Professional Documents

Culture Documents

Ifrs Alert 2017 04 Iasb Issues Materiality Practice Statement

Uploaded by

TiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ifrs Alert 2017 04 Iasb Issues Materiality Practice Statement

Uploaded by

TiCopyright:

Available Formats

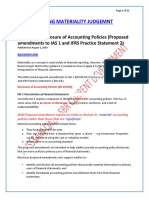

IFRS Alert

IASB issues IFRS Practice Statement 2: Making Materiality

Judgements

Issue 2017- 04

Executive summary

The International Accounting Standards Board (IASB) has published guidance on how to make materiality

judgements. The Practice Statement encourages entities to apply judgement so that financial statements focus on

the information that is useful to investors rather than trying to comply with an IFRS ‘checklist’.

Background

The concept of materiality is important in the preparation of financial statements, because it helps companies determine which

information to include in and exclude from their reports. However, management is often faced with uncertainty in applying that

concept. Such uncertainty is encountered when making decisions about recognition and measurement but most of all when

deciding what information to disclose in the notes and how to present that information.

This uncertainty has led to some entities using the disclosure requirements in IFRS Standards as a checklist rather than

judging which information would be most useful to investors and other stakeholders.

Main issues addressed by the Practice Statement

With the publication of the Practice Statement, the IASB is providing support to companies in making materiality judgements

and hopes to encourage behavioural change.

The Practice Statement gathers all the materiality requirements in IFRS Standards and adds practical guidance and

examples entities may find helpful in deciding whether information is material.

continued overleaf

Grant Thornton International Limited. All rights reserved

Issue 2017-04

Main issues addressed by the Practice Statement

The Practice Statement sets out a four-step process to making decisions on materiality:

Steps Action

Step 1—Identify • Identify information that has the potential to be material

Step 2—Assess • Assess whether the information identified in Step 1 is, in fact, material

Step 3—Organise • Organise the information within the draft financial statements in a way that

communicates the information clearly and concisely to primary users

Step 4—Review • Review the draft financial statements to determine whether all material

information has been identified and materiality considered from a wide

perspective and in aggregate, on the basis of the complete set of financial

statements.

The Practice Statement also gives guidance on specific topics such as: prior-period information; errors; information about

covenants; and materiality judgements for interim reporting.

The Practice Statement is not a Standard and its application is not mandatory or required in order to state compliance with

IFRS. It does not change existing requirements or introduce new ones. Instead, it aims to provide guidance to assist

management in applying the concept of materiality when preparing their financial statements. The guidance in the Practice

Statement can be applied from its date of publication, 14 September 2017.

Grant Thornton International Ltd comment

We welcome the publication of the Practice Statement. We think that this guidance will help

management to apply the concept of materiality and produce relevant information to investors and other

stakeholders.

© 2017 Grant Thornton International Ltd.

IFRS Alerts are developed as an information resource summarising new pronouncements issued by the International Accounting Standards Board and the IFRS Interpretations Committee.

This document is intended as a guide only and the application of its contents to specific situations will depend on the parti cular circumstances involved. While every care has been taken in

its presentation, personnel who use this document to assist in evaluating compliance with International Financial Reporting Standards should have sufficient training and experience to do

so. No person should act specifically on the basis of the material contained herein without considering and taking professional advice. Neither Grant Thornton International Ltd (GTIL), nor

any of its personnel nor any of its member firms or their partners or employees, accept any responsibility for any errors thi s document might contain, whether caused by negligence or

otherwise, or any loss, howsoever caused, incurred by any person as a result of utilising or otherwise placing any reliance upon it.

"Grant Thornton" refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory services to their clients and/or refers to one or more member firms,

as the context requires. GTIL and the member firms are not a worldwide partnership. GTIL and each member firm is a separate l egal entity. Services are delivered by the member firms.

GTIL does not provide services to clients. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions.

