo ratings yet

- Scale your Amazon FBA business with 5 strategiesDocument2 pagesScale your Amazon FBA business with 5 strategiesTop Cooling fanNo ratings yet

- Mohiuddin Shawon ResumeDocument1 pageMohiuddin Shawon ResumeTop Cooling fanNo ratings yet

- All-purpose Flour vs Rice Flour Nutrition ComparisonDocument1 pageAll-purpose Flour vs Rice Flour Nutrition ComparisonTop Cooling fanNo ratings yet

- End of Tenancy Cleaning ChecklistDocument6 pagesEnd of Tenancy Cleaning ChecklistTop Cooling fanNo ratings yet

- SEO Audit Pear Tree HomeDocument17 pagesSEO Audit Pear Tree HomeTop Cooling fanNo ratings yet

- KSP - Swinger - Trading Process 13feb'22Document24 pagesKSP - Swinger - Trading Process 13feb'22Halimah MahmodNo ratings yet

- Assets Finance CompanyDocument18 pagesAssets Finance CompanyEntersliceNo ratings yet

- CV MUHAMMAD WAQAR - Accounting and FinanceDocument3 pagesCV MUHAMMAD WAQAR - Accounting and FinanceMuhammad Waqar100% (1)

- 5311XXXXXXXXX950030-03-2024Document4 pages5311XXXXXXXXX950030-03-2024adityayadavasyNo ratings yet

- Bandhan Bank Limited IPODocument3 pagesBandhan Bank Limited IPOVeena AcharyaNo ratings yet

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32Nd Edition Anderson Test Bank Full Chapter PDFDocument50 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32Nd Edition Anderson Test Bank Full Chapter PDFJesusEvansspaj100% (8)

- HO4Document2 pagesHO4Emily Dela CruzNo ratings yet

- Midterm quiz on tax lawsDocument8 pagesMidterm quiz on tax lawsKurt dela TorreNo ratings yet

- Disclosures On Risk Based CapitalDocument5 pagesDisclosures On Risk Based CapitalFoysal SirazeeNo ratings yet

- Foreign Currency TransactionsDocument49 pagesForeign Currency TransactionsGlenn TaduranNo ratings yet

- History Islami BankingDocument14 pagesHistory Islami BankingMilon SultanNo ratings yet

- A Study On Impact of Demonetization On Online Transactions: AbstractDocument5 pagesA Study On Impact of Demonetization On Online Transactions: AbstractJaivik PanchalNo ratings yet

- Financial Analysis SpreadsheetDocument45 pagesFinancial Analysis SpreadsheetCA Bharath Bhushan D VNo ratings yet

- Analysis of Colonialism and Its Impact in Africa: Stephen Ocheni Basil C. NwankwoDocument9 pagesAnalysis of Colonialism and Its Impact in Africa: Stephen Ocheni Basil C. Nwankwomuna moonoNo ratings yet

- Statement 2023MTH10 430547526Document4 pagesStatement 2023MTH10 430547526shoykapoorNo ratings yet

- 6.accounts Machinery June 18Document142 pages6.accounts Machinery June 18tanvir tarekNo ratings yet

- Rating Action - Moodys-downgrades-Perus-rating-to-Baa1-changes-outlook-to-stable - 01sep21Document6 pagesRating Action - Moodys-downgrades-Perus-rating-to-Baa1-changes-outlook-to-stable - 01sep21jimmygerman333No ratings yet

- 06 Zonal Value of Property and How It Works - Lumina HomesDocument7 pages06 Zonal Value of Property and How It Works - Lumina HomesjrstockholmNo ratings yet

- Jcsgo Christian Academy: Senior High School DepartmentDocument4 pagesJcsgo Christian Academy: Senior High School DepartmentFredinel Malsi ArellanoNo ratings yet

- PFRS 12 Disclosure RequirementsDocument26 pagesPFRS 12 Disclosure RequirementsMeiNo ratings yet

- A Detailed Research Report On Motilal Oswal Financial Services LTDDocument19 pagesA Detailed Research Report On Motilal Oswal Financial Services LTDKushagra KejriwalNo ratings yet

- Order 111-4911697-9672231Document1 pageOrder 111-4911697-9672231de venezuelaNo ratings yet