GRT106095

You might also like

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Just To LoadDocument20 pagesJust To LoadkhairejoNo ratings yet

- Basic English Level 1Document12 pagesBasic English Level 1Ahmed Hossam BehairyNo ratings yet

- Current Issues SBR June 2022Document11 pagesCurrent Issues SBR June 2022Pui Fun LeoNo ratings yet

- Intermediate AccountingDocument48 pagesIntermediate AccountingRachelle BulawanNo ratings yet

- PSCAI Lecture 1Document39 pagesPSCAI Lecture 1Ritashree DasguptaNo ratings yet

- Fa I Chapter 1Document10 pagesFa I Chapter 1Tewanay BesufikadNo ratings yet

- Lesson 2: The Accounting Framework: TopicsDocument10 pagesLesson 2: The Accounting Framework: TopicsJean Raya May magbanuaNo ratings yet

- 01 - Lec - Conceptual FrameworkDocument5 pages01 - Lec - Conceptual FrameworkYoung MetroNo ratings yet

- Conceptual and Regulatory FrameworkDocument10 pagesConceptual and Regulatory FrameworkMohamed Yada AlghaliNo ratings yet

- Lecture 1Document24 pagesLecture 1Brenden KapoNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesAlex EiyzNo ratings yet

- 2 IFRS Framework - NOTES - V2 V3 - UpdatedDocument7 pages2 IFRS Framework - NOTES - V2 V3 - UpdatedVasileios LymperopoulosNo ratings yet

- Financial Reporting: IFRS FrameworkDocument13 pagesFinancial Reporting: IFRS FrameworkVasileios LymperopoulosNo ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- W1 Module 2 The Environment For Financial Accounting and Reporting Part 2Document5 pagesW1 Module 2 The Environment For Financial Accounting and Reporting Part 2leare ruazaNo ratings yet

- Making Materiality Judgements: IFRS Practice Statement 2Document44 pagesMaking Materiality Judgements: IFRS Practice Statement 2Ytb AccntNo ratings yet

- ACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkDocument34 pagesACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkFritzey Faye RomeronaNo ratings yet

- Ifr NotesDocument43 pagesIfr NotesMonicaNo ratings yet

- IFRS Practice Statement 2Document44 pagesIFRS Practice Statement 2JPNo ratings yet

- PS02 134Document44 pagesPS02 134Issa BoyNo ratings yet

- Valuation Concepts and MethodsDocument5 pagesValuation Concepts and MethodsYami HeatherNo ratings yet

- IFRS Conceptual FrameworkDocument7 pagesIFRS Conceptual FrameworkhemantbaidNo ratings yet

- ToA.201 Conceptual FrameworkDocument27 pagesToA.201 Conceptual Frameworknaztig_017No ratings yet

- Unit - 1 IFRS Foundation and The IASBDocument22 pagesUnit - 1 IFRS Foundation and The IASBSanthosh SanthuNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual Frameworkchaleen23No ratings yet

- Conceptual Framework For Financial Reporting: Student - Feedback@sti - EduDocument4 pagesConceptual Framework For Financial Reporting: Student - Feedback@sti - Eduwaeyo girlNo ratings yet

- Acfm Ch-Two 2022Document46 pagesAcfm Ch-Two 2022mihiretche0No ratings yet

- CD MaterialityDocument11 pagesCD MaterialityAMNA T.ZNo ratings yet

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoNo ratings yet

- Conceptual Framework For Financial ReportingDocument8 pagesConceptual Framework For Financial ReportingsmlingwaNo ratings yet

- FR Practice Questions PDF-6Document16 pagesFR Practice Questions PDF-6tugaNo ratings yet

- Group3. FARR REPORT - SolfDocument8 pagesGroup3. FARR REPORT - SolfAnnguily Sumatra GaidNo ratings yet

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- Conceptual Framework For Financial Reporting. General PrinciplesDocument5 pagesConceptual Framework For Financial Reporting. General PrinciplesLuis PurutongNo ratings yet

- Chapter-1 INTRODUCTION TO FINANCIAL ACCOUNTINGDocument15 pagesChapter-1 INTRODUCTION TO FINANCIAL ACCOUNTINGWoldeNo ratings yet

- Infonet College: Learning GuideDocument26 pagesInfonet College: Learning Guidemac video teachingNo ratings yet

- Acc140 NotesDocument72 pagesAcc140 NotesSalim Yusuf BinaliNo ratings yet

- Lesson 1Document7 pagesLesson 1Ira Charisse BurlaosNo ratings yet

- Module-1 Intro To AccountingDocument4 pagesModule-1 Intro To AccountingPam Salalima AlemaniaNo ratings yet

- FA2A - Study GuideDocument67 pagesFA2A - Study GuideHasan EvansNo ratings yet

- Consultation Paper On Sustainability Reporting: IFRS® FoundationDocument22 pagesConsultation Paper On Sustainability Reporting: IFRS® FoundationSofiya BayraktarovaNo ratings yet

- Pertemuan 1-Financial Reporting Standards Conceptual FrameworkDocument61 pagesPertemuan 1-Financial Reporting Standards Conceptual Frameworkanggi anythingNo ratings yet

- Act 330Document9 pagesAct 330Samiul21No ratings yet

- CFASDocument3 pagesCFASMeybilene BernardoNo ratings yet

- Financial Reporting Framework: Accountancy DepartmentDocument14 pagesFinancial Reporting Framework: Accountancy DepartmentJayson ChanNo ratings yet

- 0integrated Accounting: Financial Accounting & Reporting (P1)Document32 pages0integrated Accounting: Financial Accounting & Reporting (P1)Jochelle Anne PaetNo ratings yet

- Working in The Public InterestDocument12 pagesWorking in The Public InterestAthanasia MasouraNo ratings yet

- Solution Manual For Financial Accounting Theory and Analysis Text and Cases 11th EditionDocument38 pagesSolution Manual For Financial Accounting Theory and Analysis Text and Cases 11th Editionbilgeallowedly1c0v0d100% (11)

- CH 01Document30 pagesCH 01laiveNo ratings yet

- Status and Purpose of The Framework, Objective and Qualitative CharacteristicsDocument35 pagesStatus and Purpose of The Framework, Objective and Qualitative CharacteristicsCharmaine Mari OlmosNo ratings yet

- IFRS A Briefing For Boards of DirectorsDocument60 pagesIFRS A Briefing For Boards of DirectorsJose Martin Castillo PatiñoNo ratings yet

- International Financial Reporting Standards (IFRS) Are A Set of International AccountingDocument5 pagesInternational Financial Reporting Standards (IFRS) Are A Set of International AccountingAhnaf Tahmed FaizNo ratings yet

- 3 Concepts in AccountingDocument59 pages3 Concepts in Accountingedward peraltaNo ratings yet

- Workbook Financial-Management MidtermDocument33 pagesWorkbook Financial-Management MidtermMariel HablaNo ratings yet

- ACC702 Course Material & Study GuideDocument78 pagesACC702 Course Material & Study Guidelaukkeas100% (4)

- Chapter 2 - Acctg Concepts & PrinciplesDocument20 pagesChapter 2 - Acctg Concepts & PrinciplesEowyn DianaNo ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- EY-IFRS Adopted by EU 22122015Document8 pagesEY-IFRS Adopted by EU 22122015TiNo ratings yet

- Summer 2013 5Document4 pagesSummer 2013 5TiNo ratings yet

- Management Commentary Practice Statement 8 DecemberDocument32 pagesManagement Commentary Practice Statement 8 Decemberstudentul1986No ratings yet

- Ifrspracticestatement1 130Document12 pagesIfrspracticestatement1 130TiNo ratings yet

- 3RD Progress Report-21.09.2020Document7 pages3RD Progress Report-21.09.2020Rishabh SinghNo ratings yet

- Trial BalDocument5 pagesTrial BalAneel kumarNo ratings yet

- ProsidingSEMNASHPAV2021 Adhitya Y Pradhana See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/352017846 PENGARUH PROFIL EMOSI DAN SENSORI ICE CREAM DARI VCO PROSES BASAH DAN KERING DENGAN PENAMBAHAN KOLANG-KALING EFFECT OF EMOTION AND SENSORY PROFILE ICE CREAM FROM WET AND DRYDocument529 pagesProsidingSEMNASHPAV2021 Adhitya Y Pradhana See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/352017846 PENGARUH PROFIL EMOSI DAN SENSORI ICE CREAM DARI VCO PROSES BASAH DAN KERING DENGAN PENAMBAHAN KOLANG-KALING EFFECT OF EMOTION AND SENSORY PROFILE ICE CREAM FROM WET AND DRYadhitya yudha PradhanaNo ratings yet

- Water Sharing Dispute in Pakistan Standpoint of Provinces PDFDocument17 pagesWater Sharing Dispute in Pakistan Standpoint of Provinces PDFMuhammad Ali RazaNo ratings yet

- Written Statement of Rajat GuptaDocument5 pagesWritten Statement of Rajat GuptaMukesh Lal100% (4)

- A Study On Feasible Traffic Operation Alternatives Along JP Laurel Street and Santa Ana Road in Digos CityDocument8 pagesA Study On Feasible Traffic Operation Alternatives Along JP Laurel Street and Santa Ana Road in Digos CityhaeeyNo ratings yet

- Encumbrance FormDocument1 pageEncumbrance FormSuresh KumarNo ratings yet

- Return of Company Property LetterDocument1 pageReturn of Company Property LetterShraddha KhandelwalNo ratings yet

- Ining V VegaDocument3 pagesIning V VegaBasil MaguigadNo ratings yet

- EnvironmentalLaw IQ.902d654dDocument2 pagesEnvironmentalLaw IQ.902d654dSuraj Srivatsav.SNo ratings yet

- IDinsight 2020 Associate Program - Writing ExerciseDocument4 pagesIDinsight 2020 Associate Program - Writing ExerciseSaudamini Sharma0% (1)

- Individual Income TaxDocument7 pagesIndividual Income TaxNadi Hood100% (3)

- Hindu Girls CollegeDocument3 pagesHindu Girls CollegeKritik MulchandaniNo ratings yet

- AIA G712 1972 Free Sample Preview PDFDocument1 pageAIA G712 1972 Free Sample Preview PDFhymerchmidtNo ratings yet

- Certificate of Good Moral CharacterDocument11 pagesCertificate of Good Moral CharacterAvelino Jr II PayotNo ratings yet

- Celebrity Format PDF 3Document1 pageCelebrity Format PDF 3Trace AdkinNo ratings yet

- List of Slovene Laws and Regulations in EnglishDocument18 pagesList of Slovene Laws and Regulations in EnglishAnej PetačNo ratings yet

- RCC CompleteDocument77 pagesRCC CompleteJoannah GamboaNo ratings yet

- Prof Ed4 ReportDocument21 pagesProf Ed4 ReportCharmane GarelaNo ratings yet

- Ruks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media AdsDocument2 pagesRuks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media Adsluis capulongNo ratings yet

- Common Forms of BusinessDocument22 pagesCommon Forms of BusinessPanda DutchNo ratings yet

- Aleksandr Solzhenitsyn-200 Years Together (Almost Full Translation) PDFDocument435 pagesAleksandr Solzhenitsyn-200 Years Together (Almost Full Translation) PDFadavielchiù92% (13)

- Human Trafficking in Asia Going OnlineDocument8 pagesHuman Trafficking in Asia Going OnlineARC brillantesNo ratings yet

- Termination of LeasesDocument28 pagesTermination of Leasesjagwe ronnie lumalaNo ratings yet

- AP Gov Study GuideDocument33 pagesAP Gov Study GuideSHRENI JAIN100% (1)

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- People V Garcia - DigestDocument2 pagesPeople V Garcia - DigestEche AbadNo ratings yet

- Coercion and ConsensusDocument2 pagesCoercion and ConsensusERWIN MORGIANo ratings yet

- Procurement Fraud Red Flags & Investigative TechniquesDocument32 pagesProcurement Fraud Red Flags & Investigative TechniquesNdumiso ShokoNo ratings yet

- Ged109-A1 MRR1Document3 pagesGed109-A1 MRR1Alysa EgamNo ratings yet